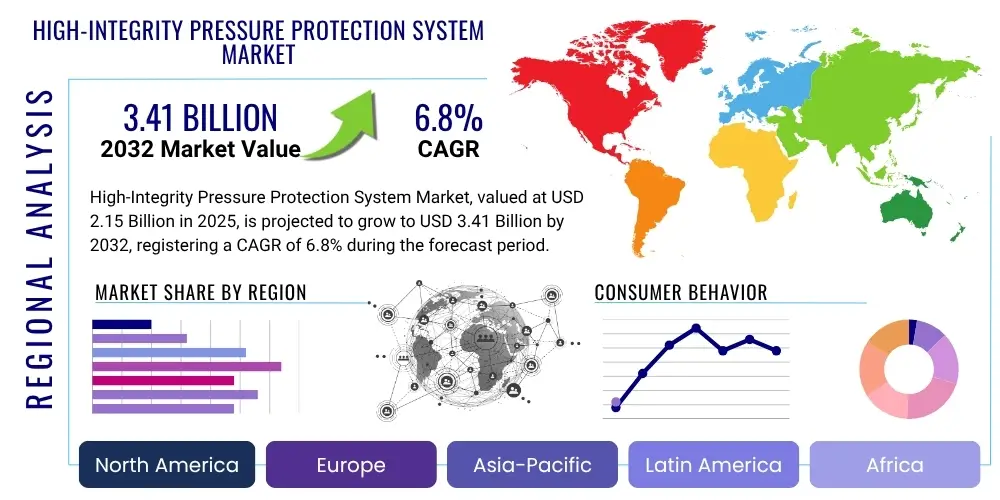

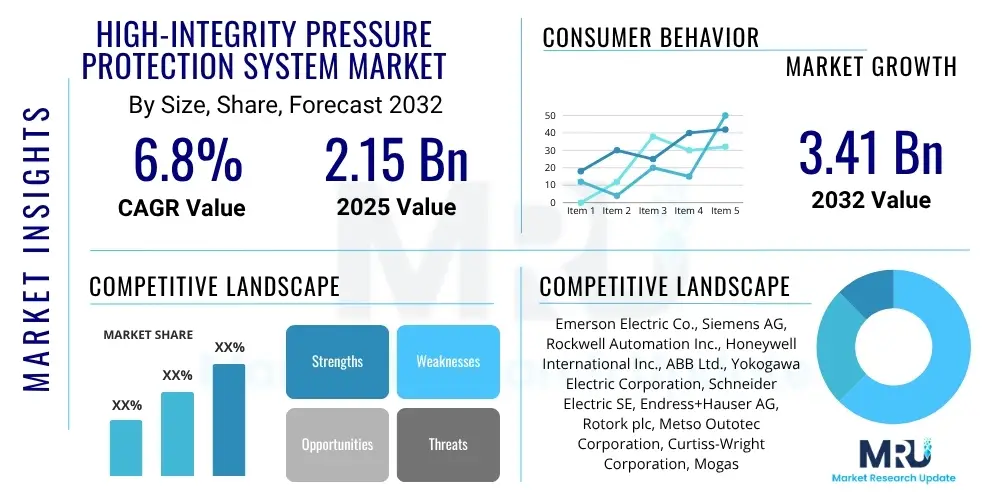

High-Integrity Pressure Protection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428824 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High-Integrity Pressure Protection System Market Size

The High-Integrity Pressure Protection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $2.15 Billion in 2025 and is projected to reach $3.41 Billion by the end of the forecast period in 2032.

High-Integrity Pressure Protection System Market introduction

The High-Integrity Pressure Protection System (HIPPS) market is defined by the deployment of specialized safety systems designed to prevent the overpressure of pipelines, vessels, and other process equipment in industrial facilities. HIPPS acts as a safety barrier, offering a reliable alternative to traditional pressure relief systems, particularly in situations where flaring or venting is undesirable due to environmental concerns, or where the sheer volume of relief would require excessively large and costly relief systems. These systems are crucial for maintaining operational integrity and ensuring personnel and environmental safety in high-risk environments.

A HIPPS typically comprises initiating devices (sensors that detect overpressure), a logic solver (which processes sensor signals and initiates the shutdown sequence), and final elements (fast-acting valves that close to isolate the high-pressure source). This integrated approach provides a robust and highly reliable safeguard, often certified to a Safety Integrity Level (SIL) 3 or 4, ensuring that the probability of failure on demand is extremely low. The core benefit of HIPPS is its ability to allow systems to operate closer to their design limits, maximizing throughput while significantly reducing the risk of catastrophic failures and environmental releases.

Major applications for HIPPS technology span across the oil and gas industry, including upstream exploration and production, midstream transportation, and downstream refining and petrochemical processing. Other significant sectors include chemical manufacturing and power generation, where high-pressure processes are commonplace. The driving factors behind market growth include increasingly stringent global safety and environmental regulations, the need to protect aging infrastructure, the rising demand for energy driving complex deepwater and unconventional resource development, and the inherent cost efficiencies HIPPS offers by minimizing the need for extensive conventional relief and flare systems.

High-Integrity Pressure Protection System Market Executive Summary

The High-Integrity Pressure Protection System (HIPPS) market is experiencing robust growth, driven by an escalating emphasis on industrial safety, environmental protection, and operational efficiency across various heavy industries. Business trends indicate a strong move towards integrated solutions, digitalization, and lifecycle service offerings, as end-users seek not only compliant systems but also those that offer enhanced diagnostics and predictive maintenance capabilities. Manufacturers are focusing on developing more compact, modular, and intelligent HIPPS solutions that can seamlessly integrate with broader plant control and safety architectures, leveraging advancements in sensor technology and logic solvers to meet evolving industry demands.

Regional trends highlight the Asia Pacific region as a significant growth hub, fueled by rapid industrialization, increasing energy consumption, and substantial investments in new petrochemical and oil and gas infrastructure, particularly in countries like China, India, and Southeast Asia. North America and Europe continue to be strong markets, primarily driven by strict regulatory frameworks, the modernization of aging assets, and the ongoing development of unconventional and deepwater hydrocarbon resources. The Middle East and Africa also present considerable opportunities due to extensive oil and gas exploration and production activities and expansion of refining capacities, necessitating advanced safety systems.

In terms of segment trends, the market is seeing a growing adoption of electronic HIPPS systems, which offer superior diagnostic capabilities and easier integration with distributed control systems (DCS) and safety instrumented systems (SIS) compared to their pneumatic or hydraulic counterparts. The oil and gas sector remains the dominant end-user, with increasing demand for HIPPS in subsea applications, gas processing plants, and high-pressure pipeline protection. There is also a notable expansion into the chemical and petrochemical industries as companies seek to manage hazardous processes more safely and efficiently, underscoring a broader industrial embrace of high-integrity safety solutions.

AI Impact Analysis on High-Integrity Pressure Protection System Market

User inquiries concerning AI's influence on the High-Integrity Pressure Protection System market frequently revolve around its potential to augment reliability, facilitate predictive maintenance, optimize operational parameters, and enhance compliance. Users are keen to understand how artificial intelligence can move HIPPS beyond reactive safety mechanisms to proactive, intelligent systems. Key concerns include the robustness of AI algorithms in safety-critical applications, the certification and validation processes for AI-driven components, and the cybersecurity implications of integrating AI into these highly sensitive systems. Expectations are high regarding AI's ability to process vast amounts of operational data for anomaly detection, thereby reducing false trips and extending equipment lifespan, while also streamlining complex regulatory adherence through automated monitoring and reporting capabilities.

- AI enables predictive maintenance by analyzing sensor data for early detection of potential failures in HIPPS components, such as valves and actuators, reducing unscheduled downtime and improving system availability.

- Advanced diagnostics powered by AI can enhance the accuracy and speed of fault identification within the HIPPS loop, ensuring quicker response times and minimizing the risk of undetected issues.

- AI algorithms can optimize HIPPS performance by learning from operational data, potentially allowing for finer tuning of setpoints and response parameters within safety limits, thereby improving process efficiency.

- Enhanced risk assessment models using AI can continuously evaluate operational conditions and external factors to provide dynamic risk profiles, informing maintenance schedules and operational adjustments for HIPPS.

- AI integration supports cybersecurity by identifying unusual data patterns or access attempts that might indicate a breach, adding another layer of protection to critical safety systems.

- AI can aid in regulatory compliance by automating data logging, report generation, and ensuring that HIPPS operation consistently meets required safety standards and performance metrics.

- Through machine learning, AI can help in root cause analysis following a HIPPS activation, providing deeper insights into incident prevention and system improvements.

DRO & Impact Forces Of High-Integrity Pressure Protection System Market

The High-Integrity Pressure Protection System market is propelled by a confluence of stringent safety regulations, increasing global energy demand requiring more complex and higher-pressure processes, and the critical need to safeguard aging infrastructure. These drivers necessitate robust, reliable safety systems that can prevent catastrophic failures and mitigate environmental impact. However, the market faces restraints such as the high initial capital expenditure associated with implementing HIPPS, the complexity of integrating these systems into existing infrastructure, and a persistent shortage of highly skilled personnel capable of designing, installing, and maintaining such specialized safety solutions. These factors can impede widespread adoption, particularly in smaller or less industrialized markets.

Opportunities within the HIPPS market are significant, primarily driven by the ongoing trend towards industrial digitalization and the integration of IIoT (Industrial Internet of Things) technologies. This allows for smarter, more connected HIPPS solutions that offer enhanced diagnostics and remote monitoring capabilities. The retrofitting of older plants with modern safety systems, expansion into emerging industrial applications beyond traditional oil and gas, and the development of more standardized, modular HIPPS designs represent further avenues for growth. Geopolitical shifts and new exploration frontiers, especially in deepwater and unconventional resources, also present substantial opportunities for HIPPS deployment.

The impact forces influencing the HIPPS market are multifaceted. The bargaining power of buyers is moderate to high, as end-users demand highly customized solutions that meet specific process requirements and adhere to rigorous safety standards, often leading to competitive bidding. The bargaining power of suppliers is also moderate due to the specialized nature of HIPPS components (e.g., SIL-certified sensors, logic solvers, and fast-acting valves), though a diverse vendor landscape helps to balance this. The threat of new entrants is relatively low due to high barriers to entry, including substantial R&D investment, strict regulatory approvals, and the need for specialized expertise and established track records in safety-critical applications. The threat of substitutes, primarily conventional pressure relief valves and flare systems, remains present but is diminishing as environmental regulations tighten and the cost-effectiveness and safety advantages of HIPPS become more apparent. Competitive rivalry among existing players is intense, with companies focusing on innovation, product differentiation, and comprehensive service offerings to gain market share.

Segmentation Analysis

The High-Integrity Pressure Protection System market is comprehensively segmented to provide a detailed understanding of its diverse components, technological types, and end-user applications. This segmentation allows for a nuanced analysis of market dynamics, revealing key areas of growth, adoption patterns, and technological preferences across different industrial landscapes. Each segment reflects specific functional requirements, operational environments, and regulatory compliance needs, shaping the demand and supply characteristics within the broader HIPPS ecosystem. Understanding these distinctions is crucial for stakeholders to identify strategic opportunities and tailor solutions effectively.

The primary segmentation categories include the distinct components that constitute a HIPPS, the different technological approaches used in its implementation, and the wide array of end-user industries that rely on these critical safety systems. Further subdivisions within these categories, such as specific types of sensors or particular oil and gas sub-sectors, offer even greater granularity. This multi-dimensional view of the market's structure provides valuable insights into how technological advancements, regulatory pressures, and industrial expansion are collectively influencing the market's trajectory and the evolution of HIPPS solutions.

- By Component

- Sensors (Pressure Transmitters, Temperature Transmitters, Flow Transmitters)

- Logic Solvers (Programmable Electronic Systems (PES), Relay-based Systems)

- Final Elements (Actuators, Valves (e.g., Ball Valves, Gate Valves, Globe Valves))

- By Type

- Pneumatic HIPPS

- Hydraulic HIPPS

- Electronic HIPPS

- By End-User Industry

- Oil and Gas (Upstream, Midstream, Downstream, Offshore, Onshore, LNG)

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear, Renewable)

- Other Industries (Pharmaceuticals, Food & Beverage, Water & Wastewater, Pulp & Paper)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For High-Integrity Pressure Protection System Market

The value chain for the High-Integrity Pressure Protection System market encompasses a series of interconnected activities, beginning from the procurement of raw materials and extending to the ultimate deployment and maintenance of HIPPS solutions by end-users. At the upstream end, the chain involves suppliers of specialized raw materials such as high-grade metals for valve bodies, advanced polymers for seals, and sophisticated electronic components for sensors and logic solvers. These are then transformed into specific HIPPS components by manufacturers who specialize in safety-certified sensors, highly reliable logic solvers, and fast-acting, high-integrity valves and actuators, adhering strictly to international safety standards like IEC 61508/61511.

Moving downstream, these discrete HIPPS components are integrated into complete systems, often by specialized system integrators or Engineering, Procurement, and Construction (EPC) companies. These entities play a crucial role in designing, assembling, testing, and commissioning the entire HIPPS solution to meet the specific requirements of a project and ensure compliance with functional safety specifications. The distribution channels for HIPPS are typically a mix of direct sales from major manufacturers for large, complex projects, where customization and direct technical support are paramount, and indirect channels through authorized distributors or value-added resellers for standard components or smaller system deployments.

The direct channel facilitates deep client engagement, crucial for complex, highly engineered safety systems, allowing for direct consultation, project management, and post-sales support tailored to the client's operational environment. Conversely, the indirect channel provides broader market reach and localized support, particularly for clients seeking off-the-shelf or semi-customized solutions. Regardless of the channel, robust aftermarket services, including spare parts, calibration, maintenance, and training, form an integral part of the value proposition, ensuring the long-term reliability and compliance of installed HIPPS, thereby extending the value chain significantly beyond initial installation.

High-Integrity Pressure Protection System Market Potential Customers

The High-Integrity Pressure Protection System market caters to a critical need for enhanced safety and operational integrity across several heavy industrial sectors. The primary potential customers are entities engaged in processes that involve high pressures and potentially hazardous materials, where the failure of conventional safety systems could lead to severe consequences. These customers prioritize robust safety measures not only for asset protection and operational continuity but also for adherence to stringent environmental regulations and the prevention of human casualties. Their purchasing decisions are heavily influenced by system reliability, adherence to safety integrity levels (SIL), and the total cost of ownership, including initial investment and ongoing maintenance.

The core customer base includes global and national oil and gas companies, encompassing operators involved in exploration and production (upstream), pipeline and storage (midstream), and refining and petrochemical processing (downstream). These organizations utilize HIPPS to protect high-pressure wells, subsea infrastructure, gas processing plants, and critical pipeline segments. Beyond the hydrocarbon sector, chemical manufacturing facilities, particularly those handling volatile or corrosive substances under extreme pressures, represent a significant customer segment. Power generation plants, especially those relying on high-pressure steam or gas turbines, also increasingly adopt HIPPS to safeguard critical equipment and personnel from overpressure scenarios, thereby preventing costly outages and ensuring uninterrupted power supply.

Furthermore, Engineering, Procurement, and Construction (EPC) contractors play a pivotal role as intermediaries, often specifying and procuring HIPPS on behalf of their end-user clients for new plant constructions or major retrofitting projects. These contractors seek reliable, compliant, and easy-to-integrate HIPPS solutions from trusted vendors. Emerging customer segments include industries such as pharmaceuticals, food and beverage, and water and wastewater treatment, where specific high-pressure processes require advanced safety measures, driven by both product integrity and worker safety considerations, indicating a broadening application scope for HIPPS technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $2.15 Billion |

| Market Forecast in 2032 | $3.41 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Siemens AG, Rockwell Automation Inc., Honeywell International Inc., ABB Ltd., Yokogawa Electric Corporation, Schneider Electric SE, Endress+Hauser AG, Rotork plc, Metso Outotec Corporation, Curtiss-Wright Corporation, Mogas Industries Inc., Johnson Controls (formerly Tyco International plc), Schlumberger Limited, Baker Hughes Company, General Electric Company, Danfoss A/S, IMI plc, Valmet Corporation, Alfa Laval AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High-Integrity Pressure Protection System Market Key Technology Landscape

The technology landscape for the High-Integrity Pressure Protection System market is characterized by a strong emphasis on functional safety, reliability, and increasingly, digitalization. At its core, HIPPS relies on highly specialized components certified to meet rigorous Safety Integrity Levels (SIL), typically SIL 3 or 4, as defined by international standards such as IEC 61508 for electrical/electronic/programmable electronic safety-related systems and IEC 61511 for the process industry sector. This certification dictates the architectural constraints, hardware fault tolerance, and diagnostic coverage required for each component to achieve the necessary risk reduction.

The technological backbone includes advanced Programmable Electronic Systems (PES) serving as logic solvers, which are designed with redundant architectures (e.g., 1oo2, 2oo3) to ensure high availability and prevent single points of failure. These are complemented by sophisticated sensors for pressure, temperature, and flow, featuring enhanced accuracy, faster response times, and built-in diagnostics that can detect internal faults. The final elements, primarily fast-acting valves and actuators, are engineered for rapid and reliable closure, often employing advanced materials and designs to withstand harsh operating environments and ensure effective isolation during an overpressure event. The integration of these components requires specialized communication protocols and system architectures to maintain integrity.

Furthermore, the market is witnessing a significant trend towards the incorporation of Industrial Internet of Things (IIoT) capabilities and cyber-physical integration. This involves smart sensors and valves capable of communicating diagnostic data in real-time, feeding into predictive maintenance algorithms and advanced analytical platforms. Machine learning is being explored to optimize HIPPS performance, reduce false trips, and predict potential component degradation, thereby enhancing overall system availability and reducing lifecycle costs. Cybersecurity measures are also paramount, as these critical safety systems become more connected, requiring robust protection against cyber threats to maintain their integrity and reliability in safeguarding industrial assets and personnel.

Regional Highlights

- North America: This region represents a mature yet dynamic market for HIPPS, driven by extensive oil and gas operations, particularly in shale and deepwater fields. Stringent federal and state safety regulations, coupled with a focus on upgrading aging infrastructure and implementing advanced technologies, fuel demand. Key countries like the United States and Canada are prominent adopters.

- Europe: Characterized by highly regulated industrial sectors and a strong emphasis on environmental protection, Europe maintains a significant HIPPS market. The presence of major petrochemical and chemical industries, alongside efforts to modernize existing facilities and reduce flare gas emissions, are primary drivers. Countries such as Germany, the UK, and Norway are leading players.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC is driven by rapid industrialization, increasing energy demand, and substantial investments in new oil and gas, petrochemical, and power generation projects. Countries like China, India, and Southeast Asian nations are witnessing significant HIPPS adoption due to expanding infrastructure and evolving safety standards.

- Latin America: This region offers considerable opportunities, particularly with ongoing offshore oil and gas exploration and production activities in countries like Brazil and Mexico. The expanding industrial sector and efforts to enhance safety in process facilities contribute to market growth, though economic volatility can influence investment cycles.

- Middle East and Africa (MEA): With vast oil and gas reserves and significant investments in upstream, midstream, and downstream projects, MEA is a crucial market for HIPPS. Expansion of refining capacities, new pipeline constructions, and a strong focus on operational safety and efficiency across the energy sector propel demand, particularly in Saudi Arabia, UAE, and Qatar.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High-Integrity Pressure Protection System Market.- Emerson Electric Co.

- Siemens AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- ABB Ltd.

- Yokogawa Electric Corporation

- Schneider Electric SE

- Endress+Hauser AG

- Rotork plc

- Metso Outotec Corporation

- Curtiss-Wright Corporation

- Mogas Industries Inc.

- Johnson Controls (formerly Tyco International plc)

- Schlumberger Limited

- Baker Hughes Company

- General Electric Company

- Danfoss A/S

- IMI plc

- Valmet Corporation

- Alfa Laval AB

Frequently Asked Questions

What is a High-Integrity Pressure Protection System (HIPPS)?

A High-Integrity Pressure Protection System (HIPPS) is a specialized safety instrumented system designed to prevent the overpressure of a plant section by automatically shutting off the source of pressure before the design pressure of the equipment is exceeded. It serves as a reliable, fast-acting alternative to conventional relief valves or flare systems.

Why is HIPPS considered important for industrial safety?

HIPPS is crucial for industrial safety because it provides an independent and highly reliable layer of protection against severe overpressure incidents, which can lead to catastrophic equipment failure, environmental damage, and loss of life. Its high integrity reduces the probability of failure on demand, safeguarding critical assets and operations.

What are the key components that constitute a HIPPS system?

A typical HIPPS system consists of three main components: initiating devices (sensors like pressure transmitters that detect overpressure), a logic solver (a programmable electronic system or relay-based system that processes sensor inputs), and final elements (fast-acting valves and actuators that close to isolate the pressure source).

How does HIPPS differ from traditional pressure relief systems?

Unlike traditional pressure relief systems that vent or flare excess pressure, HIPPS prevents overpressure by isolating the pressure source, thus containing the hazardous fluid within the system. This difference offers benefits such as reduced emissions, smaller equipment footprints, and the ability to operate processes closer to their maximum design limits.

In which industries is High-Integrity Pressure Protection System technology predominantly utilized?

High-Integrity Pressure Protection System technology is predominantly utilized in industries where high-pressure processes and hazardous fluids are common. This includes the oil and gas industry (upstream, midstream, downstream), chemical and petrochemical sectors, and increasingly, in power generation and other process industries requiring stringent safety measures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager