Helicopter Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428139 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Helicopter Blades Market Size

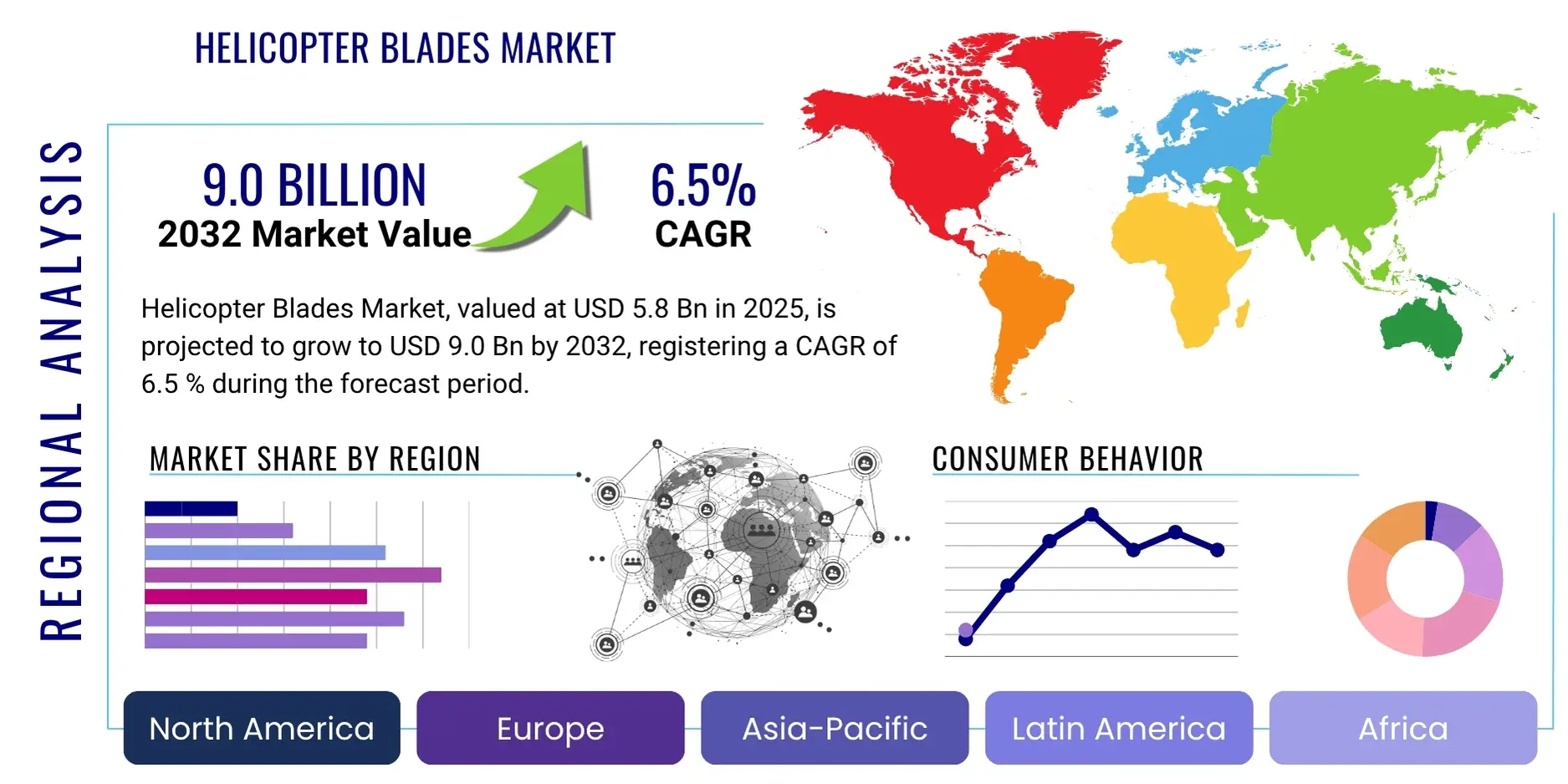

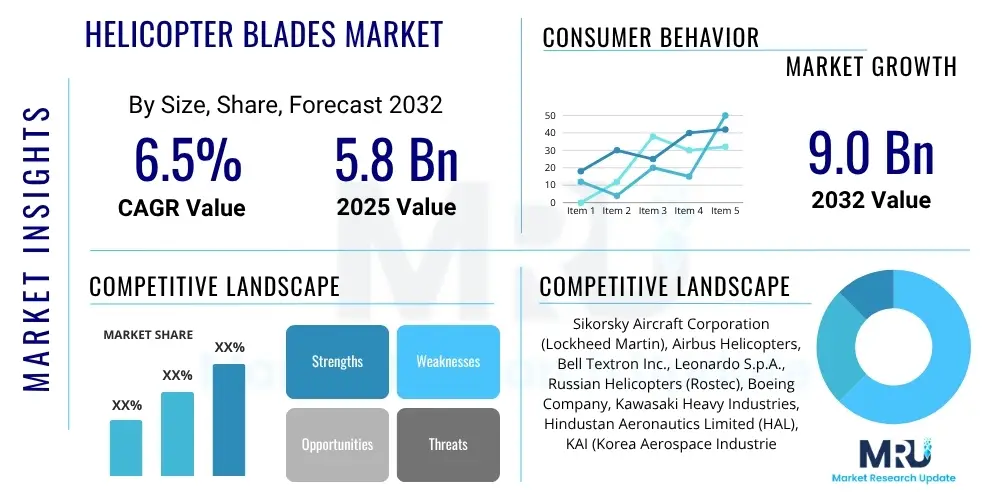

The Helicopter Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 5.8 billion in 2025 and is projected to reach USD 9.0 billion by the end of the forecast period in 2032.

Helicopter Blades Market introduction

The helicopter blades market is a critical segment within the aerospace industry, underpinning the operational capabilities of rotary-wing aircraft across military, commercial, and civil applications. Helicopter blades are complex aerodynamic structures engineered to provide lift, thrust, and control, making them fundamental to flight. Historically manufactured from metal alloys, modern blades increasingly incorporate advanced composite materials like carbon fiber, fiberglass, and aramid, offering superior strength-to-weight ratios, enhanced durability, and improved aerodynamic performance. These sophisticated materials and manufacturing techniques enable blades to withstand extreme forces, operate in diverse environmental conditions, and contribute significantly to the overall efficiency and safety of helicopters.

Major applications for helicopter blades span a wide spectrum of operations. In the military sector, they are vital for attack helicopters, transport helicopters, and reconnaissance aircraft, ensuring national security and enabling critical tactical operations. Commercial applications include passenger transport, corporate travel, offshore oil and gas operations, and heavy-lift services. Civil uses encompass emergency medical services (EMS), search and rescue (SAR), law enforcement, aerial firefighting, agricultural spraying, and tourism. Each application demands specific blade characteristics, ranging from robust design for heavy-lift and military use to optimized aerodynamics for quieter and more efficient commercial passenger transport.

The primary benefits derived from advancements in helicopter blade technology include enhanced flight performance, improved fuel efficiency, reduced maintenance costs through extended lifespans, and significant safety enhancements. Driving factors for market growth include increasing global defense expenditures, expansion of commercial aviation fleets, a growing demand for specialized civil operations, and continuous technological innovations aimed at improving blade aerodynamics, material science, and manufacturing processes. The ongoing need for maintenance, repair, and overhaul (MRO) services for existing fleets also constitutes a substantial and stable segment of the market, ensuring sustained demand for blades and related components.

Helicopter Blades Market Executive Summary

The Helicopter Blades Market is experiencing robust growth driven by a confluence of factors including escalating defense modernization programs globally, the continuous expansion of commercial and civil aviation sectors, and relentless innovation in materials science and aerodynamic design. Key business trends indicate a definitive shift towards advanced composite materials, offering superior performance attributes such as reduced weight, increased fatigue life, and enhanced damage tolerance, which are crucial for extending operational capabilities and reducing through-life costs. Manufacturers are investing heavily in research and development to create blades that can operate efficiently in diverse environments, from high altitudes to maritime conditions, meeting stringent safety and performance standards set by regulatory bodies. The aftermarket for MRO services remains a cornerstone, reflecting the long operational life of helicopters and the critical need for regular inspection, repair, and replacement of blades to ensure flight safety and operational readiness.

Regional trends highlight significant growth pockets and strategic importance across various geographies. North America and Europe, with their well-established aerospace industries and substantial defense budgets, continue to lead in technological innovation and advanced manufacturing of helicopter blades. These regions are home to major OEMs and MRO providers, driving demand for cutting-edge blade solutions. The Asia Pacific region is emerging as a critical growth engine, propelled by expanding military capabilities, increasing commercial air travel, and a rising demand for civil utility helicopters, particularly in developing economies. Latin America, the Middle East, and Africa are also showing steady growth, primarily driven by defense procurements, oil and gas exploration activities, and the nascent development of emergency services infrastructure, creating diverse opportunities for market players.

Segmentation trends reveal a clear preference for main rotor blades, which account for the largest share due to their size, complexity, and direct impact on flight dynamics, followed by tail rotor blades critical for directional control. By material, composite blades are rapidly gaining dominance over traditional metal blades due to their performance advantages, reflecting a broader industry trend towards lightweighting and advanced material adoption. Application-wise, the military segment remains a primary demand driver due to ongoing defense upgrades and procurements, while the commercial and civil segments are expanding steadily. The market is also seeing increasing demand from the original equipment manufacturers (OEMs) for new aircraft production, alongside a significant and consistent demand from the MRO sector for replacement and repair services, collectively shaping a dynamic and competitive market landscape.

AI Impact Analysis on Helicopter Blades Market

Common user questions regarding AI's impact on the Helicopter Blades Market often revolve around how artificial intelligence can enhance design, manufacturing efficiency, predictive maintenance, and overall operational safety. Users are keenly interested in whether AI can significantly reduce development cycles and costs, improve blade performance, and enable more proactive maintenance strategies. Key concerns frequently raised include the reliability of AI systems in critical aerospace applications, the integration complexity with existing legacy systems, and the data security implications of utilizing vast datasets for AI training. There is a strong expectation that AI will unlock new levels of precision and personalization in blade engineering, leading to smarter, more resilient, and ultimately safer rotary-wing aircraft.

AI's influence is profoundly shaping the early stages of helicopter blade development, particularly in design and simulation. Advanced AI algorithms, coupled with machine learning, are capable of analyzing vast datasets from aerodynamic models, material properties, and historical flight performance to generate optimized blade geometries and material compositions that were previously unachievable through traditional methods. This computational power allows for rapid prototyping and virtual testing, accelerating the design cycle and identifying potential performance bottlenecks or structural weaknesses before physical production. The ability of AI to explore a far wider design space leads to innovative blade profiles that maximize lift, minimize drag, and reduce acoustic signatures, pushing the boundaries of what is possible in rotorcraft aerodynamics.

Furthermore, AI is poised to revolutionize the manufacturing and maintenance phases of helicopter blades. In manufacturing, AI-powered quality control systems can monitor production lines in real-time, detecting micro-defects with unparalleled accuracy and ensuring consistent product quality, thereby reducing waste and rework. For operational maintenance, predictive maintenance (PdM) powered by AI and machine learning is a game-changer. By continuously monitoring sensor data from blades—such as vibration patterns, temperature, and stress levels—AI can forecast potential component failures long before they occur. This allows for scheduled maintenance interventions, minimizing unscheduled downtime, extending blade lifespans, and significantly enhancing safety by preventing in-flight failures, translating into substantial cost savings for operators and improved asset utilization.

- AI-driven generative design for optimal blade aerodynamics and structural integrity.

- Machine learning for predictive maintenance, extending blade life and reducing unscheduled downtime.

- AI-enhanced quality control in manufacturing for defect detection and process optimization.

- Development of smart blades with integrated sensors and AI for real-time performance monitoring.

- AI simulation for advanced material selection and stress analysis, improving durability.

- Robotics and AI in automated blade production, enhancing precision and efficiency.

- Support for autonomous flight systems requiring dynamic blade adjustments and self-monitoring.

DRO & Impact Forces Of Helicopter Blades Market

The Helicopter Blades Market is propelled by several key drivers, including the escalating global defense budgets allocating funds for modernizing military helicopter fleets and acquiring new advanced rotorcraft. The continuous expansion of commercial aviation, particularly in sectors like offshore transportation, air tourism, and corporate charters, further fuels demand for high-performance and reliable blades. Additionally, the increasing utilization of helicopters in diverse civil applications such as emergency medical services, law enforcement, search and rescue, and infrastructure inspection, contributes significantly to market growth. A fundamental driving force is the relentless pursuit of technological advancements in materials science, aerodynamics, and manufacturing processes, leading to the development of lighter, stronger, and more efficient blades that promise enhanced operational capabilities and fuel economy.

However, the market also faces significant restraints. The exceptionally high cost associated with the research, development, and manufacturing of advanced helicopter blades, especially those utilizing cutting-edge composite materials, poses a substantial barrier to entry and can impact procurement decisions. Stringent regulatory approval processes, including certifications from aviation authorities like the FAA and EASA, are complex, time-consuming, and expensive, demanding extensive testing and compliance, which can delay product introduction. Furthermore, the long operational lifecycle of helicopters means that replacement cycles for blades can be infrequent, leading to fluctuating demand for new blade production and placing greater emphasis on the aftermarket MRO segment rather than new sales.

Opportunities within the helicopter blades market are abundant, particularly in the aftermarket for Maintenance, Repair, and Overhaul (MRO) services, as existing fleets require continuous upkeep and modernization. The development of next-generation vertical lift platforms, including Future Vertical Lift (FVL) programs, presents significant opportunities for innovative blade designs and materials. The adoption of advanced manufacturing techniques such as additive manufacturing (3D printing) for complex blade components, alongside the integration of smart sensors for real-time health monitoring, offers avenues for technological differentiation and performance enhancement. Moreover, emerging economies in Asia Pacific, Latin America, and Africa are gradually increasing their defense spending and civilian helicopter fleets, opening up new geographical markets for both new blades and MRO services.

The impact forces influencing the market dynamics are multifaceted. The bargaining power of buyers, primarily large original equipment manufacturers (OEMs) and national defense ministries, is high due to their significant procurement volumes and the critical nature of their requirements. Conversely, the bargaining power of suppliers, especially those providing specialized raw materials like advanced composite fibers and resins, is also substantial due to the unique properties and proprietary nature of their products. The threat of new entrants into the helicopter blades manufacturing sector is low, owing to the extremely high capital investment, extensive R&D requirements, and the necessity for deep technical expertise and complex certifications. The threat of substitutes is virtually non-existent, as helicopter blades are indispensable for rotary-wing flight. Competitive rivalry among established players remains intense, driving continuous innovation in performance, cost-effectiveness, and service offerings to gain market share.

Segmentation Analysis

The Helicopter Blades Market is comprehensively segmented across various critical dimensions, providing a nuanced view of its structure and dynamics. These segmentations are crucial for understanding demand patterns, identifying growth opportunities, and assessing the competitive landscape. The market can be broadly categorized by material type, blade type, application, and end-user, each influencing procurement decisions and technological advancements. The dominance of advanced composite materials is a defining trend, alongside the perennial importance of both main and tail rotor blades for distinct flight functions. Understanding these segmentations allows market participants to tailor their strategies and product offerings to specific needs within the global aerospace ecosystem.

- By Material

- Composite Materials (Carbon Fiber, Fiberglass, Aramid, Hybrid Composites)

- Metal Alloys (Aluminum Alloys, Titanium Alloys, Steel Alloys)

- Hybrid Materials

- By Blade Type

- Main Rotor Blades

- Tail Rotor Blades

- Specialty Blades (e.g., for drone applications, experimental designs)

- By Application

- Military Helicopters (Attack, Transport, Reconnaissance, Utility)

- Commercial Helicopters (Passenger Transport, Offshore Oil & Gas, Heavy Lift)

- Civil Helicopters (Emergency Medical Services (EMS), Law Enforcement, Search & Rescue (SAR), Tourism, Agricultural, Private)

- By End-User

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) Providers

- Government/Defense Agencies

- Commercial Operators

- Private Owners

Value Chain Analysis For Helicopter Blades Market

The value chain for the Helicopter Blades Market is intricate, involving multiple specialized stages from raw material procurement to end-user operation and maintenance. Upstream activities begin with the sourcing of highly specialized raw materials, primarily advanced composite fibers such as carbon fiber, aramid, and fiberglass, along with resins and core materials. Metal alloys like aluminum, titanium, and high-strength steels are also critical inputs. These materials are procured from a limited number of specialized chemical and metallurgical suppliers who adhere to stringent aerospace quality standards. The quality and availability of these raw materials directly impact the performance and cost of the final blades, necessitating strong relationships and long-term contracts with suppliers.

Midstream activities involve the complex and precision-driven manufacturing process of the blades. This includes material preparation, laying up of composite plies, curing in autoclaves, machining, bonding, balancing, and surface finishing. This stage often incorporates advanced techniques like automated fiber placement (AFP), resin transfer molding (RTM), and hot forming. Manufacturers also integrate various components such as leading-edge protection, de-icing systems, and tip designs. Quality control and rigorous testing, including fatigue testing, aerodynamic performance validation, and non-destructive inspection, are paramount to ensure the blades meet stringent safety and performance certifications. These manufacturing operations are capital-intensive and require highly skilled labor and specialized equipment.

Downstream activities encompass the distribution, sales, installation, and extensive aftermarket support. For new aircraft, blades are typically sold directly to Original Equipment Manufacturers (OEMs) who integrate them into new helicopter assemblies. For the aftermarket, blades are distributed through a network of MRO providers, authorized service centers, and direct sales channels to helicopter operators, including military forces, commercial airlines, and civil agencies. Distribution channels can be direct, particularly for large defense contracts or major OEM sales, or indirect through specialized aerospace distributors for MRO parts. The MRO segment is critical, providing repair, overhaul, and replacement services, ensuring the continued airworthiness and operational readiness of helicopter fleets. This segment often involves a global network to support diverse operational bases, requiring robust logistics and inventory management for critical spare parts.

Helicopter Blades Market Potential Customers

The potential customers for helicopter blades are diverse, encompassing a wide range of end-users across defense, commercial, and civil sectors, each with unique requirements and procurement processes. Military organizations worldwide represent a significant customer segment, continuously investing in new attack, transport, and utility helicopters for defense modernization programs, as well as requiring extensive MRO services for their existing fleets. These customers prioritize performance, durability, and mission readiness, often engaging in long-term contracts with blade manufacturers or helicopter OEMs. The demand here is driven by geopolitical dynamics, defense budgets, and the need for advanced capabilities to maintain air superiority and operational effectiveness.

In the commercial sector, key buyers include offshore oil and gas operators who utilize helicopters for personnel and cargo transport to remote platforms, requiring blades optimized for reliability and performance in challenging maritime environments. Commercial airlines and charter companies operating helicopter services for corporate travel, tourism, and heavy-lift operations also form a crucial customer base, focusing on efficiency, passenger comfort, and reduced operating costs. These customers often seek blades that contribute to fuel efficiency and have extended service lives, thereby lowering their total cost of ownership. The growth of air taxi and urban air mobility concepts, while nascent, also represents a potential future customer segment for innovative blade designs.

The civil segment comprises a broad array of end-users, including emergency medical service (EMS) providers, law enforcement agencies, and search and rescue (SAR) organizations, all of whom rely on helicopters for critical, time-sensitive missions. These customers demand blades that ensure maximum reliability and performance under urgent operational conditions. Additionally, agricultural operators, aerial firefighting services, utility inspection companies, and private helicopter owners also constitute important customer groups, each requiring blades tailored to their specific operational profiles and environmental conditions. The MRO market also serves all these end-users by providing necessary repair and replacement blades throughout the helicopter's operational life, making MRO providers themselves significant indirect customers by stocking and supplying parts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Market Forecast in 2032 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sikorsky Aircraft Corporation (Lockheed Martin), Airbus Helicopters, Bell Textron Inc., Leonardo S.p.A., Russian Helicopters (Rostec), Boeing Company, Kawasaki Heavy Industries, Hindustan Aeronautics Limited (HAL), KAI (Korea Aerospace Industries), Dynacore Inc., General Dynamics Corporation, Kaman Corporation, Collins Aerospace (Raytheon Technologies), Safran S.A., Liebherr-Aerospace, GKN Aerospace (Melrose Industries), Cytec Solvay Group, Hexcel Corporation, Toray Industries, Mitsubishi Heavy Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helicopter Blades Market Key Technology Landscape

The technology landscape for the Helicopter Blades Market is characterized by a relentless pursuit of innovation aimed at enhancing performance, durability, and cost-efficiency. A cornerstone of this evolution is the increasing adoption of advanced composite materials, predominantly carbon fiber, fiberglass, and aramid, often integrated with sophisticated resin systems. These materials offer unparalleled strength-to-weight ratios, superior fatigue resistance, and excellent damage tolerance compared to traditional metal alloys. Manufacturers are continuously refining composite lay-up techniques, such as automated fiber placement (AFP) and automated tape laying (ATL), to achieve precise fiber orientation and optimal structural properties, which are critical for the demanding operational environment of helicopter blades. Furthermore, hybrid material systems are gaining traction, combining the best attributes of composites and metals to achieve specific performance goals, such as impact resistance and lightning strike protection.

Beyond materials, significant technological advancements are being made in aerodynamic design and manufacturing processes. Computational Fluid Dynamics (CFD) and advanced simulation software are indispensable tools, enabling engineers to model and predict blade performance with high fidelity, optimize airfoil shapes, and minimize noise signatures. This includes the development of active and passive aerodynamic devices incorporated into blade tips for improved efficiency and reduced vibration. In manufacturing, precision machining, advanced bonding techniques, and sophisticated balancing systems are vital for producing blades that meet stringent quality and safety standards. The integration of additive manufacturing (3D printing) is also emerging for complex internal structures or specialized components, offering potential for lightweighting and rapid prototyping, though its application for primary structural elements remains under intense research and development.

The future technology landscape is increasingly focused on smart blades and integrated health monitoring systems. This involves embedding sensors directly within the blade structure to monitor parameters such as stress, strain, temperature, and vibration in real-time. These "smart blades" can then feed data into AI-powered predictive maintenance systems, allowing for proactive interventions and significantly extending operational life while improving safety. Research into novel materials like smart alloys with self-healing capabilities or adaptive structures that can change their aerodynamic profile in flight is also underway, promising revolutionary improvements in helicopter performance and versatility. These technological advancements collectively drive the market towards more efficient, safer, and highly adaptable helicopter blade solutions, meeting the evolving demands of both military and civilian operators.

Regional Highlights

- North America: This region holds a dominant share in the Helicopter Blades Market, primarily driven by substantial defense expenditures, extensive R&D investments, and the presence of major aerospace OEMs and MRO providers. The demand is fueled by the modernization of military fleets, a robust commercial aviation sector, and significant civil applications including EMS and law enforcement. The U.S. remains a key player due to its large defense budget and technological leadership.

- Europe: Europe represents a mature and technologically advanced market, characterized by strong OEM presence (e.g., Airbus Helicopters, Leonardo) and a high focus on advanced materials and manufacturing techniques. Demand is supported by military procurements, a growing commercial helicopter market, and diverse civil operations. Stringent regulatory environments also drive innovation in safety and performance.

- Asia Pacific (APAC): The fastest-growing region, driven by increasing defense budgets in countries like China, India, and South Korea, coupled with expanding commercial aviation and civil applications. Rapid economic growth, urbanization, and a rise in specialized services (e.g., offshore oil & gas, tourism, emergency services) are propelling demand for new helicopters and associated blades, fostering both local manufacturing capabilities and import opportunities.

- Latin America: This region exhibits steady growth, primarily influenced by military modernization efforts and the expanding presence of civil operations, including resource extraction (oil & gas, mining) and public services. Economic development and improving infrastructure are also contributing to increased demand for utility and transport helicopters.

- Middle East and Africa (MEA): Growth in MEA is largely attributed to defense spending by oil-rich nations for security and border patrol, as well as significant investments in offshore oil & gas exploration. The expansion of tourism and nascent emergency services also creates niche demands, albeit with a smaller overall market share compared to other regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helicopter Blades Market.- Sikorsky Aircraft Corporation (Lockheed Martin)

- Airbus Helicopters

- Bell Textron Inc.

- Leonardo S.p.A.

- Russian Helicopters (Rostec)

- Boeing Company

- Kawasaki Heavy Industries

- Hindustan Aeronautics Limited (HAL)

- KAI (Korea Aerospace Industries)

- Dynacore Inc.

- General Dynamics Corporation

- Kaman Corporation

- Collins Aerospace (Raytheon Technologies)

- Safran S.A.

- Liebherr-Aerospace

- GKN Aerospace (Melrose Industries)

- Cytec Solvay Group

- Hexcel Corporation

- Toray Industries

- Mitsubishi Heavy Industries

Frequently Asked Questions

What is the projected growth rate for the Helicopter Blades Market?

The Helicopter Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032, reaching an estimated value of USD 9.0 billion by 2032.

What are the primary factors driving the Helicopter Blades Market?

Key drivers include increasing global defense budgets, expanding commercial aviation and civil applications (like EMS and SAR), and continuous technological advancements in materials science and aerodynamic design leading to more efficient and durable blades.

How is AI impacting the Helicopter Blades Market?

AI is revolutionizing the market by enabling generative design for optimal aerodynamics, enhancing predictive maintenance for extended blade life, improving manufacturing quality control, and supporting the development of smart blades with integrated real-time monitoring capabilities.

Which material types dominate the Helicopter Blades Market?

Advanced composite materials such as carbon fiber, fiberglass, and aramid are increasingly dominating the market due to their superior strength-to-weight ratio, durability, and enhanced performance characteristics compared to traditional metal alloys.

What are the key challenges faced by the Helicopter Blades Market?

Major challenges include the high costs associated with research, development, and manufacturing of advanced blades, stringent and time-consuming regulatory approval processes, and the relatively long product lifecycle of helicopters, which can lead to infrequent replacement cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager