Hazmat Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430023 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Hazmat Packaging Market Size

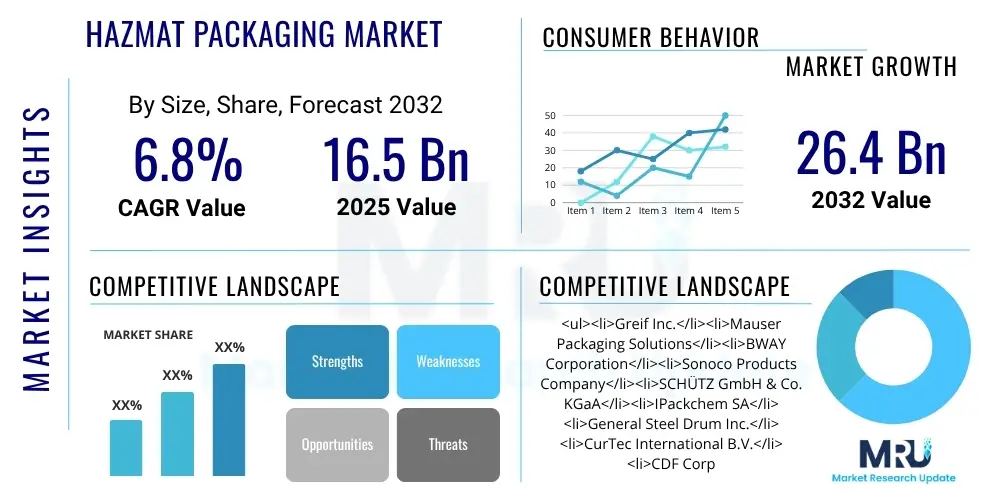

The Hazmat Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 16.5 billion in 2025 and is projected to reach USD 26.4 billion by the end of the forecast period in 2032.

Hazmat Packaging Market introduction

The Hazmat Packaging Market encompasses a specialized segment within the broader packaging industry, focusing on the design, manufacturing, and distribution of containers and materials specifically engineered for the safe transport, storage, and disposal of hazardous materials. These materials, often referred to as dangerous goods, include a wide spectrum of substances such as flammable liquids, corrosive chemicals, toxic gases, radioactive isotopes, infectious biological agents, and explosives. The paramount objective of hazmat packaging is to contain these substances securely, preventing any leakage, accidental release, or harmful exposure to humans, animals, or the environment throughout the entire supply chain, from production to final consumption or disposal. Adherence to stringent international and national regulatory frameworks, such as those stipulated by the International Air Transport Association (IATA), the International Maritime Dangerous Goods (IMDG) Code, the U.S. Department of Transportation (DOT), and the United Nations (UN) Recommendations on the Transport of Dangerous Goods, is not merely a legal requirement but a fundamental cornerstone of operational safety and risk mitigation in this critical sector.

Product offerings within the hazmat packaging market are diverse and highly specialized, ranging from robust steel and plastic drums, intermediate bulk containers (IBCs), jerricans, and composite containers to specialized fiberboard boxes, wooden crates, and flexible packaging like UN-certified bags. Each product is meticulously designed and tested to withstand extreme conditions, including variations in temperature and pressure, impacts, vibrations, and chemical reactions, ensuring the integrity of the containment during all phases of transit and storage. Advanced features often include specialized linings, vents, tamper-evident seals, and protective coatings tailored to the specific properties of the hazardous material being packaged. The selection of packaging depends on the material's hazard class, quantity, mode of transport (air, sea, road, rail), and regulatory jurisdiction. Continuous innovation in material science and engineering is vital to meet evolving safety standards and client demands for more efficient, durable, and environmentally responsible solutions.

Major applications for hazmat packaging span across an extensive range of industries, including chemicals and petrochemicals, pharmaceuticals and healthcare, oil and gas, waste management, agriculture, automotive, and defense sectors. For instance, chemical manufacturers rely on hazmat packaging for bulk and small-volume shipments of raw materials and finished products, while pharmaceutical companies use highly specialized solutions for active pharmaceutical ingredients, biological samples, and vaccines, often requiring thermal control. The benefits derived from compliant and effective hazmat packaging are profound, extending beyond regulatory adherence to encompass enhanced safety for personnel involved in handling and transport, protection of public health, safeguarding the environment from contamination, minimizing costly product loss due to damage or leakage, and avoiding severe legal penalties, fines, and significant reputational damage that can result from non-compliance or incidents. The market is primarily driven by the escalating volume of global trade in hazardous chemicals and other dangerous goods, the rapid expansion of the pharmaceutical and healthcare sectors, particularly with the rise of biologics and specialty drugs, and the increasing global stringency of transportation and storage regulations. Furthermore, industrial growth, especially in rapidly developing economies, and a heightened global awareness concerning environmental protection and occupational safety, continue to fuel the demand for high-quality, certified hazmat packaging solutions, prompting manufacturers to invest in continuous innovation and product development to ensure higher levels of containment, traceability, and safety throughout the entire dangerous goods supply chain.

Hazmat Packaging Market Executive Summary

The Hazmat Packaging Market is currently experiencing a period of significant growth and transformation, propelled by several key business trends, evolving regional dynamics, and distinct segmentation preferences. A paramount business trend observed is the increasing emphasis on advanced safety features and regulatory compliance, with companies investing heavily in R&D to develop packaging that exceeds minimum safety standards and offers superior protection against potential hazards. There is a strong movement towards sustainable packaging solutions, including the use of recycled materials, reusable packaging designs, and lighter-weight alternatives that reduce carbon footprint during transportation. Digitalization is also playing a crucial role, with the integration of IoT sensors for real-time tracking, temperature monitoring, and tamper detection, enhancing traceability and responsiveness in the event of an incident. Furthermore, market players are focusing on optimizing their supply chains through automation in packaging, handling, and logistics processes to improve efficiency, reduce operational costs, and minimize human exposure to dangerous goods. Strategic partnerships and mergers and acquisitions are common as companies seek to expand their product portfolios, geographic reach, and technological capabilities, catering to a more complex and globally interconnected hazardous materials landscape.

From a regional perspective, North America and Europe maintain substantial market shares, primarily due to their well-established industrial infrastructures, mature regulatory environments that enforce strict compliance, and a high degree of safety awareness across all sectors handling dangerous goods. These regions are characterized by a consistent demand for high-quality, certified packaging across the chemical, pharmaceutical, and oil and gas industries. However, the Asia Pacific region is poised for the most rapid expansion in the forecast period. This accelerated growth is largely attributed to the robust industrialization, burgeoning manufacturing sectors in economies like China, India, and Southeast Asian nations, and the significant increase in both domestic and international trade of hazardous substances. Governments in APAC are also progressively tightening their environmental and safety regulations, further driving the adoption of compliant hazmat packaging. Latin America, the Middle East, and Africa are also emerging as attractive markets, driven by infrastructure development projects, expansion in the oil and gas exploration and production, and rising healthcare investments, all of which necessitate reliable hazardous material containment solutions.

An analysis of market segments reveals dynamic shifts in demand and preferences. By product type, Intermediate Bulk Containers (IBCs) and drums continue to dominate, owing to their versatility, large capacity, and reusability, making them ideal for bulk chemical transport. However, specialized packaging for pharmaceuticals, such as insulated containers for biologics and vaccines, is experiencing exponential growth, driven by an expanding biotech industry and increased global health initiatives. In terms of materials, plastic packaging, particularly high-density polyethylene (HDPE), is gaining traction due to its excellent chemical resistance, durability, and cost-effectiveness. Steel packaging remains indispensable for heavy-duty applications and certain corrosive substances, while fiberboard solutions cater to specific dry hazardous goods. End-user trends show a strong demand for customized packaging solutions that not only meet regulatory requirements but also offer enhanced security features, improved handling ergonomics, and integration with digital tracking systems, highlighting a market moving towards holistic and intelligent hazardous materials logistics management. The increasing complexity of hazardous materials and their diverse applications necessitates a continuous evolution in packaging design and materials to ensure optimal safety and compliance.

AI Impact Analysis on Hazmat Packaging Market

Common user questions regarding the integration of Artificial Intelligence into the Hazmat Packaging Market predominantly focus on how AI can fundamentally transform and enhance existing safety protocols, operational efficiencies, and compliance management. Users are keenly interested in AI's capabilities to predict potential hazards, such as leakage or structural failure during transport, by analyzing vast datasets of historical incidents, environmental conditions, and material properties. Questions frequently arise about AI's role in optimizing complex logistics routes to minimize exposure risks and transit times, as well as its potential for automating rigorous inspection processes to detect subtle defects in packaging that human inspectors might miss. There is a strong expectation that AI will significantly streamline the daunting task of navigating intricate and ever-changing global regulatory frameworks, offering real-time compliance checks and generating necessary documentation with greater accuracy and speed. Users also express a desire for AI-driven solutions to improve inventory management of hazardous goods, ensuring proper storage conditions and timely replenishment or disposal, thereby reducing waste and preventing critical shortages. Underlying these inquiries are concerns about data privacy and security when handling sensitive information about dangerous goods, the reliability and transparency of AI algorithms in critical safety decisions, and the practical challenges and high initial investment associated with implementing such advanced technologies within established operational infrastructures. Overall, the collective sentiment points towards a strong desire for AI to bring a new level of intelligence, predictability, and proactive risk mitigation to the highly regulated and safety-critical domain of hazmat packaging.

- AI-powered predictive analytics can analyze historical data, weather patterns, and route specific risks to forecast potential packaging failures or transportation incidents, allowing for proactive mitigation strategies.

- Automated compliance engines, leveraging machine learning, can instantly verify hazmat packaging designs, labeling, and documentation against an extensive database of international and local regulations, significantly reducing human error and ensuring adherence.

- AI-enhanced computer vision systems can conduct highly accurate and rapid quality inspections of packaging containers, identifying microscopic cracks, deformities, or faulty seals that are imperceptible to the human eye, thereby enhancing product integrity and safety.

- Optimization algorithms driven by AI can develop the most efficient and safest logistics routes for hazardous materials, considering factors like traffic, road conditions, population density, and potential environmental impact, thereby minimizing exposure risks and transit times.

- Intelligent inventory management systems, utilizing AI, can monitor hazardous materials in real-time, providing automated alerts for storage condition deviations (temperature, humidity), expiration dates, and potential security breaches, improving traceability and reducing waste.

- AI-driven natural language processing tools can assist personnel by providing immediate access to updated safety data sheets (SDS), emergency response procedures, and regulatory guidance, enhancing training and critical decision-making during incidents.

- Robotics integrated with AI can automate the handling, filling, sealing, and palletizing of hazardous material packages, significantly reducing direct human exposure to dangerous substances and increasing operational consistency and speed.

- Advanced data analysis of past hazmat incidents and near-misses using AI can uncover hidden patterns and root causes, enabling organizations to implement continuous improvement in safety protocols, operational procedures, and packaging design to prevent future occurrences.

- AI can facilitate the development of digital twins for hazmat shipments, allowing for simulated testing of various scenarios and environmental impacts on packaging integrity without physical experimentation, accelerating design and certification processes.

- Enhanced supply chain visibility through AI provides real-time tracking and monitoring of hazmat shipments from origin to destination, offering greater control and transparency for all stakeholders.

DRO & Impact Forces Of Hazmat Packaging Market

The Hazmat Packaging Market operates under the influence of several critical Drivers, Restraints, Opportunities, and broader Impact Forces that collectively shape its growth trajectory and competitive landscape. A primary driver is the accelerating pace of globalization and the resultant surge in international trade, particularly for hazardous chemicals, pharmaceuticals, and industrial components. As economies expand and supply chains become more interconnected, the volume of dangerous goods transported across borders increases exponentially, necessitating robust, compliant, and universally accepted packaging solutions. Concurrently, the increasing stringency and harmonization of international and national regulatory frameworks, such as those imposed by the UN, IATA, IMDG, and regional bodies like the EU, force industries to adopt certified and higher-quality hazmat packaging, pushing market demand upwards. The growing global emphasis on environmental protection and occupational safety also acts as a powerful driver, compelling companies to invest in safer handling practices and packaging that minimizes the risk of spills, contamination, and exposure.

However, the market also contends with significant restraints. One major hurdle is the substantial cost associated with the research, development, manufacturing, rigorous testing, and certification of hazmat packaging. These high costs can be prohibitive for smaller enterprises, potentially leading to non-compliance or the use of sub-standard packaging, posing risks to safety and environment. The inherent complexity and dynamic nature of regulatory frameworks, which vary by jurisdiction, mode of transport, and hazard class, create a continuous compliance challenge. Companies must invest in specialized expertise and ongoing training to stay abreast of these evolving rules, adding to operational overheads. Furthermore, concerns around the environmental impact of single-use hazmat packaging, especially plastics, are growing. The challenge of responsible disposal and the push for sustainable alternatives often translates into higher initial investment costs for environmentally friendly options, which might be a barrier for cost-sensitive market segments.

Despite these restraints, the Hazmat Packaging Market is ripe with opportunities. The most promising area lies in the development and adoption of "smart packaging" technologies. Integrating IoT sensors for real-time monitoring of critical parameters like temperature, pressure, shock, and location can revolutionize traceability, enhance incident response, and ensure product integrity. The increasing demand for eco-friendly and sustainable packaging materials, including biodegradable plastics, recycled content, and innovative reusables, provides a significant avenue for market differentiation and growth, aligning with global corporate social responsibility goals. Moreover, the rapid expansion of e-commerce for specialized chemicals, laboratory supplies, and medical diagnostics creates a new niche for smaller, highly compliant, and often thermally controlled hazmat packaging solutions tailored for direct-to-consumer or direct-to-lab shipments. Broader impact forces, such as rapid technological advancements in materials science, the ongoing digitalization of supply chains, and fluctuating raw material prices, constantly reshape the competitive landscape. Geopolitical dynamics and evolving trade policies also play a crucial role, influencing trade routes, tariffs, and regulatory collaborations, all of which directly affect the demand, supply, and cost structures within the global hazmat packaging ecosystem, urging market players to remain agile and innovative to capture emerging market shares and maintain competitiveness.

Segmentation Analysis

The Hazmat Packaging Market is extensively segmented across multiple dimensions to provide a nuanced understanding of its intricate dynamics, catering to the diverse and highly specific requirements of various industries and hazardous material classifications. This comprehensive segmentation allows for a detailed analysis of market demand drivers, technological advancements, and regulatory influences on specific product types, materials, capacities, and end-user applications. By breaking down the market, stakeholders can identify niche opportunities, understand competitive landscapes within specific sub-segments, and tailor their product development and marketing strategies to address precise customer needs. The inherently complex nature of hazardous materials, coupled with ever-evolving international and regional regulations, necessitates such a granular approach to ensure both market efficiency and unwavering safety standards across the entire supply chain. Each segment reflects unique operational challenges and compliance mandates, driving distinct innovation pathways and investment priorities within the industry.

- By Product Type: This segment categorizes packaging based on its structural form and primary function, ranging from large-volume containers to specialized small packages. Each type is designed to meet specific UN packaging codes and transport regulations for different hazard classes.

- Drums and Barrels: Widely used for liquids and solids, available in steel, plastic (HDPE), and fiber. Known for durability and reusability, essential for bulk chemical transport.

- Intermediate Bulk Containers (IBCs): Large reusable containers for bulk liquids and solids, including rigid, flexible (FIBCs), and composite types. Highly efficient for intermodal transport.

- Cans: Smaller metal containers, often used for flammable liquids, aerosols, and certain chemical compounds where robust, hermetic sealing is required.

- Boxes and Crates: Made from fiberboard, wood, or plastic, these are suitable for various hazardous solids, often used as outer packaging for inner receptacles.

- Bags and Sacks: Typically flexible, UN-certified bags used for solid hazardous materials, particularly in industries like mining, agriculture, and waste management.

- Jerricans: Medium-sized plastic or metal containers for liquids, offering ergonomic handling and robust containment for smaller quantities of hazardous fluids.

- Bulk Packaging: Refers to large containers (excluding IBCs) designed for bulk solids or liquids, often integrated into transport vehicles or facilities.

- Overpacks: External packaging used to contain one or more inner packages, simplifying handling and providing additional protection during transport of dangerous goods.

- Labels and Accessories: Essential components including hazard labels, placards, absorbent materials, and specialized closures that ensure compliant and safe shipment.

- By Material: This segmentation focuses on the primary construction material, which dictates chemical compatibility, strength, weight, and reusability of the packaging.

- Plastic (HDPE, LDPE, PET, PP): Dominant due to chemical resistance, lightweight, cost-effectiveness, and versatility, particularly HDPE for drums and IBCs.

- Steel: Preferred for high-strength requirements, corrosive materials, and high-temperature applications. Offers excellent barrier properties and durability.

- Fiberboard/Paperboard: Used for dry hazardous solids, often in conjunction with inner liners, valued for its light weight and ease of disposal (when liners are removed).

- Wood: Primarily for crates and boxes, offering robust protection for certain solid hazardous materials and heavy items.

- Glass: Limited use for specific chemicals requiring inert containment, often as inner packaging for small volumes, due to its brittleness.

- Composites: Combinations of materials (e.g., plastic inner receptacle with a steel outer cage for IBCs) designed to leverage the best properties of each for optimal safety and performance.

- By Capacity: This segment categorizes packaging based on the volume it can hold, directly influencing logistics, handling equipment, and the scale of operations.

- Less than 10 Liters: Typically for laboratory chemicals, samples, and small-volume specialty products.

- 10 to 50 Liters: Common for jerricans and smaller drums, suitable for industrial chemicals and waste.

- 50 to 250 Liters: Standard drum size, widely used for lubricants, solvents, and bulk chemicals.

- 250 Liters to 1000 Liters: Primarily for IBCs, offering a balance between bulk capacity and handling flexibility.

- More than 1000 Liters: Large-scale bulk containers and specialized tank packaging for very high volumes.

- By End-User Industry: This critical segmentation highlights the diverse application areas and specific regulatory and performance needs of different industries.

- Chemicals and Petrochemicals: Largest segment, requiring robust packaging for acids, bases, solvents, and various industrial chemicals in bulk and smaller quantities.

- Pharmaceuticals and Healthcare: Demands sterile, temperature-controlled, and highly secure packaging for APIs, biologics, vaccines, diagnostic samples, and medical waste.

- Oil and Gas: Uses durable packaging for lubricants, fuels, drilling fluids, and waste products from exploration and refining processes.

- Waste Management: Requires specialized, leak-proof, and puncture-resistant containers for hazardous waste collection, transport, and disposal.

- Agriculture: Utilizes packaging for pesticides, herbicides, and other hazardous agricultural chemicals.

- Automotive: For components such as batteries, coolants, and specific oils that contain hazardous substances.

- Defense: Specializes in packaging for munitions, explosives, and other dangerous military materials, demanding extreme security and durability.

- Others (Manufacturing, Research Labs): Includes a broad range of smaller-scale industrial applications and laboratory research that handle diverse hazardous substances.

- By Region: Geographical segmentation captures the impact of regional regulations, industrialization levels, and trade flows on market demand.

- North America (U.S., Canada, Mexico): Mature market with stringent regulations and high demand from diverse industries.

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe): Strong regulatory environment, focus on sustainability, and significant industrial base.

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific): Fastest-growing region due to rapid industrial expansion and increasing trade.

- Latin America (Brazil, Argentina, Rest of Latin America): Emerging market with growing industrialization and infrastructure development.

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA): Driven by oil and gas industry and rising awareness of safety standards.

Value Chain Analysis For Hazmat Packaging Market

The value chain for the Hazmat Packaging Market is a complex and highly regulated ecosystem, beginning with the meticulous sourcing of raw materials and extending through manufacturing, distribution, and ultimate end-use. Upstream analysis focuses on the foundational supply of critical raw materials, which dictates the quality, performance, and cost-effectiveness of the final packaging products. This segment primarily involves producers of various plastics such as High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polyethylene Terephthalate (PET), and Polypropylene (PP), which are essential for manufacturing drums, jerricans, and IBCs. Steel manufacturers provide the robust metal sheets necessary for steel drums and composite IBC components, while timber suppliers provide wood for crates and pallets, and pulp and paper mills produce fiberboard for boxes. Specialty chemical companies supply additives, resins, and coatings that enhance chemical resistance, barrier properties, and UV protection for packaging. Furthermore, specialized component manufacturers produce closures, gaskets, vents, and liners that are crucial for ensuring the hermetic sealing and integrity of hazardous material containers. The quality and consistent supply of these raw materials are paramount, as any deficiency can compromise the safety and regulatory compliance of the final packaging, underscoring the need for rigorous quality control and supplier certification at this initial stage of the value chain.

Midstream activities represent the core manufacturing and assembly processes where raw materials are transformed into finished hazmat packaging solutions. This stage involves sophisticated engineering, advanced production techniques, and strict adherence to design specifications mandated by international and national dangerous goods regulations (e.g., UN packaging codes, DOT 49 CFR). Manufacturers leverage technologies such as blow molding for plastic containers, stamping and welding for steel drums, and complex assembly for composite IBCs. A significant emphasis is placed on rigorous testing protocols, including drop tests, stack tests, leakproofness tests, and hydraulic pressure tests, to ensure that each packaging type can withstand anticipated stresses during transport and storage. Certification by authorized bodies is a mandatory step, validating that the packaging meets specific performance criteria for various hazard classes. Companies in this segment often specialize in particular packaging types or cater to specific hazardous material categories, developing deep expertise in their chosen niche. Continuous investment in research and development is vital for innovation in materials, design, and manufacturing processes to enhance safety, reduce environmental impact, and improve cost efficiency, thereby maintaining a competitive edge in a highly regulated market.

Downstream analysis encompasses the distribution, logistics, and end-use phases of the hazmat packaging value chain. Distribution channels are often multifaceted, involving direct sales from manufacturers to large industrial end-users, as well as indirect channels through a network of specialized distributors, wholesalers, and third-party logistics (3PL) providers who possess expertise in handling and transporting dangerous goods. These distributors play a crucial role in inventory management, local market reach, and providing value-added services such as labeling, reconditioning, and compliance consulting. The ultimate end-users are diverse, including chemical manufacturers, pharmaceutical companies, waste management facilities, oil and gas operators, and agricultural businesses, all of whom utilize hazmat packaging for the containment and transport of their specific hazardous products or waste streams. Direct and indirect distribution channels are both prominent. Direct channels facilitate strong relationships and customized solutions for major clients, while indirect channels provide broader market penetration, especially for smaller-volume orders or regional distribution. Post-use, the value chain also extends to reverse logistics for reusable packaging (e.g., reconditioned drums and IBCs) and responsible disposal services for single-use containers, highlighting the cradle-to-grave responsibility embedded within the hazardous materials management ecosystem. Effective collaboration and communication among all stakeholders across the entire value chain are crucial for ensuring seamless operations, regulatory compliance, and overall safety.

Hazmat Packaging Market Potential Customers

The Hazmat Packaging Market serves a broad and diverse range of potential customers, primarily comprised of industries that routinely handle, store, or transport dangerous goods as part of their core operations. These end-users are driven by an absolute necessity to comply with stringent safety regulations, mitigate risks to personnel and the environment, and ensure the integrity of their products. The largest segment of potential customers typically originates from the Chemicals and Petrochemicals industry. Manufacturers and distributors of industrial chemicals, specialty chemicals, petrochemicals, acids, bases, solvents, and other hazardous compounds require vast quantities of robust and chemically resistant packaging. This includes bulk containers like drums, Intermediate Bulk Containers (IBCs), and flexible IBCs (FIBCs) for raw materials and finished products, as well as smaller jerricans and bottles for sampling and smaller shipments. Their purchasing decisions are heavily influenced by UN certification, compatibility with specific chemicals, durability for diverse transport modes, and overall cost-efficiency.

Another significant customer base resides within the Pharmaceuticals and Healthcare sectors. With the global expansion of biologics, vaccines, active pharmaceutical ingredients (APIs), diagnostic reagents, and the constant need to manage infectious medical waste, these industries require highly specialized hazmat packaging. This often includes temperature-controlled solutions, sterile containers, tamper-evident designs, and packaging specifically certified for infectious substances (e.g., Category A and B UN3373). Compliance with pharmaceutical good manufacturing practices (GMP) and strict health and safety regulations are paramount, making reliability and validation critical purchasing criteria. Similarly, the Oil and Gas industry is a major consumer, utilizing hazmat packaging for lubricants, drilling fluids, fuels, industrial oils, and waste generated from exploration, production, and refining activities. They demand extremely durable and high-capacity packaging capable of withstanding harsh environmental conditions and ensuring safe transport across often remote and challenging terrains.

Beyond these primary sectors, the Waste Management industry represents a consistent and growing customer segment, requiring a wide array of hazmat packaging for the safe collection, segregation, transportation, and disposal of hazardous waste streams from industrial, commercial, and residential sources. This encompasses specialized containers for chemical waste, medical waste, radioactive waste, and other regulated refuse. The Agriculture industry procures hazmat packaging for pesticides, herbicides, fungicides, and other hazardous crop protection chemicals. The Automotive industry requires packaging for components like batteries (lithium-ion and lead-acid), coolants, and specific oils that contain dangerous goods. The Defense sector demands packaging solutions for munitions, explosives, propellants, and other sensitive military materials, often requiring extreme durability, security features, and resistance to environmental extremes. Finally, Research Laboratories and Academic Institutions

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 16.5 billion |

| Market Forecast in 2032 | USD 26.4 billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hazmat Packaging Market Key Technology Landscape

The Hazmat Packaging Market is undergoing significant technological evolution, driven by the relentless pursuit of enhanced safety, improved regulatory compliance, and greater operational efficiency across the supply chain for dangerous goods. A primary area of innovation lies in advanced material science. This involves the development of new plastics, composites, and metal alloys that offer superior chemical resistance, impact strength, reduced weight, and improved barrier properties against permeation. For instance, multi-layer co-extruded plastic containers with advanced barrier resins are emerging to safely contain highly volatile or corrosive substances. Research is also focused on developing more sustainable materials, including bio-based plastics, recycled content, and fully recyclable composite structures, aiming to reduce the environmental footprint of packaging without compromising crucial safety attributes. Nanotechnology is also being explored for developing coatings that provide enhanced protection against UV radiation, extreme temperatures, or microbial degradation, thereby extending the integrity and lifespan of hazmat containers.

Another pivotal technological trend is the integration of smart packaging solutions within hazmat containers. This incorporates various embedded or attached sensors and communication technologies to provide real-time monitoring capabilities. IoT (Internet of Things) sensors can track critical parameters such as internal temperature, pressure, humidity, shock, tilt, and geolocation of shipments. In the event of a deviation from safe limits or an unexpected event like a drop or leak, these sensors can trigger immediate alerts to relevant stakeholders, enabling rapid intervention and mitigating potential risks. Furthermore, technologies like RFID (Radio Frequency Identification) tags, QR codes, and NFC (Near Field Communication) chips are extensively used for enhanced traceability, efficient inventory management, automated batch tracking, and providing instant digital access to essential safety data sheets (SDS) and regulatory compliance documents. This digitalization not only streamlines complex administrative processes but also significantly enhances transparency and accountability throughout the hazardous materials logistics chain, bolstering incident response capabilities and overall supply chain security.

Furthermore, automation and robotics are increasingly transforming the manufacturing, filling, handling, and inspection processes within the hazmat packaging sector. Automated filling and sealing lines minimize human exposure to dangerous substances, reduce the risk of human error, and ensure consistent adherence to precise filling levels and sealing specifications. Robotic arms are employed for handling heavy or unusually shaped hazmat containers, increasing efficiency and worker safety. Advanced testing and certification technologies are also continuously being refined, utilizing sophisticated laboratory equipment for simulating extreme transport conditions, including specialized drop tests, vibration tables, and pressure chambers to validate packaging performance against stringent UN performance standards. Finally, the application of data analytics and Artificial Intelligence (AI) is emerging as a powerful tool. AI algorithms can analyze vast datasets of historical incidents, environmental conditions, and logistical data to predict potential risks, optimize transportation routes for hazardous goods, and streamline regulatory compliance checks. These technologies collectively contribute to a more resilient, safer, and ultimately more efficient global ecosystem for the packaging and transport of hazardous materials, driving continuous improvement in the industry's ability to manage complex safety and environmental challenges.

Regional Highlights

- North America: This region holds a significant and mature share of the Hazmat Packaging Market, primarily driven by a highly developed industrial infrastructure, particularly in the chemical, petrochemical, pharmaceutical, and oil and gas sectors. The United States and Canada are the dominant countries, benefiting from substantial R&D investments and an extremely stringent regulatory framework enforced by agencies such as the U.S. Department of Transportation (DOT), Pipeline and Hazardous Materials Safety Administration (PHMSA), and Transport Canada. There is a strong emphasis on compliance and safety, leading to consistent demand for high-quality, certified packaging solutions. The adoption of advanced tracking technologies and sustainable packaging initiatives is also growing, contributing to the region's market value.

- Europe: Europe represents another key market with a robust industrial base and a long-standing commitment to environmental protection and occupational safety. The market growth here is underpinned by well-established chemical, automotive, and pharmaceutical industries, coupled with comprehensive and harmonized dangerous goods regulations such as ADR (road), RID (rail), and ADN (inland waterways), and strong implementation of IMDG (sea) and IATA (air) rules. Countries like Germany, France, the United Kingdom, and Italy are major contributors. The region is at the forefront of adopting sustainable and eco-friendly hazmat packaging solutions, driven by EU directives and a strong societal push for circular economy principles, leading to innovation in reusable and recyclable packaging materials.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for hazmat packaging during the forecast period. This rapid expansion is primarily fueled by accelerated industrialization, burgeoning manufacturing capabilities, and significant economic growth in countries like China, India, Japan, South Korea, and Southeast Asian nations. The region is witnessing a substantial increase in both domestic consumption and international trade of hazardous chemicals, pharmaceuticals, and industrial components, directly translating into higher demand for compliant packaging. While regulatory enforcement has historically been less uniform, there is a clear trend towards increasingly stringent environmental and safety regulations, pushing industries to upgrade their packaging standards. Investments in infrastructure and logistics networks further support market expansion.

- Latin America: This region presents considerable growth opportunities, driven by expanding industrial sectors, particularly in Brazil, Mexico, and Argentina. The market is propelled by increasing foreign direct investments, growing manufacturing activities, and rising demand from the agriculture (pesticides, fertilizers), petrochemicals, and mining industries. While regulatory frameworks are still evolving in some areas, there is a growing awareness and adoption of international dangerous goods standards. Infrastructure development and cross-border trade agreements are further stimulating the demand for secure and compliant hazmat packaging solutions, making it an attractive region for market penetration.

- Middle East and Africa (MEA): The MEA region is expected to witness substantial growth, largely attributable to its significant oil and gas exploration and production activities, extensive infrastructure development projects, and a steadily increasing healthcare expenditure. Countries in the GCC (Gulf Cooperation Council) and South Africa are key markets. The region's strategic location for international trade routes also contributes to the demand for hazmat packaging. Growing industrialization, coupled with a rising emphasis on adhering to international safety standards and environmental regulations, is compelling local industries to invest in high-quality hazmat packaging solutions, creating a fertile ground for market expansion and technological adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hazmat Packaging Market.- Greif Inc.

- Mauser Packaging Solutions

- BWAY Corporation

- Sonoco Products Company

- SCHÜTZ GmbH & Co. KGaA

- IPackchem SA

- General Steel Drum Inc.

- CurTec International B.V.

- CDF Corporation

- Hawman Container Services

- HazenPaper Company

- Great Western Containers Inc.

- CL Smith Company

- Hoover Ferguson Group

- Skolnik Industries Inc.

- Thermo Fisher Scientific Inc.

- World Courier (AmerisourceBergen)

- Trans-Packers Services Corp.

- Air Sea Containers Ltd.

- Fisher Container Corp.

- Constantia Flexibles Group GmbH

- Amcor Plc

Frequently Asked Questions

What is Hazmat Packaging and why is it crucial?

Hazmat packaging refers to specialized containers and materials meticulously designed and certified to safely contain, transport, and store hazardous materials (dangerous goods). It is crucial to prevent leakage, spills, and exposure risks, thereby protecting human health, public safety, and the environment, while ensuring strict compliance with global transportation regulations.

Which specific industries primarily drive the demand for Hazmat Packaging solutions?

The demand is predominantly driven by industries such as chemicals and petrochemicals, pharmaceuticals and healthcare, oil and gas, waste management, agriculture, and defense. These sectors routinely handle and transport substances requiring robust and compliant containment.

What are the main factors propelling the growth of the Hazmat Packaging Market?

Key growth drivers include the continuous expansion of global trade in dangerous goods, increasingly stringent international and national safety regulations, growing industrialization in emerging economies, and a heightened global awareness concerning environmental protection and occupational safety.

How is Artificial Intelligence (AI) influencing the Hazmat Packaging Market?

AI significantly impacts the market by enabling predictive risk analytics for transport, automating complex compliance checks, enhancing quality inspections through computer vision, optimizing logistics routes for safety and efficiency, and improving real-time inventory management of hazardous materials.

What types of materials are commonly utilized in the manufacturing of Hazmat Packaging?

Common materials include various plastics (e.g., HDPE, LDPE, PP) for their chemical resistance and versatility, steel for strength and durability, fiberboard for dry goods, wood for crates, and glass for specific inert chemical containment, often combined in composite structures for optimal performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager