Flight Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429147 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Flight Management System Market Size

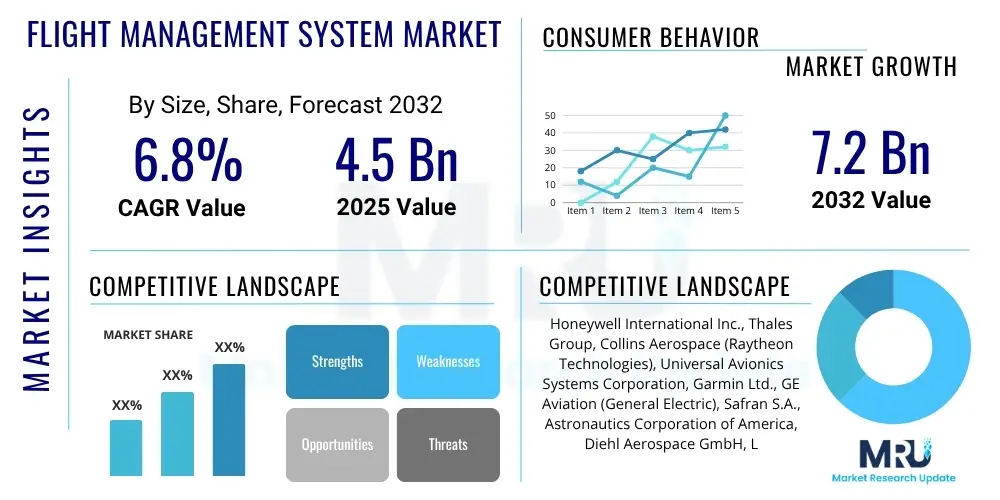

The Flight Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2032.

Flight Management System Market introduction

The Flight Management System (FMS) market encompasses the technologies and services designed to automate a wide range of in-flight tasks, offering comprehensive control over an aircraft's flight path, performance, and navigation. An FMS is a fundamental component of modern avionics, integrating various aircraft systems to optimize flight operations from pre-flight planning through landing. The core product is an integrated computer system that stores aircraft data, navigational databases, and performance models, allowing pilots to input and execute flight plans with precision, thereby enhancing operational efficiency and safety. Key applications span commercial passenger aircraft, cargo planes, business jets, and military aviation, each leveraging the FMS for streamlined flight execution and reduced pilot workload.

The primary benefits of FMS include significant improvements in fuel efficiency through optimized flight trajectories and ascent/descent profiles, enhanced navigational accuracy through integration with Global Navigation Satellite Systems (GNSS) and Inertial Reference Systems (IRS), and improved safety through better situational awareness and reduced human error. Moreover, FMS plays a crucial role in enabling more direct routes, managing air traffic congestion, and facilitating compliance with increasingly stringent air traffic control (ATC) procedures and environmental regulations. These advantages collectively drive the market, supported by factors such as the continuous growth in global air traffic, the ongoing modernization of existing aircraft fleets, and the imperative for airlines to achieve cost efficiencies and meet sustainability targets.

Flight Management System Market Executive Summary

The Flight Management System market is experiencing robust growth, primarily driven by the expansion of global commercial aviation and the escalating demand for enhanced operational efficiency and safety. Business trends indicate a strong focus on developing more integrated and intelligent FMS solutions, incorporating advanced features such as predictive maintenance, real-time weather integration, and enhanced automation to reduce pilot workload and optimize fuel consumption. The industry is also witnessing a shift towards open architectures and modular designs, facilitating easier upgrades and customization, which is crucial for prolonging the lifespan and improving the capabilities of existing FMS units. Furthermore, the increasing adoption of data analytics and connectivity solutions is transforming FMS into a more dynamic and responsive system, capable of adapting to changing flight conditions in real-time.

Regional trends highlight North America and Europe as mature markets with high rates of FMS adoption and a strong focus on technological advancements and retrofit solutions. The Asia Pacific region is poised for significant growth, fueled by rapid fleet expansion, rising air passenger traffic, and substantial investments in aviation infrastructure by emerging economies. Latin America, the Middle East, and Africa are also showing steady growth, driven by increasing connectivity and the modernization of their respective air fleets. Segmentation trends emphasize the increasing demand for integrated FMS solutions over standalone units, as well as a growing preference for software-defined functionalities that offer greater flexibility and lower lifecycle costs. The aftermarket segment, including maintenance, repair, and overhaul (MRO) services, is also expanding significantly due to the large installed base of aircraft requiring FMS upgrades and support.

AI Impact Analysis on Flight Management System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Flight Management System (FMS) market frequently center on how AI will enhance automation, improve decision-making, and ensure safety, while also raising concerns about job displacement for pilots and the complexities of AI certification. Users often inquire about AI's potential to optimize flight paths in real-time, predict maintenance needs, and manage dynamic weather conditions more effectively. There is also significant interest in how AI could contribute to autonomous flight capabilities and its role in improving air traffic management. Overall, the prevailing themes involve expectations of revolutionary operational improvements alongside cautious scrutiny of reliability, regulatory approval, and the human element in aviation. The market anticipates AI to be a transformative force, enabling FMS to become more adaptive, predictive, and ultimately, more efficient and safer.

- Enhanced real-time flight path optimization, adapting to dynamic weather and air traffic.

- Predictive maintenance for FMS components and associated aircraft systems, reducing unscheduled downtime.

- Improved decision support for pilots, offering optimized alternatives in complex scenarios.

- Advanced anomaly detection and fault diagnosis, enhancing safety and reliability.

- Facilitation of autonomous flight capabilities through sophisticated sensor fusion and control algorithms.

- Development of adaptive FMS interfaces that learn pilot preferences and operational patterns.

- More efficient fuel consumption through AI-driven trajectory management.

- Integration with advanced air traffic management systems for seamless communication and coordination.

- Personalized training simulations for pilots based on AI-generated flight scenarios.

DRO & Impact Forces Of Flight Management System Market

The Flight Management System market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and external impact forces. A primary driver is the relentless growth in global air traffic, which necessitates more efficient and precise flight operations to manage congestion and maintain safety standards. Airlines are also under constant pressure to reduce operational costs, particularly fuel expenditure, making the FMS’s capability for optimized flight planning and trajectory management a compelling value proposition. Furthermore, the ongoing modernization of aircraft fleets, with a focus on integrating advanced avionics, and the increasing stringency of aviation regulations concerning airspace efficiency and environmental impact, further accelerate FMS adoption. The desire for enhanced safety and reduced pilot workload through automation also acts as a significant driving force, pushing for more sophisticated and intuitive FMS designs.

However, several restraints temper the market’s growth. The high initial capital investment required for FMS acquisition and installation, especially for smaller operators or older aircraft, poses a significant barrier. The complexity of FMS integration into existing aircraft systems, coupled with the rigorous certification processes mandated by aviation authorities, adds to both cost and development time. Cybersecurity concerns are also a growing restraint, as FMS systems become more connected and reliant on external data sources, increasing their vulnerability to cyber threats. The impact forces within the market, such as the substantial bargaining power of major aircraft manufacturers (OEMs) who often bundle FMS with new aircraft, and the significant R&D investment required by FMS providers, shape the competitive landscape. The threat of new entrants is relatively low due to high entry barriers, while the threat of substitutes is minimal given the FMS’s critical role in modern aviation. Supplier bargaining power is moderate, influenced by the specialized nature of FMS components and software.

Segmentation Analysis

The Flight Management System market is comprehensively segmented to provide a detailed understanding of its diverse applications and technological nuances. These segments facilitate a granular analysis of market dynamics, revealing specific growth areas and strategic opportunities for stakeholders. The primary segmentation approaches typically involve categorizing FMS solutions based on their configuration, the type of aircraft they are installed in, the individual components that comprise the system, and the end-users procuring these systems. This multi-faceted segmentation allows for targeted market strategies and product development tailored to the unique requirements of each sub-market, ensuring that FMS providers can address the varied demands of the global aviation industry effectively.

- By Type

- Standalone FMS

- Integrated FMS

- By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Business Jets

- Military Aircraft

- Helicopters

- By Component

- Hardware (e.g., Control Display Units, Processors, Navigation Sensors)

- Software (e.g., Flight Planning Software, Navigation Databases, Performance Calculation Software)

- Services (e.g., Maintenance, Upgrades, Training, Data Management)

- By End User

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Airlines, MROs, Government/Military Operators)

Value Chain Analysis For Flight Management System Market

The value chain for the Flight Management System market is a complex ecosystem, beginning with the foundational technologies and extending through to the final end-user applications, characterized by intricate relationships between various industry participants. The upstream segment involves critical component suppliers and technology developers who provide the core hardware, software, and intellectual property essential for FMS functionality. This includes manufacturers of advanced microprocessors, memory units, display technologies, navigation sensors like GPS receivers and Inertial Measurement Units (IMUs), and specialized software developers creating operating systems, algorithms, and navigational databases. These suppliers often operate in highly specialized niches, requiring significant R&D investment and adherence to stringent aerospace quality standards.

Moving downstream, the value chain encompasses the integration and assembly of these components into complete FMS units. This phase is dominated by major avionics manufacturers and system integrators who design, develop, and certify the FMS for specific aircraft platforms. These integrators then supply the FMS either directly to Original Equipment Manufacturers (OEMs) like Boeing, Airbus, and Embraer for new aircraft installations, or to the aftermarket for retrofit and upgrade programs. Distribution channels are predominantly direct for OEM sales, where FMS providers work closely with aircraft manufacturers during the aircraft design and production phases. For the aftermarket, distribution involves a network of certified MRO (Maintenance, Repair, and Overhaul) facilities, authorized service centers, and direct sales to airlines and aircraft operators. Both direct and indirect channels are crucial, with indirect channels playing a significant role in providing ongoing support, upgrades, and maintenance services throughout an FMS’s operational life, ensuring widespread reach and continuous service delivery to a global customer base.

Flight Management System Market Potential Customers

The Flight Management System market serves a diverse range of end-users and buyers across the global aviation sector, each with specific operational needs and regulatory requirements. Commercial airlines, spanning major flag carriers, regional airlines, and low-cost carriers, represent the largest customer segment. These operators continuously seek FMS solutions that enhance fuel efficiency, reduce flight times, improve schedule adherence, and ultimately lower operational costs while ensuring the highest levels of safety for their extensive passenger and cargo fleets. The imperative for fleet modernization and the adoption of advanced navigation capabilities makes them primary drivers of FMS demand, both for new aircraft acquisitions and for upgrading existing fleets to comply with evolving airspace mandates. Cargo operators also constitute a significant customer group, leveraging FMS for optimized long-haul flights and precise cargo delivery schedules.

Another crucial customer segment includes business jet and general aviation operators, who demand FMS solutions that offer flexibility, ease of use, and advanced capabilities for operating in various airspace environments. For these private and corporate operators, FMS contributes to increased efficiency and safety for executive travel and specialized missions. Military and government aviation agencies form another vital customer base, requiring highly robust and secure FMS tailored for reconnaissance, transport, combat, and training aircraft. Their requirements often involve specialized functionalities, enhanced cyber resilience, and compliance with defense-specific operational protocols. Additionally, aircraft leasing companies, MRO (Maintenance, Repair, and Overhaul) providers, and flight training organizations also act as indirect or direct purchasers and influencers in the FMS market, facilitating upgrades and training on these sophisticated systems for the broader aviation community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Thales Group, Collins Aerospace (Raytheon Technologies), Universal Avionics Systems Corporation, Garmin Ltd., GE Aviation (General Electric), Safran S.A., Astronautics Corporation of America, Diehl Aerospace GmbH, L3Harris Technologies Inc., Northrop Grumman Corporation, BAE Systems plc, Leonardo S.p.A., Lufthansa Technik AG, Sagem (Safran Electronics & Defense) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flight Management System Market Key Technology Landscape

The Flight Management System (FMS) market is characterized by a dynamic and evolving technology landscape, constantly integrating advancements to enhance performance, reliability, and connectivity. At its core, modern FMS relies heavily on sophisticated navigation technologies, primarily Global Navigation Satellite Systems (GNSS) such as GPS, GLONASS, Galileo, and BeiDou, complemented by Inertial Navigation Systems (INS) for highly accurate and redundant positioning data. These systems are crucial for precise flight path adherence and situational awareness. The processing power within FMS units has dramatically increased, utilizing advanced microprocessors and robust computing architectures capable of handling complex flight planning algorithms, performance calculations, and real-time data integration from various aircraft sensors. This computational capability enables functions like Required Navigation Performance (RNP) and Area Navigation (RNAV), facilitating more direct and efficient routes.

Furthermore, the FMS market is increasingly adopting data analytics and machine learning (ML) capabilities to offer predictive insights and optimize flight operations. This includes features for predictive maintenance, real-time weather integration, and adaptive flight path adjustments based on dynamic environmental conditions and air traffic. Connectivity is another critical technological pillar, with FMS systems integrating with sophisticated data link communication systems (e.g., ACARS, FANS) to enable seamless data exchange between the aircraft, ground control, and airline operational centers. This enhanced connectivity supports services such as electronic flight bags (EFBs) and more efficient air traffic management. The industry is also seeing a shift towards open system architectures and modular software designs, which allow for easier upgrades, customization, and the integration of third-party applications, future-proofing the FMS against rapid technological obsolescence and enabling greater interoperability across different avionics platforms. Cybersecurity measures are paramount, with robust encryption and authentication protocols being embedded to protect critical flight data and ensure system integrity against potential cyber threats.

Regional Highlights

- North America: A mature market with a high adoption rate of advanced FMS, driven by technological innovation, robust aviation infrastructure, and a strong presence of leading aerospace manufacturers and airlines. Significant emphasis on next-generation air traffic management (NextGen) initiatives and retrofit programs.

- Europe: Characterized by stringent aviation regulations (e.g., SESAR), a focus on fuel efficiency, and a large installed base of aircraft requiring FMS upgrades. Strong R&D activities and a significant MRO (Maintenance, Repair, and Overhaul) sector contribute to market growth.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid growth in air passenger traffic, substantial investments in fleet expansion, and the establishment of new airlines. Emerging economies in China, India, and Southeast Asia are key contributors to the surging demand for new FMS installations.

- Latin America: Experiencing steady market growth due to increasing air travel demand, fleet modernization efforts by regional airlines, and investments in aviation infrastructure. Focus on enhancing connectivity and operational efficiency across diverse geographical terrains.

- Middle East and Africa (MEA): Growing market influenced by strategic geographical location for long-haul flights, significant investments in new aircraft by major carriers, and expanding aviation hubs. Increasing tourism and business travel contribute to the demand for advanced FMS.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flight Management System Market.- Honeywell International Inc.

- Thales Group

- Collins Aerospace (Raytheon Technologies)

- Universal Avionics Systems Corporation

- Garmin Ltd.

- GE Aviation (General Electric)

- Safran S.A.

- Astronautics Corporation of America

- Diehl Aerospace GmbH

- L3Harris Technologies Inc.

- Northrop Grumman Corporation

- BAE Systems plc

- Leonardo S.p.A.

- Lufthansa Technik AG

- Sagem (Safran Electronics & Defense)

- Novogate

- ACSS (L3Harris & Thales Joint Venture)

- Dynon Avionics

- Esterline Technologies Corporation

- Mid-Continent Instrument Co., Inc.

Frequently Asked Questions

What is a Flight Management System (FMS) and its primary function?

A Flight Management System (FMS) is an integrated avionics computer system that automates a wide range of in-flight tasks, primarily enabling pilots to plan, execute, and monitor flight paths, manage aircraft performance, and navigate precisely using various sensors and databases.

How does FMS contribute to fuel efficiency in aviation?

FMS optimizes flight trajectories, ascent and descent profiles, and cruise altitudes based on real-time data, weather conditions, and performance models. This leads to more direct routes and optimized engine settings, significantly reducing fuel consumption.

What are the key drivers for the growth of the Flight Management System market?

The primary drivers include increasing global air traffic, the imperative for airlines to achieve greater fuel efficiency and reduce operational costs, ongoing modernization of aircraft fleets, and stringent aviation regulations promoting airspace efficiency and safety.

What role does Artificial Intelligence (AI) play in the future of FMS?

AI is expected to enhance FMS capabilities through real-time flight path optimization, predictive maintenance, advanced decision support for pilots, and improved anomaly detection, ultimately contributing to more autonomous and adaptive flight operations.

Which regions are expected to experience the highest growth in the FMS market?

The Asia Pacific region is projected to experience the highest growth due to rapid fleet expansion, increasing air passenger traffic, and significant investments in aviation infrastructure, particularly in emerging economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager