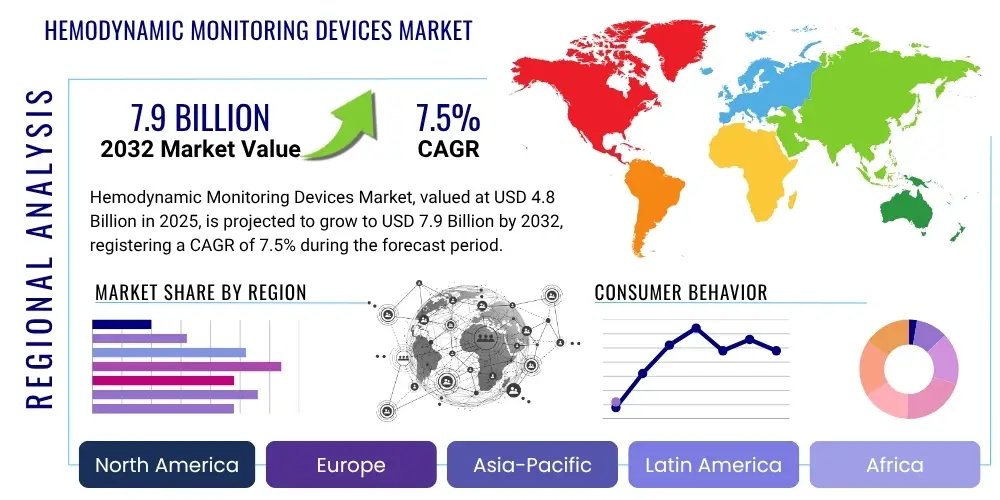

Hemodynamic Monitoring Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428864 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hemodynamic Monitoring Devices Market Size

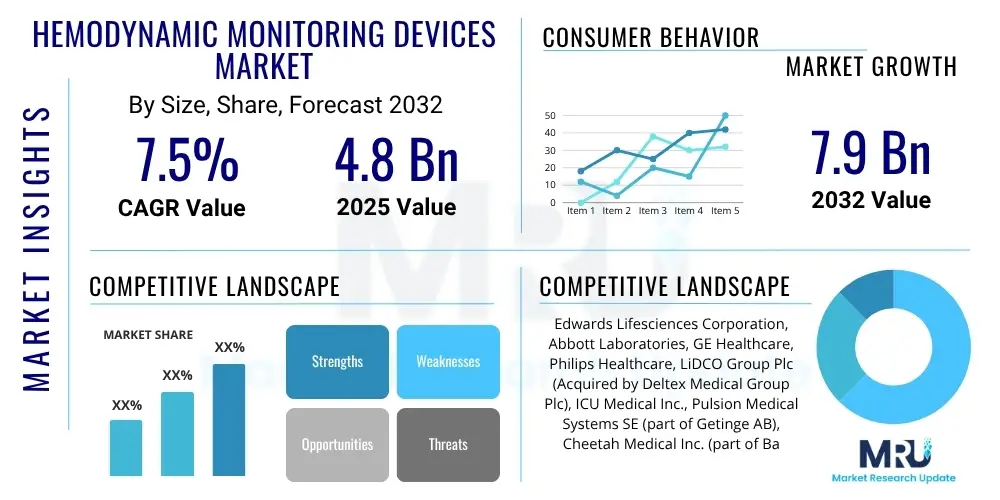

The Hemodynamic Monitoring Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2032. The market is estimated at USD 4.8 Billion in 2025 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2032.

Hemodynamic Monitoring Devices Market introduction

Hemodynamic monitoring devices are critical tools used in clinical settings to measure and assess the cardiovascular system's performance, providing essential data on blood flow, pressure, and oxygen delivery to tissues. These devices play a vital role in managing critically ill patients, those undergoing complex surgeries, and individuals with cardiovascular diseases, enabling clinicians to make informed decisions for fluid management, medication titration, and overall patient care. The continuous, real-time physiological data offered by these systems helps in the early detection of hemodynamic instability, preventing adverse outcomes and improving patient safety across various medical environments.

The product portfolio within this market spans across invasive, minimally invasive, and non-invasive technologies, each offering distinct advantages in terms of accuracy, patient comfort, and risk profile. Major applications include intensive care units (ICUs), operating rooms (ORs), emergency departments (EDs), and cardiac catheterization labs, where precise monitoring is paramount. The primary benefits derived from these devices include enhanced diagnostic capabilities, optimized treatment protocols, reduced patient complications, and improved survival rates. The market is significantly driven by factors such as the increasing prevalence of chronic diseases, the aging global population, and the continuous advancement in monitoring technologies aimed at greater accuracy, less invasiveness, and better integration with hospital information systems, thereby fulfilling the growing demand for advanced patient management solutions.

Hemodynamic Monitoring Devices Market Executive Summary

The Hemodynamic Monitoring Devices Market is experiencing robust growth, primarily fueled by an escalating global burden of cardiovascular diseases, an expanding elderly demographic more susceptible to critical illnesses, and relentless technological innovation aimed at creating more accurate, less invasive, and user-friendly monitoring solutions. Business trends indicate a strong move towards strategic collaborations and mergers among key players to expand product portfolios and geographical reach, alongside a significant investment in research and development for AI-integrated and portable devices. This competitive landscape is characterized by companies striving to differentiate through advanced data analytics, improved connectivity, and comprehensive post-sales support, adapting to the evolving needs of healthcare providers who demand integrated, real-time insights for critical patient management.

Regional trends highlight North America and Europe as dominant markets, attributed to their well-established healthcare infrastructures, high healthcare expenditure, and rapid adoption of advanced medical technologies. However, the Asia Pacific region is poised for the fastest growth, driven by improving healthcare facilities, increasing awareness of advanced patient monitoring, rising disposable incomes, and a large patient pool. This shift is encouraging market players to focus on expanding their presence in emerging economies through strategic partnerships and localized product offerings. Segment-wise, the market is observing a notable surge in the demand for minimally invasive and non-invasive monitoring devices due to their reduced risk profiles and enhanced patient comfort, signifying a broader industry trend towards less intrusive diagnostic and monitoring procedures. Furthermore, the disposables segment, including catheters and sensors, continues to be a crucial revenue stream, driven by the recurring need for replacements in various clinical applications, underlining the importance of consumable components in the overall market ecosystem.

AI Impact Analysis on Hemodynamic Monitoring Devices Market

Common user questions regarding AI's impact on hemodynamic monitoring devices frequently revolve around its potential to enhance diagnostic accuracy, facilitate predictive analytics for patient deterioration, automate complex data interpretation, and improve overall clinical workflow efficiency. Users are also concerned about the integration challenges of AI into existing hospital systems, the reliability of AI algorithms in critical care settings, data privacy and security implications, and the regulatory pathways for AI-powered medical devices. The themes consistently reflect a desire for AI to provide actionable insights, reduce clinician workload, minimize false alarms, and ultimately lead to more personalized and effective patient care, while also expressing caution regarding its validation and ethical deployment.

Based on this analysis, AI is anticipated to revolutionize hemodynamic monitoring by significantly improving the precision of physiological measurements, enabling sophisticated predictive analytics for early identification of adverse events, and automating the interpretation of vast amounts of complex data. This transformation is expected to empower clinicians with more timely and accurate insights, allowing for proactive interventions and highly personalized treatment strategies. While the integration of AI presents challenges related to data interoperability and regulatory approval, its potential to enhance patient outcomes, reduce alarm fatigue, and optimize resource allocation makes it a pivotal force driving innovation in this domain, addressing the critical need for advanced decision-support tools in acute care environments.

- Predictive analytics for early detection of patient deterioration.

- Enhanced accuracy in data interpretation and anomaly detection.

- Automated real-time data analysis, reducing manual workload.

- Personalized treatment recommendations based on patient-specific data.

- Reduction in alarm fatigue through intelligent alert systems.

- Improved workflow efficiency for healthcare professionals.

- Integration with electronic health records (EHR) for comprehensive patient profiles.

- Support for remote monitoring and telemedicine applications.

- Optimization of fluid management and vasopressor titration.

- Facilitation of research and development through pattern recognition in large datasets.

DRO & Impact Forces Of Hemodynamic Monitoring Devices Market

The hemodynamic monitoring devices market is fundamentally driven by the rising global incidence of cardiovascular diseases, an expanding geriatric population susceptible to critical conditions, and continuous advancements in medical technology offering more precise and less invasive monitoring solutions. These drivers are bolstered by an increasing demand for sophisticated patient management in critical care settings and surgical environments, where early and accurate physiological assessment is paramount for favorable patient outcomes. Restraints, however, include the substantial cost associated with acquiring and maintaining advanced monitoring systems, the persistent challenge of a shortage of skilled healthcare professionals capable of operating and interpreting complex device data, and the inherent risks tied to invasive procedures, which can deter adoption. Furthermore, stringent regulatory approval processes and concerns about data security for connected devices also pose significant hurdles to market expansion.

Opportunities within this dynamic market are abundant, particularly in the untapped potential of emerging economies where healthcare infrastructure is rapidly developing and patient awareness is growing. The market also stands to gain significantly from the ongoing development and commercialization of innovative non-invasive and portable monitoring devices, which promise greater patient comfort and accessibility across diverse care settings, including home care. Moreover, the integration of cutting-edge technologies like Artificial Intelligence and machine learning for predictive analytics and automated data interpretation represents a major avenue for future growth and competitive differentiation. Impact forces influencing the market trajectory include rapid technological innovation, evolving healthcare policies and reimbursement frameworks, fluctuating global healthcare expenditures, and increasing public and professional demands for enhanced patient safety and quality of care. These forces collectively shape the investment landscape, product development priorities, and overall market dynamics, compelling manufacturers to adapt and innovate continuously.

Segmentation Analysis

The hemodynamic monitoring devices market is comprehensively segmented to cater to diverse clinical needs and technological preferences across the global healthcare landscape. This segmentation allows for a nuanced understanding of market dynamics, distinguishing product types based on invasiveness, operational functionality, end-user application, and the specific physiological parameters measured. By dissecting the market into these crucial categories, stakeholders can identify key growth areas, evaluate competitive strategies, and tailor product development to address specific clinical challenges, ranging from intensive care management to routine surgical monitoring and emergency interventions. The evolution of these segments reflects the broader trend towards less invasive, more integrated, and smarter monitoring solutions that prioritize both patient safety and clinician efficiency.

Each segment plays a pivotal role in the market's overall growth and innovation. For instance, the shift towards non-invasive and minimally invasive technologies underscores a patient-centric approach, while the robust demand from hospitals and specialized units highlights the critical importance of these devices in acute care. The product segmentation into monitors and disposables illustrates the recurring revenue streams and the continuous need for consumable components to ensure sterile and accurate measurements. Furthermore, the application-based segmentation emphasizes the wide utility of hemodynamic monitoring across various departments, from routine surgical procedures in operating rooms to the complex management of critically ill patients in intensive care units, showcasing the versatility and indispensable nature of these devices in modern medicine.

- By Type

- Invasive Hemodynamic Monitoring Devices

- Minimally Invasive Hemodynamic Monitoring Devices

- Non-Invasive Hemodynamic Monitoring Devices

- By Product

- Monitors

- Cardiac Output Monitors

- Blood Pressure Monitors (Arterial, Central Venous)

- Oxygen Saturation Monitors (SvO2, ScvO2)

- Other Advanced Monitors (e.g., Regional Oxygen Saturation)

- Disposables

- Catheters (Pulmonary Artery Catheters, Central Venous Catheters)

- Sensors and Probes

- Pressure Transducers

- Connectivity Cables and Kits

- Monitors

- By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare Settings

- By Application

- Intensive Care Units (ICU)

- Operating Rooms (OR)

- Emergency Departments (ED)

- Cardiac Catheterization Labs

- Post-Operative Care Units

Value Chain Analysis For Hemodynamic Monitoring Devices Market

The value chain for the hemodynamic monitoring devices market begins with upstream activities involving the research and development of core technologies, acquisition of high-quality raw materials, and precision manufacturing of components such as sensors, catheters, and electronic modules. This stage is crucial for innovation, material quality, and ensuring compliance with stringent medical device standards. Manufacturers focus on integrating advanced materials, miniaturization techniques, and sophisticated software algorithms to enhance device accuracy, reliability, and user-friendliness, all while managing supplier relationships and intellectual property rights. The emphasis here is on creating a robust product that meets clinical demands for performance and safety, setting the foundation for the subsequent stages of the value chain.

Moving downstream, the value chain encompasses assembly, quality assurance, packaging, and distribution. Distribution channels are varied, including direct sales forces that engage directly with large hospital networks and healthcare systems, as well as indirect channels involving third-party distributors, wholesalers, and group purchasing organizations (GPOs) that facilitate broader market penetration, particularly in regions with less direct access. These channels are critical for market reach, efficiency, and ensuring timely delivery of products to end-users such as hospitals, ambulatory surgical centers, and clinics globally. Post-sales support, including installation, training, maintenance, and technical assistance, forms an integral part of the value chain, ensuring customer satisfaction, device longevity, and sustained operational efficiency in clinical environments, ultimately building long-term customer relationships and brand loyalty within the highly competitive medical device sector.

Hemodynamic Monitoring Devices Market Potential Customers

The primary purchasers and end-users of hemodynamic monitoring devices are diverse healthcare institutions and professionals who require precise, real-time physiological data to manage patient care effectively. Hospitals constitute the largest customer segment, particularly their intensive care units (ICUs), operating rooms (ORs), emergency departments (EDs), and cardiac care units, where critically ill patients, those undergoing major surgeries, or individuals with acute cardiovascular conditions necessitate continuous and accurate monitoring. These departments rely heavily on both invasive and non-invasive hemodynamic systems to guide fluid therapy, assess cardiac function, and manage blood pressure, ensuring optimal patient outcomes during critical periods.

Beyond traditional hospital settings, ambulatory surgical centers (ASCs) represent a growing customer base, as they increasingly perform complex outpatient procedures that require intraoperative and post-operative monitoring. Additionally, specialty clinics focusing on cardiology, pulmonology, and critical care also utilize these devices for diagnostics and ongoing patient management. Furthermore, with the advent of more portable and user-friendly non-invasive technologies, there is an emerging segment of homecare providers and remote patient monitoring services, targeting patients with chronic conditions who require long-term, non-intrusive hemodynamic assessment to prevent acute exacerbations and support continuous health management, expanding the market's reach beyond acute care facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Edwards Lifesciences Corporation, Abbott Laboratories, GE Healthcare, Philips Healthcare, LiDCO Group Plc (Acquired by Deltex Medical Group Plc), ICU Medical Inc., Pulsion Medical Systems SE (part of Getinge AB), Cheetah Medical Inc. (part of Baxter International), Nonin Medical Inc., Uscom Ltd., Masimo Corporation, Dragerwerk AG & Co. KGaA, Nihon Kohden Corporation, Siemens Healthineers AG, Argon Medical Devices Inc., Vyaire Medical Inc., Beijing Strong Biotechnologies, Spacelabs Healthcare Inc., Tensys Medical Inc., Schwarzer Cardiotek GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hemodynamic Monitoring Devices Market Key Technology Landscape

The hemodynamic monitoring market is undergoing a significant transformation driven by continuous technological advancements aimed at enhancing accuracy, reducing invasiveness, and improving integration into modern healthcare ecosystems. A pivotal shift is observed from traditional pulmonary artery catheterization, which is highly invasive, towards less intrusive methods, including advanced minimally invasive devices and a burgeoning array of non-invasive solutions. Key technological developments include sophisticated sensor technologies that allow for more precise and continuous measurement of parameters like cardiac output, stroke volume, and systemic vascular resistance. These sensors often employ advanced algorithms to compensate for patient movement and physiological variability, providing more reliable data in challenging clinical environments. The integration of high-resolution displays and intuitive user interfaces is also enhancing usability, making these complex devices more accessible to a wider range of healthcare professionals.

Furthermore, the technology landscape is increasingly defined by connectivity and data analytics. Wireless communication capabilities, such as Bluetooth and Wi-Fi, enable seamless data transfer to electronic health records (EHRs) and central monitoring stations, facilitating remote patient management and multidisciplinary team collaboration. The burgeoning field of artificial intelligence (AI) and machine learning (ML) is being leveraged to develop predictive analytics models that can anticipate hemodynamic instability before it becomes critical, thereby enabling proactive clinical interventions. This focus on intelligent data processing not only reduces alarm fatigue but also provides clinicians with actionable insights for personalized patient care. The development of portable and wearable hemodynamic monitoring solutions is also gaining traction, extending the utility of these devices beyond acute care settings into pre-hospital, home care, and ambulatory environments, reflecting a broader trend towards decentralized and continuous patient monitoring. These innovations collectively contribute to improved patient safety, optimized treatment strategies, and enhanced operational efficiency within healthcare facilities.

Regional Highlights

- North America: This region consistently holds the largest share of the hemodynamic monitoring devices market, primarily due to well-established healthcare infrastructure, high healthcare expenditure, significant adoption of advanced medical technologies, and the presence of leading market players. The rising prevalence of chronic diseases and an aging population also contribute to the high demand for advanced monitoring solutions.

- Europe: Europe represents the second-largest market for hemodynamic monitoring devices, driven by an increasing geriatric population, a strong emphasis on early diagnosis and preventive care, and favorable reimbursement policies for medical devices. Countries like Germany, the UK, and France are at the forefront of adopting advanced monitoring technologies, supported by robust healthcare systems and technological innovation.

- Asia Pacific (APAC): Expected to exhibit the fastest growth rate during the forecast period, the APAC region is characterized by rapidly developing healthcare infrastructure, increasing disposable incomes, a large patient pool, and growing awareness regarding advanced patient monitoring. Emerging economies such as China and India are investing heavily in healthcare, leading to significant market expansion opportunities and attracting major global players.

- Latin America: This region is experiencing steady growth, influenced by improving healthcare access, increasing government initiatives to modernize healthcare facilities, and a rising prevalence of cardiovascular diseases. Countries like Brazil and Mexico are key markets within Latin America, demonstrating growing demand for sophisticated medical devices as healthcare reforms take hold.

- Middle East and Africa (MEA): The MEA market for hemodynamic monitoring devices is showing gradual growth. This is largely attributed to improving healthcare expenditure, ongoing development of healthcare infrastructure, and increasing medical tourism in some parts of the region. Collaborations between local and international players are also contributing to market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hemodynamic Monitoring Devices Market.- Edwards Lifesciences Corporation

- Abbott Laboratories

- GE Healthcare

- Philips Healthcare

- ICU Medical Inc.

- Pulsion Medical Systems SE (part of Getinge AB)

- Cheetah Medical Inc. (part of Baxter International)

- Nonin Medical Inc.

- Uscom Ltd.

- Masimo Corporation

- Dragerwerk AG & Co. KGaA

- Nihon Kohden Corporation

- Siemens Healthineers AG

- Argon Medical Devices Inc.

- Vyaire Medical Inc.

- Beijing Strong Biotechnologies

- Spacelabs Healthcare Inc.

- Tensys Medical Inc.

- Schwarzer Cardiotek GmbH

- Deltex Medical Group Plc

Frequently Asked Questions

What are the primary types of hemodynamic monitoring devices?

Hemodynamic monitoring devices are primarily categorized into invasive, minimally invasive, and non-invasive types. Invasive devices offer the highest accuracy but carry risks, while minimally invasive and non-invasive options prioritize patient comfort and safety with reduced risk profiles, offering a spectrum of solutions for various clinical needs.

How does AI enhance hemodynamic monitoring?

AI significantly enhances hemodynamic monitoring by enabling predictive analytics for early patient deterioration, automating complex data interpretation, and improving diagnostic accuracy. It helps reduce alarm fatigue, streamlines workflows, and supports personalized treatment decisions through real-time, actionable insights.

What are the benefits of non-invasive hemodynamic monitoring?

Non-invasive hemodynamic monitoring offers several benefits, including reduced risk of infection and complications, enhanced patient comfort, and ease of use. It allows for continuous monitoring in various settings, from intensive care to homecare, making it suitable for a broader patient population requiring less intrusive assessment.

What factors drive the growth of the hemodynamic monitoring devices market?

The market's growth is driven by the increasing global prevalence of cardiovascular diseases, a rising aging population, technological advancements leading to less invasive and more accurate devices, and the growing demand for enhanced patient safety and critical care management in hospitals and other healthcare facilities.

Which regions are key for market growth in hemodynamic monitoring devices?

North America and Europe are currently dominant markets due to advanced healthcare infrastructure and high adoption rates. However, the Asia Pacific region is projected to be the fastest-growing market, driven by improving healthcare facilities, increasing awareness, and a large patient base in developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager