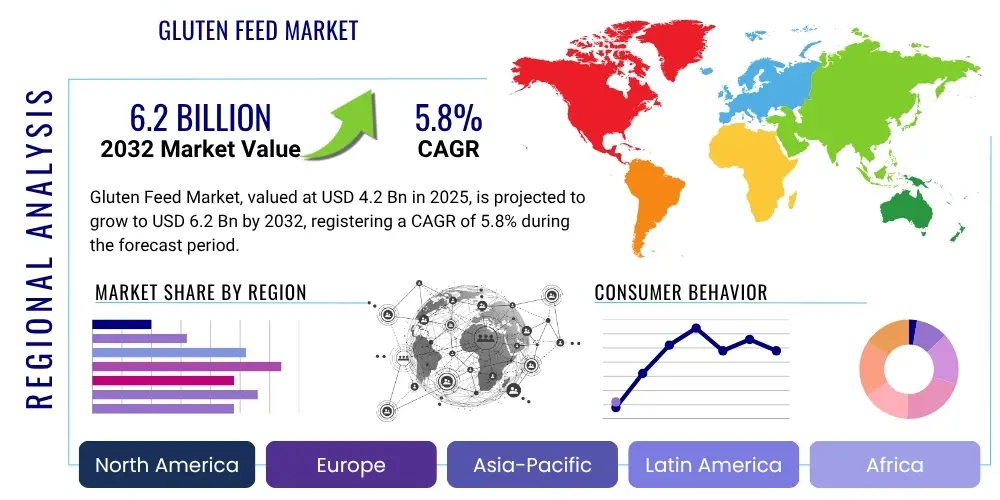

Gluten Feed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430783 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Gluten Feed Market Size

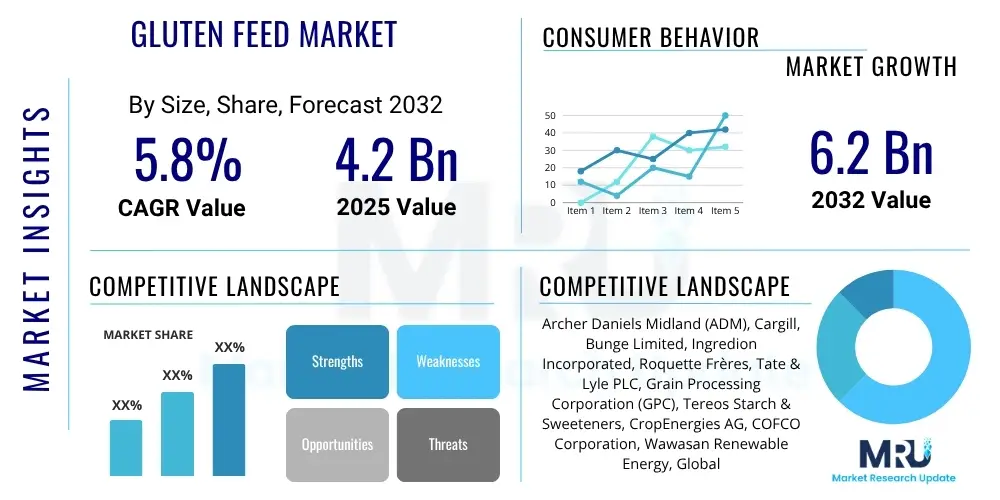

The Gluten Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 4.2 Billion in 2025 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2032.

Gluten Feed Market introduction

The Gluten Feed Market encompasses the production and distribution of a valuable co-product derived from the corn wet-milling process, primarily utilized as a high-energy and protein-rich ingredient in animal feed. This market is intrinsically linked to the global corn processing industry, as gluten feed is separated during the starch extraction process, alongside other co-products such as corn gluten meal and corn germ. Its nutritional profile, characterized by significant crude protein, fiber, and digestible energy content, makes it an attractive and cost-effective component for various livestock diets, offering a sustainable solution for animal nutrition while maximizing the value of agricultural by-products.

The primary product, corn gluten feed, is typically available in both wet and dry forms, catering to diverse feed manufacturing and livestock farming needs. Wet gluten feed, with its higher moisture content, is often used by feedlots located close to wet-milling plants, offering a palatable and economical option. Dry gluten feed, being more concentrated and stable, is preferred for long-distance transport and inclusion in commercial feed formulations, ensuring extended shelf life and ease of handling. This versatility in form enables its broad application across the animal agriculture sector, supporting various feeding strategies and supply chain requirements.

Major applications for gluten feed include its integration into diets for ruminants, such as dairy and beef cattle, where its high fiber and protein content contribute to milk production and weight gain. It is also increasingly used in poultry and swine diets as a supplemental protein and energy source, though often in smaller proportions due to specific dietary requirements of these monogastric animals. The benefits of gluten feed extend beyond its nutritional value, offering economic advantages by reducing reliance on more expensive feed ingredients like soybean meal, thereby improving the overall cost-efficiency of animal production. Key driving factors for market growth include the escalating global demand for meat and dairy products, the continuous expansion of the corn wet-milling industry, and the growing emphasis on utilizing agricultural by-products to enhance sustainability in animal farming.

Gluten Feed Market Executive Summary

The Gluten Feed Market demonstrates robust growth, propelled by the rising global demand for animal protein and the continuous expansion of corn processing capacities. Key business trends include strategic collaborations among feed manufacturers and corn processors, a push towards product differentiation through enhanced nutritional profiles, and increased investment in processing technologies to improve efficiency and reduce environmental footprint. Companies are increasingly focused on optimizing supply chains to manage transportation costs and enhance regional market penetration. Furthermore, there is a growing interest in developing sustainable sourcing strategies and adhering to stringent quality and safety standards to build consumer trust and meet evolving regulatory requirements across various regions.

Regionally, Asia Pacific stands out as the fastest-growing market, driven by rapidly expanding livestock populations and rising disposable incomes leading to higher meat and dairy consumption, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, continue to represent significant shares, characterized by advanced animal agriculture practices, technological adoption, and a strong emphasis on feed quality and safety regulations. Latin America is also emerging as a key growth region, supported by its strong agricultural base and increasing demand for animal feed ingredients. These regional dynamics are influencing investment patterns and market expansion strategies for global players seeking to capitalize on diverse growth opportunities.

Segmentation trends highlight the dominance of ruminant feed applications, particularly for dairy and beef cattle, attributed to gluten feed's suitability as a protein and energy source for these animals. The dry gluten feed segment is projected to maintain a larger market share due to its advantages in storage, transport, and integration into commercial feed formulations, although wet gluten feed continues to be a cost-effective option for localized use. The market is also experiencing shifts towards tailored feed solutions, with an increasing focus on developing gluten feed products that cater to the specific nutritional requirements of different animal species and life stages, thereby enhancing feed efficiency and animal performance across various livestock sectors.

AI Impact Analysis on Gluten Feed Market

User inquiries regarding AI's influence on the Gluten Feed Market frequently center on its potential to revolutionize supply chain management, optimize feed formulations, and enhance operational efficiencies within the corn wet-milling industry. Common questions explore how AI can predict ingredient demand and pricing fluctuations, improve quality control processes for gluten feed, and contribute to more sustainable production practices. Users are keen to understand the practical applications of AI in reducing waste, increasing yield, and fostering greater transparency throughout the feed value chain, ultimately addressing concerns about cost-effectiveness, environmental impact, and product consistency in a highly competitive market.

- Precision Nutrition Optimization: AI algorithms analyze vast datasets of animal health, growth rates, and ingredient availability to formulate optimal gluten feed inclusion levels, enhancing animal performance and reducing feed waste.

- Predictive Demand Forecasting: AI models forecast market demand for gluten feed based on livestock population trends, seasonal variations, and economic indicators, enabling producers to optimize production schedules and inventory management.

- Supply Chain Efficiency: AI-driven logistics and routing systems streamline the transportation of corn and finished gluten feed, minimizing transit times, fuel consumption, and associated costs.

- Quality Control and Assurance: AI-powered sensors and imaging systems monitor the quality and consistency of gluten feed during production, detecting contaminants or deviations from specifications in real-time to ensure product integrity.

- Operational Cost Reduction: AI optimizes energy consumption in wet-milling and drying processes, identifies maintenance needs for machinery, and automates routine tasks, leading to significant cost savings and improved resource utilization.

- Sustainability Enhancement: AI contributes to reducing the environmental footprint by optimizing resource use, minimizing waste generation, and providing insights for developing more eco-friendly production methods for gluten feed.

DRO & Impact Forces Of Gluten Feed Market

The Gluten Feed Market is primarily driven by the escalating global demand for animal protein, fueled by population growth and rising per capita consumption of meat, dairy, and eggs, particularly in developing economies. This surge in demand necessitates a continuous increase in livestock production, subsequently boosting the need for cost-effective and nutritious animal feed ingredients like gluten feed. Additionally, the inherent advantages of gluten feed, such as its high digestible energy and protein content, combined with its availability as a co-product of the robust corn wet-milling industry, position it as an economically viable alternative to other feed components, further propelling its market expansion. The growing focus on sustainable agricultural practices also favors gluten feed, as it effectively repurposes a significant industrial by-product, contributing to a circular economy model within the food and feed sectors.

Despite strong growth drivers, the market faces several restraints. The price volatility of corn, the primary raw material, significantly impacts the production costs and ultimately the market price of gluten feed, creating uncertainty for both producers and buyers. Competition from alternative feed ingredients, such as soybean meal, distiller's dried grains with solubles (DDGS), and other grain by-products, presents a constant challenge, as end-users continuously evaluate the most cost-effective nutritional options. Furthermore, stringent regulatory frameworks concerning animal feed safety, origin, and nutritional claims in various regions can impose complex compliance requirements on manufacturers, potentially hindering market entry or expansion for some players.

Opportunities for growth in the Gluten Feed Market are abundant, particularly in emerging economies where the livestock industry is rapidly modernizing and expanding. These regions offer significant untapped potential for market penetration and increased consumption. Innovation in feed formulation, focusing on developing specialized gluten feed products tailored for specific animal types or life stages, presents a pathway for value addition and market differentiation. Moreover, the increasing adoption of sustainable and circular economy principles globally creates a fertile ground for promoting gluten feed as an environmentally responsible feed ingredient, aligning with broader industry trends towards resource efficiency and waste reduction. Technological advancements in processing and quality assurance also offer avenues for improving product consistency and broadening applications.

Segmentation Analysis

The Gluten Feed Market is comprehensively segmented across various parameters to provide a detailed understanding of its dynamics and potential growth trajectories. These segmentations allow for a granular analysis of market trends, consumer preferences, and regional contributions, aiding stakeholders in strategic decision-making. The primary segmentation criteria typically include animal type, which reflects the diverse applications of gluten feed across different livestock categories, and the form in which gluten feed is traded, accounting for differences in handling, storage, and nutritional density.

- By Animal Type

- Ruminants

- Dairy Cattle

- Beef Cattle

- Poultry

- Broilers

- Layers

- Swine

- Aquaculture

- Others (e.g., Sheep, Goats)

- Ruminants

- By Form

- Wet Gluten Feed

- Dry Gluten Feed

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Gluten Feed Market

The value chain for the Gluten Feed Market begins with upstream activities centered on the cultivation and procurement of corn, the primary raw material. This involves farmers, agricultural cooperatives, and grain trading companies that supply corn to wet-milling facilities. The quality and availability of corn directly influence the efficiency and output of gluten feed production. Wet-milling processors, at the core of the value chain, convert corn into various products, with gluten feed being a significant co-product alongside starch, sweeteners, and corn oil. Their technological capabilities and operational scale dictate the cost-effectiveness and consistency of the gluten feed produced.

Downstream activities involve the distribution and utilization of gluten feed by end-users. After processing, gluten feed, in both wet and dry forms, is transported to animal feed manufacturers, livestock farms (including dairy, beef, poultry, and swine operations), and aquaculture facilities. These end-users incorporate gluten feed into balanced diets to meet the nutritional requirements of their animals. The effectiveness of gluten feed in animal nutrition, coupled with its economic advantages, determines its demand and adoption rates across the animal agriculture sector. Continuous research into optimal feed formulations also plays a role in enhancing its value downstream.

Distribution channels for gluten feed are diverse, encompassing both direct and indirect routes. Direct distribution often occurs when large wet-milling processors supply directly to major animal feed manufacturers or large-scale integrated livestock operations, fostering long-term contractual relationships. Indirect distribution involves a network of brokers, distributors, and wholesalers who facilitate the trade of gluten feed, particularly for smaller farms or feed mills that require smaller volumes or specialized logistics. The efficiency of these distribution networks is crucial for timely delivery, cost management, and maintaining the quality of the product, ensuring that gluten feed reaches its diverse customer base efficiently and economically across different geographical regions.

Gluten Feed Market Potential Customers

Potential customers for gluten feed primarily comprise entities within the animal agriculture sector seeking cost-effective and nutritionally beneficial ingredients for livestock and aquaculture diets. The largest segment of end-users includes large-scale commercial animal feed manufacturers who formulate and produce a wide range of compound feeds for various species. These manufacturers value gluten feed for its consistent quality, high protein and energy content, and its ability to act as a partial substitute for more expensive protein sources, thereby optimizing feed costs without compromising nutritional value.

Another significant customer base consists of integrated livestock operations, including extensive dairy farms, beef feedlots, poultry integrators (broiler and layer farms), and swine production facilities. These operations often possess the infrastructure to handle bulk feed ingredients and formulate their own diets, making direct procurement of gluten feed an attractive option. They utilize gluten feed to enhance the protein and fiber content of their animals' diets, contributing to improved growth rates, milk production, and overall animal health, particularly for ruminants where its fibrous nature is highly beneficial for rumen function.

Furthermore, the aquaculture sector, though a smaller consumer compared to terrestrial livestock, represents a growing segment of potential customers, particularly for species requiring high protein diets. Specialty feed producers focusing on organic or non-GMO feeds may also consider gluten feed that meets specific certification standards. Distributors and traders specializing in agricultural commodities also act as crucial intermediaries, purchasing from wet-milling plants and supplying to a fragmented market of smaller farms and localized feed mills, thus expanding the reach of gluten feed to a broader spectrum of end-users globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.2 Billion |

| Market Forecast in 2032 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Archer Daniels Midland (ADM), Cargill, Bunge Limited, Ingredion Incorporated, Roquette Frères, Tate & Lyle PLC, Grain Processing Corporation (GPC), Tereos Starch & Sweeteners, CropEnergies AG, COFCO Corporation, Wawasan Renewable Energy, Global Bio-Chem Technology Group, Vanhon Group, Futian Group, Qingdao Shengda Commercial Co., Ltd., Agrana Starch GmbH, GLG Canada, Shandong Feicheng Jintai Corn Co., Ltd., Henan Jindan Lactic Acid Technology Co., Ltd., Anyang Sunshine Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gluten Feed Market Key Technology Landscape

The key technology landscape for the Gluten Feed Market is deeply intertwined with advancements in corn wet-milling processes, which are fundamental to its production. Modern wet-milling plants utilize sophisticated separation technologies, including centrifuges, hydrocyclones, and filtration systems, to efficiently extract starch, germ, fiber, and protein components from corn kernels. Continuous improvements in these mechanical and chemical processes aim to maximize yields of all co-products, including gluten feed, while minimizing waste and energy consumption. Furthermore, advanced analytical techniques, such as Near-Infrared (NIR) spectroscopy, are increasingly deployed to rapidly assess the nutritional composition and quality of gluten feed, ensuring product consistency and adherence to specifications for feed manufacturers.

Beyond the primary processing, technologies related to drying and storage are critical for producing high-quality dry gluten feed, which accounts for a substantial portion of the market. Energy-efficient drying technologies, such as rotary drum dryers and flash dryers, are employed to reduce the moisture content of wet gluten feed, converting it into a stable, transportable, and shelf-stable product. Innovations in drying aim to preserve the nutritional integrity of the feed while lowering operational costs and environmental impact. Automated material handling systems and advanced storage solutions further contribute to maintaining product quality and optimizing supply chain logistics.

The broader technological landscape impacting the gluten feed market also includes developments in animal nutrition and feed formulation software. Precision feeding technologies leverage data analytics and sophisticated algorithms to optimize the inclusion rates of various ingredients, including gluten feed, in animal diets. These software solutions consider factors such as animal age, breed, physiological state, and desired growth performance, allowing feed producers to create highly tailored and efficient formulations. Biotechnological advancements in corn varieties that offer improved processing characteristics or enhanced nutrient profiles also indirectly influence the quality and availability of gluten feed, pushing the industry towards more efficient and sustainable production practices.

Regional Highlights

- North America: This region represents a mature and significant market for gluten feed, driven by a well-established and technologically advanced livestock industry, particularly in dairy and beef production. The presence of major corn wet-milling facilities and large animal feed manufacturers, especially in the United States, ensures a consistent supply and demand. Stringent feed quality standards and a focus on sustainable agricultural practices also influence product development and market dynamics in the region.

- Europe: The European market for gluten feed is characterized by strict regulatory frameworks concerning animal feed safety, environmental sustainability, and animal welfare. While livestock production is substantial, there's a growing emphasis on alternative protein sources and traceability. Innovation in feed formulation and a strong demand for high-quality, traceable ingredients contribute to a stable yet evolving market for gluten feed, with significant consumption in countries like the Netherlands, France, and Germany.

- Asia Pacific (APAC): The APAC region stands out as the fastest-growing market globally for gluten feed, primarily propelled by rapid economic development, increasing populations, and a significant rise in meat and dairy consumption. Countries such as China, India, and Southeast Asian nations are witnessing substantial expansion in their livestock and aquaculture sectors. This growth, coupled with the increasing adoption of commercial feed, drives robust demand for cost-effective and nutritious ingredients like gluten feed.

- Latin America: This region presents substantial growth opportunities, attributed to its vast agricultural resources and a burgeoning livestock industry, particularly in countries like Brazil and Argentina, which are major producers of beef and poultry. The increasing modernization of animal farming practices and a rising awareness of balanced nutrition for livestock contribute to the expanding demand for gluten feed as an efficient protein and energy source.

- Middle East and Africa (MEA): The MEA region is an emerging market for gluten feed, with growth driven by efforts to enhance domestic food security and reduce reliance on imported meat and dairy products. Investments in livestock farming and feed production facilities are increasing, creating new demand avenues. However, challenges related to water scarcity, climate, and geopolitical instability can influence market development and trade flows in certain areas within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gluten Feed Market.- Archer Daniels Midland (ADM)

- Cargill, Incorporated

- Bunge Limited

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Grain Processing Corporation (GPC)

- Tereos Starch & Sweeteners

- CropEnergies AG

- COFCO Corporation

- Wawasan Renewable Energy Berhad

- Global Bio-Chem Technology Group Company Limited

- Vanhon Group

- Futian Group

- Qingdao Shengda Commercial Co., Ltd.

- Agrana Starch GmbH

- GLG Canada

- Shandong Feicheng Jintai Corn Co., Ltd.

- Henan Jindan Lactic Acid Technology Co., Ltd.

- Anyang Sunshine Group Co., Ltd.

Frequently Asked Questions

What is gluten feed and its primary purpose?

Gluten feed is a valuable co-product of the corn wet-milling industry, primarily composed of corn bran, corn germ meal, and steep liquor. Its main purpose is to serve as a high-energy and protein-rich ingredient in animal feed formulations, providing essential nutrients for various types of livestock.

Which animal types are the main consumers of gluten feed?

The main consumers of gluten feed are ruminants, particularly dairy and beef cattle, due to its beneficial blend of digestible protein and fiber for rumen health. It is also utilized in diets for poultry, swine, and increasingly, in aquaculture, albeit typically in smaller proportions.

What factors are driving the growth of the global gluten feed market?

The primary factors driving market growth include the increasing global demand for meat, dairy, and egg products, the continuous expansion of the corn wet-milling industry, and the economic advantages of using gluten feed as a cost-effective alternative to more expensive feed ingredients.

What are the key challenges faced by the gluten feed market?

Key challenges include the volatility of corn prices, which directly impacts production costs, competition from alternative feed ingredients like soybean meal and DDGS, and the need to comply with evolving stringent regulatory standards for animal feed safety and composition.

Which region currently holds the largest share in the gluten feed market?

North America currently holds a significant share in the gluten feed market due to its mature livestock industry and extensive corn processing infrastructure. However, the Asia Pacific region is rapidly expanding and is projected to exhibit the fastest growth over the forecast period, driven by surging animal protein demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager