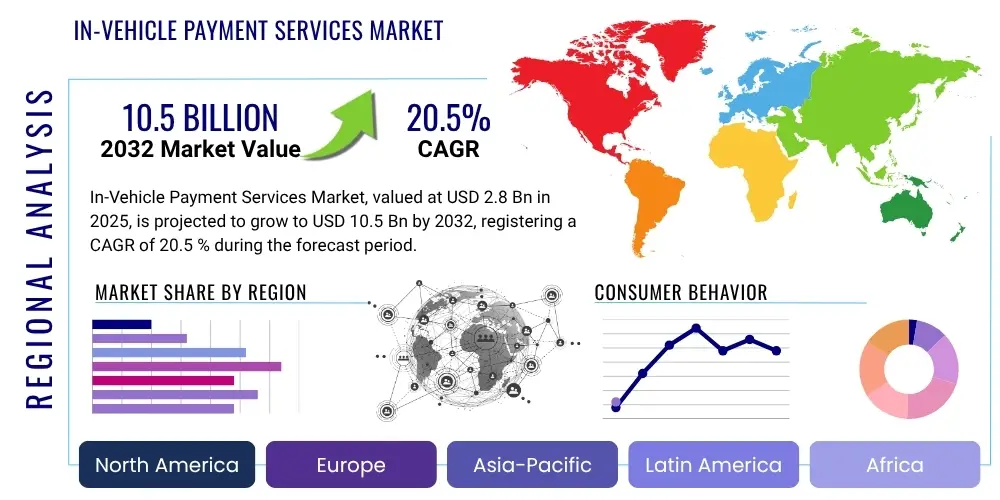

In-Vehicle Payment Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427964 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

In-Vehicle Payment Services Market Size

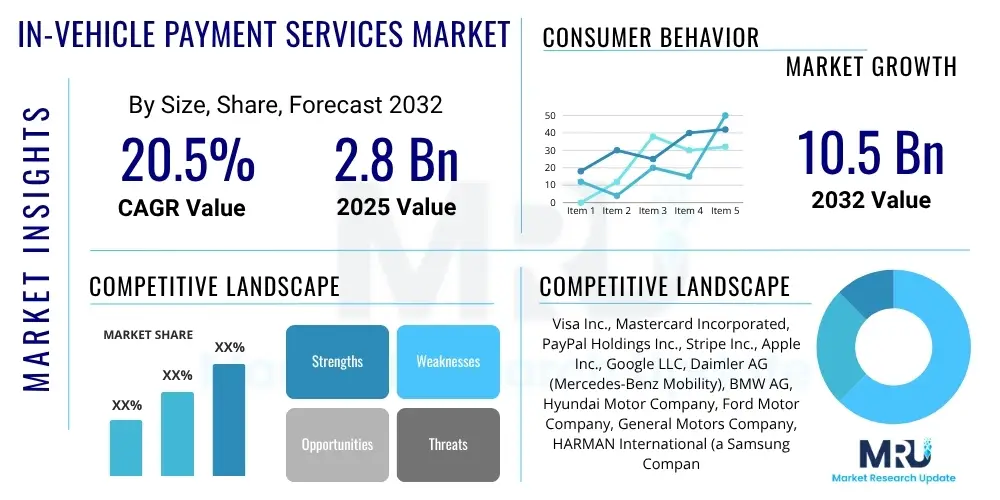

The In-Vehicle Payment Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2025 and 2032. The market is estimated at USD 2.8 billion in 2025 and is projected to reach USD 10.5 billion by the end of the forecast period in 2032.

In-Vehicle Payment Services Market introduction

The In-Vehicle Payment Services Market encompasses technologies and platforms enabling consumers to make payments for goods and services directly from their vehicles. This innovative sector integrates digital payment solutions into automotive systems, offering unparalleled convenience for transactions like fuel purchases, parking fees, tolls, and even drive-through food orders. The core product involves software and hardware integrations within the vehicle's infotainment system or dedicated payment modules, facilitating secure and seamless transactions. Major applications span a wide range of everyday necessities and luxury services, revolutionizing the way drivers interact with commercial ecosystems. Benefits include enhanced user convenience, improved efficiency for merchants, and a reduction in physical interaction points, aligning with modern preferences for digital and contactless experiences. The market's growth is primarily driven by the increasing digitalization of automotive ecosystems, the rising adoption of connected cars, and the growing consumer demand for integrated, friction-free payment methods.

In-Vehicle Payment Services Market Executive Summary

The In-Vehicle Payment Services Market is experiencing robust growth driven by significant advancements in connected car technology and evolving consumer payment behaviors. Business trends indicate a strong focus on strategic partnerships between automotive manufacturers, payment processors, and technology providers to create comprehensive and secure in-vehicle commerce ecosystems. Companies are investing heavily in user experience design, aiming for intuitive interfaces and seamless integration with existing digital wallets and banking services. Regional trends show North America and Europe leading in adoption due to established connected car infrastructure and high consumer readiness for digital payments, while Asia Pacific is emerging as a high-growth region propelled by rapid digitalization and a vast automotive market. Segment trends highlight increasing demand for fuel and charging payments, parking solutions, and integrated retail experiences, with a particular emphasis on biometric and voice-activated payment methods enhancing security and convenience. This dynamic market is poised for continued expansion as autonomous driving capabilities and smart city initiatives further integrate vehicles into the broader digital economy.

AI Impact Analysis on In-Vehicle Payment Services Market

User inquiries about AI's impact on In-Vehicle Payment Services frequently revolve around enhanced security, personalized experiences, and the potential for autonomous transactions. Consumers are keen to understand how AI will make payments safer, more intuitive, and predictive, moving beyond manual inputs to a truly integrated in-car commerce experience. Key themes include concerns about data privacy and the accuracy of AI-driven recommendations, alongside expectations for smarter payment options that anticipate needs, optimize routes, and integrate seamlessly with a driver's daily routine. The underlying sentiment is a desire for a frictionless, intelligent payment system that leverages AI to simplify financial interactions on the road.

- AI enhances fraud detection and security through real-time behavioral analytics and anomaly detection during transactions.

- Personalized payment experiences are enabled by AI, suggesting relevant services or purchases based on driver habits, location, and preferences.

- Voice-activated payments are significantly improved by AI, offering more accurate recognition and natural language processing for command execution.

- AI facilitates predictive payments, allowing vehicles to anticipate needs like fuel or parking and initiate payments automatically.

- Optimized route planning and cost management integrate AI to recommend the most economical payment options for tolls or charging stations.

- Seamless integration with smart home ecosystems and personal assistants, extending in-vehicle commerce to broader lifestyle management.

- Improved customer support and troubleshooting for payment issues through AI-powered virtual assistants.

- Data aggregation and analysis driven by AI provide valuable insights for service providers and automotive OEMs to refine offerings.

DRO & Impact Forces Of In-Vehicle Payment Services Market

The In-Vehicle Payment Services Market is significantly influenced by a confluence of driving forces, restraints, and opportunities. Key drivers include the escalating demand for connected car features, the global shift towards cashless and contactless payment methods, and the growing ecosystem of smart city infrastructure that supports vehicle-integrated transactions. Moreover, increased consumer expectation for convenience and seamless digital experiences across all aspects of life further propels market expansion. However, the market faces restraints such as significant concerns regarding data security and privacy, the complexity of integrating diverse payment technologies into existing automotive systems, and the fragmentation of regulatory frameworks across different regions. The high cost of implementing advanced in-vehicle payment hardware and software also presents a barrier, especially for mass-market vehicles. Opportunities abound in the development of standardized payment protocols, leveraging emerging technologies like 5G and blockchain for enhanced security and speed, and expanding into niche applications such as subscription services for autonomous vehicles and personalized in-car retail. These impact forces collectively shape the market's trajectory, encouraging innovation while demanding robust solutions to overcome inherent challenges.

Segmentation Analysis

The In-Vehicle Payment Services Market is segmented across various dimensions to provide a comprehensive understanding of its intricate structure and diverse offerings. These segmentations allow for a detailed examination of market dynamics based on the type of payment, the vehicle category, specific applications, underlying technology, and the components involved in delivering these services. This granular analysis helps stakeholders identify key growth areas, understand competitive landscapes, and tailor their strategies to specific consumer needs and technological advancements. Each segment plays a crucial role in the overall market ecosystem, contributing to the development and adoption of seamless in-car commerce solutions.

- By Payment Type:

- Contactless Payments

- QR Code Payments

- App-Based Payments

- Voice-Activated Payments

- Biometric Payments (e.g., fingerprint, facial recognition)

- By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Application:

- Fuel/Charging Stations

- Parking Services

- Tolls

- Drive-Through Services (e.g., fast food, coffee)

- In-Car Retail (e.g., digital content, merchandise)

- Ride-Hailing & Car-Sharing Services

- Infotainment & Connectivity Subscriptions

- By Technology:

- Near Field Communication (NFC)

- Bluetooth Low Energy (BLE)

- Wi-Fi

- Cellular (4G/5G)

- GPS

- By Component:

- Hardware (e.g., Payment Terminals, Head Units, Telematics Control Units)

- Software (e.g., Payment Gateways, Operating Systems, Apps, APIs)

- Services (e.g., Transaction Processing, Security & Fraud Management, Data Analytics, Customer Support)

Value Chain Analysis For In-Vehicle Payment Services Market

The value chain for the In-Vehicle Payment Services Market involves a complex interplay of various participants, from raw material suppliers to the ultimate end-users, ensuring the seamless delivery of integrated payment solutions. Upstream activities primarily involve semiconductor manufacturers providing chips for infotainment systems and connectivity modules, as well as software developers creating secure payment gateways and application programming interfaces (APIs). These components are then integrated by automotive OEMs and Tier 1 suppliers into vehicle systems. Downstream analysis focuses on the distribution channels which primarily include automotive dealerships and increasingly, direct-to-consumer digital platforms that offer software updates and service subscriptions. Direct channels involve automotive manufacturers embedding payment services directly into their vehicles, often through proprietary platforms like Mercedes pay or BMW ConnectedDrive. Indirect channels encompass partnerships with third-party payment providers like Visa or PayPal, and specialized service providers for parking or fuel, who integrate their services into the vehicle’s ecosystem. This intricate network ensures that the innovative payment solutions reach the consumer efficiently and securely.

In-Vehicle Payment Services Market Potential Customers

Potential customers for In-Vehicle Payment Services are broadly categorized as vehicle owners, fleet operators, and transportation service providers, all seeking enhanced convenience, efficiency, and security in their daily transactions. Individual consumers, particularly those with higher disposable incomes and a penchant for technology, are key end-users driving demand for seamless experiences in fuel purchases, parking, and toll payments. The appeal extends to commuters who spend significant time in their vehicles and value the ability to perform transactions without physical interaction. Additionally, commercial fleet operators represent a significant customer segment, benefiting from streamlined payment processes for fuel, maintenance, and route-specific expenses, leading to better cost management and operational efficiency. Ride-hailing and car-sharing companies also stand as crucial buyers, integrating these services to facilitate payments for rides, rentals, and in-car purchases, thereby improving the overall user experience and expanding their service offerings. The adoption is particularly strong among early adopters of connected and electric vehicles who are accustomed to digital integrations and value innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.8 billion |

| Market Forecast in 2032 | USD 10.5 billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., Stripe Inc., Apple Inc., Google LLC, Daimler AG (Mercedes-Benz Mobility), BMW AG, Hyundai Motor Company, Ford Motor Company, General Motors Company, HARMAN International (a Samsung Company), NXP Semiconductors N.V., Infineon Technologies AG, Robert Bosch GmbH, Panasonic Corporation, Volkswagen AG, Stellantis N.V., Continental AG, Worldline S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

In-Vehicle Payment Services Market Key Technology Landscape

The In-Vehicle Payment Services Market relies on a sophisticated array of technologies to ensure secure, convenient, and seamless transactions from within a vehicle. Central to this landscape are advanced connectivity solutions such as 4G and 5G cellular networks, Wi-Fi, and Bluetooth, which enable continuous communication between the vehicle and payment infrastructure. Near Field Communication (NFC) plays a crucial role for contactless interactions at points of sale, similar to smartphone-based mobile payments. Embedded telematics units and sophisticated infotainment systems serve as the primary hardware interfaces, integrating payment gateways and user interfaces. Secure element technology and hardware security modules (HSMs) are fundamental for protecting sensitive payment data and ensuring transactional integrity. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) are being leveraged for voice recognition, biometric authentication, and personalized payment recommendations. The increasing adoption of cloud computing platforms facilitates scalable back-end processing and data management, while blockchain technology is beginning to emerge as a potential solution for enhanced security, transparency, and decentralized transaction verification, promising a more robust and fraud-resistant payment ecosystem.

Regional Highlights

- North America: This region is a pioneer in connected car technologies and a major adopter of in-vehicle payment services, driven by high consumer purchasing power, a strong digital infrastructure, and the presence of leading automotive and tech companies. The U.S. and Canada are significant contributors, particularly in applications like fuel and parking payments.

- Europe: Characterized by stringent regulatory environments and a strong emphasis on data privacy, Europe shows steady growth. Countries like Germany, the UK, and France are leading, focusing on integrating payments with electric vehicle charging and smart city initiatives, often through collaboration between automakers and financial institutions.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC is propelled by rapid urbanization, increasing disposable incomes, and widespread smartphone adoption, particularly in China, Japan, and South Korea. This region benefits from government initiatives supporting digital payments and a large consumer base keen on adopting new technologies, especially for ride-hailing and e-commerce.

- Latin America: This region is witnessing gradual but consistent adoption, driven by the expansion of connected car sales and efforts to digitize various services. Brazil and Mexico are key markets, with an increasing focus on mobile payment integration and addressing unique regional infrastructure challenges.

- Middle East and Africa (MEA): Growth in MEA is spurred by economic diversification efforts, significant investments in smart city projects, and the rising penetration of connected vehicles. Countries like the UAE and Saudi Arabia are at the forefront, implementing advanced solutions for fuel, toll, and parking payments as part of their broader digital transformation agendas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the In-Vehicle Payment Services Market.- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- Stripe Inc.

- Apple Inc.

- Google LLC

- Daimler AG (Mercedes-Benz Mobility)

- BMW AG

- Hyundai Motor Company

- Ford Motor Company

- General Motors Company

- HARMAN International (a Samsung Company)

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Robert Bosch GmbH

- Panasonic Corporation

- Volkswagen AG

- Stellantis N.V.

- Continental AG

- Worldline S.A.

Frequently Asked Questions

Analyze common user questions about the In-Vehicle Payment Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are in-vehicle payment services?

In-vehicle payment services allow drivers to make secure digital payments for goods and services, such as fuel, parking, and tolls, directly through their car's infotainment system or integrated applications, without needing a physical card or mobile device.

How secure are in-vehicle payments?

In-vehicle payments employ advanced security measures including encryption, tokenization, biometric authentication, and secure element technology to protect sensitive financial data and prevent fraud. Transactions adhere to industry standards like PCI DSS.

What types of payments can be made using in-vehicle services?

Common applications include payments for fuel and EV charging, parking fees, road tolls, drive-through food orders, and in-car retail purchases. Future applications may extend to subscription services for autonomous features.

Which car brands offer in-vehicle payment solutions?

Leading automotive brands such as Mercedes-Benz (Mercedes pay), BMW (BMW ConnectedDrive), Ford (FordPass), and General Motors (Marketplace) are actively integrating or developing their own in-vehicle payment systems in collaboration with payment processors.

What is the future outlook for the in-vehicle payment services market?

The market is poised for significant growth, driven by increasing connected car penetration, the expansion of smart city infrastructure, and advancements in AI and 5G technology, leading to more personalized, autonomous, and integrated commerce experiences within vehicles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager