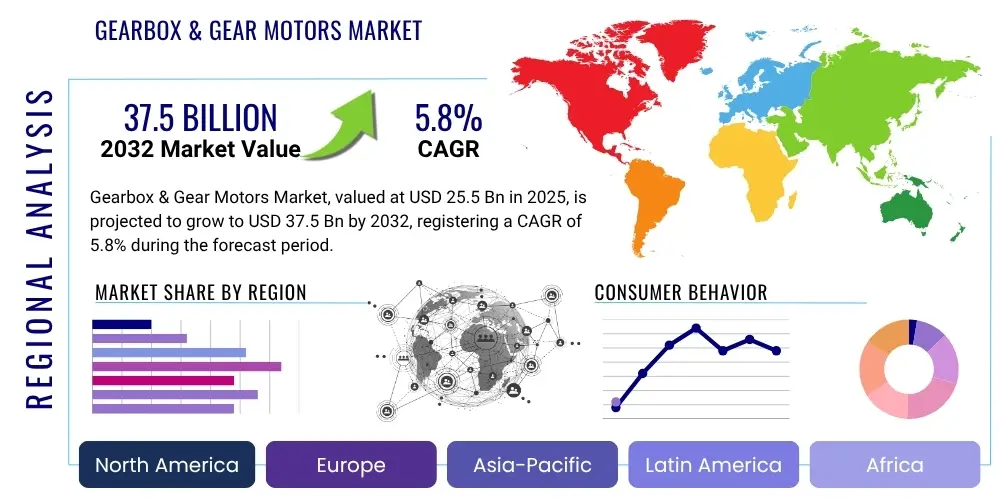

Gearbox & Gear Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 431239 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gearbox & Gear Motors Market Size

The Gearbox & Gear Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 25.5 Billion in 2025 and is projected to reach USD 37.5 Billion by the end of the forecast period in 2032.

Gearbox & Gear Motors Market introduction

The Gearbox & Gear Motors market is a foundational segment within industrial automation and mechanical power transmission, encompassing a diverse range of mechanical components engineered to precisely control rotational speed and amplify torque. Gearboxes, at their core, are intricate mechanical assemblies designed to transmit power from a prime mover, such as an electric motor or an internal combustion engine, to an output device. Their primary function involves converting high-speed, low-torque input into low-speed, high-torque output, or vice-versa, thereby optimizing the operational characteristics of machinery. This capability is critical for adapting power sources to the specific requirements of various industrial applications, ensuring machinery operates within its most efficient parameters. Gear motors represent an integrated solution, combining an electric motor and a gearbox into a single, compact unit. This integration offers significant advantages in terms of space efficiency, reduced installation complexity, and often, enhanced performance due to optimized component matching, making them highly favored in applications where space is constrained and a precise, efficient drive solution is paramount.

The applications for gearboxes and gear motors are exceptionally broad and pervasive across numerous industries globally. They are indispensable in heavy manufacturing, including the automotive sector for conveyor systems and robotic manipulators; in material handling equipment like cranes, hoists, and automated guided vehicles; in the construction industry for excavators, mixers, and drilling rigs; and crucially, in renewable energy systems such as wind turbines, where they facilitate the conversion of slow-speed wind energy into high-speed rotational energy for electricity generation. Furthermore, they are vital in packaging machinery, food and beverage processing, textile manufacturing, and mining equipment, underscoring their universal importance in enabling complex mechanical operations. The core benefits derived from deploying these technologies include substantially improved power efficiency, superior control over speed and torque, enhanced operational reliability leading to reduced downtime, and an extended lifespan for the driven equipment due to optimized load distribution. These attributes collectively contribute to increased productivity, lower operational costs, and greater safety margins in industrial environments. The sustained growth of this market is predominantly driven by the accelerating trend of global industrial automation, the pervasive demand for increasingly energy-efficient mechanical solutions in response to environmental regulations and cost pressures, and the continuous expansion and modernization of manufacturing infrastructure worldwide. The ongoing technological advancements, particularly in smart and connected systems, further amplify their critical role in shaping the future of industrial performance and efficiency.

Gearbox & Gear Motors Market Executive Summary

The global Gearbox & Gear Motors market is currently experiencing a period of significant expansion, underpinned by several macro-economic and technological trends that are reshaping industrial landscapes worldwide. The primary impetus for this growth stems from the pervasive drive towards enhanced industrial automation across diverse sectors, coupled with the increasing global emphasis on energy efficiency and sustainable operational practices. Businesses are witnessing a fundamental shift towards integrating advanced, intelligent drive solutions that offer not only superior performance but also real-time monitoring and diagnostic capabilities. Key business trends indicate a strong move towards modular gearbox designs, which provide greater flexibility and easier customization for specific application needs, along with the incorporation of integrated smart features. These smart functionalities often include embedded sensors and communication modules that enable predictive maintenance, remote diagnostics, and seamless integration with broader Industry 4.0 ecosystems. Manufacturers are strategically focusing on developing highly efficient, compact, and robust solutions, utilizing advanced materials and sophisticated manufacturing processes to meet the escalating demands for durability and precision. Furthermore, strategic alliances, mergers, and acquisitions are becoming more prevalent as companies seek to consolidate their market positions, expand their technological portfolios, and penetrate new geographical territories, thereby intensifying the competitive yet innovative environment.

Regional dynamics play a crucial role in shaping the market's trajectory, with Asia Pacific unequivocally emerging as the dominant and fastest-growing region. This robust growth is largely attributable to unprecedented rates of industrialization, particularly in rapidly developing economies such as China, India, and Southeast Asian nations, alongside a thriving automotive manufacturing base and extensive governmental investments in infrastructure projects. The region's increasing adoption of automation technologies across various industrial verticals, coupled with a growing manufacturing output, fuels a consistent demand for power transmission solutions. Conversely, established markets in North America and Europe, while demonstrating more mature growth rates, continue to hold substantial market shares. This is primarily due to their advanced industrial bases, continuous investments in research and development for cutting-edge manufacturing technologies, and a persistent drive towards modernizing existing industrial infrastructure to achieve higher levels of efficiency and productivity. These regions are characterized by a strong focus on high-precision and customized gear solutions for robotics, aerospace, and advanced machinery sectors.

Segmentation trends within the Gearbox & Gear Motors market further reveal critical insights into demand patterns and technological preferences. The demand for helical and planetary gearboxes continues to exhibit strong upward momentum, attributed to their inherent high efficiency, power density, and compact design, making them ideal for a wide range of industrial machinery, robotics, and automation applications. Planetary gearboxes, in particular, are favored in scenarios requiring high torque transmission in limited spaces. Similarly, the market is observing a pronounced trend towards integrated gear motors, where the motor and gearbox are supplied as a single unit. This integration offers significant advantages such as simplified installation, reduced alignment issues, and optimized performance, catering to the evolving requirements of end-use industries that prioritize space-saving, plug-and-play drive solutions. The automotive industry, for instance, continues to drive innovation in compact and durable gear systems for powertrain applications, while the renewable energy sector demands specialized, large-scale gearboxes for wind turbine applications. These segment-specific dynamics underscore the market's adaptability and responsiveness to diverse industrial needs and technological advancements.

AI Impact Analysis on Gearbox & Gear Motors Market

User inquiries about AI's influence on the Gearbox & Gear Motors market frequently revolve around its potential to revolutionize operational efficiency, maintenance practices, and design optimization. Common questions probe how AI can enable predictive maintenance, reduce downtime, and enhance the longevity of these critical components. There is also significant interest in AI's role in smart manufacturing, autonomous systems, and the development of intelligent gear systems that can adapt to varying operational conditions. Users expect AI to provide actionable insights into performance, minimize energy consumption, and contribute to overall system reliability, addressing concerns about unexpected failures and maintenance costs. The overarching theme of these inquiries is centered on leveraging AI to create smarter, more autonomous, and inherently more reliable industrial drive solutions.

Moreover, user expectations frequently extend to AI's role in advancing smart manufacturing initiatives and facilitating the development of truly autonomous industrial systems. There is considerable interest in how AI algorithms can be deployed for real-time performance optimization, dynamic load management, and adaptive control of gear systems to accommodate varying operational conditions. This includes questions about AI's ability to fine-tune energy consumption, thereby contributing to sustainability goals, and its potential to enable self-diagnostic and self-correcting mechanisms within gear motors. Concerns about the complexity of AI implementation, data security, and the necessity for specialized skills to manage AI-driven systems are also prevalent. Despite these considerations, the consensus points towards AI as a pivotal technology for unlocking new levels of operational intelligence, predictive accuracy, and system resilience within the Gearbox & Gear Motors domain, ultimately leading to significant improvements in productivity and asset utilization across various industries.

- AI-powered predictive maintenance: Drastically reduces unplanned downtime by forecasting potential failures based on real-time sensor data, enabling proactive servicing and asset management.

- Optimized operational parameters: AI algorithms analyze diverse performance metrics (temperature, vibration, load) to suggest or automatically implement adjustments for peak efficiency and extended component life.

- Enhanced design and simulation capabilities: Machine learning models accelerate the design process, allowing for rapid iteration and optimization of gearbox and gear motor configurations for specific applications, considering factors like material stress and thermal performance.

- Facilitation of autonomous decision-making: Integration of AI enables gear systems to contribute to autonomous functions in robotic applications and industrial machinery, adapting to dynamic environments without constant human intervention.

- Improved energy efficiency through intelligent load management: AI systems can analyze energy consumption patterns and optimize motor and gearbox operation to reduce power wastage, aligning with sustainability objectives.

- Automated quality control and fault detection: AI vision systems and data analysis can quickly identify manufacturing defects or operational anomalies, ensuring high product quality and preventing system failures.

- Development of self-adjusting and adaptive gear systems: Future applications envision AI allowing gearboxes and gear motors to dynamically adjust their own settings or even physical configurations in response to changing load requirements or wear patterns, enhancing resilience and performance over time.

DRO & Impact Forces Of Gearbox & Gear Motors Market

The Gearbox & Gear Motors market is significantly propelled by a confluence of robust drivers, while simultaneously navigating a set of inherent restraints and capitalizing on emerging opportunities, all within a dynamic framework of competitive impact forces. A primary driver is the accelerating pace of global industrial automation, which sees gear systems as indispensable components in everything from robotic arms performing intricate assembly tasks to automated guided vehicles (AGVs) transporting goods within smart factories. The imperative for energy efficiency and environmental sustainability also acts as a powerful catalyst; modern gearboxes and gear motors are engineered to minimize power loss and optimize energy consumption, aligning with stringent environmental regulations and corporate sustainability goals. Furthermore, the sustained expansion and modernization of manufacturing sectors across diverse industries, coupled with significant investments in large-scale infrastructure projects worldwide, consistently fuels demand for high-performance and reliable power transmission solutions. The robust growth observed in key end-use industries, including automotive manufacturing, construction, material handling, and particularly the rapidly expanding renewable energy sector, especially wind power generation, collectively broadifies the application base and drives continuous market expansion.

Despite the strong tailwinds, the Gearbox & Gear Motors market is confronted by several notable restraints. A significant barrier to widespread adoption, particularly for advanced or specialized solutions, is the relatively high initial capital expenditure involved in procuring and installing sophisticated gear systems. This can pose a substantial challenge for small and medium-sized enterprises (SMEs) with limited investment capacities. Moreover, the inherent complexity of maintaining these precision-engineered components, along with the requirement for highly specialized technical expertise for both installation and subsequent troubleshooting, adds to operational overheads and can deter potential buyers. The intense competitive landscape, characterized by numerous global and regional players offering a wide array of products, often leads to significant price pressures, impacting profit margins for manufacturers. Furthermore, fluctuations in raw material prices, particularly for metals like steel and aluminum, can unpredictably affect production costs and, consequently, market pricing strategies, introducing an element of volatility to the supply chain.

Opportunities for growth within the Gearbox & Gear Motors market are substantial and diverse. The burgeoning trend of integrating Internet of Things (IoT) capabilities with smart sensors offers a significant avenue for product differentiation, enabling enhanced functionalities like remote monitoring, predictive maintenance, and real-time performance analytics. This not only improves operational efficiency for end-users but also creates new revenue streams for manufacturers through service-oriented business models. The increasing demand for customized solutions, tailored to specific application requirements across niche industries, allows manufacturers to innovate and offer specialized products, thereby capturing premium market segments. The continuous research and development into lightweight and advanced materials, such as high-strength composites, promises to deliver more compact, durable, and energy-efficient designs. Additionally, the rapid global shift towards electric vehicles (EVs) and hybrid vehicles presents a novel and substantial growth opportunity for specialized, high-performance gearboxes and electric drive units, opening entirely new market verticals for power transmission component suppliers. These opportunities emphasize the market's dynamic nature and potential for continuous innovation.

In terms of impact forces, the bargaining power of buyers in the Gearbox & Gear Motors market is moderate. While large original equipment manufacturers (OEMs) possess considerable leverage due to bulk purchasing and long-term contracts, the specialized nature and performance criticality of these components limit the extent to which buyers can dictate terms without compromising quality. The bargaining power of suppliers, encompassing raw material providers and component manufacturers (e.g., bearings), is also moderate. Specialized materials and precision components can give suppliers some influence, but the global availability of many basic inputs mitigates this power. The threat of new entrants is relatively low due to the substantial capital investment required for precision manufacturing facilities, the need for extensive technological expertise, established brand loyalties, and complex certification processes. Similarly, the threat of substitute products is generally low; while alternative power transmission methods exist for specific niche applications, gearboxes and gear motors offer a unique and often indispensable combination of torque multiplication, speed reduction, and precise control that is difficult to replicate with equal efficiency and cost-effectiveness across a broad spectrum of industrial uses. Consequently, competitive rivalry among existing players remains high, driven by continuous innovation, product differentiation, strategic pricing, and aggressive market expansion efforts by a multitude of well-established global and regional manufacturers.

Segmentation Analysis

The Gearbox & Gear Motors market is characterized by a high degree of segmentation, meticulously structured to reflect the profound diversity in product types, technological configurations, operational requirements, and end-user applications that define the global industrial landscape. This granular approach to market segmentation is instrumental for analysts and stakeholders, providing an in-depth, nuanced understanding of specific demand patterns, prevailing technological preferences, and the inherent growth dynamics within distinct market niches. It enables a precise identification of market white spaces and emerging opportunities by mapping where particular product attributes or design innovations align most effectively with the operational needs of various industries. The market can be robustly categorized based on key attributes such as the fundamental product type (gearbox versus integrated gear motor), the specific internal gear mechanism employed (e.g., helical, planetary), the torque capacity range essential for specific operational demands, and the diverse range of end-use industries that rely on these critical components for their machinery. This multi-faceted segmentation framework is not merely a classification exercise; rather, it is a strategic tool that illuminates the complex interplay between technological advancements, market demands, and competitive positioning within this specialized manufacturing sector, highlighting the bespoke nature of solutions often required.

A comprehensive understanding of these detailed market segments is absolutely paramount for all participants within the Gearbox & Gear Motors ecosystem. For manufacturers, it serves as an indispensable guide for formulating targeted product development strategies, ensuring that innovation and R&D efforts are precisely aligned with identified market needs and customer pain points. This alignment minimizes development risks and maximizes the commercial viability of new product introductions. For investors and market entrants, segmentation analysis is critical for identifying high-growth segments, assessing market attractiveness, and making informed decisions regarding investment allocation and strategic market entry. For instance, the demand profile for high-precision, low-backlash planetary gearboxes, essential for advanced robotics and automation, is fundamentally distinct from the demand for robust, high-torque worm gearboxes typically used in heavy material handling. Similarly, the stringent regulatory compliance and hygienic design requirements for gear motors in the food and beverage industry necessitate specialized solutions that differ significantly from the durable, high-power solutions demanded by the mining or wind power sectors. By diligently analyzing these segment-specific dynamics, market players can effectively refine their product portfolios, optimize their go-to-market strategies, enhance their supply chain efficiencies, and proactively adapt to the continually evolving technological shifts and changing priorities across various industrial verticals. This strategic adaptability is key to maintaining competitiveness and achieving sustainable growth in a rapidly transforming global market environment.

- By Product Type

- Gearbox: These are standalone mechanical units designed to transmit power and modify torque and speed.

- Helical Gearbox: Known for high efficiency, quiet operation, and ability to handle high loads, widely used in industrial applications.

- Worm Gearbox: Offers high reduction ratios and self-locking capabilities, common in conveyors and lifting equipment.

- Planetary Gearbox: Characterized by compact size, high torque density, and precise motion control, ideal for robotics and servo applications.

- Bevel Gearbox: Used to transmit power between intersecting shafts, typically at right angles, found in printing presses and marine applications.

- Spur Gearbox: Simple, cost-effective, and efficient for moderate speeds, often used in general machinery.

- Others: Includes specialized types like Cycloidal gearboxes for high torque and shock resistance, and Hypoid gearboxes used in automotive differentials.

- Gear Motors: Integrated units combining an electric motor and a gearbox, offering a compact and efficient drive solution.

- AC Gear Motors: Versatile and widely used in general industrial applications due to their robustness and cost-effectiveness.

- DC Gear Motors: Preferred for applications requiring variable speed and precise control, often found in automotive and portable equipment.

- Servo Gear Motors: High-precision and dynamic, used in robotics, CNC machinery, and automation for accurate positioning and rapid acceleration.

- Brushless DC (BLDC) Gear Motors: Offer higher efficiency, longer life, and quieter operation compared to brushed DC motors, suitable for medical equipment and high-performance automation.

- Gearbox: These are standalone mechanical units designed to transmit power and modify torque and speed.

- By Torque: Categorization based on the torque output capacity, reflecting the power requirements of different applications.

- Up to 750 Nm: Typically for light to medium-duty applications such as small conveyors, packaging machinery, and some robotics.

- 750 Nm to 2000 Nm: Suitable for medium to heavy-duty industrial machinery, material handling, and certain automotive applications.

- Above 2000 Nm: Designed for heavy-duty applications, including mining equipment, large cranes, wind turbine drivetrains, and complex industrial processes.

- By End-Use Industry: Segmenting by the primary sector utilizing gearboxes and gear motors, highlighting diverse application needs.

- Industrial: Encompasses a broad spectrum, including general manufacturing, food & beverage processing, packaging, textiles, printing, and chemical & pharmaceutical industries.

- Automotive: For vehicle powertrains, production lines, robotics in assembly plants, and testing equipment.

- Construction: Used in heavy machinery like excavators, bulldozers, cranes, and concrete mixers.

- Material Handling: Essential for conveyors, hoists, forklifts, and automated storage and retrieval systems.

- Mining & Metals: For crushers, mills, heavy conveyors, and other robust equipment operating in harsh environments.

- Wind Power: Critical components in wind turbine drivetrains for converting wind energy into electrical power.

- Robotics & Automation: Provides precise motion control for industrial robots, collaborative robots (cobots), and automated guided vehicles (AGVs).

- Marine: Used in propulsion systems, winches, and auxiliary equipment for ships and offshore platforms.

- Agriculture: Found in tractors, harvesters, irrigation systems, and other farm machinery requiring reliable power transmission.

Value Chain Analysis For Gearbox & Gear Motors Market

The value chain for the Gearbox & Gear Motors market is an intricate network of activities that spans from raw material sourcing to final end-user application and after-sales support, illustrating the sequential stages through which value is added to the product. The chain commences with comprehensive upstream activities, which are fundamentally focused on the procurement and initial processing of a diverse array of raw materials. This critical phase involves a global network of suppliers providing high-grade ferrous and non-ferrous metals, notably specialized steels and cast iron for robust gear teeth and housings, aluminum alloys for lightweight casings, and various composites designed for enhanced durability and performance. Beyond metals, the upstream segment also includes specialized manufacturers of high-precision bearings that ensure smooth rotational motion, advanced lubricants vital for reducing friction and wear, and sophisticated electronic components, particularly for integrated smart gear motors that incorporate sensors and control units. The quality, consistency, and timely availability of these foundational raw materials and components are paramount, as they directly influence the ultimate performance, reliability, and cost-effectiveness of the finished gearbox and gear motor units. Innovations in material science, such as the development of wear-resistant coatings or advanced heat treatment processes, frequently originate in this upstream segment, offering significant competitive advantages further down the value chain by improving product attributes and extending operational lifespans.

Following the upstream stage, midstream activities encompass the core processes of design, sophisticated manufacturing, meticulous assembly, and rigorous testing of the gearboxes and gear motors. This stage is characterized by substantial investments in advanced engineering and R&D capabilities, focusing on developing more efficient, compact, and durable product solutions. Precision machining techniques, including advanced gear cutting, grinding, and honing, are extensively utilized to achieve extremely tight tolerances, which are critical for smooth operation, minimal noise, and maximum efficiency. Heat treatment processes are applied to enhance the hardness and durability of gear components, preventing premature wear. For gear motors, this stage also involves the seamless integration of electrical motors with the mechanical gearbox components, along with the incorporation of control electronics and smart sensor technologies. Manufacturers in this segment continuously strive for process optimization, leveraging automation and digital manufacturing platforms to ensure high-quality output and production scalability. The downstream segment of the value chain is dedicated to the effective distribution, strategic sales, expert installation, and comprehensive after-sales service of these sophisticated products. This final stage is crucial for ensuring customer satisfaction, building brand loyalty, and maximizing the operational utility of the delivered gear systems over their entire lifecycle.

Distribution channels within the Gearbox & Gear Motors market are multifaceted, typically employing both direct and indirect strategies to reach a diverse customer base effectively. Direct distribution involves manufacturers selling products directly to large original equipment manufacturers (OEMs) or key industrial clients who often require customized or highly specialized gear solutions. This approach frequently entails dedicated sales teams, close technical collaboration, and long-term supply agreements, fostering strong client relationships. Conversely, indirect distribution channels leverage an extensive network of independent distributors, authorized resellers, value-added integrators, and wholesalers. These intermediaries play a vital role in extending market reach, particularly to smaller enterprises, diverse regional markets, and clients requiring off-the-shelf or standard product offerings. They often provide localized inventory, technical support, and immediate availability, which are crucial for rapid deployment and ongoing operational needs. This hybrid distribution model allows manufacturers to cater to a broad spectrum of customer requirements, balancing personalized service for major accounts with efficient, broad-market penetration. Furthermore, robust after-sales services, including maintenance, spare parts supply, technical support, and repair facilities, are integral to the value proposition, ensuring continuous operational performance and enhancing the overall customer experience, which are significant factors in influencing repeat business and market reputation.

Gearbox & Gear Motors Market Potential Customers

Potential customers for Gearbox & Gear Motors constitute a broad and diverse spectrum of industries, all sharing a common need for precise, reliable, and efficient power transmission solutions to drive their machinery and operational processes. At the forefront are industrial end-users, encompassing a vast array of manufacturing facilities that form the backbone of global production. This includes large-scale automotive assembly plants, where gear motors are critical for the synchronized movement of conveyor belts, the precise positioning of robotic welding arms, and the efficient operation of paint shop applications. The food and beverage industry represents another significant customer segment, requiring specialized gearboxes and gear motors that meet stringent hygiene standards, operate reliably in demanding environments, and provide consistent performance for mixers, packaging lines, bottling machines, and various processing equipment. Similarly, the pharmaceutical sector relies on these components for precise control in drug manufacturing and packaging machinery, where accuracy and uptime are paramount.

Beyond traditional manufacturing, several other heavy industries and high-growth sectors are substantial consumers of Gearbox & Gear Motors. The construction sector, for instance, extensively utilizes robust gear systems in its heavy machinery, including excavators, bulldozers, cranes, concrete mixers, and road-building equipment, where durability, high torque, and reliability under arduous conditions are essential. The mining and metals industries demand exceptionally resilient and powerful gearboxes for their massive conveyors, crushing equipment, ball mills, and rolling mills, which operate in extremely harsh and abrasive environments. The burgeoning renewable energy sector, particularly wind power generation, is a key consumer of very large, high-torque gearboxes that serve as the crucial link in wind turbine drivetrains, translating slow, high-torque rotation from the blades into the high-speed input required by the generator. Furthermore, the rapid advancements in logistics and material handling technologies have created a significant customer base, with gear motors being integral to the efficient operation of warehouse automation systems, automated guided vehicles (AGVs), conveyor sorting systems, and robotic picking solutions. This pervasive demand across such diverse and critical industrial ecosystems underscores the indispensable role of gearboxes and gear motors in enabling modern industrial productivity and efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 25.5 Billion |

| Market Forecast in 2032 | USD 37.5 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gearbox & Gear Motors Market Key Technology Landscape

The technological landscape of the Gearbox & Gear Motors market is undergoing continuous evolution, driven by an unceasing demand for enhanced efficiency, superior reliability, extended operational lifespans, and seamless digital connectivity. A primary technological advancement lies in the pervasive adoption of sophisticated materials science, allowing for the creation of components that push performance boundaries. This includes the utilization of high-strength, lightweight alloys, advanced composites, and specialized plastics that enable the production of components that are not only more durable and significantly resistant to corrosion but also substantially lighter, thereby improving the power-to-weight ratio. This reduction in mass not only extends the operational lifespan of gear systems by notably reducing mechanical stress and wear but also contributes directly to overall energy savings by diminishing the inertial forces during operation. Concurrently, the advancement of precision manufacturing techniques, such as state-of-the-art gear cutting, grinding, honing, and superfinishing, is absolutely critical. These processes are instrumental in achieving extremely tight tolerances and exceptionally smooth surface finishes, which are pivotal for minimizing friction, significantly reducing operational noise and vibration, and ultimately maximizing mechanical efficiency. Furthermore, the increasing embrace of modular design principles is fundamentally transforming product development, offering manufacturers greater flexibility in configuring products to meet diverse application specifications and dramatically simplifying the processes of maintenance, repair, and part replacement for end-users, thereby substantially reducing the total cost of ownership over the equipment's lifespan.

Another profoundly impactful technological trend is the deep integration of digital technologies, particularly within the overarching framework of Industry 4.0 and the Industrial Internet of Things (IIoT), fundamentally transforming the way gearboxes and gear motors are monitored, managed, and optimized throughout their operational lifecycle. This involves embedding sophisticated smart sensors directly into gear systems to continuously collect real-time operational data across a spectrum of critical parameters, including internal and external temperature, precise vibration levels, dynamic load profiles, and accurate rotational speed. This wealth of raw, continuous data, when meticulously analyzed using advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms, translates into highly actionable insights that power sophisticated predictive maintenance strategies. Such capabilities allow for the proactive identification of potential mechanical anomalies or impending failures with remarkable accuracy, enabling maintenance teams to intervene precisely when needed, significantly before costly unplanned downtime occurs. This not only dramatically reduces operational interruptions and associated losses but also substantially extends the effective service life of the equipment. Remote monitoring functionalities further empower operators to oversee the performance of entire fleets of gear systems from centralized locations, ensuring continuous optimal functionality and enabling rapid, informed responses to any detected irregularities or deviations from standard operating conditions. The continuous development of intelligent drive systems, which are capable of communicating and interoperating seamlessly with other machinery and central control systems within a factory environment, represents a significant leap forward in achieving holistic system efficiency and significantly enhancing the overall level of industrial automation, ultimately culminating in the realization of truly smart and interconnected manufacturing ecosystems that are resilient and adaptive.

Regional Highlights

The global Gearbox & Gear Motors market demonstrates significant regional variations in growth drivers, adoption rates, and technological advancements, reflecting distinct industrial landscapes and economic development trajectories. Understanding these regional dynamics is crucial for market participants to tailor their strategies, identify emerging opportunities, and effectively navigate the diverse competitive environments. Each region presents a unique set of demand characteristics influenced by industrialization levels, investment in infrastructure, regulatory frameworks, and the prevalence of specific end-use sectors. This geographical analysis provides a comprehensive overview of where demand is strongest, where growth is accelerating, and the underlying factors contributing to these trends across the world.

- Asia Pacific: This region stands as the undisputed leader in the Gearbox & Gear Motors market, not only holding the largest market share but also exhibiting the most robust and rapid growth rate. This accelerated expansion is primarily fueled by unprecedented levels of industrialization, particularly in economic powerhouses like China and India, alongside significant growth in Southeast Asian nations. The region's thriving manufacturing base, extensive government investments in infrastructure development, burgeoning automotive industry, and increasing adoption of automation technologies across diverse sectors including electronics, textiles, and heavy machinery, collectively drive immense demand for power transmission solutions. Furthermore, the region's increasing focus on renewable energy projects, particularly wind power, and the expansion of material handling and logistics infrastructure, further solidify its dominant position and future growth prospects.

- North America: Representing a mature yet highly significant market, North America is characterized by continuous technological advancements and high rates of adoption of advanced automation solutions, especially within its well-established industrial sectors such as automotive, aerospace, defense, and general manufacturing. Market demand here is predominantly driven by the modernization of existing industrial facilities, the imperative for improved operational efficiency, and the replacement cycles of older equipment with more advanced, energy-efficient gear systems. The United States, being a global leader in technological innovation and advanced manufacturing, acts as the primary contributor to market revenue, supported by consistent R&D investments in smart manufacturing, robotics, and integrated drive technologies designed for high-precision and demanding applications.

- Europe: This region maintains a substantial market share, buoyed by a robust and innovative manufacturing base, particularly in countries like Germany, Italy, and the UK, which are renowned for their engineering prowess. The European market is strongly influenced by stringent energy efficiency regulations and a proactive embrace of Industry 4.0 initiatives, pushing manufacturers and end-users towards more intelligent, connected, and sustainable power transmission solutions. Significant demand emanates from the automotive sector, advanced machinery production, and, critically, the burgeoning renewable energy sector, especially the offshore and onshore wind power industries, which require large and reliable gearboxes. The focus on high-quality, customized, and technically superior products remains a hallmark of the European market.

- Latin America: This region is anticipated to experience steady and sustained growth in the Gearbox & Gear Motors market throughout the forecast period. This growth is predominantly attributed to increasing industrialization efforts, substantial investments in critical sectors such as mining, agriculture, and infrastructure development projects across major economies like Brazil, Mexico, and Argentina. As these nations strive to modernize their industrial capabilities and improve productivity, the demand for reliable and efficient power transmission components for new machinery and facility upgrades is consistently rising. Economic stabilization and foreign direct investment further contribute to market expansion by enabling greater capital expenditure in industrial equipment.

- Middle East and Africa (MEA): The MEA region is emerging as a significant growth frontier for the Gearbox & Gear Motors market, driven by concerted efforts towards industrial diversification, particularly away from sole reliance on oil and gas. Substantial investments in large-scale construction projects, infrastructure development, and the establishment of new manufacturing facilities are fueling demand for robust mechanical drive solutions. Countries such as Saudi Arabia, the UAE, and South Africa are leading these modernization efforts, which involve the adoption of advanced machinery and automation technologies. The region's strategic location and expanding trade routes also support the growth of material handling and logistics sectors, further contributing to the demand for efficient gearboxes and gear motors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gearbox & Gear Motors Market.- SEW-EURODRIVE GmbH & Co KG

- Siemens AG

- Bonfiglioli Riduttori S.p.A.

- NORD Drivesystems Pvt. Ltd.

- Rexnord Corporation

- Sumitomo Heavy Industries, Ltd.

- Wittenstein SE

- ABB Ltd.

- Dana Incorporated

- Eaton Corporation plc

- Lenze SE

- Motovario S.p.A.

- Regal Rexnord Corporation

- Tsubakimoto Chain Co.

- WEG S.A.

- Bauer Gear Motor GmbH

- Varvel S.p.A.

- Stöber Antriebstechnik GmbH + Co. KG

- Flender GmbH

- Hangzhou Advance Gearbox Group Co., Ltd.

Frequently Asked Questions

What is the projected growth rate of the Gearbox & Gear Motors Market?

The Gearbox & Gear Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032, driven by industrial automation and demand for energy-efficient solutions.

Which factors are primarily driving the Gearbox & Gear Motors Market?

Key drivers include global industrial automation, increasing demand for energy-efficient machinery, significant infrastructure development, and growth across various end-use industries like automotive and construction.

Which geographical region holds the largest market share for Gearbox & Gear Motors?

Asia Pacific currently holds the largest market share and is also the fastest-growing region, owing to rapid industrialization and manufacturing expansion in countries like China and India.

How is AI impacting the Gearbox & Gear Motors industry?

AI is significantly impacting the industry by enabling advanced predictive maintenance, optimizing operational parameters, enhancing design capabilities, and facilitating smart manufacturing processes, leading to improved efficiency and reduced downtime.

What are the main types of gearboxes available in the market?

The main types include Helical, Worm, Planetary, Bevel, and Spur gearboxes, each designed for specific applications based on efficiency, torque, and space requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager