Glazing Gel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429435 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Glazing Gel Market Size

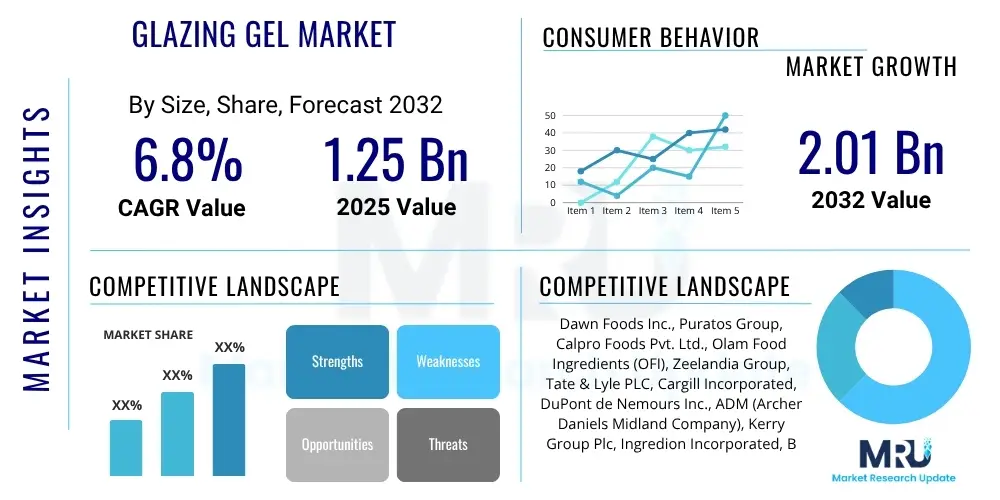

The Glazing Gel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.25 Billion in 2025 and is projected to reach USD 2.01 Billion by the end of the forecast period in 2032.

Glazing Gel Market introduction

The Glazing Gel market encompasses a specialized segment within the food ingredients industry, primarily driven by the increasing demand for visually appealing and preserved food products. Glazing gels are clear or colored, often fruit-flavored, jelly-like coatings used extensively in bakery, confectionery, and dessert applications to impart a glossy finish, enhance aesthetic appeal, and extend the shelf life of food items by protecting them from moisture loss and oxidation. These versatile products also contribute to flavor and texture profiles, making them indispensable in modern food production for both artisanal and industrial scales.

Product descriptions of glazing gels vary widely, ranging from ready-to-use formulations to concentrated powders that require rehydration. They are typically composed of water, sugar, gelling agents (such as pectin, agar-agar, or gelatin), acids, and sometimes natural or artificial flavors and colors. Major applications include coating fresh fruits on tarts, decorating cakes and pastries, enrobing individual desserts, and enhancing the presentation of savory items. The primary benefits of using glazing gels include providing a brilliant shine, protecting food from drying out, preventing discoloration of fruits, enhancing product shelf appeal, and offering a neutral or complementary flavor that enriches the overall eating experience. Driving factors for market growth include rising consumer demand for premium and visually attractive food products, expansion of the bakery and confectionery industries globally, advancements in food processing and ingredient technology, and the growing convenience food sector that relies on prolonged freshness and presentation.

Glazing Gel Market Executive Summary

The Glazing Gel market is experiencing robust growth, propelled by evolving consumer preferences for aesthetically pleasing and high-quality food products across bakery, confectionery, and dairy sectors. Business trends highlight a significant focus on innovation in clean label formulations, natural ingredients, and specialized gels catering to specific dietary requirements such as vegan or gluten-free options. Manufacturers are also investing in research and development to improve product stability, ease of application, and cost-effectiveness, recognizing the critical role glazing gels play in both product preservation and visual marketing. The competitive landscape is characterized by both established global players and emerging regional manufacturers, leading to a dynamic environment focused on product differentiation and customer-centric solutions.

Regional trends indicate that Asia Pacific is emerging as a high-growth market, driven by increasing urbanization, rising disposable incomes, and the Westernization of dietary habits which fuel demand for bakery and confectionery items. Europe and North America continue to represent mature markets, with a strong emphasis on premiumization, health-conscious offerings, and convenience. Latin America and the Middle East & Africa are also showing promising growth, attributed to expanding food service sectors and a growing appetite for diverse dessert and baked goods. These regions present significant opportunities for market penetration and expansion as local food industries modernize and scale up their production capabilities. The market is also seeing a shift towards more sustainable packaging solutions and production processes in response to growing environmental awareness.

Segment trends reveal that the clear glazing gel segment holds a dominant share due to its versatility and ability to enhance natural product appearance, while flavored and colored gels are gaining traction, particularly in specialized confectionery and dessert applications where specific aesthetic and taste profiles are desired. Applications in commercial bakeries and patisseries remain the largest consumer segment, although the use of glazing gels in industrial food processing for packaged goods and the burgeoning home baking segment are also contributing significantly to market expansion. The increasing complexity of consumer demands necessitates a diversified product portfolio from market players, ensuring that a broad range of applications and preferences can be met with innovative glazing solutions.

AI Impact Analysis on Glazing Gel Market

Common user questions regarding AI's impact on the Glazing Gel Market often revolve around optimizing production processes, enhancing product consistency, and personalizing offerings. Users inquire about how AI can streamline raw material sourcing, predict demand fluctuations, improve quality control, and even assist in developing novel formulations. The key themes that emerge are centered on achieving greater efficiency, precision, and innovation within the industry, alongside concerns about the initial investment and the potential displacement of manual labor. Stakeholders are keen to understand how AI can reduce waste, ensure food safety standards, and provide data-driven insights for strategic decision-making, ultimately leading to superior products and operational cost savings.

AI's influence on the Glazing Gel Market is poised to revolutionize several aspects, from research and development to manufacturing and supply chain management. By leveraging machine learning algorithms, companies can analyze vast datasets on ingredient performance, consumer preferences, and environmental factors to predict optimal formulations that offer enhanced stability, shine, and flavor profiles. This data-driven approach significantly accelerates the product development cycle, allowing manufacturers to respond more quickly to market trends and customize gels for specific applications or dietary requirements, such as low-sugar or plant-based alternatives. Predictive analytics can also help in identifying potential issues with raw material quality, ensuring consistency in the final product batch after batch, thereby reducing waste and improving overall product reliability.

Beyond formulation, AI technologies can optimize production lines through real-time monitoring and predictive maintenance, minimizing downtime and maximizing output efficiency. Automated quality control systems, powered by AI, can detect imperfections in gel application or texture that might be missed by human inspection, ensuring every product meets stringent quality standards. In terms of supply chain, AI can forecast demand with greater accuracy, leading to optimized inventory management, reduced logistics costs, and improved freshness of ingredients. Furthermore, AI-driven platforms can analyze consumer feedback and sales data to inform marketing strategies and product positioning, fostering a more responsive and consumer-centric approach within the Glazing Gel Market. The integration of AI tools promises a future where glazing gel production is more efficient, innovative, and tailored to individual market needs.

- AI optimizes raw material sourcing and inventory management, reducing waste.

- Predictive analytics enhance demand forecasting, improving supply chain efficiency.

- AI-driven quality control systems ensure consistent product attributes like shine and texture.

- Accelerates R&D for novel glazing gel formulations, including clean label and specialty options.

- Personalizes product development based on consumer preferences and dietary trends.

- Monitors production processes in real-time, enabling predictive maintenance and operational efficiency.

DRO & Impact Forces Of Glazing Gel Market

The Glazing Gel market is significantly shaped by a confluence of driving factors, notable restraints, and burgeoning opportunities that collectively determine its growth trajectory and competitive landscape. The primary drivers include the escalating global demand for visually appealing and premium baked goods and confectionery, where glazing gels play a crucial role in enhancing product aesthetics and perceived value. The expansion of the food service sector, increasing urbanization, and evolving consumer lifestyles that favor convenience foods also contribute to this demand. Furthermore, innovations in food processing technologies and ingredient science allow for the development of more stable, versatile, and application-specific glazing solutions, thereby expanding their utility across various food segments.

However, the market faces several restraints, most notably the volatility in the prices of key raw materials such as sugar, hydrocolloids, and specialty ingredients, which can impact manufacturing costs and product pricing. Concerns regarding the high sugar content in many traditional glazing gels, driven by a global shift towards healthier eating habits, pose a significant challenge. This pressure necessitates ongoing research into low-sugar or sugar-free alternatives. Additionally, stringent food safety regulations and varying standards across different regions for food additives and preservatives can complicate product development and market entry for manufacturers, requiring continuous compliance and adaptation. The presence of substitutes, though often less effective in terms of shine and preservation, also presents a competitive restraint.

Opportunities within the Glazing Gel market are abundant and are largely driven by emerging consumer trends and technological advancements. The growing consumer preference for clean label products, demanding natural ingredients, fewer additives, and transparent sourcing, opens avenues for developing innovative glazing gels free from artificial colors, flavors, and preservatives. The rise of vegan and plant-based diets presents a substantial opportunity for plant-derived gelling agents, catering to a broader consumer base. Furthermore, expansion into untapped emerging markets, particularly in Asia Pacific and Latin America, where the bakery and confectionery sectors are rapidly developing, offers significant growth potential. The development of functional glazing gels that offer additional benefits like fortification or extended microbial shelf life also represents a promising area for future market expansion and product differentiation, leveraging advanced ingredient technologies to meet evolving consumer and industry needs.

Segmentation Analysis

The Glazing Gel market is extensively segmented to reflect the diverse applications, formulations, and end-user requirements within the food industry. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product offerings, and develop targeted marketing strategies. The primary segmentation categories include product type, application, form, and distribution channel, each revealing distinct dynamics and growth potentials across the global landscape. These classifications allow for a granular analysis of market trends and consumer preferences, enabling more effective resource allocation and strategic planning for manufacturers and suppliers.

The segmentation by product type distinguishes between clear, flavored, and colored glazing gels, catering to different aesthetic and sensory requirements. Application segmentation covers major end-use industries such as bakery, confectionery, dairy & desserts, and savory products, each with unique needs regarding gel properties and performance. Form segmentation typically includes ready-to-use gels and concentrated powders or mixes, offering convenience and cost-efficiency respectively. Lastly, distribution channel segmentation differentiates between business-to-business (B2B) sales to food manufacturers and food service providers, and business-to-consumer (B2C) sales, primarily through retail channels for home baking. Each segment exhibits unique growth drivers and competitive intensities, shaping the overall market structure.

- By Product Type:

- Clear Glazing Gel

- Flavored Glazing Gel

- Colored Glazing Gel

- By Application:

- Bakery (Cakes, Pastries, Tarts, Breads)

- Confectionery (Candies, Chocolates, Gummy products)

- Dairy & Desserts (Yogurts, Ice Creams, Puddings)

- Savory Products (Meat Glazes, Vegetable Glazes)

- By Form:

- Ready-to-Use Glazing Gel

- Concentrated/Powdered Glazing Gel

- By Distribution Channel:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Value Chain Analysis For Glazing Gel Market

The value chain for the Glazing Gel market is a complex network of interconnected activities, beginning with the sourcing of raw materials and culminating in the delivery of the final product to diverse end-users. Upstream analysis reveals a critical dependence on suppliers of essential ingredients such as sugars (glucose syrup, sucrose), hydrocolloids (pectin, agar-agar, gelatin, carrageenan, guar gum), acids (citric acid, lactic acid), natural or artificial colors and flavors, and preservatives. The quality, consistency, and sustainable sourcing of these raw materials are paramount, as they directly influence the final product's characteristics, performance, and cost. Relationships with these suppliers are often long-term, fostering collaborations for ingredient innovation and supply chain resilience.

Midstream activities involve the manufacturing and formulation of glazing gels. This stage includes processes such as mixing, heating, gelling, and packaging, often requiring specialized equipment and technical expertise to achieve desired viscosity, clarity, stability, and sensory attributes. Manufacturers invest significantly in R&D to develop new formulations, optimize production efficiency, ensure food safety compliance, and meet specific customer requirements for shelf life, application method, and dietary considerations. Quality control at this stage is rigorous, encompassing checks for ingredient purity, microbiological safety, and adherence to product specifications before packaging and distribution.

Downstream activities focus on the distribution and sale of glazing gels to various end-users. The distribution channels are diverse, encompassing both direct and indirect routes. Direct distribution typically involves sales from manufacturers to large industrial food producers, commercial bakeries, and major food service chains, often characterized by bulk orders and customized solutions. Indirect channels involve wholesalers, distributors, and specialized ingredient suppliers who then supply smaller bakeries, patisseries, restaurants, hotels, and retail outlets for home baking. The efficiency of these distribution networks is crucial for timely delivery, maintaining product integrity, and reaching a broad customer base. Marketing and sales efforts are tailored to each channel, emphasizing product benefits, application versatility, and technical support to drive adoption and market penetration, ensuring widespread availability across the food industry.

Glazing Gel Market Potential Customers

The potential customers for Glazing Gel products span a wide spectrum within the food industry, encompassing both commercial and individual users who seek to enhance the appearance, texture, and shelf life of their food creations. Primarily, large-scale commercial bakeries and patisseries represent a significant customer segment, relying on glazing gels for high-volume production of cakes, pastries, tarts, and other baked goods that require a professional, glossy finish. These entities value consistency, ease of application, and cost-effectiveness in their ingredient sourcing. Hotels, restaurants, and catering services also constitute a substantial customer base, utilizing glazing gels to elevate the presentation of desserts, buffet items, and specialty dishes, thereby improving the dining experience for their patrons.

Beyond traditional bakery and food service, industrial food manufacturers are key buyers, particularly those involved in the production of packaged desserts, confectionery items, and dairy products. These manufacturers employ glazing gels to protect fruits in fruit tarts, add shine to chocolate confections, or enhance the visual appeal of yogurt and pudding cups, contributing to extended shelf life and consumer appeal. Specialty food producers focusing on gourmet products, organic offerings, or specific dietary needs (e.g., vegan, gluten-free) are also burgeoning customers, driving demand for specialized glazing gel formulations that align with their product ethos and consumer base. The increasing sophistication of the food processing industry continually expands the scope of applications for these versatile gels.

Furthermore, the growing trend of home baking and culinary hobbies has opened up the business-to-consumer (B2C) market for glazing gels. Individual consumers, passionate home bakers, and small-scale artisanal producers increasingly purchase these products through retail stores, online marketplaces, and specialty ingredient shops. They are driven by the desire to replicate professional results in their own kitchens, adding a touch of elegance and quality to their homemade cakes, pastries, and desserts. This segment values user-friendliness, smaller packaging sizes, and readily available instructional content, contributing to a diverse customer landscape for the Glazing Gel market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 2.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dawn Foods Inc., Puratos Group, Calpro Foods Pvt. Ltd., Olam Food Ingredients (OFI), Zeelandia Group, Tate & Lyle PLC, Cargill Incorporated, DuPont de Nemours Inc., ADM (Archer Daniels Midland Company), Kerry Group Plc, Ingredion Incorporated, Bakels Worldwide, CSM Ingredients, Agrana Beteiligungs-AG, Palsgaard A S, Givaudan SA, Firmenich International SA, Corbion N.V., Sensient Technologies Corporation, Döhler GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glazing Gel Market Key Technology Landscape

The Glazing Gel market is continuously evolving, driven by advancements in food science and processing technologies aimed at improving product functionality, stability, and appeal. A crucial aspect of this technological landscape involves the development and utilization of sophisticated hydrocolloids and gelling agents. Innovations in pectin, agar-agar, gelatin alternatives, and starches allow for the creation of gels with varying textures, melting points, and setting times, catering to diverse application requirements. This includes the engineering of thermo-reversible and thermo-irreversible gels, providing greater flexibility for manufacturers in different baking and confectionery processes. Research into new gelling synergies between different hydrocolloids is also key, enabling customized solutions for specific product attributes like brilliant shine, improved fruit adhesion, and enhanced moisture barrier properties.

Beyond gelling agents, significant technological strides are being made in formulation science to address clean label demands and specific dietary trends. This involves the use of natural colors, flavors, and fruit extracts, as well as the development of sugar-reduced or sugar-free formulations utilizing alternative sweeteners and fibers that do not compromise on taste, texture, or gloss. Emulsification and stabilization technologies are vital to ensure the smooth, homogeneous texture of glazing gels and prevent syneresis (water separation) over time, particularly in ready-to-use formats. Advanced processing techniques, such as high-shear mixing and controlled heating and cooling cycles, are employed to optimize ingredient dispersion and gel structure formation, guaranteeing consistent product quality and performance across large-scale production batches.

Furthermore, the technology landscape extends to packaging innovations that preserve the freshness and extend the shelf life of glazing gels, ranging from aseptic packaging for bulk industrial use to convenient, easy-to-use squeeze bottles for retail consumers. Automation and robotics in manufacturing facilities are increasingly being adopted to enhance production efficiency, reduce labor costs, and ensure precise ingredient handling and mixing, minimizing human error. The integration of data analytics and sensor technology allows for real-time monitoring of production parameters, facilitating immediate adjustments to maintain product specifications. These technological advancements collectively contribute to a more efficient, innovative, and responsive Glazing Gel market, capable of meeting the dynamic demands of the food industry and consumers.

Regional Highlights

- North America: This region represents a mature market for glazing gels, characterized by high consumer awareness regarding product aesthetics and quality in baked goods and desserts. Demand is primarily driven by the large commercial bakery and food service sectors, along with a growing interest in gourmet and artisanal food products. There's a strong emphasis on clean label ingredients, sugar reduction, and convenient ready-to-use formulations. Innovation in plant-based and allergen-free gels is also a significant trend, reflecting the region's health-conscious consumer base. The United States and Canada are key contributors to market revenue, with established distribution networks and advanced food processing capabilities.

- Europe: Europe stands as a major market for glazing gels, deeply rooted in its rich tradition of bakery, patisserie, and confectionery. Countries like France, Germany, Italy, and the UK are prominent consumers, with a high demand for premium quality and diverse product offerings. The market is influenced by stringent food safety regulations and a strong preference for natural ingredients, leading to continuous innovation in fruit-based and naturally colored gels. Sustainability and ethical sourcing are key considerations, driving manufacturers to adopt more responsible production practices. The region also exhibits significant potential for specialized gels catering to specific regional culinary traditions and emerging health trends.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for glazing gels, fueled by rapid urbanization, increasing disposable incomes, and the Westernization of dietary patterns. Countries such as China, India, Japan, and Australia are witnessing a surge in demand for bakery and confectionery products, creating vast opportunities for market expansion. The expanding food service industry, coupled with the rising popularity of café culture and dessert parlors, contributes significantly to market growth. Local manufacturers are focusing on adapting global product trends to regional tastes, while international players are expanding their footprint through strategic partnerships and localized product development.

- Latin America: This region presents considerable growth opportunities, driven by an expanding middle class and evolving food consumption habits. Countries like Brazil, Mexico, and Argentina are key markets, characterized by a vibrant bakery and confectionery sector. The demand for visually appealing and indulgent food items is on the rise, boosting the adoption of glazing gels. While price sensitivity can be a factor, there's a growing appreciation for quality and innovation, particularly in specialty and artisanal products. Investment in modern food processing infrastructure and increasing consumer awareness are expected to further propel market growth.

- Middle East and Africa (MEA): The MEA region is experiencing steady growth in the Glazing Gel market, primarily influenced by a growing young population, increasing tourism, and the expansion of the hospitality and food service sectors. The Gulf Cooperation Council (GCC) countries, in particular, exhibit a high demand for premium and imported food products, including sophisticated baked goods and desserts. There is an increasing focus on product diversification, halal-certified ingredients, and convenience foods. As local food production capabilities mature and international food trends gain traction, the adoption of glazing gels is expected to continue its upward trajectory, particularly in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glazing Gel Market.- Dawn Foods Inc.

- Puratos Group

- Calpro Foods Pvt. Ltd.

- Olam Food Ingredients (OFI)

- Zeelandia Group

- Tate & Lyle PLC

- Cargill Incorporated

- DuPont de Nemours Inc.

- ADM (Archer Daniels Midland Company)

- Kerry Group Plc

- Ingredion Incorporated

- Bakels Worldwide

- CSM Ingredients

- Agrana Beteiligungs-AG

- Palsgaard A S

- Givaudan SA

- Firmenich International SA

- Corbion N.V.

- Sensient Technologies Corporation

- Döhler GmbH

Frequently Asked Questions

What is a glazing gel and what are its primary uses?

A glazing gel is a jelly-like food coating applied to bakery, confectionery, and dessert items to provide a shiny, protective, and often flavorful finish. Its primary uses include enhancing visual appeal, preventing moisture loss, protecting fruits from oxidation, and extending the shelf life of food products.

What factors are driving the growth of the Glazing Gel Market?

The market growth is primarily driven by increasing consumer demand for aesthetically pleasing food, the expansion of the bakery and confectionery industries, advancements in food ingredient technology, and the rising popularity of convenience and ready-to-eat dessert products.

What are the key challenges faced by manufacturers in the Glazing Gel Market?

Key challenges include volatility in raw material prices, consumer demand for healthier, low-sugar or sugar-free options, stringent food safety regulations, and the need for continuous innovation to meet evolving dietary trends and specific application requirements.

Which region is expected to show the fastest growth in the Glazing Gel Market?

The Asia Pacific (APAC) region is anticipated to exhibit the fastest growth, driven by rapid urbanization, increasing disposable incomes, and the growing adoption of Westernized dietary habits that fuel demand for bakery and confectionery items.

How is AI impacting the Glazing Gel Market?

AI is transforming the Glazing Gel Market by optimizing raw material sourcing, enhancing precision in demand forecasting, improving quality control, and accelerating the development of innovative and customized formulations, leading to greater efficiency and product consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager