Glycinates Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428311 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Glycinates Market Size

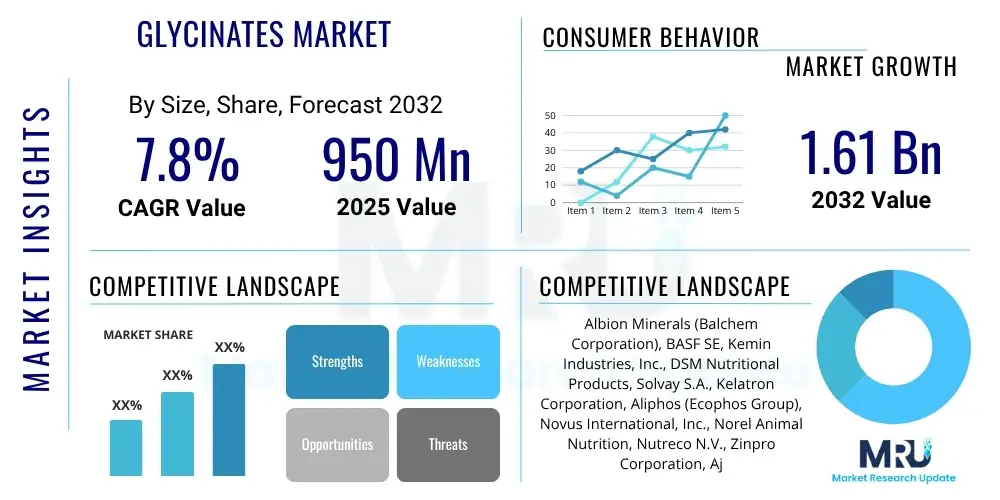

The Glycinates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 950 million in 2025 and is projected to reach USD 1.61 billion by the end of the forecast period in 2032.

Glycinates Market introduction

The Glycinates Market encompasses the production and distribution of mineral chelates where essential trace minerals like zinc, iron, copper, magnesium, and manganese are bound to glycine, the smallest amino acid. This unique chelation process significantly enhances the bioavailability and absorption of these minerals in both human and animal digestive systems compared to their inorganic counterparts, which often suffer from poor absorption and potential adverse reactions. Glycinates are recognized for their superior stability and gentler impact on the gastrointestinal tract, making them a preferred choice for fortification and supplementation across various industries.

The primary applications of glycinates span human nutrition, animal nutrition, pharmaceuticals, and food & beverages. In human nutrition, they are extensively used in dietary supplements, fortified foods, and infant formulas to address mineral deficiencies and promote overall health due to their high absorption rates and reduced interference with other nutrients. For animal nutrition, glycinates are crucial in animal feed formulations for poultry, swine, ruminants, and aquaculture, contributing to improved growth rates, enhanced immunity, better reproductive performance, and overall animal welfare. The benefits of glycinates include superior absorption, reduced dosage requirements, minimal digestive upset, and enhanced efficacy in preventing and treating mineral deficiencies.

Driving factors for the glycinates market include a global increase in health awareness, leading to higher demand for effective and bioavailable nutritional supplements. The expanding animal feed industry, driven by rising meat and dairy consumption, is also a significant catalyst, as producers seek ways to optimize animal health and productivity. Furthermore, the growing trend towards functional foods and personalized nutrition, coupled with scientific advancements validating the efficacy of amino acid chelates, are propelling market expansion. Regulatory support for the use of chelated minerals in various applications also plays a crucial role in fostering market growth.

Glycinates Market Executive Summary

The Glycinates Market is experiencing robust growth, driven primarily by the escalating demand for highly bioavailable mineral supplements in both human and animal nutrition. Key business trends indicate a strong focus on research and development to innovate new chelation technologies, expand application areas, and improve production efficiencies. Consolidation through mergers and acquisitions is also observable as major players aim to strengthen their market presence and product portfolios, while sustainability initiatives are gaining traction as consumers and regulators increasingly prioritize environmentally friendly manufacturing processes and ethically sourced ingredients across the value chain. Strategic partnerships between raw material suppliers and end-product manufacturers are also common to ensure a stable supply chain and foster collaborative innovation within the market landscape.

From a regional perspective, Asia Pacific is emerging as the fastest-growing market for glycinates, propelled by rapid urbanization, increasing disposable incomes, and the expansion of the livestock industry, particularly in countries like China and India. North America and Europe represent mature yet stable markets, characterized by high consumer awareness regarding health and wellness, stringent quality standards, and a robust nutraceutical industry. Latin America and the Middle East & Africa are showing promising growth, attributed to improving healthcare infrastructure, rising demand for fortified foods, and a growing emphasis on animal health and productivity in these regions. These diverse regional dynamics create a competitive landscape where manufacturers must adapt their strategies to cater to varied local needs and regulatory environments.

Segmentation trends highlight the continued dominance of animal nutrition applications, where glycinates are vital for optimizing feed efficiency and animal performance, though human nutrition is projected to witness the most rapid growth due to increasing consumer expenditure on health supplements and functional foods. Zinc glycinate and iron glycinate remain the leading product types due to the widespread prevalence of zinc and iron deficiencies globally, while magnesium glycinate is gaining significant traction for its benefits in muscle function and stress reduction. The market is also seeing a shift towards personalized nutrition solutions, driving demand for specialized glycinate formulations tailored to specific health needs. Powder form glycinates continue to hold the largest market share owing to their ease of handling, stability, and widespread use in both dry feed and supplement formulations.

AI Impact Analysis on Glycinates Market

Common user questions regarding AI's impact on the Glycinates Market often revolve around how artificial intelligence can enhance production efficiency, improve product quality, optimize supply chain logistics, and contribute to the development of novel formulations. Users are keen to understand if AI can accelerate research and development processes for new glycinate compounds, predict market trends more accurately, or even personalize nutritional recommendations based on genetic data. Concerns typically include the ethical implications of data privacy, potential job displacement due to automation, and the high initial investment required for AI implementation. Overall, the key themes indicate a strong expectation for AI to bring precision, efficiency, and innovation to the glycinates industry, making products more accessible and effective.

- Enhanced R&D: AI can accelerate the discovery and optimization of new glycinate formulations by simulating molecular interactions, predicting bioavailability, and streamlining experimental design, significantly reducing time-to-market for innovative products.

- Optimized Supply Chain Management: Predictive analytics powered by AI can forecast demand with greater accuracy, optimize inventory levels, manage logistics, and identify potential disruptions in the supply chain for raw materials and finished glycinates, ensuring operational efficiency and cost savings.

- Improved Quality Control: AI-driven vision systems and sensors can monitor production processes in real-time, detecting impurities, inconsistencies, or deviations from quality standards much faster and more accurately than human inspection, leading to higher product purity and safety.

- Personalized Nutrition: AI algorithms can analyze vast datasets of consumer health information, genetic predispositions, and dietary habits to recommend specific glycinate supplements tailored to individual nutritional needs, fostering the growth of the personalized nutrition segment.

- Precision Farming & Animal Nutrition: AI can be integrated into animal feed formulation software to optimize glycinate dosages based on animal age, weight, breed, and environmental conditions, maximizing feed efficiency and animal health outcomes in livestock farming.

- Market Trend Prediction: Machine learning models can analyze market data, consumer behavior, and scientific literature to identify emerging trends, predict future demand for specific glycinates, and inform strategic business decisions for manufacturers.

- Automated Production Processes: Robotics and automation, often integrated with AI, can handle repetitive and precise tasks in glycinate manufacturing, leading to increased output, reduced labor costs, and improved consistency in production quality.

- Data-Driven Marketing & Sales: AI tools can segment customer bases, analyze purchasing patterns, and predict consumer preferences, enabling more targeted marketing campaigns and personalized sales strategies for glycinate products.

DRO & Impact Forces Of Glycinates Market

The Glycinates Market is significantly propelled by several key drivers, primarily the increasing global awareness regarding health and wellness, which translates into a higher demand for efficacious and highly bioavailable nutritional supplements. Consumers are increasingly seeking natural and easily absorbable forms of minerals to address deficiencies and improve overall well-being, driving the adoption of glycinates in dietary supplements and fortified foods. Concurrently, the robust expansion of the animal feed industry, driven by a growing global population and rising meat consumption, necessitates superior quality feed additives to enhance animal health, growth rates, and productivity, for which glycinates are an ideal solution due to their proven efficacy and safety profile. Furthermore, ongoing scientific research validating the superior absorption and physiological benefits of glycinates over traditional inorganic mineral salts continues to fuel their market penetration across diverse applications, cementing their position as a preferred mineral source.

Despite the strong growth drivers, the glycinates market faces notable restraints. The relatively higher production cost of glycinates compared to conventional inorganic mineral salts poses a significant challenge, particularly in price-sensitive markets where cost-effectiveness often dictates purchasing decisions for manufacturers and consumers alike. This cost differential can limit widespread adoption, especially in developing regions. Moreover, the stringent and often varied regulatory landscapes across different countries and regions present complex hurdles for market players. Obtaining approvals, adhering to specific dosage limits, and complying with labeling requirements can be time-consuming and costly, potentially delaying market entry for new products and innovations. The availability of alternative mineral forms, albeit with lower bioavailability, also creates competitive pressure, as these alternatives often offer a more economical option, influencing the purchasing choices of budget-constrained consumers or businesses.

Opportunities within the glycinates market are vast and multifaceted, including the burgeoning demand for personalized nutrition, where AI and genetic analysis can tailor specific glycinate supplement regimens to individual needs, opening entirely new market avenues. Emerging economies in Asia Pacific and Latin America, characterized by rising disposable incomes, increasing health consciousness, and expanding industrial bases, offer significant untapped market potential for glycinate products in both human and animal nutrition. Technological advancements in chelation processes, such as novel manufacturing techniques that improve purity, stability, and cost-effectiveness, are continuously creating new possibilities for product innovation and market differentiation. Additionally, the exploration of novel applications beyond traditional uses, such as in cosmetics, sports nutrition, and specialized medical foods, presents exciting growth prospects for manufacturers willing to invest in research and development, broadening the market scope for glycinates considerably.

Segmentation Analysis

The Glycinates Market is broadly segmented based on type, application, and form, reflecting the diverse range of products and end-uses within the industry. This segmentation provides a granular view of the market dynamics, allowing for a detailed analysis of growth trends, competitive landscapes, and consumer preferences across various categories. Understanding these segments is crucial for stakeholders to identify key growth areas, develop targeted strategies, and innovate effectively to meet evolving market demands, ranging from specific mineral deficiencies to broad nutritional fortification needs across different sectors.

- By Type:

- Zinc Glycinate

- Iron Glycinate

- Copper Glycinate

- Manganese Glycinate

- Magnesium Glycinate

- Calcium Glycinate

- Others (e.g., Chromium Glycinate, Molybdenum Glycinate)

- By Application:

- Animal Nutrition

- Poultry

- Swine

- Ruminants

- Aquaculture

- Companion Animals

- Human Nutrition

- Dietary Supplements

- Fortified Foods

- Pharmaceuticals

- Infant Formula

- Pharmaceuticals

- Food & Beverages

- Personal Care

- Animal Nutrition

- By Form:

- Powder

- Liquid

Value Chain Analysis For Glycinates Market

The value chain for the Glycinates Market begins with the upstream analysis, which involves the sourcing and production of critical raw materials. This primarily includes amino acids, predominantly glycine, which can be synthesized or sourced from fermentation processes, and various metal salts such as zinc sulfate, ferrous sulfate, cupric chloride, and magnesium carbonate. Key suppliers in this stage are chemical manufacturers and producers of amino acids, whose quality and cost efficiency directly impact the final product. Maintaining stable relationships with reliable raw material suppliers is crucial to ensure consistent quality and mitigate supply chain risks, as fluctuations in raw material prices can significantly affect the overall production cost of glycinates. These foundational materials then undergo precise chelation processes to form the stable glycinate complexes.

Following the manufacturing process, the downstream analysis focuses on the distribution and end-use applications of glycinates. Manufacturers convert raw glycinates into various forms, such as powders or liquids, and may also engage in further formulation for specific applications. These products are then distributed through a multifaceted channel network. The distribution channel involves both direct and indirect routes. Direct distribution typically involves manufacturers selling directly to large-scale industrial customers, such as major animal feed producers, nutraceutical companies, or pharmaceutical firms, often through dedicated sales teams and bulk shipments. This approach allows for closer customer relationships, customized solutions, and often better control over pricing and delivery.

Indirect distribution involves leveraging a network of third-party distributors, wholesalers, and retailers. These intermediaries play a vital role in reaching smaller customers, niche markets, and geographical areas where direct sales might not be cost-effective. For instance, in the human nutrition segment, glycinate supplements are often sold through health food stores, pharmacies, and increasingly, e-commerce platforms. E-commerce has emerged as a particularly strong channel, offering manufacturers and brands direct access to a global consumer base, facilitating personalized marketing, and providing convenience for end-users. This blend of direct and indirect channels ensures broad market penetration and caters to the diverse purchasing preferences of the glycinates market's varied customer base.

Glycinates Market Potential Customers

The Glycinates Market serves a diverse range of potential customers who utilize these highly bioavailable mineral chelates for various applications, primarily centered around enhancing nutritional value and health outcomes. A significant segment of these end-users comprises animal feed manufacturers, including large-scale integrators for poultry, swine, and ruminant operations, as well as producers of specialized feeds for aquaculture and companion animals. These customers seek glycinates to improve feed conversion rates, support animal growth, boost immunity, and enhance overall animal welfare, recognizing the superior absorption of these minerals in livestock and pets compared to traditional inorganic forms. The emphasis on sustainable and efficient animal farming practices further drives demand from this sector, as glycinates contribute to reduced environmental impact by minimizing mineral excretion.

Another major customer base includes nutraceutical companies and dietary supplement brands. These firms develop and market a wide array of products aimed at human health, from general wellness supplements to targeted formulations for specific deficiencies or health conditions, such as iron-deficiency anemia, magnesium deficiency for muscle and nerve function, or zinc for immune support. The high bioavailability and gentle nature of glycinates make them a preferred choice for these applications, as they offer better efficacy and reduced gastrointestinal side effects, which is a key selling point for discerning consumers. Infant formula manufacturers also represent a critical segment, utilizing glycinates to fortify their products with essential minerals in a highly absorbable form that is gentle on an infant's developing digestive system, ensuring optimal growth and development.

Beyond nutrition, pharmaceutical companies also constitute potential customers for glycinates, particularly for drug formulations that require specific mineral cofactors or for therapies addressing severe mineral deficiencies where precise and effective delivery is paramount. The food and beverage industry represents a growing segment, with manufacturers incorporating glycinates into fortified foods and functional beverages to enhance their nutritional profile, catering to health-conscious consumers seeking added health benefits from their daily diet. Finally, emerging applications in the personal care sector, where certain minerals can contribute to skin health or hair care, also present a burgeoning customer base for glycinate suppliers, indicating the broad versatility and market potential of these advanced mineral chelates across various industrial sectors seeking high-performance ingredients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 950 million |

| Market Forecast in 2032 | USD 1.61 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albion Minerals (Balchem Corporation), BASF SE, Kemin Industries, Inc., DSM Nutritional Products, Solvay S.A., Kelatron Corporation, Aliphos (Ecophos Group), Novus International, Inc., Norel Animal Nutrition, Nutreco N.V., Zinpro Corporation, Ajinomoto Co., Inc., Evonik Industries AG, Cargill, Incorporated, Archer Daniels Midland Company (ADM), CHR. HANSEN HOLDING A/S, Glanbia Plc, Kerry Group plc, Phibro Animal Health Corporation, Bluestar Adisseo Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glycinates Market Key Technology Landscape

The Glycinates Market is underpinned by a sophisticated array of technologies focused on ensuring the purity, stability, bioavailability, and cost-effectiveness of these mineral chelates. At the core of production is the chelation process itself, which involves binding a metal ion to glycine. This typically utilizes controlled reaction conditions, including specific pH levels, temperatures, and stoichiometric ratios, to form a stable, soluble, and electrically neutral complex. Advanced techniques in chelation technology aim to optimize the bonding efficiency, prevent unwanted side reactions, and produce a highly consistent product. Technologies such as spray drying, crystallization, and granulation are crucial for converting the liquid glycinate solutions into stable, easy-to-handle powder forms, which are predominant in the market due to their longer shelf life and ease of incorporation into various end products like animal feeds and dietary supplements.

Beyond the primary production, quality control and analytical technologies play a paramount role in verifying the composition, purity, and efficacy of glycinates. High-performance liquid chromatography (HPLC) is extensively used to quantify glycine content and ensure the absence of free, unchelated metal ions, while Inductively Coupled Plasma – Mass Spectrometry (ICP-MS) or Atomic Absorption Spectroscopy (AAS) are employed to accurately determine the mineral content. These analytical methods are essential for meeting stringent regulatory standards and ensuring product consistency batch after batch. Furthermore, technologies like Fourier-transform infrared spectroscopy (FTIR) and X-ray diffraction (XRD) are utilized for structural characterization, confirming the chelation structure and crystal form, which can influence solubility and bioavailability.

Emerging technological trends are also shaping the glycinates market, including advancements in microencapsulation and sustained-release technologies. Microencapsulation involves coating glycinate particles with a protective layer, which can enhance stability, mask undesirable tastes, and control the release of the mineral in the digestive tract, further optimizing absorption. Sustained-release formulations are particularly valuable in pharmaceutical and specialized nutritional applications where a gradual, prolonged release of the mineral is desired. Additionally, process automation and real-time monitoring systems, often integrated with artificial intelligence and machine learning, are being increasingly adopted in manufacturing facilities to enhance operational efficiency, reduce human error, and achieve higher yields, contributing to more cost-effective production of high-quality glycinates and maintaining competitiveness in the global market.

Regional Highlights

- North America: Characterized by a highly health-conscious population and a well-established nutraceutical industry, driving robust demand for glycinates in dietary supplements. Strict regulatory frameworks and high consumer purchasing power support the premium pricing of high-quality, bioavailable mineral products. The region also boasts a significant animal agriculture sector, fueling demand for glycinates in advanced animal feed formulations.

- Europe: A mature market with stringent regulations regarding feed and food safety, promoting the use of high-quality, traceable glycinates. Increasing consumer awareness of animal welfare and sustainable practices, alongside a growing elderly population, boosts the demand for nutritional supplements. Western European countries like Germany, France, and the UK are key contributors to market growth.

- Asia Pacific (APAC): The fastest-growing region for the glycinates market, driven by rapid economic growth, increasing disposable incomes, and urbanization. The region’s large and expanding population, coupled with a booming livestock industry (especially in China, India, and Southeast Asia), fuels significant demand for both human and animal nutrition applications. Rising health awareness and a shift towards value-added feed ingredients are key growth catalysts.

- Latin America: An emerging market experiencing consistent growth, particularly in the animal nutrition sector, owing to the expansion of its livestock and aquaculture industries. Government initiatives to improve public health and address mineral deficiencies also contribute to the rising demand for glycinates in human nutrition. Brazil and Mexico are leading markets in the region.

- Middle East and Africa (MEA): Showing promising growth potential driven by improving healthcare infrastructure, increasing awareness of nutritional deficiencies, and a growing emphasis on modernizing animal farming practices. While currently a smaller market, investments in health and agriculture are expected to stimulate future demand for glycinates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glycinates Market.- Albion Minerals (Balchem Corporation)

- BASF SE

- Kemin Industries, Inc.

- DSM Nutritional Products

- Solvay S.A.

- Kelatron Corporation

- Aliphos (Ecophos Group)

- Novus International, Inc.

- Norel Animal Nutrition

- Nutreco N.V.

- Zinpro Corporation

- Ajinomoto Co., Inc.

- Evonik Industries AG

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- CHR. HANSEN HOLDING A/S

- Glanbia Plc

- Kerry Group plc

- Phibro Animal Health Corporation

- Bluestar Adisseo Company

Frequently Asked Questions

Analyze common user questions about the Glycinates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are glycinates and why are they considered superior?

Glycinates are amino acid chelates where a mineral (e.g., zinc, iron, magnesium) is bound to the amino acid glycine. They are considered superior due to their high bioavailability, meaning the body absorbs and utilizes them more efficiently than traditional inorganic mineral forms. This leads to better efficacy, reduced dosage requirements, and fewer gastrointestinal side effects.

What are the primary applications of glycinates?

Glycinates are predominantly used in animal nutrition (for livestock, poultry, aquaculture, and companion animals to enhance growth and health) and human nutrition (in dietary supplements, fortified foods, and infant formulas to address mineral deficiencies and promote wellness). They also find applications in pharmaceuticals and the food & beverage industry for fortification purposes.

How is the glycinates market expected to grow in the coming years?

The glycinates market is projected for significant growth, driven by increasing global health awareness, rising demand for highly bioavailable nutrients, and the expansion of the animal feed industry. Technological advancements in chelation processes and rising disposable incomes in emerging economies will also contribute to its upward trajectory, with a notable CAGR expected through 2032.

What are the key drivers fueling the growth of the glycinates market?

Key drivers include a global surge in health and wellness consciousness, leading to higher demand for effective mineral supplements. The growth of the animal feed sector seeking improved animal health and productivity, increasing prevalence of mineral deficiencies worldwide, and the expanding nutraceutical industry are also significant propellers for market growth.

What challenges does the glycinates market face?

The market faces challenges such as the higher production cost of glycinates compared to conventional inorganic mineral sources, which can impact affordability. Additionally, stringent and varying regulatory landscapes across different regions, limited consumer awareness in certain developing markets, and the availability of alternative mineral supplements pose restraints to its widespread adoption and expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager