Gas Insulated Switchgear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429455 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Gas Insulated Switchgear Market Size

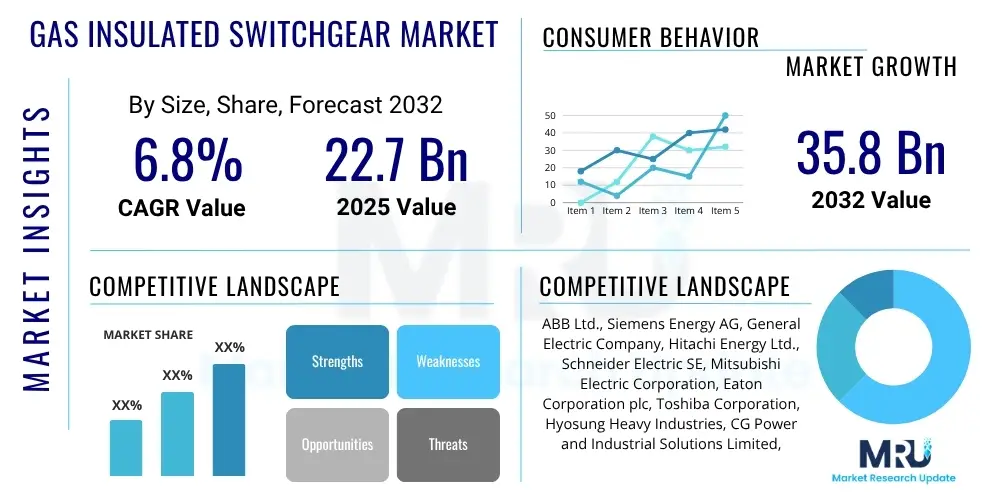

The Gas Insulated Switchgear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 22.7 billion in 2025 and is projected to reach USD 35.8 billion by the end of the forecast period in 2032.

Gas Insulated Switchgear Market introduction

The Gas Insulated Switchgear (GIS) market is a critical segment of the electrical power transmission and distribution industry, offering a compact and reliable solution for high-voltage power applications. GIS technology encapsulates active parts of a substation, such as circuit breakers, disconnectors, and busbars, within a sealed metal enclosure filled with insulating gas, typically Sulfur Hexafluoride (SF6). This innovative design significantly reduces the required footprint compared to conventional air insulated switchgear, making it ideal for urban areas, underground substations, and offshore platforms where space is a premium.

Major applications for GIS include utility transmission and distribution networks, renewable energy integration projects like wind farms and solar parks, heavy industrial complexes, and railway electrification systems. The primary benefits of GIS are its exceptional reliability, enhanced operational safety due to enclosed live parts, minimal maintenance requirements, and high resistance to environmental factors such as pollution and extreme weather. Key driving factors for the market's growth include the global push for grid modernization and expansion, rapid urbanization leading to space constraints, the increasing integration of renewable energy sources into national grids, and the rising demand for efficient and resilient power infrastructure across developing economies.

Gas Insulated Switchgear Market Executive Summary

The Gas Insulated Switchgear market is experiencing robust growth driven by several overarching business, regional, and segment trends. Globally, the market is characterized by a strong emphasis on smart grid integration, digitalization of substation components, and the development of eco-friendly alternatives to traditional SF6 gas, reflecting a broader industry commitment to sustainability. Technological advancements, particularly in monitoring and control systems, are enhancing the operational efficiency and reliability of GIS installations, making them more attractive for critical infrastructure projects.

Regional trends indicate significant market expansion in the Asia Pacific due to rapid industrialization, urbanization, and large-scale infrastructure investments, especially in countries like China and India. Europe and North America are focusing on upgrading aging grid infrastructure and integrating renewable energy, leading to a steady demand for advanced GIS solutions. In terms of segments, there is a growing shift towards higher voltage levels and compact designs to meet the evolving requirements of modern power grids. The market is also witnessing increased research and development in alternative insulating gases, driven by environmental regulations and a desire to reduce the carbon footprint associated with SF6.

AI Impact Analysis on Gas Insulated Switchgear Market

The integration of Artificial Intelligence (AI) into Gas Insulated Switchgear (GIS) operations and design is a prominent theme among users, who frequently inquire about how AI can enhance reliability, optimize performance, and improve predictive maintenance capabilities. Users are keen to understand how AI-powered analytics can process vast amounts of sensor data from GIS units to detect anomalies, predict potential failures before they occur, and ultimately extend equipment lifespan. There is also a significant interest in AI's role in automating substation operations, enabling faster fault isolation and recovery, and facilitating more efficient asset management strategies. The overarching expectation is that AI will transform GIS from a passive component into an intelligent, self-monitoring, and self-optimizing asset within the smart grid ecosystem.

- AI enhances predictive maintenance by analyzing sensor data for early fault detection.

- Optimizes grid operations through intelligent load balancing and fault localization in GIS networks.

- Improves equipment monitoring and diagnostics, leading to increased reliability and uptime.

- Automates operational tasks and decision-making for faster response to grid events.

- Facilitates smart asset management by providing insights into GIS performance and lifespan.

- Supports the integration of renewable energy sources through smarter grid control.

DRO & Impact Forces Of Gas Insulated Switchgear Market

The Gas Insulated Switchgear (GIS) market is profoundly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities. Key drivers include the escalating global demand for electricity, which necessitates continuous expansion and modernization of power transmission and distribution infrastructure. Rapid urbanization and industrialization, particularly in developing economies, create a critical need for compact and reliable substations that GIS technology efficiently addresses. Furthermore, the increasing integration of renewable energy sources like wind and solar power into existing grids mandates robust and flexible switchgear solutions capable of handling intermittent power generation, a role where GIS excels due to its high reliability and minimal maintenance requirements. Government initiatives and investments in smart grid projects also significantly propel market growth by fostering the adoption of advanced substation technologies.

However, the market faces notable restraints. The high initial capital investment required for GIS installation, compared to conventional air-insulated switchgear, can be a deterrent, especially for budget-constrained projects or smaller utilities. The complexity involved in the design, manufacturing, and installation of GIS units, often requiring specialized expertise and longer project timelines, poses another challenge. Environmental concerns surrounding SF6 gas, a potent greenhouse gas commonly used in GIS, lead to regulatory pressures and a push for alternative insulating gases, which can slow down adoption or increase development costs. The limited availability of skilled personnel for GIS installation and maintenance in some regions further contributes to market hurdles.

Despite these challenges, substantial opportunities exist within the GIS market. The development and commercialization of eco-friendly GIS solutions using alternative insulating gases, such as SF6-free options or those with lower global warming potential, present a significant growth avenue driven by stricter environmental regulations and corporate sustainability goals. The ongoing trend of smart grid development and digitalization offers opportunities for integrating advanced monitoring, control, and automation features into GIS, enhancing its intelligence and connectivity. Expanding power infrastructure in emerging markets, coupled with grid modernization efforts in developed economies, promises sustained demand. Additionally, the increasing adoption of high-voltage direct current (HVDC) transmission systems, which often utilize GIS components, opens new market segments and technological advancements.

Segmentation Analysis

The Gas Insulated Switchgear market is comprehensively segmented to provide a detailed understanding of its diverse applications, technological variations, and operational characteristics. These segmentations allow for a granular analysis of market trends, consumer preferences, and growth opportunities across various dimensions, including the type of insulating gas, the voltage level it operates at, its installation type, and its end-user applications. Understanding these segments is crucial for stakeholders to identify niche markets, develop targeted products, and formulate effective business strategies.

- By Voltage Level:

- Medium Voltage (1 kV – 72.5 kV)

- High Voltage (72.5 kV – 245 kV)

- Extra-High Voltage (245 kV – 550 kV)

- Ultra-High Voltage (Above 550 kV)

- By Installation Type:

- Indoor

- Outdoor

- By End-Use Application:

- Power Transmission & Distribution Utilities

- Industrial (Mining, Metal, Chemical, Oil & Gas, etc.)

- Power Generation (Thermal, Hydroelectric, Nuclear, Renewables)

- Transportation (Railways, Metros)

- Commercial & Residential

- By Insulating Gas Type:

- SF6 Gas

- SF6-free / Alternative Gas (e.g., g3, dry air, vacuum)

- By Product Type:

- Hybrid GIS

- Compact GIS

- Modular GIS

Value Chain Analysis For Gas Insulated Switchgear Market

The value chain for the Gas Insulated Switchgear (GIS) market encompasses a sophisticated network of activities, from the sourcing of raw materials to the final installation and after-sales service, highlighting the complex interdependencies within the industry. Upstream activities involve the procurement of critical components and raw materials such as high-purity Sulfur Hexafluoride (SF6) gas or alternative insulating gases, specialized conductors (e.g., copper, aluminum), insulators (e.g., porcelain, epoxy resins), steel and aluminum for enclosures, and various electronic components for control and monitoring systems. Key suppliers in this stage include chemical companies, metal fabricators, and specialized component manufacturers. Quality control and supply chain efficiency at this stage are paramount to the reliability and performance of the final GIS product.

Midstream activities primarily focus on the manufacturing, assembly, and testing of the GIS units. This stage involves intricate engineering design, precision manufacturing of each component, and meticulous assembly within controlled environments to ensure hermetic sealing and optimal performance. Leading manufacturers leverage advanced automation and stringent quality assurance protocols to produce highly reliable and durable GIS solutions. Downstream activities involve the distribution, installation, commissioning, and ongoing maintenance of GIS units. Distribution channels for GIS are predominantly direct, given the custom nature and high value of these products. Manufacturers often engage directly with large electric utilities, industrial clients, and EPC (Engineering, Procurement, and Construction) contractors to provide tailored solutions and specialized installation services. Indirect channels may involve system integrators for smaller or specialized projects, but direct engagement ensures technical expertise and comprehensive support.

The distribution network relies heavily on direct sales teams and dedicated project management units that work closely with end-users from the initial design phase through to installation and after-sales support. This direct approach ensures that complex technical specifications are met and that the GIS units are seamlessly integrated into the client's existing infrastructure. Post-installation, maintenance and servicing form a crucial part of the value chain, often provided by the original equipment manufacturers or certified service partners, ensuring the long-term operational integrity and efficiency of the GIS systems. This comprehensive value chain underscores the capital-intensive and technologically advanced nature of the GIS market.

Gas Insulated Switchgear Market Potential Customers

The Gas Insulated Switchgear (GIS) market primarily serves a diverse range of end-users and buyers who require robust, reliable, and space-efficient solutions for high-voltage power management. Electric utilities, encompassing national grid operators and regional power distribution companies, represent the largest customer segment, driven by the continuous need to upgrade aging infrastructure, expand transmission capacity, and integrate new power generation sources. These entities invest in GIS to enhance grid stability, improve operational efficiency, and ensure uninterrupted power supply to their consumers, often prioritizing long-term reliability and minimal maintenance requirements.

Beyond traditional utilities, heavy industries such as manufacturing, mining, metal processing, and oil and gas exploration are significant buyers. These industrial complexes demand highly reliable power distribution systems to support their continuous operations and critical processes, where even short power outages can result in substantial financial losses. The compact footprint of GIS is particularly advantageous in congested industrial environments. Furthermore, the burgeoning renewable energy sector, including large-scale wind farms and solar power plants, increasingly adopts GIS for efficient power evacuation and connection to the main grid, leveraging its resilience to harsh environmental conditions. The transportation sector, specifically railway and metro systems, also constitutes a growing customer base, utilizing GIS for traction power substations due to its compact design and high safety standards in urban settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 22.7 billion |

| Market Forecast in 2032 | USD 35.8 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, General Electric Company, Hitachi Energy Ltd., Schneider Electric SE, Mitsubishi Electric Corporation, Eaton Corporation plc, Toshiba Corporation, Hyosung Heavy Industries, CG Power and Industrial Solutions Limited, Fuji Electric Co. Ltd., Shandong Taikai Power Engineering Co. Ltd., Xinwang Electric Co. Ltd., Larson & Toubro Limited, Bharat Heavy Electricals Limited, Chint Group, Jiangsu Huapeng Electric Co. Ltd., Meidensha Corporation, Ormazabal, Arteche Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Insulated Switchgear Market Key Technology Landscape

The Gas Insulated Switchgear market is characterized by a dynamic technology landscape, continually evolving to meet demands for higher efficiency, environmental sustainability, and greater intelligence within power grids. The foundational technology involves the use of Sulfur Hexafluoride (SF6) gas as the primary insulating and arc-quenching medium due to its excellent dielectric strength and arc-quenching capabilities. However, due to SF6's high global warming potential, a significant technological shift is underway towards the development and adoption of SF6-free or alternative gas technologies. These include mixtures of fluoronitriles (e.g., g3 technology), dry air, or vacuum interrupters, which aim to reduce environmental impact while maintaining performance.

Beyond insulating gases, advancements in digital GIS (D-GIS) are transforming the market. D-GIS incorporates advanced sensor technologies, fiber optic communication, and intelligent electronic devices (IEDs) to provide real-time monitoring, diagnostics, and control capabilities. This digitalization facilitates seamless integration into smart grids, enabling predictive maintenance, enhanced fault detection, and optimized asset management through data analytics. Modular and compact designs are also prominent technological trends, allowing for quicker installation, reduced footprint, and greater flexibility in substation layouts, particularly beneficial in urban areas and for retrofitting existing infrastructure. Additionally, the development of hybrid switchgear solutions, combining elements of GIS and air-insulated switchgear, offers tailored solutions for specific site requirements, blending the advantages of both technologies. These technological advancements collectively drive the market towards more efficient, environmentally responsible, and smarter power transmission and distribution solutions.

Regional Highlights

- Asia Pacific (APAC): The largest and fastest-growing market, driven by rapid industrialization, urbanization, and significant investments in power infrastructure expansion and modernization, particularly in China and India. Government initiatives to increase electrification rates and integrate renewable energy sources further fuel demand.

- Europe: A mature market with strong emphasis on grid modernization, renewable energy integration, and upgrading aging infrastructure. Strict environmental regulations are driving the adoption of SF6-free GIS solutions. Germany, the UK, and France are key contributors.

- North America: Steady growth propelled by grid resilience improvements, replacement of aging assets, and increasing investments in smart grid technologies. The rising share of renewable energy in the energy mix in the U.S. and Canada necessitates advanced GIS solutions.

- Middle East and Africa (MEA): Emerging market driven by substantial infrastructure development projects, increasing energy demand from growing populations and industrial sectors, and significant investments in power transmission and distribution networks, especially in GCC countries.

- Latin America: Gradual growth attributed to economic development, expansion of power grids to improve electricity access, and growing investment in renewable energy projects, with Brazil and Mexico leading the regional market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Insulated Switchgear Market.- ABB Ltd.

- Siemens Energy AG

- General Electric Company

- Hitachi Energy Ltd.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Toshiba Corporation

- Hyosung Heavy Industries

- CG Power and Industrial Solutions Limited

- Fuji Electric Co. Ltd.

- Shandong Taikai Power Engineering Co. Ltd.

- Xinwang Electric Co. Ltd.

- Larson & Toubro Limited

- Bharat Heavy Electricals Limited

- Chint Group

- Jiangsu Huapeng Electric Co. Ltd.

- Meidensha Corporation

- Ormazabal

- Arteche Group

Frequently Asked Questions

What is Gas Insulated Switchgear (GIS) and how does it work?

Gas Insulated Switchgear (GIS) is a compact, metal-enclosed switchgear that uses sulfur hexafluoride (SF6) or alternative gases as an insulating medium. It works by encapsulating live parts of a substation, such as circuit breakers and disconnectors, in a sealed, gas-filled environment, providing excellent insulation and arc-quenching properties for high-voltage power transmission and distribution.

What are the primary advantages of GIS over conventional air-insulated switchgear?

GIS offers significant advantages including a highly compact design, requiring up to 90% less space, enhanced operational safety due to enclosed live parts, superior reliability in harsh environments, and minimal maintenance requirements, making it ideal for urban and demanding industrial applications.

What are the environmental concerns related to GIS, and how is the industry addressing them?

The main environmental concern is the use of SF6 gas, a potent greenhouse gas. The industry is actively addressing this by developing and adopting SF6-free technologies, utilizing alternative insulating gases with lower global warming potential, and implementing stricter SF6 handling and recycling protocols to minimize emissions.

Which regions are driving the growth of the Gas Insulated Switchgear market?

The Asia Pacific region, particularly countries like China and India, is a primary growth driver due to rapid industrialization, urbanization, and extensive power infrastructure investments. Europe and North America also contribute through grid modernization and renewable energy integration projects.

How is digital transformation impacting the GIS market?

Digital transformation is integrating advanced sensors, communication technologies, and data analytics into GIS. This enables real-time monitoring, predictive maintenance, automated fault detection, and seamless integration into smart grids, enhancing the intelligence and efficiency of power systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HV Gas Insulated Switchgear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- High-Voltage Gas Insulated Switchgear Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Below 40.5 KV, 40.5 KV-252 KV, Above 252 KV), By Application (Electric Power Transmission, Electric Power Distribution), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager