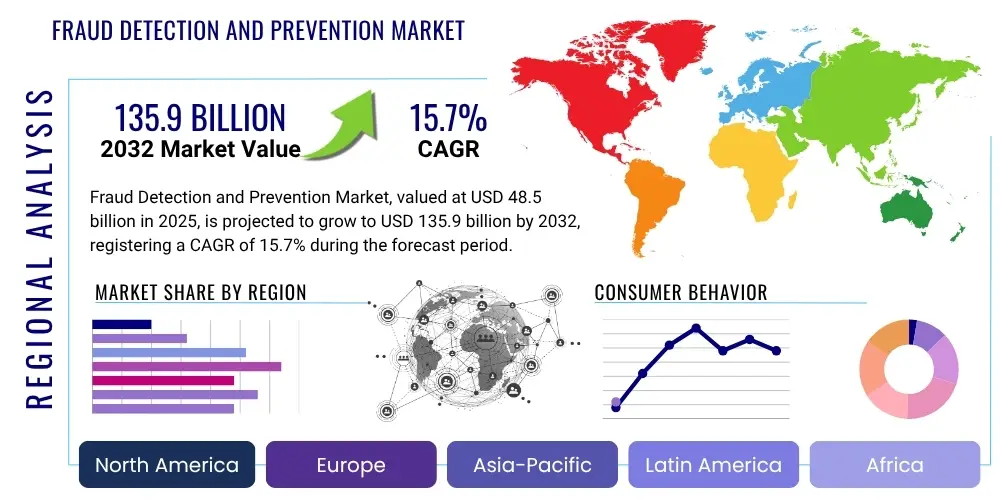

Fraud Detection and Prevention Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428919 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fraud Detection and Prevention Market Size

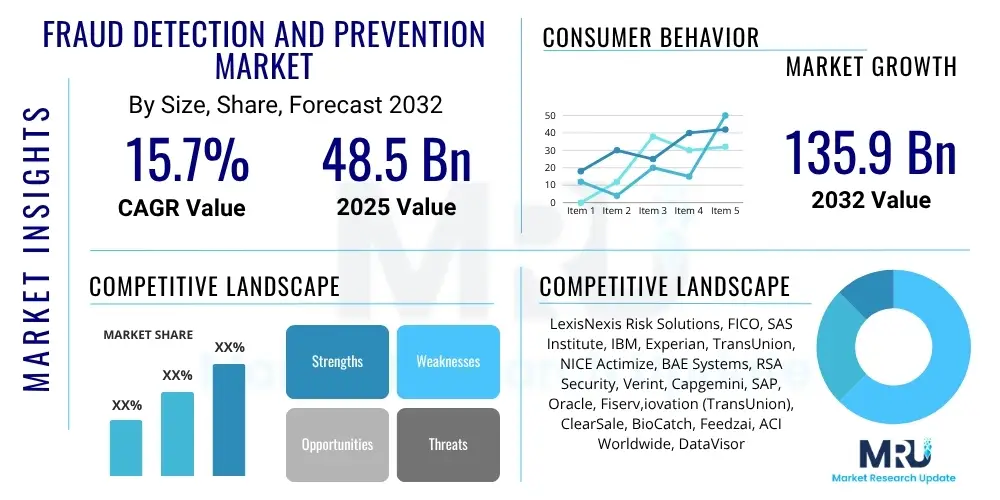

The Fraud Detection and Prevention Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% between 2025 and 2032. The market is estimated at USD 48.5 billion in 2025 and is projected to reach USD 135.9 billion by the end of the forecast period in 2032.

Fraud Detection and Prevention Market introduction

The Fraud Detection and Prevention (FDP) market encompasses a wide array of solutions and services designed to identify, prevent, and mitigate fraudulent activities across various industries. These solutions leverage advanced technologies to analyze transactional data, user behavior, and network patterns to flag suspicious activities that indicate potential fraud. The primary objective is to safeguard financial assets, protect sensitive customer information, and maintain trust in digital and traditional business operations. This market is crucial for maintaining the integrity of financial systems and consumer confidence in an increasingly digital and interconnected world.

Products within this domain range from traditional rule-based systems to sophisticated artificial intelligence and machine learning platforms that offer real-time detection capabilities. Major applications span banking, financial services, and insurance (BFSI), e-commerce and retail, telecommunications, government, and healthcare sectors, where the financial stakes of fraud are exceptionally high. The inherent benefits of robust FDP solutions include significant cost savings from prevented losses, enhanced regulatory compliance, improved customer experience through reduced friction, and strengthened brand reputation. The market's growth is predominantly driven by the escalating volume and sophistication of cybercrime, the rapid digitalization of economies, and stringent regulatory mandates requiring businesses to implement effective fraud prevention measures.

Fraud Detection and Prevention Market Executive Summary

The Fraud Detection and Prevention market is experiencing robust growth, propelled by the relentless surge in digital transactions and the increasing sophistication of fraudulent schemes. Business trends indicate a strong shift towards cloud-based FDP solutions, offering scalability and flexibility, coupled with a growing demand for integrated platforms that combine multiple fraud detection capabilities. Organizations are increasingly adopting real-time analytics and predictive modeling to pre-emptively identify and thwart fraud, moving beyond reactive detection. The emphasis is also on leveraging AI and machine learning to analyze vast datasets, identify subtle patterns, and significantly reduce false positives, thereby improving operational efficiency and customer satisfaction.

Regionally, North America and Europe continue to dominate the market due to early adoption of advanced technologies, stringent regulatory frameworks, and the presence of major FDP solution providers. However, the Asia Pacific region is emerging as the fastest-growing market, driven by rapid digital transformation, expanding e-commerce activities, and increasing financial inclusion initiatives that expose more consumers to digital risks. Latin America and the Middle East and Africa are also witnessing significant investments in FDP solutions as they digitize their economies and combat rising fraud rates. These regions present substantial growth opportunities for FDP vendors.

Segment-wise, the fraud analytics and authentication segments are experiencing high demand, fueled by the need for deeper insights into fraud patterns and stronger user verification methods. The banking and financial services sector remains the largest end-user, but retail and e-commerce, and telecommunications sectors are rapidly expanding their adoption of FDP solutions to protect against payment fraud, account takeover, and identity theft. There is a discernible trend towards holistic, end-to-end fraud management platforms that offer comprehensive protection across the entire customer lifecycle, from onboarding to transactions and claims processing, reflecting a proactive industry approach to mitigating evolving threats.

AI Impact Analysis on Fraud Detection and Prevention Market

Users frequently inquire about the transformative capabilities of Artificial Intelligence (AI) in revolutionizing fraud detection, specifically questioning how AI-driven solutions surpass traditional methods in accuracy and speed. Key themes revolve around AI's ability to process massive datasets in real-time, identify complex and evolving fraud patterns that human analysts or rule-based systems might miss, and reduce the incidence of false positives. Concerns often emerge regarding the ethical implications of AI, such as potential biases in algorithms, data privacy issues, and the need for explainable AI to ensure transparency and compliance. Expectations are high for AI to deliver more proactive, adaptive, and scalable fraud prevention strategies, alongside a desire for solutions that are easy to integrate and require minimal human intervention, effectively addressing the escalating sophistication of modern fraud schemes and the growing volume of digital transactions.

- Enhanced Predictive Capabilities: AI and machine learning algorithms excel at analyzing historical data to predict future fraud attempts, identifying patterns invisible to conventional methods.

- Real-time Fraud Detection: AI systems can process and analyze vast quantities of transactional data instantly, enabling immediate identification and blocking of fraudulent activities as they occur.

- Reduced False Positives: Advanced AI models continuously learn and adapt, leading to a significant reduction in legitimate transactions being flagged as suspicious, improving customer experience.

- Adaptive Learning: AI solutions automatically update their fraud detection models in response to new fraud tactics, ensuring continuous protection against emerging threats without manual reprogramming.

- Behavioral Analytics Integration: AI powers sophisticated behavioral analytics, profiling normal user behavior to detect anomalies indicative of account takeover or identity theft more accurately.

- Scalability and Efficiency: AI-driven platforms can efficiently scale to handle increasing data volumes and transaction rates, automating repetitive tasks and freeing human analysts for complex investigations.

- Improved Anomaly Detection: Machine learning algorithms are particularly adept at identifying outliers and unusual activities that deviate from established norms, which are often indicators of fraud.

- Enhanced Security Posture: By proactively identifying and mitigating risks, AI contributes to a stronger overall security posture, protecting businesses from significant financial and reputational damage.

DRO & Impact Forces Of Fraud Detection and Prevention Market

The Fraud Detection and Prevention market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its growth trajectory. Key drivers include the exponential increase in online transactions and digital payments, which inherently expand the attack surface for fraudsters, coupled with the escalating financial losses incurred by organizations due to sophisticated cybercrime. Furthermore, stringent regulatory mandates globally, such as GDPR, PCI DSS, and various anti-money laundering (AML) directives, compel businesses to adopt robust FDP solutions to ensure compliance and avoid hefty penalties. The rapid adoption of cloud computing and mobile technologies also contributes to the market's expansion by creating new avenues for digital engagement and, consequently, new fraud vectors that require advanced detection.

However, the market also faces considerable restraints. High implementation and maintenance costs for advanced FDP systems, particularly for smaller enterprises, can be a significant barrier to adoption. The shortage of skilled cybersecurity professionals capable of deploying, managing, and interpreting complex FDP solutions poses another challenge, leading to operational inefficiencies. Data privacy concerns and the complexities associated with cross-border data sharing, especially in light of evolving regulations, often complicate the deployment and effectiveness of global fraud detection strategies. Moreover, the dynamic and adaptive nature of fraud itself means that solutions must constantly evolve, presenting a continuous challenge for technology providers to stay ahead of malicious actors.

Despite these restraints, numerous opportunities abound, primarily driven by continuous technological advancements. The integration of artificial intelligence, machine learning, and big data analytics offers unprecedented capabilities in predictive fraud detection and behavioral biometrics, enabling more accurate and real-time prevention. The expanding use of blockchain technology for secure transactions and identity verification presents a novel approach to mitigating fraud risks. Furthermore, the growth of emerging markets, characterized by increasing internet penetration and digital commerce, offers untapped potential for FDP solution providers. Strategic partnerships and collaborations among technology vendors, financial institutions, and regulatory bodies are also fostering innovation and enhancing the collective ability to combat fraud, creating a resilient ecosystem for future growth.

Segmentation Analysis

The Fraud Detection and Prevention market is extensively segmented based on various factors, including solution type, service type, deployment mode, organization size, and industry vertical. This multi-faceted segmentation allows for a detailed analysis of market dynamics, identifying specific needs and growth areas within different categories. Each segment addresses particular facets of fraud management, reflecting the diverse requirements of end-users in their efforts to combat increasingly sophisticated fraudulent activities across both digital and traditional channels.

- By Component:

- Solution

- Services

- By Solution Type:

- Fraud Analytics

- Authentication

- Fraud Detection

- Reporting

- Case Management

- Others (e.g., identity verification)

- By Service Type:

- Consulting Services

- Integration and Implementation Services

- Support and Maintenance Services

- By Deployment Mode:

- On-Premises

- Cloud-Based

- By Organization Size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Telecommunications

- Government

- Healthcare

- Manufacturing

- Others (e.g., travel & transportation, real estate)

Value Chain Analysis For Fraud Detection and Prevention Market

The value chain for the Fraud Detection and Prevention market encompasses a series of interconnected activities, beginning with upstream technology and data providers and extending through solution development, deployment, and ongoing support to downstream end-users. Upstream activities involve research and development of core technologies such as artificial intelligence, machine learning algorithms, big data analytics platforms, and biometric identification systems. These foundational technologies are often provided by specialized firms or in-house R&D departments that continuously innovate to combat evolving fraud tactics. Data providers, including credit bureaus, identity verification services, and cybersecurity intelligence firms, also play a critical upstream role by supplying the raw data necessary for effective fraud detection models.

Midstream in the value chain, FDP solution developers and integrators transform these core technologies and data into comprehensive software platforms and services. This includes designing, developing, and customizing fraud analytics engines, authentication systems, case management tools, and reporting modules. These providers often partner with system integrators to ensure seamless deployment and integration of their solutions within the complex IT infrastructures of client organizations. Distribution channels are typically a mix of direct and indirect approaches. Direct sales involve vendors engaging directly with large enterprise clients, offering tailored solutions and professional services. Indirect channels include partnerships with value-added resellers (VARs), managed security service providers (MSSPs), and cloud marketplace providers, who extend the market reach and offer localized support and expertise.

Downstream activities focus on the delivery, implementation, and ongoing management of FDP solutions to end-users across various industries. This stage involves pre-sales consultation, custom solution configuration, system integration, training, and continuous support and maintenance services. The effectiveness of the FDP solution is ultimately measured by its ability to prevent financial losses and enhance security for end-users. The close collaboration between solution providers and end-users, especially regarding feedback and threat intelligence sharing, is crucial for refining fraud detection capabilities. The entire value chain is characterized by a strong emphasis on continuous innovation, security, and adaptability to counter the ever-changing landscape of fraudulent activities.

Fraud Detection and Prevention Market Potential Customers

The Fraud Detection and Prevention market serves a broad spectrum of potential customers across virtually all sectors that handle financial transactions, sensitive data, or digital identities. The primary objective for these end-users is to protect their assets, customers, and reputation from financial losses and operational disruptions caused by fraud. This necessitates robust solutions that can adapt to evolving threat landscapes, meet stringent regulatory requirements, and ensure business continuity. Organizations ranging from small businesses to multinational corporations are increasingly vulnerable to various forms of fraud, making FDP solutions indispensable for maintaining operational integrity and consumer trust in today's digital economy.

Key end-user segments include financial institutions such as retail banks, investment banks, credit unions, and insurance companies, which face immense pressure from payment fraud, credit card fraud, and money laundering. E-commerce and retail businesses are major buyers, seeking to combat payment fraud, identity theft, and return fraud that can significantly impact their bottom lines. Telecommunication providers invest in FDP to prevent subscription fraud, interconnect bypass fraud, and account takeover. Government agencies, including tax authorities and social welfare departments, utilize these solutions to prevent benefit fraud and identity theft. Healthcare providers are also increasingly adopting FDP to combat medical claims fraud and protect patient data. Additionally, various other sectors like travel and transportation, online gaming, and manufacturing are recognizing the critical need for sophisticated fraud detection and prevention mechanisms to safeguard their digital ecosystems and financial interests.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 48.5 billion |

| Market Forecast in 2032 | USD 135.9 billion |

| Growth Rate | 15.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LexisNexis Risk Solutions, FICO, SAS Institute, IBM, Experian, TransUnion, NICE Actimize, BAE Systems, RSA Security, Verint, Capgemini, SAP, Oracle, Fiserv,iovation (TransUnion), ClearSale, BioCatch, Feedzai, ACI Worldwide, DataVisor |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fraud Detection and Prevention Market Key Technology Landscape

The Fraud Detection and Prevention market is fundamentally driven by a dynamic and continuously evolving technology landscape, with advancements in various fields contributing to increasingly sophisticated and effective solutions. At the core, Artificial Intelligence (AI) and Machine Learning (ML) algorithms are paramount, enabling systems to learn from vast datasets, identify complex patterns, and predict potential fraud more accurately and in real-time than traditional rule-based methods. These technologies facilitate anomaly detection, behavioral analytics, and predictive modeling, which are critical for staying ahead of evolving fraud tactics. Deep learning, a subset of machine learning, further enhances the capabilities by processing even more intricate data relationships, particularly in areas like image and voice recognition for biometric authentication.

Big data analytics platforms are indispensable for processing and analyzing the massive volumes of structured and unstructured data generated across various touchpoints, including transactions, social media, and device fingerprints. These platforms provide the infrastructure necessary for AI and ML models to operate effectively, allowing for comprehensive insights into user behavior and transaction flows. Cloud computing plays a crucial role by offering scalable, flexible, and cost-effective infrastructure for deploying FDP solutions, enabling businesses to access advanced capabilities without significant upfront investment in hardware. Behavioral biometrics, leveraging AI and ML, analyzes unique user interactions such as keystroke dynamics, mouse movements, and navigation patterns to verify identity passively and detect account takeover attempts.

Moreover, technologies like robotic process automation (RPA) are increasingly being integrated to automate repetitive tasks in fraud investigation and case management, improving operational efficiency. Blockchain technology is emerging as a promising solution for secure, transparent, and immutable record-keeping, which can significantly enhance identity verification and transaction traceability, thereby reducing certain types of fraud. Furthermore, advanced encryption, tokenization, and multi-factor authentication (MFA) mechanisms are critical components of the technology landscape, providing robust security layers to protect sensitive data and authenticate users. The convergence of these technologies creates a powerful arsenal for organizations to combat the ever-growing sophistication and volume of fraud, ensuring resilience and trustworthiness in the digital economy.

Regional Highlights

- North America: This region holds the largest market share, driven by a high incidence of financial fraud, stringent regulatory compliance requirements, early adoption of advanced technologies like AI and machine learning, and the presence of numerous key market players. The United States and Canada are at the forefront of implementing sophisticated FDP solutions across BFSI, retail, and telecommunication sectors due to significant investments in cybersecurity infrastructure and proactive government initiatives.

- Europe: Europe is another dominant market, characterized by strong data privacy regulations (e.g., GDPR), a mature digital economy, and a high volume of digital transactions. Countries like the UK, Germany, and France are leading the adoption of FDP solutions, especially within the banking and financial services sectors, to combat cross-border fraud and ensure compliance with AML directives and PSD2.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC's growth is fueled by rapid digital transformation, burgeoning e-commerce markets, increasing internet penetration, and a growing awareness of cybersecurity risks among businesses and consumers. Countries such as China, India, Japan, and Australia are making substantial investments in FDP technologies to protect their expanding digital economies and address rising instances of online fraud.

- Latin America: This region is experiencing considerable growth in the FDP market due to increasing digitalization, the proliferation of online payment methods, and a rise in sophisticated fraud attacks. Brazil and Mexico are key markets, driven by the need to secure evolving financial technologies and growing e-commerce ecosystems, despite challenges related to economic instability and regulatory fragmentation.

- Middle East and Africa (MEA): The MEA market is witnessing steady growth, supported by significant government initiatives to promote digital economies, smart city projects, and diversification away from oil-dependent revenues. Countries like the UAE, Saudi Arabia, and South Africa are investing in FDP solutions to protect nascent digital infrastructure, banking systems, and burgeoning e-commerce platforms, driven by an increasing awareness of cyber threats.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fraud Detection and Prevention Market.- LexisNexis Risk Solutions

- FICO

- SAS Institute

- IBM

- Experian

- TransUnion

- NICE Actimize

- BAE Systems

- RSA Security

- Verint

- Capgemini

- SAP

- Oracle

- Fiserv

- iovation (TransUnion)

- ClearSale

- BioCatch

- Feedzai

- ACI Worldwide

- DataVisor

Frequently Asked Questions

What is the projected growth rate of the Fraud Detection and Prevention Market?

The Fraud Detection and Prevention Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% between 2025 and 2032, indicating significant expansion.

What are the primary drivers of growth in the FDP market?

Key drivers include the surge in digital transactions, increasing sophistication of cybercrime, strict regulatory compliance requirements, and the widespread adoption of cloud computing and mobile technologies.

How is Artificial Intelligence (AI) impacting fraud detection?

AI significantly enhances fraud detection by enabling real-time analysis of vast datasets, identifying complex patterns, reducing false positives, and adaptively learning from new fraud tactics, leading to more accurate and proactive prevention.

Which industries are the major adopters of Fraud Detection and Prevention solutions?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest adopter, followed closely by Retail and E-commerce, Telecommunications, Government, and Healthcare industries, all facing high fraud risks.

What are the main challenges faced by the Fraud Detection and Prevention Market?

Major challenges include high implementation and maintenance costs, a shortage of skilled cybersecurity professionals, data privacy concerns, and the continuous need to adapt to the rapidly evolving nature of fraudulent activities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fraud Detection and Prevention Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fraud Analytics, Authentication, Governance, Risk, and Compliance (GRC), Reporting, Visualization), By Application (Small, Medium, Large), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Fraud Detection and Prevention (FDP) System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud Based, On-Premises), By Application (BFSI, Retail, Telecommunication, Government/Public Sector, Healthcare, Real Estate, Energy and Power, Manufacturing, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Fraud Detection and Prevention (FDP) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Service, Software), By Application (Insurance,, Public Sector/Government Sector, Telecommunications, Banking and Financial Services, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager