Hybrid Powertrain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427926 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Hybrid Powertrain Market Size

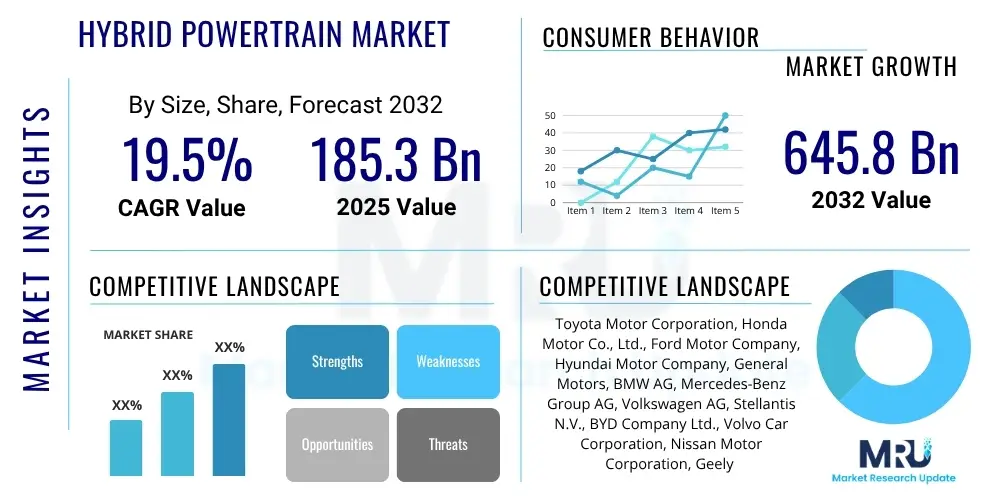

The Hybrid Powertrain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2025 and 2032. The market is estimated at USD 185.3 Billion in 2025 and is projected to reach USD 645.8 Billion by the end of the forecast period in 2032.

Hybrid Powertrain Market introduction

The hybrid powertrain market represents a pivotal segment within the automotive industry, characterized by its integration of at least two distinct power sources to propel a vehicle, most commonly an internal combustion engine (ICE) and an electric motor. This innovative approach aims to optimize fuel efficiency, reduce emissions, and enhance overall vehicle performance compared to traditional ICE-only vehicles. Product descriptions range from mild hybrids, which offer limited electric-only driving, to full hybrids and plug-in hybrids (PHEVs) that can operate on electric power for significant distances and be recharged externally.

Major applications of hybrid powertrains span across various vehicle segments, predominantly passenger cars, including sedans, SUVs, and compact cars, as well as a growing presence in commercial vehicles like buses and trucks. The primary benefits driving market adoption include substantial improvements in fuel economy, lower carbon dioxide and nitrogen oxide emissions, enhanced torque delivery for better acceleration, and the ability to recover braking energy through regenerative braking. These technological advantages address critical environmental concerns and offer economic savings to consumers through reduced fuel consumption.

Key driving factors for the market's expansion include increasingly stringent global emission regulations, such as those implemented by the European Union, China, and the United States, which compel automakers to invest in cleaner technologies. Rising consumer awareness regarding environmental sustainability and the long-term cost benefits of fuel-efficient vehicles also significantly contribute to market growth. Additionally, robust government incentives, including purchase subsidies, tax credits, and preferential parking or road access, play a crucial role in accelerating the adoption of hybrid vehicles worldwide, making them more attractive to a broader consumer base.

Hybrid Powertrain Market Executive Summary

The hybrid powertrain market is experiencing robust growth, driven by a confluence of evolving business trends, significant regional shifts, and distinct segment transformations. Business trends indicate a strong push towards electrification across the automotive industry, with major manufacturers allocating substantial research and development budgets to hybrid and electric vehicle technologies. Strategic partnerships and joint ventures between traditional automakers and technology firms are becoming commonplace, aimed at accelerating innovation in battery technology, power electronics, and motor design. Furthermore, the focus on sustainable manufacturing practices and supply chain resilience is gaining prominence, as companies strive to meet both regulatory requirements and consumer expectations for environmentally responsible products. This competitive landscape is fostering rapid technological advancements and market diversification, ensuring a dynamic environment for hybrid powertrain development and deployment.

Regional trends reveal varied adoption rates and market dynamics. Asia Pacific, particularly China and Japan, remains a dominant force, characterized by early adoption, strong government support, and significant domestic manufacturing capabilities for hybrid vehicles. Europe is witnessing accelerated growth, fueled by stringent emission targets and a rapid expansion of charging infrastructure for plug-in hybrids. North America, especially the United States, shows steady growth, influenced by a mix of consumer preference for SUVs and light trucks, alongside increasing regulatory pressures and federal incentives. Emerging markets in Latin America, the Middle East, and Africa are gradually picking up pace, albeit from a lower base, as their governments begin to introduce policies supporting greener transportation and as vehicle affordability improves for hybrid models.

Segment trends underscore the increasing diversification of hybrid powertrain applications. Passenger vehicles, particularly SUVs and Crossover Utility Vehicles (CUVs), continue to be the largest segment, with a strong consumer demand for models offering both efficiency and utility. The commercial vehicle segment, encompassing buses, trucks, and vans, is also experiencing notable growth, driven by fleet operators seeking to reduce operational costs and comply with urban emission zones. Within hybrid types, plug-in hybrid electric vehicles (PHEVs) are gaining significant traction due to their extended electric-only range and reduced range anxiety, bridging the gap between conventional ICE vehicles and pure Battery Electric Vehicles (BEVs). The technological evolution towards more compact, powerful, and cost-effective hybrid systems is consistently shaping these segment dynamics, ensuring a broad portfolio of options for diverse automotive needs.

AI Impact Analysis on Hybrid Powertrain Market

Common user questions regarding AI's impact on the Hybrid Powertrain Market often revolve around how artificial intelligence can optimize energy management, enhance predictive maintenance, and improve overall vehicle performance and efficiency. Users are keenly interested in whether AI can dynamically adjust powertrain settings in real-time based on driving conditions, traffic patterns, and driver behavior to maximize fuel economy and minimize emissions. Concerns also include the integration challenges of complex AI algorithms into existing automotive architectures and the potential for AI-driven systems to reduce the cost of hybrid technology through more efficient design and manufacturing processes. Expectations are high for AI to personalize the driving experience, predict component failures before they occur, and refine the regenerative braking process for optimal energy capture, ultimately making hybrid vehicles even more attractive and competitive.

- AI optimizes energy management systems by analyzing real-time data from various sensors to seamlessly switch between electric and internal combustion power, enhancing fuel efficiency.

- Predictive maintenance driven by AI algorithms monitors powertrain components for early detection of potential failures, reducing downtime and maintenance costs.

- AI-powered driver assistance systems adapt hybrid powertrain response based on road conditions, traffic, and driver input, improving safety and driving comfort.

- Advanced battery management systems leverage AI to monitor battery health, optimize charging cycles, and extend the overall lifespan of the hybrid battery pack.

- AI contributes to the design and simulation of more efficient hybrid powertrains, accelerating R&D and reducing development costs through iterative optimization.

- Integration of AI in manufacturing processes enables higher precision and quality control for hybrid components, minimizing defects and improving production efficiency.

- Personalized driving profiles enabled by AI learn driver habits to tailor powertrain performance, offering a customized balance of power and economy.

- AI algorithms enhance regenerative braking effectiveness by predicting braking needs and optimizing energy capture, further boosting overall vehicle efficiency.

- Supply chain optimization for hybrid components benefits from AI, predicting demand, managing inventory, and mitigating risks more effectively.

- AI facilitates the development of intelligent charging solutions for PHEVs, optimizing charging times based on grid conditions, electricity prices, and user schedules.

- Real-time diagnostics and over-the-air updates for hybrid vehicles are improved by AI, allowing for continuous performance enhancements and issue resolution.

- AI-driven data analytics provide valuable insights into hybrid vehicle performance in diverse real-world conditions, informing future design and engineering efforts.

DRO & Impact Forces Of Hybrid Powertrain Market

The Hybrid Powertrain Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, all shaped by significant impact forces. Key drivers include increasingly stringent global environmental regulations mandating lower emissions and higher fuel efficiency, pushing automakers to adopt hybrid technologies. Growing consumer awareness about climate change and the financial benefits of reduced fuel consumption further stimulate demand. Government incentives, such as tax credits, subsidies, and favorable policies for hybrid vehicle purchases and infrastructure development, also play a crucial role in accelerating market adoption and making these vehicles more accessible to the broader public. These factors collectively create a strong impetus for market expansion and technological innovation within the hybrid powertrain sector.

Conversely, the market faces several notable restraints. The initial higher purchase cost of hybrid vehicles compared to their conventional counterparts remains a significant barrier for many consumers, despite long-term fuel savings. Concerns about battery life, replacement costs, and the availability of charging infrastructure, particularly for plug-in hybrids, contribute to consumer apprehension, often termed "range anxiety." Furthermore, the complexity of integrating multiple power sources and advanced control systems increases manufacturing costs and maintenance requirements. The ongoing global supply chain disruptions for critical components, especially semiconductors and raw materials for batteries, pose additional challenges, leading to production delays and increased costs for manufacturers, impacting overall market growth.

Despite these challenges, substantial opportunities exist for the hybrid powertrain market. Technological advancements in battery chemistry promise higher energy density, faster charging, and lower costs, making hybrid vehicles more competitive and appealing. The integration of hybrid systems with autonomous driving technologies presents avenues for optimized energy management and enhanced vehicle performance. Expanding into emerging markets, where vehicle ownership is growing and environmental concerns are rising, offers significant untapped potential. Additionally, the increasing demand for commercial hybrid vehicles, such as buses and delivery trucks, driven by urban emission regulations and fleet efficiency goals, represents a burgeoning segment. The ongoing development of lightweight materials and advanced power electronics further contributes to opportunities for improved efficiency and performance, fostering sustained market growth and innovation.

Segmentation Analysis

The Hybrid Powertrain Market is extensively segmented to provide a granular understanding of its diverse components and applications. This segmentation allows for targeted analysis of market dynamics, competitive landscapes, and growth opportunities across different technological approaches and vehicle types. Key segmentation criteria include the type of hybrid system employed, the specific components integrated into the powertrain, the vehicle categories these systems are designed for, and the various applications they serve. This detailed breakdown helps stakeholders identify niche markets, tailor product development strategies, and forecast demand accurately, reflecting the multifaceted nature of hybrid automotive technology.

- By Type:

- Parallel Hybrid Electric Vehicles (PHEV)

- Series Hybrid Electric Vehicles (SHEV)

- Series-Parallel (or Power-Split) Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles (PHEV)

- Mild Hybrid Electric Vehicles (MHEV)

- Full Hybrid Electric Vehicles (FHEV)

- By Component:

- Battery (Lithium-ion, Nickel-Metal Hydride, Lead-Acid)

- Electric Motor/Generator

- Power Electronics (Inverters, Converters)

- Internal Combustion Engine (ICE)

- Transmission Systems (CVT, eCVT, AMT)

- Regenerative Braking Systems

- Control Units and Sensors

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks, CUVs)

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Buses

- Trucks

- Vans

- By Power Output:

- Below 100 kW

- 100 kW - 200 kW

- Above 200 kW

- By Application:

- Personal Mobility

- Public Transportation

- Logistics and Freight

- Specialized Vehicles

Value Chain Analysis For Hybrid Powertrain Market

The value chain for the hybrid powertrain market is complex and highly integrated, starting from the upstream suppliers of raw materials and sophisticated components, extending through manufacturing and assembly, and concluding with downstream distribution, sales, and after-market services. Upstream analysis focuses on the sourcing of critical materials such as lithium, nickel, cobalt, and rare earth elements essential for battery and electric motor production. Key players in this segment include mining companies, chemical processing firms, and specialized material suppliers. The design and manufacturing of intricate components like high-voltage batteries, electric motors, power electronics (inverters, converters), and advanced control units represent significant value-added activities, often involving specialized tier-1 suppliers who are experts in their respective fields.

Further along the value chain, the integration and assembly of these components into a cohesive powertrain system are performed by original equipment manufacturers (OEMs) or their primary suppliers. This stage involves complex engineering, software development for energy management systems, and rigorous testing to ensure optimal performance, reliability, and compliance with safety standards. The distribution channel encompasses a mix of direct and indirect approaches. Direct channels involve OEMs selling vehicles directly to consumers through their showrooms or online platforms, often supported by captive financial services. Indirect channels include independent dealerships, fleet sales, and partnerships with mobility service providers, which extend market reach and provide localized customer support. Effective logistics and supply chain management are paramount at this stage to ensure timely delivery of vehicles to market and efficient inventory management.

Downstream analysis includes vehicle sales, after-sales services, and end-of-life management. Dealerships and service centers provide maintenance, repairs, and part replacements, which are critical for customer satisfaction and brand loyalty. The complexity of hybrid systems necessitates specialized training for technicians and availability of specific diagnostic tools. Direct and indirect distribution channels also play a crucial role in delivering vehicles to end-users, with direct sales by manufacturers gaining traction for premium brands and online purchasing. Indirect sales through extensive dealership networks continue to dominate the mass market. Furthermore, the increasing focus on sustainability extends to the end-of-life phase, with growing efforts in battery recycling and component remanufacturing to minimize environmental impact and recover valuable materials, thus closing the loop in the hybrid powertrain value chain and contributing to a circular economy model.

Hybrid Powertrain Market Potential Customers

The potential customer base for the hybrid powertrain market is remarkably broad and diverse, primarily encompassing various categories of end-users and buyers who seek a balance between environmental responsibility, fuel efficiency, and vehicle performance. Private vehicle owners form a significant segment, including environmentally conscious individuals, commuters looking to reduce fuel expenses, and families prioritizing safety and reliability with a smaller carbon footprint. This group is often influenced by factors such as vehicle aesthetics, brand reputation, initial purchase cost, and available government incentives. The rising consumer awareness regarding climate change and air quality further strengthens the appeal of hybrid vehicles among this demographic, driving a consistent demand for more sustainable personal transportation solutions.

Beyond individual consumers, commercial fleets represent a rapidly expanding segment of potential customers. This includes taxi services, ride-sharing companies, corporate fleets, and logistics operators who benefit significantly from the reduced operational costs offered by hybrid vehicles through improved fuel economy. For these businesses, the decision to adopt hybrid powertrains is heavily driven by total cost of ownership (TCO), fleet management efficiency, and corporate sustainability objectives. The ability of hybrid vehicles to operate efficiently in urban stop-and-go traffic conditions, combined with reduced emissions that comply with city environmental regulations, makes them an increasingly attractive option for commercial applications. Furthermore, the durability and lower maintenance requirements, particularly for regenerative braking systems that reduce wear on traditional brakes, contribute to their economic viability for intensive commercial use.

Government agencies and public sector organizations also constitute an important customer segment, particularly for their vehicle fleets, including police cars, municipal service vehicles, and public transportation buses. These entities often lead by example in adopting greener technologies, driven by public mandates, sustainability goals, and long-term cost savings on fuel and maintenance. The procurement of hybrid vehicles by public bodies not only contributes to reducing national carbon footprints but also stimulates market growth and signals a broader acceptance of hybrid technology. Finally, emerging niche applications, such as specialized utility vehicles for infrastructure maintenance or construction, are increasingly exploring hybrid powertrains to meet specific operational requirements while adhering to environmental standards, further diversifying the potential customer landscape for hybrid powertrain manufacturers and suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 185.3 Billion |

| Market Forecast in 2032 | USD 645.8 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, Hyundai Motor Company, General Motors, BMW AG, Mercedes-Benz Group AG, Volkswagen AG, Stellantis N.V., BYD Company Ltd., Volvo Car Corporation, Nissan Motor Corporation, Geely Automobile Holdings Ltd., Audi AG, Bosch (Robert) GmbH, Continental AG, ZF Friedrichshafen AG, Magna International Inc., Denso Corporation, Schaeffler AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Powertrain Market Key Technology Landscape

The hybrid powertrain market is characterized by a dynamic and continuously evolving technology landscape, with innovations focusing on enhancing efficiency, reducing costs, and improving performance. Central to this evolution are advancements in battery technology, primarily lithium-ion batteries, which are becoming more energy-dense, lighter, and capable of faster charging. These improvements are crucial for extending electric-only ranges in plug-in hybrids and improving the overall efficiency of full and mild hybrid systems. Concurrently, electric motor technology is progressing, with developments in permanent magnet synchronous motors (PMSM) and induction motors offering higher power density and efficiency, often integrated more compactly within the transmission or axle to save space and weight.

Power electronics play an indispensable role in hybrid powertrains, managing the flow of electrical energy between the battery, electric motor, and generator. Innovations here include the use of silicon carbide (SiC) and gallium nitride (GaN) semiconductors, which allow for higher switching frequencies, increased efficiency, and reduced size and weight of inverters and converters. These advancements are critical for optimizing power delivery and minimizing energy losses. Furthermore, sophisticated control units and energy management software are at the core of hybrid systems, intelligently orchestrating the seamless transition between the internal combustion engine and electric motor, optimizing regenerative braking, and adapting to various driving conditions to maximize fuel economy and minimize emissions. Artificial intelligence and machine learning are increasingly being integrated into these control systems for predictive optimization and personalized driving experiences.

Beyond electrical components, the internal combustion engine (ICE) within hybrid powertrains is also undergoing significant refinement. Specialized Atkinson or Miller cycle engines are often employed due to their higher thermal efficiency at specific operating points, which complements the electric motor's strengths at lower speeds. Advanced engine technologies, such as turbocharging, direct injection, and variable valve timing, are optimized to work synergistically with the electric drive, ensuring high efficiency across a broader range of operating conditions. Transmission systems are also being innovated, with dedicated hybrid transmissions (DHTs) or electronically controlled continuously variable transmissions (eCVTs) designed to handle multiple power inputs and outputs efficiently. Overall, the technology landscape is driven by a holistic approach, where improvements in each component are synergistically combined to create increasingly efficient, powerful, and cost-effective hybrid powertrain solutions.

Regional Highlights

- Asia Pacific (APAC): Dominates the hybrid powertrain market, primarily driven by China and Japan. China's aggressive push for new energy vehicles (NEVs) through subsidies and regulations, coupled with a robust domestic manufacturing base, makes it a leading market. Japan, with its established hybrid technology pioneers like Toyota and Honda, maintains strong adoption rates due to long-standing environmental consciousness and advanced R&D. India and South Korea are also emerging with growing interest and investments in hybrid vehicle technologies.

- Europe: Exhibits significant growth, fueled by stringent CO2 emission targets set by the European Union and strong consumer demand for fuel-efficient and environmentally friendly vehicles. Countries like Germany, Norway, France, and the UK are experiencing rapid adoption of plug-in hybrids (PHEVs) due to attractive tax incentives, charging infrastructure development, and a strong preference for sustainable mobility solutions.

- North America: Shows steady market expansion, with the United States leading in adoption. Consumer preferences for SUVs and light trucks are increasingly met by hybrid variants. Federal tax credits and state-level incentives, alongside a growing awareness of fuel economy benefits, are key drivers. Canada and Mexico also contribute to market growth with increasing environmental regulations and diverse vehicle choices.

- Latin America: An emerging market for hybrid powertrains, with Brazil and Mexico at the forefront. Economic growth, urbanization, and a gradual shift towards cleaner transportation policies are stimulating demand. While market penetration is still lower compared to developed regions, the potential for growth is substantial as vehicle affordability and infrastructure improve.

- Middle East and Africa (MEA): Represents a nascent but growing market. Countries like the UAE and Saudi Arabia are showing early interest in diversifying their energy consumption and reducing reliance on fossil fuels in transportation. Government initiatives aimed at sustainable development and investment in smart city projects are expected to drive future adoption, particularly in urban areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Powertrain Market.- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Ford Motor Company

- Hyundai Motor Company

- General Motors

- BMW AG

- Mercedes-Benz Group AG

- Volkswagen AG

- Stellantis N.V.

- BYD Company Ltd.

- Volvo Car Corporation

- Nissan Motor Corporation

- Geely Automobile Holdings Ltd.

- Audi AG

- Bosch (Robert) GmbH

- Continental AG

- ZF Friedrichshafen AG

- Magna International Inc.

- Denso Corporation

- Schaeffler AG

Frequently Asked Questions

Analyze common user questions about the Hybrid Powertrain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of hybrid powertrains over conventional engines?

Hybrid powertrains offer significant advantages including superior fuel efficiency, reduced greenhouse gas emissions, lower running costs due to less fuel consumption, enhanced torque for improved acceleration, and the ability to capture and reuse energy through regenerative braking, contributing to a more sustainable driving experience.

How do Plug-in Hybrid Electric Vehicles (PHEVs) differ from Full Hybrid Electric Vehicles (FHEVs)?

PHEVs have larger batteries than FHEVs, allowing for a substantially longer electric-only driving range and the ability to be recharged from an external power source. FHEVs primarily recharge their batteries using the internal combustion engine and regenerative braking, offering limited electric-only range.

What is the typical lifespan of a hybrid vehicle's battery pack and its replacement cost?

Hybrid battery packs are designed to last for the lifetime of the vehicle, typically 8-10 years or 100,000-150,000 miles, often covered by manufacturer warranties. Replacement costs vary widely but have decreased over time, ranging from a few thousand to several thousand USD, depending on the vehicle model and battery type.

Are hybrid vehicles more expensive to maintain than gasoline-only cars?

While hybrid powertrains involve more complex systems, overall maintenance costs can be comparable or even lower in some aspects. Electric motors and regenerative braking reduce wear on traditional brakes and engines operate less frequently, potentially extending their lifespan. However, specialized diagnostics might be required.

How do government incentives impact the adoption of hybrid vehicles?

Government incentives, such as tax credits, purchase subsidies, and reduced registration fees, significantly reduce the initial cost burden for consumers, making hybrid vehicles more financially attractive. These policies accelerate market adoption by bridging the price gap with conventional vehicles and promoting cleaner transportation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager