High Throughput Screening Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430197 | Date : Nov, 2025 | Pages : 255 | Region : Global | Publisher : MRU

High Throughput Screening Market Size

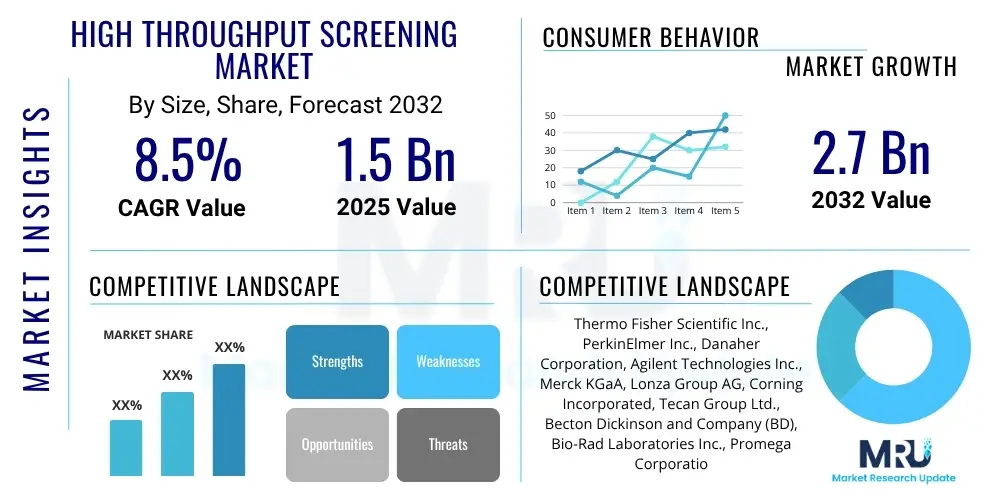

The High Throughput Screening Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 1.5 Billion in 2025 and is projected to reach USD 2.7 Billion by the end of the forecast period in 2032.

High Throughput Screening Market introduction

High Throughput Screening (HTS) is a fundamental methodology in modern drug discovery, enabling rapid and systematic testing of vast biological or chemical samples for specific activities. This accelerates drug development by efficiently identifying active compounds, antibodies, or genes that modulate target pathways. HTS utilizes miniaturized experimental setups and parallel screening, analyzing thousands to millions of experiments simultaneously. This high-efficiency paradigm significantly reduces time and financial resources, making it indispensable for pharmaceutical and biotechnology industries globally.

The HTS product portfolio includes sophisticated instruments, reagents, and software. Key components are automated liquid handling systems, multi-mode plate readers detecting various assay signals (e.g., fluorescence, luminescence), high-content imaging systems for phenotypic data, and robotics for plate manipulation. Specialized assay reagents, consumables, and powerful bioinformatics software for data acquisition, analysis, and management are integral to the HTS workflow. These integrated solutions ensure precise control, enhanced reproducibility, and efficient handling of complex experimental designs.

Major applications of HTS span primary drug screening, target identification/validation, toxicology, and functional genomics. Benefits include unparalleled efficiency in hit identification, enhanced reproducibility via automation, and capacity to explore vast chemical/biological spaces. Market growth is driven by escalating global demand for new drug discoveries, increasing R&D expenditures in pharma/biotech, and continuous technological advancements (automation, AI, assay development). Personalized medicine and complex biological targets further fuel market expansion, demanding sophisticated parallel screening capabilities.

High Throughput Screening Market Executive Summary

The High Throughput Screening (HTS) market shows robust growth, driven by dynamic business trends in drug discovery. Strategic collaborations between technology providers and pharmaceutical companies are increasing to develop integrated HTS solutions. Academic institutions and Contract Research Organizations (CROs) rapidly adopt HTS platforms to accelerate discoveries and offer specialized services. A notable shift is towards physiologically relevant models, including 3D cell cultures and phenotypic screening, improving predictive accuracy. Innovations in miniaturization, automation, and data analytics enhance HTS efficiency, broadening its applicability to biologics, gene therapies, and advanced cellular therapeutics.

Regionally, North America leads the HTS market due to substantial R&D investments, concentration of pharma/biotech firms, and advanced research infrastructure. Europe follows, buoyed by strong governmental funding and a robust biopharmaceutical industry. Asia Pacific emerges as the fastest-growing market, driven by rising healthcare expenditures, expanding life science research, and proliferation of CROs and domestic biotechnology companies in China and India. These economies are becoming key R&D hubs, attracting investment and fostering local innovation, contributing significantly to global market growth.

Market segmentation analysis highlights distinct growth patterns. Cell-based assays and label-free technologies see substantial growth for biologically relevant and real-time data. Consumables and reagents account for significant revenue from recurring demand. Applications expand beyond primary screening into target validation and toxicology. End-user growth is strong among biotechnology companies and CROs, as they lead in adopting cutting-edge HTS solutions to drive innovation and streamline discovery pipelines.

AI Impact Analysis on High Throughput Screening Market

User inquiries about AI's impact on High Throughput Screening (HTS) often highlight its potential to revolutionize the drug discovery workflow. Users want to know how AI can accelerate hit identification, optimize lead compounds, and enhance predictive power in assays. Key themes include AI for intelligent experimental design, automating data analysis, and uncovering hidden biological insights from vast HTS datasets. While enthusiasm is high, concerns exist about data integration, specialized AI expertise, and validation of AI-driven predictions. Nevertheless, expectations are strong that AI will significantly improve screening efficiency, minimize errors, facilitate novel target discovery, and ultimately elevate drug discovery success rates, transforming HTS into a data-intelligence powerhouse.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into HTS fundamentally reshapes drug discovery by introducing unprecedented efficiency, precision, and predictive capability. AI algorithms process colossal HTS data, identifying subtle patterns and correlations human analysis might miss, crucial for accelerating compound identification and understanding mechanisms. AI can predict pharmacokinetic/pharmacodynamic properties, including toxicity/efficacy, much earlier, reducing late-stage failures and cutting development costs. This shift from trial-and-error to intelligent, data-driven approaches makes drug discovery more rational and targeted, effectively prioritizing promising candidates.

- Accelerates data analysis and interpretation.

- Optimizes assay design and compound selection.

- Predicts drug candidates and off-target effects.

- Facilitates novel biological target identification.

- Automates robotic control for enhanced throughput.

- Improves data quality and error detection.

- Enables sophisticated phenotypic screening.

- Reduces time and cost in early-stage discovery.

- Supports drug repurposing.

- Aids personalized medicine.

DRO & Impact Forces Of High Throughput Screening Market

The High Throughput Screening (HTS) market is driven by escalating global demand for rapid and efficient drug discovery, crucial for combating rising chronic and infectious diseases. Increased R&D expenditures by pharmaceutical/biotechnology companies, coupled with continuous technological advancements in automation, miniaturization, and assay development, further propel market expansion. Growing adoption of HTS platforms in academic research and CROs to enhance efficiency also acts as a key driver. These cumulative forces create a powerful impact centered on innovation and urgent market demand for faster, more cost-effective, and predictive identification of therapeutic leads.

However, significant restraints temper market growth. High initial capital investment for HTS equipment and infrastructure can be prohibitive for smaller research institutions. The complexity of HTS data analysis, demanding specialized bioinformatics expertise, poses another challenge. Furthermore, relatively low hit-to-lead conversion rates in some HTS campaigns, despite high throughput, remain a concern, highlighting the need for more physiologically relevant and predictive assay models to enhance drug discovery success rates.

Opportunities for sustained growth are abundant, including novel assay technologies like advanced 3D cell culture models and organoids for enhanced physiological relevance. Deeper integration of Artificial Intelligence (AI) and Machine Learning (ML) promises to revolutionize assay design, data analysis, and lead optimization. Expansion of HTS applications into emerging therapeutic areas like gene/cell therapy and personalized medicine opens new avenues for specialized HTS platforms. Growing demand for biologics and advanced therapies creates fertile ground for tailored HTS systems, driving the next wave of therapeutic innovation.

Segmentation Analysis

The High Throughput Screening (HTS) market is comprehensively segmented by product, application, technology, end-user, and region. This granular analysis provides a robust framework for understanding market dynamics, identifying specific growth drivers, and pinpointing emerging opportunities. Each segment reflects unique characteristics, demand patterns, and technological requirements, offering valuable insights into the market's current state and trajectory. For instance, the product segment differentiates recurring expenditures on reagents/consumables from significant capital investments in instruments/software. The technology segment highlights evolving screening methodologies, from traditional biochemical to advanced cell-based and label-free approaches, showcasing continuous innovation. Analyzing these segments is essential for strategic planning and targeted market development, enabling stakeholders to tailor offerings to specific customer needs.

Detailed segmentation further illuminates the market's complexity and diverse participant needs. Understanding application-specific demand aids in developing specialized HTS solutions for primary screening, target validation, or advanced toxicology. End-user segmentation distinguishes requirements of large pharmaceutical corporations, agile biotechnology firms, CROs, and academic institutions, each with distinct budgetary constraints, throughput needs, and research objectives. This breakdown provides a nuanced view of where growth is most pronounced and innovation critical. The interplay between segments, such as how technology advancements influence drug discovery applications or how increasing CRO demand impacts instrument/reagent markets, is crucial for holistic market forecasting and strategic investment. Such delineation enables stakeholders to navigate the dynamic HTS market, identify niche opportunities, and formulate robust market entry/expansion strategies.

- Product: Components for HTS.

- Reagents and Assays: Consumables (Cell-based, Biochemical).

- Instruments: Core machinery (Robotic Systems, Liquid Handlers, Plate Readers, HCS Systems, Software/Data Tools).

- Consumables: Disposable items (microplates, tips).

- Application: HTS uses in R&D.

- Primary Screening, Target Identification/Validation, Toxicology, Drug Repurposing, Compound Profiling, Functional Genomics.

- Technology: Methodologies/platforms.

- Cell-based Assays, Label-free, Lab-on-a-chip, Bioinformatics, HCS.

- End-User: Primary customers.

- Pharma/Biotech Companies, CROs, Academic/Research Institutions, Government.

Value Chain Analysis For High Throughput Screening Market

The High Throughput Screening (HTS) market's value chain spans from upstream component suppliers to downstream end-users. Upstream involves sourcing/manufacturing essential reagents, assay kits, and consumables like microplates. This stage also includes producing sophisticated automated liquid handlers, robotic systems, multi-mode plate readers, and high-content imaging equipment. Key suppliers specialize in laboratory plastics, synthetic chemistry, and biological reagents. R&D focused on novel assay designs and technology enhancements significantly drives innovation and efficiency, influencing HTS performance across the chain.

The midstream segment integrates components into comprehensive HTS systems, involving specialized engineering and software development. This includes assembling robotic arms, liquid handlers, plate readers, and imaging systems into automated workstations. Developing sophisticated software for instrument control, data acquisition, processing, analysis, and management is paramount for handling vast HTS datasets, facilitating hit identification and data visualization. Midstream also includes HTS services from Contract Research Organizations (CROs), offering expert assay development, validation, and contract screening for clients lacking internal resources, thus expanding HTS accessibility.

Downstream, HTS technologies are applied by end-users. Pharmaceutical and biotechnology companies are the largest users, employing HTS for drug screening, target validation, and preclinical toxicology. Academic and research institutions utilize HTS in fundamental scientific research and early-stage drug discovery. Distribution channels are primarily direct sales from manufacturers to large end-users, ensuring tailored solutions. Indirect channels, via distributors and resellers, reach smaller labs and academic institutions, providing localized support. Online platforms increasingly facilitate information and procurement, enhancing market penetration.

High Throughput Screening Market Potential Customers

The High Throughput Screening (HTS) market serves a diverse customer base in life sciences research and drug discovery, requiring efficient, scalable methods to screen vast compound libraries. Leading are large pharmaceutical and biotechnology companies, major drivers of demand, investing substantially in HTS platforms to identify drug candidates, validate targets, and conduct preclinical toxicology. They seek integrated HTS solutions offering high reproducibility, speed, advanced data analytics, and customization for complex biological targets, aiming to streamline R&D and accelerate time-to-market.

Contract Research Organizations (CROs) form another significant customer group, leveraging HTS platforms to offer specialized screening services to clients, including smaller biotech firms, virtual pharma companies, and academic institutions. CROs benefit from HTS versatility and scalability, managing diverse projects from hit identification to lead optimization. Academic and research institutions (universities, government labs) are vital customers, applying HTS in basic scientific research, disease mechanism elucidation, and early-stage drug discovery. Their demand focuses on flexible, cost-effective HTS systems adaptable to various research objectives.

The evolving healthcare landscape also expands the customer base. Personalized medicine and functional genomics lead diagnostic companies and clinical research centers to adopt high-capacity screening for patient stratification and biomarker discovery. Agricultural biotechnology companies use HTS for novel pesticide or genetic trait screening. This broad utility underscores HTS's critical role across scientific and industrial sectors, driving continuous innovation and market expansion for diverse applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2032 | USD 2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific Inc., PerkinElmer Inc., Danaher Corporation, Agilent Technologies Inc., Merck KGaA, Lonza Group AG, Corning Incorporated, Tecan Group Ltd., Becton Dickinson and Company (BD), Bio-Rad Laboratories Inc., Promega Corporation, Evotec SE, Sartorius AG, Cytiva, Hamilton Company, Roche Diagnostics, Bridge Bioscience Holdings, HighRes Biosolutions, Beckman Coulter Life Sciences, Genedata AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Throughput Screening Market Key Technology Landscape

The High Throughput Screening (HTS) market features a dynamic technological landscape, continuously evolving to enhance efficiency, accuracy, and screening scope. Foundational are advanced robotic systems automating liquid handling, plate movement, and experimental workflows, ensuring precision, reproducibility, and high throughput. Complementing these are sensitive multi-mode plate readers, detecting diverse signals (e.g., fluorescence, luminescence, FRET) for biochemical/cell-based assays, providing real-time data across multiple wavelengths. These technologies form the core infrastructure for high-volume screening operations.

High-Content Screening (HCS) is crucial, integrating automated microscopy with image analysis software. HCS systems capture detailed cellular images, enabling multi-parametric data extraction on morphology, protein localization, and phenotypic changes. This offers deeper biological insights into cellular responses, improving assay physiological relevance. Microfluidics and lab-on-a-chip technologies gain traction, facilitating ultra-miniaturized assays that consume fewer reagents, offer faster reaction times, ideal for single-cell analysis and rare compound screening. These innovations reduce costs and enhance experimental control, promising greater miniaturization/integration.

Label-free technologies are critical, addressing limitations of traditional labels. Techniques like Surface Plasmon Resonance (SPR) and Biolayer Interferometry (BLI) provide real-time kinetic binding data/cellular responses without exogenous labels, simplifying assay development. Integrating advanced bioinformatics and machine learning (ML) transforms HTS data analysis. These powerful computational tools process massive datasets, identify subtle patterns, classify active compounds, and optimize leads. AI/ML are applied for intelligent experimental design, predictive toxicology, and data visualization, forming an indispensable part of the modern HTS technology ecosystem. Synergy of these diverse technologies drives the next generation of HTS for efficient, accurate, insightful drug discovery.

Regional Highlights

- North America: Dominates the global HTS market due to substantial pharmaceutical/biotechnology R&D investments. Characterized by many leading pharma companies, robust biotech firms, and advanced research infrastructure (especially US). Strong government funding, proactive technological innovation, and a favorable regulatory environment solidify its market leadership.

- Europe: Second-largest market, showing steady growth. Driven by a well-established pharmaceutical industry, increasing chronic diseases demanding therapies, and strong government support for scientific research. Key contributors include Germany, UK, France, Switzerland, boasting a strong ecosystem of pharma giants, biotech startups, and academic centers.

- Asia Pacific (APAC): Fastest-growing HTS market. Attributed to rapidly improving healthcare infrastructure, significant increases in healthcare expenditure, and burgeoning life sciences research (China, India, Japan). Increasing outsourcing of drug discovery to regional CROs and government initiatives promoting biomedical research further fuel expansion.

- Latin America: Emerging HTS market with gradual, consistent growth. Driven by improving healthcare infrastructure, rising awareness of advanced drug discovery, and growing R&D investments (Brazil, Mexico). Efforts to combat high burdens of infectious/chronic diseases stimulate demand for efficient tools.

- Middle East and Africa (MEA): Smaller but developing HTS market. Growth attributed to increasing awareness of HTS benefits and rising investments in healthcare infrastructure/scientific research by governments. Initiatives for economic diversification and local pharma manufacturing are expanding the market, though adoption remains slower.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Throughput Screening Market. These prominent companies are pivotal in driving innovation, developing advanced technologies, and expanding the global reach of High Throughput Screening solutions. Their strategic investments in research and development, robust product portfolios, and strong global presence contribute significantly to market dynamics and competitive landscape.- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Danaher Corporation

- Agilent Technologies, Inc.

- Merck KGaA

- Lonza Group AG

- Corning Incorporated

- Tecan Group Ltd.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- Promega Corporation

- Evotec SE

- Sartorius AG

- Cytiva (part of Danaher Corporation)

- Hamilton Company

- Roche Diagnostics (part of F. Hoffmann-La Roche Ltd.)

- Bridge Bioscience Holdings

- HighRes Biosolutions

- Beckman Coulter Life Sciences (part of Danaher Corporation)

- Genedata AG

Frequently Asked Questions

Here are common questions users ask about the High Throughput Screening market, reflecting key interests and concerns regarding its applications, technologies, and future impact on scientific research and drug development.

What is High Throughput Screening (HTS) and why is it crucial in modern drug discovery?

HTS is an automated experimental process rapidly testing thousands to millions of samples against a biological target/phenotype. It is crucial for accelerating hit identification, reducing time/cost, increasing efficiency/probability of discovering novel therapeutic candidates, thus streamlining drug development and enabling quicker responses to urgent medical needs.

How do technological advancements influence HTS market growth and capabilities?

Technological advancements drive HTS market growth. Innovations in automation (robotics, liquid handling) improve precision, reproducibility, and speed. Multi-mode plate readers and HCS enable diverse, biologically relevant assays. Microfluidics allows ultra-miniaturized screens. AI/ML revolutionize data analysis, experimental design, and predictive modeling, making HTS more powerful/efficient.

What are the primary challenges faced by the HTS market?

Challenges include high initial capital investment for equipment/infrastructure. Complex HTS data requires advanced bioinformatics expertise. Low hit-to-lead conversion rates and the need for more physiologically relevant assay models remain concerns, driving continuous innovation in assay development/efficiency.

Which end-user segments are major adopters of HTS technologies?

Major adopters are pharmaceutical/biotechnology companies, extensively using HTS for drug discovery/preclinical research. CROs are significant, providing specialized HTS services. Academic/research institutions (universities, government labs) employ HTS in basic scientific research, functional genomics, and early-stage drug discovery projects. Diverse demand highlights HTS's pervasive utility.

How is Artificial Intelligence (AI) transforming the future of HTS?

AI profoundly transforms HTS by integrating data-driven intelligence. AI algorithms optimize experimental design, predict optimal screening, and analyze vast datasets with unprecedented speed/accuracy, leading to quicker promising compound identification. It enhances lead optimization by predicting efficacy/toxicity, reducing late-stage failures. AI also drives advanced automation, sophisticated phenotypic screening, and unlocks novel insights, making drug discovery faster, cost-effective, more successful.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager