Food Safety Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427196 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Food Safety Testing Market Size

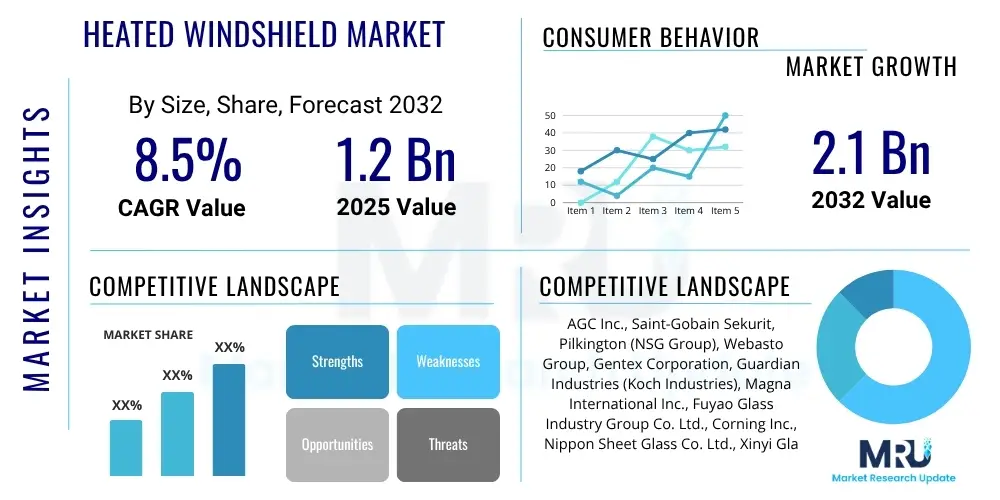

The Food Safety Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2025 and 2032. The market is estimated at USD 25.8 billion in 2025 and is projected to reach USD 42.1 billion by the end of the forecast period in 2032.

Food Safety Testing Market introduction

The global food safety testing market is a critical sector dedicated to safeguarding public health by ensuring that food products are free from harmful contaminants, adulterants, and pathogens. This market encompasses a wide array of analytical methods and technologies designed to detect potential hazards across the entire food supply chain, from raw material sourcing to final product consumption. The increasing complexity of global food trade, coupled with rising consumer awareness regarding food quality and safety, significantly underpins the demand for rigorous testing protocols. Food safety testing helps prevent foodborne illnesses, protects brand reputation, and ensures compliance with stringent international and national regulatory standards, which are continuously evolving.

The core of food safety testing involves the examination of food products for various categories of contaminants, including microbiological pathogens like Salmonella, E. coli, and Listeria, as well as chemical residues such as pesticides, heavy metals, veterinary drugs, and allergens. Additionally, testing extends to verifying the absence of genetically modified organisms (GMOs) in non-GMO labeled products, authenticating food origins to combat fraud, and detecting physical contaminants. The methodologies employed range from traditional culture-based techniques to advanced rapid detection systems, including PCR-based assays, immunoassay kits, and sophisticated chromatographic and spectroscopic instruments, each offering distinct advantages in terms of sensitivity, speed, and specificity.

Major applications of food safety testing span across diverse segments of the food industry, including meat and poultry, dairy products, processed foods, fruits and vegetables, beverages, and seafood. The benefits of comprehensive food safety testing are multi-faceted, extending beyond mere compliance to fostering consumer trust, facilitating international trade by meeting import/export requirements, and mitigating financial losses associated with product recalls and litigation. Key driving factors for market expansion include the escalating incidence of foodborne diseases, the globalization of food supply chains necessitating harmonized safety standards, a growing preference for processed and packaged foods, and continuous technological advancements that enable faster, more accurate, and cost-effective testing solutions.

Food Safety Testing Market Executive Summary

The Food Safety Testing Market is undergoing significant evolution, driven by dynamic business trends that emphasize automation, digital integration, and the adoption of rapid testing methodologies. Strategic partnerships and mergers among key players are increasingly common, aimed at expanding service portfolios, enhancing geographical reach, and leveraging technological synergies to address the complex challenges posed by diversified food supply chains. Furthermore, a pronounced trend towards contract testing organizations (CTOs) is observed, as food manufacturers seek to outsource testing services to specialized laboratories, benefiting from their expertise, advanced equipment, and accreditation, thereby optimizing operational costs and ensuring compliance without significant in-house investment. This outsourcing trend is further fueled by the need for quick turnaround times and the interpretation of intricate regulatory frameworks across various jurisdictions.

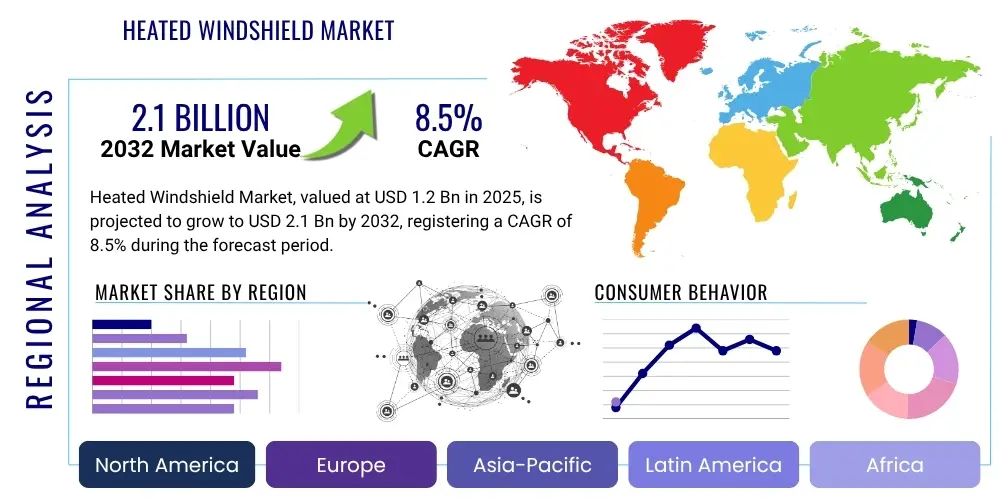

Regionally, the market exhibits varied growth trajectories, with established markets in North America and Europe characterized by mature regulatory frameworks and a high degree of consumer awareness, leading to consistent demand for comprehensive testing services. These regions are pioneers in adopting advanced testing technologies and setting global benchmarks for food safety standards. Conversely, the Asia-Pacific region is emerging as a high-growth market, propelled by rapid urbanization, expanding food processing industries, increasing disposable incomes, and a heightened focus on food safety regulations in developing economies. Countries like China and India are witnessing substantial investments in food safety infrastructure and enforcement, driven by both domestic demand for safer food and the imperative to meet international trade standards. Latin America and the Middle East & Africa also present nascent opportunities, with increasing governmental initiatives to modernize food safety regulations and growing consumer health consciousness.

Segment-wise, the market continues to be dominated by microbiological testing, which remains indispensable for detecting bacterial pathogens responsible for the majority of foodborne illnesses. However, chemical testing, particularly for contaminants like pesticides, heavy metals, allergens, and mycotoxins, is experiencing accelerated growth due to stricter maximum residue limits (MRLs) set by regulatory bodies and growing concerns over environmental pollution impacting food sources. The shift towards rapid testing technologies, including PCR and immunoassay-based methods, is a prominent segment trend, offering faster results, improved sensitivity, and enhanced efficiency compared to conventional culture-based methods. This technological evolution enables real-time monitoring and quicker decision-making in food production, significantly reducing the potential for widespread contamination incidents and minimizing product recall risks.

AI Impact Analysis on Food Safety Testing Market

Common user questions regarding AIs impact on food safety testing frequently revolve around its potential to enhance detection accuracy, predict contamination risks, automate routine tasks, and integrate disparate data sources. Users often express curiosity about how AI can move beyond traditional reactive testing to proactive risk management, what specific technologies are involved, and whether AI solutions are economically viable for small and medium-sized enterprises. There is also significant interest in AIs role in improving traceability, reducing human error, and interpreting complex data sets generated by advanced analytical instruments. Concerns typically include the reliability of AI algorithms, data privacy issues, the need for skilled personnel to manage AI systems, and the regulatory acceptance of AI-driven testing methods. These inquiries underscore a clear expectation for AI to revolutionize the speed, precision, and predictive capabilities of food safety protocols.

Artificial intelligence is poised to fundamentally transform the food safety testing market by introducing unprecedented levels of efficiency, accuracy, and predictive capabilities. AI algorithms can analyze vast datasets from various sources, including laboratory test results, environmental conditions, supply chain logistics, and even public health reports, to identify patterns and predict potential contamination outbreaks before they occur. This shift from reactive detection to proactive risk assessment enables food manufacturers to implement preventative measures, minimize waste, and protect consumer health more effectively. Machine learning models, a subset of AI, can be trained on historical contamination data to pinpoint high-risk ingredients, suppliers, or processing points, allowing for targeted testing strategies and resource allocation, thereby optimizing the entire food safety management system.

Furthermore, AI-powered systems are enhancing the automation of laboratory processes, from sample preparation and analysis to data interpretation. Robotic systems guided by AI can handle repetitive tasks with greater precision and speed than human operators, reducing manual errors and increasing sample throughput. In data analysis, AI can rapidly process complex spectroscopic or chromatographic data, identifying anomalies and potential contaminants with high sensitivity, which might be missed by traditional manual interpretation. This not only accelerates the testing workflow but also ensures a more consistent and objective analysis. The integration of AI with IoT sensors in food processing facilities allows for continuous, real-time monitoring of critical control points, enabling immediate detection of deviations and facilitating instant corrective actions, thus closing the loop between monitoring and intervention in food safety.

- Predictive analytics for contamination risk assessment across supply chains.

- Automated sample analysis and data interpretation, reducing manual error and increasing throughput.

- Real-time monitoring of critical control points in processing facilities using AI-driven IoT sensors.

- Enhanced traceability and recall management through sophisticated data integration and analysis.

- Identification of emerging pathogens and contaminants based on global data trends.

- Optimization of testing protocols and resource allocation through data-driven insights.

- Faster development and validation of new testing methods by analyzing experimental data.

DRO & Impact Forces Of Food Safety Testing Market

The Food Safety Testing Market is significantly influenced by a confluence of driving forces, inherent restraints, and burgeoning opportunities. Globalized food trade, which necessitates adherence to diverse international standards, along with the escalating incidence of foodborne diseases, are primary drivers compelling manufacturers to adopt rigorous testing. Consumer demand for transparent and safe food products, coupled with increasingly stringent regulatory frameworks enacted by governmental bodies worldwide, further propels market expansion. However, the market faces restraints such as the substantial capital investment required for advanced testing equipment, the ongoing challenge of developing standardized testing protocols across different regions, and the intricate complexity of food matrices that can complicate contaminant detection. Despite these hurdles, significant opportunities exist in the rapid adoption of innovative testing technologies like next-generation sequencing and blockchain for enhanced traceability, particularly in emerging economies where food safety infrastructure is still developing. These dynamics collectively shape an environment where technological advancement and regulatory compliance are critical for market success, further impacted by external forces like climate change affecting agricultural practices and geopolitical events disrupting supply chains.

Segmentation Analysis

The Food Safety Testing Market is broadly segmented based on various critical parameters, including the type of contaminant analyzed, the technology employed for testing, the food category being tested, and the end-user utilizing these services. This multi-faceted segmentation provides a granular view of the markets structure, reflecting the diverse requirements and specific challenges faced across the food industry. Understanding these segments is crucial for market participants to tailor their offerings, allocate resources effectively, and identify specific growth pockets. The continuous evolution of food processing techniques, ingredient sourcing, and global distribution networks necessitates a dynamic approach to segmentation, aligning with emerging risks and technological advancements.

Each segment within the food safety testing market addresses distinct aspects of food quality and safety assurance. For instance, testing for microbiological contaminants remains foundational, as pathogens are responsible for the vast majority of foodborne illnesses, demanding rapid and highly sensitive detection methods. Chemical testing, on the other hand, is gaining increasing prominence due to rising concerns over pesticide residues, heavy metals, allergens, and mycotoxins, which require sophisticated analytical instruments for accurate quantification. The advent of rapid testing technologies, from PCR-based assays to advanced immunoassays, signifies a paradigm shift towards faster turnaround times and on-site testing capabilities, which are particularly valuable for perishable goods and large-scale operations requiring immediate actionable insights.

The application of these tests varies significantly across different food categories. Meat, poultry, and seafood segments demand rigorous pathogen screening, while fruits, vegetables, and cereals often require extensive pesticide and heavy metal analysis. Dairy and processed foods have unique testing needs, including allergen detection and verification of nutritional content. The end-users of these services, predominantly food manufacturers and processors, contract laboratories, and government agencies, each have distinct requirements influenced by their operational scale, regulatory obligations, and internal capabilities. This intricate web of segmentation underscores the markets depth and the specialized expertise required to address the myriad of food safety challenges effectively, driving continuous innovation in testing methodologies and service delivery models.

- By Target Contaminant:

- Pathogens (e.g., Salmonella, E. coli, Listeria, Campylobacter)

- Toxins (e.g., Mycotoxins, Bacterial Toxins, Marine Toxins)

- Pesticides (e.g., Organochlorines, Organophosphates, Carbamates)

- Heavy Metals (e.g., Lead, Cadmium, Arsenic, Mercury)

- Allergens (e.g., Peanuts, Gluten, Dairy, Soy, Tree Nuts)

- GMOs (Genetically Modified Organisms)

- Adulterants & Residues (e.g., Antibiotics, Hormones, Veterinary Drugs)

- By Technology:

- Traditional (e.g., Culture-based methods)

- Rapid Technologies (e.g., PCR-based, Immunoassay-based, Chromatography-based, Spectroscopy-based, Biosensors)

- By Food Category:

- Meat, Poultry, and Seafood

- Dairy Products

- Processed Food

- Fruits and Vegetables

- Beverages

- Cereals and Grains

- Nutritional Products

- By End-User:

- Food & Beverage Manufacturers

- Contract Research Organizations (CROs) / Third-Party Laboratories

- Government Agencies & Research Institutes

- Retailers & Food Service Providers

Food Safety Testing Market Value Chain Analysis

The value chain of the Food Safety Testing Market is a complex ecosystem involving several interconnected stages, commencing with upstream suppliers who provide essential reagents, consumables, and analytical instruments. These suppliers are critical for equipping laboratories with the necessary tools for testing, ranging from simple culture media to sophisticated mass spectrometers and PCR machines. The quality and availability of these foundational components directly impact the efficiency and accuracy of the subsequent testing processes. Strategic relationships with reliable upstream partners are therefore paramount for testing service providers to ensure the continuity of their operations and the integrity of their results, forming the initial link in delivering comprehensive food safety assurances.

Further along the value chain, the core processing phase involves the actual execution of food safety tests, typically conducted by specialized contract laboratories, in-house facilities of large food manufacturers, or governmental regulatory bodies. These entities receive food samples from various points across the supply chain, perform the required analytical assays, and interpret the results against established safety standards. This stage heavily relies on skilled technicians, validated methodologies, and robust quality management systems to generate accurate and reliable data. The proliferation of rapid testing kits and portable devices is also transforming this stage by enabling faster, decentralized testing capabilities, pushing aspects of analysis closer to the point of origin or processing, thereby accelerating decision-making and intervention.

The downstream segment of the value chain focuses on the distribution of test results and the subsequent actions taken by food manufacturers, retailers, and ultimately, consumers. Test results are communicated to relevant stakeholders, informing decisions regarding product release, recall, or process adjustments. Distribution channels for food safety testing services primarily include direct sales relationships between testing laboratories and food producers, as well as indirect channels facilitated by consultants or industry associations. The transparency and efficiency of this information flow are crucial for maintaining market confidence and ensuring consumer protection. Effective communication of testing outcomes supports brand reputation, facilitates compliance with market regulations, and allows for timely corrective measures to prevent foodborne incidents from reaching the end consumer, thereby completing the cycle of value creation.

Food Safety Testing Market Potential Customers

The primary potential customers and end-users of food safety testing services are diverse, encompassing the entire spectrum of the food industry, from initial production to final retail. Food and beverage manufacturers, irrespective of their scale, represent a significant customer base. These entities require comprehensive testing across their raw materials, in-process goods, and finished products to comply with regulatory mandates, uphold brand integrity, and assure consumers of product safety. Their needs are often extensive, covering a wide range of contaminants such as pathogens, allergens, and chemical residues, and typically involve both routine quality control checks and targeted investigations following any contamination alerts. The increasing complexity of their supply chains and the global sourcing of ingredients further amplify their reliance on sophisticated testing solutions.

Contract laboratories, often referred to as third-party testing organizations, are also key customers, as they offer specialized analytical services to manufacturers who either lack the in-house capabilities or prefer to outsource for independent verification. These laboratories cater to a broad clientele, including small-to-medium enterprises that cannot afford to establish their own advanced testing facilities, as well as larger corporations seeking unbiased validation or additional capacity during peak seasons. Furthermore, governmental regulatory bodies and public health agencies are critical users of food safety testing services. They conduct surveillance testing, verify compliance with national food safety laws, investigate foodborne outbreaks, and establish new standards, often collaborating with accredited laboratories to fulfill their mandate of public health protection.

Beyond manufacturers and regulatory entities, the retail sector, including supermarkets, hypermarkets, and online food delivery platforms, represents another significant segment of potential customers. These businesses are increasingly implementing their own supplier auditing and product testing programs to mitigate risks and maintain consumer trust in their brands and private-label products. The hospitality industry, encompassing restaurants, hotels, and catering services, also relies on food safety testing, particularly for verifying the safety of ingredients and prepared foods to prevent foodborne incidents. This diverse customer landscape underscores the widespread imperative for food safety assurance, driving continuous demand across various touchpoints in the food supply chain and fostering a robust market for testing solutions and services.

Food Safety Testing Market Key Technology Landscape

The technology landscape within the Food Safety Testing Market is rapidly evolving, characterized by a shift towards methods that offer greater speed, sensitivity, automation, and multiplexing capabilities. Traditional culture-based methods, while foundational for microbiological analysis, are increasingly being complemented or even supplanted by rapid molecular and immunological techniques due to their significantly reduced turnaround times. Polymerase Chain Reaction (PCR) technology, in its various forms such as real-time PCR (qPCR) and multiplex PCR, remains a cornerstone for pathogen detection, providing highly sensitive and specific identification of microbial DNA. This technology allows for the detection of viable but non-culturable organisms and offers a crucial advantage in preventing widespread contamination by enabling swift corrective actions.

Immunoassays, particularly Enzyme-Linked Immunosorbent Assay (ELISA), are widely employed for the detection of allergens, toxins (like mycotoxins), and certain pathogens. ELISA offers high throughput and relatively low cost per test, making it suitable for screening large numbers of samples. Advances in immunoassay design include lateral flow devices (LFDs) and biosensors, which provide rapid, on-site testing capabilities, demanding minimal equipment and technical expertise. These point-of-care type solutions are invaluable for field applications, emergency response, and quick verification at various stages of the food supply chain, enhancing accessibility to immediate safety assessments. The integration of nanotechnology with biosensors is further pushing the boundaries of detection limits and speed.

For chemical contaminants, chromatography and spectroscopy techniques are indispensable. Gas Chromatography-Mass Spectrometry (GC-MS) and Liquid Chromatography-Mass Spectrometry (LC-MS/MS) are considered gold standards for the precise identification and quantification of pesticide residues, veterinary drugs, heavy metals, and other chemical adulterants due to their unparalleled sensitivity and specificity. Newer spectroscopic methods, such as Near-Infrared (NIR) and Raman spectroscopy, offer non-destructive, rapid analysis for quality control, authenticity verification, and compositional analysis, providing real-time data directly on the production line. Emerging technologies like Next-Generation Sequencing (NGS) are revolutionizing food safety by enabling comprehensive microbial community analysis, source tracking of contaminants, and identification of antimicrobial resistance genes, moving beyond targeted pathogen detection to a holistic understanding of food matrices. These technological advancements collectively drive the market towards more robust, efficient, and proactive food safety management systems.

Regional Highlights

- North America: This region holds a significant share in the food safety testing market, driven by stringent regulatory frameworks imposed by agencies such as the FDA and USDA, high consumer awareness regarding food quality, and the widespread adoption of advanced testing technologies. The robust presence of key market players and a mature food processing industry further contribute to its dominance.

- Europe: Characterized by comprehensive and harmonized food safety regulations (e.g., EU Food Law), Europe demonstrates a strong demand for food safety testing. High standards for imports and exports, coupled with a proactive approach to emerging food safety risks and a well-established network of accredited laboratories, solidify its position as a leading market.

- Asia-Pacific: Expected to be the fastest-growing region, propelled by rapid industrialization, expanding food processing sectors, increasing disposable incomes, and a growing middle-class demanding safer food. Countries like China, India, and Japan are investing heavily in improving food safety infrastructure and implementing stricter regulations to meet both domestic and international trade demands.

- Latin America: This region is experiencing steady growth, largely due to increasing urbanization, modernization of food production practices, and a gradual alignment with international food safety standards. Rising public awareness about foodborne illnesses and government initiatives to enhance regulatory oversight are key drivers.

- Middle East & Africa: An emerging market with significant growth potential, driven by rising food imports, increasing population, and growing concerns about food quality and safety. Investments in agricultural and food processing sectors, coupled with evolving regulatory landscapes, are paving the way for expanded testing services in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Safety Testing Market.- SGS SA

- Eurofins Scientific SE

- Intertek Group plc

- Mérieux NutriSciences Corporation

- ALS Limited

- Bureau Veritas S.A.

- Thermo Fisher Scientific Inc.

- 3M Company

- Neogen Corporation

- PerkinElmer Inc.

- DuPont de Nemours, Inc. (now IFF)

- Romer Labs Diagnostic GmbH (part of ERBER Group)

- QIAGEN N.V.

- Bio-Rad Laboratories Inc.

- Agilent Technologies, Inc.

Frequently Asked Questions

What are the primary drivers of growth in the Food Safety Testing Market?

The key drivers include the globalization of food trade, which necessitates compliance with diverse international standards, the rising incidence of foodborne diseases, increasing consumer awareness and demand for transparent food safety information, and the continuous implementation of more stringent food safety regulations by governmental bodies worldwide. Technological advancements in testing methodologies also play a crucial role.

How do evolving regulations impact the Food Safety Testing Market?

Evolving regulations, such as the Food Safety Modernization Act (FSMA) in the US or updated EU food laws, significantly shape the market by mandating more frequent and comprehensive testing, extending oversight to entire supply chains, and requiring faster detection methods. These regulations drive the adoption of advanced testing technologies and often lead to increased demand for accredited third-party laboratory services to ensure compliance.

What are the key technological advancements transforming food safety testing?

Major technological advancements include rapid molecular methods like PCR for faster pathogen detection, advanced chromatographic and spectroscopic techniques (e.g., LC-MS/MS) for precise chemical contaminant analysis, and the integration of AI and IoT for predictive risk assessment and real-time monitoring. Biosensors and next-generation sequencing (NGS) are also revolutionizing the speed, accuracy, and scope of testing capabilities.

What challenges does the Food Safety Testing Market currently face?

Challenges include the high cost of sophisticated testing equipment and specialized personnel, the lack of universally standardized testing protocols across different global regions, the complexity of food matrices which can interfere with contaminant detection, and the ongoing need to detect emerging contaminants and adulterants. Managing vast amounts of data and ensuring data integrity also presents a significant challenge.

What is the role of Artificial Intelligence (AI) in future food safety testing?

AI is expected to enable predictive analytics for identifying high-risk areas in the supply chain, automate laboratory processes to enhance efficiency and reduce human error, and facilitate real-time monitoring through smart sensors. It will also aid in rapid data analysis from complex tests, accelerating decision-making and contributing to more proactive and preventative food safety management strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food Safety Testing Market Size Report By Type (Pathogen, Genetically modified organism (GMO), Chemical and toxin, Others, , Agar culturing, PCR-based assay, Immunoassay-based, Others), By Application (Meat, Poultry, & Seafood Products, Dairy & Dairy Products, Processed Food, Beverages, Cereals & Grains, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Csa Food Safety Testing Market Size Report By Type (Allergen Testing, Chemical & Nutritional Testing, Genetically Modified Organism (GMO) Testing, Microbiological Testing, Residues & Contamination Testing, Others), By Application (Meat, Poultry, & Seafood Products, Dairy & Dairy Products, Processed Food, Beverages, Cereals & Grains, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Genetically Modified Food Safety Testing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Polymerase Chain Reaction (PCR-based), Immunoassay), By Application (Bakery & confectionery, Meat & meat products, Breakfast cereals & snacks, Food additives, Other processed food), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- The Food Safety Testing And Technologies Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pathogen, Pesticide, GMO, Toxins, Residue, Others), By Application (Meat & Poultry, Seafood, Dairy, Processed Foods, Fruits & Vegetables), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Food Safety Testing and Technologies Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pathogen, Pesticide, GMO, Toxins, Residue, Others), By Application (Meat & Poultry, Dairy, Processed Foods, Fruits & Vegetables), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager