Hardware-Assisted Verification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429823 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hardware-Assisted Verification Market Size

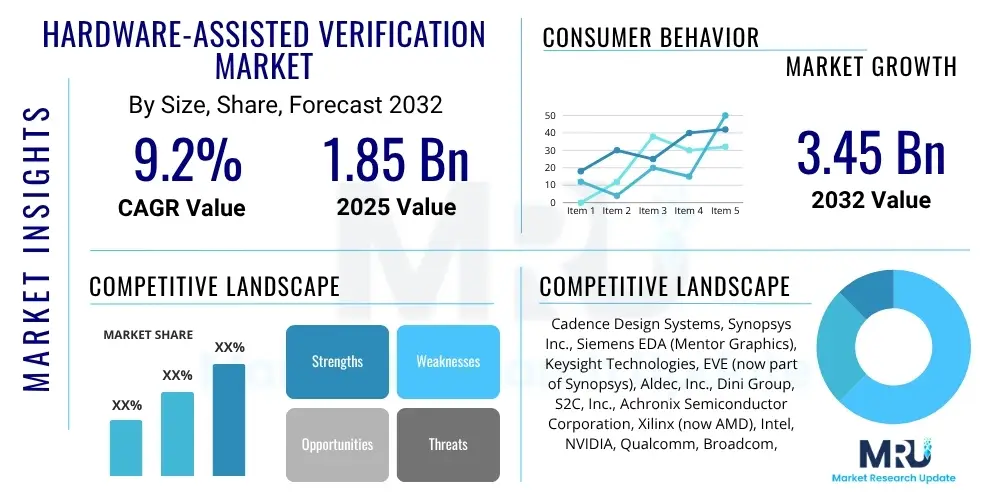

The Hardware-Assisted Verification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% between 2025 and 2032. The market is estimated at USD 1.85 billion in 2025 and is projected to reach USD 3.45 billion by the end of the forecast period in 2032.

Hardware-Assisted Verification Market introduction

The Hardware-Assisted Verification market encompasses an essential suite of technologies and methodologies designed to accelerate and enhance the verification of complex integrated circuits (ICs) and System-on-Chips (SoCs). As chip designs grow exponentially in complexity, traditional software-based simulation methods often become insufficient, leading to prolonged verification cycles and increased risk of design flaws. Hardware-assisted verification bridges this gap by leveraging specialized hardware platforms such as emulators, FPGA-based prototypes, and hardware accelerators to perform verification at much higher speeds, sometimes orders of magnitude faster than pure software simulation. This enables thorough testing of entire systems, including embedded software, before physical silicon is produced.

The core product offerings within this market include high-performance emulation systems, which can model entire SoC designs in hardware, allowing for early software development and system-level validation. FPGA-based prototyping platforms offer a cost-effective and flexible alternative for design validation, providing near-real-time performance. Simulation acceleration, another key component, combines software simulation with hardware acceleration to speed up specific parts of the verification process. Major applications span across critical industries such as semiconductor manufacturing, automotive electronics for advanced driver-assistance systems (ADAS) and autonomous driving, aerospace and defense for mission-critical systems, and telecommunications for 5G infrastructure and data centers, where reliability and performance are paramount.

The primary benefits of adopting hardware-assisted verification include significantly reduced verification time, earlier detection of design bugs, higher confidence in the final product's functionality, and accelerated time-to-market for complex electronic devices. These benefits are driving market growth, fueled by the relentless demand for more powerful and feature-rich electronic products, the increasing complexity of chip designs incorporating AI/ML accelerators and specialized processing units, and the growing importance of system-level verification that includes the interaction of hardware and software components. The continuous evolution of semiconductor technology necessitates robust and efficient verification strategies, positioning hardware-assisted verification as an indispensable tool in the modern chip design ecosystem.

Hardware-Assisted Verification Market Executive Summary

The Hardware-Assisted Verification market is experiencing robust growth, driven by an escalating need for efficient and comprehensive verification solutions in the face of increasingly intricate chip designs. Key business trends indicate a strong push towards hybrid verification environments that seamlessly integrate emulation, FPGA prototyping, and virtual prototyping to achieve optimal speed and accuracy across different stages of the design cycle. Major industry players are focusing on expanding their software stacks to complement hardware platforms, offering advanced debugging capabilities, greater design visibility, and more sophisticated automation tools. Consolidation and strategic partnerships among EDA vendors and hardware manufacturers are also prevalent, aiming to provide more integrated and complete verification flows to customers. Furthermore, the market is witnessing an uptake in cloud-based verification services, allowing companies to scale verification resources on demand and reduce significant upfront capital expenditure.

Regionally, Asia Pacific is emerging as a dominant force, propelled by the booming semiconductor manufacturing sector in countries like China, Taiwan, South Korea, and Japan. The region's significant investments in fabless design houses and integrated device manufacturers (IDMs) translate into high demand for advanced verification technologies to ensure competitive product launches. North America continues to be a crucial hub for innovation and research and development in EDA tools and complex SoC designs, maintaining its strong market share. Europe is also showing steady growth, particularly in the automotive and industrial electronics sectors, where the adoption of advanced ADAS and IoT technologies requires stringent hardware verification. Emerging markets in Latin America and the Middle East & Africa are gradually increasing their adoption as digital transformation initiatives and local electronics manufacturing grow.

In terms of segment trends, emulation platforms continue to hold a substantial market share due to their ability to handle full SoC designs with high fidelity, crucial for early software development and system integration. FPGA-based prototyping is gaining traction as a cost-effective and flexible solution for a wide range of applications, especially for smaller design blocks and specific IP validation. The services segment, encompassing consulting, support, and managed verification services, is also expected to exhibit significant growth as companies seek expert assistance to navigate the complexities of advanced verification methodologies and optimize their existing tools. The continuous evolution of technology nodes and the pervasive integration of AI/ML functionalities into new chips are further accelerating demand across all verification segments.

AI Impact Analysis on Hardware-Assisted Verification Market

User questions related to the impact of AI on the Hardware-Assisted Verification Market often revolve around how artificial intelligence can streamline the verification process, address escalating design complexity, and potentially automate tasks currently performed manually. Users are particularly interested in understanding if AI can truly reduce the significant time and cost associated with verification, how it influences test pattern generation and coverage closure, and what new tools or methodologies are emerging from this convergence. There is also curiosity about the challenges AI introduces, such as the need for specialized data sets, the interpretability of AI-driven decisions, and the potential impact on human verification engineers' roles. Expectations are high for AI to bring unprecedented levels of efficiency, intelligence, and predictive capabilities to the verification workflow, enabling faster bug detection and higher quality designs.

- Automated Test Pattern Generation: AI algorithms, especially machine learning models, can analyze historical verification data and design specifications to intelligently generate highly effective test patterns, significantly reducing manual effort and improving test coverage.

- Intelligent Bug Detection and Root Cause Analysis: AI can identify anomalies and potential design flaws much earlier in the cycle by learning from verification results and design patterns, and can assist in quickly pinpointing the root cause of issues, leading to faster debugging.

- Enhanced Coverage Analysis and Closure: Machine learning techniques can optimize coverage strategies, predict areas with insufficient testing, and guide verification engineers toward critical paths that need more attention, accelerating coverage closure and ensuring comprehensive validation.

- Adaptive Verification Environments: AI enables the creation of dynamic verification environments that can adapt to evolving design changes, optimize resource allocation for different verification tasks, and prioritize test cases based on their potential impact or likelihood of exposing bugs.

- Predictive Verification and Performance Optimization: AI can be used to predict verification bottlenecks, estimate verification effort, and optimize the utilization of hardware-assisted verification resources, thereby improving overall verification efficiency and reducing costly delays.

- Formal Verification Enhancement: AI can assist in the selection of assertions and properties for formal verification, guide proof strategies, and help manage the state explosion problem, making formal methods more scalable and effective for complex designs.

- Reduced Human Intervention: By automating repetitive and data-intensive tasks, AI frees up verification engineers to focus on more complex design challenges, strategic planning, and sophisticated problem-solving, improving overall productivity.

DRO & Impact Forces Of Hardware-Assisted Verification Market

The Hardware-Assisted Verification market is primarily driven by the exponential increase in the complexity of System-on-Chips (SoCs), which integrate billions of transistors and multiple functional blocks including CPU, GPU, memory, and specialized accelerators on a single die. This complexity makes traditional simulation-based verification prohibitively slow and ineffective, necessitating faster hardware-based methods. The relentless pressure for faster time-to-market in the competitive electronics industry is another significant driver; companies must launch products quickly to capture market share, and efficient verification is critical to meet these aggressive timelines. Furthermore, the pervasive adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and 5G communication across various applications demands robust and error-free hardware, pushing the boundaries of verification capabilities and increasing the reliance on hardware-assisted solutions. The growing need for higher verification coverage and reliability to prevent costly silicon respins also contributes significantly to market expansion, as the cost of a design error found after silicon tape-out can be astronomical.

However, several restraints impede the market's growth. The high initial cost of hardware-assisted verification platforms, including emulators and large FPGA systems, represents a substantial capital expenditure that can be a barrier for smaller companies or startups. Additionally, the complexity involved in setting up, configuring, and maintaining these sophisticated systems requires a highly skilled workforce, which is often in short supply within the industry. The integration challenges associated with incorporating hardware-assisted verification tools into existing design flows and the interoperability issues between different vendor solutions can also slow adoption. Moreover, the steep learning curve for new users and the ongoing maintenance expenses contribute to the overall total cost of ownership, making investment decisions critical and sometimes deterrent for potential adopters.

Despite these restraints, significant opportunities exist for growth and innovation. The emergence of new application areas, particularly in autonomous vehicles, edge AI, and advanced cloud computing infrastructure, presents new demands for ultra-reliable and high-performance hardware, requiring advanced verification solutions. The trend towards cloud-based verification platforms offers a compelling opportunity by enabling flexible access to high-performance computing resources and sophisticated verification environments without the burden of large upfront investments, democratizing access to these powerful tools. Furthermore, continuous technological advancements, such as hybrid verification methodologies that combine the strengths of different techniques, improvements in debugging capabilities, and the integration of AI/ML into verification flows, are opening new avenues for efficiency and effectiveness. The ongoing development of advanced verification IPs and reusable verification components also helps streamline the overall process, providing further market opportunities for specialized tool providers and service offerings.

Segmentation Analysis

The Hardware-Assisted Verification market is broadly segmented to reflect the diverse technologies, applications, and end-user requirements shaping the industry. This segmentation provides a granular view of market dynamics, enabling stakeholders to identify specific growth areas and strategic opportunities. The primary dimensions for segmentation include the type of hardware-assisted verification technology employed, the specific end-use application areas, the types of components involved, and the deployment model. Each segment plays a crucial role in addressing distinct verification challenges across the complex semiconductor design ecosystem.

- By Type: This segment differentiates between the core technologies used for hardware-assisted verification, each offering unique trade-offs in terms of speed, accuracy, and cost.

- Emulation: High-speed verification using specialized hardware platforms that model the entire SoC design, primarily used for extensive software development and system-level validation.

- FPGA-based Prototyping: Cost-effective and flexible verification using Field-Programmable Gate Arrays, offering near-real-time performance for validating design blocks or entire systems before ASIC fabrication.

- Simulation Acceleration: Combines software simulation with dedicated hardware accelerators to speed up the execution of specific parts of the verification process, improving turnaround times.

- Hybrid Verification: An integrated approach that combines software simulation, emulation, and/or FPGA prototyping to leverage the strengths of each method across different stages of the design cycle for optimal efficiency.

- By Application: This segment highlights the diverse industries that utilize hardware-assisted verification for their product development.

- Semiconductors: Core market segment, including fabless design houses, IDMs, and foundries developing complex ICs and SoCs.

- Automotive: Growing segment driven by ADAS, autonomous driving, and in-vehicle infotainment systems requiring high reliability and functional safety.

- Aerospace & Defense: Critical applications demanding rigorous verification for mission-critical systems and high-assurance hardware.

- Telecommunications: Verification for 5G base stations, networking equipment, and data center infrastructure, where high throughput and low latency are essential.

- Consumer Electronics: Verification of processors, GPUs, and other ICs used in smartphones, smart home devices, and wearable technology.

- Industrial: Verification for industrial IoT devices, automation systems, and control units requiring robustness and long-term reliability.

- By Component: This segment categorizes the various elements that constitute a hardware-assisted verification solution.

- Hardware Platforms: Includes the physical emulation systems, FPGA prototyping boards, and acceleration hardware.

- Software & Tools: Comprises the compilers, debuggers, verification IP (VIP), testbench automation tools, and overall management software.

- Services: Encompasses consulting, training, technical support, and managed verification services offered by vendors and third parties.

- By End-User: This segment focuses on the primary types of organizations that adopt these verification solutions.

- Fabless Semiconductor Companies: Companies that design and sell ICs but outsource manufacturing, heavily relying on advanced verification.

- Integrated Device Manufacturers (IDMs): Companies that design, manufacture, and sell their own ICs, requiring extensive in-house verification capabilities.

- Foundries: Semiconductor fabrication plants that offer manufacturing services, sometimes providing verification support or requiring verified IPs.

- Original Equipment Manufacturers (OEMs): Companies in sectors like automotive, aerospace, and consumer electronics that integrate SoCs into their final products and often perform system-level verification.

- By Deployment: This segment distinguishes between different models of solution deployment.

- On-premise: Verification hardware and software installed and managed within the customer's own data centers or facilities.

- Cloud-based: Verification resources accessed and managed as a service over the internet, offering scalability and reduced capital expenditure.

Value Chain Analysis For Hardware-Assisted Verification Market

The value chain for the Hardware-Assisted Verification market involves a sophisticated interplay of various stakeholders, from initial intellectual property (IP) creation to the ultimate end-users integrating verified hardware into their products. At the upstream end, the chain begins with foundational technology providers, including Electronic Design Automation (EDA) software vendors and specialized hardware component manufacturers. These companies develop and supply the core tools and platforms—such as high-capacity FPGAs, processors, and advanced software algorithms—that enable the creation of emulation and prototyping systems. Intellectual property (IP) core providers also play a crucial role by offering pre-verified functional blocks (e.g., CPU cores, memory controllers, communication interfaces) that chip designers integrate into their SoCs, reducing design complexity and verification effort.

Midstream, the value chain encompasses the hardware-assisted verification solution providers themselves. These are typically major EDA companies or specialized hardware manufacturers that develop and integrate the complete emulation, prototyping, and simulation acceleration systems. Their activities include system architecture design, hardware manufacturing, software development for compilation, debugging, and verification management, and ensuring seamless integration with existing design flows. These providers often work closely with both upstream component suppliers and downstream chip designers to tailor their solutions to specific verification needs, ensuring high performance, scalability, and compatibility. Their ability to innovate in areas such as hybrid verification methodologies, remote access capabilities, and AI-driven verification tools directly impacts the efficiency and effectiveness of the entire value chain.

Downstream, the value chain extends to the direct end-users and the distribution channels that bring these solutions to market. Direct sales are common for large semiconductor companies and major OEMs, where complex negotiations, extensive customization, and dedicated support are required. For a broader market reach, particularly to smaller design houses or emerging regions, indirect channels such as value-added resellers (VARs) and distributors play a vital role. These partners often provide localized support, training, and integration services, bridging the gap between sophisticated technology and diverse customer needs. The ultimate beneficiaries are fabless semiconductor companies, Integrated Device Manufacturers (IDMs), and Original Equipment Manufacturers (OEMs) in sectors like automotive, telecommunications, and consumer electronics, who rely on these verified hardware components to develop their final products with high confidence and accelerated time-to-market.

Hardware-Assisted Verification Market Potential Customers

The potential customers for hardware-assisted verification solutions span a wide array of organizations deeply involved in semiconductor design and product development, where the integrity and performance of integrated circuits are paramount. These primary end-users are typically characterized by their need to develop highly complex, high-performance, and reliable silicon products with aggressive time-to-market targets. Fabless semiconductor companies represent a significant customer base, as they focus exclusively on chip design and outsource manufacturing, making efficient and thorough verification critical to their business model and the quality of their intellectual property before handing off designs to foundries. These companies often deal with cutting-edge technologies and demand the most advanced verification tools to stay competitive.

Integrated Device Manufacturers (IDMs), which design, manufacture, and sell their own chips, also constitute a core segment of potential customers. Their vertically integrated operations mean they bear the full responsibility for the quality and functionality of their silicon, necessitating robust hardware-assisted verification to avoid costly manufacturing delays and product recalls. Furthermore, Original Equipment Manufacturers (OEMs) in sectors such as automotive, aerospace and defense, consumer electronics, and telecommunications are increasingly becoming direct users of these solutions. As these OEMs design their own custom SoCs for specialized applications (e.g., ADAS systems, AI accelerators, 5G modems), or require system-level validation of vendor-supplied chips with their own software, they require powerful verification platforms to ensure seamless integration and performance of their end products. University research institutions and government agencies involved in advanced electronics research and development also represent a niche but important customer segment, contributing to innovation and skill development within the ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.85 billion |

| Market Forecast in 2032 | USD 3.45 billion |

| Growth Rate | 9.2% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cadence Design Systems, Synopsys Inc., Siemens EDA (Mentor Graphics), Keysight Technologies, EVE (now part of Synopsys), Aldec, Inc., Dini Group, S2C, Inc., Achronix Semiconductor Corporation, Xilinx (now AMD), Intel, NVIDIA, Qualcomm, Broadcom, Huawei, Arm Ltd., NXP Semiconductors, STMicroelectronics, Texas Instruments, Renesas Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hardware-Assisted Verification Market Key Technology Landscape

The technological landscape of the Hardware-Assisted Verification market is dynamic and constantly evolving, driven by the need to keep pace with escalating chip design complexity and performance requirements. At its core, the market relies on sophisticated hardware platforms like emulators, which are high-capacity, reconfigurable computing systems designed to execute a digital representation of an SoC at near-real hardware speeds. These systems leverage custom processors and extensive memory to model entire designs, enabling early software bring-up and comprehensive system-level verification long before physical silicon is available. The advanced capabilities of emulators include sophisticated debugging features, waveform viewing, and power analysis, providing deep insights into design behavior.

Another pivotal technology is FPGA-based prototyping, which utilizes large, multi-FPGA systems to implement a design. This approach offers a cost-effective and flexible alternative to emulation, providing faster clock speeds and direct physical interaction with real-world interfaces, making it ideal for software development, system validation, and in-circuit testing. Recent advancements in FPGA technology, including higher gate counts, faster I/O, and integrated processing capabilities, continue to enhance their utility for verification. Furthermore, simulation acceleration techniques, often involving specialized hardware alongside traditional software simulators, accelerate specific portions of the simulation process, particularly for highly active or critical design blocks, thereby reducing overall simulation time and improving throughput.

Beyond the core hardware platforms, the technology landscape also includes a robust suite of software and methodologies that enhance the effectiveness of hardware-assisted verification. This includes advanced compilers and synthesis tools to map complex designs onto hardware platforms, sophisticated debugging environments that allow for comprehensive visibility and control, and verification IP (VIP) that provides pre-verified models for standard interfaces and protocols. The integration of formal verification techniques to mathematically prove design correctness, along with coverage-driven verification methodologies to systematically measure and improve test coverage, are also critical. Emerging trends include virtual prototyping for rapid software development on high-level models, and increasingly, cloud-based verification solutions that provide on-demand access to high-performance hardware and software resources, offering scalability and reduced capital expenditure for diverse design teams.

Regional Highlights

The global Hardware-Assisted Verification market exhibits distinct growth patterns and maturity levels across key geographical regions, influenced by varying levels of technological adoption, industrial infrastructure, and governmental support for the semiconductor sector. Each region contributes uniquely to the market's overall expansion, reflecting localized trends in research and development, manufacturing, and end-user demand for advanced electronic products. Understanding these regional dynamics is crucial for market participants to formulate effective strategies and capitalize on emerging opportunities.

- North America: This region remains a dominant force in the Hardware-Assisted Verification market, primarily due to the presence of leading EDA tool vendors, major semiconductor companies, and extensive research and development activities. The United States, in particular, drives innovation in complex SoC designs for AI/ML, high-performance computing, and advanced networking. The early adoption of cutting-edge verification methodologies and substantial investments in intellectual property further solidify its leading position.

- Europe: Europe demonstrates steady growth, propelled by robust automotive and industrial electronics sectors, particularly in Germany, France, and the UK. The emphasis on functional safety and reliability in advanced driver-assistance systems (ADAS) and industrial IoT applications necessitates stringent hardware verification, fostering demand for emulation and prototyping solutions. Collaborative research initiatives and strong academic-industrial partnerships also contribute to market expansion.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by its unparalleled semiconductor manufacturing capabilities and a booming market for consumer electronics, telecommunications, and data centers. Countries like China, Taiwan, South Korea, and Japan are major hubs for chip design and fabrication, leading to high demand for advanced verification tools to accelerate product cycles and ensure quality. Government initiatives supporting local semiconductor industries further fuel this growth.

- Latin America: This region is an emerging market for hardware-assisted verification, with increasing investments in digital infrastructure and local electronics manufacturing. While currently a smaller market, growing interest in IoT, telecommunications infrastructure development, and localized semiconductor design activities in countries like Brazil and Mexico are expected to drive gradual adoption of verification technologies.

- Middle East and Africa (MEA): The MEA region is also an nascent market, characterized by ongoing digital transformation initiatives and nascent electronics manufacturing sectors. Countries in the Gulf Cooperation Council (GCC) are investing in technology diversification, leading to increased demand for robust hardware solutions and, consequently, verification tools in areas such as smart cities, telecommunications, and defense applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hardware-Assisted Verification Market.- Cadence Design Systems

- Synopsys Inc.

- Siemens EDA (Mentor Graphics)

- Keysight Technologies

- Aldec, Inc.

- Dini Group

- S2C, Inc.

- Achronix Semiconductor Corporation

- AMD (Xilinx)

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Huawei Technologies Co., Ltd.

- Arm Holdings plc

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Microchip Technology Inc.

Frequently Asked Questions

What is Hardware-Assisted Verification and why is it important?

Hardware-Assisted Verification (HAV) refers to the use of specialized hardware platforms, such as emulators and FPGA-based prototypes, to speed up the verification of complex integrated circuits and System-on-Chips (SoCs). It is crucial because it enables faster and more comprehensive testing of designs, reduces time-to-market for electronic products, and helps detect critical bugs earlier in the development cycle, which is challenging for software-only simulations.

How does AI impact the Hardware-Assisted Verification market?

AI significantly impacts the HAV market by enhancing automation and intelligence within the verification workflow. It enables automated test pattern generation, intelligent bug detection, optimized coverage analysis, and the creation of adaptive verification environments. This leads to reduced manual effort, faster debugging, and more efficient use of verification resources, ultimately accelerating the overall design and validation process for complex chips.

What are the primary drivers for the growth of this market?

The primary drivers include the continuous increase in the complexity of SoC designs, the urgent need for faster time-to-market in the highly competitive electronics industry, and the widespread adoption of advanced technologies like AI/ML, IoT, and 5G. These factors collectively demand more robust, efficient, and accelerated verification methodologies that hardware-assisted solutions provide, ensuring higher quality and reliability of new electronic products.

What are the key challenges faced by the Hardware-Assisted Verification market?

Key challenges include the high initial investment required for advanced hardware-assisted verification platforms, which can be prohibitive for smaller companies. Additionally, there is a persistent shortage of highly skilled engineers capable of operating and optimizing these complex systems. Integration complexities with existing design flows and the ongoing maintenance costs also pose significant hurdles for wider market adoption and efficient operation.

Which regions are leading the adoption of Hardware-Assisted Verification solutions?

North America is a leading region due to strong R&D and the presence of major semiconductor and EDA companies. However, Asia Pacific is emerging as the fastest-growing region, driven by its massive semiconductor manufacturing base in countries like China, Taiwan, and South Korea, coupled with significant investments in consumer electronics and telecommunications infrastructure. Europe also shows strong adoption, particularly within the automotive and industrial electronics sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager