Frozen Foods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428310 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Frozen Foods Market Size

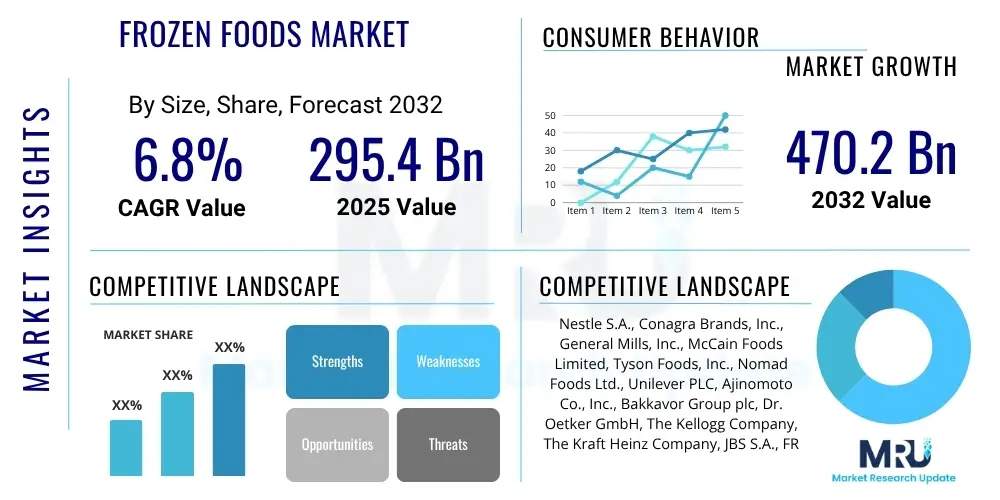

The Frozen Foods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 295.4 Billion in 2025 and is projected to reach USD 470.2 Billion by the end of the forecast period in 2032.

Frozen Foods Market introduction

The frozen foods market encompasses a wide array of food products that have been subjected to freezing temperatures to preserve their freshness, nutritional value, and flavor over extended periods. This preservation method significantly extends shelf life, making food items available year-round regardless of seasonal harvests. Products range from staples like fruits, vegetables, and meats to more elaborate offerings such as ready meals, bakery items, and specialty desserts, catering to diverse consumer needs and culinary preferences globally. The market's fundamental appeal lies in its ability to offer convenience without significant compromise on quality, fitting seamlessly into modern, fast-paced lifestyles.

Major applications of frozen foods span both household consumption and the thriving foodservice industry. For consumers, these products provide unparalleled ease of preparation, reducing cooking time and effort, which is particularly beneficial for working professionals and families. In the commercial sector, frozen ingredients and pre-prepared meals help restaurants, cafes, and institutional caterers manage inventory, reduce waste, and maintain consistent quality. The benefits extend beyond convenience, including reduced food waste due to longer shelf life, retention of vitamins and minerals when frozen quickly after harvest, and access to a wider variety of produce irrespective of geographical limitations. This robust utility underpins the market's sustained growth and expanding consumer base.

Several pivotal factors are driving the expansion of the frozen foods market. Rapid urbanization and the resultant increase in disposable incomes, especially in developing economies, are fueling demand for convenient food solutions. Furthermore, evolving consumer dietary patterns, including a growing preference for plant-based foods, organic options, and international cuisines, have spurred innovation in the frozen foods sector. Technological advancements in freezing techniques, packaging, and cold chain logistics ensure product quality and safety from production to plate. The increasing penetration of organized retail and e-commerce platforms also plays a crucial role in enhancing product accessibility and consumer reach, making frozen foods a staple in contemporary kitchens and commercial establishments alike.

Frozen Foods Market Executive Summary

The frozen foods market is experiencing robust growth, driven by a confluence of evolving business trends, shifting consumer demands, and technological advancements. Key business trends include a pronounced emphasis on health and wellness, leading to an increased offering of organic, natural, and plant-based frozen products. Manufacturers are also focusing on sustainable practices, from sourcing ingredients to eco-friendly packaging solutions, to appeal to environmentally conscious consumers. Innovation in product development, such as gourmet frozen meals and ethnic cuisines, is expanding the market's appeal, while strategic mergers and acquisitions are consolidating market power and enabling broader distribution networks. The rise of e-commerce and specialized direct-to-consumer delivery services is also transforming the retail landscape, making frozen foods more accessible than ever.

Regional trends highlight dynamic growth patterns across the globe. North America and Europe remain mature markets, characterized by high consumer awareness, strong infrastructure, and a continuous demand for convenient and premium frozen options. These regions are also at the forefront of adopting innovative products like vegan and gluten-free frozen meals. The Asia Pacific (APAC) region, however, is emerging as a significant growth engine, fueled by rapid urbanization, rising disposable incomes, and changing dietary habits. Countries like China and India are witnessing a surge in demand for ready-to-eat frozen foods, driven by busy lifestyles and the expansion of modern retail formats. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a lower base, as refrigeration infrastructure improves and consumer preferences gradually shift towards convenience foods.

Segmentation trends reveal substantial shifts within the market. The ready meals segment continues to be a dominant force, constantly innovating to offer a diverse range of global cuisines and dietary-specific options. Plant-based frozen alternatives, including meat substitutes and dairy-free desserts, are experiencing explosive growth, reflecting a broader consumer movement towards flexitarian and vegetarian diets. Frozen fruits and vegetables maintain their popularity due to their perceived health benefits and year-round availability. The bakery and seafood segments are also showing steady expansion, with a focus on value-added and convenience-oriented products. This dynamic interplay of trends underscores a vibrant and adaptable market poised for sustained expansion across various product categories and geographical areas.

AI Impact Analysis on Frozen Foods Market

The integration of Artificial Intelligence (AI) is set to profoundly transform the frozen foods market, addressing common user questions related to efficiency, safety, personalization, and sustainability. Users are keenly interested in how AI can optimize the complex frozen food supply chain, ensure superior product quality and safety from farm to freezer, and even tailor products to individual dietary needs and preferences. There is also significant curiosity about AI's role in predictive demand forecasting, reducing food waste, and enhancing the overall consumer experience. The overarching expectation is that AI will introduce unprecedented levels of precision, automation, and responsiveness, creating a more dynamic, cost-effective, and consumer-centric frozen food ecosystem. By leveraging vast datasets, AI algorithms can identify patterns, make informed decisions, and automate processes that were previously labor-intensive or prone to human error, thereby revolutionizing manufacturing, logistics, and retail strategies within the sector.

- AI-driven predictive analytics for demand forecasting, optimizing inventory and reducing waste.

- Automated quality control systems using computer vision for inspecting frozen products and packaging.

- Enhanced food safety and traceability through AI-powered sensors and blockchain integration across the supply chain.

- Personalized product development and recommendation engines based on consumer data and preferences.

- Optimization of cold chain logistics and temperature control using AI for route planning and real-time monitoring.

- AI-powered automation in manufacturing facilities for increased efficiency and reduced operational costs.

- Development of smart packaging solutions that communicate freshness and storage conditions via AI-enabled sensors.

DRO & Impact Forces Of Frozen Foods Market

The frozen foods market is propelled by a robust set of drivers that underscore its continued expansion. Foremost among these is the escalating demand for convenience foods, fueled by increasingly hectic consumer lifestyles and a growing urbanization trend globally. Consumers, especially working professionals and busy families, seek quick and easy meal solutions without compromising on nutritional value or taste, a need perfectly met by the diverse range of frozen products. Additionally, technological advancements in freezing techniques, such as Individual Quick Freezing (IQF) and cryogenic freezing, have significantly improved the quality, texture, and nutritional retention of frozen foods, dispelling older perceptions of inferiority. The rising disposable incomes in emerging economies further enable consumers to afford premium and specialty frozen food items, expanding the market's reach and product diversification. Growing awareness regarding food waste reduction also contributes, as frozen foods offer an extended shelf life compared to fresh produce, allowing for better inventory management at both household and commercial levels.

Despite strong growth drivers, the frozen foods market faces several significant restraints. A primary challenge is the consumer perception that fresh food is inherently healthier and superior in taste and nutrition, despite scientific evidence often demonstrating comparable nutritional profiles for quickly frozen products. This lingering perception necessitates substantial marketing and educational efforts from industry players. Another restraint is the substantial energy consumption associated with maintaining cold chain logistics, from production and storage to transportation and retail display, which translates into higher operational costs and environmental concerns. The limited freezer space available in many household kitchens and retail outlets also poses a practical barrier to extensive product stocking and purchase frequency. Furthermore, price sensitivity, especially in developing markets, can deter consumers from opting for frozen food varieties when fresh alternatives are perceived as more economical, even if their shelf life is shorter. These factors collectively contribute to challenges in market penetration and consumer adoption.

Significant opportunities abound within the frozen foods market, promising sustained growth and innovation. The burgeoning demand for plant-based and vegan frozen food alternatives presents a lucrative avenue for product development, catering to health-conscious consumers and those seeking sustainable dietary options. Premiumization and gourmet frozen meals, offering restaurant-quality experiences at home, are another key opportunity, targeting consumers willing to pay more for convenience and high-quality ingredients. The rapid growth of e-commerce platforms and specialized cold chain delivery services is revolutionizing distribution, making frozen foods more accessible to a wider demographic and opening new channels for market penetration. Furthermore, ongoing research and development into sustainable packaging solutions, such as biodegradable and recyclable materials, can address environmental concerns and enhance brand appeal. Impact forces, including evolving regulatory landscapes around food safety and labeling, as well as shifts in consumer purchasing behavior influenced by social media and health trends, continuously shape market dynamics, pushing manufacturers to innovate and adapt swiftly to remain competitive and relevant in this dynamic industry.

Segmentation Analysis

The frozen foods market is highly diversified, segmented across various parameters including product type, distribution channel, and end-use, each demonstrating unique growth trajectories and consumer preferences. This granular segmentation allows market players to tailor strategies, product offerings, and marketing efforts to specific consumer groups and market niches. Understanding these segments is crucial for identifying key growth areas, assessing competitive landscapes, and formulating effective market entry or expansion strategies. The dynamic interplay between these segments reflects evolving consumer demands for convenience, health, sustainability, and diverse culinary experiences, driving innovation across the entire value chain. As the market continues to mature and expand globally, a precise understanding of these segmented dynamics becomes increasingly vital for sustained success.

- By Product Type:

- Frozen Fruits & Vegetables

- Frozen Meat & Seafood (Poultry, Beef, Pork, Fish, Shellfish)

- Frozen Ready Meals (Single Serve, Multi-Serve)

- Frozen Bakery Products (Breads, Pastries, Cakes, Pizza Crusts)

- Frozen Desserts (Ice Cream, Frozen Yogurt, Sorbet, Other Desserts)

- Frozen Snacks & Appetizers (French Fries, Onion Rings, Spring Rolls, Samosas)

- Frozen Soups & Sauces

- Other Frozen Foods (e.g., Prepared Breakfast Items, Plant-Based Alternatives)

- By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Foodservice (Restaurants, Hotels, Cafes, Institutional Caterers)

- By End-Use:

- Retail (Household Consumption)

- Foodservice (Commercial Use)

Value Chain Analysis For Frozen Foods Market

The value chain for the frozen foods market is intricate, starting from agricultural inputs and extending through various stages of processing, packaging, storage, and ultimately, to the consumer. The upstream segment involves the meticulous sourcing of raw materials, primarily agricultural produce (fruits, vegetables, grains) and animal products (meat, poultry, seafood). This phase is critical for ensuring the quality, freshness, and safety of ingredients, often requiring contract farming, sustainable sourcing practices, and robust quality checks at the point of origin. Relationships with farmers, fishermen, and livestock suppliers are paramount, focusing on consistent supply, adherence to quality standards, and often, specific cultivation or harvesting techniques optimized for freezing. Furthermore, the provision of packaging materials, including specialized films, trays, and pouches designed to withstand freezing temperatures and prevent freezer burn, forms another vital upstream component, heavily influenced by material science and environmental sustainability concerns.

Moving downstream, the value chain encompasses processing, manufacturing, storage, and distribution. The processing stage involves cleaning, cutting, blanching, cooking (for ready meals), and rapid freezing using advanced technologies like IQF (Individual Quick Freezing) or blast freezing to preserve sensory and nutritional attributes. This is followed by packaging, where products are sealed in protective, often microwaveable or oven-safe, materials. Storage in large-scale cold storage facilities is a critical component, requiring precise temperature control and inventory management systems to maintain product integrity over extended periods. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers supplying directly to large supermarket chains, hypermarkets, or major foodservice clients, often leveraging their own cold chain logistics networks. This offers greater control over product handling and faster delivery, but requires significant capital investment in infrastructure.

Indirect distribution involves intermediaries such as wholesalers, distributors, and logistics partners who manage the cold chain from the manufacturer to smaller retailers, convenience stores, and diverse foodservice outlets. These partners play a crucial role in aggregating products, breaking bulk, and ensuring efficient last-mile delivery while adhering to stringent temperature requirements. The final leg of the value chain involves the retail sector, where products are displayed in freezer aisles of supermarkets, hypermarkets, and convenience stores, or sold through burgeoning online retail platforms with specialized cold chain delivery services. The foodservice segment also represents a significant end-user, with restaurants, hotels, catering companies, and institutions relying on frozen foods for operational efficiency and menu versatility. Both direct and indirect channels rely heavily on a robust, uninterrupted cold chain to maintain product quality and safety, underscoring the importance of technology and infrastructure investment across the entire value chain.

Frozen Foods Market Potential Customers

The frozen foods market caters to a vast and diverse spectrum of potential customers, spanning both individual consumers and commercial enterprises, each driven by unique needs and consumption patterns. Among individual consumers, working professionals and busy families constitute a significant demographic, valuing frozen foods for their unparalleled convenience, time-saving attributes, and ability to facilitate quick meal preparation amidst demanding schedules. The rise of single-person households and smaller family units also fuels demand for single-serve frozen meals and portion-controlled options, minimizing waste and maximizing efficiency. Health-conscious consumers represent another crucial segment, increasingly seeking frozen fruits, vegetables, and plant-based alternatives that offer nutritional benefits and align with specific dietary preferences, such as vegetarian, vegan, or gluten-free lifestyles. Furthermore, budget-conscious buyers find value in frozen foods due to their extended shelf life, allowing for bulk purchases and reduced spoilage compared to fresh produce, ultimately offering cost savings over time.

Beyond individual households, the foodservice sector forms a substantial base of potential customers for frozen foods. This includes a wide array of establishments such as restaurants, hotels, cafes, catering services, schools, hospitals, and corporate cafeterias. For these commercial entities, frozen ingredients and ready-to-use products offer immense operational advantages, including consistent quality and supply irrespective of seasonality, reduced labor costs associated with preparation, minimized food waste, and efficient inventory management. Restaurants, for instance, can maintain diverse menus by stocking a variety of frozen ingredients, while institutions benefit from the scalability and ease of preparation that frozen foods provide for large-volume catering. The ability to maintain product quality and safety through standardized freezing processes is particularly appealing to businesses that prioritize consistency and efficiency in their culinary operations, making frozen foods an indispensable component of modern commercial kitchens.

Emerging demographic trends and evolving consumption habits also continually expand the customer base for frozen foods. The increasing penetration of e-commerce and specialized home delivery services has made frozen products more accessible to urban populations and consumers with limited access to traditional retail outlets. Moreover, the growing interest in global cuisines has driven demand for international frozen specialties, appealing to adventurous eaters and multicultural households. Specific dietary needs, such as managing food allergies or specific health conditions, also carve out niche customer segments for specialized frozen offerings. As the market innovates with new product categories, sustainable packaging, and enhanced nutritional profiles, the potential customer base continues to broaden, encompassing anyone who values convenience, quality, cost-effectiveness, and diverse food options in their daily lives, ensuring a continually expanding market reach for frozen food manufacturers and distributors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 295.4 Billion |

| Market Forecast in 2032 | USD 470.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestle S.A., Conagra Brands, Inc., General Mills, Inc., McCain Foods Limited, Tyson Foods, Inc., Nomad Foods Ltd., Unilever PLC, Ajinomoto Co., Inc., Bakkavor Group plc, Dr. Oetker GmbH, The Kellogg Company, The Kraft Heinz Company, JBS S.A., FRoSTA AG, Bellisio Foods, Inc. (a subsidiary of Charoen Pokphand Foods), Findus Group (part of Nomad Foods), Hormel Foods Corporation, Goya Foods, Inc., Grupo Bimbo S.A.B. de C.V., Wawona Frozen Foods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frozen Foods Market Key Technology Landscape

The frozen foods market is continuously shaped by a dynamic and evolving technology landscape, with advancements focused on improving product quality, extending shelf life, enhancing food safety, and optimizing cold chain efficiency. A cornerstone of this landscape is sophisticated freezing technologies, prominently including Individual Quick Freezing (IQF), which rapidly freezes individual pieces of food, preventing ice crystal formation and preserving texture, flavor, and nutritional integrity. Cryogenic freezing, utilizing liquid nitrogen or carbon dioxide, offers even faster freezing rates, particularly beneficial for delicate products like berries and seafood. Blast freezing, while more conventional, remains vital for bulk freezing, especially in large-scale production. These technologies ensure that products maintain their quality characteristics upon thawing, addressing long-standing consumer concerns about the texture and taste of frozen items.

Beyond freezing methods, innovative packaging technologies play a crucial role in protecting frozen foods throughout their journey from factory to consumer. Barrier packaging materials, including multi-layered films and vacuum-sealed bags, are designed to prevent freezer burn, moisture loss, and oxidation, thereby extending product freshness and appeal. Microwaveable and oven-ready packaging solutions cater to the convenience-driven market, allowing consumers to cook or reheat meals directly in their packaging, reducing preparation time and dishwashing. Furthermore, sustainable packaging initiatives are gaining traction, with a focus on recyclable, compostable, or bio-based materials that minimize environmental impact without compromising protective qualities, aligning with growing consumer demand for eco-friendly products and corporate social responsibility goals.

The efficiency and reliability of the cold chain are paramount, and technology plays a pivotal role in its optimization. Internet of Things (IoT) sensors and real-time monitoring systems are deployed across storage facilities and transportation units to continuously track temperature, humidity, and location, ensuring strict adherence to critical parameters and immediate alerts for any deviations. This advanced tracking capabilities enhance product safety, minimize spoilage, and provide end-to-end traceability, bolstering consumer confidence. Artificial Intelligence (AI) and machine learning algorithms are also being integrated for predictive analytics in demand forecasting, optimizing production schedules, and streamlining logistics, ultimately reducing waste and operational costs. Robotics and automation in manufacturing facilities, from sorting and processing to packaging and palletizing, further enhance efficiency, consistency, and hygiene, collectively transforming the frozen foods industry into a highly sophisticated and technologically driven sector capable of meeting diverse global demands.

Regional Highlights

The global frozen foods market exhibits distinct regional dynamics, influenced by varying consumer preferences, economic conditions, and infrastructural developments. Each region contributes uniquely to the overall market growth, presenting specific opportunities and challenges for manufacturers and distributors.

- North America: This region stands as a mature and dominant market, driven by high disposable incomes, busy lifestyles, and a strong culture of convenience food consumption. The U.S. and Canada lead in product innovation, particularly in plant-based frozen meals, organic options, and ethnic ready-to-eat foods. A robust cold chain infrastructure and widespread retail penetration further support market growth.

- Europe: Europe represents another significant market, characterized by diverse culinary traditions and a growing emphasis on health, sustainability, and premiumization. Countries like the UK, Germany, and France are seeing increased demand for high-quality frozen fruits, vegetables, and gourmet ready meals. Strict food safety regulations and a strong retail presence contribute to a well-established market.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, rising middle-class populations, and changing dietary habits. Countries like China, India, and Japan are witnessing a surge in demand for frozen meats, seafood, and ready-to-cook meals due to increasing working populations and limited time for meal preparation. Improvements in cold chain logistics and the expansion of organized retail are key growth enablers.

- Latin America: This region is an emerging market for frozen foods, driven by economic development, increasing disposable incomes, and the gradual adoption of modern retail formats. Brazil and Mexico are leading the adoption, with growing demand for frozen meat, poultry, and processed foods. Investment in cold chain infrastructure is crucial for sustained growth.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth, albeit from a smaller base, primarily due to expanding expatriate populations, increasing tourism, and a shift towards modern retail. Demand is particularly noted for frozen meat, poultry, and certain convenience food items. Developing cold chain facilities and overcoming logistical challenges are important for market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frozen Foods Market.- Nestle S.A.

- Conagra Brands, Inc.

- General Mills, Inc.

- McCain Foods Limited

- Tyson Foods, Inc.

- Nomad Foods Ltd.

- Unilever PLC

- Ajinomoto Co., Inc.

- Bakkavor Group plc

- Dr. Oetker GmbH

- The Kellogg Company

- The Kraft Heinz Company

- JBS S.A.

- FRoSTA AG

- Bellisio Foods, Inc.

- Findus Group

- Hormel Foods Corporation

- Goya Foods, Inc.

- Grupo Bimbo S.A.B. de C.V.

- Wawona Frozen Foods

Frequently Asked Questions

Analyze common user questions about the Frozen Foods market and generate a concise list of summarized FAQs reflecting key topics and concerns.Are frozen foods as nutritious as fresh foods?

Many studies indicate that frozen fruits and vegetables, when frozen at their peak ripeness, can retain comparable, and sometimes even higher, levels of vitamins and minerals than their fresh counterparts that have traveled long distances or sat on shelves for extended periods. Rapid freezing techniques lock in nutrients, making frozen foods a highly nutritious and convenient option. The key is how quickly they are frozen after harvest, which minimizes nutrient degradation.

What are the key benefits of consuming frozen foods?

Frozen foods offer numerous benefits, including unparalleled convenience by reducing preparation time, extended shelf life which minimizes food waste, and year-round availability of seasonal produce. They also contribute to easier portion control, often come in pre-portioned packs, and can be more cost-effective over time due to reduced spoilage and the ability to buy in bulk. These advantages align perfectly with modern busy lifestyles and economic considerations.

How is the frozen foods market evolving with consumer health trends?

The frozen foods market is rapidly adapting to health trends by introducing a wide array of healthier options. This includes a significant increase in plant-based meat and dairy alternatives, organic frozen fruits and vegetables, gluten-free meals, and products with reduced sodium, sugar, and artificial ingredients. Manufacturers are also focusing on transparency in labeling and sourcing to meet the growing consumer demand for clean-label and natural food products, aligning convenience with wellness goals.

What role does technology play in the growth of the frozen foods market?

Technology is a critical driver, revolutionizing the frozen foods market from production to consumption. Advanced freezing techniques like IQF (Individual Quick Freezing) preserve product quality and texture. Innovative packaging extends shelf life and offers convenience (e.g., microwaveable pouches). Crucially, the Internet of Things (IoT) and AI are optimizing cold chain logistics, ensuring real-time temperature monitoring, reducing spoilage, and enhancing supply chain efficiency and food safety across the entire distribution network.

What are the primary challenges faced by the frozen foods industry?

The frozen foods industry faces challenges such as overcoming the lingering consumer perception that fresh is always superior, which requires ongoing education and marketing. High energy consumption associated with maintaining the cold chain (freezing, storage, transportation) poses environmental and cost concerns. Limited freezer space in households and retail outlets can also restrict product variety and purchase volumes. Additionally, price sensitivity in certain markets and intense competition from fresh and ready-to-eat alternatives present constant pressures on manufacturers and retailers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager