Hematocrit Test Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428153 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hematocrit Test Devices Market Size

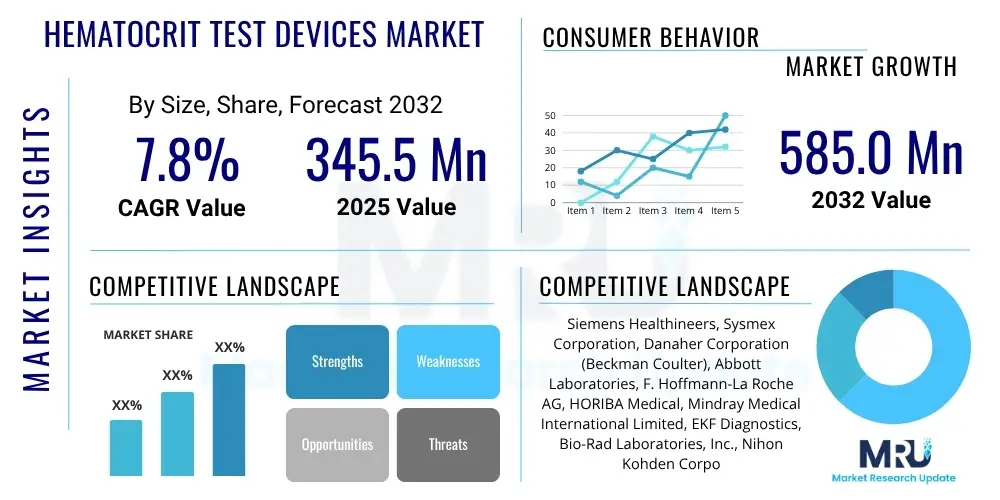

The Hematocrit Test Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 345.5 Million in 2025 and is projected to reach USD 585.0 Million by the end of the forecast period in 2032.

Hematocrit Test Devices Market introduction

The hematocrit test devices market encompasses a range of instruments and consumables used to measure the volume percentage of red blood cells (erythrocytes) in whole blood. This critical diagnostic parameter, known as hematocrit (Hct) or packed cell volume (PCV), is fundamental in diagnosing and monitoring various medical conditions, including anemia, polycythemia, and dehydration, as well as assessing blood loss and evaluating treatment efficacy. The market includes a diverse array of technologies, from traditional micro-hematocrit centrifuges to advanced automated hematology analyzers, alongside essential consumables like capillary tubes and reagents. These devices are integral to routine medical examinations, emergency diagnostics, and specialized clinical settings, offering rapid and accurate insights into a patient's erythrocytic status.

Product descriptions within this market range from compact, portable centrifuges ideal for point-of-care (POC) testing in clinics and remote areas to sophisticated, multi-parameter hematology analyzers found in high-throughput diagnostic laboratories and hospitals. Major applications span across general health screenings, pre-operative assessments, chronic disease management, and blood donation screening. The benefits of these devices are manifold: they provide essential diagnostic information, facilitate timely medical interventions, and support the continuous monitoring of patient health. The ongoing advancements in technology, leading to improved accuracy, faster results, and enhanced automation, are consistently expanding their utility and demand across the healthcare continuum.

Driving factors for the growth of the hematocrit test devices market include the increasing global prevalence of blood-related disorders such as anemia and polycythemia, a burgeoning aging population more susceptible to various chronic conditions requiring frequent blood analysis, and the rising demand for point-of-care testing solutions that offer convenience and immediate results. Furthermore, continuous technological innovations in device design, the integration of automation and data management capabilities, and growing healthcare expenditure in emerging economies are significantly contributing to market expansion. The emphasis on early disease detection and preventative healthcare initiatives worldwide also underpins the sustained demand for reliable hematocrit testing.

Hematocrit Test Devices Market Executive Summary

The hematocrit test devices market is experiencing dynamic shifts driven by several pervasive business trends, notably the increasing adoption of automation and digitalization in clinical laboratories, which streamlines workflows and enhances diagnostic efficiency. There is a strong movement towards miniaturized and portable devices, reflecting the growing preference for point-of-care (POC) testing, particularly in remote settings and emergency departments, thereby decentralizing diagnostic capabilities. Furthermore, connectivity and data integration capabilities are becoming paramount, allowing for seamless communication with electronic health records (EHRs) and laboratory information systems (LIS), which improves data management, reduces manual errors, and supports more comprehensive patient care. Strategic collaborations and partnerships among device manufacturers, software providers, and healthcare institutions are also shaping the competitive landscape, fostering innovation and market penetration. These business trends underscore a shift towards more accessible, efficient, and integrated diagnostic solutions within the global healthcare ecosystem.

Regional trends reveal varied market dynamics across geographies. North America and Europe represent mature markets characterized by well-established healthcare infrastructures, high adoption rates of advanced diagnostic technologies, and significant R&D investments. These regions are primarily driven by technological upgrades, replacement demand, and the presence of major market players. In contrast, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by its vast population, increasing prevalence of chronic diseases, improving healthcare expenditure, and rising awareness regarding early disease diagnosis. Countries like China, India, and Japan are witnessing substantial investments in healthcare infrastructure and a growing demand for affordable and accessible diagnostic solutions. Latin America, the Middle East, and Africa (MEA) are also exhibiting steady growth, fueled by expanding healthcare access, government initiatives to improve public health, and a gradual shift towards modern diagnostic practices, although market penetration for advanced devices remains comparatively lower than developed regions.

Segment trends highlight specific areas of accelerated growth and innovation within the hematocrit test devices market. The point-of-care testing segment, encompassing portable and compact devices, is experiencing robust expansion due to its convenience, rapid results, and applicability in diverse settings such as clinics, emergency rooms, and even home care. This trend is particularly vital in addressing healthcare disparities and reaching underserved populations. Simultaneously, the automated hematology analyzers segment continues to evolve with enhanced precision, higher throughput, and integration of additional parameters, catering to the needs of large diagnostic laboratories and hospitals requiring comprehensive blood analysis. The consumables segment, including capillary tubes, reagents, and control materials, forms a recurring revenue stream and is intrinsically linked to the growth of device sales. Furthermore, technology-wise, the market is witnessing increased adoption of impedance-based methods and flow cytometry for more accurate and detailed cellular analysis, gradually moving beyond traditional centrifugation methods, reflecting the industry's continuous pursuit of improved diagnostic capabilities.

AI Impact Analysis on Hematocrit Test Devices Market

User questions regarding the impact of AI on Hematocrit Test Devices Market primarily revolve around the enhancement of diagnostic accuracy, automation of analysis, potential for predictive insights, and integration with broader healthcare systems. Common inquiries include how AI can reduce human error in interpreting results, accelerate the diagnostic process, enable remote monitoring, and whether it can assist in identifying subtle anomalies that might be missed by conventional methods. There is also significant interest in AI's role in improving workflow efficiency, managing large datasets, and delivering personalized treatment recommendations based on comprehensive patient data. Concerns often arise about data privacy, the cost of implementing AI solutions, the need for robust validation, and the potential displacement of skilled laboratory professionals. Overall, users expect AI to revolutionize the precision, speed, and accessibility of hematocrit testing while seeking assurances regarding its reliability and ethical deployment.

Based on this analysis, AI's influence in the hematocrit test devices domain is poised to be transformative, focusing on elevating the diagnostic value and operational efficiency. AI algorithms can significantly augment the accuracy and consistency of hematocrit measurements by automating image analysis for microscopic evaluations, reducing inter-observer variability, and flagging samples that require further attention. Beyond mere measurement, AI is expected to provide deeper analytical insights by correlating hematocrit values with other patient data points, potentially identifying complex patterns indicative of specific diseases or risk factors. This enhanced analytical capability will empower clinicians with more informed decision-making tools, moving beyond basic diagnostic interpretation towards predictive analytics for disease progression and personalized therapeutic strategies. The integration of AI also promises to optimize laboratory workflows, from automated quality control checks to predictive maintenance of instruments, thereby minimizing downtime and maximizing throughput, leading to more cost-effective and efficient operations across healthcare settings.

Furthermore, the long-term expectations for AI in this market extend to enabling truly intelligent diagnostic systems. These systems could, for example, analyze not just the hematocrit value but also automatically assess red blood cell morphology, detect subtle changes over time, and alert healthcare providers to potential health deterioration before clinical symptoms manifest. AI can also facilitate the development of advanced point-of-care devices with built-in interpretative capabilities, making sophisticated diagnostics accessible in resource-limited environments. However, successful integration hinges on overcoming challenges related to data standardization, algorithmic bias, regulatory approval for AI-driven diagnostics, and the ongoing need for human oversight to ensure clinical relevance and patient safety. Addressing these concerns through robust validation, ethical guidelines, and continuous research will be crucial for AI to fully realize its potential in enhancing hematocrit testing and contributing to a more proactive and precise healthcare paradigm.

- Automated Image Analysis: AI can analyze microscopic images of blood samples, assisting in the precise identification and quantification of red blood cells, thus enhancing the accuracy of hematocrit determination and minimizing human error.

- Predictive Diagnostics: Leveraging AI algorithms, devices can offer predictive insights into patient conditions, correlating hematocrit levels with other biomarkers and patient history to forecast disease progression or treatment response.

- Workflow Optimization: AI-driven systems can streamline laboratory operations by automating quality control, predicting instrument maintenance needs, and optimizing sample processing, leading to increased efficiency and reduced turnaround times.

- Data Integration and Interpretation: AI facilitates the seamless integration of hematocrit data with electronic health records (EHRs) and other diagnostic results, providing a holistic view of patient health and aiding in complex data interpretation for clinicians.

- Enhanced Point-of-Care Capabilities: AI can empower portable hematocrit devices with advanced analytical and interpretive functions, enabling sophisticated diagnostics in remote or resource-limited settings without immediate access to laboratory specialists.

- Personalized Medicine: By analyzing extensive patient data, AI can contribute to personalized treatment plans, using hematocrit trends and associated data to recommend tailored interventions for conditions like anemia or polycythemia.

DRO & Impact Forces Of Hematocrit Test Devices Market

The Hematocrit Test Devices Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its trajectory and competitive landscape. Key drivers include the escalating global burden of chronic diseases such as anemia, kidney disease, and various blood disorders, which necessitate frequent and accurate hematocrit measurements for diagnosis, monitoring, and treatment efficacy. The rapidly aging global population is another significant catalyst, as older individuals are more prone to health conditions requiring routine blood tests. Furthermore, the persistent demand for rapid, accurate, and accessible diagnostic solutions, especially in point-of-care (POC) settings, fuels innovation and adoption. Technological advancements leading to more automated, compact, and integrated devices, alongside increasing healthcare expenditure worldwide, particularly in developing economies, further propel market expansion by improving accessibility and diagnostic capabilities. These drivers underscore the indispensable role of hematocrit testing in modern healthcare, pushing manufacturers to innovate and expand their product offerings.

Despite robust growth factors, the market faces several notable restraints. The high initial cost of advanced automated hematology analyzers can be a significant barrier to adoption, particularly for smaller clinics and healthcare facilities in developing regions with limited budgets. Stringent regulatory approval processes, varying across different countries and regions, impose substantial time and cost burdens on manufacturers, potentially delaying product launches and market entry. Moreover, the lack of skilled laboratory professionals and technicians, especially in underserved areas, poses challenges for the effective operation and maintenance of sophisticated hematocrit testing equipment. Calibration issues and the need for regular quality control measures also add to operational complexities and costs. Lastly, competition from alternative diagnostic methods or integrated multi-parameter analyzers that offer hematocrit alongside a broader range of blood parameters can also exert pressure on standalone hematocrit test device sales, urging manufacturers to emphasize unique value propositions and cost-effectiveness.

Amidst these challenges, considerable opportunities exist for market growth and innovation. Emerging markets across Asia Pacific, Latin America, and Africa present vast untapped potential, driven by improving healthcare infrastructure, increasing health awareness, and a growing middle class with rising disposable incomes. The integration of hematocrit testing with telemedicine and remote patient monitoring platforms offers a novel avenue for market expansion, particularly in managing chronic conditions and providing care in geographically dispersed populations. Continued research and development into miniaturized, non-invasive, and highly portable devices that can deliver accurate results quickly will unlock new application areas and enhance accessibility. Strategic collaborations and partnerships between device manufacturers, diagnostic service providers, and technology firms can facilitate the development of integrated solutions and expand market reach. Furthermore, the incorporation of artificial intelligence (AI) and machine learning (ML) into hematocrit analysis promises to revolutionize data interpretation, diagnostic accuracy, and predictive capabilities, offering a significant growth opportunity for manufacturers willing to invest in these advanced technologies and enhance the diagnostic value of their devices.

- Drivers:

- Increasing prevalence of blood disorders (e.g., anemia, polycythemia).

- Rising aging population globally, more susceptible to chronic conditions.

- Growing demand for point-of-care (POC) testing solutions.

- Technological advancements leading to automation, precision, and portability.

- Increasing healthcare expenditure and improved access to diagnostics in emerging economies.

- Restraints:

- High cost of advanced automated hematocrit devices.

- Stringent regulatory approval processes and compliance requirements.

- Shortage of skilled laboratory professionals and technicians.

- Calibration challenges and the need for regular quality control.

- Competition from integrated multi-parameter hematology analyzers.

- Opportunities:

- Untapped potential in emerging markets with improving healthcare infrastructure.

- Integration with telemedicine and remote patient monitoring.

- Development of miniaturized, non-invasive, and highly portable diagnostic devices.

- Strategic collaborations and partnerships for broader market penetration.

- Incorporation of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced diagnostics.

- Impact Forces:

- Technological Advancements: Strong Positive - drives innovation, accuracy, and efficiency.

- Regulatory Landscape: Moderate to Strong Impact (can be both positive for safety and negative for market entry barriers).

- Economic Factors: Moderate - healthcare budgets influence purchasing power, especially for high-cost devices.

- Demographic Shifts: Strong Positive - aging population directly increases demand for diagnostic testing.

- Healthcare Policies & Initiatives: Moderate to Strong - government spending and preventative care programs can boost market growth.

Segmentation Analysis

The Hematocrit Test Devices Market is intricately segmented across various parameters, allowing for a comprehensive understanding of its diverse landscape and specific growth avenues. These segmentations are crucial for identifying distinct customer needs, technological preferences, and regional market dynamics, thereby enabling market players to tailor their strategies and product offerings effectively. The primary segmentation approaches include product type, which differentiates between the various instruments and consumables available; portability, distinguishing between benchtop and portable devices based on their mobility and application settings; end-user, categorizing the market by the types of healthcare facilities and professionals utilizing these devices; and technology, focusing on the underlying methodologies employed for hematocrit measurement. Each segment offers unique insights into market trends and opportunities, reflecting the evolving demands of the global healthcare sector and the continuous pursuit of more efficient and accessible diagnostic solutions for red blood cell volume analysis.

Understanding these granular segments is vital for stakeholders to navigate the market effectively. For instance, the demand for portable hematocrit devices is surging due to the expansion of point-of-care testing and emergency services, while large diagnostic laboratories continue to rely on high-throughput automated analyzers. Similarly, hospitals and blood banks have distinct requirements compared to smaller clinics or home care settings, influencing device design and functional specifications. The technological segmentation highlights advancements from traditional centrifugation methods to more sophisticated impedance-based and flow cytometry techniques, each offering varying levels of precision, speed, and additional diagnostic parameters. This detailed segmentation not only helps in accurate market forecasting but also aids in strategic product development, targeted marketing campaigns, and identifying potential areas for innovation and investment across the entire value chain of hematocrit testing, ensuring that the market continues to evolve in response to the dynamic needs of patients and healthcare providers globally.

- By Product Type:

- Hematocrit Centrifuges

- Automated Hematocrit Analyzers

- Semi-Automated Hematocrit Analyzers

- Consumables (Capillary Tubes, Reagents, Control Materials)

- By Portability:

- Portable Devices

- Benchtop Devices

- By End-User:

- Hospitals

- Diagnostic Laboratories

- Blood Banks

- Point-of-Care Settings (Clinics, Physician Offices, Emergency Rooms)

- Home Healthcare

- Research & Academic Institutes

- By Technology:

- Micro-hematocrit Method

- Automated Cell Counter Method (Impedance, Flow Cytometry)

- Spectrophotometry

- Microfluidic Technology

Value Chain Analysis For Hematocrit Test Devices Market

The value chain for the Hematocrit Test Devices Market is a complex and interconnected network, beginning with upstream activities focused on raw material procurement and component manufacturing. This initial stage involves suppliers providing critical materials such as specialized plastics for device casings and consumables like capillary tubes, precision electronic components for analyzers (sensors, microprocessors, optical parts), and various chemical reagents essential for automated testing processes. The quality and reliability of these upstream inputs directly influence the performance and accuracy of the final diagnostic products. Manufacturers typically engage with a global network of suppliers to ensure cost-effectiveness, quality standards, and supply chain resilience. Efficient management of this upstream segment is crucial for controlling production costs, maintaining product quality, and ensuring the consistent availability of hematocrit test devices in the market.

Moving downstream, the value chain progresses through the manufacturing, assembly, and quality assurance processes, culminating in the distribution and sales of hematocrit test devices. Manufacturers develop and produce the various types of centrifuges, automated analyzers, and consumables, adhering to stringent regulatory standards such as ISO certifications and specific regional health regulations. Once manufactured, these products reach the end-users through a multi-faceted distribution channel. This includes direct sales forces employed by major market players, which primarily target large hospitals, national diagnostic laboratory chains, and blood banks. These direct channels allow for personalized sales support, product training, and direct customer relationships. Additionally, third-party distributors and wholesalers play a significant role, particularly in reaching smaller clinics, physician offices, and point-of-care settings, as well as penetrating emerging markets where local market knowledge and extensive networks are essential.

Both direct and indirect distribution channels are vital for market penetration and customer reach within the hematocrit test devices market. Direct channels offer manufacturers greater control over branding, pricing, and customer service, fostering stronger relationships with key institutional clients. They also facilitate the direct collection of market feedback, which is invaluable for product development and improvement. Conversely, indirect channels leverage the existing infrastructure and market expertise of distributors, allowing manufacturers to expand their geographical footprint and reach a broader base of diverse end-users more cost-effectively, without the need for extensive internal sales teams in every region. The optimal strategy often involves a hybrid approach, combining the strengths of both direct engagement for strategic accounts and indirect partnerships for wider market coverage. This ensures that hematocrit test devices are efficiently delivered to a wide range of healthcare providers, ultimately supporting diagnostic needs across the global healthcare landscape.

Hematocrit Test Devices Market Potential Customers

The potential customers for Hematocrit Test Devices represent a broad spectrum of healthcare entities and professionals, all united by the critical need for accurate and timely red blood cell volume measurements. At the forefront are hospitals, encompassing a wide range of departments such as emergency rooms, intensive care units, general medicine wards, and surgical units, where hematocrit tests are fundamental for patient admission, monitoring blood loss, assessing fluid balance, and diagnosing conditions like anemia or polycythemia. These institutions typically require high-throughput automated analyzers capable of processing a large volume of samples quickly and integrating with existing laboratory information systems (LIS) for seamless data management. Their demand extends to both benchtop and point-of-care devices, depending on the specific departmental needs and immediate diagnostic requirements, often seeking devices that offer reliability, speed, and minimal operator intervention to enhance workflow efficiency.

Diagnostic laboratories, both independent and hospital-affiliated, constitute another significant customer segment. These laboratories serve as central hubs for processing a vast array of patient samples referred by physicians and clinics. They prioritize highly accurate, fully automated hematology analyzers that can perform complete blood counts (CBCs) including hematocrit, often with advanced differential capabilities. Factors like throughput capacity, calibration stability, reagent cost-effectiveness, and compliance with rigorous quality control standards are paramount for these customers. Blood banks also represent a specialized but crucial customer group, utilizing hematocrit devices for screening potential blood donors to ensure their eligibility based on red blood cell volume and to ensure the quality of collected blood products. For blood banks, efficiency and robust screening capabilities are key to maintaining a safe and sufficient blood supply.

Beyond traditional hospital and laboratory settings, the market for hematocrit test devices is increasingly expanding to point-of-care (POC) settings, which include small clinics, physician offices, urgent care centers, and even home healthcare environments. These customers prioritize portable, user-friendly, and rapid-testing devices that can deliver immediate results at the patient's side, facilitating quicker diagnostic decisions and treatment initiation. The demand in this segment is driven by the desire for convenience, reduced turnaround times, and improved patient access to diagnostics, particularly in remote or underserved areas. Furthermore, research and academic institutes frequently utilize hematocrit devices for studies related to blood disorders, hematology research, and drug development, requiring instruments that offer high precision and sometimes specialized features for experimental protocols. This diverse customer base underscores the pervasive and essential role of hematocrit testing across the entire healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 345.5 Million |

| Market Forecast in 2032 | USD 585.0 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Healthineers, Sysmex Corporation, Danaher Corporation (Beckman Coulter), Abbott Laboratories, F. Hoffmann-La Roche AG, HORIBA Medical, Mindray Medical International Limited, EKF Diagnostics, Bio-Rad Laboratories, Inc., Nihon Kohden Corporation, Boule Diagnostics AB, Erba Diagnostics Mannheim GmbH, Shenzhen Landwind Medical Co., Ltd., SFRI, DIALAB GmbH, Drucker Diagnostics, Convergent Technologies GmbH & Co. KG, Arkray, Inc., ACON Laboratories, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hematocrit Test Devices Market Key Technology Landscape

The Hematocrit Test Devices Market is characterized by a diverse and continuously evolving technological landscape, striving for enhanced accuracy, speed, automation, and portability in red blood cell volume measurement. Historically, the micro-hematocrit method, involving centrifugation of capillary tubes to separate red blood cells from plasma, has been a foundational technology. While robust and cost-effective, it is a manual or semi-automated process susceptible to human error and relatively slow for high-throughput environments. Current advancements, however, are shifting towards highly automated solutions. Automated hematology analyzers, which often employ impedance-based or flow cytometry technologies, represent a significant leap. Impedance-based methods measure changes in electrical resistance as blood cells pass through an aperture, while flow cytometry uses laser light scattering to analyze cells individually, providing highly precise hematocrit values along with other complete blood count parameters with minimal user intervention and high throughput.

Beyond these established automated methods, the technological landscape is further enriched by innovations aimed at increasing efficiency and expanding application areas. Spectrophotometry, for instance, can be employed in some analyzers to determine hemoglobin concentration, from which hematocrit can be derived. More recently, microfluidic technologies are gaining traction, enabling the development of compact, lab-on-a-chip devices that require minimal sample volumes and offer rapid results. These microfluidic platforms are particularly promising for point-of-care (POC) testing and resource-limited settings due to their small footprint and ease of use. The trend towards miniaturization and integration is also leading to the development of non-invasive or minimally invasive techniques for hematocrit estimation, though these are still largely in research and development phases and aim to reduce the need for traditional blood draws, potentially revolutionizing patient experience.

The convergence of these core technologies with digital advancements defines the cutting edge of the market. Connectivity features, allowing devices to integrate seamlessly with Laboratory Information Systems (LIS) and Electronic Health Records (EHRs), are becoming standard, facilitating automated data logging, reducing transcription errors, and improving overall data management. Furthermore, the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms is poised to transform data interpretation, quality control, and predictive diagnostics. These advanced analytical tools can identify subtle patterns, enhance the accuracy of cellular analysis, and even predict instrument malfunctions, thereby optimizing laboratory workflows and improving diagnostic reliability. The focus is increasingly on creating smart, interconnected diagnostic ecosystems that not only provide accurate hematocrit values but also offer comprehensive insights and operational efficiencies to healthcare providers globally.

Regional Highlights

- North America: This region holds a significant share of the Hematocrit Test Devices Market, driven by a well-developed healthcare infrastructure, high adoption of advanced diagnostic technologies, and substantial healthcare expenditure. The presence of major market players, robust R&D activities, and a high prevalence of chronic diseases requiring frequent blood analysis further contribute to its dominance. The United States and Canada are key contributors, focusing on automation and point-of-care solutions.

- Europe: The European market is characterized by stringent regulatory standards, advanced diagnostic capabilities, and a strong emphasis on research and development. Countries like Germany, the UK, France, and Italy are prominent contributors, with a consistent demand for high-quality, reliable hematocrit testing devices. The aging population and increasing awareness about early disease diagnosis also fuel market growth.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region in the Hematocrit Test Devices Market. This growth is attributed to the vast and rapidly growing population, improving healthcare infrastructure, increasing disposable incomes, and rising awareness about health and diagnostics. Countries such as China, India, Japan, and South Korea are experiencing significant market expansion due to increasing government investments in healthcare and the rising prevalence of blood-related disorders.

- Latin America: The market in Latin America is witnessing steady growth, primarily driven by increasing healthcare access, government initiatives to improve public health, and a gradual shift towards modern diagnostic practices. Brazil, Mexico, and Argentina are key markets, showing a growing demand for cost-effective and efficient diagnostic solutions, including portable hematocrit devices for widespread use.

- Middle East and Africa (MEA): The MEA region is an emerging market with substantial growth potential. Improvements in healthcare expenditure, increasing health awareness, and the development of healthcare infrastructure in countries like Saudi Arabia, UAE, and South Africa are driving demand. The prevalence of certain infectious diseases and blood disorders also necessitates robust diagnostic capabilities, including hematocrit testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hematocrit Test Devices Market.- Siemens Healthineers

- Sysmex Corporation

- Danaher Corporation (Beckman Coulter)

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- HORIBA Medical

- Mindray Medical International Limited

- EKF Diagnostics

- Bio-Rad Laboratories, Inc.

- Nihon Kohden Corporation

- Boule Diagnostics AB

- Erba Diagnostics Mannheim GmbH

- Shenzhen Landwind Medical Co., Ltd.

- SFRI

- DIALAB GmbH

- Drucker Diagnostics

- Convergent Technologies GmbH & Co. KG

- Arkray, Inc.

- ACON Laboratories, Inc.

Frequently Asked Questions

Analyze common user questions about the Hematocrit Test Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a hematocrit test and why is it important?

A hematocrit test measures the percentage of red blood cells in your blood, indicating the volume of oxygen-carrying cells. It is crucial for diagnosing conditions like anemia (low hematocrit), polycythemia (high hematocrit), assessing blood loss, and monitoring treatment for various blood disorders. Accurate hematocrit levels are vital for overall health assessment and treatment planning.

What are the different types of hematocrit test devices available?

Hematocrit test devices primarily include traditional micro-hematocrit centrifuges for manual or semi-automated processing, and automated hematology analyzers that measure hematocrit as part of a complete blood count (CBC) using technologies like impedance or flow cytometry. Portable, point-of-care (POC) devices are also gaining popularity for rapid, on-site testing in diverse clinical settings.

How do technological advancements impact the hematocrit test devices market?

Technological advancements are driving the market by improving accuracy, speed, and automation. Innovations include more precise automated analyzers, miniaturized and portable devices for point-of-care testing, and the integration of AI/ML for enhanced data analysis, quality control, and predictive diagnostics. These developments contribute to more efficient and accessible testing.

Which regions are key growth areas for hematocrit test devices?

North America and Europe are mature markets with high adoption of advanced devices. However, the Asia Pacific (APAC) region, driven by its large population, improving healthcare infrastructure, and increasing health awareness, is projected to be the fastest-growing market. Latin America, the Middle East, and Africa are also emerging as significant growth areas due to expanding healthcare access.

What are the main challenges faced by the hematocrit test devices market?

Key challenges include the high cost of advanced automated devices, which can be a barrier for smaller healthcare facilities. Stringent regulatory approval processes, the ongoing need for skilled operators, and calibration complexities also pose significant hurdles. Competition from integrated multi-parameter analyzers further necessitates continuous innovation and differentiation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager