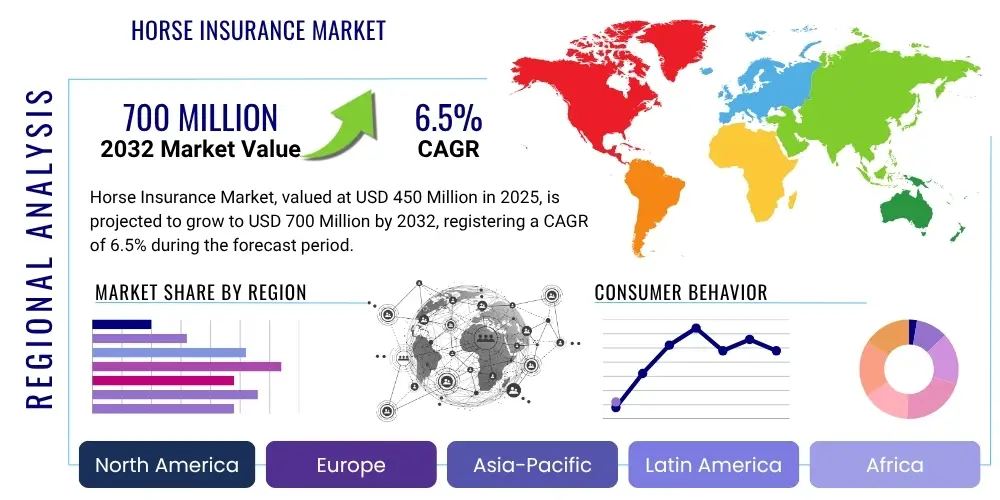

Horse Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428873 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Horse Insurance Market Size

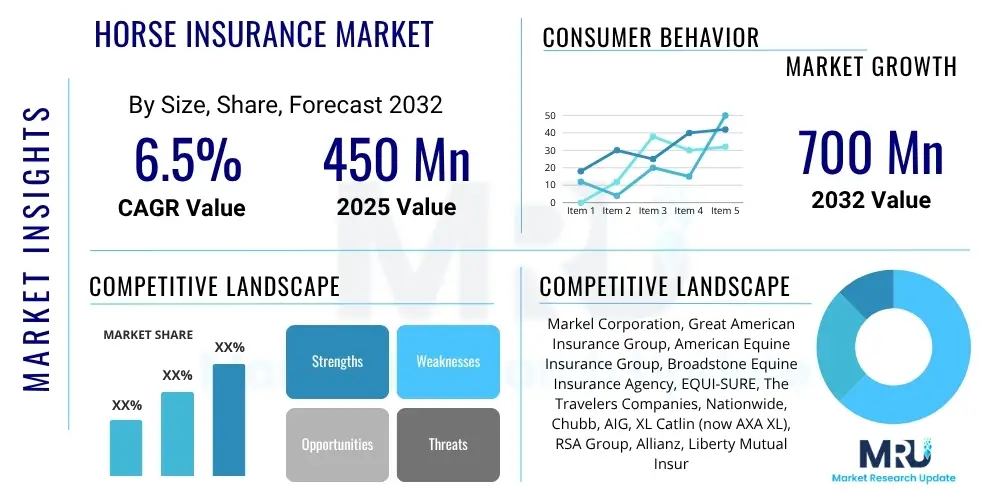

The Horse Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2025 and 2032. The market is estimated at USD 450 Million in 2025 and is projected to reach USD 700 Million by the end of the forecast period in 2032.

Horse Insurance Market introduction

The Horse Insurance Market encompasses a specialized financial service designed to provide comprehensive protection for horse owners against various risks associated with equine ownership. This market primarily addresses the significant financial outlays involved in horse care, including veterinary expenses, mortality, theft, and liability. As an essential tool for risk management, horse insurance policies offer peace of mind and financial stability to individuals and businesses engaged in equestrian activities, breeding, and general horse ownership. The growing appreciation for horses as companions, athletes, and valuable assets, coupled with the increasing professionalization of equestrian sports, continues to drive demand within this niche yet expanding sector.

The core product offerings within horse insurance include mortality insurance, which covers the loss of a horse due to accidental death, illness, or humane destruction; major medical and surgical insurance, covering veterinary treatment costs for injuries or illnesses; and liability insurance, protecting owners from claims arising from damage or injury caused by their horse. Additional coverages, such as loss of use, theft, and transit insurance, further diversify the product portfolio, catering to specific needs of diverse horse owners. The benefits extend beyond financial compensation, offering access to professional support and facilitating responsible horse ownership practices, emphasizing welfare and longevity.

Major applications of horse insurance span across various segments, including equestrian sports, recreational riding, breeding, and working horses. Driving factors for market growth include the increasing cost of equine veterinary care, a rising global horse population, heightened awareness among owners regarding financial risks, and the growing popularity of equestrian events. Furthermore, the increasing disposable income in developing regions and a cultural shift towards viewing horses as cherished companions rather than mere livestock contribute significantly to the market's expansion, making insurance a crucial aspect of responsible horse stewardship.

Horse Insurance Market Executive Summary

The Horse Insurance Market is experiencing robust growth driven by a confluence of factors including increasing horse ownership, escalating veterinary costs, and a heightened awareness regarding the financial risks associated with equine care. Business trends indicate a shift towards digital policy management, personalized insurance products, and enhanced customer experience through online platforms. Insurers are leveraging data analytics to refine risk assessment models and offer more tailored coverage options, addressing the diverse needs of sport horse owners, leisure riders, and breeding operations. The market is also witnessing consolidation among smaller specialized insurers and larger multi-line providers, aiming to broaden geographical reach and expand product portfolios, while simultaneously improving operational efficiencies to maintain competitive pricing.

Regional trends highlight North America and Europe as dominant markets, characterized by well-established equestrian industries, high disposable incomes, and strong regulatory frameworks that often encourage insurance adoption. These regions benefit from a high concentration of professional equestrian activities, breeding farms, and recreational horse ownership. Conversely, the Asia Pacific and Latin American regions are emerging as significant growth opportunities, driven by increasing participation in equestrian sports, rising disposable incomes, and a growing appreciation for horses. Investments in equestrian infrastructure and the internationalization of equine events are further propelling market development in these developing economies, albeit with varying levels of insurance penetration and regulatory maturity.

Segmentation trends reveal that mortality and major medical insurance remain the leading coverage types, reflecting the primary concerns of horse owners regarding the fundamental welfare and value of their animals. Surgical insurance is also gaining traction due to advancements in veterinary medicine and the increasing feasibility of complex procedures. From a horse type perspective, sport horses and breeding horses command higher insurance values due to their significant economic contribution and inherent risks, leading to more comprehensive and higher-premium policies. The market is also seeing an expansion in liability coverage as legal frameworks evolve and public awareness of equine-related liabilities increases, underscoring a holistic approach to risk mitigation for horse owners and equestrian businesses alike.

AI Impact Analysis on Horse Insurance Market

Common user questions regarding AI's impact on the Horse Insurance Market frequently revolve around how artificial intelligence will influence premium calculations, the speed and accuracy of claims processing, and the potential for detecting fraudulent claims. Users are also interested in whether AI can facilitate more personalized insurance offerings, improve overall risk assessment for individual horses, and enhance customer service interactions. There is a general expectation that AI could lead to more efficient and potentially more affordable insurance solutions, but also underlying concerns about data privacy, the potential for algorithmic bias, and the balance between automated processes and the essential human touch in a specialized and emotionally driven sector like equine care.

Based on this analysis, the key themes, concerns, and expectations users have about AI's influence in the Horse Insurance Market primarily focus on efficiency gains, personalization, and fairness. Users anticipate that AI can streamline administrative tasks, leading to quicker policy issuance and claims settlements, thus reducing waiting times and administrative burdens. The ability of AI to analyze vast datasets for more accurate risk profiling is seen as a significant advantage, potentially leading to fairer and more granular premium adjustments based on a horse's health history, activity level, and environmental factors. However, there is a clear demand for transparency in AI models and assurance that technological advancements will not compromise the ethical considerations inherent in insuring living, sentient beings, nor diminish the quality of empathetic customer support.

- Enhanced Predictive Analytics: AI algorithms can analyze vast amounts of data including veterinary records, breed-specific predispositions, environmental factors, and activity levels to more accurately assess a horse's individual risk profile, leading to highly customized premiums.

- Automated Claims Processing: Machine learning can accelerate the review and approval of claims by identifying patterns in submitted documentation, flagging discrepancies, and automating routine approvals, significantly reducing processing times and operational costs.

- Sophisticated Fraud Detection: AI systems can identify unusual claim patterns or anomalies in medical records that might indicate fraudulent activity, improving the integrity of the insurance process and potentially leading to lower costs for honest policyholders.

- Personalized Policy Offerings: AI allows insurers to create highly tailored insurance products and endorsements based on a horse's specific needs, use, and owner preferences, moving beyond one-size-fits-all policies.

- Improved Customer Service: AI-powered chatbots and virtual assistants can provide instant support for routine inquiries, policy explanations, and basic claims assistance, offering 24/7 availability and freeing human agents for more complex issues.

- Telematics and Wearable Integration: AI can process data from equine wearables (e.g., heart rate monitors, GPS trackers) to provide real-time health insights and activity monitoring, potentially allowing for proactive risk mitigation and dynamic premium adjustments.

DRO & Impact Forces Of Horse Insurance Market

The Horse Insurance Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all shaped by various impact forces. A primary driver is the continually escalating cost of equine veterinary care, which includes advanced diagnostics, surgical procedures, and long-term treatments. These high expenses make insurance an increasingly essential financial safeguard for horse owners. Concurrently, the rising global horse population, coupled with an increased participation in equestrian activities ranging from competitive sports to recreational riding, broadens the customer base for insurance products. Furthermore, greater awareness among horse owners regarding the comprehensive risks associated with equine ownership, from health issues to liability, acts as a strong impetus for insurance adoption, fostering a more proactive approach to risk management within the equestrian community.

Despite robust drivers, the market faces notable restraints. The relatively high cost of horse insurance premiums can be a deterrent for some owners, particularly those with multiple horses or limited disposable income. This perception of high cost often leads some to forego coverage, viewing it as a discretionary expense rather than a necessity. Moreover, a lack of standardized policies across different providers and regions can create confusion for potential buyers, making it challenging to compare offerings and understand true coverage limits. The perception among some horse owners that their animals face a low risk of serious illness or injury also acts as a restraint, leading to underinsurance or non-insurance, particularly in less competitive or recreational segments. Economic downturns can further impact the market, as horse ownership and associated insurance often fall under discretionary spending, making them vulnerable to budget cuts during financial instability.

Opportunities for growth are abundant within the Horse Insurance Market. Emerging markets, particularly in Asia Pacific and Latin America, present untapped potential due to growing equestrian interest and rising disposable incomes. The integration of advanced technologies like telematics and wearable devices offers a significant opportunity to enhance risk assessment, provide proactive health monitoring, and develop innovative, data-driven insurance products. The development of specialized and bundled insurance packages tailored for specific horse disciplines (e.g., dressage, racing, therapeutic riding) or breeding operations can attract niche segments. Additionally, leveraging digital platforms for policy sales, management, and claims processing can improve accessibility, efficiency, and customer engagement, further expanding market reach and operational effectiveness. These strategic advancements are crucial for sustained market expansion.

Segmentation Analysis

The Horse Insurance Market is segmented to provide a detailed understanding of its diverse landscape and to identify key areas of growth and demand. This comprehensive segmentation allows insurers and stakeholders to tailor products and marketing strategies to specific customer needs and market dynamics. The primary bases for segmentation include the type of coverage offered, the specific type of horse being insured, the channels through which insurance products are distributed, and the ultimate end-users or buyers of these policies. Analyzing these segments provides critical insights into purchasing behaviors, prevalent risk concerns, and the most effective ways to reach target audiences within the equestrian community.

- By Coverage Type:

- Mortality Insurance: Covers the death of a horse due to accident, illness, or humane destruction.

- Major Medical Insurance: Provides coverage for extensive veterinary treatments for illnesses or injuries, excluding routine care.

- Surgical Insurance: Specifically covers the costs associated with surgical procedures.

- Loss of Use Insurance: Compensates the owner if a horse becomes permanently incapable of performing its insured use (e.g., competitive sport, breeding) due to illness or injury.

- Liability Insurance: Protects the owner against third-party claims for property damage or bodily injury caused by their horse.

- Others: Includes specialized coverages like colic surgery coverage, theft, transit insurance, and catastrophic accident insurance.

- By Horse Type:

- Sport Horses: Includes horses used for competitive disciplines such as show jumping, dressage, eventing, racing, and polo.

- Leisure Horses: Covers horses primarily used for recreational riding, trail riding, or pleasure.

- Breeding Horses: Focuses on horses used for breeding purposes, including stallions and broodmares, often with coverage for unborn foals.

- Working Horses: Encompasses horses used for specific tasks such as ranch work, police work, or therapeutic riding.

- Others: May include youngstock, ponies, or miniature horses, each with specific insurance needs.

- By Distribution Channel:

- Direct Sales: Policies sold directly by insurance companies to clients, often through their websites or dedicated sales teams.

- Agents/Brokers: Independent insurance professionals who advise clients and sell policies from multiple carriers.

- Online Platforms: Digital marketplaces and aggregators that allow clients to compare and purchase policies online.

- By End-User:

- Individual Owners: Private individuals who own horses for personal use, recreation, or hobby.

- Equestrian Businesses: Commercial entities such as stables, training facilities, breeding operations, riding schools, and competition organizers.

Value Chain Analysis For Horse Insurance Market

The value chain for the Horse Insurance Market is complex, involving multiple stages and stakeholders from initial risk assessment to claims settlement and customer support. At the upstream end, the process begins with data providers and risk assessment services. This includes access to comprehensive veterinary databases, equine health records, breed-specific risk profiles, and potentially even data from equine wearables. Reinsurance companies also play a crucial upstream role by enabling primary insurers to underwrite larger and more specialized risks, spreading the financial burden and ensuring market stability. The quality and availability of this data directly influence the accuracy of underwriting and the competitiveness of premium offerings, forming the foundational layer of the insurance product.

The mid-stream of the value chain involves the insurance companies themselves, along with their distribution channels. Insurers engage in product development, actuarial analysis to price policies, underwriting to assess individual applications, and policy administration. Distribution is a critical component, with policies typically reaching customers through direct sales channels, such as company websites and dedicated sales teams, as well as indirect channels like independent insurance agents and brokers. These intermediaries are vital for providing expert advice, facilitating policy comparisons, and assisting clients with complex insurance needs. Online aggregators and digital platforms are increasingly becoming important indirect channels, offering convenience and broader access for customers seeking competitive quotes.

Downstream in the value chain are the end-users of the product: horse owners and equestrian businesses. These policyholders directly interact with the insurance providers for policy management, premium payments, and, most critically, claims submission. Supporting this downstream interaction are various service providers, including veterinary clinics and hospitals that provide the care covered by medical policies, as well as legal services for liability claims. Effective claims handling and efficient payout processes are paramount for customer satisfaction and retention. The entire value chain relies on seamless communication and data exchange between these diverse entities to ensure that horse owners receive timely and appropriate financial protection, ultimately contributing to responsible horse ownership and the sustainability of the equestrian industry.

Horse Insurance Market Potential Customers

Potential customers for the Horse Insurance Market are diverse, encompassing a wide spectrum of individuals and entities within the equestrian community, each with varying needs and risk profiles. The primary demographic includes private horse owners, ranging from those who own a single horse for pleasure riding to those with multiple horses for competitive sports or breeding. These individual owners seek protection against the significant financial implications of equine health issues, accidents, theft, or liability. Their decisions are often influenced by the emotional attachment to their animals, the economic value of their horses, and a desire for financial security in the face of unpredictable events, making them a foundational segment of the market.

Beyond individual owners, a substantial segment of potential customers comprises various equestrian businesses and organizations. This includes professional riders and trainers who depend on the health and performance of their horses for their livelihood, making comprehensive coverage for mortality, medical, and loss of use crucial. Breeding farms represent another key segment, requiring specialized policies that cover breeding risks, unborn foals, and high-value broodmares and stallions. Riding schools and livery stables also necessitate robust insurance, particularly for liability coverage, to protect against incidents involving clients or horses under their care. These commercial entities often require more extensive and tailored insurance portfolios than individual owners, reflecting their higher exposure to risk and economic investment in their equine operations.

Furthermore, event organizers for equestrian competitions, therapeutic riding centers, and equine charities also represent significant potential customers. Event organizers require liability insurance to cover participants, spectators, and potential damage during their events. Therapeutic riding centers, which often cater to vulnerable populations, need specialized liability and medical coverage for their therapy horses. Equine charities, dedicated to rescuing and rehoming horses, may seek coverage for their charges to ensure their welfare and protect their financial investments in rehabilitation. The breadth of these potential customers underscores the multifaceted nature of the horse insurance market, demanding flexible and customizable insurance solutions that address the unique requirements of each segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 450 Million |

| Market Forecast in 2032 | USD 700 Million |

| Growth Rate | CAGR of 6.5% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Markel Corporation, Great American Insurance Group, American Equine Insurance Group, Broadstone Equine Insurance Agency, EQUI-SURE, The Travelers Companies, Nationwide, Chubb, AIG, XL Catlin (now AXA XL), RSA Group, Allianz, Liberty Mutual Insurance, Farmers Insurance, Tokio Marine Holdings, Zurich Insurance Group, NFU Mutual, Equine Insurance UK, Chartis (AIG), StarNet Insurance Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Horse Insurance Market Key Technology Landscape

The Horse Insurance Market is increasingly integrating advanced technologies to enhance its operational efficiency, risk assessment capabilities, and customer experience. One significant area of technological advancement is the adoption of telematics and wearable devices for equine health monitoring. These devices, worn by horses, can collect real-time data on activity levels, heart rate, temperature, and even location, providing invaluable insights into a horse's well-being. This data, when analyzed, can inform more precise risk profiles, potentially leading to dynamic pricing models and proactive interventions that prevent severe health issues, thereby reducing claims frequency and severity for insurers, while promoting better animal welfare for owners.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming various facets of the insurance value chain, from underwriting to claims processing. AI algorithms can analyze vast datasets, including veterinary records, claims history, breed-specific predispositions, and environmental factors, to develop highly accurate predictive models for equine health risks. This allows for more granular and personalized premium calculations, moving away from broad generalizations. Furthermore, AI-powered systems can automate and accelerate the claims assessment process by intelligently reviewing submitted documents, identifying patterns, and flagging potential fraud, leading to faster settlements and reduced administrative overhead. The deployment of AI chatbots and virtual assistants also enhances customer service, providing instant answers to common queries and streamlining initial interactions.

Beyond data analytics, blockchain technology is emerging as a potential game-changer, particularly in enhancing transparency and security within the Horse Insurance Market. By providing an immutable and verifiable ledger for policy contracts, ownership records, and claims history, blockchain can reduce disputes, prevent fraud, and streamline transactions across multiple parties. Digital platforms and cloud computing solutions form the backbone for these technological integrations, enabling seamless data storage, secure communication, and efficient management of policies and customer interactions. These technologies collectively contribute to a more sophisticated, responsive, and ultimately more competitive horse insurance industry, driving innovation and meeting the evolving demands of modern horse ownership.

Regional Highlights

- North America: This region represents a highly mature and significant market for horse insurance, primarily driven by a large horse population, a strong equestrian culture, and a high participation rate in competitive equine sports. Countries like the United States and Canada boast well-established regulatory frameworks, a high prevalence of professional horse ownership, and substantial disposable incomes among horse owners, leading to a high demand for comprehensive insurance products. The market here is characterized by a mix of large national insurers and specialized equine insurance agencies, offering a wide array of coverages from mortality and medical to liability and loss of use. Continuous advancements in veterinary medicine and a strong emphasis on animal welfare further drive the adoption of sophisticated insurance policies.

- Europe: Europe is another dominant region in the Horse Insurance Market, benefiting from a rich equestrian heritage, diverse horse breeds, and a significant economic contribution from the equine industry in countries such as the UK, Germany, France, and the Netherlands. The market is supported by a large number of leisure riders, breeding operations, and world-renowned equestrian events. Regulatory landscapes vary by country, influencing policy structures and consumer choice, but overall, there is a strong inclination towards insuring valuable horses and mitigating financial risks. The presence of specialized equine insurers alongside major multinational companies contributes to a competitive market, with a growing focus on tailored products and digital service delivery to meet the demands of a discerning clientele.

- Asia Pacific (APAC): The APAC region is identified as an emerging market with substantial growth potential for horse insurance. Countries like China, India, Australia, and Japan are witnessing a rising interest in equestrian sports and recreational horse ownership, fueled by increasing disposable incomes and the Westernization of leisure activities. While insurance penetration is currently lower compared to North America and Europe, the expanding horse population and the development of new equestrian facilities signal a promising future. Opportunities abound for insurers to educate potential clients about the benefits of coverage and to adapt policy offerings to local cultural contexts and economic conditions. Australia, in particular, has a relatively established market due to its significant horse racing and breeding industries.

- Latin America: The Latin American market for horse insurance is developing, with countries such as Brazil, Argentina, and Mexico showing increasing awareness and adoption. The region possesses a strong tradition of horse breeding, particularly for disciplines like polo and rodeo, and recreational riding. However, market growth is often challenged by economic volatility, varying regulatory environments, and a lower overall disposable income compared to more developed markets. Despite these hurdles, there is a growing recognition among owners of high-value sport horses and breeding stock regarding the necessity of insurance. Insurers are gradually expanding their presence, often offering tailored products to cater to the specific needs of local equestrian communities and agricultural sectors where horses play a functional role.

- Middle East and Africa (MEA): The MEA region represents a niche but high-value segment within the Horse Insurance Market. Countries in the Middle East, particularly the UAE and Saudi Arabia, are home to highly valuable horses, including Arabian purebreds and racehorses, often owned by affluent individuals and royal families. This segment drives demand for premium, comprehensive coverage, including mortality, major medical, and specialized high-value transit insurance. In Africa, the market is more nascent, with pockets of demand driven by professional equestrian communities and wildlife management efforts. Growth in this region is characterized by specialized offerings for luxury horses and a gradual increase in awareness within developing equestrian sectors, although overall market penetration remains relatively low.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Horse Insurance Market.- Markel Corporation

- Great American Insurance Group

- American Equine Insurance Group

- Broadstone Equine Insurance Agency

- EQUI-SURE

- The Travelers Companies

- Nationwide

- Chubb

- AIG

- AXA XL (formerly XL Catlin)

- RSA Group

- Allianz

- Liberty Mutual Insurance

- Farmers Insurance

- Tokio Marine Holdings

- Zurich Insurance Group

- NFU Mutual

- Equine Insurance UK

- StarNet Insurance Company

- American N

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager