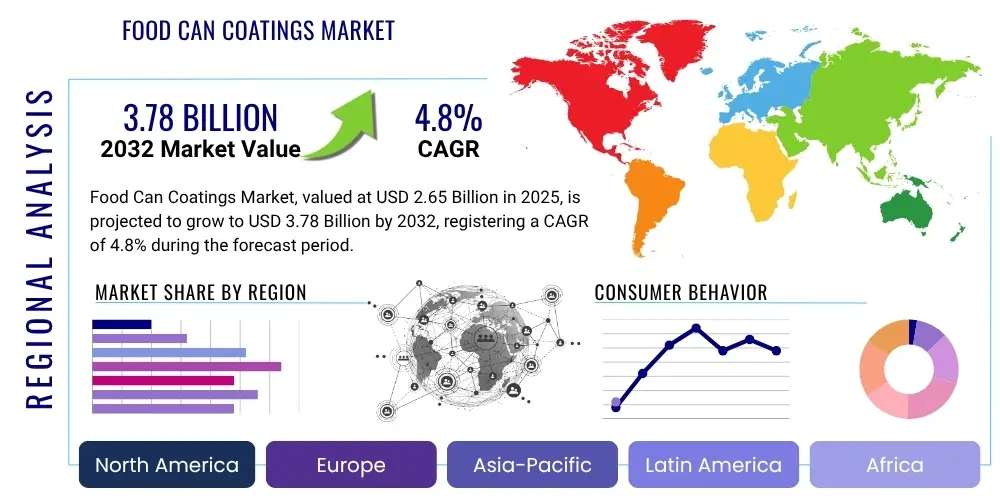

Food Can Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428701 | Date : Oct, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Food Can Coatings Market Size

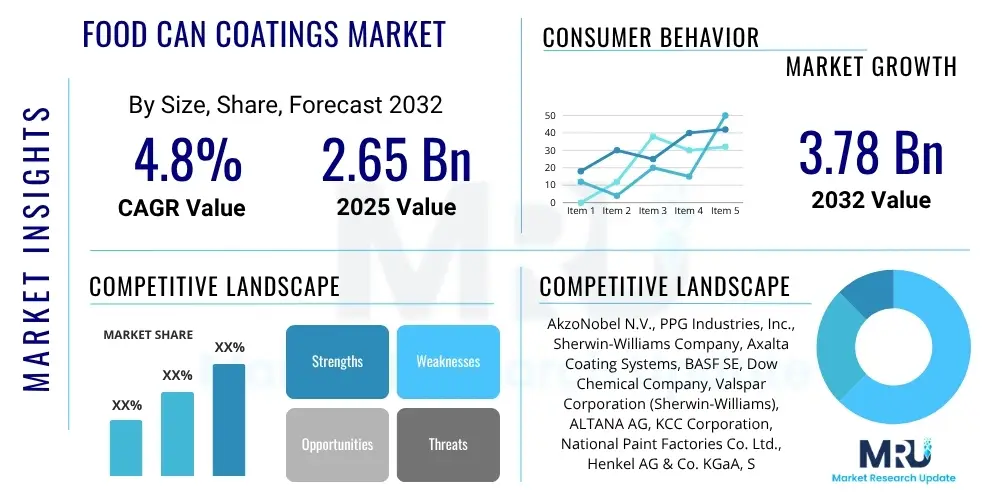

The Food Can Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 2.65 Billion in 2025 and is projected to reach USD 3.78 Billion by the end of the forecast period in 2032.

Food Can Coatings Market introduction

The Food Can Coatings Market encompasses the specialized internal and external protective layers applied to metal food and beverage cans. These coatings are crucial for ensuring food safety, preserving product quality, and extending shelf life by preventing corrosion of the metal can, interaction between the food product and the can material, and migration of undesirable substances into the food. The primary function is to create a inert barrier between the metal substrate and the often acidic, alkaline, or corrosive contents, protecting both the food from metallic contamination and the can from degradation.

Product descriptions within this market range from traditional epoxy-based coatings, known for their excellent adhesion and barrier properties, to innovative Bisphenol A non-intent (BPA-NI) alternatives, including acrylic, polyester, polypropylene, and organosol-based systems. These newer formulations are developed in response to evolving regulatory landscapes and increasing consumer demand for food packaging perceived as safer and more sustainable. Major applications span a vast array of food products, including canned fruits and vegetables, processed meats and seafood, ready meals, soups, sauces, infant formula, and pet food, as well as a significant segment for carbonated and non-carbonated beverages.

The benefits derived from advanced food can coatings are multifaceted, primarily centered around enhanced food preservation, maintaining nutritional value, and ensuring consumer health. These coatings offer superior corrosion resistance, chemical inertness, and heat stability, which are essential during sterilization processes. Key driving factors for market growth include the continuously rising global demand for packaged and processed food due to urbanization, changing lifestyles, and convenience-seeking consumers. Furthermore, stringent food safety regulations globally, coupled with continuous innovation in coating materials, particularly towards environmentally friendly and health-conscious BPA-NI solutions, are propelling market expansion and technological advancements.

Food Can Coatings Market Executive Summary

The Food Can Coatings Market is experiencing robust expansion, driven by persistent demand for safe, convenient, and shelf-stable food products worldwide. Business trends indicate a significant strategic shift towards research and development in BPA-non-intent (BPA-NI) coating technologies, as manufacturers strive to meet evolving consumer preferences and comply with stricter regulatory frameworks concerning chemical migration. This involves substantial investment in developing alternative chemistries that offer equivalent or superior performance to traditional epoxy-based coatings, particularly in terms of adhesion, flexibility, and barrier properties. Additionally, consolidation through mergers and acquisitions is observed as companies seek to expand their technological portfolios, geographic reach, and market share in this competitive landscape.

Regional trends highlight the Asia Pacific as the fastest-growing market, propelled by rapid urbanization, increasing disposable incomes, and the expansion of the food processing and canning industries in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, are characterized by stringent food safety regulations and high consumer awareness regarding chemical exposure, leading to accelerated adoption of BPA-NI solutions and a strong emphasis on sustainable packaging innovations. Latin America and the Middle East & Africa regions are emerging as promising markets, driven by improving economic conditions, a growing middle class, and increasing investment in food manufacturing infrastructure, leading to a rising demand for coated food cans.

Segmentation trends reveal a clear inclination towards BPA-NI coatings, which are projected to capture a larger market share over the forecast period, gradually phasing out traditional BPA-based variants, especially in sensitive applications like infant formula and baby food. Among BPA-NI options, polyester and acrylic coatings are gaining traction due to their versatile application properties and perceived safety profiles. In terms of application, the market for coatings on beverage cans continues to be substantial, while the processed fruits, vegetables, meat, and seafood segments are also demonstrating steady growth. Manufacturers are increasingly focusing on developing specialized coatings tailored to specific food chemistries to optimize preservation and flavor integrity, further diversifying the market segments.

AI Impact Analysis on Food Can Coatings Market

User questions regarding AI's impact on the Food Can Coatings Market frequently center on how artificial intelligence can enhance manufacturing efficiency, ensure quality control, accelerate new material development, and optimize supply chains. Key themes include the potential for AI-driven predictive maintenance to reduce downtime in coating lines, AI's role in detecting microscopic defects in coated cans, and the application of machine learning algorithms to screen and optimize novel coating formulations for desired barrier properties and chemical resistance. Concerns often revolve around the initial investment costs, data privacy, and the need for specialized expertise to implement and manage AI systems effectively within existing production environments. Expectations are high for AI to contribute significantly to cost reduction, product consistency, and faster innovation cycles, ultimately addressing both regulatory pressures and consumer demands for safer and more sustainable coatings.

- AI-driven optimization of coating thickness and uniformity, reducing material waste.

- Predictive analytics for equipment maintenance, minimizing production line downtime.

- Enhanced quality control through automated defect detection systems using computer vision.

- Accelerated R&D for novel coating formulations via machine learning algorithms.

- Supply chain optimization for raw materials, improving efficiency and reducing costs.

- Personalized coating solutions based on specific food product chemistries.

- Improved sustainability monitoring by tracking material usage and waste generation.

DRO & Impact Forces Of Food Can Coatings Market

The Food Can Coatings Market is primarily driven by the escalating global consumption of packaged and processed food, a trend fueled by urbanization, convenience-oriented lifestyles, and expanding global food supply chains. Stringent food safety regulations imposed by various governmental and international bodies, such as the FDA, EFSA, and WHO, mandate the use of safe and effective barrier coatings to prevent food contamination and preserve product integrity. This regulatory push, particularly regarding Bisphenol A (BPA) content, acts as a significant driver for innovation in BPA-non-intent (BPA-NI) coating technologies. Furthermore, the inherent benefits of metal cans, including their excellent barrier properties, recyclability, and ability to ensure long shelf life, reinforce the demand for specialized coatings that complement these attributes and provide robust protection against corrosion and chemical interaction.

However, the market faces significant restraints. The high cost associated with research and development for new, high-performance, and compliant coating materials, especially BPA-NI alternatives, can be a barrier for smaller manufacturers. Regulatory uncertainty and evolving standards across different regions also create complexity and demand substantial investment in compliance and reformulation efforts. Additionally, consumer concerns over potential chemical migration from packaging materials, regardless of scientific validation, can sometimes lead to negative perceptions, impacting market acceptance of certain coating types. Competition from alternative packaging solutions, such as flexible pouches, glass containers, and plastic packaging, which are continuously innovating in terms of convenience and sustainability, also presents a challenge to the growth of the metal can and, consequently, the food can coatings market.

Opportunities for market expansion are substantial, particularly in emerging economies where the food processing industry is rapidly developing and demand for packaged food is surging due to demographic shifts and rising disposable incomes. The development and commercialization of advanced materials, including bio-based and plant-derived coatings, represent a significant opportunity for manufacturers to address sustainability concerns and appeal to eco-conscious consumers. Specialization in coatings for specific food types, such as high-acid products or sensitive infant formulas, allows for premium product offerings. Impact forces include the fluctuating prices of raw materials, such as resins and solvents, which can directly affect manufacturing costs and market pricing. Moreover, shifts in consumer preferences towards organic, natural, and minimally processed foods, combined with increasing demand for transparency in food packaging, continue to shape market dynamics, pushing for innovative, safe, and transparent coating solutions.

Segmentation Analysis

The Food Can Coatings Market is comprehensively segmented based on various attributes, including the type of coating material, the presence of Bisphenol A (BPA), and the specific application areas. This segmentation provides a granular view of the market dynamics, allowing stakeholders to identify niche opportunities and tailor strategies for specific consumer demands and regulatory environments. Understanding these segments is crucial for predicting market shifts, allocating resources effectively, and fostering innovation in areas with high growth potential, especially as the industry moves towards safer and more sustainable solutions.

- By Type

- Epoxy

- Acrylic

- Polyester

- Oleoresinous

- Alkyd

- Phenolic

- Other Types (e.g., Polypropylene, Vinyls)

- By Material/BPA Content

- BPA-based Coatings

- BPA-non-intent (BPA-NI) Coatings

- By Application

- Fruits and Vegetables

- Meat and Seafood

- Pet Food

- Beverages (Soft Drinks, Juices, Beer, Energy Drinks)

- Soups, Sauces, and Ready Meals

- Dairy and Infant Formula

- Other Food Products (e.g., Bakery, Spices)

- By End-Use Industry

- Food Processing Industry

- Beverage Industry

- Pet Food Industry

Value Chain Analysis For Food Can Coatings Market

The value chain for the Food Can Coatings Market is a complex network involving several key stages, beginning with the production of raw materials and extending through various manufacturing processes to the ultimate end-users. The upstream segment of the value chain is dominated by chemical manufacturers and suppliers who provide essential raw materials such as various resins (epoxy, acrylic, polyester), solvents (e.g., water-based, organic), pigments, and performance-enhancing additives (e.g., lubricants, curing agents). These suppliers play a critical role in determining the quality, cost, and availability of the foundational components that define the properties of the final coating product. Innovation in raw material synthesis, particularly towards bio-based and sustainable feedstocks, is a continuous driver within this segment, influencing the overall market direction and sustainability profile of the coatings.

Further down the value chain, coating manufacturers process these raw materials into specialized formulations tailored for specific applications in food cans. This stage involves extensive research and development to create coatings that meet stringent performance criteria, including adhesion, flexibility, corrosion resistance, and compliance with food contact regulations. These coating products are then supplied to metal can manufacturers, who apply them to both the interior and exterior surfaces of cans through various methods such as spray coating, roller coating, or electrocoating. The efficiency and precision of this application process are vital for ensuring the protective integrity of the can, with close collaboration between coating suppliers and can manufacturers often leading to optimized application technologies and product performance.

The downstream segment involves the ultimate end-users: food and beverage processing companies. These companies fill the coated cans with their products, relying heavily on the quality and safety assurances provided by the coatings to preserve freshness, extend shelf life, and protect consumer health. The distribution channel for food can coatings is primarily direct, especially for large-scale can manufacturers who purchase directly from coating suppliers. However, smaller regional can manufacturers or specialized producers might engage with indirect distribution channels through distributors or agents who provide a broader range of products and technical support. The entire value chain is heavily influenced by regulatory bodies and consumer demand, which mandate continuous innovation and adherence to the highest safety and environmental standards, impacting every stage from raw material sourcing to final product packaging.

Food Can Coatings Market Potential Customers

The primary potential customers for the Food Can Coatings Market are extensive and diverse, encompassing various segments of the food and beverage industry. At the forefront are large-scale food processing companies that rely on metal cans for preserving and distributing a wide array of products, including fruits, vegetables, soups, sauces, ready meals, and processed meats. These companies require high-performance coatings that can withstand rigorous sterilization processes, prevent product spoilage, and maintain the integrity and flavor profile of their contents over extended periods. Their purchasing decisions are heavily influenced by regulatory compliance, cost-effectiveness, and the proven safety and performance of coating solutions, particularly with the increasing emphasis on Bisphenol A non-intent (BPA-NI) options.

Another significant customer segment includes beverage manufacturers, ranging from producers of carbonated soft drinks, juices, and energy drinks to breweries. For this segment, coatings must offer excellent barrier properties against highly corrosive or carbonated liquids, prevent taste contamination, and provide aesthetic appeal. The demand for lightweight and sustainable packaging also plays a crucial role in their choice of coating suppliers. Furthermore, the burgeoning pet food industry represents a substantial and growing customer base, as canned wet pet food is a popular and convenient option for pet owners. Pet food manufacturers seek robust coatings that can handle diverse product formulations, ensure product safety, and offer a long shelf life, mirroring many of the requirements of human food products.

Beyond the direct food and beverage producers, metal can manufacturers themselves are critical immediate customers. They procure coatings directly from suppliers to apply to the cans before they are sold to the food and beverage companies. These can manufacturers often work in close collaboration with coating suppliers to develop bespoke solutions that meet specific can production line requirements and end-use performance criteria. Additionally, private label food brands and contract packers, who produce goods for various retailers, also represent a significant customer segment. Their needs often involve versatile coating solutions that can adapt to a broad portfolio of products, along with reliable supply and technical support to ensure consistency and compliance across their diverse product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.65 Billion |

| Market Forecast in 2032 | USD 3.78 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, Axalta Coating Systems, BASF SE, Dow Chemical Company, Valspar Corporation (Sherwin-Williams), ALTANA AG, KCC Corporation, National Paint Factories Co. Ltd., Henkel AG & Co. KGaA, Showa Denko K.K., Hexion Inc., CAN-PACK S.A., Crown Holdings, Inc., Ardagh Group S.A., Toyo Seikan Group Holdings, Ltd., JFE Holdings, Inc., Nippon Steel Corporation, Silgan Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Can Coatings Market Key Technology Landscape

The Food Can Coatings Market is characterized by a dynamic technology landscape driven by continuous innovation aimed at enhancing food safety, improving performance, and meeting sustainability goals. Traditionally, the market has relied heavily on solvent-borne epoxy-phenolic coatings, known for their excellent barrier properties, adhesion, and chemical resistance. However, the industry has been undergoing a significant shift towards water-borne and Bisphenol A non-intent (BPA-NI) technologies to address growing regulatory pressures and consumer concerns regarding BPA exposure. This transition involves substantial investment in research and development to formulate alternative polymer systems, such as polyesters, acrylics, and organosols, that can replicate or surpass the performance of conventional epoxy coatings while adhering to stricter health and environmental standards.

Current key technologies focus on a variety of application methods and coating types. Spray coating remains a dominant technique for internal can surfaces, offering uniform coverage essential for food contact. Roller coating is prevalent for exterior surfaces and sheet applications, while electrocoating is gaining traction for its ability to achieve complete coverage and maximize material utilization. Innovations also extend to curing technologies, with thermal curing being standard, but advancements in UV and E-beam curing are emerging for specific applications, offering faster processing times and lower energy consumption. The development of multi-layer coatings, which combine different polymer types to achieve specific barrier, adhesion, and flexibility properties, is another area of active technological exploration, providing tailored solutions for diverse food products.

Future technological advancements are anticipated in several critical areas. This includes the development of more sophisticated barrier coatings that can effectively block oxygen, moisture, and other permeants, extending shelf life even further and allowing for aseptic packaging solutions. The integration of "smart" or active packaging functionalities, such as antimicrobial coatings or oxygen scavengers embedded within the coating matrix, is on the horizon to provide additional layers of protection. Furthermore, there is a strong push towards fully bio-based and biodegradable coating materials derived from renewable resources, moving away from petrochemical dependence and aligning with the principles of a circular economy. Nanotechnology is also being explored to create ultra-thin, high-performance barriers with enhanced properties, promising revolutionary changes in the future of food can coatings.

Regional Highlights

- North America: This region is a mature market characterized by stringent food safety regulations and high consumer awareness regarding chemical exposure in food packaging. The demand for Bisphenol A non-intent (BPA-NI) coatings is particularly strong here, driving significant investment in R&D for alternative formulations. Key drivers include a stable packaged food industry and continuous innovation in sustainable packaging solutions.

- Europe: Europe exhibits strong growth driven by robust regulatory frameworks (e.g., REACH, specific food contact material regulations) that prioritize consumer health and environmental protection. There is a high adoption rate of BPA-NI and water-based coatings, reflecting a strong emphasis on sustainability and circular economy principles. Western Europe leads in technological advancements and premium coating solutions.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for food can coatings, fueled by rapid urbanization, increasing disposable incomes, and the booming food processing and canning industries, especially in countries like China, India, and Southeast Asia. While cost-effectiveness remains a key factor, rising awareness of food safety and environmental concerns is gradually pushing towards higher-quality and more compliant coating solutions.

- Latin America: This region represents an emerging market with significant growth potential, driven by improving economic conditions, a growing middle class, and increasing consumption of packaged and convenience foods. Investments in food processing infrastructure are expanding, leading to a rising demand for coated food cans, though adoption of advanced coating technologies may be slower compared to developed regions.

- Middle East and Africa (MEA): The MEA market is experiencing steady growth, supported by urbanization, a growing population, and increased demand for packaged food due to changing lifestyles. Development of local food production capabilities and improving cold chain logistics contribute to market expansion. Emphasis is often on basic protective coatings, with a gradual shift towards advanced solutions as regulatory landscapes evolve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Can Coatings Market.- AkzoNobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams Company

- Axalta Coating Systems

- BASF SE

- Dow Chemical Company

- Valspar Corporation (Sherwin-Williams)

- ALTANA AG

- KCC Corporation

- National Paint Factories Co. Ltd.

- Henkel AG & Co. KGaA

- Showa Denko K.K.

- Hexion Inc.

- CAN-PACK S.A.

- Crown Holdings, Inc.

- Ardagh Group S.A.

- Toyo Seikan Group Holdings, Ltd.

- JFE Holdings, Inc.

- Nippon Steel Corporation

- Silgan Holdings Inc.

Frequently Asked Questions

What are food can coatings and why are they important?

Food can coatings are specialized protective layers applied to metal food cans to prevent corrosion, ensure food safety by acting as a barrier against metal-food interaction, and extend product shelf life. They are crucial for preserving the nutritional value and sensory qualities of canned foods and beverages.

What is the difference between BPA-based and BPA-NI coatings?

BPA-based coatings contain Bisphenol A, a chemical historically used for its effective barrier properties. BPA-NI (Bisphenol A non-intent) coatings are formulations designed to achieve similar protection without intentionally adding BPA, developed in response to regulatory pressures and consumer demand for alternative materials perceived as safer.

How do food can coatings ensure food safety?

Coatings prevent the migration of metal ions from the can into the food and protect the can from corrosive food contents. This barrier function maintains the chemical integrity of the food, prevents spoilage, and ensures that the canned product remains safe and hygienic for consumption over its intended shelf life.

What are the key trends shaping the food can coatings market?

The market is primarily driven by the transition towards BPA-NI and sustainable coating solutions, increased demand for packaged food globally, stringent food safety regulations, and continuous innovation in materials offering enhanced barrier properties, corrosion resistance, and environmental friendliness.

What are the environmental considerations for food can coatings?

Environmental concerns include the use of solvents in some traditional coatings and the disposal of non-recyclable multi-layer materials. The industry is actively addressing this through the development of water-borne, high-solids, and bio-based coatings, alongside efforts to ensure compatibility with metal can recycling processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager