General Anesthesia Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428231 | Date : Oct, 2025 | Pages : 248 | Region : Global | Publisher : MRU

General Anesthesia Drugs Market Size

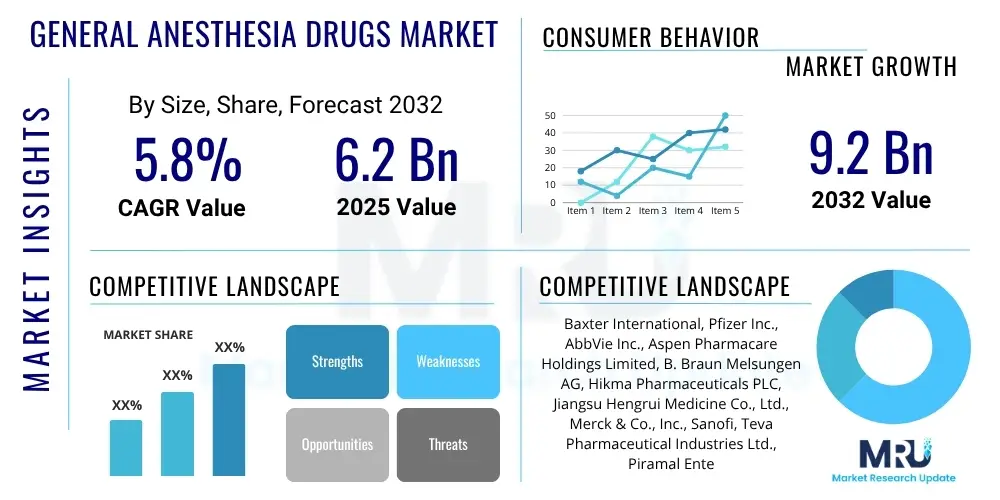

The General Anesthesia Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2032. This sustained growth is primarily driven by an increasing global surgical procedure volume, advancements in medical technology, and a rising prevalence of chronic diseases necessitating surgical interventions. The market expansion is also supported by continuous research and development efforts aimed at introducing more effective and safer anesthetic agents, coupled with improving healthcare infrastructure in developing economies.

General Anesthesia Drugs Market introduction

The General Anesthesia Drugs Market encompasses pharmaceutical agents utilized to induce a state of unconsciousness, analgesia, amnesia, and muscle relaxation, facilitating complex surgical procedures and diagnostic interventions without patient awareness or pain. These drugs are critical components of modern medicine, enabling a wide array of medical procedures from routine operations to highly intricate surgeries. The market primarily deals with various classes of pharmacological compounds, including intravenous anesthetics and inhaled anesthetics, each with distinct mechanisms of action and clinical applications. The goal of general anesthesia is to create a reversible state of profound unconsciousness, ensuring patient comfort and safety throughout the duration of the medical procedure.

The product description for general anesthesia drugs covers a spectrum of agents tailored for different stages of anesthesia, including induction, maintenance, and emergence. Intravenous agents like Propofol, Etomidate, and Ketamine are commonly used for rapid induction, while volatile agents such as Sevoflurane, Desflurane, and Isoflurane are frequently employed for maintaining anesthesia. Major applications span across general surgery, orthopedic surgery, cardiovascular surgery, neurosurgery, dental procedures, and various diagnostic imaging requiring patient immobility. The benefits of these drugs are profound, allowing for pain-free surgical experiences, precise control over physiological responses, and reduced patient anxiety. Driving factors for this market include the escalating number of surgical procedures globally due to an aging population, the increasing incidence of chronic diseases, and technological advancements in drug delivery systems and patient monitoring. Furthermore, expanding healthcare access in emerging markets and rising healthcare expenditures are significantly contributing to market growth, fostering innovation and demand for more sophisticated anesthetic solutions that enhance patient outcomes and safety.

General Anesthesia Drugs Market Executive Summary

The General Anesthesia Drugs Market is undergoing dynamic shifts, influenced by several business, regional, and segmental trends. Business trends highlight an intensified focus on research and development to create novel anesthetic agents with improved safety profiles, faster induction and recovery times, and fewer side effects. Pharmaceutical companies are also engaging in strategic collaborations, mergers, and acquisitions to consolidate market share and leverage specialized expertise, particularly in areas like personalized medicine and targeted drug delivery. Furthermore, generic competition remains a significant factor, especially with the patent expiry of several blockbuster drugs, leading to price pressures but also expanding access to essential medicines in lower-income regions. The market is also seeing increased investment in automated drug delivery systems and smart infusion pumps that integrate with patient monitoring, aiming to enhance precision and reduce human error during anesthesia administration, reflecting a broader trend towards digitalization in healthcare.

From a regional perspective, North America and Europe continue to hold substantial market shares due to advanced healthcare infrastructure, high healthcare spending, and a prevalence of complex surgical procedures. However, the Asia Pacific region is emerging as the fastest-growing market, driven by rapidly improving healthcare facilities, increasing medical tourism, a large patient pool, and rising disposable incomes. Latin America and the Middle East & Africa are also demonstrating growth, albeit at a slower pace, as healthcare reforms and infrastructure development take precedence. Segmental trends indicate a strong demand for intravenous anesthetics, particularly Propofol, owing to its favorable pharmacokinetic properties and wide clinical acceptance. Inhaled anesthetics like Sevoflurane and Desflurane also maintain robust demand, valued for their predictable effects and ease of administration. The application segment sees general surgery and orthopedic procedures as major contributors, while end-user segments like hospitals and ambulatory surgical centers remain the primary consumers, reflecting the concentration of surgical interventions in these settings. The growing emphasis on outpatient surgeries is further boosting demand within ambulatory surgical centers, influencing manufacturers to develop agents suitable for rapid recovery and discharge.

AI Impact Analysis on General Anesthesia Drugs Market

The integration of Artificial Intelligence (AI) is set to profoundly transform the General Anesthesia Drugs Market by addressing critical user concerns regarding safety, efficacy, and personalized patient care. Users are increasingly questioning how AI can minimize adverse drug reactions, optimize dosing for individual patient profiles, and predict complications more accurately during and after anesthesia. There is a palpable expectation for AI to enhance precision, reduce human error, and streamline clinical workflows, ultimately leading to improved patient outcomes and more efficient resource utilization in operating rooms. The key themes revolve around AI's potential in predictive analytics for patient response, personalized drug administration, real-time monitoring, and accelerating the discovery and development of novel anesthetic compounds with superior therapeutic indices. Stakeholders also ponder the ethical implications and the necessity for robust validation of AI systems in such a critical domain. The aim is for AI to move beyond mere data aggregation to provide actionable insights that directly influence clinical decision-making, offering a new paradigm for patient management in anesthesiology.

- AI-powered predictive analytics enhance patient risk assessment by analyzing vast datasets of patient histories, physiological parameters, and genetic information, thereby optimizing pre-operative planning and drug selection to mitigate potential adverse events.

- Personalized anesthesia delivery systems, driven by AI algorithms, enable precise titration of anesthetic agents in real-time based on continuous patient monitoring, ensuring optimal drug concentration for depth of anesthesia while minimizing over- or under-dosing.

- AI-assisted drug discovery and development accelerates the identification of novel general anesthesia compounds by simulating molecular interactions and predicting efficacy and safety profiles, significantly reducing the time and cost associated with traditional R&D.

- Real-time monitoring and alert systems, leveraging AI, provide continuous analysis of vital signs, EEG data, and other physiological indicators, detecting subtle deviations that might precede complications and alerting anesthesiologists, thereby enhancing patient safety during procedures.

- Improved post-operative care and recovery protocols are being developed with AI, which can predict patient recovery trajectories and identify individuals at higher risk for post-anesthesia complications, leading to tailored interventions and faster discharge.

- Automated record-keeping and data analysis capabilities of AI reduce the administrative burden on anesthesiologists, freeing up valuable time for direct patient care and providing comprehensive data for quality improvement initiatives and research.

- Enhanced training and simulation platforms utilize AI to create realistic virtual environments for anesthesiology residents and practitioners, allowing them to practice complex scenarios and refine their decision-making skills in a safe, controlled setting.

DRO & Impact Forces Of General Anesthesia Drugs Market

The General Anesthesia Drugs Market is significantly shaped by a complex interplay of drivers, restraints, and opportunities, collectively forming the impact forces that dictate its trajectory. Among the primary drivers is the continually increasing volume of surgical procedures performed worldwide, propelled by an aging global population more susceptible to various medical conditions requiring intervention, as well as the rising prevalence of chronic diseases like cardiovascular disorders, cancer, and orthopedic ailments. Advancements in surgical techniques, including minimally invasive procedures, have broadened the scope of treatable conditions, consequently expanding the demand for general anesthesia. Furthermore, increasing healthcare expenditure, particularly in emerging economies, alongside a growing awareness of and access to modern medical treatments, further stimulates market growth. The ongoing research and development by pharmaceutical companies to introduce safer, more effective, and faster-acting anesthetic agents also acts as a significant market driver, promising improved patient outcomes and reduced recovery times, which are crucial for patient satisfaction and healthcare system efficiency.

However, the market also faces considerable restraints that temper its growth potential. High development costs and stringent regulatory approval processes for new drugs contribute to a lengthy and expensive pathway to market, limiting innovation to a select few large pharmaceutical players. The potential for adverse side effects associated with general anesthesia drugs, ranging from nausea and vomiting to more severe cardiovascular and respiratory complications, necessitates cautious administration and continuous monitoring, often leading to a preference for regional or local anesthesia where clinically appropriate. Furthermore, the expiration of patents for key anesthetic drugs leads to the influx of generic versions, intensifying price competition and eroding profit margins for innovator companies, particularly in saturated markets. This competitive pressure, combined with healthcare cost containment measures adopted by governments and insurance providers, poses a challenge for maintaining premium pricing for branded products.

Opportunities within the General Anesthesia Drugs Market are largely centered around unmet medical needs and geographical expansion. Emerging economies present vast untapped markets with improving healthcare infrastructure, a burgeoning middle class, and increasing access to modern medical facilities, offering significant growth prospects for manufacturers. The development of personalized medicine approaches, leveraging pharmacogenomics to tailor anesthetic regimens based on individual patient genetic profiles, represents a substantial future opportunity to enhance efficacy and minimize adverse reactions. Technological advancements in drug delivery systems, such as closed-loop anesthesia systems and smart infusion pumps, offer avenues for improved precision and safety, further driving market innovation. Investment in novel drug formulations that offer better bioavailability, faster onset, and reduced post-operative complications also represents a lucrative opportunity. The impact forces are thus a dynamic blend: regulatory hurdles and cost pressures act as significant restraints, while demographic shifts, technological progress, and expanding healthcare access provide potent drivers and open up new avenues for market expansion and product differentiation. The balance between these forces will ultimately define the market's trajectory in the coming years, pushing companies to innovate while navigating a complex operational landscape.

Segmentation Analysis

The General Anesthesia Drugs Market is segmented comprehensively to provide a detailed understanding of its various components, reflecting the diverse range of products, applications, and end-users that shape its landscape. This segmentation allows for a granular analysis of market dynamics, growth drivers, and competitive strategies across different categories. The primary methods of segmentation include drug type, which differentiates between inhaled and intravenous agents, each with unique clinical profiles and market shares. Further segmentation by application highlights the specific surgical and diagnostic procedures where these drugs are predominantly used, providing insights into demand patterns from various medical specialties. End-user segmentation categorizes the institutions that consume these drugs, such as hospitals, ambulatory surgical centers, and clinics, illustrating the varying requirements and procurement patterns of different healthcare settings. Finally, distribution channel analysis elucidates how these critical medications reach their end-users, covering hospital pharmacies, retail pharmacies, and online platforms. This multi-dimensional approach to segmentation is essential for stakeholders to identify niche markets, understand consumer behavior, and formulate targeted business strategies to maximize market penetration and profitability, especially in an evolving healthcare ecosystem driven by efficiency and patient-centric care.

- By Drug Type

- Inhaled Anesthetics

- Sevoflurane

- Desflurane

- Isoflurane

- Nitrous Oxide

- Others (e.g., Halothane, Enflurane - less common now)

- Intravenous Anesthetics

- Propofol

- Etomidate

- Ketamine

- Midazolam

- Dexmedetomidine

- Others (e.g., Thiopental - less common now, Remifentanil)

- Inhaled Anesthetics

- By Application

- General Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Neurosurgery

- Dental Surgery

- Obstetric and Gynecological Surgery

- Diagnostic Procedures (e.g., MRI, CT requiring sedation)

- Others (e.g., Bariatric Surgery, Trauma Surgery)

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (e.g., Dental Clinics, Plastic Surgery Clinics)

- Emergency Medical Services

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Sales (Manufacturer to Institutions)

Value Chain Analysis For General Anesthesia Drugs Market

The value chain for the General Anesthesia Drugs Market is a complex network involving multiple stages, from the initial sourcing of raw materials to the final delivery and administration of the anesthetic agents to patients. This chain begins with upstream activities, which encompass the research and development phase where new drug candidates are identified, synthesized, and rigorously tested for efficacy and safety. This stage also includes the sourcing and manufacturing of active pharmaceutical ingredients (APIs) and excipients from various chemical suppliers. API manufacturers play a crucial role, adhering to strict quality standards and regulatory guidelines to produce the core chemical compounds that form the basis of the anesthetic drugs. The efficiency and cost-effectiveness of these upstream processes significantly impact the final product's pricing and market availability, driving innovation in chemical synthesis and purification techniques to optimize yield and reduce impurities. The intellectual property generated during R&D, often protected by patents, provides a competitive advantage for innovator companies, shaping the market landscape for many years.

Moving downstream, the value chain progresses to the manufacturing of the finished pharmaceutical products, which involves formulation, sterile filling, packaging, and quality control. This stage is dominated by large pharmaceutical companies and contract manufacturing organizations (CMOs) that possess the sophisticated infrastructure and expertise required for drug production. Following manufacturing, the products enter the distribution channel, which can be direct or indirect. Direct distribution typically involves manufacturers selling directly to large hospital networks, government healthcare systems, or bulk purchasers, often facilitated by a dedicated sales force. Indirect distribution is more prevalent and involves wholesalers and distributors acting as intermediaries, managing warehousing, logistics, and delivery to a wide array of end-users including smaller hospitals, ambulatory surgical centers, clinics, and retail pharmacies. These distributors play a vital role in ensuring broad market access, maintaining appropriate stock levels, and navigating complex regulatory requirements across different regions. The final stage involves the procurement of these drugs by healthcare providers and their administration to patients by trained medical professionals such as anesthesiologists, nurse anesthetists, and certified registered nurse anesthetists (CRNAs), completing the cycle of the value chain. Each link in this chain contributes to the overall cost, quality, and accessibility of general anesthesia drugs, highlighting the importance of integrated supply chain management and strong partnerships for market success and patient safety.

General Anesthesia Drugs Market Potential Customers

The potential customers for the General Anesthesia Drugs Market are diverse and primarily comprise entities within the healthcare sector that perform surgical procedures or diagnostic interventions requiring patient unconsciousness and pain management. The largest segment of end-users is hospitals, ranging from large university teaching hospitals and multi-specialty medical centers to smaller community hospitals. These institutions conduct a vast array of surgical operations across numerous specialties, including general surgery, orthopedics, cardiology, neurosurgery, and oncology, making them primary consumers of general anesthesia drugs. Hospitals require a broad spectrum of anesthetic agents to cater to different patient populations, comorbidities, and procedural complexities, often maintaining extensive formularies to ensure availability. Their procurement decisions are influenced by drug efficacy, safety profiles, cost-effectiveness, and supplier reliability, as well as institutional guidelines and patient demographics.

Beyond traditional hospitals, Ambulatory Surgical Centers (ASCs) represent a rapidly growing segment of potential customers. ASCs specialize in outpatient surgeries and procedures that do not require an overnight stay, offering a more cost-effective and convenient alternative to hospital-based care for eligible patients. The demand for general anesthesia drugs in ASCs is driven by the increasing shift towards outpatient settings for less complex surgeries, emphasizing agents that offer rapid induction, quick recovery times, and minimal post-operative side effects to facilitate same-day discharge. Specialized clinics, such as dental clinics, plastic surgery clinics, and gastroenterology centers, also constitute important end-users. These clinics often perform procedures under conscious sedation or light general anesthesia, requiring specific types of anesthetic drugs suitable for their specialized services. Furthermore, emergency medical services (EMS) and military field hospitals also represent a segment of customers, needing general anesthesia drugs for critical care and trauma interventions in challenging environments. The evolving healthcare landscape, with its emphasis on efficiency, cost reduction, and patient-centered care, continually reshapes the needs and preferences of these diverse customer segments, influencing product development and market strategies for general anesthesia drug manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2032 | USD 9.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Baxter International, Pfizer Inc., AbbVie Inc., Aspen Pharmacare Holdings Limited, B. Braun Melsungen AG, Hikma Pharmaceuticals PLC, Jiangsu Hengrui Medicine Co., Ltd., Merck & Co., Inc., Sanofi, Teva Pharmaceutical Industries Ltd., Piramal Enterprises Limited, Fresenius Kabi AG, Dr. Reddy's Laboratories Ltd., GlaxoSmithKline plc, AstraZeneca PLC, Sun Pharmaceutical Industries Ltd., Alvogen, Sagent Pharmaceuticals Inc., Aurobindo Pharma Ltd., Par Pharmaceutical (Endo International plc). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

General Anesthesia Drugs Market Key Technology Landscape

The General Anesthesia Drugs Market is increasingly being shaped by a dynamic technological landscape that encompasses innovations in drug discovery, formulation, delivery systems, and patient monitoring. In the realm of drug discovery, advanced computational methods, including artificial intelligence (AI) and machine learning (ML), are being leveraged to accelerate the identification of novel anesthetic compounds. These technologies enable researchers to screen vast chemical libraries, predict molecular interactions, and model drug-receptor binding with unprecedented accuracy, thereby reducing the time and cost associated with traditional drug development cycles. Furthermore, pharmacogenomics is gaining traction, allowing for the development of personalized anesthetic regimens based on individual genetic profiles, minimizing adverse drug reactions and optimizing therapeutic outcomes, which represents a significant technological leap towards precision medicine in anesthesiology. The integration of high-throughput screening and combinatorial chemistry also continues to contribute to the pipeline of potential new agents, ensuring a continuous evolution of options for medical professionals.

In terms of drug delivery, significant technological advancements are transforming how general anesthesia drugs are administered, focusing on enhanced precision, safety, and patient comfort. Smart infusion pumps, for instance, offer highly accurate and controlled delivery of intravenous anesthetics, often integrating with patient monitoring systems to adjust dosages in real-time. Closed-loop anesthesia systems represent a major innovation, utilizing feedback from physiological parameters (like EEG-derived depth of anesthesia or vital signs) to automatically titrate anesthetic drug concentrations, mimicking the actions of an experienced anesthesiologist and aiming to maintain optimal anesthetic depth while minimizing drug exposure. These systems reduce manual intervention, improve consistency, and can potentially lower drug consumption. Patient-controlled analgesia (PCA) devices, while primarily for post-operative pain, signify a broader trend towards patient-centric control and precise dosing that can also influence intra-operative drug delivery strategies. Furthermore, the development of novel drug formulations, such as liposomal encapsulations or transdermal patches for specific agents, seeks to improve bioavailability, extend duration of action, or reduce side effects, broadening the utility and safety profile of existing compounds. These innovations collectively aim to make anesthesia safer, more efficient, and tailored to individual patient needs, pushing the boundaries of what is possible in modern surgical care.

Monitoring technologies during anesthesia are also experiencing rapid evolution, driven by the need for more comprehensive and less invasive ways to assess a patient's physiological state. Advanced patient monitors now integrate multiple parameters, including electrocardiography (ECG), non-invasive blood pressure (NIBP), pulse oximetry, capnography, and temperature, providing a holistic view of the patient's vital functions. Beyond standard parameters, technologies for monitoring the depth of anesthesia, such as bispectral index (BIS) monitors and other electroencephalogram (EEG)-derived indices, are becoming more sophisticated, helping anesthesiologists prevent both awareness during surgery and excessive sedation. Continuous glucose monitoring, continuous cardiac output monitoring, and enhanced neuromuscular blockade monitoring also contribute to a safer anesthetic experience. The digital integration of these monitoring devices with electronic health records (EHRs) and closed-loop delivery systems is creating a more connected operating room environment. This allows for real-time data analysis, predictive alarming, and improved decision support for anesthesiologists, fundamentally transforming the practice of anesthesiology from an art to a data-driven science. These technological advancements collectively enhance patient safety, optimize drug use, and improve clinical outcomes, maintaining the market's trajectory towards increasingly sophisticated and individualized care.

Regional Highlights

- North America: This region dominates the General Anesthesia Drugs Market, primarily due to highly developed healthcare infrastructure, substantial healthcare expenditure, and a high volume of complex surgical procedures. The presence of leading pharmaceutical companies, advanced research and development capabilities, and a robust regulatory framework contribute significantly to market leadership. An aging population and the increasing prevalence of chronic diseases also fuel demand. Furthermore, the rapid adoption of advanced medical technologies and personalized medicine approaches, including AI-driven drug delivery and monitoring systems, positions North America at the forefront of innovation. The competitive landscape is characterized by intense R&D activities and strategic collaborations aimed at developing next-generation anesthetic agents with improved safety profiles and efficacy.

- Europe: Europe represents a mature and significant market for general anesthesia drugs, driven by a well-established healthcare system, an aging demographic, and a high standard of medical care across countries like Germany, France, and the UK. Stringent regulatory bodies ensure high-quality drug standards, while continuous investments in medical research and development lead to the introduction of novel agents and improved delivery techniques. The region benefits from universal healthcare coverage in many countries, which supports sustained demand for surgical procedures. However, economic pressures and generic competition remain key factors influencing market dynamics, leading to a focus on cost-effectiveness and value-based healthcare.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for general anesthesia drugs, propelled by rapidly improving healthcare infrastructure, increasing disposable incomes, and a vast and growing patient population. Countries like China, India, and Japan are investing heavily in modernizing their healthcare systems, expanding hospital capacities, and increasing access to advanced medical treatments. The rise of medical tourism, particularly in Southeast Asian countries, further contributes to the demand for surgical procedures and, consequently, anesthetic agents. Moreover, the increasing prevalence of lifestyle diseases and a growing awareness of modern healthcare services are significant drivers. This region offers immense opportunities for market players due to its large untapped market potential and evolving regulatory landscape.

- Latin America: This region demonstrates steady growth in the general anesthesia drugs market, primarily influenced by improving economic conditions, expanding healthcare access, and increasing government investments in health infrastructure across countries like Brazil, Mexico, and Argentina. A growing middle class and rising awareness of modern medical treatments contribute to the demand for surgical interventions. While still developing compared to North America and Europe, the region is witnessing a gradual adoption of advanced medical technologies and pharmaceutical products. Challenges include varying regulatory environments and disparities in healthcare access, but overall, the market is on an upward trajectory as healthcare systems mature and become more accessible to the wider population.

- Middle East and Africa (MEA): The MEA region is experiencing growth in the general anesthesia drugs market, driven by increasing healthcare expenditure, particularly in the Gulf Cooperation Council (GCC) countries, and significant investments in developing state-of-the-art medical facilities. The rising prevalence of chronic diseases and an increasing expatriate population needing advanced medical care contribute to the demand for surgical procedures. However, market growth in Africa is more varied, with some countries showing rapid development in healthcare infrastructure while others face significant challenges related to access, funding, and skilled medical professionals. Overall, the region presents opportunities for market expansion, especially as governments prioritize healthcare reforms and invest in improving medical services to meet the needs of a growing and diverse population.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the General Anesthesia Drugs Market.- Baxter International Inc.

- Pfizer Inc.

- AbbVie Inc.

- Aspen Pharmacare Holdings Limited

- B. Braun Melsungen AG

- Hikma Pharmaceuticals PLC

- Jiangsu Hengrui Medicine Co., Ltd.

- Merck & Co., Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Piramal Enterprises Limited

- Fresenius Kabi AG

- Dr. Reddy's Laboratories Ltd.

- GlaxoSmithKline plc

- AstraZeneca PLC

- Sun Pharmaceutical Industries Ltd.

- Alvogen

- Sagent Pharmaceuticals Inc.

- Aurobindo Pharma Ltd.

- Par Pharmaceutical (Endo International plc)

Frequently Asked Questions

What are the primary types of general anesthesia drugs?

The general anesthesia drugs market primarily consists of two main categories: inhaled anesthetics and intravenous anesthetics. Inhaled anesthetics, often referred to as volatile agents, are administered as gases through a breathing mask or endotracheal tube and include compounds such as Sevoflurane, Desflurane, and Isoflurane, along with Nitrous Oxide. These agents are favored for their ease of control, allowing anesthesiologists to rapidly adjust the depth of anesthesia during surgery based on patient needs and procedural requirements. Their quick onset and offset also contribute to faster patient recovery times, which is crucial for modern surgical practices aiming for efficiency.

Intravenous anesthetics, on the other hand, are administered directly into a patient's bloodstream, typically used for induction of anesthesia or as total intravenous anesthesia (TIVA) for maintenance. Prominent examples include Propofol, known for its rapid and smooth induction and recovery; Etomidate, often chosen for hemodynamically unstable patients due to its minimal cardiovascular effects; Ketamine, which provides both anesthesia and analgesia; Midazolam, commonly used for sedation and amnesia; and Dexmedetomidine, valued for its sedative and analgesic properties without significant respiratory depression. These drugs are essential for various surgical settings, offering flexibility and precision in managing patient consciousness and pain levels throughout the operative period. The choice between inhaled and intravenous agents, or a combination thereof, depends on several factors, including the patient's medical history, the type and duration of the surgical procedure, and the specific expertise of the anesthesiologist, all aimed at achieving optimal patient outcomes.

The continuous innovation within both inhaled and intravenous categories aims to develop agents with improved safety profiles, fewer side effects, and enhanced pharmacokinetic properties, such as faster metabolism and reduced accumulation in the body. This relentless pursuit of better anesthetic options is a driving force in the market, ensuring that medical professionals have access to a diverse arsenal of drugs to meet the complex and evolving demands of modern surgery. The specific characteristics of each drug type, including their onset time, duration of action, and potential side effects, dictate their preferred usage in different clinical scenarios, making the understanding of these categories fundamental to comprehending the general anesthesia drugs market.

How is the general anesthesia drugs market influenced by surgical volume?

The general anesthesia drugs market is intrinsically linked to and significantly influenced by the global volume of surgical procedures. An increase in the number of surgeries performed worldwide directly translates into a higher demand for anesthetic agents, as these drugs are indispensable for almost all surgical interventions requiring patient unconsciousness and pain management. Factors contributing to the rising surgical volume include an aging global population, which necessitates more medical procedures for age-related conditions such as cardiovascular diseases, orthopedic ailments like joint replacements, and various forms of cancer. As life expectancies increase, so does the incidence of chronic diseases, subsequently increasing the need for surgical solutions.

Furthermore, advancements in medical technology and surgical techniques, including the proliferation of minimally invasive procedures, have broadened the scope of treatable conditions, making surgery a viable option for a wider range of patients. This expansion not only increases the number of procedures but also contributes to the complexity of some surgeries, potentially requiring longer durations of anesthesia. Economic growth and improving healthcare access in emerging markets also play a crucial role, as more individuals can afford and access surgical treatments, particularly in regions where healthcare infrastructure is rapidly developing. These demographic and medical trends collectively create a robust and expanding demand base for general anesthesia drugs.

Conversely, any decline in surgical volumes, perhaps due to pandemics, economic downturns affecting elective procedures, or significant shifts towards non-surgical treatments, could negatively impact the market. However, the consistent growth in healthcare spending, particularly in developed nations, and ongoing efforts to expand universal healthcare coverage globally tend to support a sustained increase in surgical activity. Therefore, tracking surgical trends, population demographics, and healthcare policy changes is paramount for stakeholders in the general anesthesia drugs market, as these factors directly dictate the consumption patterns and overall growth trajectory of anesthetic agents worldwide. The relationship is symbiotic: more surgeries require more anesthesia, driving market expansion and innovation in drug development.

What are the main challenges faced by manufacturers in this market?

Manufacturers in the General Anesthesia Drugs Market face several significant challenges that impact their operational strategies and profitability. One primary challenge is the stringent and complex regulatory landscape that governs drug approval processes globally. Developing a new anesthetic agent requires extensive preclinical and clinical trials, which are time-consuming and exceptionally costly. Meeting the rigorous safety and efficacy standards set by regulatory bodies like the FDA in the US, EMA in Europe, or PMDA in Japan, demands significant investment in research and development, often spanning several years. Any delays or failures in these trials can result in substantial financial losses and protracted market entry, making innovation a high-risk endeavor for pharmaceutical companies.

Another major challenge stems from intellectual property and generic competition. Once a patent for a blockbuster anesthetic drug expires, generic manufacturers can introduce cheaper bioequivalent versions into the market. This influx of generics intensifies price competition, significantly eroding the market share and profit margins of innovator companies. While beneficial for healthcare systems in terms of cost containment, this scenario forces branded drug manufacturers to continuously invest in R&D for novel compounds to maintain a competitive edge and differentiate their product portfolios. Managing a portfolio of both patented and off-patent drugs while navigating varying pricing pressures across different geographies requires sophisticated market strategies and robust supply chain management to remain viable.

Furthermore, the market is continually challenged by the need to develop drugs with improved safety profiles and reduced side effects. Anesthetic agents, by nature, carry inherent risks, and patients and healthcare providers constantly seek drugs that offer faster recovery, fewer post-operative complications like nausea, vomiting, or cognitive dysfunction, and minimal impact on vital physiological functions. This demand for safer, more patient-friendly options drives continuous pressure on manufacturers to innovate, often requiring substantial investment in refining existing formulations or discovering entirely new classes of compounds. Additionally, issues such as supply chain disruptions, geopolitical instability impacting raw material sourcing, and increasing healthcare cost containment measures from governments and insurance providers further complicate the operational environment for manufacturers, necessitating resilient business models and strategic partnerships.

How is AI transforming the administration of general anesthesia?

Artificial Intelligence (AI) is ushering in a transformative era for the administration of general anesthesia by enhancing precision, safety, and personalization of patient care. One of the most significant impacts of AI is in predictive analytics, where algorithms analyze vast amounts of patient data, including medical history, physiological parameters, and genetic information, to predict individual responses to anesthetic agents. This capability allows anesthesiologists to tailor drug selection and dosage more accurately before a procedure, minimizing the risk of adverse reactions and optimizing the anesthetic plan for each patient. By identifying high-risk patients proactively, AI aids in formulating personalized anesthetic strategies, moving away from a one-size-fits-all approach towards truly individualized medicine, which represents a profound shift in clinical practice.

Moreover, AI is revolutionizing real-time drug delivery and patient monitoring during surgery. Closed-loop anesthesia systems, powered by AI, continuously monitor a patient's depth of anesthesia, vital signs, and other physiological indicators, then automatically adjust the infusion rates of anesthetic drugs to maintain optimal levels. This automation reduces the need for constant manual adjustments by anesthesiologists, freeing them to focus on broader patient management and critical decision-making. These AI-driven systems aim to prevent both under-anesthesia (which can lead to awareness) and over-anesthesia (which can cause prolonged recovery and increased complications), thereby enhancing patient safety and improving clinical outcomes. The ability of AI to process and interpret complex, multi-modal data streams instantaneously far surpasses human cognitive capabilities, leading to more consistent and accurate drug titration.

Beyond the operating room, AI contributes to improved post-operative care and operational efficiency. AI algorithms can predict patient recovery trajectories and identify those at higher risk for post-anesthesia complications, enabling earlier interventions and personalized recovery protocols. This can lead to faster patient discharge, improved resource utilization within hospitals, and reduced healthcare costs. Furthermore, AI assists in automated record-keeping and data analysis, which not only reduces the administrative burden on medical staff but also generates invaluable insights for quality improvement, research, and the development of best practices in anesthesiology. The ethical implications and the necessity for robust validation of these AI systems remain crucial considerations, ensuring that technology serves to augment, rather than replace, expert human judgment in such a critical medical domain. The ongoing evolution of AI promises a future where anesthesia administration is safer, more efficient, and exquisitely tailored to each patient's unique needs.

Which geographical region dominates the general anesthesia drugs market?

North America currently dominates the general anesthesia drugs market, holding the largest share and significantly influencing global market trends. This region's leadership is attributable to several key factors that collectively foster a robust and innovative healthcare environment. Firstly, North America boasts highly advanced and extensive healthcare infrastructure, characterized by state-of-the-art hospitals, specialized surgical centers, and well-equipped research institutions. This infrastructure supports a high volume of complex surgical procedures and diagnostic interventions, directly driving the demand for a broad spectrum of general anesthesia drugs.

Secondly, the region benefits from substantial healthcare expenditure, both from government funding and private insurance, which allows for greater access to advanced medical treatments and fosters continuous investment in medical technology and pharmaceutical research. The presence of leading global pharmaceutical companies, many of which are headquartered in North America, fuels intensive research and development activities aimed at discovering and commercializing novel anesthetic agents with improved safety profiles, faster onset/offset characteristics, and fewer side effects. These companies often lead innovation in drug delivery systems and patient monitoring technologies, further cementing the region's dominant position.

Moreover, North America's demographic trends, including an aging population and a high prevalence of chronic diseases, necessitate a continuous demand for surgical interventions, thereby sustaining market growth. A stringent yet supportive regulatory framework encourages pharmaceutical innovation while ensuring drug safety and efficacy. The rapid adoption of cutting-edge medical technologies, including AI-driven solutions for personalized anesthesia and advanced patient monitoring, further distinguishes the North American market. While emerging markets in Asia Pacific are experiencing rapid growth, North America's mature market, robust healthcare system, and continuous innovation pipeline ensure its continued dominance in the general anesthesia drugs sector for the foreseeable future, serving as a benchmark for quality and technological advancement.

What role do ambulatory surgical centers (ASCs) play in the market growth?

Ambulatory Surgical Centers (ASCs) play a profoundly significant and increasingly critical role in driving the growth of the general anesthesia drugs market. ASCs specialize in outpatient surgical procedures, allowing patients to undergo surgery and return home the same day, which offers several advantages over traditional hospital-based surgeries. The rising preference for ASCs is propelled by their ability to provide high-quality surgical care at a lower cost, enhanced convenience for patients, and a reduced risk of hospital-acquired infections. This shift towards outpatient settings for a wide array of procedures, ranging from ophthalmology and orthopedics to gastroenterology and pain management, directly escalates the demand for general anesthesia drugs specifically suited for quick recovery and discharge.

For the general anesthesia drugs market, the growth of ASCs necessitates anesthetic agents with specific characteristics. There is a strong demand for drugs that offer rapid induction and emergence from anesthesia, minimal post-operative side effects such as nausea, vomiting, or cognitive impairment, and a quick return to baseline cognitive function. Drugs like Propofol and Sevoflurane are particularly favored in ASCs due to their favorable pharmacokinetic and pharmacodynamic profiles that align with the rapid turnaround requirements of outpatient surgery. This demand influences pharmaceutical manufacturers to focus their research and development efforts on creating or refining anesthetic formulations that meet these precise clinical needs, ensuring efficient patient flow and satisfaction in the ASC environment. The competitive landscape within ASCs also promotes innovation and cost-effectiveness in anesthetic drug provision.

Furthermore, the expansion of ASCs contributes to increased overall surgical volume by making surgical procedures more accessible and affordable, particularly for elective surgeries that might otherwise be delayed or forgone due to cost or inconvenience. As healthcare systems globally seek to reduce costs and improve efficiency, the model of care offered by ASCs is gaining widespread acceptance and adoption. This trend ensures a sustained and growing market for general anesthesia drugs, with a specific emphasis on agents that facilitate a seamless and speedy recovery process. Consequently, pharmaceutical companies that can effectively cater to the unique demands of ASCs by providing high-performance, rapid-acting, and cost-effective anesthetic solutions are well-positioned for significant market success and growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- General Anesthesia Drugs Market Size Report By Type (Propofol, Etomidate, Midazolam, Sevoflurane, Isoflurane, Others), By Application (Intravenous Anesthetics, Inhalational Anesthetics), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- General Anesthesia Drugs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Inhalation Anesthestic, Intravenous Anesthestic), By Application (Hospital Use, Clinic Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager