Gathering Pipeline Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429650 | Date : Nov, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Gathering Pipeline Market Size

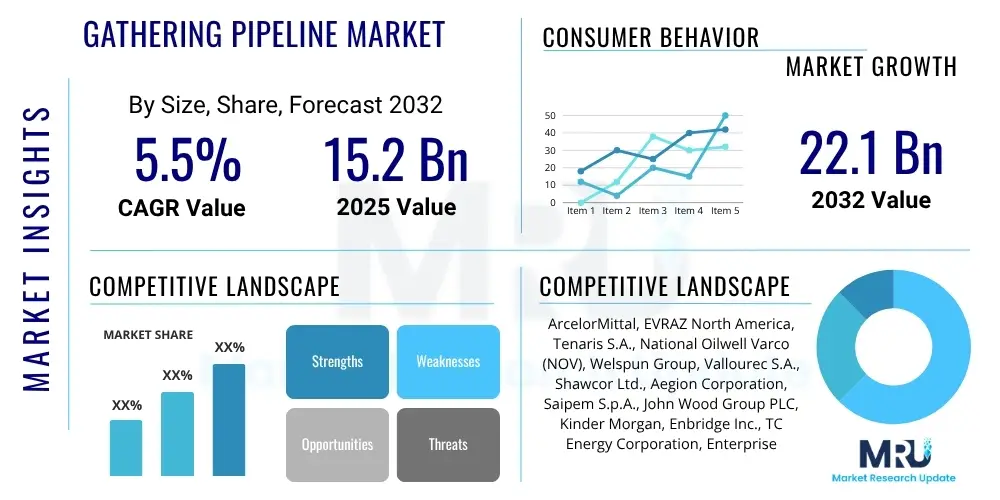

The Gathering Pipeline Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2025 and 2032. The market is estimated at $15.2 Billion in 2025 and is projected to reach $22.1 Billion by the end of the forecast period in 2032.

Gathering Pipeline Market introduction

The Gathering Pipeline Market encompasses the infrastructure and services dedicated to collecting crude oil, natural gas, and natural gas liquids (NGLs) from individual wellheads and transporting them to larger transmission pipelines or processing facilities. These pipelines are typically smaller in diameter and operate at lower pressures than main transmission lines, forming the crucial initial link in the hydrocarbon transportation network. The market includes a wide array of products such as steel pipes, composite materials, valves, pumps, compressors, and various monitoring and control systems, all designed to ensure efficient and safe delivery of hydrocarbons from the point of extraction to initial processing or storage.

Major applications of gathering pipelines are predominantly found in the upstream oil and gas sector, particularly within conventional and unconventional resource plays such as shale gas, tight oil, and offshore fields. The primary benefits derived from these systems include enhanced operational efficiency, significant reduction in transportation costs compared to alternative methods like trucking, improved safety by minimizing human exposure to hazardous materials, and a reduced environmental footprint through streamlined transport. The market's growth is predominantly driven by increasing global energy demand, continuous exploration and production activities, and technological advancements that enable access to previously inaccessible reserves.

The inherent need to connect geographically dispersed well sites to central processing hubs makes gathering pipelines indispensable. Their construction and maintenance require specialized engineering and construction services, contributing significantly to the overall market value. As energy landscapes evolve, the design and operational parameters of gathering pipelines are also adapting, incorporating advanced materials for durability and smart technologies for optimal performance and regulatory compliance.

Gathering Pipeline Market Executive Summary

The Gathering Pipeline Market is experiencing dynamic shifts influenced by global energy demands, technological innovations, and evolving regulatory frameworks. Business trends indicate a strong focus on optimizing operational efficiency and enhancing safety through digitalization and automation, leading to increased adoption of smart pipeline solutions. Companies are also investing in advanced materials and construction techniques to improve pipeline integrity and extend operational lifespans, while strategic mergers and acquisitions are shaping competitive landscapes and fostering consolidation among key players. Furthermore, there is a growing emphasis on environmental compliance and sustainability, prompting investments in leak detection systems and infrastructure upgrades to minimize emissions and prevent spills, aligning with broader ESG objectives.

Regional trends highlight North America's continued dominance, largely driven by robust shale oil and gas production, particularly in basins like the Permian and Appalachian. The Asia Pacific region is emerging as a significant growth hub, fueled by increasing energy consumption, new field discoveries, and substantial investments in energy infrastructure in countries such as China, India, and Australia. The Middle East and Africa also present considerable opportunities due to extensive proven reserves and ongoing upstream development projects aimed at boosting crude oil and natural gas output. In contrast, Europe is witnessing more moderated growth, influenced by stringent environmental policies and a pivot towards renewable energy sources, though gas infrastructure remains critical for energy security.

Segment trends reveal a rising demand for larger diameter pipelines capable of handling increased volumes from prolific well pads, alongside a growing preference for composite materials and corrosion-resistant alloys that offer superior durability and reduced maintenance requirements. The application segment for natural gas gathering pipelines is projected to expand significantly, driven by the global energy transition and the role of natural gas as a bridge fuel. Furthermore, there is an accelerating trend towards integrating Internet of Things (IoT) sensors, artificial intelligence (AI), and machine learning (ML) technologies for real-time monitoring, predictive maintenance, and optimized flow management, transforming traditional pipeline operations into data-driven systems.

AI Impact Analysis on Gathering Pipeline Market

User inquiries concerning AI's influence on the Gathering Pipeline Market frequently revolve around how it can enhance operational efficiency, improve safety protocols, and optimize maintenance schedules. Key themes indicate an expectation that AI will provide predictive capabilities for equipment failure and leaks, automate routine tasks, and offer advanced data analytics to inform decision-making. There are also concerns regarding the integration complexity with existing infrastructure, data security, and the necessity for a skilled workforce to manage AI-driven systems, highlighting a balance between anticipated benefits and implementation challenges.

- Predictive maintenance schedules for pumps, valves, and compressors.

- Enhanced leak detection and pinpointing through real-time data analysis.

- Optimized flow assurance and throughput management based on demand and supply.

- Automated anomaly detection for operational irregularities and security breaches.

- Improved integrity management by analyzing inspection data from PIGs.

- Risk assessment and mitigation strategies for pipeline infrastructure.

- Digital twin creation for comprehensive operational visibility and simulation.

DRO & Impact Forces Of Gathering Pipeline Market

The Gathering Pipeline Market is propelled by several significant drivers, including the persistent global demand for energy, which necessitates continuous exploration and production of hydrocarbons. This demand is further amplified by new discoveries in both conventional and unconventional oil and gas fields, particularly in regions like North America, and emerging economies in Asia Pacific. Technological advancements in drilling and extraction, such as horizontal drilling and hydraulic fracturing, have unlocked vast reserves, directly fueling the need for extensive gathering pipeline networks. Infrastructure development, especially in developing nations, also serves as a crucial driver, as these regions expand their energy ecosystems.

However, the market faces considerable restraints. Volatile crude oil and natural gas prices can significantly impact investment decisions for new pipeline projects, leading to project delays or cancellations. Stringent environmental regulations and increasing public opposition to fossil fuel infrastructure pose challenges, prolonging permitting processes and increasing project costs. The inherently high capital expenditure required for pipeline construction and the complex land acquisition procedures further complicate market expansion. Geopolitical tensions and political instability in key oil and gas-producing regions can also disrupt supply chains and investment flows.

Despite these challenges, opportunities abound. The growing adoption of smart pipeline technologies, including IoT sensors, advanced analytics, and AI for predictive maintenance and operational optimization, presents a significant growth avenue. The expansion into unconventional plays continues to unlock new resource potential, necessitating further gathering infrastructure development. Moreover, the long-term potential for repurposing existing gas gathering pipelines for hydrogen transportation, as part of the broader energy transition, offers a futuristic growth trajectory. The need for enhanced safety and environmental performance also drives innovation and investment in advanced monitoring and leak detection systems.

Segmentation Analysis

The Gathering Pipeline Market is comprehensively segmented to provide a detailed understanding of its diverse components and demand dynamics. This segmentation facilitates a deeper analysis of market trends, allowing stakeholders to identify specific growth areas and challenges within various product types, operational parameters, and end-use applications. Key segmentation categories include material type, pipeline diameter, application, and end-use industry, each reflecting distinct technological requirements and market influences.

Understanding these segments is crucial for strategic planning, as it highlights where innovation is concentrated, where regulatory impacts are most felt, and which areas offer the highest potential for investment and expansion. For instance, the demand for specific materials is often driven by environmental conditions and desired service life, while diameter segmentation relates directly to production volumes and flow rates. Application-based segmentation provides insight into the relative importance of different hydrocarbon types, and end-use segmentation delineates the primary consumers of gathering pipeline infrastructure.

- By Material:

- Steel

- Composite

- High-Density Polyethylene (HDPE)

- Other Alloys

- By Diameter:

- Small Diameter (Less than 6 inches)

- Medium Diameter (6-12 inches)

- Large Diameter (Above 12 inches)

- By Application:

- Crude Oil

- Natural Gas

- Natural Gas Liquids (NGLs)

- Produced Water

- By End-Use Industry:

- Upstream Oil & Gas (E&P Companies)

- Midstream Oil & Gas (Pipeline Operators, Processing Facilities)

Value Chain Analysis For Gathering Pipeline Market

The value chain for the Gathering Pipeline Market is multifaceted, commencing with the upstream activities involving raw material procurement and the manufacturing of essential components. This stage includes suppliers of steel, composite resins, and other alloys, along with manufacturers of specialized fittings, valves, pumps, and compressors. These foundational elements are critical for the structural integrity and operational efficiency of any pipeline system. The quality and availability of these materials directly impact construction costs, pipeline longevity, and overall project timelines, making reliable upstream suppliers indispensable for the entire chain.

Moving downstream, the value chain progresses through the actual design, engineering, and construction of gathering pipelines. This phase involves engineering, procurement, and construction (EPC) firms that specialize in pipeline infrastructure development, along with specialized pipeline manufacturers and fabrication companies. These entities are responsible for transforming raw materials and components into functional pipeline networks, adhering to strict safety standards and regulatory requirements. Once constructed, the pipelines enter the operational phase, managed by midstream oil and gas companies or directly by exploration and production (E&P) firms, who are also responsible for ongoing maintenance, monitoring, and integrity management, often contracting third-party service providers for these specialized tasks.

Distribution channels for gathering pipeline products and services primarily involve direct sales from manufacturers and EPC contractors to oil and gas operators and midstream companies. Specialized distributors may also play a role in supplying specific components or technologies. For complex projects, integrated service providers offer comprehensive solutions from design to commissioning and ongoing support. Both direct sales and indirect channels via distributors ensure that a wide array of products and services, ranging from specific pipe segments to advanced leak detection systems, reach the end-users effectively. This integrated approach ensures efficient project execution and long-term operational reliability.

Gathering Pipeline Market Potential Customers

The primary potential customers and end-users of gathering pipeline systems are entities deeply entrenched in the hydrocarbon exploration, production, and initial transportation sectors. These include a broad spectrum of oil and gas companies, ranging from multinational corporations to independent operators, all requiring robust infrastructure to move extracted resources from wellheads to processing or transmission points. Their needs are diverse, driven by factors such as geographic location of wells, type of hydrocarbon being produced, and existing infrastructure capabilities.

Specifically, exploration and production (E&P) companies are significant buyers, as gathering pipelines are an integral part of their field development plans, essential for monetizing their discoveries. Midstream companies, which specialize in the transportation and processing of hydrocarbons, also represent a substantial customer base, as they often own and operate extensive gathering systems that feed into their larger pipeline networks. National Oil Companies (NOCs) globally constitute a major segment of potential customers, particularly in regions with state-controlled energy sectors, where they are responsible for national energy infrastructure development and management. Furthermore, independent operators, often focused on specific basins or unconventional plays, consistently require tailored gathering pipeline solutions.

These customers seek solutions that offer reliability, cost-efficiency, scalability, and compliance with stringent safety and environmental regulations. They are increasingly interested in advanced technologies such as smart pipelines, predictive maintenance systems, and remote monitoring capabilities to optimize their operations and reduce operational risks. The decision-making process for these buyers is typically complex, involving long-term strategic planning, significant capital investment, and rigorous technical and economic evaluations, making deep industry expertise a critical asset for suppliers in this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $15.2 Billion |

| Market Forecast in 2032 | $22.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, EVRAZ North America, Tenaris S.A., National Oilwell Varco (NOV), Welspun Group, Vallourec S.A., Shawcor Ltd., Aegion Corporation, Saipem S.p.A., John Wood Group PLC, Kinder Morgan, Enbridge Inc., TC Energy Corporation, Enterprise Products Partners L.P., Williams Companies, Inc., Plains All American Pipeline, L.P., MPLX LP, Magellan Midstream Partners, L.P., DCP Midstream, BP Midstream Partners LP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gathering Pipeline Market Key Technology Landscape

The Gathering Pipeline Market is continually evolving with the integration of advanced technologies aimed at enhancing operational efficiency, safety, and environmental compliance. A prominent aspect of this landscape involves the deployment of next-generation pipeline materials, moving beyond traditional carbon steel to include corrosion-resistant alloys, high-strength low-alloy steels, and composite pipes. These materials offer superior durability, reduced maintenance requirements, and are better suited for handling corrosive fluids and high-pressure environments, directly contributing to the longevity and reliability of pipeline infrastructure, especially in challenging operational conditions.

Another crucial technological trend is the widespread adoption of smart pipeline solutions, driven by the Internet of Things (IoT) and advanced sensor technologies. These systems integrate various sensors for real-time monitoring of pressure, temperature, flow rates, and leak detection across the pipeline network. The data collected is then fed into sophisticated analytics platforms, often powered by Artificial Intelligence (AI) and Machine Learning (ML) algorithms, to provide predictive insights into potential failures, optimize operational parameters, and enable proactive maintenance. This shift towards data-driven operations minimizes downtime, reduces operational costs, and significantly improves safety by detecting anomalies before they escalate into major incidents.

Furthermore, the market is witnessing increased investment in autonomous inspection tools and digital twin technology. Robotic in-line inspection tools, commonly known as PIGs (Pipeline Inspection Gauges), are becoming more advanced, equipped with high-resolution sensors and AI capabilities for more accurate defect detection and characterization. Digital twin technology creates virtual replicas of physical pipeline assets, allowing operators to simulate various scenarios, test operational changes, and predict asset behavior in a controlled environment, thereby optimizing design, construction, and long-term operational strategies. These technological advancements collectively contribute to a more resilient, efficient, and environmentally responsible gathering pipeline network.

Regional Highlights

- North America: Dominant market share attributed to extensive shale oil and gas production, particularly in the Permian Basin, Marcellus, and Eagle Ford. Continuous investment in new drilling activities and associated midstream infrastructure drives consistent demand for gathering pipelines. The region benefits from a mature oil and gas industry with established technological capabilities.

- Europe: Characterized by an aging infrastructure and a strong focus on natural gas as a transition fuel. While new large-scale oil and gas developments are less common, upgrades, maintenance, and the potential for hydrogen blending or repurposing existing gas pipelines offer market relevance. Stringent environmental regulations influence technology adoption for emission reduction and leak prevention.

- Asia Pacific: Rapidly growing market driven by increasing energy demand from industrialization and urbanization, especially in China, India, and Southeast Asian countries. Significant new oil and gas discoveries in countries like Australia, Malaysia, and Indonesia, coupled with substantial government investments in energy infrastructure, fuel the expansion of gathering networks.

- Latin America: Exhibits considerable growth potential due to vast untapped resources, particularly in unconventional plays like Argentina's Vaca Muerta shale and offshore discoveries in Brazil and Guyana. Political and economic stability can impact investment, but the fundamental resource wealth ensures ongoing relevance for gathering pipeline development.

- Middle East and Africa (MEA): Major oil and gas producing region with extensive existing infrastructure and ongoing expansion projects aimed at maximizing production capacity. Countries like Saudi Arabia, UAE, Qatar, and Nigeria are key players, with continuous investments in gathering systems to connect new fields and enhance existing ones, often leveraging state-of-the-art technologies for efficiency and sustainability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gathering Pipeline Market.- ArcelorMittal

- EVRAZ North America

- Tenaris S.A.

- National Oilwell Varco (NOV)

- Welspun Group

- Vallourec S.A.

- Shawcor Ltd.

- Aegion Corporation

- Saipem S.p.A.

- John Wood Group PLC

- Kinder Morgan

- Enbridge Inc.

- TC Energy Corporation

- Enterprise Products Partners L.P.

- Williams Companies, Inc.

- Plains All American Pipeline, L.P.

- MPLX LP

- Magellan Midstream Partners, L.P.

- DCP Midstream

- BP Midstream Partners LP

Frequently Asked Questions

What is a gathering pipeline?

A gathering pipeline is a system of smaller-diameter pipelines used to transport crude oil, natural gas, and natural gas liquids from individual wellheads to larger transmission pipelines or initial processing facilities.

What factors are driving the growth of the Gathering Pipeline Market?

Market growth is driven by increasing global energy demand, new oil and gas discoveries, technological advancements in extraction, and significant investments in energy infrastructure, particularly in unconventional resource plays.

How does AI impact the Gathering Pipeline Market?

AI significantly impacts the market by enabling predictive maintenance, enhancing leak detection, optimizing operational efficiency, improving safety through automated monitoring, and facilitating advanced data analytics for better decision-making.

What are the primary challenges faced by the Gathering Pipeline Market?

Key challenges include volatile oil and gas prices, stringent environmental regulations, high capital expenditure requirements for construction, complex land acquisition processes, and public opposition to new fossil fuel infrastructure projects.

Which regions are most significant in the Gathering Pipeline Market?

North America holds a dominant market share due to extensive shale production. Asia Pacific is a high-growth region driven by rising energy demand, while the Middle East and Africa are key due to vast oil and gas reserves and ongoing infrastructure expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager