Gigabit Ethernet Test Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430088 | Date : Nov, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gigabit Ethernet Test Equipment Market Size

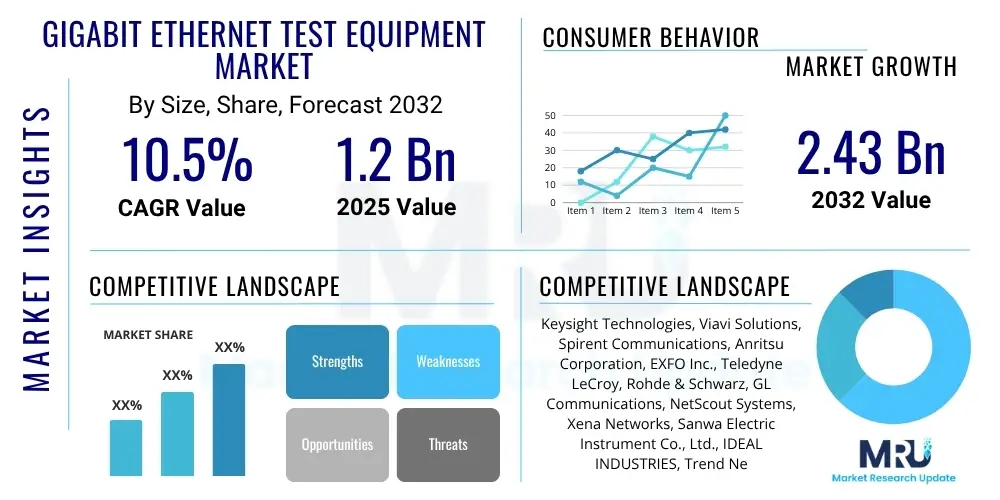

The Gigabit Ethernet Test Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 2.43 Billion by the end of the forecast period in 2032.

Gigabit Ethernet Test Equipment Market introduction

The Gigabit Ethernet Test Equipment Market encompasses a broad range of hardware and software solutions designed to verify, monitor, and troubleshoot Gigabit Ethernet networks and devices. These tools are crucial for ensuring the high performance, reliability, and compliance of network infrastructure operating at speeds of 1 Gbps and beyond. As data traffic continues to surge globally due to digital transformation initiatives and the proliferation of connected devices, the demand for robust and efficient testing solutions is escalating across various sectors.

Gigabit Ethernet test equipment includes devices for protocol analysis, performance testing, compliance validation, and network monitoring. Products range from handheld field testers for installation and maintenance to sophisticated lab-based systems for product development and certification. These tools are indispensable for network equipment manufacturers, telecommunication service providers, data centers, and large enterprises that rely on stable and high-speed network operations. The primary benefit of employing such equipment is the proactive identification and resolution of network issues, minimizing downtime, and optimizing overall network efficiency.

Major applications of Gigabit Ethernet test equipment span across several critical areas, including the deployment and maintenance of enterprise networks, testing new networking hardware and software, and ensuring quality of service (QoS) for various data-intensive applications. Driving factors for market growth include the increasing adoption of cloud computing, the expansion of IoT ecosystems, the rollout of 5G networks, and the continuous demand for faster and more reliable data transmission infrastructure. These factors collectively underscore the vital role of advanced testing solutions in the modern digital landscape.

Gigabit Ethernet Test Equipment Market Executive Summary

The Gigabit Ethernet Test Equipment Market is currently experiencing robust growth, propelled by the global surge in data consumption and the continuous evolution of network technologies. Key business trends indicate a shift towards integrated testing platforms, emphasizing software-defined testing, and the incorporation of artificial intelligence and machine learning for predictive analytics and automated fault detection. Companies are investing in solutions that offer comprehensive visibility across complex multi-vendor networks, addressing the increasing demand for end-to-end network performance validation and ensuring interoperability across diverse network environments. The competitive landscape is characterized by innovation in portable, modular, and cloud-enabled testing solutions, enabling greater flexibility and remote diagnostic capabilities for network professionals.

Regional trends highlight North America and Europe as established markets, driven by early adoption of advanced networking technologies and significant investments in data center infrastructure and telecommunications. However, the Asia Pacific region is emerging as a critical growth engine, fueled by rapid digitalization, extensive deployment of 5G networks, and burgeoning cloud service adoption in countries like China, India, and Japan. Latin America, the Middle East, and Africa are also showing promising growth, albeit from a smaller base, as these regions accelerate their digital transformation initiatives and upgrade their network infrastructures. These regional dynamics are fostering localized demand for specialized testing equipment tailored to specific infrastructure and regulatory requirements.

Segment trends within the market reveal a strong demand for 100 Gigabit and 400 Gigabit Ethernet test solutions, reflecting the industry's progression towards higher speeds to accommodate escalating data throughput. The market for field testing equipment is expanding due to the need for efficient installation and maintenance of network infrastructure in diverse locations, while laboratory and R&D testing segments remain vital for product development and certification. Furthermore, the emphasis on security testing and compliance validation is growing, driven by stricter regulatory frameworks and the increasing sophistication of cyber threats. These trends collectively shape a dynamic market focused on scalability, precision, and operational efficiency in network testing.

AI Impact Analysis on Gigabit Ethernet Test Equipment Market

Users are frequently inquiring about how Artificial Intelligence (AI) can fundamentally transform the functionality and efficiency of Gigabit Ethernet test equipment. There is significant interest in AI's capability to automate complex testing procedures, predict network failures before they occur, and provide more insightful diagnostics than traditional methods. Common concerns revolve around the integration challenges of AI into existing test infrastructures, the need for specialized data scientists or AI engineers, and the accuracy and reliability of AI-driven recommendations. Expectations are high for AI to reduce human intervention, accelerate troubleshooting, optimize network performance, and enhance security posture in increasingly intricate network environments.

- Automated Test Script Generation: AI can analyze network configurations and historical data to automatically generate test cases, reducing manual effort and potential for human error.

- Predictive Network Maintenance: AI algorithms analyze real-time network telemetry and test data to identify potential anomalies and predict future failures, enabling proactive maintenance.

- Enhanced Anomaly Detection: Machine learning models can detect subtle deviations from normal network behavior that may indicate performance degradation or security breaches.

- Intelligent Troubleshooting: AI-powered systems can correlate multiple data points from various test instruments to quickly pinpoint the root cause of network issues.

- Optimization of Test Parameters: AI can dynamically adjust test parameters and scenarios to achieve more comprehensive coverage and identify edge-case vulnerabilities.

- Self-Healing Networks: In future iterations, AI could enable test equipment to not only diagnose but also suggest or even initiate self-correction mechanisms in networks.

- Data Analytics and Reporting: AI can process vast amounts of test data, generating actionable insights and intuitive reports for network engineers and management.

DRO & Impact Forces Of Gigabit Ethernet Test Equipment Market

The Gigabit Ethernet Test Equipment market is primarily driven by the escalating demand for high-speed internet and reliable network connectivity across various industries. The proliferation of cloud computing services, the widespread adoption of the Internet of Things (IoT), and the global rollout of 5G infrastructure are significantly increasing data traffic, necessitating robust Gigabit Ethernet networks and, consequently, advanced testing solutions. Furthermore, the continuous digital transformation initiatives undertaken by enterprises worldwide are pushing for greater network capacity and performance, making precise and efficient network testing indispensable for ensuring operational continuity and service quality. This fundamental need for superior network performance and uptime is a powerful market driver.

However, the market also faces notable restraints. The high initial investment cost associated with advanced Gigabit Ethernet test equipment can be a significant barrier for smaller enterprises or those with limited capital budgets. The rapid pace of technological change in networking standards, such as the frequent updates from 100G to 400G and future 800G Ethernet, often leads to equipment obsolescence, requiring continuous upgrades and further investment. The complexity of integrating sophisticated testing solutions into existing network architectures, coupled with the need for specialized technical expertise to operate and interpret test results, also poses challenges. Economic uncertainties and fluctuations in capital expenditure by key end-users can also temporarily dampen market growth.

Opportunities for growth are abundant, particularly in emerging markets where network infrastructure is rapidly expanding and upgrading. The ongoing development of Terabit Ethernet technologies presents a significant future growth avenue, driving demand for next-generation test equipment. The increasing adoption of software-defined networking (SDN) and network functions virtualization (NFV) mandates new testing methodologies, creating opportunities for software-centric and virtualized testing solutions. Furthermore, the integration of artificial intelligence and machine learning capabilities into test equipment offers a compelling opportunity to enhance automation, predictive analytics, and diagnostic accuracy, enabling more intelligent and efficient network management. These technological advancements are reshaping the market landscape.

The market is also shaped by several impact forces. The bargaining power of buyers is moderate to high, as end-users often require customized solutions and have several vendors to choose from, especially for general-purpose testing. The bargaining power of suppliers, particularly for critical components like specialized chipsets and optical modules, can be significant. The threat of new entrants is relatively low due to the high R&D costs, specialized expertise, and established relationships required to compete effectively. However, the threat of substitute products or services, such as integrated network monitoring software that reduces the need for dedicated hardware testers in certain scenarios, remains a factor. Competitive rivalry within the market is intense, with key players constantly innovating to offer more advanced, cost-effective, and user-friendly solutions.

Segmentation Analysis

The Gigabit Ethernet Test Equipment Market is comprehensively segmented to provide a detailed understanding of its various facets, enabling stakeholders to identify specific growth areas and market trends. These segments are typically categorized based on product type, application, end-user industry, and region, each reflecting unique demands and technological requirements. Understanding these segmentations is crucial for market participants to tailor their offerings, develop targeted marketing strategies, and make informed business decisions within the dynamic networking industry. The granular breakdown allows for a precise analysis of competitive landscapes and emerging opportunities.

- By Product Type:

- Protocol Analyzers

- Performance Testers (BERT, Throughput Testers)

- Conformance & Compliance Testers

- Network Emulators

- Cable & Connectivity Testers

- Optical Test Equipment (for fiber-based Gigabit Ethernet)

- Portable/Handheld Testers

- Rack-Mounted/Lab Testers

- By Application:

- Installation & Maintenance

- Network Monitoring & Troubleshooting

- Research & Development (R&D)

- Manufacturing & Quality Control

- Network Security Testing

- Certification & Compliance

- By End User:

- Telecommunication Service Providers

- Data Centers & Cloud Service Providers

- Enterprises (Banking, Healthcare, IT, Education, Government, etc.)

- Network Equipment Manufacturers (NEMs)

- Cable Operators

- Research & Educational Institutions

- By Ethernet Speed:

- 1 Gigabit Ethernet

- 10 Gigabit Ethernet

- 25 Gigabit Ethernet

- 40 Gigabit Ethernet

- 50 Gigabit Ethernet

- 100 Gigabit Ethernet

- 200 Gigabit Ethernet

- 400 Gigabit Ethernet

- By Component:

- Hardware

- Software

- Services

Value Chain Analysis For Gigabit Ethernet Test Equipment Market

The value chain for the Gigabit Ethernet Test Equipment market begins with upstream activities involving the research and development of core technologies, including high-speed ASICs, FPGAs, optical transceivers, and specialized software algorithms. Component suppliers, such as semiconductor manufacturers and optical module providers, play a critical role in delivering the necessary building blocks for test equipment manufacturers. These manufacturers then design, assemble, and rigorously test their products before they are released to the market. This initial phase is capital-intensive and requires significant intellectual property and technical expertise to develop advanced, high-precision measurement capabilities.

Downstream activities in the value chain primarily involve the distribution, sales, and post-sales support of the test equipment. Distribution channels are varied, encompassing direct sales forces, a network of value-added resellers (VARs), system integrators, and specialized distributors. These intermediaries often provide localized support, technical expertise, and integration services to end-users. After-sales support, including calibration, maintenance, software updates, and training, is crucial for customer satisfaction and long-term relationships, forming an integral part of the overall value proposition. The effectiveness of these downstream channels significantly impacts market penetration and customer loyalty.

Both direct and indirect distribution channels are prominent in this market. Direct sales are typically preferred for large enterprise clients, telecommunication service providers, and data centers that require highly customized solutions, direct technical engagement, and complex contractual agreements. Indirect channels, through distributors and VARs, are more common for reaching smaller and medium-sized enterprises (SMEs), regional markets, and for standardized, off-the-shelf products. The optimal mix of direct and indirect channels is often determined by the product complexity, geographical reach, and the specific needs of the target customer segment. The synergy between robust manufacturing and efficient distribution ensures that innovative test solutions reach the diverse end-users promptly.

Gigabit Ethernet Test Equipment Market Potential Customers

The primary potential customers for Gigabit Ethernet Test Equipment are organizations heavily reliant on high-speed, reliable network infrastructure for their operations. This includes a broad spectrum of end-users whose core business functions depend on flawless data transmission and network performance. These customers require sophisticated tools to ensure the quality, efficiency, and security of their network deployments, ranging from initial installation and continuous monitoring to comprehensive troubleshooting and capacity planning. The critical nature of network connectivity across modern industries makes this equipment indispensable for maintaining competitive advantage and operational continuity.

Telecommunication service providers represent a significant customer segment, continuously expanding and upgrading their fixed and mobile networks to support increasing subscriber demands for higher bandwidth, 5G services, and fiber-to-the-home deployments. Data centers and cloud service providers are another crucial group, investing heavily in Gigabit Ethernet test equipment to manage the massive data traffic volumes, ensure low latency, and maintain the high availability of their cloud infrastructure and hosted applications. Network equipment manufacturers (NEMs) also form a core customer base, utilizing these tools extensively for product development, quality assurance, and certification of their routers, switches, and other networking devices before they reach the market.

Furthermore, large enterprises across various sectors, including banking and financial services, healthcare, government, education, and IT, are increasingly adopting Gigabit Ethernet test equipment. These enterprises leverage the technology to ensure their internal networks, campus connectivity, and data center operations meet stringent performance and security requirements. Research and educational institutions also utilize this equipment for advanced networking research, experimental setups, and training the next generation of network engineers. These diverse end-users collectively drive the demand for a wide array of Gigabit Ethernet test solutions tailored to their specific operational contexts and technological needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 2.43 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Viavi Solutions, Spirent Communications, Anritsu Corporation, EXFO Inc., Teledyne LeCroy, Rohde & Schwarz, GL Communications, NetScout Systems, Xena Networks, Sanwa Electric Instrument Co., Ltd., IDEAL INDUSTRIES, Trend Networks (Formerly IDEAL Networks), Fluke Corporation, Allied Telesis, Broadcom Inc., Intel Corporation, Marvell Technology, Cisco Systems, Huawei Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gigabit Ethernet Test Equipment Market Key Technology Landscape

The Gigabit Ethernet Test Equipment market is continuously evolving, driven by advancements in network technologies and the demand for higher speeds and more complex network architectures. A pivotal technology in this landscape is the capability to support multi-gigabit and higher-speed Ethernet standards, specifically 100 Gigabit, 200 Gigabit, and 400 Gigabit Ethernet, with anticipation for 800 Gigabit and Terabit Ethernet solutions. This requires sophisticated hardware with high-speed interfaces, specialized optical transceivers, and powerful processing capabilities to accurately generate, capture, and analyze traffic at these extreme rates. The core of this technological evolution lies in the development of highly integrated chipsets and programmable logic devices that can handle vast amounts of data without introducing errors or bottlenecks in the test path.

Another significant technological trend is the increasing integration of software-defined networking (SDN) and network functions virtualization (NFV) capabilities into test solutions. As networks become more virtualized and software-centric, traditional hardware-centric testing methods are insufficient. Modern test equipment incorporates software platforms that can emulate virtual network functions, test SDN controller interactions, and validate the performance of virtualized infrastructures. This shift enables more agile and flexible testing environments, supporting the rapid deployment and modification of network services. Furthermore, the adoption of cloud-based testing platforms allows for remote access, collaborative testing, and scalable test resources, reducing the need for extensive on-site hardware.

The integration of advanced analytics, artificial intelligence (AI), and machine learning (ML) is also reshaping the technology landscape. These capabilities enable test equipment to perform more intelligent fault isolation, predictive maintenance, and automated performance optimization. Tools capable of deep packet inspection (DPI) combined with AI can identify complex anomalies, security threats, and performance bottlenecks that might be missed by conventional methods. Precision Time Protocol (PTP) and SyncE testing are becoming crucial for ensuring synchronization in time-sensitive applications like 5G and industrial IoT. The focus is on delivering comprehensive, automated, and insightful testing solutions that can keep pace with the increasing complexity and demands of modern Gigabit Ethernet networks.

Regional Highlights

- North America: This region holds a significant share of the Gigabit Ethernet Test Equipment market, primarily due to the early adoption of advanced networking technologies, substantial investments in data center infrastructure, and the presence of numerous key market players. The strong push for 5G deployment, widespread cloud service adoption, and continuous upgrades in enterprise networks fuel demand.

- Europe: The European market is characterized by stringent regulatory requirements and a focus on network security and compliance. Countries like Germany, the UK, and France are prominent contributors, driven by significant R&D activities, smart city initiatives, and ongoing telecommunication infrastructure modernization projects.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, the APAC region is a rapidly expanding market. Factors such as rapid digitalization, extensive deployment of 5G networks, growing adoption of cloud services, and significant investments in IT and telecommunication infrastructure in countries like China, India, Japan, and South Korea are key drivers.

- Latin America: This region is experiencing steady growth, driven by increasing internet penetration, governmental initiatives for digital inclusion, and expansion of data centers. Brazil and Mexico are leading contributors, investing in network upgrades and expanding their telecommunications services.

- Middle East and Africa (MEA): The MEA market is witnessing emerging growth, fueled by infrastructure development projects, smart city initiatives in the GCC countries, and increasing digitalization across various sectors. Investments in fiber optic networks and data centers are driving the demand for test equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gigabit Ethernet Test Equipment Market.- Keysight Technologies

- Viavi Solutions

- Spirent Communications

- Anritsu Corporation

- EXFO Inc.

- Teledyne LeCroy

- Rohde & Schwarz

- GL Communications

- NetScout Systems

- Xena Networks

- Sanwa Electric Instrument Co., Ltd.

- IDEAL INDUSTRIES

- Trend Networks (Formerly IDEAL Networks)

- Fluke Corporation

- Allied Telesis

- Broadcom Inc.

- Intel Corporation

- Marvell Technology

- Cisco Systems

- Huawei Technologies

Frequently Asked Questions

What is Gigabit Ethernet Test Equipment used for?

Gigabit Ethernet Test Equipment is used to verify, troubleshoot, and monitor the performance, reliability, and compliance of networks and devices operating at Gigabit Ethernet speeds. It ensures optimal network functionality, minimizes downtime, and validates adherence to industry standards.

What are the primary drivers of the Gigabit Ethernet Test Equipment market?

The market is primarily driven by the exponential growth in data traffic, rapid expansion of cloud computing and IoT ecosystems, global 5G network deployments, and ongoing digital transformation initiatives across enterprises that demand high-speed and reliable network infrastructure.

How is AI impacting Gigabit Ethernet Test Equipment?

AI is transforming test equipment by enabling automated test script generation, predictive network maintenance, intelligent anomaly detection, and enhanced troubleshooting. It helps in optimizing test parameters, generating insightful reports, and moving towards self-healing network capabilities.

Which regions are key contributors to the Gigabit Ethernet Test Equipment market?

North America and Europe are significant established markets. Asia Pacific is identified as the fastest-growing region due to extensive digitalization and infrastructure development. Latin America and MEA are emerging markets with increasing investments in network upgrades.

What types of products are included in Gigabit Ethernet Test Equipment?

Product types include protocol analyzers, performance testers (BERT, throughput), conformance and compliance testers, network emulators, cable and connectivity testers, optical test equipment, as well as handheld and lab-based testing solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager