Fossil Fuel New Energy Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427769 | Date : Oct, 2025 | Pages : 254 | Region : Global | Publisher : MRU

Fossil Fuel New Energy Generation Market Size

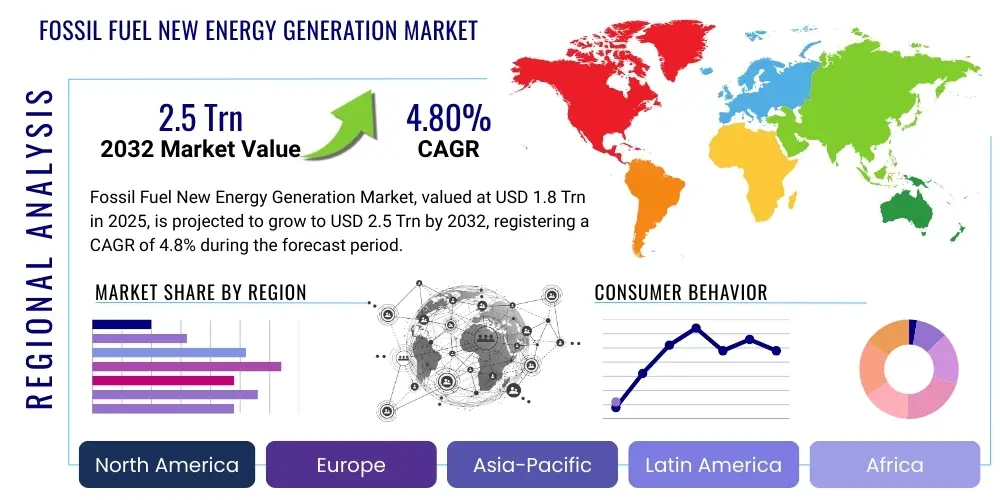

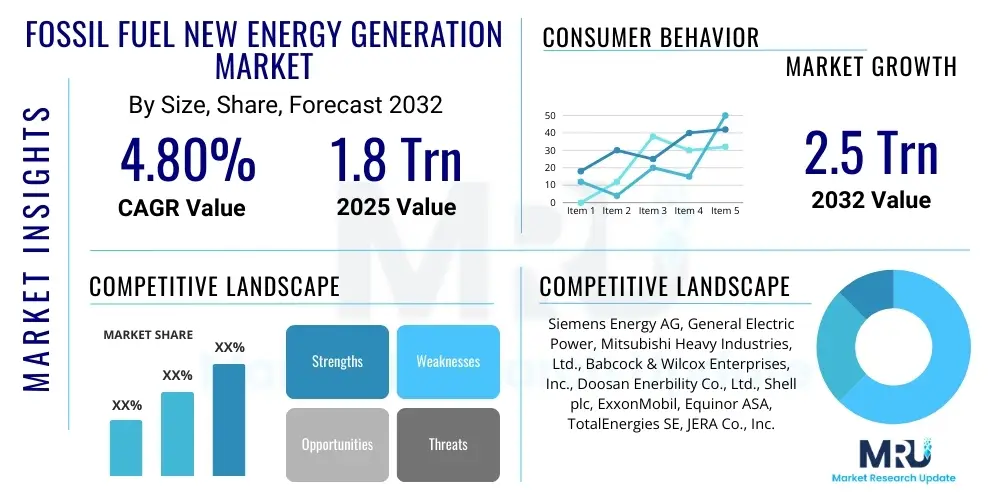

The Fossil Fuel New Energy Generation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2025 and 2032. The market is estimated at USD 1.8 trillion in 2025 and is projected to reach USD 2.5 trillion by the end of the forecast period in 2032.

Fossil Fuel New Energy Generation Market introduction

The Fossil Fuel New Energy Generation Market encompasses the evolving landscape of power generation where traditional fossil fuels are employed in conjunction with advanced technologies to enhance efficiency, reduce environmental impact, and facilitate a smoother energy transition. This market is characterized by significant innovation aimed at prolonging the viability and reducing the carbon footprint of fossil fuel-based electricity, acknowledging their continued role in ensuring grid stability and energy security amidst the global shift towards renewable sources. It includes the adoption of technologies such as advanced gas turbines, ultra-supercritical coal combustion, and pioneering carbon capture, utilization, and storage (CCUS) solutions, which fundamentally redefine how fossil fuels are integrated into modern energy systems.

Major applications within this market span a broad spectrum, from large-scale utility power plants providing base-load electricity and grid stabilization, to industrial facilities requiring reliable process heat and steam generation, and the burgeoning sector of blue hydrogen production. The inherent benefits include leveraging existing infrastructure, providing dispatchable power to balance intermittent renewables, and offering a cost-effective pathway to meet escalating global energy demand. Furthermore, these technologies offer a pragmatic solution for economies heavily reliant on fossil fuels to transition towards cleaner energy mixes without compromising immediate energy needs or economic stability, thereby addressing critical aspects of energy policy and industrial development.

Driving factors for the markets continued evolution are multifaceted. They include persistent global energy demand growth, particularly in emerging economies, the imperative for energy security in a volatile geopolitical landscape, and the crucial requirement for grid reliability that intermittent renewable sources alone cannot always provide. Advancements in material science and digital control systems continuously improve the efficiency and reduce emissions from fossil fuel plants, while supportive policy frameworks in certain regions, incentivizing CCUS and hydrogen development, further propel market expansion. The continuous need for a balanced energy portfolio that ensures affordability, reliability, and sustainability remains a core impetus for innovation in fossil fuel new energy generation.

Fossil Fuel New Energy Generation Market Executive Summary

The Fossil Fuel New Energy Generation Market is experiencing dynamic shifts, driven by a complex interplay of global energy demands, environmental imperatives, and technological advancements. Business trends indicate a strategic pivot from new traditional fossil fuel plant construction towards modernization, efficiency upgrades, and the integration of carbon abatement technologies, particularly Carbon Capture, Utilization, and Storage (CCUS). Investments are increasingly directed towards natural gas-fired power generation, favored for its lower emissions profile compared to coal, and its flexibility to complement renewable energy sources. Furthermore, the market is witnessing growing interest in hydrogen production from fossil fuels with CCUS (blue hydrogen) as a transitional fuel, signaling a significant evolution in energy commodity value chains and an increased focus on circular economy principles within the energy sector.

Regionally, the market exhibits considerable heterogeneity. Asia Pacific continues to be a primary driver of energy demand, with ongoing reliance on fossil fuels, yet also demonstrates a rapidly expanding interest and investment in CCUS and high-efficiency power generation technologies, especially in industrial clusters. North America is characterized by robust natural gas production and significant federal incentives for CCUS, positioning it as a leader in innovative emission reduction strategies for its extensive fossil fuel infrastructure. Europe, while strongly committed to decarbonization and renewable expansion, still leverages natural gas for energy security and grid balancing, with a strong emphasis on research and development into hydrogen and advanced CCUS solutions to meet ambitious climate targets, showcasing varied paces and approaches to the energy transition.

Segment-wise, the market is primarily shaped by innovations in fuel types and power generation technologies. Natural gas remains a cornerstone, with advanced combined cycle gas turbines (CCGT) offering superior efficiency and lower emissions than older coal plants, providing crucial grid flexibility. The CCUS segment is poised for substantial growth, driven by policy support and the necessity to decarbonize hard-to-abate industrial sectors and existing fossil fuel power assets. While coals overall share is declining in many developed regions, ultra-supercritical and advanced ultra-supercritical technologies continue to be deployed in specific markets, striving for improved efficiency. The emerging hydrogen economy, with blue hydrogen serving as an initial scalable pathway, represents a critical new segment influencing future investment and technological development across the entire energy generation value chain.

AI Impact Analysis on Fossil Fuel New Energy Generation Market

Common user inquiries concerning Artificial Intelligences influence on the Fossil Fuel New Energy Generation Market often revolve around optimizing operational efficiency, enhancing predictive maintenance, and integrating advanced control systems to manage the complex dynamics of a transitioning energy landscape. Users are particularly keen on understanding how AI can facilitate carbon capture processes, improve fossil fuel plant performance, and contribute to grid stability when combined with intermittent renewable energy sources. Key themes highlight expectations for AI to drive cost reductions, improve safety protocols, and accelerate the development and deployment of cleaner fossil fuel technologies, while also acknowledging concerns regarding data security, algorithmic bias, and the necessity for robust digital infrastructure to support these advancements in critical energy infrastructure.

- AI-driven predictive maintenance significantly reduces downtime and operational costs by forecasting equipment failures in fossil fuel plants, optimizing maintenance schedules, and extending asset lifespans through continuous real-time data analysis.

- Optimization of combustion processes through AI algorithms enhances fuel efficiency and lowers emissions by precisely controlling air-to-fuel ratios and other operational parameters, leading to more sustainable fossil fuel utilization.

- AI plays a crucial role in grid stability and energy management by forecasting demand and supply fluctuations, enabling fossil fuel generators to adjust output rapidly and efficiently, thereby balancing the intermittency of renewable sources.

- Advanced AI models are being developed to optimize carbon capture, utilization, and storage (CCUS) processes, improving capture rates, reducing energy intensity, and enhancing the overall economic viability of these critical decarbonization technologies.

- AI supports the development and deployment of digital twins for fossil fuel power plants, allowing for virtual testing of operational scenarios, training, and performance benchmarking without disrupting actual plant operations, leading to safer and more efficient innovation.

- Enhanced cybersecurity measures are increasingly being integrated with AI to protect critical energy infrastructure from cyber threats, ensuring the reliable and secure operation of advanced fossil fuel generation facilities in an interconnected environment.

- AI facilitates the integration of diverse energy sources, including fossil fuels and renewables, into hybrid systems by optimizing dispatch strategies, storage solutions, and transmission capacities to create a more resilient and efficient overall energy supply network.

DRO & Impact Forces Of Fossil Fuel New Energy Generation Market

The Fossil Fuel New Energy Generation Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various Impact Forces. Key drivers include persistent global energy demand growth, particularly in rapidly industrializing economies, which necessitates reliable and dispatchable power sources that fossil fuels can currently provide at scale. The imperative for energy security, alongside the inherent cost-effectiveness of established fossil fuel infrastructure, continues to drive investment. Furthermore, technological advancements in areas like high-efficiency power generation and carbon capture, utilization, and storage (CCUS) offer pathways to decarbonize fossil fuel usage, presenting a pragmatic option for bridging the energy transition gap while maintaining economic stability and grid reliability.

However, significant restraints temper this growth. Stringent and evolving environmental regulations, coupled with increasing public and investor pressure for decarbonization, pose considerable challenges to new fossil fuel projects. The high capital expenditures associated with deploying advanced fossil fuel technologies, especially CCUS, often deter investment, while fierce competition from increasingly cost-competitive renewable energy sources like solar and wind further constrains market expansion. The implementation of carbon pricing mechanisms and taxes in various jurisdictions also adds financial burden, diminishing the economic attractiveness of fossil fuel-dependent energy generation over the long term, pushing for a quicker shift towards entirely renewable alternatives where feasible.

Opportunities within this market are substantial, primarily centering on the development and scaling of blue hydrogen production, which utilizes natural gas with CCUS to produce a low-carbon fuel that can be used across multiple sectors. The integration of advanced modular technologies, such as small modular reactors (SMRs) alongside flexible natural gas plants, offers hybrid power solutions for enhanced grid stability and resilience. Continued innovation in CCUS technologies, aiming to reduce costs and improve capture efficiency, along with the retrofitting of existing fossil fuel infrastructure to accommodate these solutions, presents a significant avenue for growth. These opportunities align with the global goal of net-zero emissions while ensuring a stable and secure energy supply during the transition.

The market is profoundly influenced by several overarching impact forces. Geopolitical stability plays a critical role, affecting global energy prices and supply chain reliability, which in turn influences investment decisions in both fossil fuel and renewable projects. Rapid technological breakthroughs in energy storage, advanced materials, and digitalization capabilities continuously reshape the competitive landscape, creating new possibilities for optimizing energy generation. Evolving regulatory landscapes, driven by international climate agreements and national energy policies, dictate the pace and direction of decarbonization efforts. Societal pressure for environmental stewardship and sustainability, alongside the volatility of global energy prices, further exert significant influence on market dynamics, compelling stakeholders to innovate and adapt their strategies to meet the converging demands for affordability, security, and environmental responsibility.

Segmentation Analysis

The Fossil Fuel New Energy Generation Market is comprehensively segmented by fuel type, technology, application, and end-use, reflecting the diverse strategies employed to optimize and decarbonize fossil fuel-based energy production. This segmentation allows for a granular understanding of market dynamics, revealing where innovation and investment are most concentrated. Each segment represents distinct challenges and opportunities, driven by varying resource availability, technological maturity, regulatory frameworks, and specific energy demands across different regions and industrial sectors. Analyzing these segments provides critical insights into the markets current structure and its potential trajectories as the global energy landscape continues its multifaceted transition towards lower-carbon solutions while maintaining reliability.

- By Fuel Type:

- Natural Gas: Dominates new fossil fuel generation due to its lower carbon intensity compared to coal, abundance, and flexibility for dispatchable power generation, often serving as a bridge fuel in the energy transition.

- Coal: While facing decline in many developed economies, advanced coal technologies like ultra-supercritical plants are still deployed in some regions to improve efficiency and reduce emissions, particularly where coal is a primary indigenous energy resource.

- Oil: Primarily used for peaking power plants, industrial processes, and in regions with limited natural gas infrastructure, though its role in new energy generation is increasingly constrained by environmental concerns and cost.

- Other Fossil Fuels (e.g., Synthetic Fuels): Emerging technologies explore synthetic fuels derived from coal or natural gas, often combined with CCUS, as a pathway to cleaner liquid or gaseous fuels for specialized applications.

- By Technology:

- Combined Cycle Gas Turbines (CCGT): Highly efficient technology using both gas and steam turbines to generate electricity, offering flexibility and relatively lower emissions, making it a preferred choice for new natural gas plants.

- Carbon Capture, Utilization, and Storage (CCUS): Technologies designed to capture CO2 emissions from power plants and industrial sources, either for permanent storage or for utilization in other industrial processes, critical for decarbonizing fossil fuel use.

- Ultra-Supercritical (USC) and Advanced Ultra-Supercritical (A-USC) Coal: Advanced combustion technologies for coal-fired power plants that operate at higher temperatures and pressures, significantly improving efficiency and reducing CO2 emissions per unit of electricity generated.

- Integrated Gasification Combined Cycle (IGCC): Converts fossil fuels into synthesis gas before combustion, allowing for easier removal of pollutants and potentially higher efficiency, especially when integrated with CCUS.

- Fluidized Bed Combustion (FBC): A combustion technology used for burning various fuels efficiently, including low-grade coals and biomass, with reduced emissions of sulfur dioxide and nitrogen oxides.

- By Application:

- Power Generation: The primary application, encompassing base-load, intermediate, and peaking power plants utilizing various fossil fuels and associated new technologies for electricity production.

- Industrial Heat & Steam Generation: Fossil fuels provide essential high-temperature heat and steam for energy-intensive industries such as cement, steel, chemicals, and refining, with efforts to incorporate efficiency and emissions reduction technologies.

- Hydrogen Production (Blue Hydrogen): A growing application focused on producing hydrogen from natural gas or coal, with integrated CCUS to mitigate carbon emissions, positioning it as a low-carbon energy carrier for various sectors.

- By End-Use:

- Utilities: Large-scale public and private power providers that operate power plants and distribution networks, serving residential, commercial, and industrial customers.

- Industrial: Energy-intensive industries such as manufacturing, mining, and petrochemicals that consume significant amounts of power and heat, often generated on-site or purchased from utilities.

- Commercial: Businesses and institutions requiring electricity and heating/cooling for their operations, including offices, retail establishments, and data centers.

Fossil Fuel New Energy Generation Market Value Chain Analysis

The Value Chain Analysis for the Fossil Fuel New Energy Generation Market reveals a complex network of activities, commencing from the exploration and extraction of fossil fuels through to their transformation into electricity or other energy products and final delivery to consumers. This chain involves distinct upstream, midstream, and downstream segments, each critical for the efficient and reliable functioning of the market. Understanding these interdependencies is essential for identifying areas of innovation, cost optimization, and potential decarbonization efforts across the entire life cycle of fossil fuel-based energy generation. The inherent complexity mandates robust logistical and operational coordination to ensure energy security and supply chain resilience.

The upstream segment primarily involves the exploration, drilling, and extraction of raw fossil fuel resources, including crude oil, natural gas, and coal. This stage also encompasses initial processing activities, such as natural gas liquefaction (LNG) for transport or coal washing to improve quality. Key players at this stage include major energy companies and mining corporations, focusing on resource discovery, efficient extraction techniques, and compliance with environmental regulations. Technological advancements in seismic imaging, directional drilling, and enhanced oil/gas recovery techniques are crucial here, impacting the availability and cost of raw materials for energy generation, forming the fundamental base of the entire value chain.

The midstream activities focus on the transportation and storage of fossil fuels from production sites to power generation facilities or industrial end-users. This segment includes an extensive network of pipelines for natural gas and crude oil, shipping via tankers for LNG and coal, and large-scale storage facilities. Ensuring the safe, efficient, and reliable movement of vast quantities of energy resources is paramount. Downstream activities constitute the core of "new energy generation," involving the conversion of fossil fuels into electricity, process heat, or hydrogen, often through advanced power plants incorporating technologies like CCGT, USC coal, or CCUS. This stage also includes the transmission and distribution of generated electricity to various end-users through national grids and local networks.

Distribution channels for the output of fossil fuel new energy generation are primarily direct to large industrial consumers or through established electricity grids managed by utilities and independent system operators. Direct sales or long-term power purchase agreements are common for large-scale industrial customers requiring dedicated, reliable power and steam. For broader consumption, electricity is fed into the grid, where it is then distributed to residential, commercial, and other industrial end-users via regulated utility companies or competitive electricity markets. The direct channel offers custom solutions and enhanced reliability for specific industrial needs, while the indirect channel via the grid ensures widespread availability and integration into the broader energy ecosystem, facilitating a stable and accessible energy supply.

Fossil Fuel New Energy Generation Market Potential Customers

The potential customers for the Fossil Fuel New Energy Generation Market are diverse, primarily comprising entities with significant energy demands that prioritize reliability, cost-effectiveness, and, increasingly, lower carbon intensity solutions. These end-users and buyers span multiple sectors, reflecting the foundational role that dispatchable fossil fuel power continues to play in global energy systems, even amidst the transition to renewables. Identifying these core customer groups is crucial for market participants to tailor their technological offerings, service models, and decarbonization strategies, ensuring the continued relevance and adoption of advanced fossil fuel generation solutions that address specific operational and environmental requirements across various economic activities.

Electric utilities and Independent Power Producers (IPPs) represent a cornerstone of the customer base. These entities are responsible for generating, transmitting, and distributing electricity to residential, commercial, and industrial consumers. Their primary need is for reliable, base-load, and dispatchable power generation that can quickly adjust to grid demand fluctuations and back up intermittent renewable sources. As such, they are key buyers of advanced natural gas combined cycle plants, high-efficiency coal plants, and increasingly, integrated carbon capture solutions to meet regulatory requirements and investor expectations for reduced emissions while maintaining system stability and energy security for their extensive customer bases.

Heavy industries, including those in the cement, steel, chemical, and refining sectors, constitute another significant segment of potential customers. These industries are typically energy-intensive, requiring large volumes of continuous process heat, steam, and electricity that fossil fuel-based generation can reliably provide. Their focus is on ensuring uninterrupted operations, minimizing energy costs, and implementing solutions that help them achieve their own decarbonization targets. Consequently, they are prime candidates for on-site fossil fuel co-generation facilities, industrial-scale CCUS projects, and blue hydrogen solutions that can replace existing high-carbon inputs, thereby enabling these foundational industries to maintain competitiveness while addressing their environmental footprints.

Fossil Fuel New Energy Generation Market Key Technology Landscape

The Fossil Fuel New Energy Generation Markets technological landscape is characterized by continuous innovation aimed at enhancing efficiency, reducing emissions, and enabling the flexible integration of fossil fuels within a cleaner energy mix. This landscape is a dynamic arena where mature technologies are being refined alongside the rapid development and deployment of novel solutions designed to address the environmental challenges associated with fossil fuel combustion. Understanding these key technologies is fundamental to grasping the markets trajectory, identifying investment opportunities, and evaluating the pathways available for decarbonization efforts within the energy sector, ultimately contributing to a more sustainable and resilient global energy infrastructure for future generations.

A primary focus lies on advancements in combustion and power cycle technologies. Modern Combined Cycle Gas Turbines (CCGT) are at the forefront, leveraging sophisticated aerodynamic designs, advanced materials, and precise control systems to achieve efficiencies exceeding 60%. These systems also offer rapid start-up and ramp-up capabilities, making them ideal for balancing the intermittency of renewable energy sources. Similarly, Ultra-Supercritical (USC) and Advanced Ultra-Supercritical (A-USC) coal-fired power plants operate at significantly higher temperatures and pressures than conventional plants, drastically improving thermal efficiency and reducing specific CO2 emissions, thereby extending the viable operational life of existing coal fleets under stringent environmental mandates through continuous upgrades.

Crucially, Carbon Capture, Utilization, and Storage (CCUS) technologies are evolving rapidly, representing a cornerstone of the decarbonization strategy for fossil fuel new energy generation. This includes pre-combustion capture (e.g., in Integrated Gasification Combined Cycle - IGCC), post-combustion capture (chemical absorption from flue gases), and oxy-fuel combustion (burning fuel in pure oxygen). Beyond capture, innovations in CO2 utilization—converting captured carbon into valuable products like building materials, chemicals, or synthetic fuels—are gaining traction, offering economic incentives. Additionally, digitalization and AI-driven plant optimization are revolutionizing operations, enabling predictive maintenance, real-time performance adjustments, and enhanced safety protocols, further refining the efficiency and environmental performance of fossil fuel-based power plants and ensuring their continued role in a balanced global energy portfolio.

Regional Highlights

- North America: This region exhibits a robust and evolving fossil fuel new energy generation market, driven by abundant natural gas resources and significant investments in Carbon Capture, Utilization, and Storage (CCUS). The U.S. benefits from policy support, such as tax credits (e.g., 45Q), fostering CCUS deployment across gas-fired power plants and industrial facilities, aiming for energy independence and lower emissions from its extensive fossil fuel infrastructure.

- Europe: Europe is characterized by stringent environmental regulations and ambitious decarbonization targets, leading to a rapid phase-out of coal-fired power plants. However, natural gas continues to play a critical transitional role for grid stability and security. The region is a leader in CCUS research and development, particularly for industrial clusters, and is heavily investing in blue hydrogen initiatives to leverage existing natural gas networks while striving for net-zero emissions.

- Asia Pacific: As the worlds largest energy consumer, Asia Pacific continues to rely significantly on fossil fuels, especially coal, for its rapidly expanding industrial and economic growth. However, theres a growing commitment to deploying high-efficiency low-emission (HELE) coal technologies and a substantial increase in interest and investment in CCUS projects, particularly in countries like China, India, Japan, and Australia, to mitigate the environmental impact of their energy demands.

- Middle East & Africa: This region possesses vast oil and natural gas reserves, positioning it as a significant player in the fossil fuel market. Countries like Saudi Arabia and the UAE are investing heavily in blue hydrogen production and CCUS facilities, leveraging their natural gas resources to diversify their energy exports and reduce domestic carbon footprints, while also addressing rapidly growing internal electricity demands.

- South America: South Americas energy mix includes a strong component of hydropower, but natural gas is increasingly utilized for base-load and flexible power generation, especially in countries like Brazil, Argentina, and Colombia. The region is witnessing a gradual shift towards modernizing existing fossil fuel plants and exploring CCUS opportunities, driven by industrial growth and the need for reliable energy to complement its renewable resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fossil Fuel New Energy Generation Market.- Siemens Energy AG

- General Electric (GE) Power

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Babcock & Wilcox Enterprises, Inc.

- Doosan Enerbility Co., Ltd.

- Shell plc

- ExxonMobil

- Equinor ASA

- TotalEnergies SE

- JERA Co., Inc.

Frequently Asked Questions

What defines the Fossil Fuel New Energy Generation Market?

The Fossil Fuel New Energy Generation Market encompasses the sector focused on generating power from fossil fuels using advanced technologies to enhance efficiency, reduce emissions, and ensure grid stability, thereby addressing environmental concerns while meeting escalating global energy demands during the energy transition.

How do environmental regulations impact this market?

Environmental regulations significantly impact this market by driving the adoption of cleaner technologies like CCUS and high-efficiency plants, increasing operational costs for non-compliant facilities, and influencing investment away from traditional fossil fuel projects towards those with lower carbon footprints, ultimately accelerating decarbonization efforts.

What role does Carbon Capture, Utilization, and Storage (CCUS) play?

CCUS plays a pivotal role by capturing carbon dioxide emissions from fossil fuel power plants and industrial sources, preventing their release into the atmosphere. It is crucial for decarbonizing hard-to-abate sectors and enabling the continued, yet cleaner, use of fossil fuels as a bridge to a fully renewable energy system.

How do fossil fuels integrate with renewable energy in new generation systems?

Fossil fuels, particularly natural gas, integrate with renewable energy primarily as a flexible, dispatchable backup, providing grid stability and balancing the intermittency of solar and wind power. Hybrid systems optimize this integration through smart grids and advanced control systems, ensuring reliable electricity supply.

What are the key technological advancements driving this market?

Key technological advancements include advanced Combined Cycle Gas Turbines (CCGT), Ultra-Supercritical (USC) and Advanced Ultra-Supercritical (A-USC) coal technologies for efficiency, and rapidly evolving Carbon Capture, Utilization, and Storage (CCUS) solutions, alongside digitalization and AI for optimized plant operations and emissions reduction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager