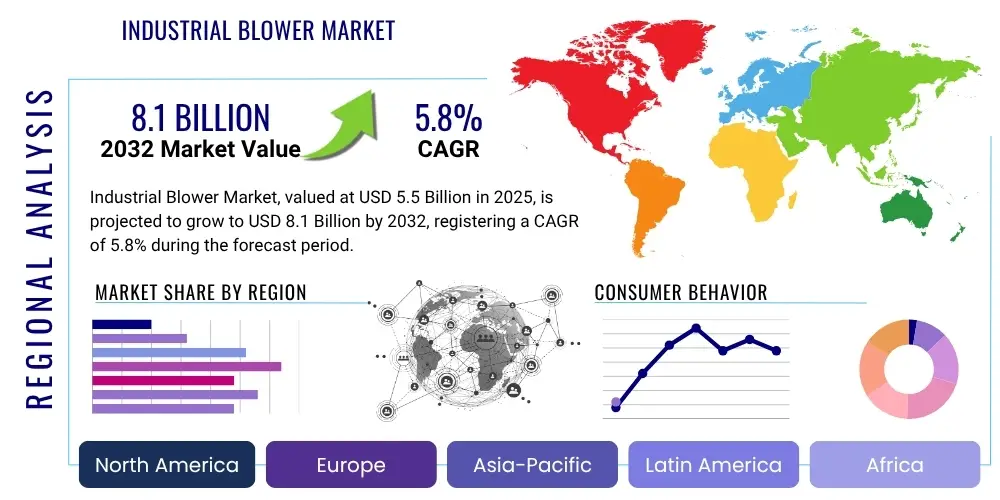

Industrial Blower Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429283 | Date : Oct, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Blower Market Size

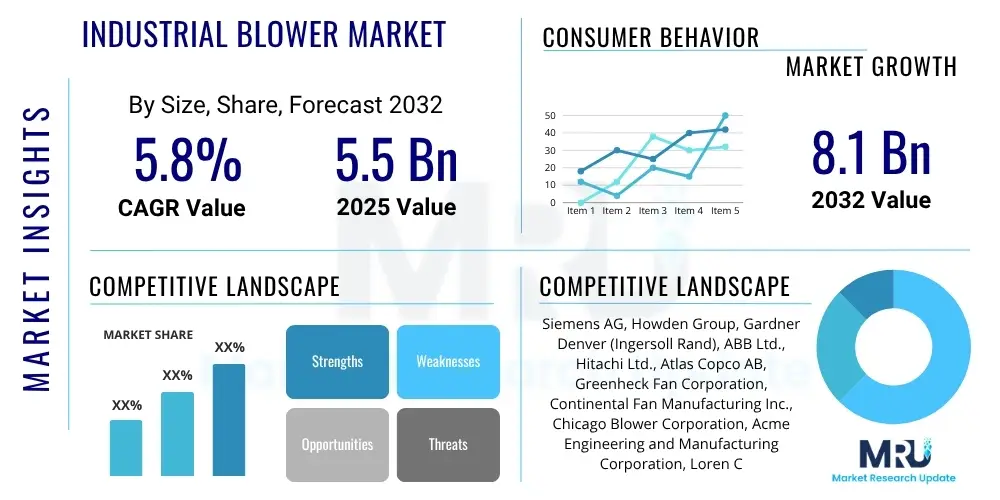

The Industrial Blower Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 5.5 Billion in 2025 and is projected to reach USD 8.1 Billion by the end of the forecast period in 2032. This substantial growth trajectory is primarily driven by the continuous expansion of industrial infrastructure across developing economies, coupled with significant investments in upgrading and modernizing existing manufacturing facilities in mature markets. The increasing global emphasis on energy efficiency and sustainable operational practices compels industries to adopt advanced blower systems that offer superior performance with reduced power consumption. Furthermore, evolving environmental regulations, especially those related to air quality control and pollution abatement, mandate the implementation of effective air and gas handling solutions, thereby consistently fueling demand for industrial blowers across various processing and manufacturing sectors. The market's resilience is also attributed to its critical role in maintaining optimal operational conditions and ensuring safety across a multitude of industrial applications.

Industrial Blower Market introduction

Industrial blowers are indispensable mechanical devices engineered to move considerable volumes of air or other gases against resistance, serving a critical role in a wide spectrum of industrial applications. These vital components are fundamental to maintaining controlled atmospheric conditions, facilitating process efficiency, and ensuring a safe working environment within diverse industrial settings. Their operational principles vary, encompassing different designs such as centrifugal, axial, and positive displacement blowers, each specifically engineered to address distinct airflow, pressure, and volume requirements. The product range includes low-pressure, high-volume units for ventilation and cooling, as well as high-pressure, lower-volume blowers essential for pneumatic conveying and combustion processes, highlighting their versatility and application-specific nature across industries.

The major applications of industrial blowers span across virtually all manufacturing, processing, and infrastructure sectors. They are extensively utilized in HVAC systems for large commercial and industrial complexes to regulate air quality and temperature, in power generation plants for boiler draft and flue gas desulfurization, and in the chemical industry for material transport, fume extraction, and reactor cooling. Furthermore, they are crucial in wastewater treatment for aeration, in mining operations for subterranean ventilation and dust control, and in the food and beverage industry for drying, cooling, and ingredient conveying. These diverse applications underscore the foundational importance of industrial blowers in modern industrial ecosystems, supporting critical operational functions and contributing significantly to overall productivity and operational integrity.

The benefits derived from deploying advanced industrial blowers are manifold, including enhanced energy efficiency through optimized designs and motor integration, leading to substantial reductions in operational costs and carbon footprint. They improve air quality by effectively removing pollutants, dust, and fumes, thereby ensuring a healthier and safer work environment compliant with occupational health standards. Industrial blowers contribute significantly to process optimization by providing precise control over airflow and pressure, which is vital for consistency and quality in manufacturing. The market's sustained growth is further driven by the accelerating pace of global industrialization, particularly in emerging economies, alongside a pervasive global emphasis on energy conservation and increasingly stringent environmental protection regulations that necessitate efficient and reliable air handling solutions across all industrial segments.

Industrial Blower Market Executive Summary

The Industrial Blower Market is currently navigating a dynamic landscape characterized by several pivotal business trends, notably the pervasive drive towards automation, the increasing demand for energy-efficient solutions, and a growing emphasis on sustainability within industrial operations. Manufacturers are increasingly integrating advanced control systems and sensors into blowers, enabling them to become integral components of smart factories and Industrial Internet of Things (IIoT) ecosystems. This shift allows for real-time monitoring, remote diagnostics, and predictive maintenance capabilities, which collectively aim to minimize operational downtime, enhance overall equipment effectiveness (OEE), and significantly reduce operational expenditures. The market is also responding to the need for customized and application-specific blower solutions that can seamlessly adapt to diverse and evolving industrial processes, from high-temperature environments to corrosive atmospheres, thereby maximizing performance and reliability.

Regional trends indicate that Asia Pacific continues to be the primary engine of growth for the industrial blower market, driven by unparalleled rates of industrialization, extensive infrastructure development projects, and the establishment of new manufacturing hubs, particularly in countries such as China, India, and across Southeast Asia. These regions are witnessing massive investments in power generation, chemical processing, and wastewater treatment, all of which require substantial blower installations. In contrast, mature markets in North America and Europe are experiencing growth largely through the replacement of legacy systems with technologically superior, energy-efficient models. This trend is reinforced by stringent environmental regulations and a strong corporate commitment to reducing energy consumption and carbon emissions. Emerging markets in Latin America and the Middle East & Africa are also presenting promising opportunities, fueled by diversification efforts, urbanization, and investments in industrial and resource processing sectors, thereby broadening the global demand base.

Segmentation trends within the market highlight the continued dominance of centrifugal blowers due to their broad applicability, versatility, and efficiency across a wide range of pressure and volume requirements. However, positive displacement and axial blowers maintain strong positions in specialized niche applications where specific performance characteristics are paramount. From an end-use perspective, sectors such as HVAC, power generation, chemical processing, and wastewater treatment remain the largest consumers, primarily due to the critical and continuous need for air and gas handling in their core operations. There is a discernible trend towards higher performance, greater reliability, and lower total cost of ownership (TCO) across all segments, pushing manufacturers to innovate in areas like materials science, aerodynamic design, and intelligent control systems. This demand for sophisticated, tailored solutions underscores the market's evolution towards more advanced and integrated industrial equipment.

AI Impact Analysis on Industrial Blower Market

The integration of Artificial Intelligence (AI) is fundamentally transforming the Industrial Blower Market by addressing critical user questions related to operational efficiency, predictive maintenance, and energy management, which are paramount concerns for industrial operators. Users are increasingly seeking solutions that can proactively minimize unexpected downtime, optimize blower performance under dynamically varying loads, and substantially reduce the considerable energy expenditures inherent in continuous industrial operations. The primary focus of these inquiries revolves around leveraging AI-driven analytics for smart condition monitoring, accurate fault detection, and real-time operational adjustments. This paradigm shift signifies a move from traditional, reactive maintenance protocols to sophisticated, data-driven proactive strategies, promising enhanced reliability, increased operational lifespan, and improved sustainability across all industrial applications where blowers are employed.

Key themes consistently emerging from common user questions emphasize the application of advanced machine learning algorithms to meticulously analyze vast datasets generated by blower operations. These datasets include real-time metrics such as vibration levels, temperature fluctuations, pressure differentials, airflow rates, and motor current draws. By identifying intricate patterns and anomalies within this data, AI systems can accurately predict potential equipment malfunctions or impending failures long before they manifest, enabling maintenance teams to schedule interventions proactively. This foresight not only prevents costly and disruptive unplanned outages but also facilitates optimal resource allocation for maintenance activities and extends the operational longevity of critical blower assets. The ability to forecast and prevent failures is a significant value proposition that AI brings to the industrial blower domain, directly addressing user demands for enhanced uptime and reliability.

Furthermore, the transformative influence of AI extends to optimizing the energy footprint of industrial blowers. Users anticipate that AI will enable intelligent energy management by dynamically adjusting blower speeds, pressures, and flow rates in precise alignment with real-time process demands and system requirements. This adaptive control capability ensures that blowers operate at their most efficient point, eliminating unnecessary energy waste during periods of low demand or fluctuating loads, thereby leading to substantial energy savings and a tangible reduction in greenhouse gas emissions. Ultimately, AI's profound impact is expected to evolve industrial blowers into highly intelligent, autonomous, and resilient assets, seamlessly integrated into broader Industrial IoT (IIoT) ecosystems. This evolution will empower them to contribute significantly to the ambitious productivity and sustainability objectives of modern manufacturing, power generation, chemical processing, and other heavy industrial plants worldwide, by offering unparalleled levels of control, efficiency, and operational insight.

- Predictive maintenance and advanced fault detection capabilities using machine learning algorithms to analyze operational data.

- Real-time optimization of blower performance, dynamically adjusting speed, pressure, and flow rates based on process demands.

- Significant reduction in energy consumption through intelligent load management, adaptive control, and identification of inefficient operating points.

- Enhanced operational efficiency, leading to minimized unplanned downtime and increased overall equipment effectiveness (OEE).

- Seamless integration with industrial IoT (IIoT) platforms for comprehensive system monitoring, data acquisition, and remote diagnostics.

- Improved operational safety by anticipating and mitigating potential equipment failures and ensuring stable process conditions.

- Generation of data-driven insights for improved asset management, maintenance scheduling, and extending equipment lifespan.

- Facilitation of autonomous operation and self-regulation of blower systems in response to changing environmental or process variables.

- Optimization of lubrication schedules and component replacement cycles based on actual usage and wear patterns.

DRO & Impact Forces Of Industrial Blower Market

The Industrial Blower Market is intricately shaped by a confluence of drivers, restraints, opportunities, and broader competitive and economic impact forces. Key drivers propelling market expansion include the accelerating pace of global industrialization, particularly evident in rapidly developing economies, which necessitates the establishment of new manufacturing facilities and critical infrastructure projects requiring extensive air and gas handling solutions. Concurrently, the increasing global imperative for energy efficiency and sustainable operational practices is driving widespread adoption of advanced, high-performance blowers that offer superior energy consumption profiles and reduced environmental footprints. Furthermore, stringent environmental regulations worldwide, focusing on air quality control, dust collection, and emission reduction, mandate the implementation of efficient ventilation and processing systems, thereby consistently stimulating demand for industrial blowers capable of meeting these evolving compliance standards. The growing trend of automation and digitalization across various industries also acts as a significant driver, as modern blowers are increasingly designed for seamless integration into smart factory environments, enhancing their appeal and market growth.

However, the market's growth trajectory is tempered by several significant restraints. A primary impediment is the often-substantial initial capital investment required for purchasing and installing industrial blowers, especially for large-scale, specialized, or custom-engineered units, which can be a barrier for small and medium-sized enterprises (SMEs) with limited capital budgets. Price volatility and supply chain disruptions affecting key raw materials such as steel, aluminum, and various specialized alloys directly influence manufacturing costs, subsequently impacting the final product pricing and market competitiveness. Additionally, the intensive maintenance requirements of certain complex blower types, coupled with the potential for technological obsolescence as newer, more efficient designs emerge, pose challenges. The inherent complexity of accurately integrating blowers into diverse industrial processes and the need for highly specialized engineering expertise during installation and commissioning also contribute to market friction, sometimes deterring rapid adoption or expansion.

Despite these challenges, the Industrial Blower Market presents numerous compelling opportunities for sustained growth and innovation. The burgeoning demand for highly customized blower solutions, meticulously engineered to meet the unique and specific operational requirements of niche industrial applications, offers a significant avenue for manufacturers to differentiate their offerings and capture premium market segments. The continuous and rapid evolution of IoT and AI technologies provides unprecedented prospects for developing intelligent, connected blowers equipped with advanced predictive maintenance capabilities, sophisticated energy management systems, and enhanced remote monitoring functionalities, leading to superior operational efficiency. Moreover, strategic expansion into untapped geographical markets, particularly those undergoing significant industrial development, alongside the research and development of blowers utilizing advanced materials for improved durability, lighter weight, and heightened efficiency in challenging environments, represents lucrative long-term growth opportunities. The broader impact forces, encompassing intense competitive rivalry among established market leaders and agile new entrants, the growing bargaining power of industrial buyers driven by performance expectations and total cost of ownership considerations, and the constant threat of substitute technologies or disruptive innovations, continually shape market dynamics and necessitate adaptive strategic responses from all market participants.

Segmentation Analysis

The Industrial Blower Market is rigorously segmented across multiple critical dimensions, providing a comprehensive framework for understanding its intricate structure, diverse demand patterns, and distinct growth opportunities within various niches. These meticulously defined segmentations enable market participants to conduct granular analyses of market demand based on specific product characteristics, functional applications, end-user industry requirements, and geographical economic landscapes. Such detailed segmentation is indispensable for identifying underserved market segments, developing highly targeted product portfolios, and formulating robust, data-driven market entry and expansion strategies. The fundamental necessity for industrial operations to precisely control airflow and gas movement mandates a broad array of blower types, each inherently designed to fulfill highly specific functional prerequisites and operational performance criteria across an expansive spectrum of industrial environments.

A primary axis of segmentation is by type, which distinctly categorizes blowers into centrifugal, positive displacement, and axial flow variants. Centrifugal blowers, characterized by their radial airflow, are highly versatile and widely adopted for applications requiring moderate to high pressures and varying flow rates. Positive displacement blowers, such as rotary lobe or screw blowers, are specifically engineered for applications demanding constant volume flows against high differential pressures, often used in pneumatic conveying or aeration. Axial flow blowers, conversely, are optimized for moving large volumes of air or gas at lower pressures, commonly found in ventilation and cooling systems. This type-based differentiation highlights the technological diversity and specialized engineering inherent in the market, allowing end-users to select the optimal blower for their specific operational demands. Furthermore, segmenting by application elucidates the critical functional roles blowers play, encompassing essential processes like combustion air supply, industrial drying, general ventilation, material handling through pneumatic systems, precision cooling, and critical dust collection, showcasing their indispensable nature across core industrial operations.

The segmentation by end-use industry further accentuates the widespread and fundamental reliance of various economic sectors on industrial blowers. Key sectors include the chemical industry, where blowers are vital for fume extraction, material transfer, and process cooling; the power generation sector, utilizing blowers for boiler combustion, induced draft, and flue gas desulfurization systems; and the expansive HVAC industry, requiring blowers for large-scale air circulation and conditioning in commercial and industrial buildings. Other significant end-users comprise the food & beverage industry for drying and conveying, mining operations for ventilation and safety, wastewater treatment plants for aeration processes, the pulp & paper industry for drying and material handling, oil & gas for process air, automotive for paint booths and component drying, and pharmaceuticals for cleanroom ventilation and precise process air. These multifaceted segmentations collectively paint a holistic and nuanced picture of the industrial blower market's structure, revealing its profound interconnectedness with global industrial output and its continuous evolution driven by technological advancements and specific industry demands.

- By Type:

- Centrifugal Blower (Radial Blade, Forward-Curved, Backward-Inclined)

- Positive Displacement Blower (Rotary Lobe, Rotary Screw, Regenerative)

- Axial Flow Blower (Tubeaxial, Vaneaxial, Propeller)

- By Application:

- Combustion Air Supply

- Drying and Cooling

- Industrial Ventilation

- Material Handling (Pneumatic Conveying)

- Dust Collection and Fume Extraction

- Aeration (Wastewater Treatment)

- HVAC Systems

- Process Air/Gas Supply

- By End-Use Industry:

- Chemical & Petrochemical

- Power Generation

- HVAC (Commercial & Industrial)

- Food & Beverage Processing

- Mining & Metals

- Wastewater Treatment

- Pulp & Paper

- Oil & Gas

- Automotive & Transportation

- Pharmaceuticals & Life Sciences

- Textiles

- Electronics Manufacturing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Industrial Blower Market

The value chain for the Industrial Blower Market is a comprehensive sequence of interconnected activities, each adding distinct value to the final product and service offering, from the conceptualization stage through to post-sales support and eventual end-of-life considerations. The upstream segment of the value chain is primarily focused on the meticulous procurement of raw materials and essential components. This involves sourcing high-quality metals such as various grades of steel, aluminum, and cast iron for casings and impellers, alongside specialized materials for bearings, seals, and noise attenuation. Crucial components like electric motors, variable frequency drives (VFDs), sophisticated control systems, and sensors are procured from a global network of specialized suppliers. The strategic importance of this stage lies in ensuring material quality, cost-effectiveness, and supply chain reliability, which directly influence the performance, durability, and final pricing of industrial blowers. Innovation in raw material science and component technology at this initial stage profoundly impacts the subsequent manufacturing processes and the overall competitiveness of the finished product in the market.

Midstream activities encompass the core processes of research and development, design engineering, manufacturing, assembly, and rigorous quality control. This phase demands substantial investment in R&D to develop advanced aerodynamic designs that maximize efficiency and minimize noise, utilizing cutting-edge computational fluid dynamics (CFD) and finite element analysis (FEA) software. Precision manufacturing processes, including CNC machining, welding, and balancing, are critical to ensuring the structural integrity, optimal performance, and longevity of the blowers. Assembly lines are often configured for modular production, allowing for customization to meet specific client requirements regarding capacity, pressure, and environmental conditions. Stringent quality assurance protocols, involving performance testing, vibration analysis, and acoustic measurements, are implemented at various stages to ensure compliance with international standards and customer specifications. Effective production planning and lean manufacturing principles are paramount here to achieve cost efficiencies, reduce lead times, and maintain high product quality, thereby securing a competitive advantage for blower manufacturers in a demanding global market.

The downstream segment of the value chain focuses intensely on market access, distribution, sales, installation, and comprehensive after-sales support services, which are pivotal for customer satisfaction and long-term market penetration. Distribution typically occurs through a multifaceted approach, combining direct sales channels for large industrial clients and bespoke project installations with an extensive network of specialized distributors, value-added resellers, and system integrators for broader market reach. Direct sales allow manufacturers to offer deep technical expertise and tailored solutions, fostering strong client relationships. Indirect channels leverage regional partners for localized service, quicker delivery, and enhanced market penetration, particularly in diverse geographical landscapes. Installation and commissioning services are often provided by manufacturers or certified partners to ensure correct setup and optimal performance. Furthermore, robust after-sales services, including preventative maintenance, on-demand repairs, spare parts supply, technical support, and performance monitoring, are crucial for maintaining customer loyalty, enhancing equipment reliability, and generating recurring revenue streams. The efficiency and reliability of these distribution and service channels are essential for effectively reaching potential customers and sustaining a strong presence in the highly competitive industrial blower market.

Industrial Blower Market Potential Customers

The industrial blower market serves an incredibly broad and diverse customer base, reflecting the fundamental and pervasive need for efficient air and gas movement across virtually every industrial and commercial sector. Potential customers are primarily organizations that require precise control over their environmental conditions, necessitate efficient material handling, or depend on specialized process ventilation or combustion air supply to uphold operational efficacy, adhere to stringent regulatory standards, and safeguard personnel. This extensive applicability ensures that demand for industrial blowers emanates from both heavy and light manufacturing industries, as well as critical infrastructure, processing plants, and various service sectors, making them an indispensable component in a wide array of economic activities globally. The nature of these customers often dictates specific requirements regarding blower capacity, pressure, material construction, and control integration, leading to a highly segmented demand profile.

Key segments of end-user/buyers include large-scale manufacturing facilities, exemplified by automotive assembly plants, where industrial blowers are critically employed for ventilation in paint booths, efficient drying of painted components, and fume extraction from welding areas. Chemical and petrochemical processing plants represent another significant customer segment, relying heavily on blowers for the pneumatic conveying of granular materials, efficient fume extraction from reaction vessels, and precise air supply for various chemical processes and reactor cooling. Power generation facilities, including thermal, nuclear, and waste-to-energy plants, are substantial consumers, utilizing blowers for crucial applications such as forced draft, induced draft for boilers, and efficient flue gas desulfurization systems to meet environmental emission standards. Furthermore, the expansive HVAC industry, particularly for large commercial buildings, data centers, and industrial complexes, constitutes a substantial customer base, integrating industrial blowers into sophisticated ventilation, air conditioning, and air purification systems to maintain optimal indoor air quality and temperature control.

Beyond these major sectors, the mining industry heavily procures robust, heavy-duty blowers for critical mine ventilation systems, ensuring breathable air and controlling hazardous gas accumulation in subterranean environments, as well as for dust suppression and material transport. Wastewater treatment plants depend significantly on high-efficiency blowers for aeration processes, which are fundamental to biological wastewater treatment and odor control. The food and beverage industry employs blowers for a variety of applications including drying processes for grains and snacks, cooling baked goods, and pneumatic conveying of ingredients and finished products, adhering to strict hygiene standards. Pharmaceutical manufacturing facilities utilize blowers for cleanroom ventilation, material drying, and controlled air supply in sterile processing environments, while the pulp & paper industry relies on them for drying processes and material handling. This broad and deep spectrum of industrial applications ensures a continuously robust, diversified, and resilient demand base for industrial blower manufacturers, requiring them to offer a wide range of specialized and standard products to cater to distinct customer needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 5.5 Billion |

| Market Forecast in 2032 | USD 8.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Howden Group, Gardner Denver (Ingersoll Rand), ABB Ltd., Hitachi Ltd., Atlas Copco AB, Greenheck Fan Corporation, Continental Fan Manufacturing Inc., Chicago Blower Corporation, Acme Engineering and Manufacturing Corporation, Loren Cook Company, Fl盲ktGroup, Twin City Fan Companies, Ltd., PennBarry, CECO Environmental, Cincinnati Fan, Air Control Industries, Inc., New York Blower Company, General Blower Company, Zhejiang Jieneng Compressor Manufacturing Co., Ltd., Soler & Palau Ventilation Group, Nidec Corporation, Dongguan BLOWER Co., Ltd., Robinson Fans, Inc., Tuthill Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Blower Market Key Technology Landscape

The Industrial Blower Market's technological landscape is undergoing a profound transformation, propelled by relentless innovation aimed at achieving higher operational efficiency, reducing environmental impact, and enabling seamless integration into advanced manufacturing and processing ecosystems. A cornerstone technology widely adopted is the Variable Frequency Drive (VFD), which allows for exceptionally precise control over the electric motor's speed, thereby optimizing blower output to match actual process demands and significantly curtailing energy consumption by avoiding unnecessary full-load operation. Alongside VFDs, the widespread integration of advanced motor designs, including highly efficient Permanent Magnet Synchronous Motors (PMSM) and Electronically Commutated (EC) motors, is becoming standard. These modern motors offer superior energy conversion efficiency, extended operational lifespans, and reduced heat generation compared to conventional induction motors, directly addressing the critical industry imperative for lower operating costs and adherence to increasingly stringent energy efficiency regulations globally.

Furthermore, the advent of the Industrial Internet of Things (IIoT) and sophisticated Artificial Intelligence (AI) solutions is revolutionizing blower monitoring, predictive maintenance, and overall operational intelligence. IIoT sensors are intrinsically integrated into modern blowers to continuously collect real-time data on a multitude of parameters, including vibration levels, bearing temperatures, motor current draw, static and differential pressures, and airflow rates. This voluminous data, when rigorously analyzed by advanced AI and machine learning algorithms, enables the early identification of subtle patterns indicative of impending mechanical failures, wear-and-tear, or suboptimal performance. This predictive capability empowers maintenance teams to proactively schedule interventions, replacing components or performing necessary adjustments before a critical breakdown occurs, thereby minimizing costly unplanned downtime, extending the operational lifespan of high-value equipment, and optimizing maintenance schedules through data-driven insights, which marks a significant departure from traditional reactive or time-based maintenance paradigms.

The ongoing development and adoption of advanced materials constitute another pivotal aspect shaping the technological evolution of industrial blowers. Manufacturers are actively exploring and implementing lightweight, high-strength, and highly corrosion-resistant composite materials and specialized alloys for the construction of impellers, casings, and other critical components. These material innovations contribute significantly to enhanced durability, particularly in highly corrosive, abrasive, or high-temperature operating environments, while also reducing the overall weight of the unit, potentially leading to easier installation and reduced structural requirements. Concurrently, significant advancements in noise reduction technologies are being implemented, including optimized aerodynamic impeller designs, sophisticated acoustic enclosures, and advanced vibration dampening systems, all aimed at complying with increasingly strict occupational health and safety regulations and improving working conditions. Moreover, the emerging application of digital twin technology, which creates a virtual replica of a physical blower system, is gaining considerable traction. This enables comprehensive simulation, continuous performance optimization, remote diagnostics, and lifecycle management, providing operators with unprecedented levels of control and insight, ultimately contributing to superior operational excellence and prolonged equipment performance across diverse industrial applications.

Regional Highlights

- North America: This region represents a mature yet dynamic market characterized by stringent environmental regulations, a pervasive emphasis on energy efficiency, and high adoption rates of advanced industrial technologies. Growth is primarily driven by the ongoing replacement and modernization of aging industrial infrastructure with technologically superior, smart, and energy-efficient blower systems. There's a strong focus on integrating IoT-enabled solutions for predictive maintenance and operational optimization across manufacturing, HVAC, and processing sectors, leading to steady demand for innovative products.

- Europe: The European industrial blower market demonstrates stable and consistent growth, significantly influenced by rigorous emission standards, ambitious sustainability initiatives, and substantial investments in industrial automation and Industry 4.0 paradigms. The demand landscape is robust, particularly for highly customized and exceptionally efficient blowers tailored for a wide array of process industries, including the chemical, automotive, food & beverage, and pharmaceutical sectors, where precision and reliability are paramount. Regulatory pressures for reduced noise pollution and enhanced energy performance continue to spur innovation.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, APAC's industrial blower market is propelled by unparalleled rates of industrialization, the rapid establishment of new manufacturing capabilities, extensive infrastructure development projects, and substantial foreign direct investment, particularly in economic powerhouses like China, India, Japan, South Korea, and the burgeoning economies of Southeast Asia. The demand is exceptionally high across critical sectors such as power generation, chemical processing, wastewater treatment, and electronics manufacturing, driven by economic expansion and increasing industrial output.

- Latin America: This region is an emerging market characterized by promising growth prospects, largely attributable to increasing industrialization efforts, particularly within the mining, oil & gas, and food processing sectors. Significant investments in modernizing existing industrial infrastructure and establishing new manufacturing capacities are creating substantial new opportunities for industrial blower manufacturers. The demand is also influenced by increasing urbanization and the need for improved public utilities, including water and wastewater treatment, which rely heavily on blower systems.

- Middle East & Africa (MEA): The MEA industrial blower market is exhibiting significant growth potential, driven by national strategies focused on economic diversification away from hydrocarbon dependence, leading to considerable investments in manufacturing, water desalination and treatment, and power generation infrastructure projects. The region is increasingly prioritizing the adoption of energy-efficient and robust industrial solutions to support its sustainable industrial expansion and address burgeoning population demands for modern utilities and industrial output.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Blower Market.- Siemens AG

- Howden Group

- Gardner Denver (Ingersoll Rand)

- ABB Ltd.

- Hitachi Ltd.

- Atlas Copco AB

- Greenheck Fan Corporation

- Continental Fan Manufacturing Inc.

- Chicago Blower Corporation

- Acme Engineering and Manufacturing Corporation

- Loren Cook Company

- Fl盲ktGroup

- Twin City Fan Companies, Ltd.

- PennBarry

- CECO Environmental

- Cincinnati Fan

- Air Control Industries, Inc.

- New York Blower Company

- General Blower Company

- Zhejiang Jieneng Compressor Manufacturing Co., Ltd.

- Soler & Palau Ventilation Group

- Nidec Corporation

- Dongguan BLOWER Co., Ltd.

- Robinson Fans, Inc.

- Tuthill Corporation

Frequently Asked Questions

What is an industrial blower and its primary functions in manufacturing?

An industrial blower is a mechanical device engineered to move large volumes of air or gas at specific pressures, crucial for essential manufacturing processes such as ventilation to maintain air quality, drying of products, cooling of equipment, pneumatic conveying of materials, and effective dust collection and fume extraction, ensuring optimal operational efficiency and safety.

How does Artificial Intelligence (AI) significantly impact the efficiency and maintenance of industrial blowers?

AI revolutionizes blower efficiency and maintenance by enabling advanced predictive analytics on operational data, identifying potential equipment failures proactively, optimizing energy consumption through adaptive controls tailored to real-time demands, and facilitating seamless integration into smart factory systems for continuous, intelligent performance management and reduced downtime.

Which key industries are the major end-users or primary potential customers for industrial blowers globally?

The major end-user industries for industrial blowers include chemical & petrochemical, power generation, HVAC (commercial & industrial), food & beverage processing, mining & metals, wastewater treatment, pulp & paper, oil & gas, automotive & transportation, and pharmaceuticals & life sciences, all of which critically rely on blowers for their core operational processes.

What are the most significant driving factors contributing to the growth of the industrial blower market?

The industrial blower market's growth is predominantly driven by escalating global industrialization, particularly in emerging economies, increasing mandates for energy-efficient solutions, the enforcement of stringent environmental regulations, the widespread adoption of industrial automation and digitalization, and continuous investments in modernizing and expanding industrial infrastructure worldwide.

What are the main technological advancements shaping the modern industrial blower market landscape?

Key technological advancements include the widespread integration of Variable Frequency Drives (VFDs) for precise motor control, adoption of highly efficient Permanent Magnet Synchronous Motors (PMSM) and EC motors, deployment of IIoT sensors for real-time data collection, AI/ML for predictive maintenance, advanced material science for durability, and improved noise reduction technologies, all aiming for enhanced efficiency and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager