Foam Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430062 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Foam Packaging Market Size

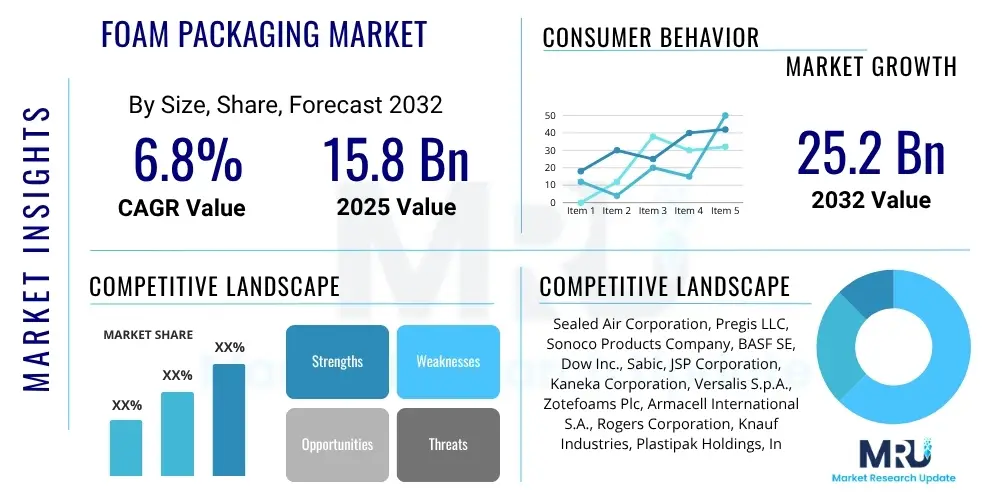

The Foam Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 15.8 billion in 2025 and is projected to reach USD 25.2 billion by the end of the forecast period in 2032.

Foam Packaging Market introduction

The foam packaging market encompasses a wide array of packaging solutions utilizing various foam materials, primarily designed for protective, insulating, and void-filling applications across numerous industries. These materials, including Expanded Polystyrene (EPS), Polyurethane (PU), Polyethylene (PE), and Polypropylene (PP) foams, are critical for safeguarding products during transit and storage due to their excellent cushioning properties, lightweight nature, and thermal insulation capabilities. The versatility of foam packaging allows for custom-molded designs that precisely fit products, offering superior protection against shock, vibration, and temperature fluctuations, which is particularly vital for fragile or sensitive goods.

Major applications for foam packaging span across the electronics, automotive, food and beverage, pharmaceutical, and consumer goods sectors. In electronics, it protects delicate components and finished products from impact, while in automotive, it cushions parts and contributes to lightweighting initiatives. For food and pharmaceuticals, foam packaging provides thermal insulation and barrier properties essential for maintaining product integrity and safety. The inherent benefits of foam packaging, such as its cost-effectiveness, high strength-to-weight ratio, and ability to be recycled in certain forms, make it a preferred choice for companies seeking reliable and efficient packaging solutions.

The market's growth is primarily driven by the exponential expansion of e-commerce, which necessitates robust and protective packaging for diverse products shipped globally. Additionally, increasing industrial output, growing demand for consumer electronics, and stringent regulations concerning product safety and integrity further fuel the adoption of foam packaging. The lightweight nature of foam also contributes to reduced shipping costs and fuel consumption, aligning with broader sustainability goals and operational efficiencies across supply chains.

Foam Packaging Market Executive Summary

The foam packaging market is experiencing significant evolution driven by shifts in consumer behavior, technological advancements, and a heightened focus on sustainability. Key business trends indicate a growing preference for customized and lightweight foam solutions that offer superior protection while minimizing material usage and environmental impact. Companies are increasingly investing in research and development to create innovative foam types, including bio-based and recycled content foams, to address environmental concerns and comply with evolving regulatory landscapes. Automation in foam production and packaging processes is also gaining traction, enhancing efficiency and reducing labor costs across the value chain, thereby influencing market dynamics and competitive strategies.

Regional trends highlight the Asia Pacific (APAC) region as a dominant and rapidly growing market, primarily due to expanding manufacturing bases, increasing disposable incomes, and the flourishing e-commerce sector in countries like China and India. North America and Europe, while mature markets, are witnessing a strong emphasis on sustainable packaging practices, driving innovation towards recyclable and biodegradable foam solutions. Latin America and the Middle East & Africa are emerging markets, showing consistent growth propelled by industrialization and infrastructural development, leading to increased demand for protective packaging in various end-use industries. These regional disparities create diverse opportunities and challenges for market players, necessitating tailored approaches to product development and market penetration.

In terms of segmentation, the market is seeing notable trends across material types and end-use industries. Polyethylene (PE) and Polyurethane (PU) foams continue to hold substantial shares due to their excellent cushioning and insulating properties, respectively. However, there is a rising interest in Expanded Polystyrene (EPS) alternatives and newer, more sustainable foam materials. The electronics and automotive industries remain pivotal end-users, driving demand for high-performance protective foam. Simultaneously, the food and beverage sector is increasingly adopting foam packaging for its thermal insulation benefits, particularly for perishable goods. The shift towards lightweight and eco-friendly solutions across all segments underscores a collective industry effort to balance performance with environmental responsibility.

AI Impact Analysis on Foam Packaging Market

User inquiries about AI's impact on the foam packaging market frequently revolve around themes of efficiency, customization, material innovation, and supply chain optimization. Common concerns include how AI can reduce waste, predict demand more accurately, and enable the creation of highly specialized packaging designs. Users are also interested in AI's role in enhancing sustainability efforts, from optimizing recycling processes to developing novel, eco-friendly foam materials. Expectations are high for AI to streamline operations, reduce costs, and ultimately deliver more effective and sustainable packaging solutions across the industry.

- AI-powered demand forecasting leading to optimized inventory management and reduced overproduction of packaging materials.

- Automated design optimization, allowing for rapid prototyping of foam packaging that minimizes material usage while maximizing protection.

- Enhanced quality control through AI-driven inspection systems, identifying defects in foam production with higher accuracy and speed.

- Predictive maintenance for foam manufacturing machinery, reducing downtime and increasing operational efficiency.

- Intelligent routing and logistics optimization in the supply chain, lowering transportation costs and environmental impact.

- Development of smart packaging solutions integrating AI for real-time tracking, temperature monitoring, and product integrity verification.

- AI-assisted material science research to accelerate the discovery and formulation of new bio-based or recyclable foam polymers.

DRO & Impact Forces Of Foam Packaging Market

The foam packaging market is propelled by several significant drivers, notably the robust expansion of the e-commerce sector globally, which necessitates protective and lightweight packaging for a vast array of goods. The increasing demand for electronics, automotive components, and pharmaceuticals, all requiring specialized cushioning and insulation, further fuels market growth. Additionally, the growing awareness regarding product damage prevention during transit, coupled with the need for enhanced food safety and extended shelf life for perishable goods, continues to drive the adoption of foam packaging solutions. The inherent benefits of foam, such as its versatility, cost-effectiveness, and excellent protective properties, cement its position as a critical component in modern supply chains.

Despite strong drivers, the market faces notable restraints, primarily stemming from environmental concerns associated with the non-biodegradable nature of conventional plastic foams. This leads to increasing regulatory pressure and a negative public perception, pushing industries towards more sustainable alternatives. Raw material price volatility, particularly for petrochemical derivatives, also poses a significant challenge, impacting manufacturing costs and profit margins for foam producers. Furthermore, the complexities and costs associated with establishing efficient recycling infrastructure for various foam types can hinder broader adoption and sustainable practices, thereby restraining market expansion in certain regions.

Opportunities within the foam packaging market are largely centered on innovation and sustainability. The development of bio-based, biodegradable, and recyclable foam materials presents a lucrative avenue for growth, aligning with global environmental objectives and consumer preferences. The integration of smart packaging technologies, such as sensors for temperature and shock monitoring, offers enhanced value propositions for sensitive goods. Moreover, the trend towards lightweighting in packaging across industries, coupled with the rising industrialization and urbanization in emerging economies, creates substantial opportunities for manufacturers to expand their product portfolios and geographical reach. The shift towards a circular economy model encourages investment in advanced recycling technologies and closed-loop systems for foam packaging materials, opening new markets and revenue streams.

Segmentation Analysis

The foam packaging market is comprehensively segmented based on various factors, including material type, product type, end-use industry, and function, providing a granular view of market dynamics and opportunities. This segmentation helps in understanding the diverse applications and demands across different sectors, allowing manufacturers to tailor their product offerings and strategies effectively. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory environments, and evolving consumer needs. Analyzing these segments is crucial for stakeholders to identify key market niches, assess competitive landscapes, and formulate informed business decisions in the dynamic foam packaging industry.

- By Material Type

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Polyurethane (PU) Foam

- Polyethylene (PE) Foam

- Polypropylene (PP) Foam

- Others (e.g., PVC foam, natural foams)

- By Product Type

- Flexible Foam

- Rigid Foam

- By End-Use Industry

- Food and Beverage

- Pharmaceuticals

- Electronics

- Automotive

- Consumer Goods

- Industrial

- Others (e.g., Building & Construction, Textiles)

- By Function

- Cushioning

- Void Fill

- Insulation

- Surface Protection

- Blocking and Bracing

Value Chain Analysis For Foam Packaging Market

The value chain for the foam packaging market begins with the upstream suppliers of raw materials, primarily petrochemical companies that provide polymers such as polystyrene, polyurethane precursors, polyethylene, and polypropylene. These raw materials undergo polymerization and are then supplied to foam manufacturers. The quality and cost of these primary inputs significantly influence the final product's performance and pricing, establishing a critical dependency on the petrochemical industry. Technological advancements in polymer science also emerge at this stage, influencing the development of new foam properties like enhanced strength, flexibility, or biodegradability.

The manufacturing stage involves the conversion of raw polymers into various foam types through processes like extrusion, molding, and foaming. Foam producers often specialize in specific material types or product forms, creating a diverse landscape of suppliers. These manufacturers then either directly supply foam sheets, blocks, or custom-molded parts to end-users or pass them on to converters. Converters further process the foam into final packaging products, which may involve cutting, shaping, laminating, or assembling custom packaging solutions tailored to specific product requirements. This stage is crucial for value addition, where design and engineering expertise transform basic foam materials into protective and functional packaging.

The downstream segment of the value chain involves the distribution and ultimate consumption of foam packaging. Distribution channels can be direct, where foam manufacturers or converters supply directly to large end-user industries such as automotive or electronics original equipment manufacturers (OEMs). Alternatively, indirect channels involve third-party distributors, wholesalers, and packaging solution providers who cater to a wider range of smaller businesses or specialized packaging needs. End-users, including industries like food and beverage, pharmaceuticals, and e-commerce, integrate these foam packaging solutions into their product supply chains. Effective logistics and timely delivery are paramount in this stage to ensure product protection and market responsiveness, contributing significantly to customer satisfaction and loyalty.

Foam Packaging Market Potential Customers

The foam packaging market caters to a diverse range of end-user industries, each with distinct needs for product protection, insulation, and void fill. Key potential customers include manufacturers in the electronics sector, who rely heavily on foam packaging to safeguard delicate components and finished goods like smartphones, televisions, and computing devices from shock and vibration during transportation. The automotive industry is another significant customer, utilizing foam to protect sensitive parts, reduce vehicle weight, and for sound insulation, ensuring components reach assembly lines or consumers in pristine condition. These sectors demand high-performance, custom-molded foam solutions that meet stringent quality and safety standards.

The food and beverage industry represents a substantial customer base, particularly for thermally insulated foam packaging that preserves the freshness and quality of perishable items such as fresh produce, dairy products, and prepared meals. For pharmaceutical companies, foam packaging is essential for protecting temperature-sensitive drugs and fragile medical devices, ensuring compliance with strict regulatory requirements for temperature control and sterility during distribution. These customers prioritize materials that are safe for direct food or drug contact, offer reliable insulation, and often require specialized designs to accommodate unique product shapes and sizes, playing a critical role in public health and safety.

Furthermore, the booming e-commerce sector has created a massive demand for foam packaging across a broad spectrum of consumer goods, ranging from fragile home decor and glassware to toys and cosmetics. Online retailers require cost-effective, lightweight, and efficient packaging solutions that can withstand the rigors of parcel delivery and reduce shipping costs. Industrial manufacturers also constitute a vital customer segment, using foam for protecting heavy machinery parts, tools, and industrial equipment during storage and transport. These diverse end-users drive continuous innovation in foam packaging, pushing for solutions that offer enhanced protection, sustainability, and economic viability across a vast array of product categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 billion |

| Market Forecast in 2032 | USD 25.2 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sealed Air Corporation, Pregis LLC, Sonoco Products Company, BASF SE, Dow Inc., Sabic, JSP Corporation, Kaneka Corporation, Versalis S.p.A., Zotefoams Plc, Armacell International S.A., Rogers Corporation, Knauf Industries, Plastipak Holdings, Inc., Recticel NV, Synthos S.A., Covestro AG, Arkema S.A., Huntsman Corporation, Woodbridge Foam Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Foam Packaging Market Key Technology Landscape

The foam packaging market is continuously evolving with significant advancements in manufacturing technologies aimed at improving material performance, sustainability, and production efficiency. Core technologies include various foaming processes such as extrusion, injection molding, and bead molding, which enable the creation of foams with diverse densities, cell structures, and mechanical properties. Innovations in these processes focus on optimizing energy consumption, reducing waste, and enhancing the uniformity and integrity of the foam. For instance, advanced extrusion techniques allow for the production of thinner, yet equally protective, foam sheets, contributing to material reduction and lightweighting initiatives across the industry.

Material science is another critical technological frontier, driving the development of novel foam compositions. There is a strong emphasis on creating sustainable alternatives to conventional petroleum-based foams, including bio-based foams derived from renewable resources like starch, corn, or fungi. Furthermore, advancements in polymer recycling technologies are crucial for increasing the recyclability and recycled content of traditional plastic foams, aligning with circular economy principles. These innovations also extend to developing multi-layered foam structures or composite materials that combine different foam types or integrate other materials to achieve enhanced barrier properties, insulation, or impact resistance for specialized packaging applications.

Digitalization and automation are transforming the foam packaging landscape, from design to production. Computer-aided design (CAD) and simulation software enable highly precise and customized foam packaging solutions, optimizing material usage and protective efficacy before physical prototyping. Advanced robotics and automated production lines are being implemented to increase throughput, reduce labor costs, and improve consistency in foam cutting, shaping, and assembly. Furthermore, the integration of Industry 4.0 concepts, such as IoT sensors and data analytics, is providing real-time insights into manufacturing processes, enabling predictive maintenance and continuous process optimization. These technological advancements collectively contribute to more efficient, adaptable, and environmentally responsible foam packaging solutions.

Regional Highlights

- North America: This region represents a mature yet dynamic market for foam packaging, driven by robust e-commerce growth, significant presence of electronics and automotive industries, and increasing adoption of sustainable packaging solutions. Strict environmental regulations are pushing manufacturers towards innovative recyclable and bio-based foams.

- Europe: Characterized by a strong emphasis on sustainability and circular economy initiatives, Europe is a leader in developing eco-friendly foam packaging. The region's pharmaceutical and food and beverage sectors drive demand for high-performance insulating and protective foams, with a focus on closed-loop recycling systems.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, propelled by rapid industrialization, burgeoning manufacturing sectors in China, India, and Southeast Asia, and a massive expansion of e-commerce. Increasing disposable incomes and urbanization further boost demand for consumer goods packaging, fueling the growth of the foam packaging market.

- Latin America: This region exhibits steady growth, influenced by improving economic conditions, expanding retail infrastructure, and increasing foreign investment in manufacturing sectors. Demand for protective packaging in the food and beverage, and electronics industries is a key driver.

- Middle East and Africa (MEA): The MEA market is an emerging region with growing potential, primarily driven by industrial development, increasing construction activities, and rising demand for packaged food and consumer goods. Investments in logistics and supply chain infrastructure are also contributing to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Foam Packaging Market.- Sealed Air Corporation

- Pregis LLC

- Sonoco Products Company

- BASF SE

- Dow Inc.

- Sabic

- JSP Corporation

- Kaneka Corporation

- Versalis S.p.A.

- Zotefoams Plc

- Armacell International S.A.

- Rogers Corporation

- Knauf Industries

- Plastipak Holdings, Inc.

- Recticel NV

- Synthos S.A.

- Covestro AG

- Arkema S.A.

- Huntsman Corporation

- Woodbridge Foam Corporation

Frequently Asked Questions

What is foam packaging used for?

Foam packaging is primarily used for protecting products during shipping and storage, offering cushioning against impacts, filling voids, and providing thermal insulation. It is crucial for safeguarding fragile electronics, automotive parts, perishable foods, and pharmaceuticals.

What are the main types of foam used in packaging?

The main types include Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Polyurethane (PU) foam, Polyethylene (PE) foam, and Polypropylene (PP) foam, each offering distinct properties suited for various applications.

Is foam packaging sustainable or recyclable?

While traditional foam packaging like EPS can be challenging to recycle due to collection and processing complexities, advancements are leading to more recyclable options and the development of bio-based or biodegradable foams, improving its environmental profile.

Which industries are the largest consumers of foam packaging?

The electronics, automotive, food and beverage, pharmaceutical, and e-commerce industries are the largest consumers, driven by the need for robust product protection, thermal insulation, and efficient void fill solutions.

What are the future trends in the foam packaging market?

Future trends include a strong shift towards sustainable and eco-friendly foams (bio-based, recycled content), lightweighting solutions, integration of smart packaging technologies, and increased automation in manufacturing processes to enhance efficiency and customization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager