In-building Wireless Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430859 | Date : Nov, 2025 | Pages : 251 | Region : Global | Publisher : MRU

In-building Wireless Market Size

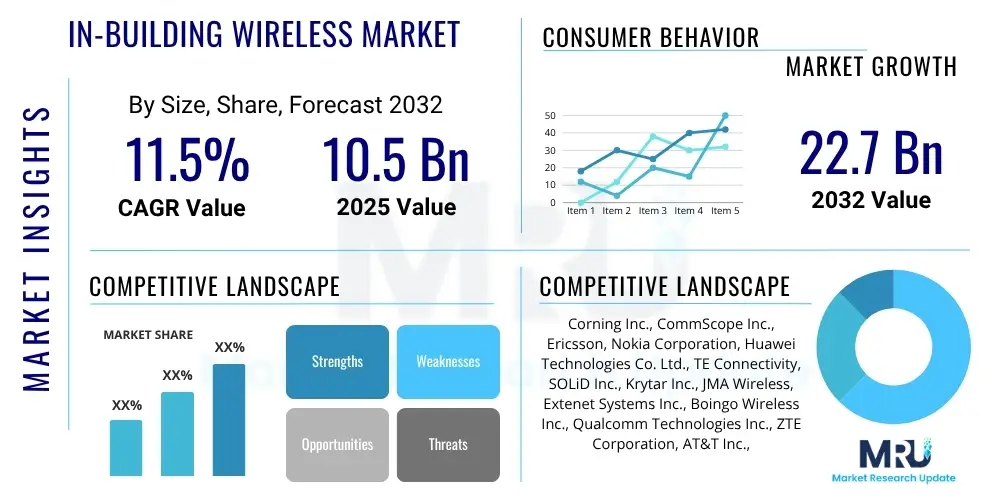

The In-building Wireless Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2025 and 2032. The market is estimated at USD 10.5 billion in 2025 and is projected to reach USD 22.7 billion by the end of the forecast period in 2032.

In-building Wireless Market introduction

In-building wireless solutions are meticulously engineered systems designed to augment and extend reliable cellular, Wi-Fi, and critical public safety radio coverage within enclosed structures. These advanced infrastructures specifically address the widespread challenge of signal attenuation, where external wireless signals struggle to penetrate modern building materials like concrete, steel, and low-emissivity glass, resulting in poor indoor reception, dropped calls, and slow data speeds. The objective is to create a seamless connectivity experience that mirrors or surpasses outdoor network performance, ensuring consistent signal strength and capacity throughout interior spaces. This category encompasses diverse technologies, including Distributed Antenna Systems (DAS), Small Cells, and robust enterprise-grade Wi-Fi networks, often deployed in integrated configurations to achieve optimal performance across various spectrums.

The applications for in-building wireless technologies are extensive and critical across numerous sectors. Major applications span a broad spectrum of venue types, from sprawling commercial office complexes, dynamic retail environments, and luxury hospitality establishments to mission-critical healthcare facilities, bustling transportation hubs such as international airports and extensive train stations, and large public gathering venues like sports stadiums and convention centers. Furthermore, government buildings and public safety facilities rely heavily on these systems for secure and uninterrupted communication. The multitude of benefits derived from these deployments are significant, including a dramatically improved mobile user experience, enabling seamless voice communication, high-speed data transfer, and reliable support for an ever-growing array of Internet of Things (IoT) devices. Crucially, they ensure uninterrupted communication for emergency services and public safety personnel, which is often mandated by strict regulations, thereby enhancing overall safety, operational efficiency, and occupant satisfaction within modern smart environments.

The burgeoning market for in-building wireless solutions is primarily propelled by several powerful driving forces. Foremost among these is the escalating global demand for ubiquitous, high-speed data access, fueled by the exponential proliferation of smartphones, tablets, and bandwidth-intensive applications that require constant connectivity. Concurrently, the rapid global deployment of 5G networks necessitates sophisticated indoor coverage solutions to fully realize its promised potential for ultra-low latency and massive connectivity, as 5G's higher frequencies are particularly susceptible to indoor signal degradation. Moreover, the increasing adoption of smart building initiatives, which integrate vast networks of IoT devices for advanced automation, energy management, security, and environmental control, heavily relies on a robust and pervasive indoor wireless backbone. Lastly, stringent regulatory mandates for reliable public safety communication within structures, particularly in highly developed regions, act as a non-negotiable driver, compelling building owners and operators to implement compliant in-building wireless systems to ensure effective emergency responder communication and occupant safety. These combined factors solidify the market's strong growth trajectory and technological advancement.

In-building Wireless Market Executive Summary

The in-building wireless market is currently undergoing a period of dynamic transformation and robust expansion, fundamentally driven by the escalating global need for seamless indoor connectivity and continuous advancements in wireless communication technologies. Key business trends underscore a significant strategic shift towards converged wireless solutions, which are designed to seamlessly integrate traditional cellular capabilities with advanced Wi-Fi functionality. This convergence simplifies overall network management, reduces infrastructure redundancy, and delivers a superior, unified user experience across different access technologies. Additionally, the widespread adoption of neutral host models is gaining considerable momentum; these models allow multiple mobile network operators to share a single, common in-building wireless infrastructure. This approach significantly reduces individual capital expenditures for carriers and simplifies deployment complexities for building owners, fostering greater industry collaboration and accelerating the rollout of enhanced connectivity in diverse indoor environments such as commercial complexes, public venues, and residential developments.

From a regional perspective, North America and Europe continue to assert their leadership positions in the adoption, deployment, and innovation of in-building wireless solutions. This leadership is attributed to their mature technological infrastructures, high levels of smartphone penetration, and the presence of advanced regulatory frameworks that often mandate specific requirements for indoor public safety communication coverage. However, the Asia Pacific (APAC) region is rapidly emerging as a pivotal growth engine, characterized by extensive urbanization, substantial governmental and private sector investments in smart city projects, and an exploding demand for robust connectivity across commercial, residential, and industrial sectors, particularly in fast-growing economies like China, India, and Southeast Asian nations. Latin America and the Middle East and Africa (MEA) regions are also demonstrating accelerating growth potential, propelled by ongoing digital transformation initiatives, increasing mobile subscriber bases, and continuous improvements in telecommunication infrastructure development, driving demand for enhanced indoor coverage in urban centers and newly developed areas.

Analysis of segmentation trends within the market reveals a sustained and significant demand for foundational technologies such as Distributed Antenna Systems (DAS) and Small Cells. These technologies remain indispensable for comprehensive indoor coverage and capacity enhancement, especially given the accelerating global rollout of 5G networks which necessitate denser and more localized indoor signal distribution. The commercial sector, encompassing offices, retail, and hospitality, alongside the critical public safety segment, are experiencing particularly robust growth. This growth is driven by the imperative for enhanced productivity in corporate environments, superior customer experiences in consumer-facing venues, and the absolute necessity of reliable communication capabilities for emergency services. Furthermore, there is a burgeoning interest and investment in private LTE and 5G networks, specifically tailored for enterprises, offering dedicated, highly secure, and customizable wireless environments that address the unique operational and security requirements of various industries such as manufacturing, healthcare, and logistics, enabling advanced automation and real-time data exchange.

AI Impact Analysis on In-building Wireless Market

Users frequently express considerable curiosity about the transformative potential of artificial intelligence (AI) within the dynamic in-building wireless market, particularly concerning its ability to revolutionize network optimization, enable autonomous management, and significantly enhance operational efficiencies. Common inquiries often delve into how AI algorithms can dynamically adjust network parameters in real time to flawlessly meet fluctuating demand, predict and proactively address potential outages before they impact service, or even personalize connectivity experiences for individual occupants based on their location and specific application needs. The key themes consistently emerging from these user questions revolve around AI's inherent capability to streamline highly complex network operations, minimize the need for manual intervention, and unlock unprecedented levels of network performance, reliability, and responsiveness. Alongside these high expectations, users also voice concerns regarding potential data privacy implications associated with AI-driven monitoring, the perceived complexity of seamlessly integrating advanced AI solutions into existing legacy infrastructures, and the crucial need for adequately skilled personnel capable of effectively managing and evolving these intelligent wireless systems.

There is a strong and widespread expectation that AI will be the primary catalyst driving the evolution towards more intelligent, self-optimizing, and inherently self-healing in-building wireless networks. Stakeholders anticipate that AI-driven insights will dramatically improve resource allocation, effectively mitigate signal interference, and precisely optimize signal propagation patterns, thereby maximizing both coverage and capacity while simultaneously minimizing energy consumption for more sustainable operations. The deep integration of AI is also viewed as fundamentally crucial for enabling a new generation of advanced use cases within smart buildings, such as highly accurate indoor location-based services, sophisticated predictive maintenance protocols for network components, and advanced real-time security monitoring capabilities that can detect anomalies with unprecedented speed. Ultimately, the industry consensus is that AI is poised to become a pivotal force, fundamentally transforming in-building wireless systems from traditionally reactive platforms into proactive, highly adaptive, predictive, and exceptionally efficient connectivity solutions that can anticipate and respond to dynamic environmental and user demands.

- Automated network optimization for dynamic traffic management, load balancing, and precise resource allocation based on real-time usage patterns and environmental conditions.

- Predictive maintenance and proactive fault detection capabilities, leveraging machine learning to identify potential equipment failures or network degradation, thereby minimizing downtime and service interruptions.

- Enhanced network security through advanced anomaly detection, real-time identification of unauthorized access attempts, sophisticated threat intelligence analysis, and automated response mechanisms.

- Optimized energy consumption across the entire in-building wireless infrastructure, employing AI algorithms to intelligently manage power usage for sustainable operations and significant cost reduction.

- Personalized user experience delivery through context-aware connectivity, dynamically adapting bandwidth, latency, and service quality based on individual occupant needs, device capabilities, or specific application requirements.

- Seamless and intelligent integration with broader smart building management systems, enabling holistic control, centralized monitoring, and enhanced operational insights across all building functions.

- Real-time analytics for comprehensive network performance monitoring, granular user behavior insights, capacity planning, and long-term strategic network evolution based on predictive modeling.

- Improved troubleshooting and diagnostics through AI-driven root cause analysis, automated problem identification, and intelligent recommendations for rapid resolution, reducing manual intervention.

- Dynamic interference management and frequency optimization, using AI to detect and mitigate sources of interference for clearer signals and improved network stability.

DRO & Impact Forces Of In-building Wireless Market

The in-building wireless market is driven by a powerful confluence of imperative factors that undeniably underscore its increasing necessity in contemporary infrastructure development and operational efficiency. A foremost driver is the explosive and relentless growth in mobile data traffic, coupled with the pervasive reliance on smartphones, tablets, and an ever-expanding array of connected devices, which collectively demand ubiquitous, high-speed, and reliable indoor connectivity across all environments. Furthermore, the accelerating global rollout of 5G technology acts as a significant catalyst, as its higher frequency bands often struggle with building penetration, thereby necessitating robust in-building solutions to fully unlock 5G's transformative potential for ultra-low latency and massive connectivity. The burgeoning trend of smart buildings, which intricately integrate vast networks of Internet of Things (IoT) devices for sophisticated automation, precise energy management, advanced security systems, and environmental control, heavily relies on a pervasive and high-performance indoor wireless backbone. Crucially, stringent regulatory mandates, particularly those pertaining to reliable public safety radio coverage (ERRC) within commercial, public, and increasingly residential buildings, act as a non-negotiable and powerful driver, compelling widespread adoption to ensure effective emergency responder communication and enhance occupant safety during critical incidents. These multifaceted forces collectively shape a market landscape where superior indoor connectivity is unequivocally transforming from a luxury into a fundamental, indispensable utility for modern society.

Despite these compelling growth drivers, the in-building wireless market concurrently faces several inherent restraints that temper its expansion trajectory and present notable challenges for stakeholders. The most significant hurdle remains the substantial initial capital investment required for designing, procuring, and deploying complex in-building wireless systems. This substantial cost encompasses not only the advanced hardware such as DAS components, small cells, and extensive cabling infrastructure but also specialized engineering design, skilled installation labor, and integration services, which can be prohibitively expensive for many building owners, particularly in smaller or older structures. Furthermore, the sheer complexity involved in effectively designing, deploying, and managing diverse in-building solutions, which often necessitates integrating multiple technologies (e.g., DAS, small cells, Wi-Fi, private networks) and coordinating with numerous stakeholders (mobile network operators, system integrators, building developers, regulatory bodies), presents a considerable logistical and technical challenge. This complexity can lead to extended deployment timelines, increased project management overheads, and potential technical bottlenecks during the integration phase.

Moreover, persistent interoperability challenges between equipment from different vendors and varying wireless standards can further complicate seamless integration and ongoing maintenance, leading to potential performance inefficiencies and increased operational expenditures. Navigating the fragmented regulatory landscape, which often varies significantly across different countries, regions, and even local jurisdictions regarding spectrum allocation, public safety requirements, and permissible power levels, adds another layer of complexity and potential delays to project execution. These technical and regulatory hurdles, combined with the often-high operational costs associated with maintaining and upgrading complex indoor networks, represent significant impediments that market participants must strategically address. However, opportunities for sustained growth are abundant, particularly in the burgeoning expansion of private LTE and 5G networks tailored specifically for enterprises, which offer dedicated, highly secure, and customizable wireless connectivity for mission-critical applications across industrial, healthcare, and logistical sectors. The increasing adoption of neutral host models, where a single robust in-building system supports multiple mobile network operators, presents a significant opportunity to collectively reduce deployment costs and accelerate market penetration, especially in multi-tenant environments. Furthermore, the proactive integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for sophisticated network optimization, predictive maintenance, and real-time performance analytics offers a promising pathway to dramatically increased efficiency, enhanced reliability, and continuous innovation. The ongoing pervasive digitalization across virtually all economic sectors, coupled with the escalating need for resilient and secure communication infrastructure in critical facilities, ensures a fertile ground for strategic investments and continuous technological advancements in the in-building wireless domain. The cumulative impact forces undeniably indicate a strong positive trajectory for the market, particularly within urban developments, smart infrastructure projects, and critical operational environments, effectively outweighing many of the existing restraints and driving sustained expansion.

Segmentation Analysis

The in-building wireless market is meticulously segmented across several key dimensions, providing a granular and comprehensive understanding of its diverse landscape and enabling a deeper, more nuanced appreciation of market dynamics, specific growth drivers, and distinct challenges inherent within various sub-sectors. These crucial segments are precisely defined by the type of components that constitute the wireless infrastructure, the overarching system architectures deployed, the specific venue types or building environments where these sophisticated solutions are implemented, and the foundational wireless technologies integrated into the network. This multi-faceted segmentation is instrumental in highlighting the wide array of diverse requirements and highly specialized applications that modern in-building wireless solutions are meticulously designed to address, ranging from dramatically enhancing mobile broadband capacity in sprawling commercial office towers to ensuring absolutely critical communication capabilities for public safety personnel in emergency-response zones. The intricate interplay between these segments showcases the market’s adaptability and its commitment to catering to highly specific needs across a broad operational spectrum.

A thorough understanding of these comprehensive segmentations is absolutely crucial for all key stakeholders, including leading manufacturers, specialized service providers, telecommunication carriers, and building owners, enabling them to precisely identify niche markets, strategically tailor product and service offerings, and devise exceptionally effective deployment and operational strategies. For instance, the connectivity needs of a colossal sports stadium, which requires immense high-density public access Wi-Fi and robust cellular capacity for tens of thousands of simultaneous users, fundamentally differ from those of a critical healthcare facility, which demands ultra-reliable, low-latency connectivity for medical Internet of Things (IoT) devices, seamless telemedicine services, and uninterrupted emergency communications. Similarly, a manufacturing plant might prioritize a private 5G network for industrial automation and real-time data processing, distinct from a multi-dwelling residential unit primarily seeking consistent cellular coverage and high-speed Wi-Fi for its occupants. As continuous technological advancements relentlessly introduce new capabilities and regulatory environments progressively evolve, the intricate nuances within each of these market segments will invariably continue to shape the overall market growth trajectories, foster significant innovation, and drive the development of highly specialized, bespoke solutions precisely engineered for each distinct and unique application area.

- Component: This segment analyzes the fundamental building blocks of in-building wireless systems.

- Hardware: Encompasses all physical equipment such as Distributed Antenna Systems (DAS) units (headends, remote units), Small Cells (femtocells, picocells, microcells), signal Repeaters and boosters, various types of Antennas (omni-directional, directional, panel), specialized Cabling and Connectors (coaxial, fiber optic), and Hybrid Solutions that combine different technologies.

- Services: Includes the vital support functions required for planning, deployment, and ongoing operation. This covers Consulting services for network design and strategy, comprehensive Design and Installation services, crucial Maintenance and Support for system longevity, full Managed Services where third parties operate the network, and Optimization Services to ensure peak performance.

- System Type: Categorizes solutions based on their architectural approach to signal distribution and amplification.

- Distributed Antenna System (DAS): Solutions for distributing signals from multiple sources through a network of antennas. Sub-types include Passive DAS (using coaxial cables), Active DAS (using fiber optics for longer distances and more capacity), and Hybrid DAS (combining elements of both).

- Small Cell: Low-power cellular base stations providing localized coverage and capacity. Includes Femtocells (for residential/small office), Picocells (for larger enterprises/public spaces), and Microcells (for urban street level/large buildings).

- Private LTE/5G Networks: Dedicated, localized cellular networks for specific organizations, offering enhanced security, reliability, and control for critical operations.

- Wi-Fi: Includes advanced Wi-Fi standards like Wi-Fi 6 (802.11ax), Wi-Fi 6E (extending into 6 GHz band), and the upcoming Wi-Fi 7 (802.11be) for ultra-high-speed and capacity.

- Other Technologies: Encompasses devices like Repeaters and Signal Boosters used for extending coverage in smaller, less complex environments.

- Venue Type: Classifies the market based on the specific type of building or location where solutions are deployed.

- Commercial Buildings: Includes a wide range such as expansive Office Spaces, dynamic Retail Outlets and large Shopping Malls, diverse Hospitality venues (Hotels, Resorts, Convention Centers), and corporate campuses.

- Healthcare: Covers critical environments like Hospitals, Clinics, extensive Medical Campuses, and Assisted Living Facilities, where reliable communication is life-critical.

- Public Venues: High-density areas such as Sports Stadiums, Arenas, Concert Halls, international Airports, busy Train Stations, Underground Subways, and large Exhibition Centers.

- Government and Public Safety: Encompasses essential services like Emergency Services (police, fire, EMS), various Government Facilities, and secure Military Bases.

- Industrial: Includes challenging environments like Manufacturing Plants, Warehouses, Logistics Centers, and Mining Sites, often requiring robust private networks.

- Residential: Primarily focuses on Multi-Dwelling Units (MDUs) and High-Rise Apartments, ensuring consistent tenant connectivity.

- Education: Covers Universities, Schools, and other academic institutions needing pervasive Wi-Fi and cellular coverage.

- Technology: Segments based on the underlying wireless communication standards supported.

- 4G/LTE: The current prevalent cellular technology, still widely supported for high-speed mobile data.

- 5G: The next generation of cellular technology, including Sub-6 GHz and millimeter-wave (mmWave) bands, demanding advanced indoor solutions.

- Wi-Fi Standards: Latest iterations like 802.11ax (Wi-Fi 6) and 802.11be (Wi-Fi 7) offering enhanced speed, capacity, and efficiency.

- Public Safety Radio: Specialized communication systems like Project 25 (P25), TETRA, and FirstNet-compatible solutions, critical for emergency responders.

- LoRaWAN: Low-power, wide-area network technology for IoT devices requiring long battery life and limited data.

- Bluetooth: Short-range wireless technology for device connectivity and specific indoor positioning applications.

Value Chain Analysis For In-building Wireless Market

The value chain for the in-building wireless market constitutes a highly intricate and interconnected ecosystem, requiring the seamless collaboration of numerous specialized entities to successfully deliver pervasive and high-performance indoor connectivity solutions. At the foundational upstream segment, the chain originates with a diverse array of component manufacturers responsible for the production of critical hardware. These include semiconductors, sophisticated radio frequency (RF) components, advanced antennas, high-performance optical fiber, and specialized cabling infrastructure. These suppliers are pivotal, as they provide the fundamental building blocks and highly specialized sub-systems that enable the core functionality and performance of advanced wireless systems. This upstream segment is characterized by intensive research and development investments aimed at producing increasingly high-performance, compact, and energy-efficient components, which are absolutely crucial for optimal signal distribution, amplification, and reception within the inherently challenging enclosed environments of modern buildings. Continuous innovation in advanced materials science, miniaturization techniques, and power efficiency is a defining characteristic of this initial stage, directly influencing the capabilities of the final deployed solutions.

Moving further downstream in the value chain, these specialized components are then procured by original equipment manufacturers (OEMs), major equipment vendors, and system manufacturers. These entities are responsible for the complex task of integrating the various components into complete and functional in-building wireless solutions. This intensive phase involves the meticulous design, engineering, and assembly of sophisticated systems such as Distributed Antenna System (DAS) headends and remote units, various types of small cells (e.g., femtocells, picocells, microcells), high-performance Wi-Fi access points, and signal repeaters. Following the manufacturing and integration phase, specialized system integrators, value-added resellers (VARs), and prominent telecommunication service providers assume a critically important role in the deployment and ongoing management of these intricate networks. Their deep technical expertise is indispensable for conducting thorough site surveys, performing detailed system engineering, executing precise installation and commissioning processes, and ensuring seamless interoperability with existing network infrastructure while strictly adhering to all relevant regulatory standards and building codes. These mid-to-downstream players often serve as the primary interface between the technology developers and the ultimate end-users, translating complex technical requirements into practical, deployable solutions.

Distribution channels for in-building wireless solutions are typically structured into both direct and indirect models, each serving distinct market needs and customer segments. Large-scale, high-value projects, which frequently involve major enterprise clients, expansive government bodies, or incumbent mobile network operators, commonly leverage direct sales channels. This direct approach fosters closer, more collaborative relationships between the core manufacturers or leading integrators and the end-customer, allowing for highly customized solutions and direct communication throughout the project lifecycle. Conversely, indirect channels are comprised of an extensive network of specialized distributors, certified resellers, and channel partners who are instrumental in extending market reach and providing localized support and expertise, particularly for smaller projects or geographically dispersed deployments. These indirect partners often offer additional value-added services such as local project management, specialized installation, and comprehensive ongoing maintenance, thereby ensuring efficient delivery and robust support across diverse geographical regions and vertical markets. This multi-channel approach is vital for adapting to varying customer scales and geographic requirements, ensuring that in-building wireless solutions can reach a broad and diverse customer base effectively.

In-building Wireless Market Potential Customers

Potential customers for in-building wireless solutions encompass an exceptionally broad and diverse spectrum of organizations and entities, all universally united by the critical and escalating need for robust, pervasive, and utterly reliable indoor connectivity. These end-users, who are the ultimate buyers and beneficiaries of these advanced technological solutions, span virtually any type of enclosed structure where external cellular and data signals either struggle to penetrate effectively or where high-density user traffic necessitates significantly enhanced capacity and consistent performance. A particularly significant customer segment includes commercial real estate developers, property managers, and facility owners who are increasingly driven to attract and retain tenants by offering premium, seamless connectivity as a fundamental and expected amenity in modern workspaces. This imperative extends equally to luxury hospitality venues like hotels, resorts, and convention centers, as well as bustling retail establishments and expansive shopping malls, where a superior guest and customer experience, facilitated by uninterrupted connectivity, is paramount for sustained business success, brand reputation, and overall satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 10.5 billion |

| Market Forecast in 2032 | USD 22.7 billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Inc., CommScope Inc., Ericsson, Nokia Corporation, Huawei Technologies Co. Ltd., TE Connectivity, SOLiD Inc., Krytar Inc., JMA Wireless, Extenet Systems Inc., Boingo Wireless Inc., Qualcomm Technologies Inc., ZTE Corporation, AT&T Inc., Verizon Communications Inc., Crown Castle International Corp., American Tower Corporation, Casa Systems Inc., Airspan Networks Inc., Parallel Wireless |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

In-building Wireless Market Key Technology Landscape

The in-building wireless market is defined by an exceptionally dynamic and continuously evolving technology landscape, one that is meticulously crafted to meet the escalating and increasingly complex demands for seamless, high-performance indoor connectivity. Distributed Antenna Systems (DAS) remain a foundational and highly versatile technology, proving particularly effective in efficiently distributing cellular and critical public safety radio signals across expansive, architecturally complex, or historically challenging structures. DAS solutions, which are readily available in passive, active, and hybrid configurations, are absolutely crucial for extending outdoor macro network coverage and significantly augmenting capacity deep inside buildings, thereby ensuring consistent signal strength and robust service for both voice and data communications. Their inherent modular nature allows for exceptional scalability and comprehensive support for multiple frequency bands and various mobile network operators, rendering them highly versatile and indispensable across a wide array of diverse venue types, from underground tunnels to high-rise commercial towers, effectively overcoming signal penetration limitations posed by modern building materials.

Small Cells, a broad category encompassing femtocells, picocells, and microcells, represent another critically important pillar of the in-building wireless technology ecosystem. These compact, low-power cellular base stations are strategically deployed to precisely fill coverage gaps, provide localized capacity enhancements in high-traffic density areas, and efficiently offload traffic from congested macro networks. With the rapid global advent and deployment of 5G, small cells are becoming even more indispensable, especially for effectively delivering the ultra-high bandwidth, incredibly low latency, and massive connectivity promised by millimeter-wave (mmWave) spectrum, which is characterized by its inherent susceptibility to signal attenuation and limited penetration capabilities through physical obstructions. Furthermore, the rising prominence of private LTE and private 5G networks is gaining significant traction; these dedicated, localized wireless networks offer enterprises highly secure, reliable, and customizable connectivity infrastructure specifically tailored for mission-critical applications across various industries, often integrated seamlessly with edge computing capabilities for ultra-low latency localized data processing and enhanced security protocols, empowering advanced automation and real-time operational insights.

Moreover, advanced Wi-Fi standards, particularly Wi-Fi 6 (802.11ax), the recently introduced Wi-Fi 6E (which extends into the less congested 6 GHz band), and the emerging Wi-Fi 7 (802.11be) standards, are absolutely integral components of the holistic in-building wireless ecosystem. These cutting-edge technologies offer superior performance in high-density indoor environments, supporting a significantly greater number of simultaneous users, delivering dramatically higher throughput speeds, and achieving ultra-low latency, making them ideally suited for corporate offices, sprawling educational institutions, and bustling public venues that demand robust, high-capacity wireless access. Complementary technologies such as intelligent signal boosters, sophisticated repeaters, and hybrid fiber-coaxial (HFC) networks also continue to play vital roles in specific, often smaller or less complex, deployment scenarios, efficiently extending and enhancing wireless coverage with cost-effectiveness. The relentless ongoing innovation in advanced antenna design, precision RF filtering, and sophisticated digital signal processing further contributes significantly to the overall robustness, reliability, and spectral efficiency of modern in-building wireless solutions, ensuring their capability to not only accommodate current demands for pervasive connectivity but also to proactively support future bandwidth-intensive applications like immersive augmented reality (AR), virtual reality (VR), and complex holographic communications within indoor spaces, thus future-proofing connectivity investments.

Regional Highlights

- North America: This region stands as a dominant and mature market for in-building wireless solutions, characterized by its pioneering adoption of advanced wireless technologies and substantial, continuous investments in cutting-edge 5G infrastructure. A significant driver here is the robust regulatory push for mandated public safety communication coverage within buildings, ensuring emergency responder safety. The strong presence of major telecommunication carriers and leading technology providers, coupled with exceptionally high smartphone penetration rates and a pervasive culture of high data consumption, collectively drives sustained and increasing demand across commercial, government, public venue, and critical infrastructure segments. Innovation in neutral host and private network deployments is also notably strong.

- Europe: Europe represents another highly developed and tightly regulated market within the in-building wireless domain, characterized by a profound focus on digital transformation initiatives, the development of smart city ecosystems, and a continuous commitment to enhancing mobile broadband services. Countries such as Germany, the United Kingdom, France, and the Nordics are experiencing substantial deployment activities, primarily driven by strong enterprise demand for improved productivity, high volumes of passenger traffic in sprawling transportation hubs, and rigorously evolving public safety regulations. The adoption of neutral host models is gaining considerable traction across the continent as a strategic approach to optimize deployment costs and accelerate widespread service delivery.

- Asia Pacific (APAC): The APAC region is unequivocally projected to be the fastest-growing market for in-building wireless solutions globally, propelled by unparalleled rates of urbanization, colossal infrastructure development projects, and a burgeoning demand stemming from rapidly emerging economies such as China, India, and the dynamic nations of Southeast Asia. The region is witnessing widespread and rapid adoption across new commercial buildings, extensive residential complexes, and modern transportation sectors. This growth is significantly bolstered by an expanding mobile subscriber base, robust government initiatives promoting digital inclusion, and ambitious smart city development programs that require pervasive, high-capacity indoor connectivity.

- Latin America: This region is undergoing a substantial and accelerating period of digital transformation, marked by increasing mobile penetration rates and significant, ongoing investments in upgrading and expanding telecommunication networks. The demand for improved in-building wireless connectivity is particularly robust in burgeoning urban centers, expanding commercial hubs, and developing public venues, as countries across Latin America vigorously strive to enhance digital access, bridge connectivity gaps, and provide reliable infrastructure to support sustained economic growth and social development. Investment in basic and advanced solutions is on the rise.

- Middle East and Africa (MEA): The MEA region is experiencing substantial investment in visionary smart city projects, large-scale tourism infrastructure development, and advanced enterprise connectivity solutions. Countries in the Middle East, particularly the UAE, Saudi Arabia, and Qatar, are at the forefront of adopting cutting-edge in-building wireless technologies to support their ambitious national development plans, accommodate a rapidly growing influx of international visitors, and facilitate the expansion of diverse businesses. Africa is also demonstrating increased market penetration, largely driven by mobile-first strategies, the rapid expansion of urban areas, and a growing recognition of the economic benefits of enhanced indoor connectivity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the In-building Wireless Market.- Corning Inc.

- CommScope Inc.

- Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- TE Connectivity

- SOLiD Inc.

- Krytar Inc.

- JMA Wireless

- Extenet Systems Inc.

- Boingo Wireless Inc.

- Qualcomm Technologies Inc.

- ZTE Corporation

- AT&T Inc.

- Verizon Communications Inc.

- Crown Castle International Corp.

- American Tower Corporation

- Casa Systems Inc.

- Airspan Networks Inc.

- Parallel Wireless

Frequently Asked Questions

What is in-building wireless technology and why is it essential for modern structures?

In-building wireless technology refers to advanced systems meticulously designed to enhance, distribute, and ensure reliable cellular, Wi-Fi, and critical public safety radio signals within the confines of various building structures. It is absolutely essential for modern structures because conventional outdoor wireless signals frequently struggle to penetrate contemporary building materials such as concrete, steel, and low-emissivity glass, leading to pervasive poor indoor reception, frustrating dropped calls, and unacceptably slow data speeds. These solutions are vital for maintaining continuous communication, supporting digital operations, and ensuring occupant safety.

What are the primary types of in-building wireless systems and their typical applications?

The primary types of in-building wireless systems include Distributed Antenna Systems (DAS), which utilize a network of strategically placed antennas to distribute signals from multiple sources, making them ideal for large venues like stadiums and airports. Another key type is Small Cells (such as femtocells, picocells, and microcells), which are low-power, localized base stations providing targeted coverage and capacity in specific areas like offices or shopping malls. Additionally, advanced Wi-Fi networks and specialized public safety radio systems are integral components, often deployed in conjunction with DAS or small cells to create a comprehensive indoor connectivity solution, addressing diverse needs from public access to mission-critical communications.

How does 5G technology profoundly influence the demand and deployment of in-building wireless solutions?

5G technology profoundly influences the demand for in-building wireless solutions because its higher frequency bands, particularly millimeter-wave (mmWave) spectrum, have extremely limited penetration capabilities through building materials. To fully deliver the promised benefits of 5G, including ultra-high speeds, significantly lower latency, and massive connectivity for IoT, pervasive and robust indoor coverage through advanced DAS, 5G-enabled small cells, and private 5G networks becomes absolutely critical. This ensures a truly seamless, high-performance user experience both outdoors and deep within buildings, unlocking the full potential of 5G applications and services across all environments.

What are the main driving forces behind the significant growth observed in the in-building wireless market?

The significant growth in the in-building wireless market is propelled by several powerful driving forces. These include the exponential increase in global mobile data consumption, the widespread proliferation of connected Internet of Things (IoT) devices in smart environments, the accelerating worldwide rollout of 5G networks that necessitate enhanced indoor signal propagation, the rapid adoption of smart building technologies for automation and efficiency, and increasingly stringent regulatory mandates for reliable public safety communication coverage within enclosed structures, all collectively creating an imperative for ubiquitous indoor connectivity.

Who are the key potential customers and sectors that predominantly invest in in-building wireless services?

Key potential customers and sectors predominantly investing in in-building wireless services are diverse and extensive. They include commercial building owners and developers seeking to enhance tenant experience, hospitality venues aiming to provide superior guest connectivity, large retail enterprises, critical healthcare facilities, government and public safety agencies due to regulatory mandates, high-traffic transportation hubs like airports and train stations, large-scale industrial complexes for automation, and educational institutions for digital learning. All these sectors prioritize enhanced indoor connectivity for operational efficiency, safety compliance, and overall user satisfaction, driving substantial market demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- In-Building Wireless Market Size Report By Type (DAS, Small Cell, 5G, VoWifi), By Application (Commercials, Government, Hospitals, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- In-Building Wireless In 5G Era Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (DAS, Small Cel, V-RAN), By Application (eMBB, URLLC, mMTC, FWA, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager