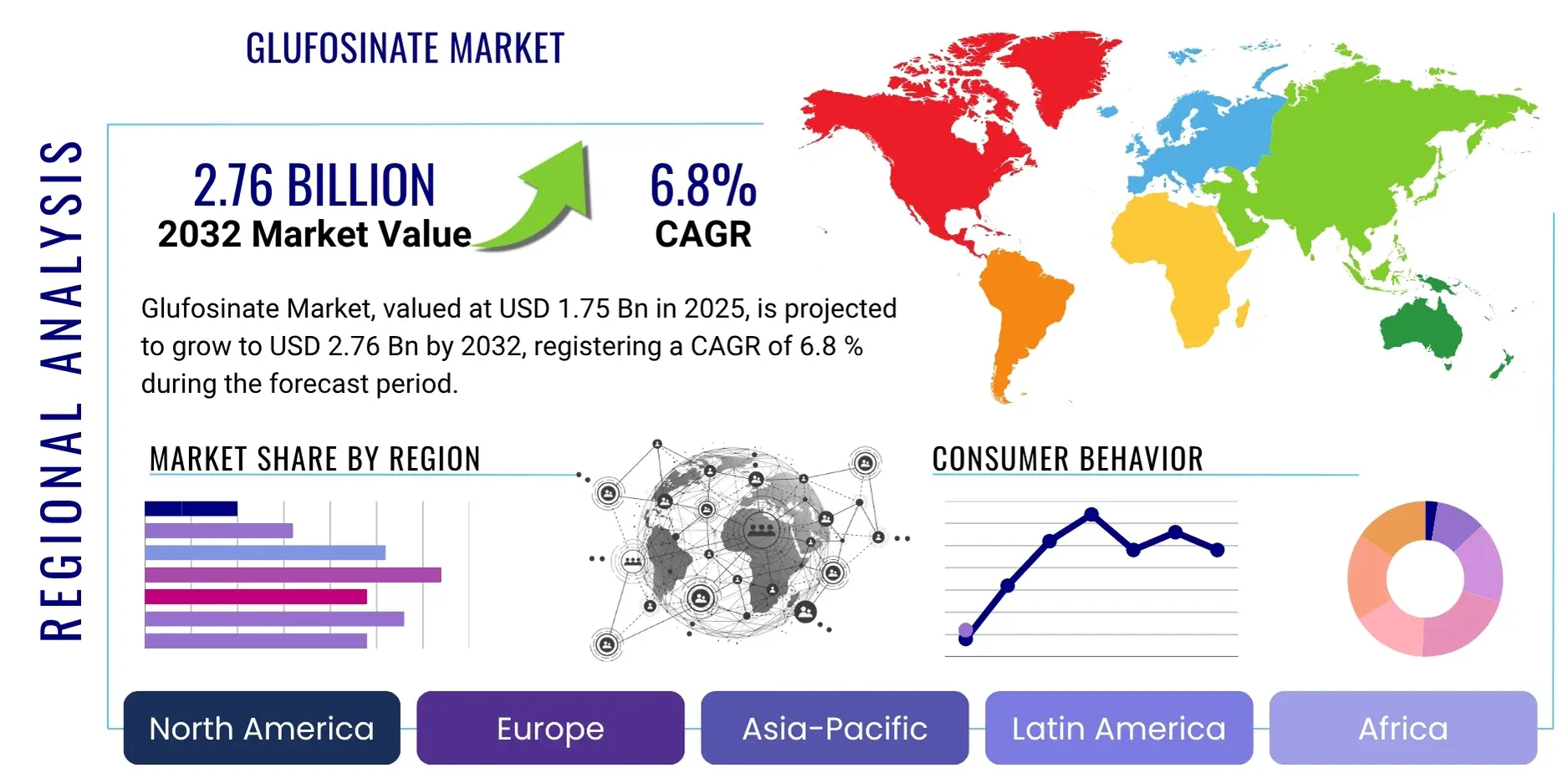

Glufosinate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428132 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Glufosinate Market Size

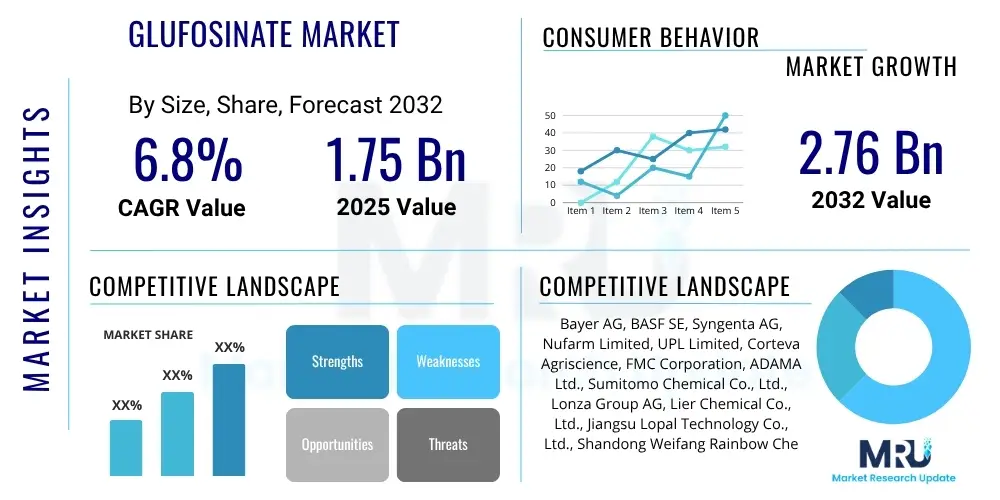

The Glufosinate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 1.75 Billion in 2025 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2032.

Glufosinate Market introduction

The Glufosinate market encompasses the global production, distribution, and consumption of glufosinate-ammonium, a broad-spectrum, non-selective contact herbicide used primarily in agricultural and non-agricultural settings. As a phosphinic acid derivative, glufosinate is highly effective in controlling a wide range of annual and perennial grasses and broadleaf weeds, including those that have developed resistance to glyphosate, another widely used herbicide. Its unique mode of action, inhibiting glutamine synthetase, prevents the synthesis of glutamine, leading to the accumulation of ammonia in plant cells, which disrupts photosynthesis and ultimately causes plant death. This distinctive mechanism makes it a crucial tool in integrated weed management strategies, especially in areas where weed populations exhibit multiple herbicide resistance. The herbicide is characterized by its relatively rapid action and low residual activity in the soil, offering flexibility in crop rotation and minimizing environmental persistence concerns compared to some other chemical alternatives.

Major applications of glufosinate span across various agricultural segments, including use in glufosinate-tolerant crops such as canola, corn, soybeans, and cotton, where it provides excellent post-emergence weed control without harming the genetically modified crop. Beyond these genetically modified applications, it is also extensively utilized for weed control in non-tolerant crops like fruits, vines, nuts, and vegetables, typically applied as a directed spray to avoid crop contact. Furthermore, glufosinate finds significant utility in non-agricultural areas for total vegetation control, such as along railway lines, roadsides, industrial sites, and in forestry applications, demonstrating its versatility. The benefits of glufosinate include its efficacy against difficult-to-control weeds, its value in resistance management programs by offering an alternative mode of action, and its relatively favorable environmental profile regarding soil residue. These attributes contribute to enhancing crop yields and ensuring food security by minimizing competitive weed pressure, thereby supporting global agricultural productivity.

Driving factors for the glufosinate market are multifaceted, primarily stemming from the escalating issue of herbicide-resistant weeds worldwide, particularly resistance to glyphosate, which necessitates alternative control measures. The continuous expansion of planted areas for glufosinate-tolerant crops, driven by their agronomic advantages and ease of weed management, also fuels demand. Global population growth and the consequent need for increased food production exert pressure on farmers to optimize yields, making effective weed control indispensable. Additionally, the adoption of sustainable farming practices such like no-till or minimum-tillage systems, which rely heavily on herbicides for weed suppression rather than mechanical cultivation, further boosts glufosinate consumption. Economic factors, including the increasing disposable incomes in developing regions leading to higher demand for diverse food products, indirectly support the market by encouraging agricultural expansion and intensive farming practices that benefit from advanced crop protection solutions like glufosinate. The continuous innovation in formulation technologies also plays a role in enhancing product performance and user convenience, contributing to its market growth.

Glufosinate Market Executive Summary

The Glufosinate market is currently experiencing dynamic shifts influenced by a combination of global business trends, evolving regional agricultural practices, and specific segment advancements. In terms of business trends, the market is characterized by strategic collaborations, mergers, and acquisitions aimed at consolidating market share, enhancing research and development capabilities, and optimizing supply chains. Key players are increasingly focusing on developing advanced formulations that offer improved efficacy, reduced environmental impact, and greater user safety, often incorporating adjuvants or encapsulation technologies. There is a growing emphasis on product differentiation and value-added services, including integrated weed management solutions, to gain a competitive edge. Furthermore, companies are investing in expanding their manufacturing capacities, particularly in regions with high agricultural growth, to meet rising demand and reduce logistical costs. The shift towards digital agriculture and precision farming also presents opportunities for integrating glufosinate applications with advanced analytics, thereby optimizing usage and minimizing waste.

Regional trends significantly shape the glufosinate landscape, with Asia Pacific emerging as the dominant market, driven by extensive agricultural activities in countries like China, India, and Southeast Asian nations. The region's large farming population, increasing adoption of modern agricultural techniques, and the prevalence of glyphosate-resistant weeds are key contributors to its growth. North America, particularly the United States, represents another substantial market, characterized by large-scale farming operations and a mature market for herbicide-tolerant crops, necessitating effective weed resistance management. Europe faces stricter regulatory scrutiny regarding herbicide use, leading to a focus on sustainable formulations and integrated pest management approaches, which can impact market growth but also foster innovation in safer alternatives. Latin America, with its vast agricultural lands in Brazil and Argentina, shows robust growth potential as farmers increasingly adopt advanced crop protection solutions to boost productivity. The Middle East and Africa, while smaller, are exhibiting gradual growth driven by efforts to enhance food security and modernize agricultural practices.

Segment trends within the glufosinate market reflect varying demands across different crop types and applications. The largest segment remains glufosinate-tolerant crops, where the herbicide is synergistically used to manage weeds effectively without affecting the crop, ensuring high yields. This segment continues to grow with the expanding global cultivation of genetically modified corn, soy, canola, and cotton. Non-tolerant crops, including fruits, vegetables, and perennial crops, constitute another significant segment, relying on glufosinate for directed and inter-row weed control. The market also sees differentiation based on formulation types, with liquid concentrates being prevalent due to ease of application and handling, while granular or dry formulations cater to specific niche applications or distribution requirements. The non-agricultural segment, covering total vegetation control in industrial areas, infrastructure, and forestry, maintains a steady demand, driven by maintenance requirements and safety considerations. The overarching trend across all segments is the increasing demand for sustainable and effective solutions that can address complex weed challenges while adhering to evolving environmental and regulatory standards, pushing manufacturers towards continuous innovation and responsible product stewardship.

AI Impact Analysis on Glufosinate Market

The integration of Artificial Intelligence (AI) and machine learning technologies is poised to significantly transform the glufosinate market, addressing several critical challenges and optimizing various aspects of the value chain. Users are frequently questioning how AI can contribute to more precise and efficient herbicide application, mitigate environmental impact, and accelerate the development of new glufosinate formulations or integrated weed management strategies. There is a strong interest in AI's potential to analyze vast datasets related to weed populations, soil conditions, weather patterns, and crop health to recommend optimal glufosinate dosages and timing, thereby reducing overuse and promoting sustainable agriculture. Concerns often revolve around the initial investment costs of AI-powered systems, data privacy, the need for robust data infrastructure in rural areas, and the skills gap for farmers and agricultural professionals to effectively utilize these advanced technologies. Despite these challenges, the prevailing expectation is that AI will be a powerful enabler for enhanced productivity, resource efficiency, and environmental stewardship within the glufosinate sector.

Stakeholders also anticipate AI's role in improving supply chain resilience and market forecasting for glufosinate. Common user questions probe how AI algorithms can predict demand fluctuations, optimize inventory levels, and identify potential disruptions in raw material supply or distribution networks, leading to more stable market conditions. Furthermore, there is considerable interest in AI’s ability to analyze consumer behavior and market trends, allowing glufosinate manufacturers and distributors to tailor their product offerings and marketing strategies more effectively. The potential for AI in regulatory compliance and environmental monitoring is another key theme, with users wondering if AI can help track glufosinate residues, model environmental dispersion, and ensure adherence to evolving global regulations, thereby bolstering brand reputation and reducing legal risks. The overall sentiment is one of cautious optimism, recognizing AI's profound potential to revolutionize the glufosinate market by fostering smarter, more sustainable, and economically viable practices, provided that the inherent complexities of its implementation are adequately addressed through collaborative efforts across the industry.

The discussions surrounding AI's impact extend to its capacity for accelerating research and development in glufosinate chemistry and resistance management. Users inquire about AI’s role in discovering new active ingredients or synergistic adjuvants, predicting herbicide efficacy against novel weed biotypes, and designing more robust glufosinate-tolerant crop varieties. AI-driven predictive modeling can significantly reduce the time and cost associated with traditional R&D, enabling faster market entry for innovative solutions. Furthermore, AI can enhance integrated weed management (IWM) strategies by analyzing the efficacy of different control methods—chemical, cultural, mechanical, and biological—in specific agroecosystems, providing data-driven recommendations for optimal sequential or rotational herbicide use. This includes predicting the likelihood of weed resistance development based on historical data and environmental factors, thereby allowing proactive adjustments to treatment protocols. The emphasis is on utilizing AI not just for efficiency gains but also as a strategic tool for foresight, innovation, and proactive problem-solving in the complex domain of weed science and crop protection.

- Precision Application Optimization: AI-driven systems integrate sensor data from drones or ground vehicles with real-time analytics to determine precise glufosinate dosage, timing, and location, minimizing waste and maximizing efficacy against specific weed patches, thereby reducing overall herbicide usage and environmental footprint.

- Weed Resistance Prediction and Management: Machine learning algorithms analyze genetic data of weeds, historical treatment records, and environmental factors to predict the emergence and spread of glufosinate-resistant biotypes, enabling proactive adjustments to herbicide rotations and integrated weed management strategies before resistance becomes widespread.

- Supply Chain and Demand Forecasting: AI tools analyze vast market data, weather patterns, crop planting intentions, and geopolitical factors to provide highly accurate forecasts for glufosinate demand, optimizing production schedules, inventory levels, and logistics to prevent shortages or surpluses and ensure market stability.

- R&D Acceleration for Novel Formulations: AI-powered computational chemistry and molecular modeling can screen vast chemical libraries, predict the efficacy and safety profiles of new glufosinate formulations or synergistic active ingredients, drastically cutting down the time and cost associated with traditional laboratory experimentation and bringing innovative products to market faster.

- Enhanced Environmental Monitoring and Regulatory Compliance: AI systems can process satellite imagery and environmental sensor data to monitor glufosinate dispersion, degradation, and potential impacts on non-target organisms, assisting in real-time environmental risk assessment and ensuring compliance with increasingly stringent global regulatory standards, thereby building public trust.

- Automated Crop Protection Decisions: AI assists farmers in making data-driven decisions by integrating information on crop health, soil nutrient levels, and pathogen presence with weed pressure data, offering holistic recommendations for glufosinate application within a broader crop protection plan, enhancing overall farm productivity and sustainability.

- Personalized Agronomic Advisory: AI-driven platforms provide tailored advice to farmers on glufosinate use based on their specific field conditions, crop types, historical data, and local environmental regulations, fostering improved decision-making and optimal resource utilization, which boosts overall agricultural output.

DRO & Impact Forces Of Glufosinate Market

The Glufosinate market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and various impact forces that collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating prevalence of herbicide-resistant weeds, particularly those resistant to glyphosate, compelling farmers worldwide to adopt alternative active ingredients like glufosinate to maintain crop yields and manage weed populations effectively. The continuous expansion of genetically modified crops tolerant to glufosinate, such as specific varieties of corn, soybeans, and canola, further solidifies its market position by offering a robust weed control solution that aligns with modern farming practices. Moreover, the increasing global demand for food, driven by a growing population, necessitates higher agricultural productivity, where efficient weed management through herbicides like glufosinate becomes indispensable. The adoption of no-till or reduced-tillage farming practices, which minimize soil disturbance and conserve soil moisture, also boosts glufosinate demand as these systems rely heavily on chemical weed control rather than mechanical cultivation. This shift towards more sustainable land management practices, paradoxically, increases the reliance on effective herbicides for initial weed knockdown and long-term suppression, highlighting glufosinate’s critical role.

Despite its significant advantages, the glufosinate market faces several restraints and challenges. Foremost among these are the stringent regulatory frameworks and environmental concerns associated with pesticide use in many regions, particularly in Europe, where there is constant pressure to reduce chemical inputs and promote organic farming. Public perception regarding the environmental safety and potential health impacts of herbicides can also lead to public scrutiny and calls for stricter regulations or outright bans. The availability of alternative weed control methods, including other herbicides, biological controls, and cultural practices, presents competitive pressure and can limit market expansion in certain niches. Price volatility of key raw materials required for glufosinate synthesis, coupled with fluctuations in global energy prices, can impact production costs and ultimately influence market pricing and profitability. Furthermore, the potential for glufosinate resistance to develop in weeds over time, though currently less widespread than glyphosate resistance, remains a long-term concern that necessitates ongoing research and responsible stewardship practices to mitigate.

Opportunities within the glufosinate market are numerous and primarily revolve around technological advancements and market diversification. The ongoing research and development into novel glufosinate formulations that offer improved efficacy, reduced application rates, enhanced environmental profiles, and increased user safety present significant growth avenues. The development and broader adoption of new herbicide-tolerant crop varieties, engineered to be resistant to glufosinate, will naturally expand the herbicide's addressable market. Furthermore, integrating glufosinate into comprehensive integrated weed management (IWM) strategies, often in conjunction with other herbicides with different modes of action or non-chemical methods, represents a sustainable path for long-term market relevance and effective resistance management. Emerging markets in Asia Pacific, Latin America, and Africa, characterized by rapidly developing agricultural sectors and increasing adoption of modern farming technologies, offer substantial untapped growth potential. Impact forces such as evolving climate change patterns, which can alter weed distribution and growth cycles, and geopolitical stability, influencing agricultural trade and policies, can also significantly impact the glufosinate market. Shifting consumer preferences towards sustainably produced food also acts as a powerful force, encouraging manufacturers to invest in solutions that align with environmental stewardship, thereby driving innovation in product development and responsible use practices for glufosinate.

Segmentation Analysis

The Glufosinate market is meticulously segmented to provide a granular understanding of its diverse applications and market dynamics, offering insights into specific demand drivers and growth opportunities across various categories. This comprehensive segmentation helps market participants to tailor their strategies, develop targeted products, and optimize distribution channels to effectively cater to the distinct needs of different end-users. The primary segmentation criteria typically include crop type, form, and application, each revealing critical trends and competitive landscapes that shape the overall market trajectory. By dissecting the market into these components, stakeholders can better analyze market share, identify fast-growing niches, and anticipate shifts in consumer preferences or regulatory environments, enabling more informed decision-making and strategic planning.

- By Crop Type

- Glufosinate-Tolerant Crops (e.g., Canola, Corn, Soybeans, Cotton)

- Non-Tolerant Crops (e.g., Fruits, Vegetables, Vines, Tree Nuts, Oil Palm)

- Cereals & Grains (e.g., Wheat, Rice, Barley)

- Oilseeds & Pulses (e.g., Rapeseed, Lentils, Sunflower)

- Specialty Crops (e.g., Sugar Beet, Ornamentals)

- By Form

- Liquid Formulations (e.g., Soluble Concentrates, Emulsifiable Concentrates)

- Dry Formulations (e.g., Water-Dispersible Granules, Soluble Powders)

- By Application

- Agricultural Uses (e.g., Pre-plant, Post-emergence, Desiccation)

- Non-Agricultural Uses (e.g., Industrial & Commercial Vegetation Management, Forestry, Aquatic Weed Control, Turf & Ornamentals)

- By Mode of Action

- Post-Emergence Herbicides

- Pre-Emergence Herbicides (limited, primarily in combination products)

- By Distribution Channel

- Direct Sales

- Distributors & Retailers

- Online Channels

Value Chain Analysis For Glufosinate Market

A comprehensive value chain analysis for the glufosinate market reveals a multi-layered process that begins with the sourcing of raw materials and extends all the way to the end-use application in agricultural and non-agricultural settings, encompassing upstream, midstream, and downstream activities. The upstream segment involves the procurement and processing of key chemical precursors and raw materials necessary for glufosinate synthesis. These typically include phosphorus trichloride, ammonia, formaldehyde, and various organic solvents, which are often sourced from specialized chemical manufacturers. The quality, availability, and cost stability of these raw materials are critical determinants of the overall production cost and efficiency of glufosinate manufacturers. Strong relationships with reliable suppliers, long-term contracts, and diversification of sourcing strategies are essential for manufacturers to mitigate supply chain risks and ensure a consistent supply of inputs. Innovation in the upstream segment, such as the development of more sustainable or cost-effective synthesis routes for these precursors, can significantly impact the overall competitiveness and environmental footprint of the glufosinate industry.

The midstream segment focuses on the intricate manufacturing and formulation processes of glufosinate-ammonium. This involves complex chemical synthesis reactions to produce the active ingredient, followed by its formulation into commercially viable products such as soluble concentrates or water-dispersible granules. Formulators often incorporate various adjuvants, surfactants, and inert ingredients to enhance the efficacy, stability, and handling characteristics of the final product. Research and development activities are paramount at this stage, focusing on improving the active ingredient's synthesis yield, developing advanced formulations that offer better weed control, reduced drift, and greater safety, and ensuring compliance with global regulatory standards for purity and composition. Large chemical companies with extensive R&D capabilities and sophisticated manufacturing infrastructure typically dominate this stage, leveraging proprietary technologies and economies of scale. The quality control and assurance processes implemented during manufacturing are crucial for ensuring product consistency and performance, which directly impacts farmer trust and market acceptance.

The downstream segment encompasses the distribution, marketing, and sales of glufosinate products to end-users, along with post-sales support and technical advisory services. Distribution channels are varied and include both direct sales models, where manufacturers sell directly to large agricultural cooperatives, industrial users, or government agencies, and indirect channels, which involve a network of regional distributors, wholesalers, and local agricultural retailers. The effectiveness of the distribution network is critical for market penetration, especially in diverse geographical regions with varying agricultural infrastructures. Marketing strategies focus on educating farmers and other users about the benefits of glufosinate, particularly its role in weed resistance management and its efficacy against glyphosate-resistant weeds. Technical support, including agronomic advice on application rates, timing, and integration into overall crop protection plans, is a vital component of the value proposition, ensuring optimal product performance and fostering customer loyalty. The entire value chain is characterized by a high degree of integration for major players, from raw material sourcing to direct sales, allowing for greater control over quality, cost, and market responsiveness, while smaller players may specialize in specific segments like formulation or regional distribution.

Glufosinate Market Potential Customers

The potential customers for glufosinate are primarily agricultural entities and land management organizations that require effective and broad-spectrum weed control solutions across various settings. At the forefront are commercial farmers, particularly those cultivating major row crops such as corn, soybeans, canola, and cotton, especially if they are growing glufosinate-tolerant varieties. These large-scale agricultural operations represent a significant portion of the market, driven by the need to maximize yields and manage herbicide-resistant weed populations, which pose a continuous threat to crop productivity. Farmers cultivating non-tolerant crops like fruits, vegetables, vines, and tree nuts also constitute a substantial customer base, where glufosinate is carefully applied as a directed spray for inter-row weed control, avoiding contact with the crop itself. The decision-making process for these farmers is influenced by factors such as product efficacy, cost-effectiveness, compatibility with existing farming practices, and local regulatory requirements, making robust technical support and accessible distribution crucial for market penetration and sustained usage.

Beyond individual commercial farmers, agricultural cooperatives and large agribusinesses represent another key customer segment. These entities often purchase glufosinate in bulk to supply their member farmers or to use across their extensive landholdings, benefiting from economies of scale and centralized procurement. Their purchasing decisions are often driven by strategic considerations, including product availability, integrated crop protection programs, and long-term supply agreements with manufacturers. Government agricultural agencies and research institutions also act as indirect customers, influencing market adoption through recommendations, research initiatives on weed management, and regulatory oversight that impacts product specifications and approved uses. These organizations play a vital role in disseminating information and promoting best practices, indirectly driving demand for effective herbicides like glufosinate by validating its utility in modern agricultural systems and supporting sustainable farming practices that incorporate its responsible use as part of a broader strategy to maintain agricultural output and minimize environmental impact.

In addition to agricultural applications, a diverse range of non-agricultural entities constitute a growing customer base for glufosinate. This includes industrial and commercial vegetation management companies responsible for maintaining clear rights-of-way along railway tracks, roadsides, utility lines, and industrial sites to prevent overgrowth that could pose safety hazards or hinder operations. Forestry companies utilize glufosinate for site preparation and conifer release applications, controlling competing vegetation to promote timber growth. Municipal and government bodies use it for weed control in public parks, recreational areas, and around infrastructure, balancing efficacy with public safety and environmental considerations. Furthermore, professional landscapers and turf management companies may use glufosinate in specific scenarios, particularly for spot treatments or renovation projects in non-crop areas. The unique needs of these varied customers, such as rapid action, residual control where necessary, and targeted application capabilities, drive demand for specialized glufosinate formulations and application technologies. The selection criteria for these non-agricultural users often emphasize safety for applicators and the public, environmental impact, and cost-effectiveness over large areas, making glufosinate an attractive option due to its broad-spectrum control and relatively favorable environmental profile compared to some older chemical alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 2.76 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, BASF SE, Syngenta AG, Nufarm Limited, UPL Limited, Corteva Agriscience, FMC Corporation, ADAMA Ltd., Sumitomo Chemical Co., Ltd., Lonza Group AG, Lier Chemical Co., Ltd., Jiangsu Lopal Technology Co., Ltd., Shandong Weifang Rainbow Chemical Co., Ltd., Beijing Nutrichem Co., Ltd., Zhejiang Wynca Chemical Group Co., Ltd., Qingdao Kexin Chemical Co., Ltd., Sichuan Leshan Fuhua Tongda Agro-Chemical Technology Co., Ltd., Anhui Fengle Agrochemical Co., Ltd., Sino-Agri United Biotechnology Co., Ltd., Hunan Haili Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glufosinate Market Key Technology Landscape

The glufosinate market's technological landscape is continuously evolving, driven by the need for enhanced efficacy, reduced environmental impact, improved user safety, and optimized production processes. One of the most significant technological advancements revolves around formulation chemistry. Modern glufosinate formulations are increasingly incorporating advanced adjuvant systems, which are substances added to enhance the herbicide's activity, such as improving spray droplet retention, increasing leaf penetration, or reducing drift. These innovative adjuvants contribute to more consistent weed control under diverse environmental conditions and allow for lower application rates of the active ingredient, thereby improving cost-effectiveness and minimizing chemical load on the environment. Additionally, encapsulation technologies are being explored to create controlled-release formulations, which can extend the herbicide's residual activity, reduce volatility, and offer greater flexibility in application timing, addressing specific agronomic challenges and enhancing product stability.

Another crucial technological aspect is the development and widespread adoption of glufosinate-tolerant crops through genetic engineering. Biotechnology companies have successfully introduced genes into staple crops like corn, soybeans, canola, and cotton, conferring resistance to glufosinate-ammonium. This technological breakthrough allows farmers to apply glufosinate post-emergence to control a broad spectrum of weeds without harming the crop, revolutionizing weed management strategies, especially in regions battling glyphosate-resistant weeds. Continued research in crop biotechnology aims to develop new glufosinate-tolerant varieties for other crops and to stack multiple herbicide tolerance traits, offering even greater flexibility and robustness in weed control programs. These genetically modified organisms (GMOs) are foundational to the sustained demand for glufosinate in large-scale agriculture, and ongoing innovation in this field directly underpins the market's growth and efficacy in addressing complex weed challenges.

Beyond product formulation and crop genetics, the glufosinate market is also benefiting from advancements in precision agriculture technologies. The integration of geospatial data, remote sensing (e.g., drone and satellite imagery), and variable rate application equipment enables highly targeted and site-specific glufosinate application. These technologies allow farmers to identify weed hotspots within a field and apply the herbicide only where and when needed, optimizing resource use, reducing chemical runoff, and improving overall farm sustainability. Robotics and autonomous farming equipment equipped with advanced sensors and AI algorithms are also emerging, capable of differentiating between crops and weeds to facilitate highly precise spot spraying, further minimizing glufosinate usage while maximizing efficacy. Furthermore, process optimization technologies in glufosinate manufacturing, such as continuous flow synthesis and advanced catalytic processes, aim to improve production efficiency, reduce waste, and lower energy consumption, contributing to more sustainable and cost-effective production of the active ingredient. These interconnected technological advancements are collectively driving the glufosinate market towards greater efficiency, sustainability, and adaptability in the face of evolving agricultural demands and environmental pressures.

Regional Highlights

- Asia Pacific: This region stands as the largest and fastest-growing market for glufosinate, primarily driven by extensive agricultural land, increasing population pressure necessitating higher food production, and the rapid adoption of modern farming practices. Countries like China, India, and Southeast Asian nations are significant contributors, propelled by the rising incidence of glyphosate-resistant weeds and the widespread cultivation of glufosinate-tolerant crops, especially in major commodity markets. Governmental support for agricultural modernization and the presence of numerous domestic manufacturers also fuel market expansion, making it a critical hub for both production and consumption.

- North America: A mature yet highly significant market, North America, particularly the United States and Canada, showcases strong demand for glufosinate. This is largely due to the widespread adoption of large-scale farming operations, advanced agricultural technologies, and the severe challenges posed by glyphosate-resistant weeds, which have pushed farmers to seek alternative control methods. The robust infrastructure for genetically modified crops tolerant to glufosinate further underpins its market dominance, ensuring sustained usage in corn, soybean, and cotton production.

- Europe: The European market for glufosinate is characterized by stringent regulatory landscapes and a strong emphasis on sustainable agriculture and environmental protection. While demand exists, particularly in countries with significant agricultural sectors, market growth is often tempered by regulatory hurdles, including restrictions on certain active ingredients and a push towards integrated pest management (IPM) strategies. This environment fosters innovation in safer, more environmentally friendly formulations and careful stewardship practices, influencing product development and market access.

- Latin America: This region presents a market with significant growth potential, driven by vast agricultural lands in countries such as Brazil and Argentina, which are major global producers of soybeans, corn, and other crops. The increasing adoption of modern farming techniques, expanding cultivation of glufosinate-tolerant crops, and the escalating challenge of herbicide resistance contribute to the rising demand for effective weed control solutions. Economic development and investments in agricultural infrastructure further support the expansion of the glufosinate market in this dynamic region.

- Middle East and Africa (MEA): While currently a smaller market compared to other regions, MEA is anticipated to exhibit gradual growth due to efforts to enhance food security, modernize agricultural practices, and expand arable land under cultivation. Countries in this region are increasingly adopting advanced crop protection solutions to improve yields and combat weed infestations. The growing awareness about efficient farm management and the introduction of new crop varieties are expected to drive the glufosinate market forward, albeit at a more measured pace.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glufosinate Market.- Bayer AG

- BASF SE

- Syngenta AG

- Nufarm Limited

- UPL Limited

- Corteva Agriscience

- FMC Corporation

- ADAMA Ltd.

- Sumitomo Chemical Co., Ltd.

- Lonza Group AG

- Lier Chemical Co., Ltd.

- Jiangsu Lopal Technology Co., Ltd.

- Shandong Weifang Rainbow Chemical Co., Ltd.

- Beijing Nutrichem Co., Ltd.

- Zhejiang Wynca Chemical Group Co., Ltd.

- Qingdao Kexin Chemical Co., Ltd.

- Sichuan Leshan Fuhua Tongda Agro-Chemical Technology Co., Ltd.

- Anhui Fengle Agrochemical Co., Ltd.

- Sino-Agri United Biotechnology Co., Ltd.

- Hunan Haili Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Glufosinate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is glufosinate and how does it work as a herbicide?

Glufosinate-ammonium is a broad-spectrum, non-selective contact herbicide that effectively controls a wide range of annual and perennial grasses and broadleaf weeds. Its unique mode of action involves inhibiting the glutamine synthetase enzyme in plants, which is crucial for nitrogen metabolism. This inhibition leads to a rapid accumulation of toxic levels of ammonia within plant cells, disrupting photosynthesis and causing rapid desiccation and death of the plant. Unlike systemic herbicides, glufosinate has limited translocation within the plant, making it effective for post-emergence application on actively growing weeds, particularly in glufosinate-tolerant crops or as a directed spray in non-tolerant crops.

Why is glufosinate gaining importance in agricultural weed management?

Glufosinate is gaining significant importance primarily due to the increasing prevalence of herbicide-resistant weeds, especially those resistant to glyphosate, which was once the most widely used herbicide. As weeds develop resistance to multiple modes of action, glufosinate offers a crucial alternative with a different biochemical target, making it a valuable tool in integrated weed management strategies. It helps farmers rotate herbicides to prevent or manage resistance, ensuring sustainable crop production and maintaining high yields in the face of evolving weed challenges. Its efficacy in glufosinate-tolerant crops also makes it a cornerstone for efficient and flexible weed control in modern agriculture.

What are the primary applications of glufosinate in both agricultural and non-agricultural sectors?

In the agricultural sector, glufosinate is extensively used for weed control in glufosinate-tolerant crops such as corn, soybeans, canola, and cotton, where it provides effective post-emergence weed management without harming the genetically modified crop. It is also used as a directed spray in non-tolerant crops like fruits, vines, nuts, and vegetables. Additionally, it serves as a desiccant in some crops prior to harvest and for burndown applications before planting. In non-agricultural sectors, glufosinate is applied for total vegetation control along railway lines, roadsides, industrial sites, and in forestry for site preparation and conifer release, demonstrating its versatility in various land management contexts where broad-spectrum weed eradication is required for safety or maintenance purposes.

What are the main regulatory and environmental considerations associated with glufosinate use?

Glufosinate use is subject to varying regulatory scrutiny globally, with concerns primarily centered on its potential environmental impact and residue levels in food. Regulators assess its toxicity to non-target organisms, persistence in soil and water, and potential for off-target movement (drift). Strict application guidelines, pre-harvest intervals, and maximum residue limits (MRLs) are established to ensure product safety and minimize environmental risks. While glufosinate generally has a relatively short soil half-life, ensuring responsible application practices and adherence to local regulations is crucial for maintaining its market acceptance and demonstrating environmental stewardship. Continued research into even safer formulations and sustainable application methods is ongoing to address these considerations.

How do glufosinate-tolerant crops contribute to the market's growth and efficacy?

Glufosinate-tolerant crops are a fundamental driver of the glufosinate market's growth and efficacy because they allow for the safe and effective application of the herbicide directly over the crop, providing excellent post-emergence weed control. This genetic modification enables farmers to manage weeds that emerge after planting without harming the desirable crop. This technology provides farmers with greater flexibility in weed management timing, helps control a broader spectrum of weeds, and is particularly valuable in combating glyphosate-resistant weeds by offering an alternative mode of action. The widespread adoption of these genetically modified crops, especially in major agricultural regions, directly translates to increased demand and sustained usage of glufosinate, bolstering its market position.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Glufosinate Market Size Report By Type (95%TC, 50%TK), By Application (Herbicide, Insecticides and fungicides, GM crops, Desiccant), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Glufosinate Market Statistics 2025 Analysis By Application (Herbicide, Insecticides and fungicides, GM crops, Desiccant), By Type (95%TC, 50%TK), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Glufosinate Ammonium Market Statistics 2025 Analysis By Application (Herbicide, Insecticides and Fungicides, GM Crops, Desiccant), By Type (95%TC, 50%TK), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager