Food & Beverage Wastewater Recovery System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428091 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Food & Beverage Wastewater Recovery System Market Size

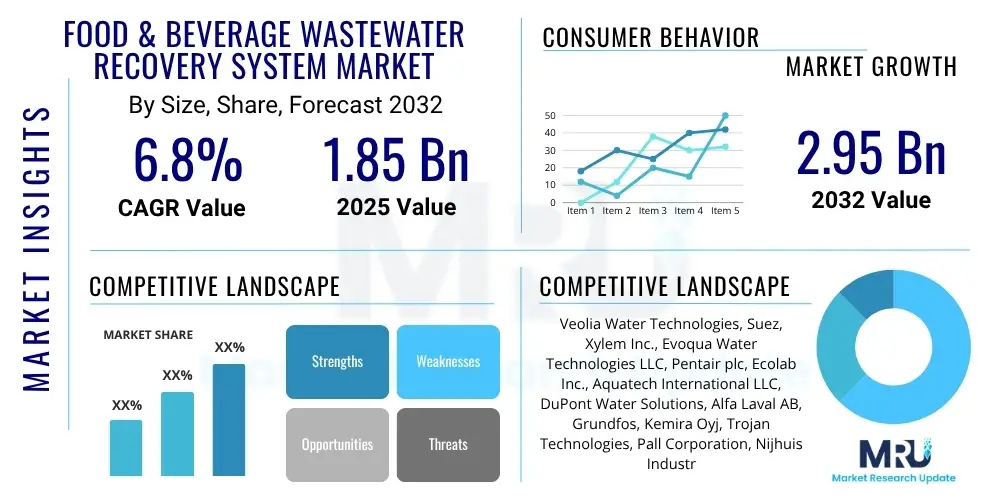

The Food & Beverage Wastewater Recovery System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.85 Billion in 2025 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2032.

Food & Beverage Wastewater Recovery System Market introduction

The Food & Beverage (F&B) Wastewater Recovery System Market encompasses a wide array of technologies and solutions designed to treat, purify, and reuse wastewater generated during various stages of food and beverage production. This market is driven by increasing environmental regulations, growing concerns over water scarcity, and the rising operational costs associated with fresh water intake and wastewater discharge. As F&B industries consume substantial volumes of water, the implementation of advanced recovery systems is becoming imperative for sustainable operations and economic viability.

Product descriptions within this market range from sophisticated membrane filtration technologies like Reverse Osmosis (RO), Ultrafiltration (UF), and Membrane Bioreactors (MBR) to biological treatment processes such as Anaerobic Digestion and Sequencing Batch Reactors (SBR), alongside physical-chemical methods like Dissolved Air Flotation (DAF). These systems are engineered to remove suspended solids, organic matter, nutrients, and other contaminants, enabling the treated water to be recycled back into processing, cleaning, or utility applications. The versatility of these systems allows for their application across diverse F&B sub-sectors, addressing unique wastewater compositions and regulatory requirements.

Major applications of these recovery systems include water reuse for non-contact cooling, boiler feed, irrigation, and process water for less critical stages, thereby significantly reducing the reliance on municipal water supplies. The primary benefits extend beyond mere compliance with discharge limits; they encompass substantial cost savings on water procurement and effluent treatment, enhanced corporate sustainability profiles, and improved operational efficiency. The market is further propelled by driving factors such as rapid industrialization, expansion of the global F&B sector, and the increasing adoption of circular economy principles, which emphasize resource optimization and waste reduction across industrial value chains.

Food & Beverage Wastewater Recovery System Market Executive Summary

The Food & Beverage Wastewater Recovery System Market is experiencing robust growth, primarily fueled by a confluence of stringent environmental regulations globally, escalating water scarcity challenges, and the F&B industry's intensified focus on sustainability and operational efficiency. Business trends indicate a shift towards more integrated and automated wastewater treatment solutions that offer higher recovery rates and lower energy consumption. Companies are increasingly investing in modular and scalable systems that can adapt to varying wastewater volumes and compositions, reflecting a desire for flexibility and future-proofing their operations. The market also observes a growing preference for solutions that not only recover water but also facilitate resource recovery, such as biogas from organic waste or nutrient recovery, aligning with broader circular economy objectives and yielding additional revenue streams or cost reductions.

Regional trends reveal disparate rates of adoption and technological sophistication. North America and Europe, characterized by mature F&B industries and well-established environmental regulatory frameworks, lead in the adoption of advanced membrane technologies and intelligent control systems. These regions are prioritizing highly efficient, automated, and low-footprint solutions to meet strict discharge limits and corporate sustainability mandates. Conversely, the Asia Pacific region, driven by rapid industrialization, expanding F&B production, and emerging environmental concerns, presents significant growth opportunities. Here, the focus is often on initial compliance and basic treatment solutions, though increasing investments in advanced recovery systems are being observed as regulations tighten and water stress becomes more pronounced. Latin America, the Middle East, and Africa are also witnessing gradual market expansion, primarily influenced by population growth, urbanization, and the development of local F&B manufacturing capabilities.

Segmentation trends highlight the increasing importance of technology type and application in shaping market dynamics. Membrane technologies, particularly MBR and RO, continue to dominate due to their superior efficiency in contaminant removal and water purification, making them ideal for high-quality water reuse. The dairy, brewing, and meat processing sectors are among the largest end-users, given their high water consumption and significant wastewater generation. Within these segments, the demand is particularly strong for solutions that can handle high organic loads and fluctuating pH levels. Furthermore, the market is seeing enhanced integration of digital technologies, including IoT and AI, to optimize system performance, enable predictive maintenance, and provide real-time monitoring and control, thereby driving the evolution of smart wastewater recovery infrastructure.

AI Impact Analysis on Food & Beverage Wastewater Recovery System Market

Common user questions related to the impact of AI on the Food & Beverage Wastewater Recovery System Market frequently revolve around how AI can enhance efficiency, reduce operational costs, and improve compliance. Users are keen to understand AI's capabilities in real-time monitoring, predictive maintenance, and optimized process control. Questions often include: "How can AI reduce energy consumption in wastewater treatment?", "What role does AI play in improving water quality for reuse?", "Can AI help predict equipment failures in recovery systems?", "How does AI contribute to meeting stringent environmental regulations?", and "What are the investment requirements and ROI for AI integration in F&B wastewater treatment?". Based on this analysis, the key themes indicate a strong user interest in AI's potential for automation, data-driven optimization, and intelligent decision-making to overcome traditional operational challenges in F&B wastewater management.

AI's influence is transforming the F&B wastewater recovery landscape by enabling a paradigm shift from reactive maintenance and empirical control to proactive, predictive, and optimized operational strategies. Through advanced algorithms and machine learning models, AI can analyze vast datasets from sensors, flow meters, and laboratory tests in real-time, identifying patterns and anomalies that human operators might miss. This capability allows for continuous optimization of chemical dosing, aeration rates, and filtration processes, leading to significant reductions in energy consumption, chemical usage, and overall operational expenditure. The predictive power of AI extends to anticipating equipment malfunctions, scheduling preventive maintenance before failures occur, and thereby minimizing downtime and extending the lifespan of critical infrastructure components.

Furthermore, AI-powered systems are instrumental in ensuring consistent water quality, which is paramount for reuse applications and regulatory compliance. By learning from historical data and adapting to dynamic wastewater characteristics, AI can fine-tune treatment parameters to consistently meet stringent discharge limits and internal water quality standards for recycling. This not only mitigates the risk of non-compliance fines but also enhances the overall sustainability profile of F&B operations. The integration of AI also facilitates more efficient resource recovery, such as optimizing anaerobic digesters for maximum biogas production or enhancing nutrient recovery processes, thereby adding significant value to the F&B industry's circular economy initiatives.

- Predictive analytics for early detection of system anomalies and potential equipment failures, significantly reducing unplanned downtime.

- Optimized chemical dosing and energy consumption through real-time data analysis and machine learning algorithms, leading to substantial cost savings.

- Enhanced process control and automation, allowing systems to adapt dynamically to varying wastewater characteristics and flow rates for consistent output quality.

- Improved water quality monitoring and compliance reporting by leveraging AI to analyze sensor data and ensure adherence to environmental regulations.

- Resource recovery optimization, such as maximizing biogas production from anaerobic digestion or improving nutrient extraction efficiency.

- Reduced human intervention requirements and operational errors through intelligent automation and decision support systems.

- Data-driven insights for long-term system planning, upgrades, and efficiency improvements.

DRO & Impact Forces Of Food & Beverage Wastewater Recovery System Market

The Food & Beverage Wastewater Recovery System Market is profoundly shaped by a complex interplay of various drivers, restraints, and opportunities, collectively forming the impact forces that dictate its growth trajectory. Key drivers include the ever-tightening environmental regulations globally, which compel F&B manufacturers to invest in advanced treatment solutions to meet stringent discharge standards and avoid hefty penalties. Coupled with this, the pervasive issue of water scarcity in many regions and the rising cost of fresh water intake are powerful economic incentives for industries to adopt recovery and reuse systems. Furthermore, increasing public and corporate focus on sustainability, driven by consumer demand for eco-friendly products and corporate social responsibility initiatives, is pushing F&B companies to reduce their environmental footprint, making wastewater recovery a strategic imperative.

However, the market also faces significant restraints. The high initial capital investment required for installing sophisticated wastewater recovery systems can be a deterrent for many small and medium-sized enterprises (SMEs), particularly those with limited financial resources. The operational complexity of these systems, requiring specialized technical expertise for maintenance and troubleshooting, often poses a challenge in regions with a shortage of skilled personnel. Moreover, the highly variable and complex composition of wastewater from different F&B processes, ranging from high organic loads in dairy to high salinity in some seafood processing, demands customized solutions, which can increase engineering complexity and cost. Regulatory inconsistencies across different geographies or occasional loopholes can also slow down adoption in certain areas, particularly where enforcement is less rigorous.

Despite these challenges, substantial opportunities exist for market expansion. Continuous technological advancements, particularly in membrane filtration, biological treatment, and digital integration (IoT, AI), are making recovery systems more efficient, cost-effective, and user-friendly. The increasing demand for advanced treatment solutions that can handle diverse contaminant profiles and deliver high-quality reusable water opens new avenues for innovation. Governments worldwide are increasingly offering incentives, subsidies, and grants for industries adopting sustainable practices and investing in water-saving technologies, further stimulating market growth. The global expansion of the F&B sector, especially in developing economies, coupled with a growing awareness of water conservation, creates a fertile ground for new installations and upgrades of existing facilities. These impact forces collectively drive innovation, influence investment decisions, and ultimately shape the competitive landscape of the Food & Beverage Wastewater Recovery System Market.

Segmentation Analysis

The Food & Beverage Wastewater Recovery System Market is comprehensively segmented across several critical dimensions, including technology, application, and end-use industry. This granular segmentation provides a detailed understanding of the market structure, highlighting the diverse solutions available and the specific demands from various sectors within the F&B industry. The market's complexity necessitates a nuanced approach to segmentation, enabling suppliers to tailor their offerings and F&B producers to identify the most suitable systems for their unique wastewater challenges and water reuse goals. Understanding these segments is crucial for strategic planning and market entry, as each segment presents distinct technological preferences, regulatory pressures, and economic considerations.

By dissecting the market based on these parameters, stakeholders can gain insights into the growth drivers specific to certain technologies, the evolving demand patterns across different applications, and the particular requirements of various food and beverage manufacturing processes. For instance, the demand for high-purity water for direct process reuse might favor advanced membrane technologies, while systems focused on reducing biological oxygen demand (BOD) for discharge might lean towards biological treatment options. Similarly, the needs of a dairy processing plant, characterized by high organic content, will differ significantly from a beverage bottling plant, which might prioritize turbidity and microbial removal. This detailed segmentation not only informs product development and marketing strategies but also helps in forecasting future market trends and identifying emerging niches within the broader wastewater recovery ecosystem.

- By Technology

- Membrane Bioreactor (MBR)

- Reverse Osmosis (RO)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Microfiltration (MF)

- Dissolved Air Flotation (DAF)

- Sequencing Batch Reactor (SBR)

- Activated Sludge Process

- Anaerobic Digestion

- Chemical Precipitation

- Ozonation

- UV Disinfection

- Advanced Oxidation Processes (AOPs)

- Electrochemical Treatment

- By Application

- Water Recovery and Reuse

- Solids Recovery (e.g., for animal feed, biogas)

- Energy Recovery (e.g., biogas from anaerobic digestion)

- Nutrient Recovery (e.g., phosphorus, nitrogen)

- Chemical Recovery

- FOG (Fats, Oils, and Grease) Recovery

- By End-Use Industry

- Dairy Processing

- Brewery and Distillery

- Meat, Poultry, and Seafood Processing

- Soft Drinks and Beverages

- Fruits and Vegetables Processing

- Bakery and Confectionery

- Sugar and Starch Processing

- Grain Processing

- Edible Oil Processing

- Other Food Processing (e.g., snacks, condiments)

Value Chain Analysis For Food & Beverage Wastewater Recovery System Market

The value chain for the Food & Beverage Wastewater Recovery System Market is a complex network of interconnected activities, beginning from the sourcing of raw materials and components to the final delivery, installation, and ongoing maintenance of sophisticated treatment systems. At the upstream end, the chain involves manufacturers of specialized components such as membranes (polymeric and ceramic), pumps, valves, sensors, chemical dosing equipment, and various filtration media. These suppliers often specialize in high-precision engineering and advanced material science, providing the foundational technologies that enable effective wastewater treatment. The quality and innovation within this segment directly influence the performance and cost-efficiency of the entire recovery system. Sourcing robust and reliable components is critical to ensure the longevity and effectiveness of the downstream integrated solutions.

The midstream segment of the value chain is dominated by equipment manufacturers, system integrators, and engineering, procurement, and construction (EPC) firms. These entities are responsible for designing, fabricating, assembling, and often installing complete wastewater recovery plants. They integrate various components, optimize process flows, and ensure that the final system meets the specific requirements of the F&B client, including regulatory compliance and water quality targets for reuse. This stage often involves significant R&D efforts to develop innovative treatment processes, automate operations, and improve energy efficiency. The expertise of these integrators in understanding diverse F&B wastewater characteristics and applying appropriate treatment trains is paramount to the success of recovery projects.

Downstream, the value chain focuses on the end-users—the Food & Beverage processing companies themselves—who are the ultimate beneficiaries of these systems. This segment also includes service providers offering operation, maintenance, and upgrade services, as well as specialized consultants who provide guidance on system selection, regulatory compliance, and optimization. Distribution channels are varied, often involving direct sales from large system integrators to major F&B corporations for bespoke solutions. For smaller, more standardized systems or specific components, indirect channels through distributors, agents, and increasingly, online marketplaces, play a role. The effectiveness of the entire value chain hinges on seamless collaboration, technological advancement at each stage, and a clear understanding of the evolving needs of the F&B industry for sustainable water management. Direct sales ensure customized solutions and direct feedback, while indirect channels provide wider market reach and often lower procurement costs for standardized parts.

Food & Beverage Wastewater Recovery System Market Potential Customers

The potential customers for Food & Beverage Wastewater Recovery Systems encompass a broad spectrum of entities within the F&B industry, all sharing a common need to manage wastewater efficiently, comply with environmental regulations, reduce operational costs, and enhance their sustainability profiles. These customers primarily consist of large-scale food and beverage manufacturing plants that operate with significant water footprints and generate substantial volumes of effluent. Their operations often involve continuous processes, requiring robust and reliable wastewater treatment and recovery solutions that can handle fluctuating loads and diverse contaminant profiles. The imperative for these large enterprises is not just regulatory compliance but also the economic benefits derived from reduced water intake, lower discharge fees, and potential resource recovery from waste streams, such as biogas or nutrient-rich sludge.

Specific end-user/buyers of these products include major players in the dairy industry, such as milk processing plants, cheese manufacturers, and yogurt producers, which generate wastewater high in organic matter, fats, and solids. Breweries and distilleries represent another significant customer segment, characterized by wastewater with high BOD and COD from fermentation and cleaning processes. Meat, poultry, and seafood processing facilities are also key buyers, dealing with wastewater containing blood, fats, proteins, and suspended solids. Furthermore, soft drink and juice manufacturers, fruit and vegetable canning operations, and confectioneries, while varying in wastewater characteristics, all face the challenge of treating process water before discharge or reuse. These industries are under increasing pressure to demonstrate environmental stewardship and are actively seeking solutions that can improve their water management practices.

Beyond the immediate production facilities, potential customers also extend to companies looking to expand their operations, establish new facilities, or upgrade existing infrastructure to meet evolving environmental standards. Smaller and medium-sized enterprises (SMEs) within the F&B sector, though perhaps slower adopters due to initial investment costs, represent a growing segment as awareness of water scarcity and regulatory enforcement increases. Additionally, contract manufacturers for F&B products, which serve multiple brands, also seek efficient and scalable wastewater recovery systems to maintain competitive advantages and comply with various client-specific sustainability mandates. The common denominator among all these potential customers is the strategic importance of water in their operations and the recognition that sustainable water management is crucial for long-term business viability and competitive advantage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 Billion |

| Market Forecast in 2032 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez, Xylem Inc., Evoqua Water Technologies LLC, Pentair plc, Ecolab Inc., Aquatech International LLC, DuPont Water Solutions, Alfa Laval AB, Grundfos, Kemira Oyj, Trojan Technologies, Pall Corporation, Nijhuis Industries, Pureflow Inc., Samco Technologies Inc., Lenntech B.V., Metito Holdings, Blue Water Technologies, Membrane Technology and Research Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food & Beverage Wastewater Recovery System Market Key Technology Landscape

The Food & Beverage Wastewater Recovery System Market is characterized by a dynamic and continuously evolving technology landscape, driven by the need for higher efficiency, lower operational costs, and stricter adherence to environmental standards. At the forefront are advanced membrane technologies, including Ultrafiltration (UF), Nanofiltration (NF), and Reverse Osmosis (RO), which are highly effective in removing suspended solids, bacteria, viruses, dissolved salts, and other contaminants to produce high-quality permeate suitable for various reuse applications. Membrane Bioreactors (MBR) combine biological treatment with membrane separation, offering a compact footprint and excellent effluent quality, making them particularly attractive for facilities with space constraints or stringent discharge requirements. These membrane systems are constantly being refined for improved flux, reduced fouling, and extended lifespan through innovations in material science and module design.

Beyond membrane filtration, biological treatment processes remain fundamental to breaking down organic matter. Anaerobic digestion is gaining prominence not only for its efficiency in treating high organic load wastewater but also for its ability to generate biogas, a renewable energy source, thereby contributing to the circular economy. Aerobic processes like Activated Sludge and Sequencing Batch Reactors (SBR) are also widely employed, continuously being optimized for better nutrient removal and energy efficiency through advanced aeration control and microbial population management. Chemical-physical treatments such as Dissolved Air Flotation (DAF) are critical for removing fats, oils, grease (FOG), and suspended solids, serving as effective pre-treatment steps to protect downstream membrane systems or biological reactors from overloading.

The integration of digital technologies, notably the Internet of Things (IoT) and Artificial Intelligence (AI), is rapidly transforming the operational paradigm of wastewater recovery systems. IoT sensors enable real-time monitoring of critical parameters such as pH, temperature, flow rates, and contaminant levels, providing operators with immediate insights into system performance. AI and machine learning algorithms then analyze this vast amount of data to predict system failures, optimize chemical dosing, fine-tune energy consumption (e.g., for pumps and blowers), and automate process control for maximum efficiency and consistent water quality. Furthermore, advanced oxidation processes (AOPs) utilizing ozone, UV, or hydrogen peroxide are being increasingly adopted for the removal of recalcitrant organic compounds and disinfection, ensuring that recovered water meets the highest standards for critical reuse applications. This technological convergence is leading to smarter, more resilient, and cost-effective wastewater recovery solutions for the F&B industry.

Regional Highlights

- North America: This region is characterized by stringent environmental regulations, particularly concerning wastewater discharge and water reuse. There is a strong emphasis on adopting advanced technologies for water scarcity management and ensuring food safety. High operational costs drive the adoption of efficient, automated recovery systems.

- Europe: Driven by comprehensive EU directives on water quality and circular economy principles, Europe is a leader in adopting sophisticated wastewater recovery solutions. Countries like Germany, France, and the Netherlands show high technological penetration and investment in sustainable water management practices across the F&B sector.

- Asia Pacific (APAC): The APAC region represents the largest and fastest-growing market due to rapid industrialization, burgeoning population, and significant expansion of the F&B processing industry. Emerging economies like China and India face increasing water stress and tightening environmental regulations, leading to substantial investments in wastewater recovery infrastructure, though the level of technology adoption varies widely.

- Latin America: This region is witnessing steady growth in the F&B wastewater recovery market, spurred by urbanization, rising F&B consumption, and increasing environmental awareness. While basic treatment solutions are common, there is a growing demand for advanced systems to address water scarcity issues and improve regulatory compliance in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Marked by extreme water scarcity, the MEA region is increasingly prioritizing water conservation and reuse. Investments in F&B manufacturing are driving the adoption of wastewater recovery systems, particularly in countries with significant oil and gas revenues that can fund infrastructure projects. The focus is on robust and efficient solutions to maximize water recovery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food & Beverage Wastewater Recovery System Market.- Veolia Water Technologies

- Suez

- Xylem Inc.

- Evoqua Water Technologies LLC

- Pentair plc

- Ecolab Inc.

- Aquatech International LLC

- DuPont Water Solutions

- Alfa Laval AB

- Grundfos

- Kemira Oyj

- Trojan Technologies

- Pall Corporation

- Nijhuis Industries

- Pureflow Inc.

- Samco Technologies Inc.

- Lenntech B.V.

- Metito Holdings

- Blue Water Technologies

- Membrane Technology and Research Inc.

Frequently Asked Questions

What is the primary driver for wastewater recovery in the F&B industry?

The primary driver is the combination of stringent environmental regulations, escalating water scarcity, and the need for F&B companies to reduce operational costs associated with water intake and wastewater discharge. Sustainability goals and corporate social responsibility also play significant roles.

What technologies are commonly used in Food & Beverage wastewater recovery systems?

Common technologies include membrane filtration (MBR, UF, RO), biological treatments (Anaerobic Digestion, SBR, Activated Sludge), physical-chemical processes (DAF, chemical precipitation), and disinfection methods (UV, ozonation). Advanced Oxidation Processes (AOPs) and digital integrations like AI and IoT are also increasingly prevalent.

How does wastewater recovery benefit F&B companies?

Benefits include significant cost savings from reduced fresh water consumption and lower effluent treatment fees, enhanced compliance with environmental regulations, improved corporate sustainability profiles, potential for resource recovery (e.g., biogas, nutrients), and increased operational resilience against water scarcity.

What are the key challenges in implementing F&B wastewater recovery systems?

Key challenges involve high initial capital investment, the complex and variable composition of F&B wastewater requiring customized solutions, the need for skilled personnel for operation and maintenance, and regulatory complexities across different regions. Energy consumption and potential fouling of membranes are also considerations.

How is AI impacting the Food & Beverage Wastewater Recovery System Market?

AI is transforming the market by enabling real-time monitoring, predictive maintenance, and optimized process control, leading to enhanced operational efficiency, reduced energy and chemical consumption, improved water quality consistency, and better compliance. AI also supports data-driven decision-making for long-term system optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager