Hydrocarbon Gas Analyzer Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428796 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hydrocarbon Gas Analyzer Systems Market Size

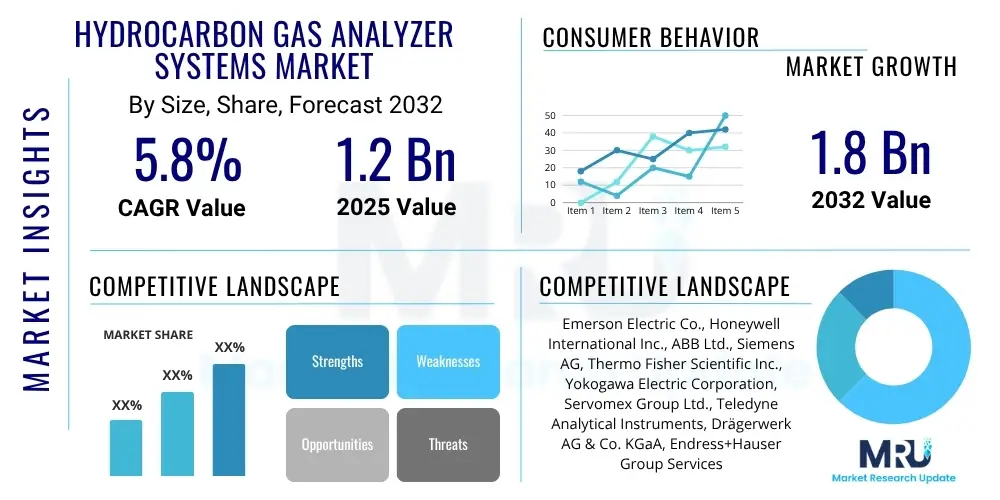

The Hydrocarbon Gas Analyzer Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 1.2 Billion in 2025 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2032.

Hydrocarbon Gas Analyzer Systems Market introduction

The Hydrocarbon Gas Analyzer Systems Market encompasses a critical segment within industrial and environmental monitoring, providing sophisticated instrumentation for the precise detection and quantification of various hydrocarbon gases in diverse settings. These systems are indispensable tools designed to identify and measure specific hydrocarbons, ranging from simple methane to complex volatile organic compounds (VOCs), or to determine the total hydrocarbon content in a gas mixture. Their operational principles often leverage advanced analytical techniques, including spectroscopy, chromatography, and ionization, tailored to specific application requirements for accuracy, speed, and sensitivity across a wide range of operational parameters.

Major applications for these analyzer systems are broad and critical, spanning across high-stakes sectors such as oil and gas exploration and refining, petrochemical manufacturing, and the broader chemical industry where process control, leak detection, and product quality assurance are paramount. Beyond core industrial operations, they are extensively utilized in environmental monitoring for ambient air quality assessment, stack emissions compliance, and landfill gas analysis. Furthermore, these systems play a crucial role in industrial safety protocols to prevent combustible gas accumulation in enclosed spaces, tunnels, and storage facilities, thereby mitigating explosion risks. Additional significant application areas include automotive emissions testing for regulatory compliance and research and development, as well as specific quality control processes in pharmaceutical manufacturing and food and beverage production.

The core benefits derived from the deployment of these sophisticated systems are manifold, including substantially enhanced operational safety by providing early warning for potential hazards, ensuring rigorous adherence to increasingly stringent national and international environmental regulations, and optimizing industrial processes for peak efficiency and product quality. These analyzers play a vital role in protecting personnel from exposure to harmful pollutants and contributing significantly to overall environmental sustainability and corporate social responsibility goals. The market's robust growth is primarily driven by escalating global demand for energy, a relentless focus on industrial and occupational safety standards, tightening environmental protection mandates worldwide, and continuous advancements in sensor technology, analytical methodologies, and data integration capabilities that continually improve system performance, reliability, and utility in challenging environments.

Hydrocarbon Gas Analyzer Systems Market Executive Summary

The Hydrocarbon Gas Analyzer Systems Market is poised for substantial growth, propelled by a dynamic interplay of evolving business landscapes, regional developmental trajectories, and specific segment-wise demands. Current business trends highlight a notable shift towards the development of more compact, portable, and robust analytical solutions that offer enhanced field deployability, reduced operational footprints, and greater ease of use. There is also a strong emphasis on integrating these systems with advanced communication protocols, enabling seamless wireless connectivity, remote monitoring capabilities, and real-time data access for rapid decision-making. Manufacturers are increasingly focused on leveraging Internet of Things (IoT) platforms and AI-driven analytics to transform raw data into actionable intelligence, facilitating predictive maintenance for equipment, optimized process performance, and streamlined compliance reporting across various industrial settings. Innovations in sensor technology are also leading to higher accuracy, greater selectivity, faster response times, and extended operational lifespans, even when deployed in harsh or corrosive environmental conditions.

From a regional perspective, the market exhibits diverse yet significant growth patterns. The Asia Pacific (APAC) region is emerging as a dominant force and a key growth engine, fueled by rapid industrialization, substantial expansion in the chemical and petrochemical industries, and growing governmental initiatives towards stringent environmental protection and industrial safety in economies such as China, India, Japan, and Southeast Asian nations. North America and Europe, while more mature markets, continue to hold substantial market share and drive innovation, primarily propelled by stringent regulatory frameworks for emissions control and occupational safety, alongside a strong emphasis on technological advancement, digital transformation, and proactive environmental stewardship. Latin America and the Middle East and Africa (MEA) are also experiencing steady growth, largely attributed to increasing investments in oil and gas infrastructure, mining operations, and the subsequent demand for robust and reliable monitoring solutions to ensure safe and compliant operations.

Segmentation trends within the market underscore the diversified needs of end-users and the specialization of product offerings. The demand for fixed, continuous emission monitoring systems (CEMS) remains consistently high for large industrial complexes, ensuring ongoing regulatory compliance and process integrity. Concurrently, portable and handheld devices are gaining considerable traction for on-site inspections, targeted leak detection surveys, emergency response scenarios, and mobile applications due to their flexibility, ease of use, and rapid deployment capabilities. The oil and gas sector continues to be the largest end-user segment, driven by pervasive safety and environmental requirements throughout the entire value chain, from upstream exploration to downstream refining. However, segments like environmental monitoring agencies, industrial hygiene specialists, and specialty chemical manufacturing are also demonstrating accelerated adoption, reflecting a broader societal and regulatory push for cleaner air, safer workplaces, and improved public health outcomes. The evolution towards multi-gas analysis capabilities, modular designs, and integrated smart solutions represents a significant segment trend, addressing comprehensive and versatile monitoring needs.

AI Impact Analysis on Hydrocarbon Gas Analyzer Systems Market

User inquiries related to the impact of Artificial Intelligence (AI) on Hydrocarbon Gas Analyzer Systems predominantly focus on how AI can fundamentally enhance the intelligence, efficiency, and predictive capabilities of these critical monitoring tools, thereby transforming traditional gas analysis. Key themes frequently observed include the potential for AI algorithms to offer more accurate fault detection, minimize instances of false alarms, provide deep predictive maintenance insights for analyzer health, and facilitate seamless integration with broader industrial Internet of Things (IoT) ecosystems for holistic plant monitoring. Users also express keen interest in AI's role in optimizing calibration cycles to extend operational uptime, interpreting complex gas mixture data with greater precision, and streamlining compliance reporting by automating data aggregation and analysis. Concerns often center on the initial investment required for implementing AI-powered systems, the necessity for robust and secure data infrastructure to handle large volumes of sensor data, and the cybersecurity implications of connecting analytical equipment to advanced AI platforms. The overarching expectation is that AI will elevate hydrocarbon gas analysis from a reactive measurement process to a proactive, intelligent monitoring and management paradigm, ultimately boosting operational efficiency, enhancing safety protocols, and optimizing resource utilization.

- Enhanced predictive maintenance schedules for analyzer systems through pattern recognition, significantly reducing unexpected downtime and overall operational costs.

- Improved data interpretation and advanced anomaly detection in complex hydrocarbon gas mixtures, leveraging machine learning to identify subtle shifts and leading to greater accuracy and quicker identification of critical events.

- Automated calibration and self-diagnosis features integrated into analyzers, minimizing manual intervention, reducing human error, and ensuring sustained optimal performance and compliance.

- Seamless integration with industrial IoT platforms for real-time, comprehensive environmental and safety monitoring networks across entire facilities, enabling centralized data management.

- Advanced analytics for identifying intricate patterns in gas leaks, emissions, or process upsets, providing early warnings and enabling quicker, more targeted response and mitigation strategies.

- Optimization of sampling rates, analysis parameters, and even sensor selection based on real-time environmental conditions, process variations, or historical data, maximizing efficiency.

- Development of smart alerts, decision-support systems, and augmented reality interfaces to assist operators in critical situations, providing guided troubleshooting and response protocols.

- Reduction of false alarms by differentiating between genuine threats and transient environmental factors, thereby improving operator trust and reducing unnecessary interventions.

- Improved regulatory compliance through automated data logging, trend analysis, and report generation, ensuring adherence to environmental and safety standards with minimal manual effort.

DRO & Impact Forces Of Hydrocarbon Gas Analyzer Systems Market

The Hydrocarbon Gas Analyzer Systems Market is significantly influenced by a robust set of drivers that are collectively propelling its expansion and innovation. Foremost among these are the increasingly stringent global environmental regulations, such as those imposed by the EPA in North America, the European Union's Industrial Emissions Directive, and various national policies in Asia Pacific, which mandate significant reductions in industrial emissions, improved ambient air quality, and effective wastewater treatment. This relentless regulatory push forces industries across all sectors to adopt advanced monitoring solutions for compliance. Concurrently, there is a heightened and non-negotiable focus on industrial and occupational safety to prevent catastrophic incidents like explosions, fires, and toxic gas releases in hazardous environments, thereby boosting consistent demand for reliable leak detection and continuous monitoring systems. Furthermore, the persistent global demand for energy, particularly from conventional and unconventional fossil fuels, necessitates efficient and safe operations in the oil and gas sector, where hydrocarbon analyzers are integral for every stage of the value chain. Finally, continuous technological advancements, including the development of more sensitive, selective, and robust sensors, along with seamless integration capabilities with IoT, AI, and cloud computing, further stimulate market growth by offering superior performance, enhanced data insights, and improved operational utility.

Despite these powerful drivers, several restraints pose challenges to the market's unhindered growth and widespread adoption. A significant barrier is the relatively high initial capital investment required for purchasing and installing advanced hydrocarbon gas analyzer systems, especially for comprehensive, fixed installations that require complex infrastructure integration. This considerable cost can be prohibitive for small to medium-sized enterprises (SMEs) and can lead to deferred upgrade cycles even for larger corporations during periods of economic uncertainty. The inherent complexity of calibration, routine maintenance, and servicing of these sophisticated analytical instruments also represents a notable restraint, demanding highly specialized technical expertise and incurring significant ongoing operational costs. Moreover, the global shortage of skilled personnel capable of operating, interpreting data from, and servicing these high-tech analytical instruments can hinder adoption, particularly in developing regions. Economic slowdowns, volatility in commodity prices, or geopolitical instabilities can also lead to reduced capital expenditure in key end-user sectors, thereby slowing down market progression.

However, the market is also characterized by substantial opportunities that promise future expansion and innovation, and is shaped by several powerful impactful forces. Emerging economies, particularly those undergoing rapid industrialization and infrastructure development across Asia Pacific and Latin America, present vast untapped markets for hydrocarbon gas analyzer systems as they increasingly adopt stricter environmental and safety standards comparable to developed nations. The ongoing integration of advanced digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and cloud computing, offers significant opportunities for developing smart, interconnected, and predictive monitoring solutions that revolutionize data analysis and operational efficiency. There is also a growing demand for portable, handheld, and even drone-mounted systems for applications requiring mobility, rapid response, and remote sensing in challenging terrains, opening entirely new product development avenues. The primary impact forces shaping this market are undoubtedly the unyielding regulatory pressures from governmental bodies worldwide, the relentless pace of technological innovation driving performance improvements, escalating global concerns about environmental sustainability and climate change, and the imperative for operational safety and risk mitigation in high-risk industrial environments. These forces collectively dictate the market's strategic direction, investment priorities for stakeholders, and the pace of technological evolution.

Segmentation Analysis

The Hydrocarbon Gas Analyzer Systems Market is comprehensively segmented to provide a detailed understanding of its diverse components and evolving dynamics. This segmentation facilitates targeted market strategies and highlights specific growth areas across various parameters. The market is typically analyzed based on factors such as the underlying technology employed for gas detection, the physical type of the analyzer system, its primary application area, and the end-use industries that constitute its customer base. Each segment exhibits unique growth trajectories and demand drivers, reflecting the varied requirements of different sectors and operational contexts. This granular analysis allows stakeholders to identify key market niches, assess competitive landscapes, and forecast future trends more accurately for strategic planning.

Technological segmentation is crucial, differentiating systems based on their core detection principles, which include Flame Ionization Detectors (FID) for accurate total hydrocarbon measurements, Nondispersive Infrared (NDIR) for precise specific gas measurements, and advanced spectroscopic methods like Tunable Diode Laser Absorption Spectroscopy (TDLAS) for highly selective and interference-free detection of individual hydrocarbon species. Each technology caters to different levels of precision, speed, and environmental resilience. The distinction between portable, stationary/fixed, and vehicle-mounted analyzer types addresses varying deployment needs, with portable units offering flexibility for field work and rapid response, stationary units providing continuous monitoring for critical infrastructure, and vehicle-mounted systems enabling mobile leak detection and environmental surveys. This multi-faceted approach ensures comprehensive coverage across various operational scales and mobility requirements within diverse industries.

Application-based segmentation categorizes systems by their primary use, such as process monitoring and control, environmental monitoring for air quality, industrial safety monitoring, or emission monitoring for regulatory compliance. Each application demands specific performance criteria, calibration protocols, and regulatory adherence. For instance, process monitoring often requires real-time, high-accuracy, and robust measurements in harsh conditions, while environmental monitoring focuses on ultra-low detection limits and comprehensive data logging for reporting. The end-use industry segmentation provides deep insight into the major consumers, including the oil and gas, chemical, petrochemical, and power generation sectors, highlighting their unique demands, operational challenges, and procurement patterns. Understanding these distinct segments is vital for manufacturers to tailor their product offerings, develop targeted marketing campaigns, and address the specific pain points and regulatory pressures of different customer groups effectively, thereby unlocking specialized growth opportunities within the broader market landscape and driving product innovation.

- By Technology

- Flame Ionization Detector (FID)

- Nondispersive Infrared (NDIR)

- Thermal Conductivity Detector (TCD)

- Photoionization Detector (PID)

- Chemiluminescence

- Tunable Diode Laser Absorption Spectroscopy (TDLAS)

- Gas Chromatography (GC)

- Catalytic Bead Sensors

- Metal Oxide Semiconductor (MOS) Sensors

- By Type

- Portable Analyzers

- Stationary/Fixed Analyzers

- Vehicle Mounted Analyzers

- Handheld Analyzers

- By Application

- Process Monitoring and Control

- Environmental Monitoring

- Industrial Safety Monitoring

- Emission Monitoring and Compliance

- Leak Detection and Repair (LDAR)

- Quality Control and Assurance

- Occupational Health and Hygiene

- By End-Use Industry

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear, Renewables)

- Automotive (Emissions Testing, Research)

- Environmental Agencies and Research Institutions

- Pharmaceuticals and Biotechnology

- Food and Beverage Processing

- Mining and Metallurgy

- Waste Management and Landfills

- Manufacturing and Industrial Facilities

Value Chain Analysis For Hydrocarbon Gas Analyzer Systems Market

The value chain for Hydrocarbon Gas Analyzer Systems is a multi-stage process, beginning with fundamental research and development and extending through the intricate phases of component sourcing, manufacturing, assembly, and finally, distribution, sales, and post-sales support to the end-users. The upstream segment of this value chain is critical and involves the meticulous procurement of highly specialized raw materials and precision components. This includes advanced sensor elements, such as those made from metal oxides, catalytic beads, or specialized optical materials, precision optical components for NDIR and TDLAS technologies, sophisticated electronic circuits, microprocessors for data processing, and robust, often explosion-proof, materials for system enclosures capable of withstanding harsh industrial environments. Key suppliers in this initial stage are often highly specialized component manufacturers and technology providers who develop cutting-edge materials and sub-systems essential for achieving optimal analyzer performance, reliability, and longevity.

Following the upstream supply, the manufacturing and assembly phase constitutes the core of the value chain, where innovation meets production. Here, various sourced components are meticulously integrated, precisely calibrated, and rigorously tested before being assembled into complete, functional analyzer systems. This stage requires significant investment in precision engineering, often involving cleanroom facilities for sensor assembly, advanced automated manufacturing processes, and comprehensive quality control procedures to ensure the accuracy, reliability, and extended operational lifespan of the final product. Manufacturers frequently employ sophisticated automation and robotic systems to streamline production, maintain consistent quality standards, and meet specific industry certifications. This phase is also characterized by intensive in-house research and development efforts aimed at innovating new analytical methods, improving the performance of existing technologies, and ensuring strict compliance with evolving industry-specific certifications and international safety standards.

The downstream segment focuses on efficient market access and comprehensive customer fulfillment, primarily achieved through well-defined and strategically managed distribution channels. Direct sales efforts involve manufacturers engaging directly with large industrial clients, governmental agencies, and prominent research institutions. This direct approach allows for the provision of highly customized solutions, immediate technical support, and the cultivation of deeper, long-term customer relationships, which is vital for complex, high-value instrumentation. Conversely, indirect distribution involves leveraging a robust network of specialized distributors, value-added resellers (VARs), and system integrators. These partners provide broader market penetration, particularly in diverse geographical regions, offering localized sales support, expert installation, comprehensive training programs, and essential maintenance services. The strategic choice between direct and indirect channels often depends on market maturity, product complexity, geographical reach, and the desired level of customer engagement and post-sales support, ensuring that these sophisticated analyzer systems reach their intended end-users efficiently and effectively, along with all necessary after-sales service and technical assistance.

Hydrocarbon Gas Analyzer Systems Market Potential Customers

The Hydrocarbon Gas Analyzer Systems Market serves a broad and diverse range of potential customers, essentially comprising any industrial or environmental entity where the accurate detection and quantification of hydrocarbon gases are paramount for operational integrity, safety compliance, environmental stewardship, or product quality control. These end-users or buyers typically operate in sectors with inherent risks associated with flammable or toxic gases, or those operating under stringent regulatory scrutiny for emissions and air quality. A primary and dominant customer segment includes large-scale industrial complexes such as oil refineries, natural gas processing plants, and liquefied natural gas (LNG) terminals, where continuous monitoring of process streams, ambient air, and fugitive emissions is critical for preventing leaks, ensuring explosion safety, and optimizing production yields. These facilities often require a combination of both fixed and portable systems for comprehensive and flexible coverage across vast operational areas.

Another highly significant group of buyers originates from the chemical and petrochemical manufacturing sectors. Here, hydrocarbon analyzers are indispensable for monitoring reactor outputs, ensuring the purity and consistency of chemical feedstocks, detecting fugitive emissions from critical equipment, and maintaining a safe and healthy working environment for personnel. The pharmaceutical industry also represents a growing customer base, utilizing these systems extensively for solvent recovery processes, monitoring cleanroom environments for residual hydrocarbons that could contaminate products, and ensuring the overall quality and safety of their sensitive manufactured goods. Similarly, the food and beverage industry employs these analyzers for detecting contaminants, monitoring fermentation and storage processes, and ensuring product integrity and compliance with food safety standards. These diverse industrial applications highlight the versatility and essential nature of these analytical tools.

Beyond core industrial applications, governmental bodies and environmental agencies constitute a crucial and expanding customer segment. These entities deploy hydrocarbon gas analyzers for ambient air quality monitoring in urban and industrial areas, assessing the environmental impact of various industrial activities on local ecosystems, and rigorously enforcing emission standards through regulatory oversight. Automotive manufacturers and specialized research facilities are also key users, relying heavily on these systems for engine exhaust analysis, regulatory compliance testing for new vehicle models, and the ongoing research and development of cleaner propulsion technologies and alternative fuels. The expanding need for both continuous online monitoring and rapid on-site analysis across these varied sectors underscores the pervasive and increasing demand for reliable, high-performance hydrocarbon gas analyzer systems, with each distinct customer group seeking specific functionalities and performance characteristics tailored precisely to their unique operational, safety, and regulatory requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2032 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Honeywell International Inc., ABB Ltd., Siemens AG, Thermo Fisher Scientific Inc., Yokogawa Electric Corporation, Servomex Group Ltd., Teledyne Analytical Instruments, Drägerwerk AG & Co. KGaA, Endress+Hauser Group Services AG, Fuji Electric Co. Ltd., Sick AG, Testo SE & Co. KGaA, MSA Safety Inc., Spectris plc (Malvern Panalytical), California Analytical Instruments, Inc., AMETEK Process Instruments, Gasmet Technologies Oy, Nova Analytical Systems, Bacharach Inc., KROHNE Messtechnik GmbH, Shimadzu Corporation, Hitachi High-Tech Corporation, Analytik Jena AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrocarbon Gas Analyzer Systems Market Key Technology Landscape

The Hydrocarbon Gas Analyzer Systems Market is characterized by a sophisticated and continually evolving technological landscape, driven by the persistent demand for enhanced accuracy, speed, selectivity, and robustness in gas detection across diverse and challenging applications. Traditional and widely adopted technologies form the foundational bedrock, with Flame Ionization Detectors (FID) remaining a cornerstone due to their exceptional sensitivity in measuring total hydrocarbon concentrations. FID systems are extensively utilized in industrial emission m

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager