HVDC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429368 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

HVDC Converter Market Size

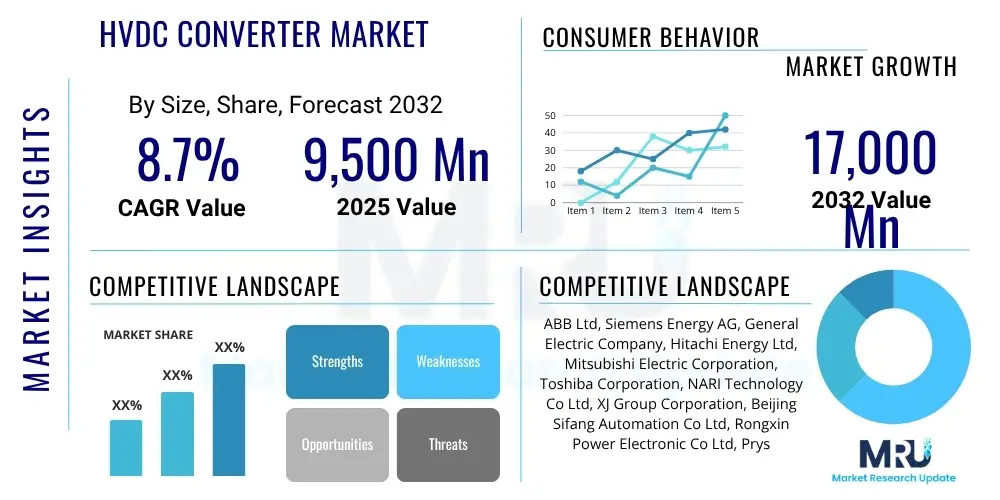

The HVDC Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2025 and 2032. The market is estimated at $9,500 Million in 2025 and is projected to reach $17,000 Million by the end of the forecast period in 2032.

HVDC Converter Market introduction

The High Voltage Direct Current (HVDC) converter market encompasses the advanced power electronics and associated equipment essential for transforming alternating current (AC) to direct current (DC) and vice versa, primarily for the efficient and reliable transmission of bulk electricity. These sophisticated systems serve as the backbone for modern power grids, enabling seamless integration of diverse power sources and facilitating power exchange over vast geographical distances. HVDC technology has evolved significantly since its inception, moving from basic mercury-arc valve converters to advanced semiconductor-based solutions, reflecting a continuous drive for improved performance, greater flexibility, and enhanced system control within the global energy infrastructure.

The core products within this market are the HVDC converter stations, which are comprised of converter valves (typically thyristors for Line Commutated Converters or IGBTs for Voltage Source Converters), transformers, smoothing reactors, harmonic filters, and sophisticated control and protection systems. Line Commutated Converters (LCC) have traditionally been employed for very high power, long-distance point-to-point transmission due to their robustness and mature technology. In contrast, Voltage Source Converters (VSC), particularly those utilizing Modular Multilevel Converter (MMC) topologies, offer superior advantages such as independent control of active and reactive power, black start capabilities, and suitability for multi-terminal DC grids and connections to weak AC systems. These technical distinctions shape their respective application domains.

Major applications for HVDC converter systems are extensive and critically important for contemporary energy challenges. They are indispensable for integrating remote renewable energy sources, such as large-scale offshore wind farms and distant hydropower plants, into existing grids. Furthermore, HVDC links are vital for interlinking national and regional power grids, enhancing energy security, enabling cross-border energy trading, and stabilizing grid operations by connecting asynchronous networks. The benefits derived from deploying HVDC systems are compelling, including drastically reduced transmission losses over long distances, minimized land usage for transmission corridors, improved grid stability through advanced control, and the capability to effectively manage power flow fluctuations inherent with renewable energy integration. These benefits are the primary driving factors propelling the expansion of the HVDC converter market globally, alongside the increasing demand for electricity and the urgent need for grid modernization.

HVDC Converter Market Executive Summary

The HVDC Converter Market is demonstrating vigorous expansion, predominantly fueled by the global transition towards a greener energy mix and the strategic imperative to upgrade and expand power transmission infrastructure. Current business trends indicate a heightened focus on technological advancements, particularly in Voltage Source Converter (VSC) technology, where Modular Multilevel Converters (MMC) are seeing widespread adoption due to their inherent flexibility and enhanced performance characteristics. Major market players are strategically investing in research and development, forming alliances, and engaging in mergers and acquisitions to consolidate their positions, broaden their product portfolios, and enhance their capabilities in delivering comprehensive HVDC solutions. There is also a discernible trend towards the digitalization of HVDC operations, incorporating advanced analytics and real-time monitoring to optimize system performance and reliability, while cybersecurity for these critical assets remains a paramount concern.

From a regional perspective, the Asia Pacific region stands out as the predominant growth hub for HVDC converters, primarily driven by large-scale infrastructure projects, rapid urbanization, and ambitious national renewable energy targets in countries such as China, India, and South Korea. Europe continues its strong market presence, largely due to extensive investments in offshore wind energy development and the creation of a unified European electricity market through robust cross-border interconnections. North America is experiencing substantial growth as well, as utility companies commit to grid modernization, the integration of significant amounts of intermittent renewable energy, and the enhancement of grid resilience against severe weather events, often facilitated by new HVDC transmission lines.

An analysis of market segmentation reveals distinct trends. The By Technology segment shows a pronounced shift towards VSC solutions, particularly MMCs, over traditional Line Commutated Converters (LCCs) for new installations, owing to their versatility and advanced features suitable for modern grids. Within the By Component segment, there is increasing demand for high-performance power semiconductors like IGBTs, sophisticated control and protection systems, and resilient DC cables capable of handling extreme conditions. The By Application segment highlights renewable energy integration, especially offshore wind power evacuation, as the fastest-growing area, closely followed by bulk power transmission over long distances and inter-regional grid connections. Furthermore, the market is observing a trend towards higher power rating converters as the scale of global energy projects continues to grow, demanding greater transmission capacity.

AI Impact Analysis on HVDC Converter Market

Common user questions and concerns regarding the influence of Artificial Intelligence (AI) on the HVDC Converter Market frequently center on how AI can fundamentally transform the operational efficiency, predictive capabilities, and overall resilience of these complex systems. Key areas of interest include the utilization of AI for intelligent grid management, optimizing power flow in real-time under fluctuating conditions, and developing sophisticated algorithms for early fault detection and predictive maintenance. Stakeholders are keen to understand how AI can reduce operational expenditures, enhance decision-making through advanced data analytics, and improve the lifespan and reliability of high-value HVDC assets, thereby ensuring a more stable and cost-effective energy transmission network.

The integration of AI in HVDC converter technology promises a paradigm shift in how these critical infrastructure components are managed and operated. AI-powered analytics can process vast amounts of operational data from sensors, converters, and the wider grid, identifying subtle anomalies that precede equipment failure. This allows for scheduled, proactive maintenance instead of reactive repairs, significantly reducing unexpected downtime and extending asset life. Furthermore, AI algorithms can dynamically optimize the control parameters of HVDC converters in response to real-time grid conditions, ensuring maximum efficiency, minimal losses, and enhanced grid stability, especially crucial when integrating variable renewable energy sources.

- Predictive Maintenance: AI algorithms analyze operational data from converter valves, transformers, and cooling systems to predict potential failures, enabling proactive maintenance and reducing unscheduled outages, thereby improving system reliability and extending asset lifespan.

- Optimized Power Flow Management: AI-driven control systems dynamically adjust HVDC converter operations to optimize power flow across the grid, minimize transmission losses, and respond rapidly to changes in generation or demand, enhancing overall grid efficiency and economic dispatch.

- Enhanced Grid Stability and Resilience: AI monitors grid parameters in real time, detecting disturbances, voltage fluctuations, or frequency deviations and initiating rapid corrective actions through HVDC converters, thereby bolstering grid stability and preventing cascading failures.

- Advanced Fault Detection and Diagnosis: Machine learning models quickly identify the precise location and nature of faults within complex HVDC systems, reducing the time required for diagnosis and repair, leading to faster service restoration and improved operational continuity.

- Design and Planning Optimization: AI assists in simulating and modeling various HVDC system designs and operational scenarios, enabling engineers to optimize converter station layouts, component selection, and control strategies for enhanced performance, reduced costs, and faster project development.

- Improved Cybersecurity: AI-powered intrusion detection systems can analyze network traffic and system behavior within HVDC control networks, identifying anomalous patterns indicative of cyber threats or attacks, thereby protecting critical energy infrastructure from malicious actors.

- Automated System Control: AI enables higher levels of automation in routine operational tasks and complex decision-making processes, reducing reliance on manual intervention, improving operational consistency, and freeing human operators to focus on strategic oversight.

DRO & Impact Forces Of HVDC Converter Market

The HVDC Converter Market is shaped by a intricate interplay of distinct drivers, formidable restraints, compelling opportunities, and powerful impact forces that collectively dictate its growth trajectory and evolutionary path. A primary driver is the accelerating global transition towards renewable energy sources, such as offshore wind, solar, and hydropower, which are often located far from major consumption centers. HVDC technology is uniquely positioned to efficiently transmit this power over long distances with minimal losses. Furthermore, the imperative to modernize aging grid infrastructures in developed nations and expand electricity access in emerging economies, coupled with the rising demand for efficient and stable cross-border energy trading, significantly fuels market expansion by requiring robust and interconnected transmission solutions.

However, the market also contends with substantial restraints that can impede its growth. The high initial capital expenditure associated with the installation of HVDC converter stations and the extensive high-voltage DC transmission lines represents a significant financial barrier, especially for projects in regions with limited investment capacity or unfavorable economic conditions. The inherent complexity of designing, engineering, and commissioning HVDC systems necessitates highly specialized technical expertise and often involves lengthy project timelines, which can deter potential investors. Moreover, the fragmented and often inconsistent regulatory frameworks across different countries, coupled with environmental permitting challenges, can introduce delays and increase the overall risk profile of HVDC projects. Additionally, the growing threat of cyberattacks on critical infrastructure poses a persistent challenge, demanding continuous investment in advanced security measures for HVDC control systems.

Despite these restraints, significant opportunities abound for stakeholders in the HVDC converter market. The booming offshore wind energy sector globally presents a particularly lucrative avenue, as HVDC is the preferred solution for evacuating power from large-scale offshore farms. The ongoing development of smart grid technologies and the potential for creating multi-terminal HVDC networks offer opportunities for integrating HVDC converters into more sophisticated, resilient, and digitally managed power systems. Emerging economies, particularly in Asia Pacific and Africa, offer vast untapped potential for new HVDC installations as they industrialize and strive to meet escalating electricity demands. Furthermore, continuous technological advancements, such as the miniaturization of converter components, improved efficiency of power semiconductors, and the development of more compact and modular designs, are consistently broadening the application scope and improving the economic viability of HVDC solutions across various voltage and power levels.

Segmentation Analysis

A comprehensive segmentation analysis of the HVDC Converter Market provides critical insights into the diverse factors influencing its structure, competitive landscape, and future growth prospects. The market is typically broken down by key attributes such as technology utilized, the various components that make up a converter station, its primary applications, and the power ratings it is designed to handle. This detailed segmentation allows for a granular understanding of where investment and innovation are concentrated, revealing the specific niches and trends that are driving market evolution. Understanding these distinctions is paramount for strategic planning, product development, and market entry strategies for companies operating within or looking to enter this dynamic sector.

The By Technology segment delineates between established and emerging converter designs, with a clear trend towards more advanced solutions. The By Component segment highlights the intricate engineering involved in HVDC systems, from core power electronics to ancillary support systems, and points to areas of high-value manufacturing. The By Application segment categorizes the diverse uses of HVDC technology, reflecting its critical role across various facets of the power industry, from long-distance transmission to specialized industrial feeds. Finally, the By Power Rating segment distinguishes market needs based on the scale of electrical capacity required, catering to projects ranging from smaller interconnections to massive bulk power transfer systems. Each segment experiences unique growth drivers and competitive pressures, contributing to the overall complexity and opportunities within the HVDC converter market.

- By Technology

- Line Commutated Converters (LCC): Characterized by thyristor valves, suitable for high power and long-distance point-to-point transmission, known for robustness.

- Voltage Source Converters (VSC): Utilizes IGBTs, offers active and reactive power control, black start capability, and suitability for weak AC grids and multi-terminal systems.

- Modular Multilevel Converters (MMC): A type of VSC, highly flexible, scalable, and dominant for new HVDC projects, especially offshore.

- Two-Level/Three-Level Converters: Earlier VSC topologies, still used in certain applications but less flexible than MMC.

- Hybrid HVDC: Combines elements of LCC and VSC to leverage the advantages of both, offering tailored solutions for specific grid requirements and transitions.

- By Component

- Converter Valves (Thyristors, IGBTs): The core semiconductor devices responsible for AC/DC conversion.

- Transformers: Essential for adjusting voltage levels and providing galvanic isolation.

- Smoothing Reactors: Used to reduce ripples in DC current and limit fault currents.

- Harmonic Filters: Mitigate harmonic distortion injected into the AC system by the converter.

- DC Capacitors: Provide voltage smoothing and energy storage in VSC systems.

- Control and Protection Systems: Advanced digital systems ensuring safe, stable, and efficient operation of the converter station.

- DC Switchgear: Components for switching and isolating DC circuits within the station.

- Cooling Systems: Crucial for dissipating heat generated by power electronics to maintain optimal operating temperatures.

- By Application

- Grid Interconnections: Linking asynchronous AC grids or different power regions to enhance reliability and enable energy trading.

- Offshore Wind Power Integration: Evacuating power from large-scale offshore wind farms to onshore grids, typically using VSC technology.

- Bulk Power Transmission: Transporting large amounts of electricity over very long distances, often from remote generation sites.

- Urban Infeed/City Center Feeds: Delivering power to densely populated urban areas with limited space for AC transmission infrastructure.

- Oil and Gas Platforms: Providing stable power supplies to offshore platforms from onshore grids.

- Renewable Energy Integration (Onshore Wind, Solar): Connecting large onshore renewable power plants to the main transmission network.

- By Power Rating

- Low Power (<500 MW): Suitable for smaller interconnections, industrial applications, or regional grid enhancements.

- Medium Power (500 MW - 1500 MW): Covers a wide range of applications, including regional bulk power transfer and larger renewable integration projects.

- High Power (>1500 MW): Primarily for major intercontinental or trans-regional bulk power transmission corridors and very large renewable energy complexes.

Value Chain Analysis For HVDC Converter Market

The HVDC Converter Market’s value chain is characterized by a high degree of technical specialization and significant capital investment at each stage, stretching from the provision of fundamental raw materials to the deployment and ongoing maintenance of complex power systems. At the upstream stage, it involves suppliers of critical raw materials such as high-purity silicon for semiconductor manufacturing, specialized steel for structural components, and high-conductivity copper and aluminum for electrical conductors and cables. Beyond raw materials, there are manufacturers of sophisticated electronic components, including Insulated Gate Bipolar Transistors (IGBTs) and thyristors, which are the heart of the converter valves, alongside producers of advanced insulating materials, high-grade oils for transformers, and precision control system components. The quality and reliability of these upstream inputs directly dictate the performance and longevity of the final HVDC converter system.

Moving further down the value chain, the market involves the core players responsible for the engineering, manufacturing, and assembly of complete HVDC converter stations. These include major Original Equipment Manufacturers (OEMs) and technology providers who specialize in the design and production of converter valves, transformers, smoothing reactors, and the intricate control and protection systems. These entities often operate on an Engineering, Procurement, and Construction (EPC) basis, undertaking full project responsibility from initial design to final commissioning. They collaborate closely with construction firms, civil engineering contractors, and specialized installation teams to integrate all components into a functional HVDC system. The complexity and bespoke nature of each project necessitate a highly coordinated effort and deep technical expertise throughout the manufacturing and construction phases, ensuring adherence to stringent safety and operational standards.

The downstream segment of the value chain focuses on the distribution, installation, and ongoing support for HVDC systems. Due to the scale and customization of HVDC projects, distribution channels are predominantly direct, involving direct engagement between the major technology providers and end-user utilities, national grid operators, and large-scale renewable energy developers. This direct relationship facilitates detailed technical discussions, custom solution development, and robust after-sales support. Indirect channels may involve partnerships with regional system integrators or specialized consulting firms that assist end-users in project conceptualization and vendor selection. Post-installation, the value chain extends to long-term operation and maintenance (O&M) service providers, who ensure the continued efficiency, reliability, and security of the HVDC links throughout their operational lifespan. This often includes predictive maintenance, remote monitoring, and rapid response to any operational anomalies, forming a crucial part of the total cost of ownership for HVDC assets.

HVDC Converter Market Potential Customers

The HVDC Converter Market primarily targets a specific and highly specialized clientele within the global energy sector, consisting of entities responsible for the generation, transmission, and distribution of electricity across large geographical areas. The foremost potential customers are national and regional Transmission System Operators (TSOs) and large utility companies that manage and operate national grids. These operators frequently invest in HVDC technology to enhance grid stability, reinforce existing transmission capacities, reduce congestion, and establish robust interconnections with neighboring grids or countries. Their objectives include ensuring energy security, optimizing resource utilization across diverse generation portfolios, and complying with regulatory mandates for grid resilience and efficiency.

A rapidly expanding segment of potential customers includes independent power producers (IPPs) and developers specializing in large-scale renewable energy projects, particularly those involving offshore wind farms, remote solar parks, and distant hydropower installations. For these developers, HVDC converters are indispensable for efficiently evacuating the generated power over long distances, including challenging subsea environments, to the main power grids. The economic viability and successful integration of such massive renewable energy schemes heavily rely on the performance and cost-effectiveness of the chosen HVDC transmission solutions, making these project developers key decision-makers and significant purchasers within the market.

Beyond traditional utilities and renewable developers, other potential customers, albeit smaller in volume, include large industrial complexes requiring stable and high-quality power supplies, such as aluminum smelters or chemical plants, which may leverage dedicated HVDC links. Research institutions and governmental energy agencies also represent niche customers, investing in pilot projects or advanced HVDC solutions for R&D purposes and technology demonstration. The increasing focus on smart grid initiatives and the development of urban infeed projects to supply densely populated areas with reliable power further expand the customer base, demonstrating the versatile applicability of HVDC converter technology across various sectors of the energy landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $9,500 Million |

| Market Forecast in 2032 | $17,000 Million |

| Growth Rate | CAGR 8.7% |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd, Siemens Energy AG, General Electric Company, Hitachi Energy Ltd, Mitsubishi Electric Corporation, Toshiba Corporation, NARI Technology Co Ltd, XJ Group Corporation, Beijing Sifang Automation Co Ltd, Rongxin Power Electronic Co Ltd, Prysmian Group, Nexans SA, Sumitomo Electric Industries Ltd, LS Electric Co Ltd, China XD Electric Co Ltd, Arteche Group, TBEA Co Ltd, NR Electric Co Ltd, Hyosung Heavy Industries, Efacec Power Solutions, Showa Electric Wire Cable Co Ltd, Zhongli Group Co Ltd, Jiangsu Hengtong OpticElectric Co Ltd, Apar Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVDC Converter Market Key Technology Landscape

The HVDC Converter Market is underpinned by a profoundly innovative and continuously evolving technology landscape, where breakthroughs in power electronics, control systems, and component materials are consistently reshaping industry capabilities. At the forefront of this evolution is Voltage Source Converter (VSC) technology, particularly the Modular Multilevel Converter (MMC) topology. MMC has emerged as the industry standard for new HVDC projects due to its inherent advantages, including superior waveform quality, reduced filtering requirements, independent control of active and reactive power, and enhanced grid support functions such as black start capability and seamless integration with weak or passive AC grids. The modular design of MMCs also allows for greater scalability and easier maintenance, further solidifying its dominant position in modern HVDC deployments, particularly for offshore wind power evacuation and multi-terminal DC grids.

Beyond the core converter technology, significant advancements are being realized in complementary areas. The development of advanced power semiconductors, such as those based on silicon carbide (SiC) and gallium nitride (GaN), is progressing, offering the potential for even higher efficiency, greater power density, and reduced physical footprint of converter stations. While not yet broadly adopted for very high-power HVDC due to cost and manufacturing scalability, these wide-bandgap materials promise revolutionary improvements. Additionally, research into hybrid HVDC systems, which combine the established reliability of Line Commutated Converters (LCC) with the flexibility of VSCs, offers tailored solutions for specific grid modernization and expansion projects, seeking to leverage the best of both worlds. Digitalization is another transformative force, with the integration of digital twin technology, advanced sensors, and real-time data analytics enhancing operational insights, predictive maintenance capabilities, and overall system optimization.

Furthermore, the technology landscape is being shaped by innovations in critical auxiliary components and system-level concepts. This includes the development of faster and more reliable DC circuit breakers, which are essential for the safe and stable operation of multi-terminal DC grids and meshed DC networks, still largely in the R&D phase. Progress in high-performance DC cables, including superconducting variants, also holds promise for future ultra-low-loss transmission. The increasing sophistication of control and protection algorithms, often incorporating artificial intelligence and machine learning, is vital for managing the complexity of hybrid AC/DC grids and ensuring robust operation under various fault conditions. Adherence to evolving international grid codes and standards also drives technological development, ensuring interoperability and enhancing the overall resilience and intelligence of the global HVDC infrastructure.

Regional Highlights

- Asia Pacific: This region stands as the undisputed leader in the HVDC converter market, driven by unparalleled infrastructure development, rapid industrialization, and ambitious national grids projects, notably in China which boasts the longest and highest capacity HVDC lines globally. India, South Korea, and Australia are also making significant investments in long-distance HVDC links to integrate vast renewable energy resources and improve grid reliability.

- Europe: A mature yet highly dynamic market, propelled by aggressive decarbonization targets and the rapid expansion of offshore wind farms in the North and Baltic Seas. European countries are heavily investing in HVDC for cross-border grid interconnections to create a more resilient and integrated continental energy market, with the UK, Germany, and the Nordic countries leading specific high-profile projects.

- North America: Experiencing substantial growth as the region focuses on modernizing its aging grid infrastructure, integrating massive renewable energy projects from remote areas (e.g., wind in the Midwest, solar in the Southwest), and enhancing grid resilience against extreme weather events. Key initiatives involve new HVDC transmission corridors and upgrades to existing AC systems for improved stability.

- Latin America: This region exhibits promising growth, primarily due to its abundant hydropower resources, often located far from major consumption centers, necessitating efficient HVDC transmission. Brazil, in particular, has a well-established HVDC network for transmitting power from its large hydro plants. There is also a growing emphasis on inter-country grid connections to optimize regional energy resources.

- Middle East and Africa (MEA): An emerging market characterized by increasing investments in power infrastructure development to support industrial growth, rapid urbanization, and ambitious national visions for diversified energy mixes. HVDC projects here often focus on long-distance transmission from new generation facilities and strengthening national grids to improve access and reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVDC Converter Market.- ABB Ltd

- Siemens Energy AG

- General Electric Company

- Hitachi Energy Ltd

- Mitsubishi Electric Corporation

- Toshiba Corporation

- NARI Technology Co Ltd

- XJ Group Corporation

- Beijing Sifang Automation Co Ltd

- Rongxin Power Electronic Co Ltd

- Prysmian Group

- Nexans SA

- Sumitomo Electric Industries Ltd

- LS Electric Co Ltd

- China XD Electric Co Ltd

- Arteche Group

- TBEA Co Ltd

- NR Electric Co Ltd

- Hyosung Heavy Industries

- Efacec Power Solutions

- Showa Electric Wire Cable Co Ltd

- Zhongli Group Co Ltd

- Jiangsu Hengtong OpticElectric Co Ltd

- Apar Industries Ltd

Frequently Asked Questions

What is an HVDC converter and how does it work to transmit electricity?

An HVDC converter is a critical component in High Voltage Direct Current transmission systems. It functions by converting alternating current (AC) electricity, typically generated at power plants, into direct current (DC) for efficient transmission over long distances or through subsea cables. At the receiving end, another converter station performs the inverse operation, converting the DC back into AC for distribution to consumers. This two-stage conversion minimizes energy losses and allows for the connection of asynchronous grids, enhancing overall system stability and reliability.

What are the primary differences between Line Commutated Converters (LCC) and Voltage Source Converters (VSC)?

Line Commutated Converters (LCC) utilize thyristor valves and rely on the existing AC grid voltage for commutation, making them robust for high-power, long-distance point-to-point transmission. Voltage Source Converters (VSC), on the other hand, employ Insulated Gate Bipolar Transistors (IGBTs) and can independently control active and reactive power, offer black start capability, and can connect to weak or passive AC grids. VSCs, especially Modular Multilevel Converters (MMC), are preferred for offshore wind integration and multi-terminal DC grids due to their superior flexibility and control characteristics.

Why is HVDC transmission gaining preference over traditional AC for long-distance power transfer?

HVDC transmission is increasingly preferred for long-distance power transfer due to its inherent advantages, including significantly lower transmission losses, especially over distances exceeding 500-800 kilometers or for subsea cable applications. It also eliminates reactive power flow and associated compensation needs, which further reduces losses and infrastructure costs. It also offers the unique ability to connect asynchronous AC grids, which enhances grid stability, provides better power flow control, and reduces the environmental footprint associated with transmission corridors.

How does HVDC technology specifically support the global integration of renewable energy sources?

HVDC technology plays a pivotal role in the global integration of renewable energy sources by enabling the efficient transmission of power from geographically remote generation sites, such as large offshore wind farms, distant solar parks, or remote hydropower plants, to major load centers. It effectively mitigates transmission bottlenecks, reduces energy losses over long distances, and provides the necessary grid stabilization for variable and intermittent renewable generation, thereby facilitating the global shift towards a decarbonized energy future and the achievement of ambitious climate targets.

What are the key driving factors currently fueling the growth of the HVDC Converter Market?

The HVDC Converter Market's growth is primarily driven by several critical factors. These include the escalating global demand for electricity, the urgent need for large-scale integration of renewable energy sources, and widespread initiatives for grid modernization and expansion in both developed and emerging economies. Furthermore, the strategic imperative for enhancing energy security through cross-border grid interconnections, the inherent efficiency benefits of HVDC for long-distance bulk power transmission, and continuous technological advancements in converter systems are significant contributors to market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HVDC Converter Station Market Statistics 2025 Analysis By Application (Underground Power links, Powering Island and Remote Loads, Connecting Wind Farms, Interconnecting Networks, Oil & Gas Platforms), By Type (0-500MW, 501MW-999MW, 1000MW-2000MW, 2000+ MW), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- HVDC Converter Station Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Monopolar Converter Station, Bipolar Converter Station, Back-to-Back Converter Station, Multi-terminal Converter Station), By Application (Power Industry, Powering Island and Remote Loads, Interconnecting Networks, Oil & Gas, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager