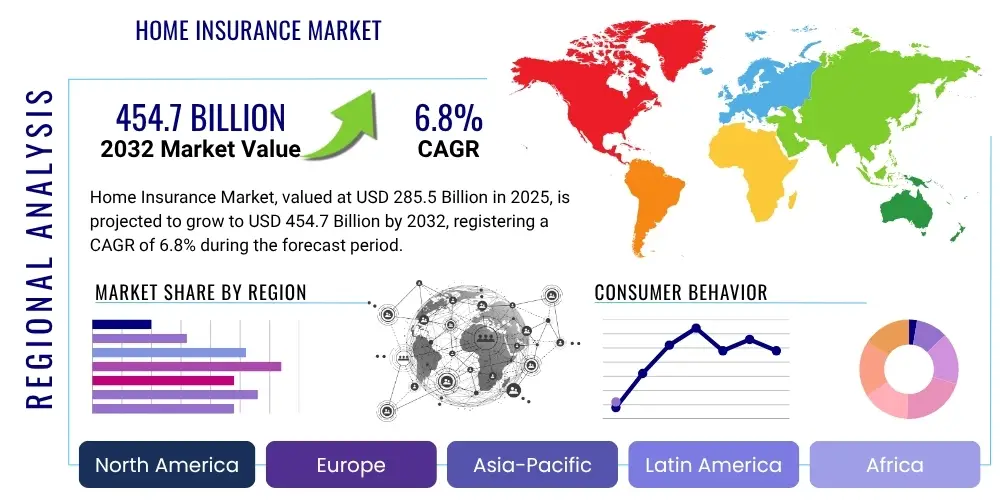

Home Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428639 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Home Insurance Market Size

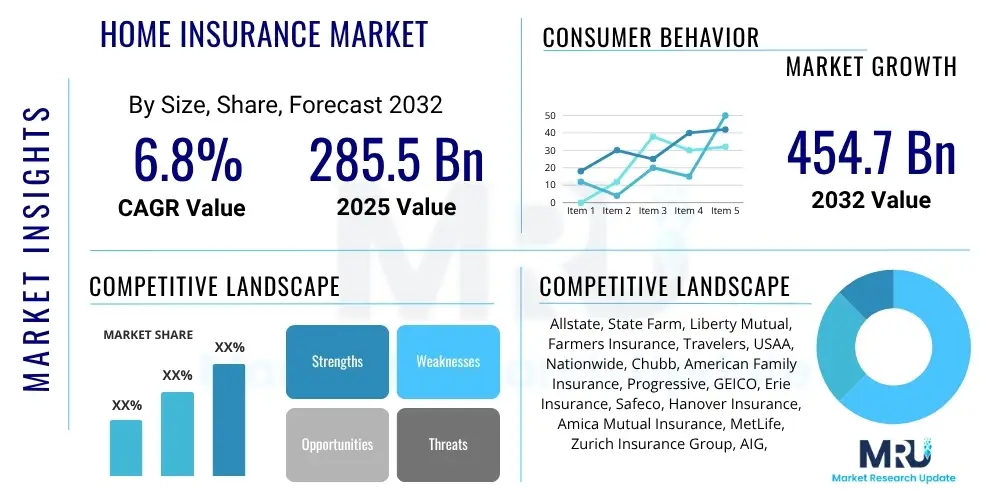

The Home Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at $285.5 Billion in 2025 and is projected to reach $454.7 Billion by the end of the forecast period in 2032.

Home Insurance Market introduction

The Home Insurance Market encompasses policies designed to protect individuals and families from financial losses due to damage to their homes and personal belongings, as well as liability for accidents occurring on their property. This essential financial product provides critical safeguards against a wide array of perils, including natural disasters, theft, vandalism, and accidental damages. Its core purpose is to restore policyholders to their pre-loss condition, offering peace of mind and financial stability in the face of unforeseen events.

The primary applications of home insurance extend to various residential property types, including single-family homes, condominiums, and rental units, with specialized policies catering to the unique needs of each. Key benefits include comprehensive coverage for dwelling structures, personal possessions, additional living expenses incurred during repairs, and protection against legal liabilities. The market is significantly driven by factors such as increasing global urbanization, a rise in property values, and the growing frequency and intensity of extreme weather events attributed to climate change. Moreover, the mandatory requirement for home insurance by mortgage lenders further propels its demand across diverse demographics.

Product offerings within the home insurance sector are continually evolving, integrating advanced features and customization options to meet consumer demands. These include standard policies covering basic perils, comprehensive policies offering broader protection, and specialized endorsements for high-value items or specific risks like earthquake or flood. The market's growth trajectory is further fueled by technological advancements enabling more accurate risk assessment and personalized policy development, enhancing both insurer efficiency and customer satisfaction.

Home Insurance Market Executive Summary

The Home Insurance Market is experiencing dynamic shifts, characterized by significant business trends towards digital transformation, personalized policy offerings, and enhanced risk assessment methodologies. Insurers are increasingly leveraging data analytics and artificial intelligence to refine underwriting processes, detect fraud more effectively, and improve customer engagement through streamlined digital platforms. This technological integration is driving operational efficiencies and fostering a more competitive landscape, encouraging product innovation and customer-centric service models.

Regional trends indicate robust growth in emerging economies, fueled by expanding middle classes, increasing homeownership rates, and developing regulatory frameworks. In mature markets like North America and Europe, the focus remains on adapting to evolving climate risks, managing rising repair costs, and addressing customer expectations for seamless digital interactions. Asia Pacific is poised for substantial market expansion, driven by rapid urbanization and infrastructure development, while Latin America and the Middle East and Africa present nascent opportunities with growing insurance penetration.

Segmentation trends highlight a growing demand for flexible and customizable insurance products. There is a notable rise in interest for usage-based insurance models and policies that integrate smart home technology, offering potential premium reductions for proactive risk mitigation. The distribution landscape is also evolving, with direct-to-consumer online channels gaining prominence alongside traditional agent and broker networks, catering to a diverse consumer base seeking convenience and competitive pricing. This holistic evolution across business, regional, and segment dynamics underscores a market in constant adaptation to economic, technological, and environmental forces.

AI Impact Analysis on Home Insurance Market

User inquiries about AI's influence on the Home Insurance Market frequently revolve around how artificial intelligence can personalize policies, accelerate claims processing, enhance fraud detection, and the implications for job roles within the industry. There is a strong user interest in understanding AI's role in predictive risk assessment, particularly concerning natural disasters, and the ethical considerations surrounding data privacy and algorithmic bias. Customers also seek clarity on whether AI-driven efficiencies translate into more affordable premiums and how smart home device integration, powered by AI, affects their coverage and rates. The overarching themes reflect a mixture of optimism about AI's potential to revolutionize service delivery and operational efficiency, coupled with concerns regarding data security, algorithmic fairness, and the human element in complex situations.

- AI enables highly personalized policy pricing through advanced data analysis of individual risk profiles.

- Expedited claims processing and settlement due to AI-driven automation and damage assessment.

- Enhanced fraud detection capabilities utilizing machine learning algorithms to identify suspicious patterns.

- Improved risk assessment and underwriting accuracy by analyzing vast datasets, including weather patterns and property characteristics.

- Integration with smart home devices for proactive risk mitigation and potential premium discounts.

- Development of predictive models for potential hazards, allowing for preventative recommendations.

- Augmented customer service through AI-powered chatbots and virtual assistants, providing 24/7 support.

- Operational efficiency gains through automation of routine tasks, reducing administrative costs.

- New product development, such as parametric insurance, triggered by AI-monitored events.

- Challenges in data privacy, security, and the potential for algorithmic bias in decision-making.

DRO & Impact Forces Of Home Insurance Market

The Home Insurance Market is profoundly shaped by a confluence of drivers, restraints, opportunities, and external impact forces. A primary driver is the increasing global vulnerability to natural disasters, including floods, wildfires, hurricanes, and earthquakes, which elevates the perceived need for robust insurance coverage. Coupled with this is the continuous growth in global property values and construction costs, necessitating higher coverage limits and subsequently expanding the market size. Urbanization trends, leading to denser living conditions and increased property ownership, also contribute significantly to market expansion. Furthermore, regulatory mandates, particularly in regions prone to specific perils or those requiring insurance for mortgage approval, play a crucial role in driving demand. The rapid adoption of digital technologies by insurers and consumers alike is also a powerful driver, enabling more accessible, efficient, and personalized insurance solutions.

However, the market faces several significant restraints. High premium costs, particularly in high-risk areas, can deter potential policyholders, leading to underinsurance or non-insurance. Economic downturns and inflationary pressures can reduce disposable income, making insurance less affordable for some segments of the population. Complex policy terms and a general lack of consumer understanding regarding coverage details often lead to dissatisfaction and mistrust. The intense competition from both traditional insurers and emerging insurtech companies also puts pressure on pricing and profitability. Moreover, the increasing frequency and severity of large-scale catastrophic events can strain insurers' reserves and lead to market volatility, potentially restricting coverage availability in certain regions.

Opportunities for growth are abundant, particularly through the integration of smart home technologies, which allow for proactive risk mitigation and can lead to lower premiums for policyholders. The development of personalized and usage-based insurance products, tailored to individual behaviors and property characteristics, offers a significant avenue for market differentiation and customer acquisition. Expansion into underserved emerging markets, where homeownership is growing and insurance penetration is low, represents a substantial long-term growth opportunity. Additionally, strategic partnerships with technology providers, real estate firms, and mortgage lenders can create synergistic ecosystems, enhancing distribution and customer reach. The market is further impacted by evolving regulatory landscapes, consumer behavior shifts towards digital channels, and continuous technological advancements that redefine risk assessment and claims management. These forces collectively shape the competitive dynamics and future trajectory of the home insurance industry.

Segmentation Analysis

The Home Insurance Market is comprehensively segmented to address the diverse needs of policyholders and to accurately reflect the varied nature of residential properties and associated risks. This segmentation allows insurers to tailor products, pricing, and distribution strategies more effectively, optimizing market reach and customer satisfaction. Key segments typically include divisions based on property type, coverage scope, distribution channels, and geographic application, each offering distinct characteristics and growth trajectories within the broader market landscape. Understanding these segments is crucial for analyzing market dynamics, identifying niche opportunities, and developing targeted marketing approaches.

- By Property Type

- Homeowner Insurance: Covers owner-occupied single-family homes, condominiums, and townhouses.

- Renter Insurance: Protects personal belongings and liability for tenants in rented properties.

- Condominium Insurance: Specialized policies for condo unit owners, covering interior damage and personal property.

- By Coverage Type

- Dwelling Coverage: Protects the structure of the home against specified perils.

- Personal Property Coverage: Covers belongings such as furniture, electronics, and clothing.

- Liability Coverage: Provides protection against claims for bodily injury or property damage to others.

- Additional Living Expenses (ALE): Covers costs if the home becomes uninhabitable due to a covered loss.

- Other Structures Coverage: Insures detached structures like garages or sheds.

- By Distribution Channel

- Direct Sales: Online platforms, company websites, and call centers.

- Agents and Brokers: Independent agents, captive agents, and insurance brokers.

- Bancassurance: Distribution through banking partners.

- Other Channels: Affinity groups, partnerships.

- By Application/Location

- Urban: Properties located in densely populated city areas.

- Suburban: Properties in areas surrounding major cities.

- Rural: Properties in less populated, often agricultural areas.

- By Policy Type

- Standard/Named Peril Policies: Cover only perils specifically listed in the policy.

- All-Risk/Open Peril Policies: Cover all perils except those specifically excluded.

Value Chain Analysis For Home Insurance Market

The value chain for the Home Insurance Market begins with upstream activities focused on data acquisition, risk assessment, and product development. This involves gathering extensive data from various sources, including property records, geographical information systems, historical claims data, and increasingly, real-time data from IoT devices and satellite imagery. Actuaries and data scientists then leverage this information to develop sophisticated risk models, set appropriate premiums, and design policy terms. Technology vendors play a crucial role here, providing software, platforms, and analytical tools that empower insurers to conduct precise underwriting and manage complex policy portfolios. Reinsurers also sit upstream, providing financial backing to insurers to mitigate large-scale catastrophic risks, thereby stabilizing the market.

Midstream activities primarily encompass distribution and policy administration. Distribution channels are varied, including direct sales through online portals and call centers, indirect sales via independent agents and captive brokers, and partnerships through bancassurance or other affinity groups. These channels are responsible for customer acquisition, policy issuance, and initial customer support. Policy administration involves managing client accounts, processing renewals, handling endorsements, and ensuring compliance with regulatory requirements. Customer relationship management (CRM) systems and enterprise resource planning (ERP) solutions are critical technologies supporting these midstream operations, aiming to streamline processes and enhance the customer experience.

Downstream activities focus on claims management and customer retention. When a policyholder files a claim, claims adjusters assess damages, verify coverage, and facilitate the settlement process. This often involves collaboration with third-party service providers such as contractors, restoration companies, and legal professionals. The efficiency and fairness of claims handling are paramount for customer satisfaction and retention. Post-claims, customer service and ongoing communication are vital for maintaining loyalty and encouraging renewals. Both direct (insurer-to-customer) and indirect (through agents/brokers) distribution channels continue their role in customer service throughout the policy lifecycle, ensuring policyholders receive support and clarity, thus completing the value cycle and informing future product development.

Home Insurance Market Potential Customers

The Home Insurance Market targets a broad spectrum of end-users and buyers, each with distinct needs and risk profiles. The largest segment comprises homeowners, particularly those purchasing a property with a mortgage, as lenders typically mandate insurance coverage. This group includes first-time homebuyers who are new to the complexities of property ownership and require guidance, as well as repeat homebuyers who may seek more customized or comprehensive policies based on previous experiences. Homeowners are primarily concerned with protecting their dwelling, personal belongings, and safeguarding against liability risks.

Another significant customer base includes renters, who, despite not owning the physical structure of their residence, possess valuable personal property and face liability risks. Renter's insurance is crucial for protecting their possessions against theft, fire, and other perils, and for providing liability coverage in case of accidents occurring within their rented space. This segment is often younger, more mobile, and may require more accessible and affordable policy options.

Condominium owners represent a specialized segment, requiring policies that bridge the gap between their individual unit coverage and the master policy typically held by the condominium association. These buyers are focused on interior unit damage, personal property, and liability within their specific living space. Additionally, property investors and landlords constitute potential customers, needing landlord insurance to protect their investment properties, often covering structural damage, loss of rental income, and liability associated with tenant use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $285.5 Billion |

| Market Forecast in 2032 | $454.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allstate, State Farm, Liberty Mutual, Farmers Insurance, Travelers, USAA, Nationwide, Chubb, American Family Insurance, Progressive, GEICO, Erie Insurance, Safeco, Hanover Insurance, Amica Mutual Insurance, MetLife, Zurich Insurance Group, AIG, Intact Financial Corporation, Desjardins General Insurance |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Insurance Market Key Technology Landscape

The Home Insurance Market is undergoing a profound transformation driven by the integration of cutting-edge technologies that enhance every facet of the insurance lifecycle, from risk assessment to claims processing. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, enabling insurers to analyze vast amounts of data to predict risks more accurately, personalize premiums, and detect fraudulent claims with greater precision. These technologies facilitate dynamic pricing models and predictive analytics, allowing for proactive interventions and tailored customer advice.

The Internet of Things (IoT) plays a pivotal role, particularly through smart home devices such as sensors for water leaks, smoke detectors, security cameras, and smart thermostats. These devices provide real-time data that can help prevent damages, alert homeowners to potential issues, and demonstrate proactive risk mitigation to insurers, potentially leading to reduced premiums. Integration of IoT data allows for a more granular understanding of individual property risks and behavioral patterns, fostering a shift towards preventive insurance models rather than purely reactive ones.

Big Data Analytics is essential for processing and interpreting the enormous volumes of structured and unstructured data generated from various sources, including claims history, geographic information systems, social media, and third-party data providers. Cloud Computing provides the scalable infrastructure necessary to store and process this data, supporting robust AI/ML applications and enabling seamless digital interactions. Furthermore, blockchain technology is emerging as a tool for secure and transparent claims processing, policy management, and fraud prevention, offering immutable records and streamlined transactions. Telematics, traditionally used in auto insurance, is also finding applications in home insurance through property monitoring and usage-based models, further enriching the technological landscape and driving innovation.

Regional Highlights

- North America: A mature market characterized by high insurance penetration, stringent regulatory frameworks, and significant adoption of digital technologies. The region faces increasing risks from severe weather events, driving demand for comprehensive coverage and innovative climate-resilient solutions.

- Europe: Exhibits a diverse landscape with varying levels of digital maturity and regulatory harmonization. Western Europe demonstrates high penetration and a focus on personalized policies and sustainability, while Eastern Europe presents growth opportunities fueled by rising homeownership and economic development.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid urbanization, expanding middle-class populations, and increasing property values. Emerging economies like India and China are experiencing significant growth in insurance uptake, with a strong emphasis on digital distribution and mobile-first strategies.

- Latin America: Characterized by lower insurance penetration but substantial growth potential. Economic stability, increasing homeownership, and growing awareness of natural disaster risks are primary drivers. Market players are focused on simplifying policy structures and enhancing digital access.

- Middle East and Africa (MEA): A developing market with diverse economic and regulatory environments. Growth is spurred by infrastructure development, rising disposable incomes, and increasing awareness of the importance of property protection. Digital transformation and customized Islamic finance compliant insurance products are key trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Insurance Market.- Allstate

- State Farm

- Liberty Mutual

- Farmers Insurance

- Travelers

- USAA

- Nationwide

- Chubb

- American Family Insurance

- Progressive

- GEICO

- Erie Insurance

- Safeco

- Hanover Insurance

- Amica Mutual Insurance

- MetLife

- Zurich Insurance Group

- AIG

- Intact Financial Corporation

- Desjardins General Insurance

Frequently Asked Questions

What is home insurance?

Home insurance is a type of property insurance that protects an individual's residence and belongings against damage, and also provides liability coverage for accidents on the property. It offers financial protection against perils such as fire, theft, natural disasters, and provides peace of mind for homeowners and renters alike.

Why do I need home insurance?

Home insurance is essential for financial protection against unforeseen events that could damage your property or cause liability claims. Mortgage lenders typically require it, and it safeguards your investment, covering repair costs, replacement of personal belongings, and legal expenses if someone is injured on your property.

What does home insurance typically cover?

Standard home insurance policies generally cover damage to the dwelling structure, personal belongings, and other structures on your property. They also provide liability protection for injuries or damage to others, and often include additional living expenses if your home becomes uninhabitable due to a covered loss.

How can I reduce my home insurance premiums?

You can reduce premiums by increasing your deductible, bundling policies (e.g., home and auto), installing smart home security systems, improving your home's resilience to natural disasters, maintaining a good credit score, and asking about available discounts for loyalty or being claims-free.

How has technology impacted home insurance?

Technology has revolutionized home insurance by enabling more accurate risk assessment through AI and big data, facilitating personalized policies, and speeding up claims processing. Smart home devices allow for proactive risk mitigation, while digital platforms enhance customer experience and streamline policy management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager