Gastrointestinal Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428601 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Gastrointestinal Diagnostics Market Size

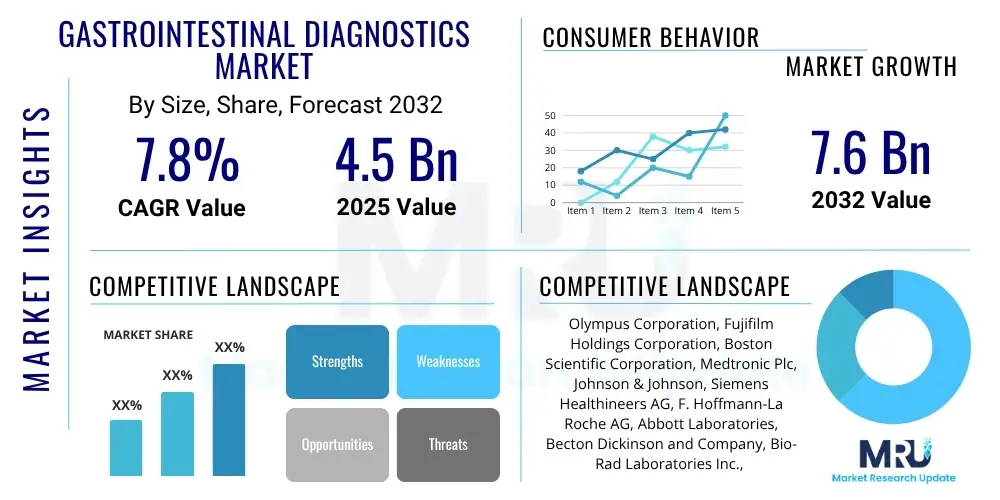

The Gastrointestinal Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 4.5 Billion in 2025 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2032.

Gastrointestinal Diagnostics Market introduction

The Gastrointestinal Diagnostics Market encompasses a broad spectrum of medical tests, devices, and procedures designed to detect, diagnose, and monitor conditions affecting the digestive system. This critical field includes solutions for common disorders such as inflammatory bowel disease, irritable bowel syndrome, gastroesophageal reflux disease, and various cancers like colorectal and gastric cancer. Key products range from advanced endoscopic instruments and imaging systems to sophisticated laboratory tests, including molecular and genetic assays, and non-invasive breath and stool tests. These diagnostic tools are essential for early detection, accurate disease staging, and guiding effective treatment strategies, ultimately improving patient outcomes and quality of life.

The primary applications of gastrointestinal diagnostics extend across hospitals, specialized gastroenterology clinics, and diagnostic laboratories, serving a diverse patient population. The benefits of these diagnostics are profound, enabling timely intervention, reducing the progression of severe diseases, and minimizing healthcare costs associated with advanced-stage treatments. A significant driving factor for market growth is the escalating global prevalence of gastrointestinal disorders, largely attributable to changing dietary habits, aging populations, increasing awareness about early diagnosis, and continuous advancements in diagnostic technologies that offer higher accuracy and less invasiveness. This market's trajectory is also shaped by a growing emphasis on personalized medicine and the integration of artificial intelligence for enhanced diagnostic precision.

Gastrointestinal Diagnostics Market Executive Summary

The Gastrointestinal Diagnostics Market is experiencing robust growth, propelled by several key business, regional, and segment trends. Business trends indicate a strong emphasis on research and development to introduce innovative, less invasive, and more accurate diagnostic solutions, alongside strategic collaborations and mergers among market players to expand product portfolios and geographical reach. There is a discernible shift towards integrating digital health solutions and telemedicine, further streamlining diagnostic pathways and patient management. Companies are also focusing on optimizing supply chain resilience and expanding manufacturing capacities to meet rising demand.

Regional trends highlight North America and Europe as dominant markets due to well-established healthcare infrastructures, high incidence of GI diseases, and significant adoption of advanced technologies. However, the Asia Pacific region is emerging as the fastest-growing market, driven by improving healthcare access, increasing disposable incomes, a large patient population, and rising awareness regarding early disease detection. Latin America, the Middle East, and Africa also present significant untapped potential with increasing investments in healthcare facilities. Segment trends reveal a growing preference for non-invasive and minimally invasive diagnostic procedures, with molecular diagnostics witnessing substantial uptake due to their precision and ability to detect genetic predispositions and biomarkers. While traditional endoscopy remains foundational, advanced imaging techniques and point-of-care testing are also gaining traction, catering to diverse clinical needs and enhancing diagnostic efficiency across various healthcare settings.

AI Impact Analysis on Gastrointestinal Diagnostics Market

Common user questions regarding AI's impact on the Gastrointestinal Diagnostics Market frequently center on its ability to enhance diagnostic accuracy, speed up interpretation of complex data, and contribute to earlier disease detection. Users are keen to understand how AI addresses challenges such as inter-observer variability in endoscopic findings, the sheer volume of diagnostic images requiring analysis, and the potential for personalized treatment recommendations. Concerns often include data privacy and security, the regulatory landscape for AI-driven diagnostic tools, and the ethical implications of relying on algorithmic decisions in patient care. Expectations are high for AI to reduce healthcare costs, improve workflow efficiency for clinicians, and ultimately lead to better patient outcomes by identifying subtle disease markers that human eyes might miss.

Based on this analysis, AI is poised to revolutionize gastrointestinal diagnostics by providing unprecedented capabilities for image analysis, predictive modeling, and workflow optimization. It is expected to significantly augment clinicians' ability to interpret endoscopic images, pathology slides, and radiological scans with higher precision and speed, thereby facilitating earlier and more accurate diagnoses. While offering immense potential for personalized medicine and early intervention, the widespread adoption of AI necessitates careful consideration of data governance, validation of AI algorithms in diverse clinical settings, and seamless integration into existing healthcare workflows to ensure both efficacy and trust among medical professionals and patients.

- Enhanced image analysis: AI algorithms analyze endoscopic, radiological, and pathological images for subtle anomalies, improving detection rates for polyps, lesions, and early cancers.

- Predictive analytics: AI models use patient data to predict disease progression, recurrence risk, and response to therapy, enabling personalized treatment plans.

- Workflow optimization: AI tools automate routine tasks, triage urgent cases, and assist in documentation, reducing physician workload and improving efficiency.

- Drug discovery and development: AI accelerates the identification of novel biomarkers and therapeutic targets for GI disorders, speeding up new drug development.

- Improved diagnostic accuracy: AI reduces inter-observer variability in diagnoses, leading to more consistent and reliable results across different practitioners and institutions.

- Personalized medicine: AI facilitates the tailoring of diagnostic and treatment strategies based on an individual's genetic makeup, lifestyle, and disease characteristics.

- Remote diagnostics: AI-powered platforms support remote image interpretation and consultations, expanding access to specialized GI care, especially in underserved areas.

DRO & Impact Forces Of Gastrointestinal Diagnostics Market

The Gastrointestinal Diagnostics Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all contributing to its overall impact forces. Key drivers include the escalating global prevalence of chronic and acute gastrointestinal disorders, such as Inflammatory Bowel Disease (IBD), Irritable Bowel Syndrome (IBS), and various GI cancers, which necessitate timely and accurate diagnosis. Technological advancements, particularly in endoscopy, molecular diagnostics, and imaging modalities, continually push the boundaries of diagnostic capabilities, offering improved sensitivity and specificity. Furthermore, increasing awareness among both healthcare providers and the general population about the importance of early detection and preventive screening programs, coupled with rising healthcare expenditure, actively propels market expansion.

However, the market also faces considerable restraints that temper its growth. The high cost associated with advanced diagnostic equipment, such as sophisticated endoscopes and molecular testing platforms, can pose a barrier to adoption, especially in resource-limited settings. A shortage of skilled professionals required to operate complex diagnostic machinery and interpret results, alongside stringent regulatory approval processes for new devices and assays, can impede market entry and innovation. Moreover, challenges related to reimbursement policies and limited insurance coverage for certain advanced diagnostic procedures in some regions also act as significant headwinds, impacting patient access and market penetration.

Opportunities abound, however, particularly with the emergence of non-invasive diagnostic tests, which promise to reduce patient discomfort and expand screening accessibility. The growing focus on personalized medicine, driven by advancements in genomics and proteomics, creates avenues for highly targeted diagnostic solutions. Expansion into lucrative emerging markets, characterized by improving healthcare infrastructures and large patient populations, presents substantial growth potential. The integration of Artificial Intelligence and machine learning for enhanced diagnostic accuracy and efficiency, along with the development of user-friendly point-of-care diagnostics, are also pivotal opportunities poised to reshape the market landscape and overcome existing diagnostic challenges.

Segmentation Analysis

The Gastrointestinal Diagnostics Market is comprehensively segmented based on various critical parameters, including product type, disease indication, end-user, and technology. This segmentation provides a granular view of the market, enabling stakeholders to understand specific areas of growth, competitive landscapes, and unmet needs. Each segment plays a crucial role in addressing the diverse requirements for diagnosing the wide array of gastrointestinal conditions, from common functional disorders to life-threatening cancers, influencing product development, market strategies, and investment decisions across the industry.

The product type segment differentiates between devices, services, and reagents, reflecting the varied nature of diagnostic offerings. Disease indication segmentation highlights the impact of specific GI disorders on market demand and the development of targeted diagnostic solutions. End-user categories illustrate the primary purchasers and environments where these diagnostics are utilized, while the technology segment showcases the innovation and advancements driving the market forward, from traditional methods to cutting-edge molecular and AI-powered tools. This comprehensive segmentation is vital for analyzing market dynamics and identifying strategic growth opportunities within the evolving gastrointestinal diagnostics landscape.

- Product Type

- Diagnostic Devices

- Endoscopes (Flexible Endoscopes, Rigid Endoscopes, Capsule Endoscopes)

- Imaging Systems (CT Scanners, MRI Scanners, Ultrasound Systems, X-ray Systems)

- Biopsy Devices

- Manometry Systems

- Diagnostic Services

- Laboratory Testing Services (Blood Tests, Stool Tests, Biopsy Analysis)

- Pathology Services

- Imaging Services

- Reagents and Kits

- Immunoassay Kits

- Molecular Diagnostic Kits (PCR-based, NGS-based)

- Histology and Cytology Stains

- Breath Test Reagents

- Diagnostic Devices

- Disease Indication

- Inflammatory Bowel Disease (IBD)

- Crohn's Disease

- Ulcerative Colitis

- Irritable Bowel Syndrome (IBS)

- Gastroesophageal Reflux Disease (GERD)

- Celiac Disease

- Gastric Cancer

- Colorectal Cancer

- Pancreatic Cancer

- Hepatitis

- Peptic Ulcers

- Infectious Gastroenteritis

- Inflammatory Bowel Disease (IBD)

- End-User

- Hospitals

- Diagnostic Laboratories

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Research and Academic Institutes

- Technology

- Endoscopy

- Video Endoscopy

- Capsule Endoscopy

- Chromoendoscopy

- Narrow Band Imaging (NBI)

- Imaging Technologies

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- X-ray

- Molecular Diagnostics

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Microarray

- FISH

- Immunodiagnostics

- Stool Testing

- Blood Testing

- Breath Testing

- Biopsy

- Endoscopy

Value Chain Analysis For Gastrointestinal Diagnostics Market

The value chain for the Gastrointestinal Diagnostics Market spans from the sourcing of raw materials to the final delivery of diagnostic services to end-users, involving multiple interconnected stages. Upstream activities primarily involve the procurement of specialized chemicals, biological reagents, optical components, precision mechanical parts, and electronic components from various suppliers. These raw materials are crucial for the manufacturing of sophisticated diagnostic devices, reagents, and kits. This stage also includes research and development efforts by companies to innovate new diagnostic methods and improve existing ones, requiring significant investment in scientific expertise and laboratory infrastructure.

Midstream processes encompass the manufacturing and assembly of diagnostic instruments such as endoscopes, imaging systems, and molecular diagnostic platforms. It also includes the production of diagnostic reagents and kits, ensuring stringent quality control and regulatory compliance. Downstream activities focus on the distribution and sales of these products and services. Distribution channels can be both direct, where manufacturers sell directly to hospitals and large diagnostic laboratories through their sales force, and indirect, involving third-party distributors and wholesalers who reach a broader network of clinics and smaller laboratories. The final stage involves the provision of diagnostic services by hospitals, specialized clinics, and independent diagnostic laboratories to patients, utilizing the manufactured products and integrating them into clinical practice.

Direct distribution offers greater control over sales and customer relationships but requires significant investment in sales infrastructure. Indirect channels provide wider market penetration and leverage existing logistical networks. Both direct and indirect models are vital for ensuring comprehensive market coverage, allowing diagnostic solutions to reach a diverse range of healthcare providers and ultimately benefit a broader patient population. The efficiency and optimization of this value chain are critical for reducing costs, improving access to diagnostics, and enhancing overall market growth and competitiveness.

Gastrointestinal Diagnostics Market Potential Customers

The primary end-users and buyers in the Gastrointestinal Diagnostics Market are diverse, encompassing a wide range of healthcare entities that require accurate and timely diagnostic capabilities for digestive disorders. Hospitals, particularly those with dedicated gastroenterology departments and large pathology labs, represent a significant segment of potential customers. They require a comprehensive suite of diagnostic tools, including advanced endoscopic systems, imaging equipment, and a broad range of laboratory tests, to manage a high volume of diverse patient cases, from routine screenings to complex disease management and emergency interventions. Their need for integrated solutions and high-throughput capabilities makes them key purchasers.

Diagnostic laboratories, both independent and hospital-affiliated, are another critical customer segment. These facilities specialize in processing various biological samples, such as blood, stool, and biopsy tissues, using immunodiagnostic and molecular diagnostic techniques. They focus on scalability, precision, and efficiency, often seeking automated systems and high-volume reagent kits. Gastroenterology clinics and specialty clinics, while smaller in scale than hospitals, are increasingly investing in specialized diagnostic equipment like capsule endoscopes, breath test devices, and point-of-care testing solutions to offer localized, convenient diagnostic services to their specific patient populations, thereby enhancing patient care and reducing referral times. Additionally, ambulatory surgical centers (ASCs) that perform endoscopic procedures are vital customers for flexible endoscopes and related accessories. Research and academic institutions also serve as potential customers, utilizing advanced diagnostic tools for clinical trials, scientific research, and developing novel diagnostic biomarkers and methodologies, contributing to the innovation pipeline of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2032 | USD 7.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific Corporation, Medtronic Plc, Johnson & Johnson, Siemens Healthineers AG, F. Hoffmann-La Roche AG, Abbott Laboratories, Becton Dickinson and Company, Bio-Rad Laboratories Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings, Hologic Inc., Exact Sciences Corporation, Guardant Health Inc., Invitae Corporation, Takeda Pharmaceutical Company Limited, GE Healthcare, Pentax Medical (HOYA Corporation), Cook Medical LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gastrointestinal Diagnostics Market Key Technology Landscape

The Gastrointestinal Diagnostics Market is characterized by a rapidly evolving technological landscape, driven by the demand for less invasive, more accurate, and faster diagnostic solutions. Advanced endoscopy techniques represent a cornerstone, with innovations such as capsule endoscopy offering non-invasive visualization of the entire small bowel, and chromoendoscopy or Narrow Band Imaging (NBI) enhancing the detection of subtle mucosal changes and early-stage lesions within the colon and stomach. These advancements improve diagnostic yield and reduce the need for repeat procedures. High-resolution manometry is another crucial technology, providing detailed functional assessments of esophageal and anorectal motility disorders, leading to more precise diagnoses of conditions like achalasia and functional dyspepsia.

Beyond endoscopy, molecular diagnostics are transforming the field by enabling the detection of specific genetic mutations, microbial DNA, and biomarkers associated with various GI diseases, including colorectal cancer, inflammatory bowel disease, and infectious gastroenteritis. Techniques like Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) offer unparalleled sensitivity and specificity, facilitating personalized medicine approaches. Breath tests, such as those for Helicobacter pylori infection or small intestinal bacterial overgrowth (SIBO), provide convenient and non-invasive diagnostic options. Furthermore, the integration of Artificial Intelligence (AI) and machine learning into image analysis for endoscopy and radiology is emerging as a significant technological trend, promising to enhance diagnostic accuracy, reduce interpretation errors, and optimize workflow efficiency for clinicians, particularly in identifying precancerous lesions and complex disease patterns.

Liquid biopsies, which involve analyzing circulating tumor DNA (ctDNA) or other biomarkers in blood samples, are gaining traction for non-invasive screening and monitoring of gastrointestinal cancers, offering a less burdensome alternative to tissue biopsies. Point-of-care testing (POCT) solutions are also being developed to provide rapid diagnostic results closer to the patient, particularly for infectious GI diseases or inflammation markers, thereby enabling quicker clinical decisions and improving patient management. The continuous innovation across these technological domains underscores a commitment to improving patient care by making gastrointestinal diagnostics more accessible, precise, and less burdensome.

Regional Highlights

- North America: This region holds a dominant share in the Gastrointestinal Diagnostics Market, primarily due to its well-established healthcare infrastructure, high prevalence of chronic GI disorders, and significant adoption of advanced diagnostic technologies. The presence of major market players, coupled with substantial research and development investments and favorable reimbursement policies, further fuels market growth. Increasing awareness programs for early disease detection and a rising geriatric population also contribute significantly to the market's expansion in this region.

- Europe: The European market for gastrointestinal diagnostics is characterized by a growing emphasis on preventive healthcare and early disease diagnosis, supported by government initiatives and public health campaigns. The rising incidence of lifestyle-related GI diseases, an aging population, and continuous technological advancements in diagnostic equipment are key drivers. Countries like Germany, the UK, and France are at the forefront, showcasing high adoption rates of advanced endoscopic and molecular diagnostic techniques, alongside a robust regulatory framework that encourages innovation and patient safety.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for gastrointestinal diagnostics, driven by rapidly improving healthcare infrastructure, increasing disposable incomes, and a vast patient pool. Growing awareness about various GI conditions and the benefits of early screening, coupled with increasing investments in healthcare by both public and private sectors, are propelling market expansion. Emerging economies within this region, such as China, India, and Japan, are witnessing a surge in demand for advanced diagnostic solutions, with a notable rise in medical tourism and the entry of global market players seeking to capitalize on untapped market potential.

- Latin America: The Latin American market is experiencing steady growth, fueled by increasing healthcare expenditure, improving access to healthcare facilities, and a rising prevalence of infectious and chronic GI diseases. Efforts to modernize healthcare systems and an expanding middle class are driving the adoption of more advanced diagnostic technologies, though challenges related to healthcare access and affordability persist in some areas.

- Middle East and Africa (MEA): The MEA region is an emerging market for gastrointestinal diagnostics, marked by increasing investments in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries. The rising burden of non-communicable diseases, including GI disorders, and improving diagnostic capabilities are contributing to market growth. However, disparities in healthcare access and limited resources in certain parts of Africa remain significant factors influencing market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gastrointestinal Diagnostics Market.- Olympus Corporation

- Fujifilm Holdings Corporation

- Boston Scientific Corporation

- Medtronic Plc

- Johnson & Johnson

- Siemens Healthineers AG

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- Hologic Inc.

- Exact Sciences Corporation

- Guardant Health Inc.

- Invitae Corporation

- Takeda Pharmaceutical Company Limited

- GE Healthcare

- Pentax Medical (HOYA Corporation)

- Cook Medical LLC

Frequently Asked Questions

What are the latest technological advancements in GI diagnostics?

The latest technological advancements include high-resolution endoscopy with AI-powered image analysis, advanced capsule endoscopy, molecular diagnostics using NGS, non-invasive liquid biopsies for cancer, and enhanced breath testing for H. pylori and SIBO, all contributing to improved accuracy and patient comfort.

How is AI transforming gastrointestinal diagnosis?

AI is transforming GI diagnosis by enhancing the accuracy and speed of image interpretation (endoscopy, radiology, pathology), aiding in early disease detection, predicting disease progression, and optimizing clinical workflows, ultimately leading to more personalized and efficient patient care.

What are the key drivers for growth in the GI diagnostics market?

Key drivers include the increasing global prevalence of gastrointestinal disorders, continuous technological advancements in diagnostic tools, rising healthcare expenditure, and growing awareness among the public and medical professionals regarding the importance of early and accurate diagnosis.

What challenges does the GI diagnostics market face?

Challenges include the high cost of advanced diagnostic equipment, the shortage of skilled healthcare professionals to operate and interpret complex diagnostics, stringent regulatory approval processes, and limitations in reimbursement policies in various regions, which can hinder market adoption.

Which regions are leading the growth in the gastrointestinal diagnostics market?

North America currently leads the gastrointestinal diagnostics market due to robust healthcare infrastructure and high technology adoption. However, the Asia Pacific region is projected to be the fastest-growing market, driven by improving healthcare access and increasing medical awareness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager