Fluorescence Guided Surgery Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427913 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Fluorescence Guided Surgery Systems Market Size

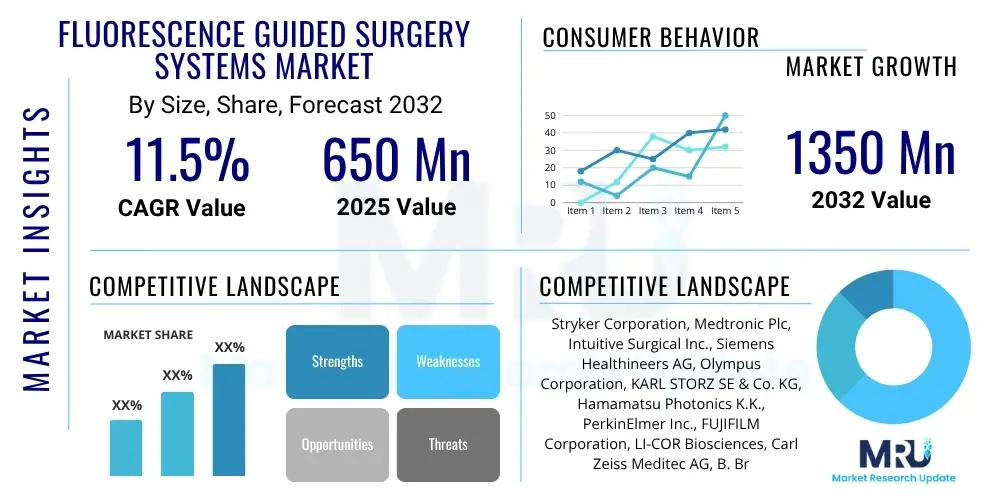

The Fluorescence Guided Surgery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 650 Million in 2025 and is projected to reach USD 1350 Million by the end of the forecast period in 2032.

Fluorescence Guided Surgery Systems Market introduction

The Fluorescence Guided Surgery (FGS) Systems market represents a rapidly advancing segment within medical technology, offering enhanced visualization capabilities during surgical procedures. FGS utilizes specialized imaging agents and devices to make target tissues, such as tumors or specific anatomical structures, glow brightly under near-infrared light, providing surgeons with real-time, high-contrast visualization that is not possible with conventional white light. This innovation significantly aids in precise tissue differentiation, enabling more complete resections of cancerous tissues, accurate identification of critical structures like nerves or vessels, and assessment of tissue perfusion. The core principle revolves around administering a fluorescent tracer, which selectively accumulates in or highlights the area of interest, followed by illumination with an appropriate light source and detection using a specialized camera system integrated into surgical instruments or scopes.

The primary applications of FGS systems span a wide array of surgical disciplines, prominently including oncology, where it is used in breast cancer, lung cancer, colorectal cancer, and brain tumor resections to ensure clear surgical margins. Beyond cancer surgery, FGS finds utility in cardiovascular procedures for assessing myocardial perfusion, in gastrointestinal surgery for anastomotic leak detection, in reconstructive and plastic surgery for flap viability assessment, and in lymph node mapping. Its versatility and ability to provide immediate, actionable information during surgery are transforming surgical approaches across these fields. The increasing adoption of minimally invasive surgical techniques, coupled with a growing emphasis on precision medicine, further propels the demand for FGS systems that can seamlessly integrate into advanced surgical platforms, including robotic surgery setups.

The manifold benefits of FGS systems are substantial and directly impact patient outcomes and healthcare economics. These systems contribute to improved surgical precision by enabling surgeons to visualize structures that are otherwise indiscernible to the naked eye, leading to more thorough disease removal and reduced recurrence rates, particularly in oncological contexts. Furthermore, FGS can help minimize collateral damage to healthy tissue, thereby reducing operative time, blood loss, and the incidence of post-operative complications. This leads to faster patient recovery, shorter hospital stays, and a lower burden on healthcare resources. The driving factors behind market expansion include the rising global incidence of chronic diseases requiring surgical intervention, particularly cancer, the growing preference for minimally invasive surgical approaches, continuous technological advancements in imaging agents and hardware, and the increasing awareness among surgeons and healthcare providers about the clinical advantages offered by fluorescence guidance. Additionally, favorable reimbursement policies in developed economies and a robust pipeline of novel fluorescent dyes are set to further accelerate market growth.

Fluorescence Guided Surgery Systems Market Executive Summary

The Fluorescence Guided Surgery Systems Market is undergoing significant transformation, driven by a confluence of technological advancements, evolving surgical practices, and an increasing focus on enhancing patient safety and outcomes. Business trends indicate a strong push towards miniaturization and integration of FGS capabilities into existing robotic and laparoscopic platforms, broadening their applicability and ease of use in diverse surgical environments. Strategic partnerships between imaging system developers and pharmaceutical companies producing fluorescent agents are becoming common, aiming to create comprehensive solutions that offer superior specificity and sensitivity. The market also observes a rising emphasis on product innovation, with companies investing heavily in R&D to develop multi-modal imaging systems, which combine fluorescence with other imaging modalities, and to introduce AI-powered image analysis for real-time decision support. Furthermore, the expansion of direct sales channels alongside collaborations with group purchasing organizations reflects a concerted effort to enhance market penetration and accessibility for healthcare providers globally.

Regionally, North America continues to dominate the FGS market, primarily due to its advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and significant R&D investments by key market players. The robust presence of major medical device manufacturers and fluorescent dye producers, coupled with supportive reimbursement policies, underpins this leadership. Europe also holds a substantial market share, fueled by a strong focus on clinical research, an aging population driving demand for complex surgeries, and increasing awareness of FGS benefits among healthcare professionals. Meanwhile, the Asia Pacific region is emerging as the fastest-growing market, propelled by rapidly improving healthcare facilities, a burgeoning medical tourism sector, increasing healthcare expenditure, and a large patient pool. Countries like Japan, China, and India are becoming key growth engines, witnessing rising adoption of advanced surgical techniques and an expanding base of skilled surgeons. Latin America and the Middle East & Africa regions are experiencing nascent growth, driven by government initiatives to modernize healthcare and increasing foreign investments in medical infrastructure.

From a segmentation perspective, the market is primarily categorized by product, application, and end-user. The systems segment, comprising the imaging consoles, cameras, and light sources, holds a significant share due to the capital-intensive nature of these devices. However, the consumables segment, which includes fluorescent dyes and disposables, is projected to exhibit a higher growth rate owing to their recurring purchase cycle. In terms of application, oncology remains the largest segment, with FGS being increasingly vital for precise tumor margin assessment and sentinel lymph node detection across various cancer types. The increasing use in cardiovascular, gastrointestinal, and reconstructive surgeries also contributes significantly to market growth. Among end-users, hospitals represent the largest segment, given their extensive infrastructure and volume of complex surgical procedures. Nevertheless, ambulatory surgical centers (ASCs) are poised for rapid growth due driven by the shift towards outpatient surgeries and cost-efficiency considerations. The overall trend indicates a market characterized by continuous innovation, strategic collaborations, and a global expansion into diverse clinical settings, underscoring its pivotal role in modern surgical practice.

AI Impact Analysis on Fluorescence Guided Surgery Systems Market

The integration of Artificial intelligence (AI) into Fluorescence Guided Surgery (FGS) systems is eliciting considerable user interest and driving profound transformations within the market. Common user questions frequently revolve around how AI can enhance the precision and efficacy of FGS, specifically concerning its capability to differentiate between healthy and diseased tissue with greater accuracy, interpret complex imaging data in real-time, and automate certain aspects of surgical planning or execution. Users are keen to understand if AI can overcome current limitations, such as the need for subjective interpretation of fluorescence signals, the potential for non-specific dye uptake, and the challenges in standardizing image analysis across different procedures and patient populations. There is also significant anticipation regarding AI's potential to improve surgical workflows, reduce cognitive load on surgeons, and ultimately lead to superior patient outcomes by providing more objective and data-driven insights during critical intraoperative moments. Concerns often touch upon data privacy, the validation of AI algorithms in diverse clinical scenarios, regulatory pathways for AI-enabled devices, and the necessary training for surgical teams to effectively leverage these advanced capabilities.

The prevailing themes emerging from these inquiries highlight a strong expectation that AI will unlock new levels of diagnostic and therapeutic precision within FGS. Users envision AI algorithms being able to analyze subtle patterns in fluorescence intensity and distribution that might be missed by the human eye, thereby improving the sensitivity and specificity of tumor detection or critical structure identification. There is a clear desire for AI to provide predictive analytics, estimating, for instance, the likelihood of positive surgical margins or potential complications based on intraoperative fluorescence data combined with pre-operative imaging and patient history. This move towards intelligent real-time guidance is seen as crucial for minimizing re-operation rates and enhancing the safety of complex procedures. The integration of AI is also expected to facilitate the development of more personalized surgical approaches, where algorithms adapt to individual patient anatomies and pathologies, offering tailored recommendations for dye dosage, illumination parameters, and surgical trajectory.

Beyond intraoperative guidance, users are increasingly interested in AI's role in the broader FGS ecosystem, including pre-operative planning and post-operative assessment. For instance, AI could assist in analyzing pre-operative imaging to better predict the optimal use of fluorescent agents or in post-operative analysis to quantitatively assess surgical completeness and tissue perfusion, providing objective metrics for clinical decision-making and research. The expectation is that AI will move FGS from a purely visualization tool to a powerful diagnostic and predictive platform, offering comprehensive support throughout the surgical journey. The convergence of advanced imaging, sophisticated fluorescent probes, and intelligent AI algorithms is seen as the next frontier for FGS, promising to redefine surgical standards by making procedures safer, more efficient, and more effective. Addressing user expectations will involve robust clinical validation, transparent algorithm development, and comprehensive educational programs to ensure seamless integration and widespread adoption of AI-enhanced FGS systems in clinical practice.

- Enhanced image analysis for superior tissue differentiation and margin assessment.

- Real-time quantitative fluorescence data interpretation, reducing subjective bias.

- Predictive analytics for surgical outcomes and complication risk assessment.

- Automated anomaly detection and critical structure identification during surgery.

- Integration with robotic surgical platforms for autonomous or semi-autonomous guidance.

- Personalized surgical planning based on pre-operative and intraoperative data fusion.

- Optimization of fluorescent dye dosage and administration protocols.

- Improved surgeon training and performance feedback through AI-driven analytics.

- Development of smart alerts and decision support systems to prevent surgical errors.

DRO & Impact Forces Of Fluorescence Guided Surgery Systems Market

The Fluorescence Guided Surgery (FGS) Systems market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the core impact forces influencing its trajectory. A primary driver is the accelerating global prevalence of chronic diseases, particularly various forms of cancer, which necessitate surgical intervention for diagnosis and treatment. FGS offers a distinct advantage in oncological surgery by providing real-time visualization of tumor margins, thereby increasing the likelihood of complete resection and reducing recurrence rates. This clinical superiority, coupled with the rising demand for minimally invasive surgical procedures that FGS readily supports, fuels its adoption. Furthermore, continuous advancements in imaging technology, including the development of more sensitive cameras, brighter light sources, and more specific fluorescent agents, enhance the efficacy and applicability of these systems. Increased healthcare expenditure worldwide, especially in developed economies, and growing awareness among surgeons about the tangible benefits of FGS in improving patient outcomes also serve as robust market accelerators, encouraging investment in and adoption of these sophisticated tools across various surgical disciplines.

Despite the compelling advantages, the FGS market faces several notable restraints that could temper its growth. The high initial capital cost associated with FGS systems, including the imaging console, specialized cameras, and integration modules, poses a significant barrier to adoption for smaller hospitals and healthcare facilities with budget constraints. This is particularly pronounced in developing regions where healthcare infrastructure might be less robust. Furthermore, the stringent regulatory approval processes for both FGS devices and novel fluorescent agents can prolong market entry and increase R&D costs, thereby impacting product innovation timelines. Another critical restraint is the limited availability of skilled professionals proficient in operating and interpreting FGS data; comprehensive training is often required for surgeons and support staff, representing an additional investment. The current reliance on specific fluorescent dyes, some of which may have limitations regarding specificity or depth of penetration, also presents a challenge that the market continually strives to overcome, as broader applicability hinges on the development of versatile and highly selective agents.

Conversely, the FGS market is replete with significant opportunities that promise to unlock substantial future growth. The expansion into emerging economies, characterized by rapidly developing healthcare infrastructure, increasing disposable incomes, and a growing burden of chronic diseases, represents a vast untapped market. These regions are increasingly investing in advanced medical technologies to improve healthcare standards. Another key opportunity lies in the ongoing development of multimodal imaging systems that integrate fluorescence with other imaging modalities like ultrasound, MRI, or CT, offering a more comprehensive intraoperative view and potentially expanding FGS applications. The burgeoning field of artificial intelligence (AI) and machine learning (ML) presents a transformative opportunity, enabling automated image analysis, predictive modeling for surgical outcomes, and enhanced real-time guidance, which can elevate the precision and efficiency of FGS to unprecedented levels. Furthermore, the continuous discovery and commercialization of novel fluorescent probes with enhanced specificity, improved pharmacokinetics, and broader indications beyond oncology are expected to significantly broaden the clinical utility of FGS, extending its reach into new surgical specialties and complex procedures, thereby solidifying its position as an indispensable tool in modern surgical practice.

Segmentation Analysis

The Fluorescence Guided Surgery Systems market is meticulously segmented to provide a granular understanding of its diverse components, offerings, and end-user applications. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, competitive landscapes, and evolving demands across different product types, surgical procedures, and healthcare settings. The market is primarily divided by Product (Systems and Consumables), by Application (Oncology, Cardiovascular Surgery, Gastrointestinal Surgery, Plastic & Reconstructive Surgery, and Others), and by End-User (Hospitals, Ambulatory Surgical Centers, and Academic & Research Institutions). Each segment reflects unique market dynamics, adoption patterns, and technological requirements, contributing to the overall complexity and growth potential of the FGS ecosystem. Understanding these distinctions is crucial for manufacturers, healthcare providers, and investors alike to strategically navigate and capitalize on the market's opportunities and challenges, while catering to the specific needs of varied clinical environments and patient populations with tailored solutions.

The segmentation by Product differentiates between the capital equipment, referred to as 'Systems,' which includes the core imaging consoles, specialized cameras, light sources, and associated hardware, and the 'Consumables,' primarily encompassing the various fluorescent dyes and disposables used in each procedure. While systems represent a significant upfront investment, consumables drive recurring revenue streams. The Application segmentation highlights the diverse surgical fields benefiting from FGS, with oncology being the dominant segment due to the critical need for precise tumor margin assessment across numerous cancer types. However, the expanding utility in areas like cardiovascular surgery for perfusion assessment and gastrointestinal surgery for anastomotic leak detection underscores the versatility of FGS technology. Lastly, the End-User segmentation categorizes the primary healthcare facilities adopting these systems, with hospitals being the largest segment dueable to their capacity for complex procedures and comprehensive patient care, while ambulatory surgical centers are increasingly adopting FGS for outpatient surgeries, driven by efficiency and cost-effectiveness considerations.

- By Product

- Systems

- Consumables (Fluorescent Dyes, Disposables)

- By Application

- Oncology

- Breast Cancer Surgery

- Colorectal Cancer Surgery

- Lung Cancer Surgery

- Brain Tumor Surgery

- Head and Neck Cancer Surgery

- Other Oncology Applications

- Cardiovascular Surgery

- Gastrointestinal Surgery

- Plastic & Reconstructive Surgery

- Other Applications (e.g., Urology, Gynecology, Lymphatic Imaging)

- Oncology

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Institutions

Value Chain Analysis For Fluorescence Guided Surgery Systems Market

The value chain for the Fluorescence Guided Surgery (FGS) Systems Market is a multifaceted and interconnected network, beginning with upstream activities focused on research and development, progressing through manufacturing and distribution, and culminating in downstream processes of sales, post-sale support, and end-user adoption. Upstream analysis involves critical activities such as the discovery and synthesis of novel fluorescent dyes, development of advanced imaging sensors and optical components, and the creation of sophisticated software algorithms for image processing and analysis. Key players in this stage often include specialized chemical companies, biotechnology firms, and optics manufacturers, alongside academic institutions engaged in basic research. The quality and specificity of fluorescent agents are paramount, requiring extensive preclinical and clinical trials to ensure safety and efficacy. Similarly, the performance of the imaging hardware, including resolution, sensitivity, and real-time capabilities, is dependent on cutting-edge engineering and materials science, where precision component suppliers play a crucial role, often involving highly specialized R&D to meet the rigorous demands of surgical environments.

Moving downstream, the value chain encompasses the manufacturing and assembly of the complete FGS systems, integrating all components into functional and user-friendly devices. This stage often involves complex manufacturing processes, strict quality control measures, and adherence to medical device regulations (e.g., FDA, CE Mark). Once manufactured, these systems are disseminated through various distribution channels to reach end-users. Direct distribution channels involve manufacturers selling directly to hospitals and surgical centers, often accompanied by dedicated sales teams that provide product demonstrations, training, and ongoing technical support. This approach allows for closer customer relationships and direct feedback. Indirect distribution channels, on the other hand, utilize third-party distributors, wholesalers, and medical equipment suppliers who have established networks and market penetration in specific regions or healthcare segments. These intermediaries facilitate logistics, warehousing, and local market access, especially in geographically dispersed or emerging markets, often leveraging their existing relationships with healthcare providers. The choice between direct and indirect channels often depends on market maturity, geographical reach, and strategic priorities of the manufacturers.

The final stages of the value chain focus on installation, training, and post-sale services, which are critical for successful adoption and sustained usage of FGS systems. Comprehensive training programs for surgeons, nurses, and technicians are essential to ensure the safe and effective operation of the complex equipment and interpretation of fluorescence images. Technical support, maintenance, and regular software updates are also vital to ensure system longevity and optimal performance. Furthermore, clinical education and evidence generation through collaborations with key opinion leaders and academic centers are integral to driving broader acceptance and establishing best practices. The efficacy of the entire value chain hinges on seamless coordination among all participants, from raw material suppliers to end-users, ensuring that high-quality, clinically valuable FGS solutions are delivered efficiently and supported effectively throughout their lifecycle. Ultimately, the successful delivery of advanced FGS systems depends on robust innovation at the upstream level, efficient production and distribution downstream, and unwavering commitment to customer support and clinical education. This integrated approach ensures that the transformative potential of fluorescence-guided surgery is fully realized for improved patient care.

Fluorescence Guided Surgery Systems Market Potential Customers

The potential customers for Fluorescence Guided Surgery (FGS) Systems are primarily concentrated within the professional healthcare sector, encompassing a broad range of medical institutions and specialists who perform surgical procedures requiring enhanced visualization and precision. Hospitals, particularly large tertiary and quaternary care facilities, represent the largest and most significant segment of end-users. These institutions often have specialized surgical departments (e.g., oncology, cardiology, gastroenterology, plastic surgery), substantial patient volumes, and the financial capacity to invest in advanced medical technologies. Within hospitals, the primary buyers or decision-makers include heads of surgical departments, chief medical officers, procurement committees, and hospital administrators who evaluate the clinical benefits, cost-effectiveness, and integration capabilities of FGS systems into existing surgical workflows. The imperative for these hospitals to offer state-of-the-art care, reduce re-operation rates, improve patient outcomes, and maintain a competitive edge drives their interest in adopting FGS technology across multiple surgical disciplines, making them central to market demand.

Beyond traditional hospital settings, Ambulatory Surgical Centers (ASCs) are rapidly emerging as a crucial and growing segment of potential customers for FGS systems. ASCs specialize in outpatient surgical procedures, driven by factors such as lower costs, increased patient convenience, and a focus on efficiency. As FGS technology becomes more compact, integrated, and cost-efficient for less complex procedures, its adoption in ASCs for surgeries such as breast lumpectomies, sentinel lymph node biopsies, and certain reconstructive procedures is gaining momentum. The decision-makers in ASCs are typically owner-physicians, facility administrators, and clinical directors who prioritize technologies that enhance surgical precision while aligning with the center's operational model of high throughput and cost containment. The ability of FGS to reduce intraoperative complications and potentially shorten recovery times, thereby facilitating faster patient discharge, makes it an attractive investment for these specialized outpatient facilities, supporting the broader trend of shifting surgeries from inpatient to outpatient settings.

Furthermore, Academic & Research Institutions constitute another vital segment of potential customers, serving as centers for clinical innovation, medical education, and evidence-based practice. These institutions not only integrate FGS systems into their surgical training programs to educate future generations of surgeons but also utilize them extensively for preclinical and clinical research aimed at exploring new applications, developing novel fluorescent probes, and advancing the fundamental understanding of fluorescence imaging in vivo. Researchers, principal investigators, and university hospital surgical department heads are key decision-makers in this segment, driven by the pursuit of scientific discovery, the need for advanced tools to support groundbreaking studies, and the mandate to publish findings that shape future medical practice. Their adoption of FGS systems often influences broader market acceptance and drives the development of next-generation technologies. Together, these diverse end-user groups form the robust customer base driving the sustained growth and technological evolution within the Fluorescence Guided Surgery Systems market, each with distinct motivations and procurement processes, but united by the common goal of enhancing surgical precision and patient care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 650 Million |

| Market Forecast in 2032 | USD 1350 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Medtronic Plc, Intuitive Surgical Inc., Siemens Healthineers AG, Olympus Corporation, KARL STORZ SE & Co. KG, Hamamatsu Photonics K.K., PerkinElmer Inc., FUJIFILM Corporation, LI-COR Biosciences, Carl Zeiss Meditec AG, B. Braun Melsungen AG, Richard Wolf GmbH, Da Vinci Medical Inc., Johnson & Johnson (through acquired entities). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorescence Guided Surgery Systems Market Key Technology Landscape

The key technology landscape of the Fluorescence Guided Surgery Systems market is characterized by rapid innovation across several interdependent domains, including advanced imaging hardware, sophisticated fluorescent agents, and intelligent software platforms. At the core are the near-infrared (NIR) imaging systems, which typically consist of a high-resolution camera, a specialized light source (e.g., LED or laser) for exciting the fluorescent dyes, and a display monitor for real-time visualization. Modern systems are increasingly integrated into existing surgical platforms, such as laparoscopic towers and robotic surgical systems, providing seamless workflow integration. Technological advancements focus on improving image quality, sensitivity, and depth of penetration, enabling surgeons to visualize structures more clearly and from greater tissue depths. Miniaturization of cameras and light sources, along with the development of flexible endoscopes with FGS capabilities, further expand the applicability of these systems in various minimally invasive procedures, enhancing maneuverability and access to difficult-to-reach anatomical areas, thus driving precision in complex surgeries.

Parallel to hardware evolution, significant progress is being made in the development of fluorescent contrast agents, which are foundational to FGS efficacy. Indocyanine green (ICG) remains the most widely used FDA-approved dye, but ongoing research is yielding a new generation of targeted fluorescent probes. These novel agents are designed with enhanced specificity, accumulating more selectively in diseased tissues (e.g., specific cancer cells) or binding to particular cellular receptors, thereby improving the contrast between target and healthy tissues. Beyond diagnostic applications, there's a growing focus on therapeutic fluorescent agents that can guide drug delivery or photodynamic therapy. Furthermore, the development of activatable probes, which become fluorescent only in the presence of specific enzymatic activity or pH changes associated with pathology, offers unprecedented precision. The ability to image multiple fluorophores simultaneously (multi-spectral imaging) is also a key area of development, allowing for the concurrent visualization of different tissue types or biological processes, providing a more comprehensive intraoperative picture, leading to more informed surgical decisions.

The integration of advanced software and computational capabilities forms another critical pillar of the FGS technology landscape. This includes sophisticated image processing algorithms that enhance signal-to-noise ratio, correct for tissue autofluorescence, and provide quantitative analysis of fluorescence intensity. Real-time image fusion, which overlays fluorescence data onto white-light or pre-operative imaging (CT/MRI), offers surgeons a more complete and contextualized view of the surgical field. Increasingly, artificial intelligence (AI) and machine learning (ML) are being incorporated to automate image interpretation, detect subtle anomalies, provide predictive insights (e.g., likelihood of positive margins), and even offer augmented reality guidance during surgery. These AI-powered tools aim to reduce human error, streamline decision-making, and personalize surgical approaches based on individual patient data. The convergence of these technological advancements—from high-performance imaging hardware and highly specific fluorescent agents to intelligent software and AI—is continuously expanding the capabilities and clinical utility of Fluorescence Guided Surgery, solidifying its role as an indispensable tool for achieving greater surgical precision and improved patient outcomes.

Regional Highlights

- North America: This region holds the largest market share, driven by its well-established healthcare infrastructure, high adoption rate of advanced surgical technologies, significant R&D investments by key players, and favorable reimbursement policies. The presence of major medical device manufacturers and a high prevalence of chronic diseases also contribute to its dominance.

- Europe: Europe represents a substantial market, characterized by strong government support for healthcare innovation, a growing elderly population requiring frequent surgeries, and increasing awareness among surgeons regarding the benefits of FGS. Countries like Germany, the UK, and France are leading contributors to market growth due to their robust healthcare systems and research activities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic development, improving healthcare infrastructure, rising healthcare expenditure, and a large patient pool. Emerging economies such as China, India, and Japan are investing heavily in modernizing their surgical facilities and adopting advanced medical technologies, driving significant market expansion.

- Latin America: This region is experiencing nascent growth, primarily driven by increasing healthcare awareness, improving access to medical services, and government initiatives aimed at upgrading healthcare facilities. Economic stability and increasing foreign investment in healthcare infrastructure are gradually paving the way for FGS adoption.

- Middle East and Africa (MEA): The MEA market is still in its early stages but shows promising growth potential. Factors contributing to this growth include increasing healthcare spending, a rise in medical tourism, and a growing recognition of the need for advanced surgical techniques to address the region's disease burden. Strategic collaborations and investments are key to its future development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorescence Guided Surgery Systems Market.- Stryker Corporation

- Medtronic Plc

- Intuitive Surgical Inc.

- Siemens Healthineers AG

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Hamamatsu Photonics K.K.

- PerkinElmer Inc.

- FUJIFILM Corporation

- LI-COR Biosciences

- Carl Zeiss Meditec AG

- B. Braun Melsungen AG

- Richard Wolf GmbH

- Da Vinci Medical Inc.

- Johnson & Johnson (through acquired entities)

- C. R. Bard, Inc. (now part of BD)

- Mizuho OSI Inc.

- Leica Microsystems (part of Danaher Corporation)

- Nipro Corporation

- Verathon Inc.

Frequently Asked Questions

Analyze common user questions about the Fluorescence Guided Surgery Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fluorescence Guided Surgery (FGS) and how does it benefit patients?

Fluorescence Guided Surgery (FGS) is a medical imaging technique that uses fluorescent dyes and specialized cameras to provide surgeons with real-time, high-contrast visualization of tissues during an operation. It highlights structures like tumors, blood vessels, or lymphatic nodes that are otherwise difficult to see, leading to more precise resections, reduced damage to healthy tissue, and improved patient outcomes by minimizing complications and recurrence rates.

What are the primary applications of FGS systems in modern surgery?

The primary applications of FGS systems are extensive, with oncology being the leading area for precise tumor margin assessment in cancers like breast, colorectal, and lung. Beyond oncology, FGS is widely used in cardiovascular surgery for perfusion assessment, gastrointestinal surgery for anastomotic leak detection, plastic and reconstructive surgery for flap viability, and lymph node mapping across various procedures.

What are the key technological components of an FGS system?

A typical FGS system comprises a specialized near-infrared (NIR) camera system, a high-intensity light source (LED or laser) to excite the fluorescent dyes, and a monitor for real-time image display. These systems often integrate with existing surgical platforms, such as laparoscopic or robotic systems, and rely on specific fluorescent contrast agents, like ICG, for visualizing target tissues effectively.

How is Artificial Intelligence (AI) impacting the future of FGS?

AI is profoundly impacting FGS by enhancing image analysis, enabling more accurate tissue differentiation, and providing real-time quantitative data interpretation. AI algorithms can help in predicting surgical outcomes, automating anomaly detection, and offering personalized guidance, thereby augmenting surgical precision, reducing subjective interpretation, and expanding the capabilities of FGS systems.

What challenges does the FGS market currently face?

The FGS market faces challenges such as the high initial capital cost of acquiring these advanced systems, which can limit adoption in smaller healthcare facilities. Other restraints include stringent regulatory approval processes for new devices and fluorescent agents, the need for specialized training for surgical teams, and ongoing efforts to develop fluorescent dyes with greater specificity and depth penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager