Industrial Adhesives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428297 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Adhesives Market Size

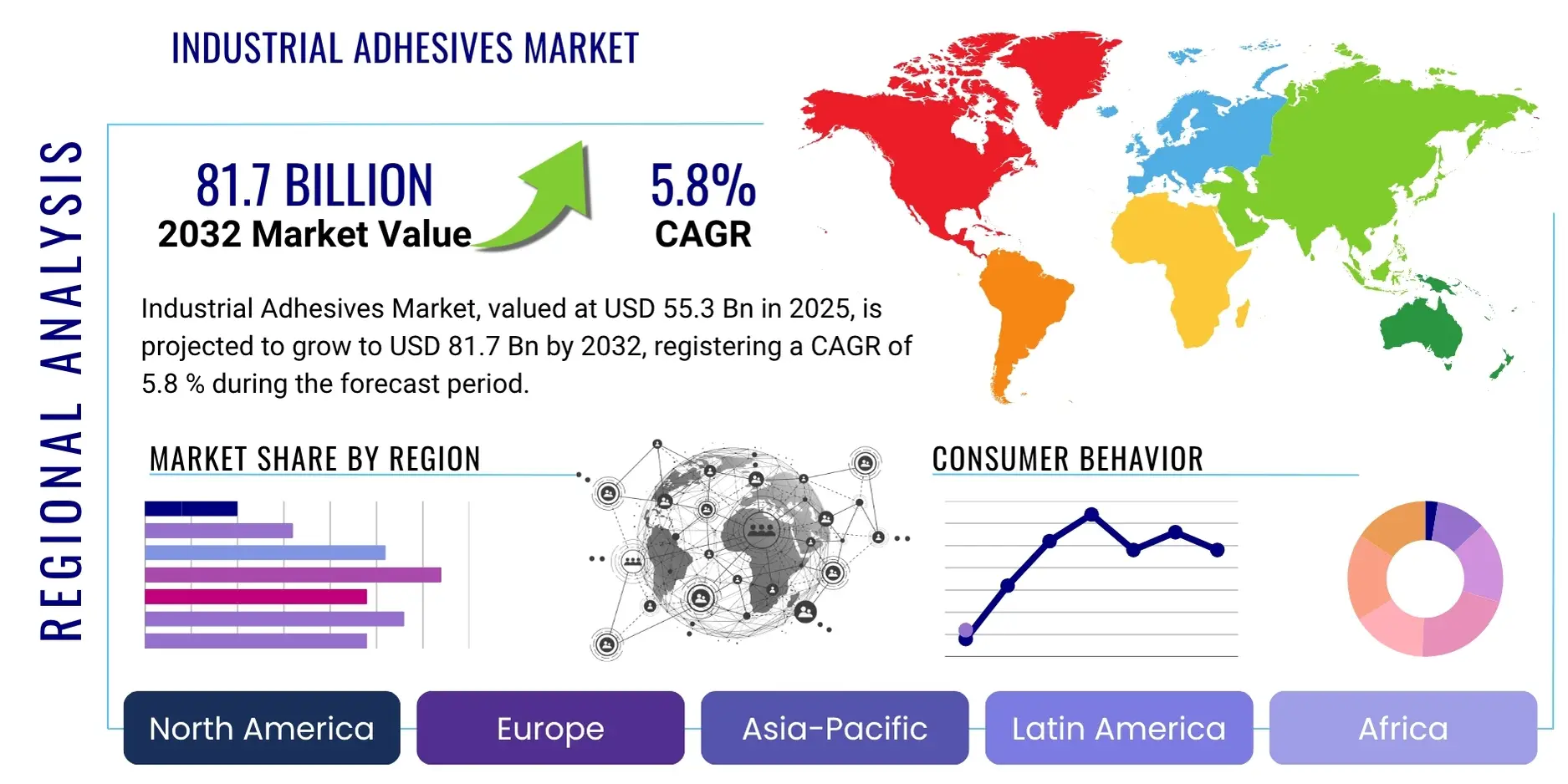

The Industrial Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 55.3 Billion in 2025 and is projected to reach USD 81.7 Billion by the end of the forecast period in 2032.

Industrial Adhesives Market introduction

The industrial adhesives market encompasses a vast array of chemical formulations meticulously engineered to bond diverse materials in manufacturing, assembly, and construction processes. These specialized adhesives offer superior performance characteristics compared to traditional mechanical fasteners or welding, including enhanced structural integrity, improved aesthetics, weight reduction, and resistance to harsh environmental conditions such as temperature extremes, moisture, and chemicals. Their critical role extends across numerous heavy industries, where they are indispensable for creating durable, efficient, and innovative products. The versatility of modern industrial adhesives allows for their application in intricate designs and automated production lines, significantly contributing to the advancement of manufacturing techniques globally.

Product descriptions within this market range from high-strength structural adhesives like epoxies and polyurethanes, crucial for load-bearing applications, to flexible sealants and pressure-sensitive adhesives used in packaging and tapes. Major applications span a broad economic landscape, including automotive manufacturing for vehicle lightweighting and component assembly, the construction sector for flooring, roofing, and panel bonding, electronics assembly for miniaturization and thermal management, and robust packaging solutions for consumer goods. The continuous evolution of material science and engineering demands ever more sophisticated bonding agents capable of joining composite materials, advanced plastics, and specialized metals, driving ongoing research and development within the industry.

The primary benefits derived from using industrial adhesives include significant cost savings through optimized production processes, enhanced product performance and longevity, and the ability to achieve designs that are impossible with conventional fastening methods. These adhesives contribute to reduced assembly times, lower labor costs, and improved product aesthetics by eliminating visible fasteners. The market's robust growth is fundamentally driven by several overarching factors: increasing global industrial production, a persistent trend towards lightweighting in transportation and consumer goods, stringent regulatory requirements promoting sustainable and low-VOC adhesive solutions, and the accelerating pace of technological innovation that continually expands the scope and efficacy of adhesive applications across new industries and material combinations.

Industrial Adhesives Market Executive Summary

The industrial adhesives market is currently experiencing dynamic growth, propelled by several influential business trends that are reshaping global manufacturing landscapes. A significant driver is the relentless pursuit of efficiency and cost-effectiveness in production processes, leading industries to increasingly adopt advanced adhesive solutions that offer faster curing times, automated application capabilities, and reduced labor requirements. Furthermore, the global push towards sustainability has catalyzed demand for eco-friendly formulations, including bio-based, solvent-free, and low-VOC (Volatile Organic Compound) adhesives, aligning with stricter environmental regulations and corporate responsibility initiatives. The burgeoning e-commerce sector also plays a pivotal role, driving innovations in packaging adhesives that ensure product integrity and presentability during transit, while the electronics industry continuously demands specialized adhesives for miniaturization and thermal management of sophisticated devices.

Regionally, the market exhibits varied growth patterns with distinct opportunities and challenges. The Asia Pacific region stands out as the primary growth engine, fueled by rapid industrialization, expanding manufacturing bases, and significant investments in infrastructure development, particularly in emerging economies such as China, India, and Southeast Asian nations. North America and Europe, while more mature, maintain steady growth, characterized by a strong focus on high-performance specialty adhesives, advanced R&D, and the adoption of smart manufacturing technologies within sectors like automotive, aerospace, and construction. Latin America and the Middle East & Africa are emerging as promising markets, driven by urbanization, increasing industrial output, and diversification of economic activities, creating new avenues for adhesive applications in construction and general manufacturing.

Segmentation trends within the industrial adhesives market highlight a clear shift towards high-performance and specialty adhesive products that cater to specific, demanding applications. Reactive adhesives, including epoxies, polyurethanes, and cyanoacrylates, are gaining prominence due to their superior bonding strength, durability, and versatility across complex substrates and harsh operating conditions. Similarly, hot-melt adhesives are witnessing innovation, with formulations offering enhanced thermal resistance and faster processing speeds, making them ideal for high-volume production lines. The end-use industry analysis reveals sustained strong demand from the automotive sector for lightweighting, the construction industry for durable and weather-resistant bonding, and the electronics sector for precision bonding and thermal management. This granular segmentation underscores the market's adaptability and responsiveness to specialized industrial requirements, fostering continuous product diversification and technological advancements across all major categories.

AI Impact Analysis on Industrial Adhesives Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the industrial adhesives market primarily center on its transformative potential across the entire product lifecycle, from initial material discovery and formulation to manufacturing optimization, application, and even supply chain management. Common questions explore how AI can accelerate the development of novel adhesive compounds with precisely tailored properties, predicting material interactions and performance characteristics more efficiently than traditional empirical methods. There is significant interest in AI's role in enhancing manufacturing process control, ensuring consistent quality, and minimizing waste through predictive analytics and real-time adjustments. Furthermore, users often inquire about AI-driven solutions for optimizing adhesive application systems, improving precision, and facilitating automation on production lines. These questions collectively underscore a strong anticipation for AI to usher in a new era of innovation, efficiency, and sustainability within the industrial adhesives sector.

The integration of AI and machine learning algorithms is poised to revolutionize the industrial adhesives market by providing unprecedented capabilities for data analysis and decision-making. In research and development, AI can rapidly screen vast databases of chemical structures and material properties, identifying potential candidates for new adhesive formulations that meet specific performance criteria, such as enhanced strength, flexibility, or temperature resistance. This predictive capability significantly reduces the time and cost associated with traditional trial-and-error experimentation. Moreover, AI algorithms can analyze complex simulation data to optimize molecular structures and predict long-term durability under various environmental stresses, leading to the creation of more robust and reliable adhesive products tailored for demanding industrial applications. This proactive approach to material science will accelerate the pace of innovation, bringing next-generation adhesives to market faster.

Beyond product development, AI is set to profoundly impact manufacturing and operational efficiency within the adhesives industry. AI-powered sensors and analytics can monitor production lines in real-time, detecting anomalies, predicting equipment failures, and optimizing process parameters such as temperature, pressure, and mixing ratios to ensure consistent product quality and maximize yield. This predictive maintenance and process optimization capability reduces downtime, lowers operational costs, and minimizes material waste, contributing significantly to sustainability goals. Furthermore, in application, AI can integrate with robotic dispensing systems to achieve unprecedented levels of precision and speed, adapting to variations in substrate geometry and environmental conditions. Supply chain logistics will also benefit from AI-driven forecasting and optimization, leading to more efficient raw material procurement, inventory management, and distribution networks, thereby enhancing overall market responsiveness and resilience.

- AI-driven material informatics accelerates the discovery and formulation of new adhesive compounds.

- Predictive analytics optimizes manufacturing processes, leading to reduced waste and improved consistency.

- AI-powered quality control systems enhance detection of defects and ensure product performance.

- Machine learning algorithms enable smarter inventory management and optimized supply chain logistics.

- Robotics integrated with AI enhance precision and speed in adhesive dispensing and application.

- AI assists in predicting adhesive performance under varied stress conditions, improving product reliability.

- Personalized adhesive solutions can be developed faster through AI analysis of client-specific requirements.

- Market forecasting and trend analysis become more accurate with AI-driven data processing.

DRO & Impact Forces Of Industrial Adhesives Market

The industrial adhesives market is shaped by a confluence of potent Drivers, Restraints, and Opportunities (DRO), along with broader Impact Forces that dictate its growth trajectory and competitive landscape. Key drivers include the ever-increasing demand for lightweight materials in industries such as automotive and aerospace, where adhesives replace heavier mechanical fasteners to improve fuel efficiency and performance. Rapid urbanization and infrastructure development globally are bolstering demand from the construction sector for durable and efficient bonding solutions. Furthermore, the miniaturization trend in electronics necessitates highly specialized adhesives for component assembly and thermal management, while the expansion of the e-commerce sector fuels demand for high-performance packaging adhesives that ensure product integrity during shipping. Continuous advancements in adhesive technology, yielding products with enhanced strength, flexibility, and environmental resistance, also act as significant market catalysts.

However, the market faces several notable restraints. Volatility in the prices of key raw materials, such as crude oil derivatives (for synthetic polymers) and specialty chemicals, can significantly impact manufacturing costs and profit margins. Stringent environmental regulations, particularly regarding the emission of Volatile Organic Compounds (VOCs) and the use of certain hazardous substances, compel manufacturers to invest heavily in R&D for more sustainable and compliant formulations, which can be costly and time-consuming. The technical complexity involved in bonding dissimilar materials and achieving optimal adhesion under diverse operating conditions also presents a challenge, requiring specialized expertise and sometimes limiting broader adoption. Moreover, the long curing times associated with some high-performance adhesives can slow down production processes, creating a bottleneck for efficiency-driven industries.

Despite these restraints, abundant opportunities exist for market expansion and innovation. The burgeoning demand for bio-based and sustainable adhesives, driven by consumer preference and regulatory pressures, offers a lucrative avenue for product development and market penetration. Untapped potential in emerging economies, characterized by growing manufacturing sectors and expanding consumer bases, presents significant growth prospects for global players. The increasing adoption of smart adhesives capable of self-healing, sensing, or conducting electricity opens new application frontiers in advanced electronics and specialized industrial contexts. Furthermore, strategic collaborations and mergers & acquisitions among key players can facilitate technological exchange and broaden market reach. These dynamic forces, alongside global economic stability, geopolitical shifts, and rapid material science innovations, collectively exert a profound impact on the industrial adhesives market, shaping investment decisions, product development strategies, and competitive positioning across the value chain.

Segmentation Analysis

The industrial adhesives market is meticulously segmented across various critical dimensions, providing a comprehensive framework for understanding its intricate dynamics and diverse application landscape. This granular classification allows stakeholders to identify specific growth areas, assess competitive intensity, and tailor product development strategies to meet precise industry demands. Segmentation is typically performed by product type, technology, end-use industry, and resin type, each category highlighting distinct performance attributes and market requirements. This approach ensures that the vast array of adhesive formulations, from general-purpose bonding agents to highly specialized compounds, are systematically categorized to reflect their intended use and chemical composition. The nuanced understanding derived from this segmentation is crucial for strategic planning and market entry decisions across the globe.

Within each primary segmentation, further sub-segments offer deeper insights into market trends and technological shifts. For instance, classifying by technology reveals the dominance and growth rates of acrylic, epoxy, polyurethane, and silicone-based adhesives, each possessing unique characteristics like strength, flexibility, and environmental resistance. Similarly, segmenting by end-use industry highlights the critical roles adhesives play in automotive assembly, packaging integrity, construction longevity, and electronics miniaturization, showcasing how adhesive properties are customized to specific industrial challenges. This detailed breakdown facilitates a more precise analysis of demand drivers, regional consumption patterns, and the competitive landscape, making it possible to identify niche markets and emerging opportunities within the broader industrial adhesives sector.

- By Product Type:

- Water-based: Emulsion, dispersion adhesives. Used in packaging, woodworking, construction.

- Solvent-based: Solutions of polymers in organic solvents. High strength, fast drying, used in automotive, footwear.

- Hot-melt: Thermoplastic polymers applied molten. Rapid set, used in packaging, nonwovens, woodworking.

- Reactive: Curing by chemical reaction (e.g., polyurethanes, epoxies, cyanoacrylates). High performance, structural bonding.

- Pressure-sensitive: Form permanent bond when slight pressure is applied. Tapes, labels, graphic films.

- By Technology:

- Acrylic: Versatile, good adhesion to plastics, metals. Used in automotive, construction, medical.

- Epoxy: High strength, chemical & heat resistance. Structural bonding in aerospace, construction, electronics.

- Polyurethane: Flexible, good adhesion to diverse substrates. Used in construction, automotive, footwear.

- Cyanoacrylate (Super Glue): Fast curing, strong bond for small surfaces. Used in electronics, medical, MRO.

- Silicone: High temperature and weather resistance, flexibility. Used in electronics, automotive sealing, construction.

- Vinyl: Polyvinyl acetate (PVA), ethylene vinyl acetate (EVA). Used in woodworking, packaging, paper.

- Styrenic Block Copolymers (SBC): Used in pressure-sensitive tapes and labels.

- Polyamide: High temperature, chemical resistance. Used in automotive, electrical.

- By End-Use Industry:

- Automotive & Transportation: Lightweighting, structural bonding, interior & exterior assembly.

- Packaging: Food & beverage packaging, flexible packaging, corrugated boxes.

- Construction: Flooring, roofing, wall panels, insulation, windows, doors.

- Electronics: Component bonding, thermal management, circuit board assembly, display bonding.

- Woodworking: Furniture, cabinetry, laminate, plywood, parquet.

- Medical: Disposable medical devices, surgical drapes, wound care, drug delivery systems.

- Aerospace: Structural bonding, interior components, lightweighting.

- General Industrial: Appliance assembly, sporting goods, textiles, marine.

- By Resin Type:

- Synthetic: Acrylic, Epoxy, Polyurethane, Cyanoacrylate, Silicone, Vinyl, Polyamide, etc. Dominant for high-performance needs.

- Natural: Starch, Dextrin, Protein, Animal Glues. Used in paper, packaging, woodworking for traditional applications.

Value Chain Analysis For Industrial Adhesives Market

The industrial adhesives market's value chain is a complex ecosystem beginning with upstream raw material sourcing and extending through manufacturing, distribution, and end-user application. Upstream analysis involves the procurement of diverse chemical feedstocks and additives from petrochemical companies, specialty chemical manufacturers, and natural product suppliers. These critical raw materials include various polymers (e.g., acrylics, epoxies, polyurethanes, silicones), resins, tackifiers, solvents, and performance-enhancing additives such as catalysts, stabilizers, and fillers. The quality and availability of these components directly impact the final adhesive product's performance, cost, and environmental profile. Raw material suppliers play a crucial role in innovation, often collaborating with adhesive manufacturers to develop advanced formulations with improved properties and sustainability attributes.

Midstream activities primarily encompass the sophisticated manufacturing processes employed by adhesive producers. This involves complex chemical synthesis, compounding, and blending of raw materials to create a wide array of adhesive products, each tailored for specific industrial applications. Manufacturers invest heavily in research and development to formulate adhesives that meet stringent performance requirements, environmental regulations, and application method compatibility (e.g., spray, roller, bead, robotic dispensing). Quality control, formulation optimization, and efficient production scale-up are paramount in this stage to ensure product consistency, reliability, and cost-effectiveness. This phase also involves packaging adhesives into various formats, from bulk containers to cartridges, suitable for industrial use.

Downstream analysis focuses on the distribution channels and the ultimate consumption by end-users. Industrial adhesives are distributed through a multifaceted network that includes direct sales forces for large-volume industrial clients (e.g., major automotive OEMs, aerospace manufacturers), a wide array of specialized distributors and resellers who cater to small and medium-sized enterprises (SMEs) and specific regional markets, and increasingly, through online platforms and e-commerce channels. Direct distribution allows for customized service, technical support, and strong client relationships, while indirect channels provide broader market reach and efficient logistics for diverse customer bases. The end-users, spanning industries like automotive, construction, electronics, and packaging, then apply these adhesives in their manufacturing and assembly processes, often requiring technical support and specialized equipment to achieve optimal bonding performance. The effectiveness of the distribution network and the provision of adequate technical support are crucial for market penetration and sustained customer satisfaction.

Industrial Adhesives Market Potential Customers

The potential customers for industrial adhesives represent a vast and diverse spectrum of manufacturing and assembly industries that rely on advanced bonding solutions to create, enhance, or repair their products. These customers are typically original equipment manufacturers (OEMs), Tier 1 and Tier 2 suppliers, and specialized contractors across a multitude of sectors, all seeking robust, reliable, and efficient bonding alternatives to traditional mechanical fastening methods or welding. Key decision-makers within these organizations include R&D engineers who specify adhesive properties for new designs, production managers focused on optimizing assembly lines and improving throughput, procurement officers responsible for sourcing cost-effective and compliant materials, and quality assurance teams ensuring product integrity and performance. Their purchasing decisions are critically influenced by factors such as adhesive strength, durability, application speed, material compatibility, environmental resistance, cost-effectiveness, and compliance with industry-specific regulations.

End-users and buyers in this market encompass a wide range of industries, each with unique adhesive requirements. For instance, the automotive and transportation sectors are major consumers, using adhesives for structural bonding, interior trim assembly, and lightweighting initiatives to improve fuel efficiency and safety. The construction industry utilizes adhesives for flooring, roofing, paneling, insulation, and sealing applications, demanding products with excellent weather resistance and long-term durability. In the electronics sector, manufacturers require precision adhesives for bonding delicate components, encapsulating circuitry, and managing thermal dissipation in smartphones, tablets, and advanced electronic devices. The packaging industry relies on high-speed, food-safe adhesives for flexible packaging, corrugated boxes, and labels to ensure product protection and brand presentation. Furthermore, industries like woodworking, medical devices, aerospace, and general industrial assembly consistently seek innovative adhesive solutions tailored to their specific materials and operational challenges, underscoring the broad applicability and indispensable nature of industrial adhesives across modern manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 55.3 Billion |

| Market Forecast in 2032 | USD 81.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, Arkema (Bostik), DuPont de Nemours, Inc., Ashland Global Holdings Inc., BASF SE, Huntsman Corporation, Dow Inc., Wacker Chemie AG, Jowat SE, Avery Dennison Corporation, RPM International Inc., Franklin International, ITW Performance Polymers, Lord Corporation, Pidilite Industries Ltd., Delo Industrie Klebstoffe GmbH & Co. KGaA, Permabond Engineering Adhesives |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Adhesives Market Key Technology Landscape

The industrial adhesives market is defined by a dynamic and evolving technology landscape, continuously driven by the imperative to improve performance, enhance sustainability, and optimize application efficiency across diverse industrial sectors. A significant aspect of this landscape involves advancements in polymer chemistry, leading to the development of high-performance structural adhesives such as advanced epoxies, polyurethanes, and acrylics. These formulations offer superior shear and tensile strength, excellent resistance to environmental factors (e.g., moisture, temperature, chemicals), and the ability to bond dissimilar substrates, making them indispensable for critical applications in automotive, aerospace, and construction. Innovations in toughening agents and flexibilizers are further enhancing the durability and impact resistance of these high-strength adhesives, expanding their utility in demanding environments.

Another pivotal area of technological focus is the development of more sustainable and environmentally friendly adhesive solutions. This includes the widespread adoption of water-based adhesives, which significantly reduce VOC emissions and improve workplace safety compared to traditional solvent-based counterparts. Similarly, solvent-free technologies, such as reactive hot melts and 100% solids formulations, are gaining traction due to their minimal environmental impact and high-performance characteristics. UV-curable and electron beam (EB) curable adhesives represent a rapidly growing segment, offering instant curing capabilities, reduced energy consumption, and high throughput, particularly advantageous in high-volume manufacturing processes for electronics, medical devices, and graphic arts. These technologies address regulatory pressures and consumer demand for greener products.

Beyond traditional formulations, the market is witnessing the emergence of advanced functional adhesives incorporating smart materials and nanotechnology. This includes the development of electrically conductive adhesives for electronics, which replace solder in sensitive applications, and thermally conductive adhesives for efficient heat dissipation in LED lighting and microelectronics. Self-healing adhesives, capable of repairing micro-cracks and extending product lifespan, are an exciting area of research and development. Furthermore, advancements in robotic dispensing systems and automated application technologies are enhancing the precision, speed, and consistency of adhesive application on production lines, contributing to higher manufacturing efficiency and reduced material waste. These integrated technological innovations collectively underscore the market's trajectory towards smarter, more sustainable, and high-performance bonding solutions, continually pushing the boundaries of material science and engineering.

Regional Highlights

- North America: A mature market driven by innovation in automotive, aerospace, and electronics sectors, with increasing demand for sustainable and high-performance adhesive solutions. Strong R&D capabilities and a focus on advanced manufacturing processes characterize this region.

- Europe: Emphasizes robust R&D for high-performance and eco-friendly adhesives, particularly in the construction and automotive industries. Strict environmental regulations significantly influence product development towards low-VOC and sustainable formulations.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, expanding manufacturing bases in countries like China, India, Japan, and South Korea. Significant demand stems from packaging, automotive, construction, and electronics industries due to economic growth and infrastructure development.

- Latin America: An emerging market presenting considerable growth opportunities, driven by increasing investments in infrastructure projects, a growing automotive production base, and general industrial expansion across countries such as Brazil and Mexico.

- Middle East & Africa (MEA): Growth is propelled by large-scale construction and infrastructure development projects, alongside efforts to diversify industrial sectors. This leads to increased adoption of advanced bonding solutions in various applications, from oil & gas to consumer goods manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Adhesives Market.- 3M Company

- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- Arkema (Bostik)

- DuPont de Nemours, Inc.

- Ashland Global Holdings Inc.

- BASF SE

- Huntsman Corporation

- Dow Inc.

- Wacker Chemie AG

- Jowat SE

- Avery Dennison Corporation

- RPM International Inc.

- Franklin International

- ITW Performance Polymers

- Lord Corporation

- Pidilite Industries Ltd.

- Delo Industrie Klebstoffe GmbH & Co. KGaA

- Permabond Engineering Adhesives

Frequently Asked Questions

What are the primary types of industrial adhesives?

Industrial adhesives broadly categorize into water-based, solvent-based, hot-melt, reactive, and pressure-sensitive types, each suited for different applications and materials based on their unique chemical compositions and curing mechanisms.

Which end-use industries are the largest consumers of industrial adhesives?

The automotive, packaging, construction, and electronics industries are among the largest consumers, extensively utilizing industrial adhesives for assembly, structural bonding, sealing, and lightweighting across their diverse product lines.

What are the key drivers for growth in the industrial adhesives market?

Growth is primarily driven by the increasing demand for lightweight and high-performance materials, advancements in manufacturing automation, stringent environmental regulations promoting sustainable solutions, and expanding applications in electronics and packaging sectors.

What challenges does the industrial adhesives market face?

Challenges include fluctuating raw material prices, complex regulatory landscapes regarding VOC emissions, the technical difficulty of bonding diverse and specialized substrates, and the need for ongoing R&D to meet evolving industrial demands.

How is sustainability impacting industrial adhesive development?

Sustainability is profoundly impacting the market by driving intense focus on the development of bio-based, solvent-free, and low-VOC adhesive formulations, aiming to reduce environmental footprint and improve worker safety in manufacturing processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager