Food and Beverage Metal Cans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428567 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Food and Beverage Metal Cans Market Size

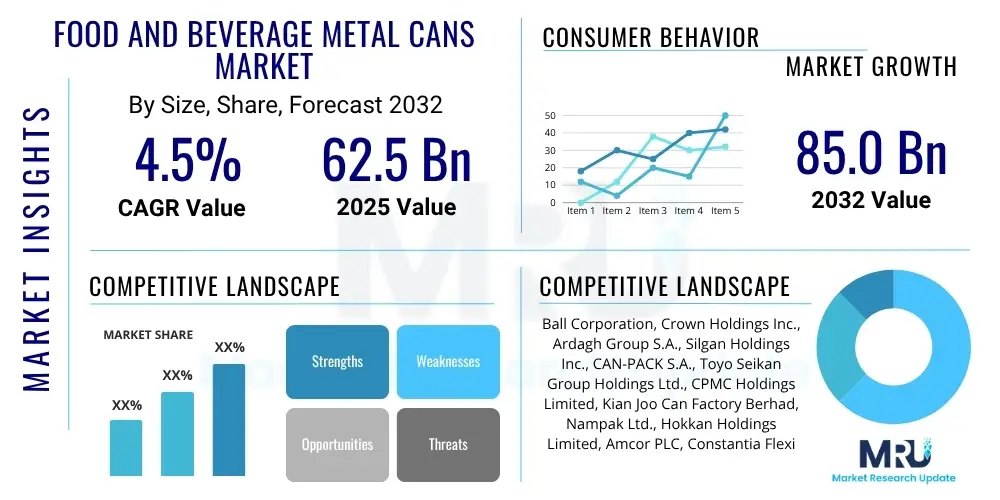

The Food and Beverage Metal Cans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2025 and 2032. The market is estimated at $62.5 Billion in 2025 and is projected to reach $85.0 Billion by the end of the forecast period in 2032.

Food and Beverage Metal Cans Market introduction

The Food and Beverage Metal Cans Market encompasses the global production, distribution, and consumption of rigid metal containers primarily fabricated from aluminum and steel. These robust packaging solutions are extensively utilized across the food and beverage industry for their unparalleled ability to preserve product integrity, extend shelf life, and ensure consumer safety. Metal cans offer an impervious barrier against light, oxygen, moisture, and external contaminants, making them ideal for a wide spectrum of perishable and non-perishable goods. Their inherent strength and resistance to extreme temperatures also facilitate effective sterilization processes, crucial for shelf-stable food products, while their lightweight properties contribute to cost efficiencies in logistics. The market is characterized by a mature yet innovative landscape, continually evolving to meet changing consumer demands and environmental imperatives, focusing on both material science and manufacturing process enhancements.

The product portfolio within this market is diverse, including two-piece cans, predominantly used for carbonated soft drinks, beer, and energy drinks, valued for their seamless construction and pressure resistance. Three-piece cans, on the other hand, are widely employed for various processed foods such as vegetables, fruits, meat, seafood, and soups, offering greater flexibility in size and shape. Major applications span across the entire spectrum of consumer packaged goods, addressing the needs of a global population increasingly reliant on convenient and safe food and beverage options. The benefits of metal cans extend beyond preservation to include excellent printability for branding and marketing, as well as superior portability and stackability, enhancing their appeal in modern retail environments and for on-the-go consumption. The distinctive metallic sheen also often conveys a perception of quality and premiumization, particularly in the beverage segment.

Driving factors for the Food and Beverage Metal Cans Market are multifaceted and deeply intertwined with global socio-economic and environmental shifts. A primary driver is the accelerating pace of urbanization worldwide, leading to busier lifestyles and a corresponding surge in demand for convenient, pre-packaged meals and ready-to-drink beverages. The growing global emphasis on sustainable packaging solutions is another pivotal factor, as metal cans boast an exceptionally high recycling rate and can be infinitely recycled without degradation of material quality, aligning perfectly with circular economy principles. Furthermore, stringent global food safety regulations necessitate packaging that provides optimal protection, a requirement metal cans inherently fulfill. Continuous technological advancements in can manufacturing, such as lightweighting techniques and innovative coating solutions, along with the expansion of organized retail chains and e-commerce platforms, further bolster market expansion and innovation.

Food and Beverage Metal Cans Market Executive Summary

The Food and Beverage Metal Cans Market is experiencing dynamic expansion, underpinned by significant business, regional, and segment-specific trends that collectively shape its trajectory. From a business perspective, the industry is heavily investing in research and development to enhance sustainability, primarily through advanced lightweighting technologies for both aluminum and steel cans, aiming to reduce material consumption and carbon footprint. Consolidation and strategic partnerships remain prevalent, as major players acquire smaller, specialized manufacturers or collaborate with technology providers to broaden their product portfolios and geographical reach, ensuring resilient supply chains and fostering innovation. There is also an increasing focus on operational efficiencies through automation and digitalization, driven by rising labor costs and the need for higher production speeds to meet escalating global demand.

Regional trends reveal a robust growth trajectory, particularly within the Asia Pacific region, fueled by burgeoning populations, rapid economic development, and increasing disposable incomes that translate into higher consumption of packaged food and beverages. Countries like China, India, and Southeast Asian nations are witnessing substantial investments in new can manufacturing facilities and modern retail infrastructure. While North America and Europe represent mature markets, they are characterized by strong innovation in premium and specialty packaging, a pronounced shift from plastic to aluminum in various beverage categories due to environmental concerns, and rigorous adherence to advanced recycling practices. Latin America and the Middle East and Africa also present burgeoning opportunities, driven by expanding beverage consumption and ongoing urbanization, though often with a focus on more standardized, cost-effective packaging solutions.

Segment-wise, the market sees continued dominance from the beverage can sector, especially for carbonated soft drinks, beer, and energy drinks, where portability, chilling efficiency, and brand visibility are paramount. The emergence of craft beverages, including craft beer, ciders, and ready-to-drink cocktails, has further propelled demand for highly customizable and aesthetically appealing aluminum cans. In the food segment, metal cans remain indispensable for processed fruits, vegetables, meat, and pet food, valued for their long shelf life and protective qualities, particularly for products requiring retort processing. A notable trend is the increasing adoption of BPA-non-intent (BPA-NI) and plant-based coatings across both food and beverage applications, responding to heightened consumer health awareness and evolving regulatory landscapes. This shift reflects a broader industry commitment to safer and more environmentally friendly packaging alternatives, differentiating products in a competitive market.

AI Impact Analysis on Food and Beverage Metal Cans Market

Common user questions regarding the influence of Artificial Intelligence on the Food and Beverage Metal Cans Market frequently center on its potential to revolutionize manufacturing processes, enhance product quality, and optimize supply chain operations. Users are keen to understand how AI can improve efficiency by enabling predictive maintenance for complex can-making machinery, thereby minimizing costly downtime and extending equipment lifespan. There is also significant curiosity about AI's role in advancing quality control, using machine vision and deep learning algorithms to detect minute defects at high speeds that might be imperceptible to the human eye, ensuring consistent product standards. Furthermore, inquiries often touch upon AI's capacity to facilitate more sustainable practices, such as intelligent energy management, waste reduction through process optimization, and even improving the efficiency of post-consumer recycling through advanced sorting technologies. The overarching expectation is that AI will usher in an era of smarter, more responsive, and environmentally conscious can production.

- AI-driven predictive maintenance algorithms analyze sensor data from can manufacturing equipment to forecast potential failures, significantly reducing unplanned downtime and optimizing maintenance schedules, leading to higher operational continuity.

- Advanced AI-powered vision systems are deployed for real-time, high-speed inspection of cans during production, identifying even microscopic defects in shape, coating, or print quality with unprecedented accuracy, thereby ensuring superior product integrity and reducing waste.

- AI optimizes supply chain management by leveraging machine learning for highly accurate demand forecasting, inventory management, and logistics planning, leading to reduced stockouts, minimized warehousing costs, and more efficient distribution networks.

- Process optimization through AI and machine learning algorithms allows for fine-tuning production parameters, such as material usage and energy consumption, resulting in significant reductions in raw material waste, energy expenditure, and overall operational costs.

- AI facilitates the development of innovative and customized packaging designs by analyzing consumer data and trends, enabling manufacturers to rapidly iterate on designs that resonate with target demographics and specific product requirements.

- Intelligent automation in manufacturing plants, powered by AI, enhances overall factory floor efficiency, reduces reliance on manual labor for repetitive tasks, and improves worker safety by automating hazardous processes.

- AI algorithms contribute to sustainable practices by analyzing waste streams and optimizing recycling processes, for instance, by improving the accuracy of sorting different metal types in recycling facilities, thus increasing the purity and value of recycled materials.

DRO & Impact Forces Of Food and Beverage Metal Cans Market

The Food and Beverage Metal Cans Market is influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that collectively shape its growth trajectory and competitive landscape. Primary drivers include the relentless global expansion of convenience food and ready-to-drink beverage consumption, fueled by accelerated urbanization, busier consumer lifestyles, and the increasing penetration of organized retail and e-commerce platforms. The inherent properties of metal cans—such as superior barrier protection against light, oxygen, and moisture—ensure extended product shelf life, making them indispensable for global distribution. Furthermore, the growing consumer and regulatory emphasis on sustainable packaging solutions strongly favors metal cans due to their infinite recyclability and high recycled content rates, aligning perfectly with burgeoning circular economy principles worldwide. Continuous innovation in can design and manufacturing technologies, including lightweighting and aesthetic enhancements, further stimulates market demand.

Despite these robust drivers, the market faces significant restraints. The pronounced volatility in raw material prices, particularly for aluminum and steel, poses a consistent challenge, directly impacting manufacturing costs and profitability. Geopolitical tensions and trade disputes can exacerbate these price fluctuations, creating an unpredictable supply environment. Intense competition from alternative packaging materials, such as PET plastic bottles, glass bottles, and flexible pouches, represents another substantial restraint. While metal cans offer distinct advantages, these alternatives often provide cost-effectiveness or specific functional benefits that appeal to certain market segments. Additionally, the capital-intensive nature of metal can manufacturing, requiring substantial upfront investment in advanced machinery and infrastructure, acts as a barrier to entry for new players and limits the agility of existing manufacturers to rapidly scale or diversify production lines in response to sudden market shifts.

Opportunities for growth within the Food and Beverage Metal Cans Market are abundant and diverse. Emerging economies across Asia Pacific, Latin America, and the Middle East and Africa present significant untapped potential, driven by rising disposable incomes, expanding middle-class populations, and developing retail infrastructures that increase access to packaged goods. The surging popularity of premium, craft, and functional beverages—including specialty coffees, energy drinks, and sparkling waters—offers lucrative avenues for customized, high-value metal can packaging that appeals to discerning consumers and supports brand differentiation. Moreover, advancements in printing technologies, such as digital printing, allow for greater design flexibility, personalized branding, and shorter production runs, catering to niche markets and promotional campaigns. The ongoing development of innovative can coatings, including BPA-non-intent (BPA-NI) and bio-based alternatives, also creates opportunities to meet evolving health and environmental standards, enhancing product safety and market acceptance.

Beyond the immediate drivers, restraints, and opportunities, several broader impact forces exert considerable influence. Increasingly stringent global environmental regulations, particularly concerning plastic waste and carbon emissions, are pushing the entire packaging industry towards more sustainable and recyclable options, a trend from which metal cans significantly benefit. Shifting consumer health preferences, such as a demand for "clean label" products and concerns about chemical migration from packaging, mandate continuous research and development into safer can linings. Furthermore, technological innovation, including advancements in automation, AI-driven analytics, and energy-efficient manufacturing processes, continues to redefine industry standards, driving operational efficiencies and fostering new product capabilities. The rise of e-commerce also impacts packaging design, emphasizing robust, lightweight, and stackable solutions that can withstand the rigors of direct-to-consumer shipping, further benefiting metal cans.

Segmentation Analysis

The Food and Beverage Metal Cans Market is intricately segmented across several critical dimensions, including material type, can type, primary application, and geographical region. This comprehensive segmentation is fundamental for stakeholders to gain a granular understanding of market dynamics, identify specific growth corridors, assess competitive intensities, and formulate targeted strategic initiatives. Each segment reveals distinct demand patterns, technological preferences, and regulatory influences, providing clarity on where specific investments and innovations yield the most impactful returns. The choice of material, for instance, significantly dictates the properties and recyclability of the can, while the application segment highlights the diverse end-user needs and consumption trends driving product development across the vast food and beverage landscape. Understanding these nuanced segments is paramount for strategic market positioning and maximizing growth opportunities.

- By Material

- Aluminum Cans: Highly favored, especially in the beverage industry, due to their exceptionally light weight, superior thermal conductivity for quick chilling, and impressive infinite recyclability, contributing significantly to reduced environmental impact.

- Steel Cans (Tinplate, Tin-free steel): Widely utilized for packaging processed food products like vegetables, fruits, soups, and pet food, owing to their robust strength, cost-effectiveness, and excellent suitability for retort sterilization processes which extend shelf life significantly.

- By Type

- 2-Piece Cans: Manufactured from a single piece of metal (typically aluminum) for the body and a separate end, these are prevalent for carbonated beverages due to their seamless construction, which enhances pressure resistance and print aesthetics.

- 3-Piece Cans: Consisting of three components—a cylindrical body and two ends (top and bottom)—these cans, often made from steel, offer greater versatility in terms of size and shape, making them ideal for a wide range of food products requiring varied capacities.

- By Application

- Beverages: This dominant segment includes a broad spectrum of drinks leveraging metal cans for their protective and branding capabilities.

- Carbonated Soft Drinks (CSD): A traditional and massive user of aluminum cans globally.

- Alcoholic Beverages: Encompasses beer, ciders, spirits, and ready-to-drink (RTD) cocktails, seeing strong growth especially in craft and premium segments.

- Juices and Nectars: Benefit from the light and oxygen barrier provided by metal cans.

- Energy Drinks and Sports Drinks: Rely on the robustness and portability of metal cans for active consumers.

- Bottled Water: A growing trend in aluminum cans for a sustainable alternative to plastic.

- Ready-to-Drink (RTD) Coffee and Tea: Expanding market seeking convenience and extended shelf life.

- Food: A substantial segment that values metal cans for their ability to preserve food quality over long periods.

- Processed Fruits and Vegetables: A traditional application, benefiting from retort processing capability.

- Meat and Seafood: Requires stringent preservation, fulfilled effectively by metal cans.

- Pet Food: Utilizes metal cans for convenience, portion control, and long-term freshness.

- Soups and Sauces: Metal cans are essential for these categories due to high-temperature processing needs.

- Dairy and Infant Formula: Specialized applications requiring high hygiene standards and airtight seals.

- Ready Meals and Convenience Foods: Meeting consumer demand for quick, easy-to-prepare options.

- Oils and Fats: Requires light and air protection to prevent spoilage.

- Beverages: This dominant segment includes a broad spectrum of drinks leveraging metal cans for their protective and branding capabilities.

- By End-User

- Beverage Industry

- Food Processing Industry

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Food and Beverage Metal Cans Market

The value chain for the Food and Beverage Metal Cans Market is a sophisticated network of interconnected stages, beginning with the critical upstream activities that lay the foundation for the entire production process. This initial phase involves the extraction and primary processing of raw materials, predominantly bauxite for aluminum production and iron ore for steel manufacturing. Major global mining companies and metal smelters transform these ores into ingots, sheets, or coils of aluminum and steel, which are then supplied to can manufacturers. Essential auxiliary materials, such as various types of coatings, lacquers, and inks for internal can protection and external branding, are sourced from specialized chemical and printing suppliers. The quality, availability, and cost fluctuations of these raw materials exert a profound influence on the pricing and sustainability of the final metal can products, making robust supply chain management at this stage absolutely critical for market stability.

The midstream segment of the value chain is where the actual transformation of raw metal into finished cans takes place. Can manufacturers operate highly automated and technologically advanced production facilities capable of immense output volumes. This complex process involves precision cutting of metal sheets, deep drawing and ironing for 2-piece cans, or rolling and welding for 3-piece can bodies, followed by flanging, seaming, cleaning, and drying. Advanced internal coatings are applied to prevent metal-product interaction and ensure food safety, while external decoration, often involving multi-color printing, is executed for branding and marketing appeal. Significant investments are continuously made in high-speed machinery, process automation, and quality control systems, frequently incorporating machine vision and AI, to maximize efficiency, reduce waste, and meet stringent industry standards. Innovation at this stage focuses on lightweighting, enhancing durability, and developing novel can designs that differentiate products in a competitive market.

The downstream segment of the value chain involves the distribution and ultimate utilization of the manufactured metal cans. Once produced, cans are transported to food and beverage filling and processing companies, which are the primary end-users. These companies perform critical operations such as product filling, sealing, sterilization (retort processing for food cans), and secondary packaging. The distribution channels are predominantly direct, with large can manufacturers establishing long-term supply contracts with major multinational food and beverage corporations. For smaller brands or specialized requirements, indirect channels involving distributors, brokers, or co-packing facilities play a crucial role in accessing can supplies. Effective logistics, including just-in-time delivery systems, are vital to minimize inventory costs and ensure a steady supply to high-volume fillers. Post-consumption, the value chain extends into municipal and private recycling infrastructure, where collection, sorting, and reprocessing of used metal cans close the loop, emphasizing the circularity and environmental benefits inherent to this packaging material.

Food and Beverage Metal Cans Market Potential Customers

The potential customers for the Food and Beverage Metal Cans Market are diverse and extensive, primarily comprising entities within the global beverage and food processing industries, ranging from global conglomerates to regional and craft producers. In the beverage sector, major multinational corporations such as The Coca-Cola Company, PepsiCo, Anheuser-Busch InBev, and Heineken represent a foundational customer base, requiring vast quantities of aluminum cans for their carbonated soft drinks, beers, and other ready-to-drink products distributed worldwide. Beyond these giants, a rapidly growing segment of craft breweries, artisan cider producers, and specialty beverage manufacturers also constitutes significant potential customers. These smaller, often innovation-driven entities frequently seek bespoke canning solutions, including unique sizes, custom printing, and smaller order volumes, to stand out in increasingly competitive markets and appeal to discerning consumer tastes for premium and authentic products.

Within the food processing industry, potential customers include leading global food manufacturers like Nestlé, Unilever, Conagra Brands, General Mills, and Dole Food Company, which rely heavily on metal cans for the preservation and distribution of a wide array of products. These include canned fruits, vegetables, meat, seafood, soups, sauces, and ready-to-eat meals, where the cans' ability to withstand retort processing and ensure long-term shelf stability is paramount. The pet food industry, with key players such as Mars Petcare, Nestlé Purina, and Hill's Pet Nutrition, also represents a substantial customer segment, utilizing metal cans for convenient, portion-controlled, and fresh-keeping solutions for wet pet food. These customers prioritize packaging that guarantees product safety, maintains nutritional integrity, and offers consumer convenience, aligning perfectly with the robust protective qualities of metal cans.

Furthermore, the market's customer base extends to various institutional buyers, including catering services, military organizations, and emergency relief agencies, which often procure canned goods for their durability, extended shelf life, and ease of storage and distribution in diverse environments. The burgeoning e-commerce sector has also opened new avenues, with direct-to-consumer (D2C) food and beverage brands seeking packaging that is robust enough for shipping, visually appealing, and reflective of sustainable values. Local agricultural cooperatives and small-batch food producers also constitute an important segment, often accessing metal cans through packaging distributors or co-packers. Essentially, any business involved in the production, preservation, and distribution of shelf-stable food and beverage products, prioritizing product integrity, safety, and sustainability, is a key potential customer for the metal can industry, driving continuous innovation and demand across the value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $62.5 Billion |

| Market Forecast in 2032 | $85.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Silgan Holdings Inc., CAN-PACK S.A., Toyo Seikan Group Holdings Ltd., CPMC Holdings Limited, Kian Joo Can Factory Berhad, Nampak Ltd., Hokkan Holdings Limited, Amcor PLC, Constantia Flexibles GmbH, Universal Can Corporation, Daiwa Can Company, Envases Universales, ORG Technology Co. Ltd., United Can Company, Jindal Aluminium Ltd., BWAY Corporation, Independent Can Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food and Beverage Metal Cans Market Key Technology Landscape

The Food and Beverage Metal Cans Market is profoundly shaped by a continually evolving technology landscape, with innovations driving advancements in efficiency, sustainability, and product differentiation. A cornerstone of this landscape is lightweighting technology, particularly for aluminum cans, where sophisticated metallurgical techniques and advanced can-forming processes enable a significant reduction in material thickness without compromising structural integrity or product protection. This not only yields substantial cost savings in raw materials and transportation but also considerably lowers the environmental footprint per can. The ongoing development of high-speed manufacturing lines, incorporating precision tooling and advanced automation, further enhances production efficiency, allowing manufacturers to meet escalating global demand with reduced lead times and optimized resource utilization, leading to improved economies of scale.

Another critical area of technological innovation lies in the realm of advanced coatings and liners. With heightened consumer awareness and stricter regulatory mandates concerning food contact materials, there is an intense focus on developing BPA-non-intent (BPA-NI) and entirely plant-based internal coatings. These next-generation linings are designed to provide superior barrier protection, prevent chemical migration into the food or beverage, and maintain product flavor and integrity over extended shelf periods, all while ensuring compliance with global health standards and consumer preferences for "cleaner" packaging. Externally, advancements in digital printing and hig

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food and Beverage Metal Cans Market Size Report By Type (Three-Piece cans, Two-piece Cans), By Application (Food Industry, Beverage Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Food and Beverage Metal Cans Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Three-Piece cans, Two-piece Cans), By Application (Food Industry, Beverage Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager