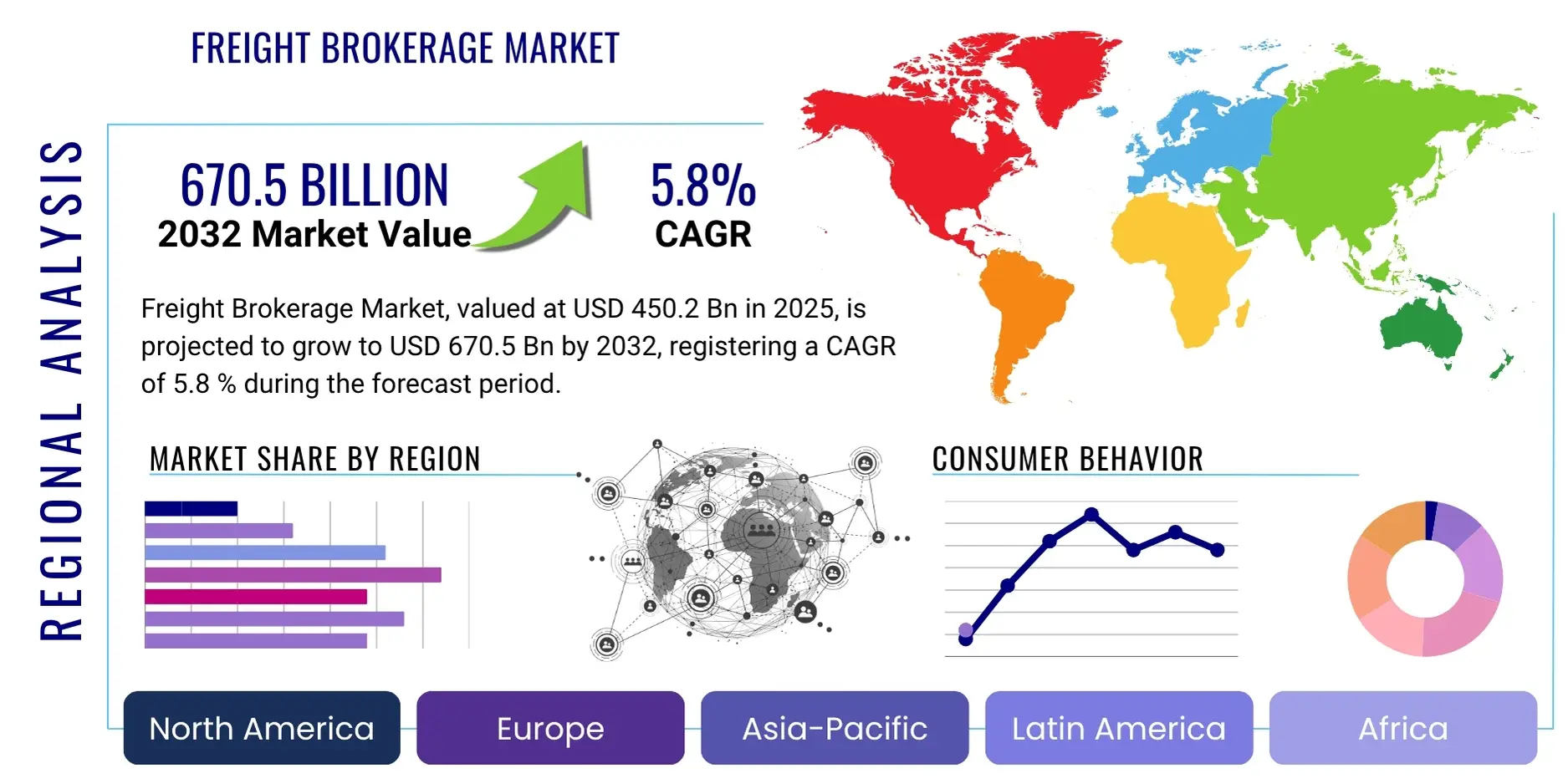

Freight Brokerage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428136 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Freight Brokerage Market Size

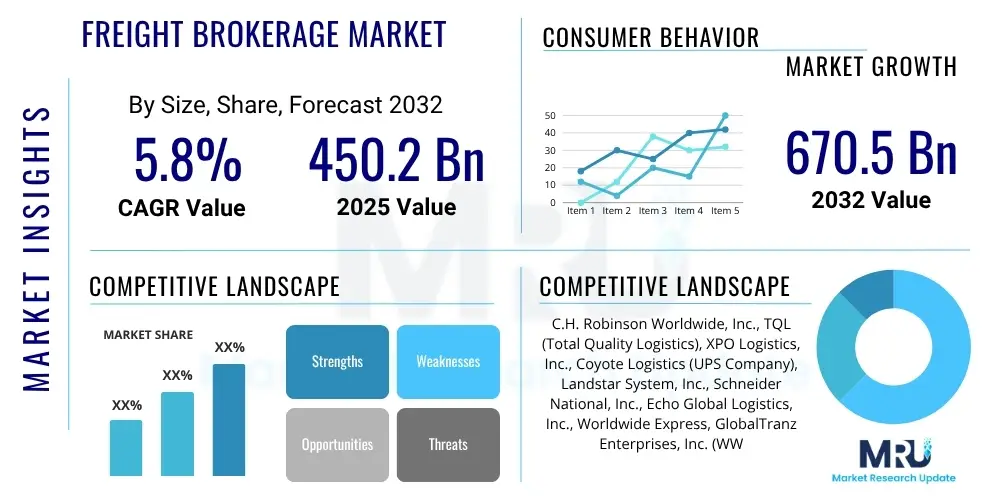

The Freight Brokerage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 450.2 billion in 2025 and is projected to reach USD 670.5 billion by the end of the forecast period in 2032.

Freight Brokerage Market introduction

The freight brokerage market serves as a critical intermediary within the expansive global supply chain, facilitating the efficient movement of goods from shippers to carriers. Freight brokers act as vital links, connecting businesses requiring transportation services with available trucking, rail, ocean, or air carriers. Their primary role involves negotiating rates, coordinating logistics, and ensuring timely and cost-effective delivery of freight, often managing complex shipping requirements across diverse geographical regions. This intricate coordination alleviates operational burdens for shippers, allowing them to focus on core business activities while benefiting from optimized transportation solutions.

Product descriptions within the freight brokerage sector encompass a wide array of services designed to meet varied logistical needs. These services include full truckload (FTL) and less-than-truckload (LTL) shipping, intermodal solutions combining different transport modes, expedited freight for urgent deliveries, and specialized transport for oversized or hazardous materials. Major applications span across virtually every industry vertical, including manufacturing, retail, e-commerce, food and beverage, automotive, and healthcare, all of which rely heavily on dependable freight movement for their operations. The brokers leverage their extensive networks and market expertise to match specific cargo requirements with suitable carrier capabilities, offering flexible and scalable solutions.

The benefits derived from engaging freight brokerage services are manifold, extending to both shippers and carriers. Shippers gain access to a vast network of vetted carriers, competitive pricing, enhanced efficiency through streamlined logistics, and risk mitigation against supply chain disruptions. Brokers often provide valuable market insights, helping shippers navigate fluctuating fuel costs, regulatory changes, and capacity shortages. For carriers, brokers offer a consistent stream of freight, optimize their route planning, reduce empty miles, and manage administrative tasks like invoicing, thereby improving their operational profitability and asset utilization. These synergistic advantages collectively drive the market forward, fostering greater resilience and dynamism in global trade.

Freight Brokerage Market Executive Summary

The freight brokerage market is experiencing robust growth, primarily fueled by an evolving landscape characterized by increased globalization, the proliferation of e-commerce, and persistent supply chain complexities. Business trends indicate a strong move towards digitalization, with brokers investing heavily in advanced transportation management systems (TMS), predictive analytics, and real-time visibility platforms to enhance service delivery and operational efficiency. There is a growing demand for specialized logistics solutions, including cold chain management, hazardous materials transport, and last-mile delivery, reflecting the diversification of client needs. Furthermore, sustainability considerations are becoming paramount, pushing brokers to integrate eco-friendly practices and optimize routes to reduce carbon footprints, aligning with corporate social responsibility initiatives.

Regional trends reveal significant expansion in emerging markets, particularly within Asia Pacific, driven by rapid industrialization, burgeoning consumer bases, and expanding trade corridors. North America and Europe continue to represent mature markets, distinguished by intense competition and a high degree of technological adoption aimed at optimizing existing infrastructure and addressing labor shortages. Latin America and the Middle East & Africa regions are also demonstrating considerable potential, as infrastructural developments and economic diversification initiatives stimulate demand for robust logistics services. Cross-border freight movements are becoming more intricate, necessitating brokers with strong international networks and expertise in customs regulations and compliance across diverse jurisdictions.

Segmentation trends highlight a notable shift towards intermodal and multimodal solutions, as businesses seek greater flexibility, cost-effectiveness, and reduced environmental impact. The Less Than Truckload (LTL) segment is witnessing substantial growth, propelled by the increasing volume of smaller, more frequent shipments driven by e-commerce and just-in-time inventory strategies. Technological advancements are also influencing segment performance, with brokers leveraging data analytics to better manage capacity and pricing within specific freight types. The market is increasingly differentiated by value-added services, such as cargo insurance, tracking, and customized reporting, enabling brokers to carve out niche markets and provide superior service offerings beyond basic transportation coordination.

AI Impact Analysis on Freight Brokerage Market

The integration of Artificial Intelligence (AI) is fundamentally reshaping the freight brokerage landscape, ushering in an era of unprecedented efficiency, precision, and predictive capabilities. Users are keen to understand how AI can transform traditional brokerage operations, address chronic industry challenges, and deliver tangible value. Key themes emerging from these inquiries often revolve around the automation of routine tasks, the optimization of complex decision-making processes, and the potential for enhanced forecasting in dynamic market conditions. There is considerable interest in how AI tools can provide real-time visibility into freight movements, improve route planning, and facilitate more accurate pricing, thereby reducing operational costs and improving service levels. Concerns also include the required investment in technology, the availability of skilled personnel to manage AI systems, and the implications for job roles within the industry.

Expectations from AI's influence are high, focusing on its capacity to process vast amounts of data to identify patterns, predict demand fluctuations, and proactively manage potential disruptions. Users anticipate that AI will lead to smarter carrier selection, ensuring optimal matching based on performance metrics, equipment availability, and service history. This will not only improve reliability but also foster stronger, data-driven relationships between brokers, shippers, and carriers. Furthermore, the ability of AI to automate communication and documentation processes is expected to free up human brokers to concentrate on more strategic tasks, such as complex problem-solving and client relationship management, thereby elevating the overall value proposition of brokerage services.

- Enhanced load matching and carrier selection efficiency through predictive analytics.

- Optimized route planning and real-time traffic condition adjustments for faster deliveries.

- Automated pricing and negotiation, leading to more competitive and dynamic rate offerings.

- Improved demand forecasting and capacity management to mitigate market volatility.

- Streamlined administrative tasks and documentation, reducing manual errors and operational costs.

- Predictive maintenance for fleets, minimizing breakdowns and service interruptions.

- Enhanced fraud detection and security measures through pattern recognition in transaction data.

- Real-time visibility and tracking capabilities, offering greater transparency throughout the supply chain.

- Personalized customer service and proactive problem-solving through AI-driven insights.

- Development of autonomous logistics solutions and smart warehouses, revolutionizing operational models.

DRO & Impact Forces Of Freight Brokerage Market

The freight brokerage market is profoundly influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory and operational dynamics. Key drivers propelling market expansion include the sustained growth of global trade, necessitating sophisticated logistics solutions to navigate intricate international supply chains. The explosive growth of e-commerce, particularly cross-border online retail, continuously generates demand for efficient, reliable, and often expedited freight services. Furthermore, businesses increasingly seek to outsource logistics functions to focus on core competencies, thereby expanding the addressable market for freight brokers. Technological advancements, such as the widespread adoption of digital platforms and data analytics, are also significant drivers, enhancing efficiency and transparency across the brokerage ecosystem.

Conversely, several restraints temper the market's growth potential. Economic downturns and geopolitical uncertainties can lead to reduced shipping volumes and increased market volatility, directly impacting brokerage revenues. Intense competition within the fragmented freight brokerage industry often results in margin compression, particularly for smaller players. Regulatory complexities, including evolving environmental standards, cross-border customs procedures, and driver hour restrictions, pose significant compliance challenges. Additionally, fluctuations in fuel prices and driver shortages in key regions can significantly increase operational costs and reduce carrier availability, thereby restricting the capacity and profitability of brokerage services.

Opportunities within the freight brokerage market are abundant and diverse, often arising from the very challenges faced by the industry. The increasing demand for specialized logistics, such as cold chain, hazardous materials, and oversized cargo transport, presents lucrative niche markets. Expanding into emerging economies, where infrastructure development and industrialization are accelerating, offers substantial growth prospects. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and blockchain provides avenues for innovation, enabling brokers to offer superior services, optimize operations, and create new value propositions. Sustainable logistics practices, including green shipping and route optimization for reduced emissions, represent a growing opportunity as environmental consciousness increases across the supply chain. Impact forces, such as technological disruption, economic cycles, regulatory shifts, and geopolitical events, continuously reshape the market, demanding agility and adaptability from all participants.

Segmentation Analysis

The freight brokerage market is highly segmented, reflecting the diverse needs of the global shipping industry and the specialized services required to move a wide array of goods across various modes of transport. This comprehensive segmentation allows market participants to tailor their offerings, optimize their operational strategies, and effectively target specific client groups. The segmentation approach typically considers factors such as the type of service rendered, the primary mode of transportation utilized, and the end-use industry that generates the shipping demand. Understanding these distinct segments is crucial for analyzing market dynamics, identifying growth opportunities, and assessing competitive landscapes within this complex logistical ecosystem.

For instance, services can range from standard truckload movements to highly specialized and expedited deliveries, each requiring different operational capabilities and pricing structures. The selection of a transportation mode—road, rail, ocean, or air—is often dictated by factors like cargo type, urgency, distance, and cost considerations, further stratifying the market. Moreover, the varying logistical demands of sectors such as manufacturing, retail, and food & beverage necessitate customized brokerage solutions. This detailed segmentation not only provides a granular view of market structure but also helps in forecasting future trends and assessing the impact of macro-economic and technological shifts on specific market niches. Analyzing these segments is vital for strategic planning and competitive positioning in the freight brokerage industry.

- By Type of Service:

- Full Truckload (FTL)

- Less Than Truckload (LTL)

- Intermodal

- Expedited

- Specialty Freight (e.g., Heavy Haul, Temperature Controlled, Hazardous Materials)

- By Mode of Transport:

- Road Freight

- Rail Freight

- Ocean Freight

- Air Freight

- Multimodal/Intermodal Freight

- By End-Use Industry:

- Manufacturing

- Retail & E-commerce

- Food & Beverage

- Automotive

- Healthcare & Pharmaceuticals

- Agriculture

- Construction

- Chemicals

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Freight Brokerage Market

The value chain for the freight brokerage market is a complex network involving various stakeholders, starting from the upstream suppliers and extending to the downstream customers, all interconnected by a series of activities that add value to the final delivery of goods. Upstream in this chain are the primary carriers—trucking companies, railroads, ocean liners, and airlines—who provide the physical transportation assets and services. Also critical are technology providers offering Transportation Management Systems (TMS), Electronic Logging Devices (ELDs), and other software solutions that enable brokers to manage operations, optimize routes, and track shipments. Furthermore, fuel suppliers, maintenance providers, and equipment manufacturers also form part of the upstream ecosystem, providing essential resources and infrastructure for carriers, which in turn impacts the services offered by brokers.

Midstream, the freight brokers themselves play a pivotal role, serving as the central orchestrator. Their core activities include market analysis, rate negotiation, carrier vetting and selection, load matching, shipment tracking, and dispute resolution. Brokers leverage their expertise and network to create efficient matches between shippers’ freight and carriers’ available capacity, essentially streamlining the logistics process. They add value by providing specialized knowledge, reducing the administrative burden on both shippers and carriers, and offering flexibility and scalability that individual entities might struggle to achieve independently. This intermediary function is crucial for optimizing costs and improving the reliability of freight movement.

Downstream, the immediate beneficiaries are the shippers—manufacturers, distributors, retailers, and e-commerce companies—who rely on the efficient movement of their products to end-consumers. The distribution channel can be direct, where brokers work directly with shippers, or indirect, involving partnerships with 3PLs (Third-Party Logistics providers) or 4PLs (Fourth-Party Logistics providers) who might integrate brokerage services into broader supply chain management offerings. The ultimate end-user, whether an individual consumer or a business receiving goods, benefits from the smooth and timely delivery facilitated by the entire value chain. Effective collaboration and communication across all these stages are paramount for ensuring a seamless and responsive freight brokerage service that meets the dynamic demands of global commerce.

Freight Brokerage Market Potential Customers

The potential customer base for the freight brokerage market is exceptionally broad, encompassing a diverse range of industries and business sizes, all of whom require reliable and efficient transportation of goods. Essentially, any business involved in the movement of physical products, whether raw materials, finished goods, or components, can be a potential end-user or buyer of freight brokerage services. This includes large multinational corporations with complex global supply chains, as well as small to medium-sized enterprises (SMEs) that may lack the internal resources or expertise to manage their logistics in-house. These customers seek cost-effective, flexible, and scalable shipping solutions that allow them to maintain optimal inventory levels, meet production schedules, and satisfy customer demands without the overhead of managing carrier networks directly.

Key sectors representing significant potential customers include the manufacturing industry, which constantly moves raw materials to factories and finished products to distribution centers; the retail and e-commerce sectors, which depend on rapid and consistent fulfillment to meet consumer expectations; and the food and beverage industry, which requires specialized handling for perishable goods. Additionally, the automotive sector frequently uses brokers for just-in-time parts delivery, while the healthcare and pharmaceutical industries rely on precise and often temperature-controlled transport for sensitive medications and medical devices. Agricultural businesses, construction companies, and chemical manufacturers also frequently engage freight brokers for their unique logistical needs.

Beyond specific industries, potential customers are often distinguished by their shipping volume, frequency, and the complexity of their logistical requirements. Businesses with fluctuating shipping needs, those entering new markets, or those facing seasonal peaks often turn to brokers for their agility and ability to scale. Companies looking to optimize their transportation spend, improve supply chain visibility, or mitigate risks associated with carrier selection and compliance are also prime candidates for engaging freight brokerage services. Ultimately, any organization seeking to enhance its logistical efficiency, reduce operational headaches, and gain access to a wider network of carriers at competitive rates represents a valuable potential customer for freight brokers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 450.2 billion |

| Market Forecast in 2032 | USD 670.5 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | C.H. Robinson Worldwide, Inc., TQL (Total Quality Logistics), XPO Logistics, Inc., Coyote Logistics (UPS Company), Landstar System, Inc., Schneider National, Inc., Echo Global Logistics, Inc., Worldwide Express, GlobalTranz Enterprises, Inc. (WWEX Company), J.B. Hunt Transport Services, Inc., Ryder System, Inc., RXO, Inc., Convoy, Inc., Uber Freight LLC, DAT Solutions LLC, Arrive Logistics, Inc., Nolan Transportation Group, BlueGrace Logistics, Allen Lund Company, McLeod Software |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freight Brokerage Market Key Technology Landscape

The freight brokerage market is undergoing a significant technological transformation, driven by the imperative for greater efficiency, transparency, and data-driven decision-making. At the core of this evolution are Transportation Management Systems (TMS), which serve as the operational backbone for brokers. Modern TMS platforms are increasingly cloud-based, offering robust functionalities for order management, load planning, dispatching, carrier selection, and freight auditing. These systems provide a centralized hub for managing complex logistical processes, enabling brokers to streamline operations, reduce manual errors, and enhance communication across the supply chain. The continuous advancement of TMS with features like predictive analytics and automation is critical for competitive advantage.

Beyond TMS, several other technologies are playing pivotal roles. Electronic Logging Devices (ELDs) ensure compliance with regulations and provide real-time data on driver hours, which brokers leverage for more accurate capacity planning and delivery scheduling. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing various aspects, from automated pricing and intelligent load matching to demand forecasting and route optimization. These AI-powered tools process vast datasets to identify patterns, predict market fluctuations, and suggest optimal solutions, thereby improving efficiency and reducing costs. Furthermore, the Internet of Things (IoT) enables real-time tracking of shipments and assets, providing invaluable visibility into freight location, temperature, and condition, which is particularly vital for sensitive cargo.

The technology landscape also includes the growing adoption of Application Programming Interfaces (APIs) for seamless integration with shipper and carrier systems, fostering a more interconnected and collaborative ecosystem. Blockchain technology is emerging as a solution for enhanced transparency, security, and immutable record-keeping of freight transactions, offering potential for improved trust and reduced fraud. Moreover, advanced analytics and business intelligence tools empower brokers to extract actionable insights from operational data, enabling continuous improvement and strategic decision-making. The combination of these technologies creates a dynamic and intelligent brokerage environment, allowing firms to offer more sophisticated services and adapt rapidly to evolving market demands.

Regional Highlights

- North America: This region represents the largest and most mature freight brokerage market, characterized by extensive transportation infrastructure, high adoption of digital logistics solutions, and a strong presence of major industry players. The U.S. market, in particular, is highly competitive and technologically advanced, driven by e-commerce growth and robust manufacturing activity. Canada and Mexico also contribute significantly, with cross-border trade being a key driver.

- Europe: The European market is fragmented but growing, influenced by cross-border trade within the EU and increasing demand for multimodal logistics. Regulatory frameworks, particularly those related to emissions and driver welfare, shape operational practices. Digitalization and sustainable logistics initiatives are key trends across Western and Eastern European countries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrialization, expanding manufacturing bases in countries like China and India, and the burgeoning e-commerce sector. Investments in infrastructure development, increasing urbanization, and growing intra-regional trade are significant market drivers. Japan, Australia, and Southeast Asian nations are also key contributors.

- Latin America: This region presents significant growth opportunities, driven by urbanization, expanding agricultural and extractive industries, and improving trade relations. Brazil, Mexico, and Argentina are major markets. Challenges include infrastructural limitations and political instability in some areas, but digital transformation efforts are gaining traction.

- Middle East & Africa (MEA): The MEA market is experiencing growth due to economic diversification efforts, significant infrastructure projects (e.g., in the UAE and Saudi Arabia), and increasing trade flows, particularly between Asia and Europe. The development of logistics hubs and the adoption of modern technologies are key trends, though regional conflicts can pose challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freight Brokerage Market.- C.H. Robinson Worldwide, Inc.

- TQL (Total Quality Logistics)

- XPO Logistics, Inc.

- Coyote Logistics (UPS Company)

- Landstar System, Inc.

- Schneider National, Inc.

- Echo Global Logistics, Inc.

- Worldwide Express

- GlobalTranz Enterprises, Inc. (WWEX Company)

- J.B. Hunt Transport Services, Inc.

- Ryder System, Inc.

- RXO, Inc.

- Convoy, Inc.

- Uber Freight LLC

- DAT Solutions LLC

- Arrive Logistics, Inc.

- Nolan Transportation Group

- BlueGrace Logistics

- Allen Lund Company

- McLeod Software

Frequently Asked Questions

What is a freight broker and what services do they provide?

A freight broker acts as an intermediary connecting shippers (businesses needing goods transported) with carriers (trucking companies, rail lines, etc.). They offer services like load matching, rate negotiation, shipment tracking, and managing documentation, helping shippers find reliable transportation and carriers fill their loads efficiently.

How does AI impact the freight brokerage market?

AI significantly impacts freight brokerage by enabling automated pricing, optimized load matching, predictive analytics for demand and capacity, and real-time route optimization. This leads to increased efficiency, reduced operational costs, and improved decision-making for brokers, shippers, and carriers.

What are the primary benefits of using a freight broker?

The primary benefits include access to a vast network of vetted carriers, competitive pricing, enhanced shipping flexibility and scalability, reduced administrative burden, and expertise in navigating complex logistics, ultimately saving time and money for shippers.

What challenges does the freight brokerage industry currently face?

Key challenges include intense market competition, economic volatility affecting shipping volumes, driver shortages, fluctuating fuel prices, and increasing regulatory complexities. Adapting to technological advancements and cybersecurity threats also remains a significant hurdle.

What key technologies are shaping the freight brokerage landscape?

The freight brokerage landscape is shaped by Transportation Management Systems (TMS), Electronic Logging Devices (ELDs), Artificial Intelligence (AI) and Machine Learning (ML), Internet of Things (IoT) for tracking, and API integrations for seamless data exchange. Blockchain is also an emerging technology enhancing transparency and security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager