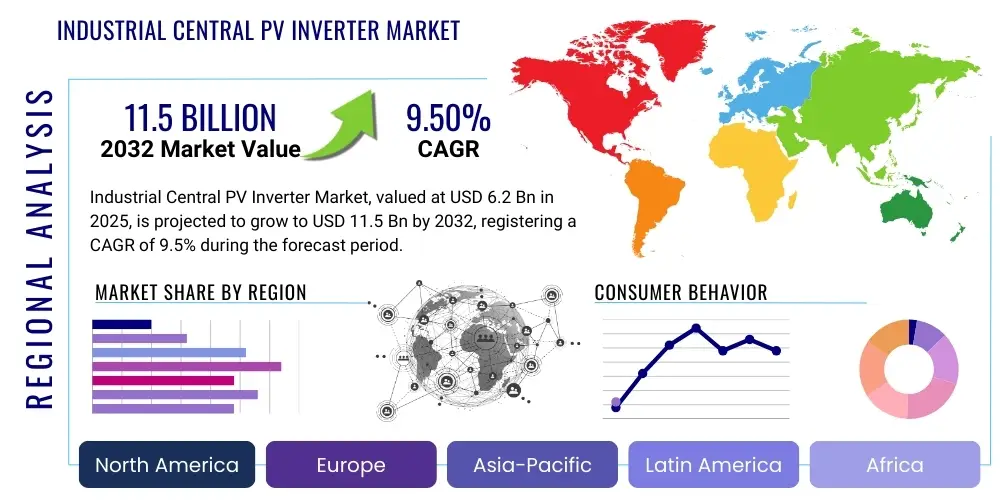

Industrial Central PV Inverter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427658 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Central PV Inverter Market Size

The Industrial Central PV Inverter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2025 and 2032. The market is estimated at USD 6.2 billion in 2025 and is projected to reach USD 11.5 billion by the end of the forecast period in 2032.

Industrial Central PV Inverter Market introduction

The Industrial Central PV Inverter Market serves as a critical backbone for large-scale solar power generation, transforming the direct current (DC) electricity produced by solar panels into alternating current (AC) suitable for grid integration and industrial consumption. These robust inverters are specifically designed for utility-scale solar farms, large commercial and industrial (C&I) installations, and mega-projects where efficiency, reliability, and high power output are paramount. Product descriptions typically highlight their advanced functionalities, including maximum power point tracking (MPPT), sophisticated grid management capabilities, and high conversion efficiencies, often exceeding 98%. Major applications span across utility-scale solar power plants providing clean energy to national grids, large manufacturing facilities aiming for energy independence or reduced operational costs through solar self-consumption, and extensive commercial complexes seeking sustainable power solutions. The primary benefits derived from these systems include significant reductions in carbon emissions, enhanced energy security through diversified power sources, lower long-term operational costs due to free solar energy, and improved grid stability facilitated by smart inverter features. Driving factors for market expansion are multifaceted, encompassing the global push for renewable energy adoption, favorable government policies and incentives for solar power, escalating electricity demand from industrial sectors, technological advancements leading to more efficient and cost-effective inverters, and the decreasing overall cost of solar photovoltaic (PV) installations, making large-scale solar projects increasingly economically viable and attractive to investors and industrial consumers alike. The increasing integration of smart grid technologies also fuels the demand for central inverters with advanced communication and control features, enabling better power quality and grid ancillary services.

Industrial Central PV Inverter Market Executive Summary

The Industrial Central PV Inverter Market is experiencing robust growth, driven by a confluence of global business trends, regional energy policies, and evolving technological advancements across various segments. Business trends indicate a strong move towards decarbonization and energy independence among industrial giants, leading to significant investments in utility-scale and large commercial solar projects globally. Companies are increasingly prioritizing sustainability initiatives and seeking reliable, cost-effective power solutions, making central PV inverters an essential component of their energy strategies. Furthermore, the expansion of green financing and corporate power purchase agreements (PPAs) is accelerating the deployment of large-scale solar installations, directly boosting demand for high-capacity inverters. Regional trends highlight Asia-Pacific as a dominant and rapidly expanding market, primarily due to ambitious renewable energy targets in China and India, coupled with significant manufacturing capacities and supportive government frameworks. Europe continues its strong growth trajectory, driven by the EUs Green Deal and extensive grid modernization efforts, while North America sees sustained investment, particularly in the utility sector and large commercial projects, propelled by tax credits and clean energy mandates. Latin America and the Middle East & Africa are emerging as high-growth regions, spurred by abundant solar resources and increasing electrification needs. Segment trends indicate a continuous focus on higher power density, advanced thermal management, and enhanced grid integration features within the central inverter product category. There is a growing demand for inverters capable of providing sophisticated grid support services, such as reactive power compensation, fault ride-through capabilities, and frequency regulation, which are critical for maintaining grid stability with high renewable penetration. The competitive landscape is characterized by innovation in modular designs, improved efficiency, and the integration of artificial intelligence for predictive maintenance and optimized performance, ensuring the longevity and reliability of these essential components in demanding industrial environments.

AI Impact Analysis on Industrial Central PV Inverter Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Central PV Inverter Market consistently revolve around themes of operational efficiency, predictive maintenance, enhanced performance optimization, and the seamless integration of renewable energy sources into the grid. Common questions explore how AI can reduce downtime, improve energy yield, and manage complex grid interactions, signaling a strong user expectation for tangible benefits and increased system intelligence. There is significant interest in AIs role in diagnosing potential faults before they escalate, optimizing inverter performance under varying environmental conditions, and contributing to overall grid stability. Users are keen to understand the practical applications of machine learning algorithms in real-time data analysis from inverters, expecting these capabilities to translate into higher ROI and more reliable operations for large-scale solar projects. The convergence of AI with IoT (Internet of Things) for remote monitoring and control, as well as its potential to unlock new levels of efficiency and resilience in industrial PV installations, forms a central part of user concerns and optimistic projections. This comprehensive analysis points towards a future where AI is not just an add-on but an intrinsic component of advanced central PV inverter systems, transforming their functionality from mere DC-to-AC conversion devices into intelligent, self-optimizing energy management hubs capable of proactive decision-making and dynamic grid response, thereby maximizing the value and longevity of solar assets for industrial and utility-scale applications.

- AI-driven predictive maintenance significantly reduces downtime by forecasting equipment failures, optimizing maintenance schedules, and enabling proactive repairs, thereby enhancing operational reliability for central PV inverters.

- Optimized energy yield is achieved through AI algorithms that continuously analyze environmental data and inverter performance to fine-tune Maximum Power Point Tracking (MPPT) under diverse conditions, maximizing electricity generation.

- Enhanced grid integration capabilities leverage AI for real-time grid status analysis, allowing inverters to provide advanced ancillary services like voltage support and frequency regulation, crucial for grid stability in high renewable penetration scenarios.

- Improved fault detection and diagnostics are facilitated by machine learning models that quickly identify anomalies and pinpoint the root cause of issues, streamlining troubleshooting and minimizing service interruptions.

- AI-powered performance analytics offer deep insights into inverter operations, identifying inefficiencies, predicting degradation, and providing actionable recommendations for long-term asset management and increased ROI.

DRO & Impact Forces Of Industrial Central PV Inverter Market

The Industrial Central PV Inverter Market is shaped by a dynamic interplay of drivers, restraints, opportunities, and inherent impact forces that dictate its growth trajectory and strategic direction. A primary driver is the accelerating global adoption of renewable energy, fueled by stringent climate change policies, national decarbonization goals, and the economic competitiveness of solar power. Government incentives, such as tax credits, subsidies, and renewable energy mandates, play a pivotal role in promoting large-scale solar projects that necessitate central inverters. Furthermore, the continuous decline in the levelized cost of electricity (LCOE) from solar PV, coupled with rising conventional energy prices and increasing industrial electricity demand, makes solar investments highly attractive. However, several restraints temper this growth. The high initial capital expenditure for large-scale solar installations, including the cost of central inverters, can be a barrier for some investors. Grid integration challenges, particularly in regions with underdeveloped or aging grid infrastructure, pose technical hurdles for connecting massive solar arrays. Policy uncertainties and changes in regulatory frameworks can also create market volatility and deter long-term investment. Despite these challenges, significant opportunities abound. The ongoing technological advancements in inverter design, including the development of gallium nitride (GaN) and silicon carbide (SiC) based power semiconductors, are enhancing efficiency, power density, and reliability, thereby expanding application possibilities. The growing demand for smart grid solutions and energy storage integration presents new avenues for central inverters with advanced control and communication features. Moreover, the increasing focus on microgrids and decentralized energy systems within industrial complexes offers specialized market niches. Impact forces, such as the volatility of raw material prices, geopolitical stability affecting global supply chains, and rapid technological obsolescence, continuously influence market dynamics, requiring manufacturers and project developers to maintain agility and innovation. The push towards energy independence and resilience further amplifies the strategic importance of reliable, high-performance central PV inverters, cementing their role in the future energy landscape.

Segmentation Analysis

The Industrial Central PV Inverter Market is segmented across various dimensions to provide a comprehensive understanding of its structure, dynamics, and growth potential. These segmentations typically include power rating, which differentiates inverters based on their output capacity suitable for different scales of industrial and utility projects; technology type, distinguishing between various semiconductor materials and conversion architectures; end-user application, separating utility-scale installations from large commercial and industrial applications; and regional geography, highlighting market performance across major economic zones. This multi-faceted approach allows for granular analysis of market trends, competitive positioning, and strategic opportunities within specific sub-markets, aiding stakeholders in making informed business decisions. For instance, the power rating segmentation helps manufacturers tailor products for specific project sizes, while the end-user application segmentation guides marketing and sales strategies to target the most relevant customers, ensuring that product development aligns with the evolving needs of the industrial solar sector. Furthermore, understanding the adoption patterns across different technology types provides insights into innovation cycles and the shifting preferences towards more efficient and resilient inverter solutions, critical for long-term investment and product lifecycle management in this rapidly evolving industry.

- By Power Rating:

Typically segmented into inverters below 1 MW, 1 MW to 2.5 MW, and above 2.5 MW, addressing varying scales of utility and industrial solar projects.

- By Technology Type:

Includes categories such as Silicon-based inverters and advanced Wide Bandgap (WBG) semiconductor-based inverters (SiC, GaN), reflecting different efficiency and performance characteristics.

- By Application:

Differentiated into Utility-Scale Solar Power Plants and Commercial & Industrial (C&I) Solar Installations, catering to distinct operational requirements and grid integration complexities.

- By Component:

Segmentation may include power stacks, control units, cooling systems, and communication modules, highlighting the specialized sub-systems within a central inverter.

- By Region:

Market analysis is often segmented geographically into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, considering regional energy policies and market maturity.

Industrial Central PV Inverter Market Value Chain Analysis

The value chain of the Industrial Central PV Inverter Market is a complex ecosystem spanning multiple stages, from raw material procurement to end-user deployment and ongoing maintenance, involving a diverse array of stakeholders. Upstream analysis focuses on the sourcing of critical components and raw materials, including semiconductors (silicon, silicon carbide, gallium nitride), magnetic components, capacitors, cooling systems, and enclosures. These suppliers are foundational, providing specialized, high-performance materials essential for the reliability and efficiency of central inverters. The manufacturing stage involves the intricate assembly, testing, and quality control of these sophisticated electronic devices. Inverter manufacturers often invest heavily in R&D to integrate advanced power electronics, control algorithms, and communication protocols. Downstream analysis encompasses the distribution, installation, and operational phases. Distribution channels are varied, including direct sales from manufacturers to large utility companies or EPC (Engineering, Procurement, and Construction) firms, as well as indirect channels through specialized distributors and integrators who cater to smaller industrial and commercial projects. Direct sales often involve complex contractual agreements and long-term partnerships, whereas indirect channels allow for broader market reach and specialized local support. The installation phase is typically managed by EPC contractors or specialized solar installers who are responsible for the physical deployment, electrical integration, and commissioning of the inverters within the larger solar power plant. Post-installation, operations and maintenance (O&M) services, provided either by manufacturers, third-party service providers, or the end-users themselves, are crucial for ensuring the long-term performance and reliability of the inverters, often involving remote monitoring, diagnostics, and periodic servicing. This intricate network ensures the efficient delivery of high-quality central PV inverters to support the growing demands of the industrial and utility-scale solar sectors.

Industrial Central PV Inverter Market Potential Customers

The Industrial Central PV Inverter Market primarily targets a distinct group of end-users and buyers with significant energy demands and a strategic imperative for renewable energy integration. Foremost among these are utility-scale solar farm developers and operators, who deploy vast arrays of solar panels to generate electricity for national grids. These entities require high-capacity, robust, and highly efficient central inverters capable of handling immense power loads, offering advanced grid management features, and ensuring long-term reliability under stringent operational conditions. Another key customer segment comprises large industrial facilities, such as manufacturing plants, chemical processing units, and mining operations, which consume substantial amounts of electricity. These industries increasingly invest in large-scale solar installations, often paired with central inverters, to reduce operational costs, achieve energy independence, meet corporate sustainability goals, and mitigate exposure to volatile energy prices. Commercial enterprises with extensive infrastructure, including large data centers, logistics hubs, and expansive retail complexes, also represent a significant customer base. Their need for continuous, reliable power and their commitment to environmental stewardship drive their adoption of central PV inverter solutions for onsite generation. Furthermore, EPC (Engineering, Procurement, and Construction) firms specializing in solar projects act as crucial intermediaries, purchasing inverters as part of comprehensive project solutions for their clients. Government agencies and public sector utilities, particularly those managing large infrastructure projects or promoting national energy transitions, also constitute vital end-users, requiring dependable and scalable inverter technology. The demand from these diverse customer groups is unified by the common objective of harnessing solar energy efficiently and effectively to power their operations, reduce environmental impact, and enhance overall energy security and cost predictability.

Industrial Central PV Inverter Market Key Technology Landscape

The technology landscape of the Industrial Central PV Inverter Market is characterized by continuous innovation aimed at enhancing efficiency, reliability, power density, and grid compatibility. A significant trend is the increasing adoption of Wide Bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and Gallium Nitride (GaN), which are replacing traditional silicon-based power electronics. These advanced materials enable higher switching frequencies, leading to smaller, lighter, and more efficient inverters with reduced cooling requirements and higher power density. The integration of sophisticated Maximum Power Point Tracking (MPPT) algorithms is paramount, with advanced multi-MPPT designs becoming standard, allowing for optimized energy harvest even under complex shading conditions or varying irradiance levels across large solar arrays. Thermal management technologies, including advanced liquid cooling and optimized air-cooling systems, are critical for maintaining inverter performance and extending lifespan, especially in harsh industrial environments. Communication protocols and data analytics capabilities are evolving rapidly, with inverters increasingly incorporating IoT (Internet of Things) for real-time monitoring, remote diagnostics, and predictive maintenance, often leveraging cloud-based platforms. Furthermore, the development of smart grid-ready inverters with advanced grid support functions, such as reactive power compensation, voltage ride-through, and black start capabilities, is a key technological imperative. These features enable seamless integration into modern grids, enhancing stability and reliability, especially as renewable energy penetration increases. Modular inverter designs are also gaining traction, offering greater flexibility, scalability, and ease of maintenance, allowing for efficient component replacement and system upgrades without complete shutdown. Lastly, the convergence of AI and machine learning for performance optimization, fault detection, and energy forecasting is poised to revolutionize the intelligence and autonomy of central PV inverters, making them more resilient and adaptive components within complex energy systems.

Regional Highlights

- Asia-Pacific: Dominant market share driven by aggressive renewable energy targets in China and India, substantial government support, and large-scale utility projects. Significant manufacturing base and rapid industrialization further fuel demand for industrial PV inverters.

- Europe: Strong market growth attributed to the European Green Deal, extensive grid modernization efforts, and high consumer and corporate awareness of sustainability. Germany, Spain, and Italy lead in adopting advanced central inverter technologies for solar farms.

- North America: Consistent growth, particularly in the United States, propelled by federal tax credits, state-level renewable portfolio standards, and increasing investments in utility-scale solar and large commercial & industrial projects. Canada also shows steady progress in solar integration.

- Latin America: Emerging as a high-growth region due to abundant solar resources, rising electricity demand, and favorable regulatory frameworks in countries like Brazil, Chile, and Mexico. Focus on reducing reliance on fossil fuels and expanding electrification.

- Middle East & Africa: Significant potential driven by massive solar irradiation, ambitious national energy diversification strategies (e.g., UAE, Saudi Arabia, South Africa), and a growing need for reliable power solutions for industrial development and energy export.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Central PV Inverter Market.- SMA Solar Technology AG

- Huawei Technologies Co. Ltd.

- Sungrow Power Supply Co. Ltd.

- Fronius International GmbH

- SolarEdge Technologies Inc.

- Ingeteam S.A.

- ABB Ltd.

Frequently Asked Questions

What is an Industrial Central PV Inverter and why is it important for large-scale solar projects?

An Industrial Central PV Inverter is a high-power electronic device designed for large-scale solar installations, such as utility-scale solar farms and extensive commercial or industrial facilities. Its primary function is to convert the direct current (DC) electricity generated by solar panels into alternating current (AC) that is compatible with the grid and industrial machinery. It is crucial because it ensures the efficient, reliable, and safe integration of massive solar power outputs into the electrical infrastructure, managing power flow, optimizing energy harvest, and often providing essential grid support services for stable operation of the entire system.

How do central inverters differ from string or microinverters in industrial applications?

Central inverters differ significantly in scale and application from string and microinverters. Central inverters are large, powerful units designed to handle the entire output of a massive array of solar panels, making them ideal for utility-scale and very large industrial projects where high power output and robust grid integration are paramount. String inverters, conversely, are smaller and manage power from a "string" of panels, suitable for medium-sized commercial or residential installations. Microinverters are even smaller, attached to individual panels, offering panel-level optimization for smaller, more complex residential or light commercial setups. The choice depends on project size, complexity, cost considerations, and specific operational requirements, with central inverters offering the highest power density and most advanced grid management for industrial-scale deployment.

What are the key factors driving the growth of the Industrial Central PV Inverter Market?

The growth of the Industrial Central PV Inverter Market is propelled by several key factors. These include the global push for renewable energy adoption driven by climate change concerns and decarbonization goals, leading to increased investments in utility-scale solar projects. Favorable government policies and incentives, such as tax credits and renewable energy mandates, significantly encourage solar deployment. The decreasing levelized cost of solar electricity makes large-scale solar more competitive, attracting industrial and commercial entities seeking lower operational costs and energy independence. Furthermore, continuous technological advancements enhancing inverter efficiency, reliability, and smart grid integration capabilities are crucial drivers, making these systems more attractive and effective for large-scale power generation and grid stabilization.

What role does Artificial Intelligence (AI) play in modern Industrial Central PV Inverters?

Artificial Intelligence (AI) is transforming modern Industrial Central PV Inverters by introducing advanced capabilities that enhance performance and reliability. AI algorithms are used for predictive maintenance, anticipating potential failures and optimizing service schedules to minimize downtime. They improve energy yield by dynamically adjusting Maximum Power Point Tracking (MPPT) under varying environmental conditions. AI also enables sophisticated grid support functionalities, allowing inverters to react intelligently to grid fluctuations, provide reactive power compensation, and offer frequency regulation services for enhanced grid stability. Through real-time data analysis and machine learning, AI-powered inverters can optimize operational efficiency, diagnose faults rapidly, and contribute to the overall resilience and longevity of large-scale solar assets.

What are the major technological advancements expected in Industrial Central PV Inverters?

Major technological advancements expected in Industrial Central PV Inverters are primarily focused on higher efficiency, increased power density, and enhanced grid functionality. This includes the widespread adoption of Wide Bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN), leading to smaller, lighter, and more efficient designs with improved thermal performance. Further advancements in modular architectures will offer greater flexibility and ease of maintenance. Expect more sophisticated control algorithms for MPPT and grid support services, including enhanced fault ride-through and energy storage integration. The increasing integration of AI and IoT for predictive analytics, remote monitoring, and self-optimization will also be pivotal, making future inverters smarter, more autonomous, and seamlessly integrated into complex energy management systems and smart grids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager