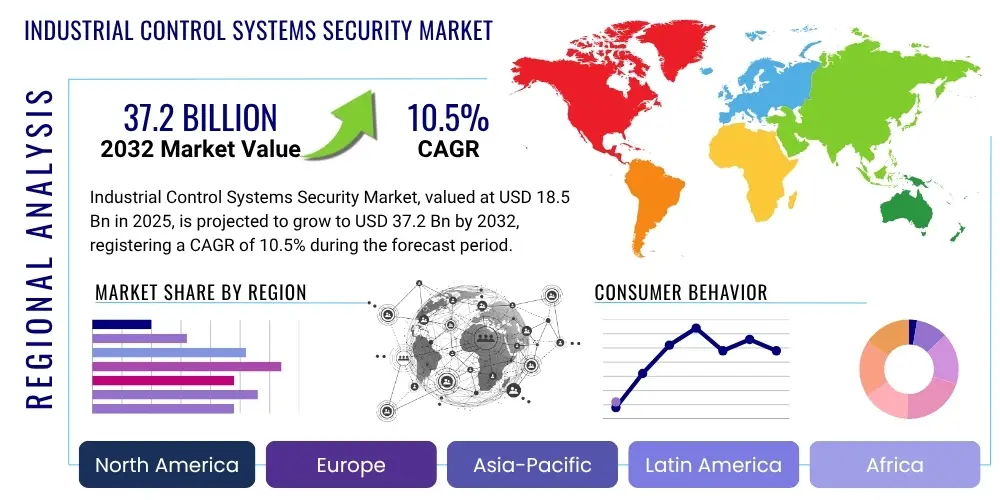

Industrial Control Systems Security Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430629 | Date : Nov, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Control Systems Security Market Size

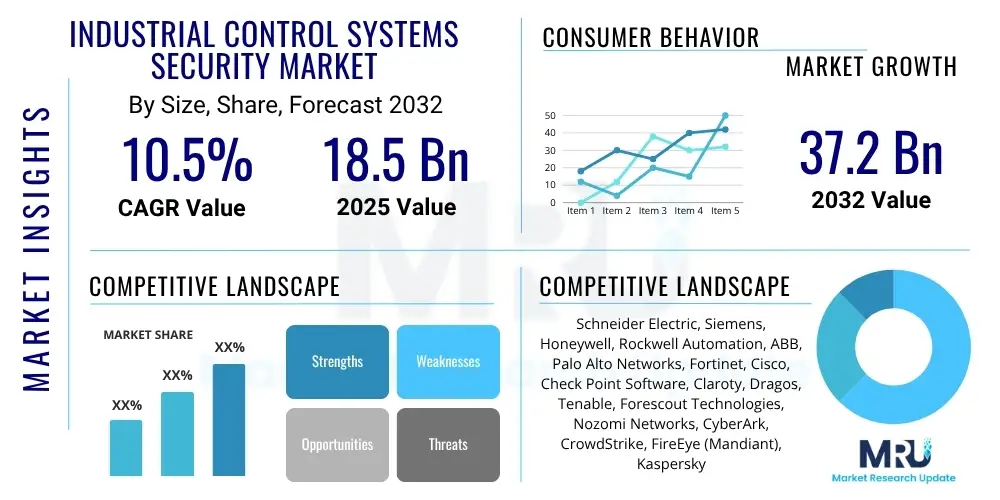

The Industrial Control Systems Security Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at $18.5 Billion in 2025 and is projected to reach $37.2 Billion by the end of the forecast period in 2032.

Industrial Control Systems Security Market introduction

The Industrial Control Systems (ICS) Security Market encompasses a critical sector dedicated to protecting the operational technologies (OT) that manage industrial processes. This includes safeguarding Supervisory Control and Data Acquisition (SCADA) systems, Distributed Control Systems (DCS), Programmable Logic Controllers (PLCs), and other control components from cyber threats. The increasing connectivity of OT environments with traditional IT networks, driven by digital transformation and the Industrial Internet of Things (IIoT), has significantly expanded the attack surface, making robust ICS security solutions indispensable for maintaining operational continuity, safety, and data integrity.

Products within this market range from specialized firewalls and intrusion detection/prevention systems tailored for OT environments to advanced security information and event management (SIEM) solutions, endpoint protection, and comprehensive vulnerability management platforms. These solutions are designed to address the unique challenges of ICS, such as real-time operation requirements, legacy systems, and the severe physical consequences of a successful cyberattack. Major applications span critical infrastructure sectors including energy, utilities, manufacturing, oil and gas, and transportation, where the disruption of control systems can have far-reaching economic and societal impacts.

The primary benefits of implementing robust ICS security include enhanced resilience against cyberattacks, ensuring the availability and reliability of critical operations, protecting intellectual property, and safeguarding human lives and the environment. Key driving factors for market growth involve the escalating sophistication and frequency of cyber threats targeting industrial targets, the imperative for regulatory compliance with evolving cybersecurity standards, and the widespread adoption of digital technologies across industrial sectors that necessitate a strong security posture to mitigate associated risks.

Industrial Control Systems Security Market Executive Summary

The Industrial Control Systems Security Market is experiencing significant expansion, driven by the increasing digitalization of industrial operations and the concurrent rise in targeted cyberattacks. Business trends highlight a convergence of IT and OT security strategies, with organizations seeking integrated solutions that provide holistic visibility and control across their entire operational landscape. There is also a growing demand for managed security services, as specialized expertise in OT cybersecurity remains a scarce resource for many industrial enterprises, leading them to outsource security monitoring and incident response.

From a regional perspective, North America continues to be a dominant market, largely due to stringent regulatory frameworks, high levels of technological adoption, and a mature cybersecurity ecosystem. However, the Asia Pacific region is projected to demonstrate the fastest growth, propelled by rapid industrialization, extensive investments in critical infrastructure development, and an increasing awareness of cyber risks within its burgeoning manufacturing and energy sectors. Europe also represents a substantial market, driven by comprehensive data protection regulations and government initiatives aimed at strengthening industrial resilience against cyber threats.

Segmentation trends indicate a robust demand for software solutions, particularly those offering advanced threat detection, vulnerability management, and security analytics. Services, including consulting, integration, and managed security services, are also capturing a significant market share as organizations seek expert assistance in navigating complex ICS security landscapes. End-user segments such as power and utilities, manufacturing, and oil and gas remain pivotal, given their operational criticality and vulnerability to sophisticated cyber incidents, underscoring a continuous investment in specialized security measures to protect their extensive and interconnected industrial assets.

AI Impact Analysis on Industrial Control Systems Security Market

Users frequently inquire about AI's role in proactive threat detection, automating responses, and identifying vulnerabilities within complex industrial environments. There are significant expectations around AI's capacity to enhance the speed and accuracy of anomaly detection in ICS networks, potentially revolutionizing how organizations defend their critical assets. Concerns often arise regarding the reliability of AI in high-stakes operational settings, the potential for AI-driven systems to introduce new vulnerabilities, and the ethical implications of autonomous decision-making in safety-critical applications. Users are keen to understand how AI can move beyond merely identifying threats to predict sophisticated attacks, optimize security operations, and reduce the burden on human analysts, while simultaneously questioning the skills required to manage and maintain these advanced AI security tools effectively.

- Enhanced Anomaly Detection: AI algorithms can analyze vast datasets of operational telemetry to detect deviations from normal behavior, identifying potential cyber threats or operational anomalies that human analysts might miss.

- Predictive Threat Intelligence: AI can process global threat intelligence feeds and historical attack patterns to predict future attack vectors and identify vulnerabilities in ICS, enabling proactive defense strategies.

- Automated Incident Response: AI-powered tools can automate aspects of incident response, such as isolating compromised systems or deploying countermeasures, significantly reducing the mean time to respond (MTTR) to cyber incidents.

- Vulnerability Management Optimization: AI can prioritize vulnerabilities based on their exploitability and potential impact on specific industrial processes, streamlining patching and mitigation efforts.

- Improved Asset Inventory and Monitoring: AI assists in automatically discovering and classifying OT assets, maintaining accurate inventories, and continuously monitoring their security posture in dynamic environments.

- Facilitating Zero Trust Architectures: AI can help enforce granular access policies and continuously verify user and device identities in real-time, which is crucial for implementing Zero Trust models in ICS.

- Generation of New Attack Vectors: Adversaries are also leveraging AI to develop more sophisticated and evasive attack techniques, posing new challenges for traditional ICS security measures.

DRO & Impact Forces Of Industrial Control Systems Security Market

The Industrial Control Systems Security Market is significantly shaped by a confluence of driving forces, inherent restraints, and emerging opportunities. Drivers such as the escalating volume and sophistication of cyberattacks targeting critical infrastructure globally are compelling organizations to invest proactively in advanced security solutions. Moreover, stringent regulatory compliance requirements, including those from NERC CIP, NIS Directive, and various national cybersecurity frameworks, mandate robust security measures for industrial operators, thereby fueling market demand. The ongoing convergence of IT and OT networks, a cornerstone of digital transformation and Industry 4.0 initiatives, while offering efficiency gains, simultaneously broadens the attack surface, creating an urgent need for integrated security platforms that can bridge the traditional gap between IT and OT security.

However, the market faces several notable restraints that temper its growth. The high initial implementation costs associated with deploying comprehensive ICS security solutions can be a significant barrier for smaller enterprises or those with legacy systems. The complexity of integrating new security technologies with existing, often proprietary and aging, industrial infrastructure presents substantial technical and operational challenges. Furthermore, a persistent shortage of skilled cybersecurity professionals with specialized knowledge in OT environments hinders effective deployment and management of these systems, forcing organizations to rely on external expertise or managed services. The inherent fragility and real-time operational demands of ICS environments also mean that security solutions must be carefully designed to avoid any disruption, which can complicate deployment and testing phases.

Amidst these challenges, considerable opportunities are emerging that promise to accelerate market expansion. The rapid adoption of the Industrial Internet of Things (IIoT) and cloud-based industrial applications is creating new avenues for security solutions that can protect distributed and interconnected assets. The growing demand for managed security services for OT environments provides a scalable and cost-effective solution for organizations lacking in-house capabilities. Furthermore, advancements in proactive threat intelligence, behavioral analytics, and AI/ML-driven security solutions offer significant potential for enhanced threat detection and response, transforming the security landscape from reactive to predictive. These impact forces collectively define a dynamic market where the need for protection is paramount, yet practical implementation remains complex, driving innovation and strategic partnerships.

Segmentation Analysis

The Industrial Control Systems Security market is comprehensively segmented to address the diverse needs of industrial environments, reflecting the varied technological approaches and end-user requirements within critical infrastructure. These segmentations allow for a granular understanding of market dynamics, enabling vendors to tailor their offerings and organizations to select solutions that best fit their specific operational and security profiles. The primary segmentation categories include components, security types, deployment methods, and end-user industries, each reflecting distinct drivers and adoption patterns that shape the overall market landscape and future growth trajectories.

- Component:

- Hardware (e.g., specialized firewalls, intrusion prevention systems, secure gateways)

- Software (e.g., SIEM, Endpoint Detection and Response (EDR), Vulnerability Management, Threat Intelligence Platforms)

- Services (e.g., Consulting, Managed Security Services, Implementation and Integration, Training and Support)

- Security Type:

- Network Security (e.g., perimeter security, network segmentation, deep packet inspection)

- Endpoint Security (e.g., host-based intrusion detection, anti-malware for OT endpoints)

- Application Security (e.g., securing SCADA/DCS applications, patch management)

- Database Security (e.g., protecting historians and industrial databases)

- Cloud Security (e.g., securing industrial cloud platforms and SaaS solutions)

- Deployment Type:

- On-premises

- Cloud (Hybrid, Public, Private)

- End User:

- Power and Utilities

- Manufacturing

- Oil & Gas

- Transportation Systems

- Chemicals & Pharmaceuticals

- Food & Beverage

- Mining

- Water & Wastewater Management

- Others (e.g., Building Management Systems, Smart Cities)

Value Chain Analysis For Industrial Control Systems Security Market

The value chain for the Industrial Control Systems Security Market involves a complex interplay of various stakeholders, starting from the foundational technology providers and extending to the ultimate end-users. The upstream segment of the value chain is dominated by core technology developers and component manufacturers. These entities are responsible for innovating and producing the fundamental hardware components like specialized processors, secure gateways, and network devices, as well as developing sophisticated software platforms, including operating systems, cybersecurity frameworks, and advanced analytics engines. Research and development plays a crucial role here, driving advancements in threat intelligence, behavioral analytics, and AI/ML capabilities specific to OT environments. Strategic partnerships between IT security vendors and OT solution providers are also common in this segment, aiming to combine their respective expertise.

Moving downstream, the value chain encompasses various service providers and integrators who bridge the gap between technology creators and end-user deployment. This includes system integrators who specialize in customizing and deploying complex ICS security architectures within diverse industrial settings, often dealing with legacy systems and proprietary protocols. Managed security service providers (MSSPs) form another critical part of the downstream segment, offering continuous monitoring, threat detection, incident response, and security management as a service, which is particularly valuable for organizations lacking in-house OT security expertise. Consulting firms provide crucial advisory services, helping organizations assess risks, develop security strategies, and ensure compliance with industry regulations. The distribution channel involves both direct and indirect sales approaches, catering to different market needs.

Direct sales are typically employed for large enterprises with complex requirements or highly customized solutions, where direct engagement with vendors ensures a tailored approach and dedicated support. This often involves large-scale critical infrastructure operators or government agencies. Conversely, indirect channels, such as value-added resellers (VARs), distributors, and technology partners, play a vital role in extending market reach, particularly to small and medium-sized industrial enterprises. These partners often provide localized support, implementation services, and integrate various products to offer comprehensive solutions. This multi-faceted value chain ensures that a broad spectrum of industrial organizations, regardless of their size or security maturity, can access the necessary technologies and expertise to safeguard their operational environments from evolving cyber threats.

Industrial Control Systems Security Market Potential Customers

The potential customers for Industrial Control Systems Security solutions are primarily organizations operating critical infrastructure and industrial facilities where the availability, integrity, and confidentiality of operational technologies are paramount. These end-users span a wide array of sectors, each facing unique security challenges and regulatory pressures. The core imperative across all these potential buyers is the need to protect against cyberattacks that could lead to operational downtime, safety hazards, environmental damage, financial losses, or the compromise of sensitive industrial processes and intellectual property.

Key segments of potential customers include power and utilities companies, such as electricity grids, water treatment plants, and gas distribution networks, which are highly susceptible targets due to their societal importance. Manufacturing enterprises, including automotive, chemical, pharmaceutical, and discrete manufacturing, represent a significant customer base, as they rely heavily on automated production lines and connected machinery (IIoT) that require robust protection from cyber threats that could halt production or corrupt product quality. Oil and gas companies, encompassing exploration, production, refining, and pipeline operations, are also major buyers, seeking to secure their geographically dispersed and highly automated assets from both cyber espionage and disruptive attacks.

Furthermore, transportation systems, including railways, aviation, and maritime operations, depend on secure ICS for traffic control, signaling, and logistics, making them crucial potential customers. Other important segments include mining operations, food and beverage processing, and various public sector organizations managing smart city infrastructure or defense-related industrial assets. Essentially, any entity whose operations are underpinned by SCADA, DCS, PLCs, or other industrial automation systems is a potential customer for ICS security, driven by the dual needs of maintaining operational resilience and adhering to increasingly stringent cybersecurity mandates to prevent catastrophic failures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $18.5 Billion |

| Market Forecast in 2032 | $37.2 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Siemens, Honeywell, Rockwell Automation, ABB, Palo Alto Networks, Fortinet, Cisco, Check Point Software, Claroty, Dragos, Tenable, Forescout Technologies, Nozomi Networks, CyberArk, CrowdStrike, FireEye (Mandiant), Kaspersky Lab, Sophos, IBM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Control Systems Security Market Key Technology Landscape

The technology landscape for Industrial Control Systems Security is rapidly evolving, integrating advanced capabilities to counter increasingly sophisticated threats targeting operational technology environments. Core to this landscape are Next-Generation Firewalls (NGFWs) and Intrusion Detection/Prevention Systems (IDS/IPS) specifically designed for OT protocols and traffic patterns, providing deep packet inspection and network segmentation crucial for isolating critical assets. Security Information and Event Management (SIEM) solutions are being adapted to correlate events from both IT and OT networks, offering unified visibility and facilitating faster threat detection. These systems are crucial for monitoring, logging, and analyzing security events across diverse industrial environments.

Beyond traditional perimeter defenses, the market leverages a suite of specialized technologies. Endpoint Detection and Response (EDR) and Extended Detection and Response (XDR) platforms are gaining traction, offering granular visibility and control over industrial endpoints, including HMIs, engineering workstations, and servers. Identity and Access Management (IAM) solutions are being enhanced to manage both human and machine identities in OT settings, ensuring least privilege access. Vulnerability Management (VM) platforms are critical for identifying and prioritizing weaknesses in ICS assets, often integrated with asset inventory solutions to maintain an up-to-date view of the attack surface. Threat Intelligence Platforms (TIPs) provide actionable insights into emerging threats specific to industrial sectors, allowing organizations to adopt a more proactive defensive posture against known and zero-day attacks.

Emerging technologies like Deception Technology are creating decoy ICS assets to lure and detect attackers, while advanced behavioral analytics and Machine Learning (ML) algorithms are being deployed for anomaly detection, identifying unusual operational patterns that may indicate a cyber compromise. The concept of Zero Trust Architecture is also gaining prominence, enforcing strict verification for every user and device attempting to access network resources, regardless of their location. Furthermore, the exploration of blockchain for immutable logging and secure communication in distributed industrial environments signifies the innovative frontier of ICS security. These technologies collectively form a robust defense-in-depth strategy, addressing the unique challenges posed by interconnected and safety-critical industrial infrastructure.

Regional Highlights

- North America: Dominant market share due to stringent regulatory compliance (e.g., NERC CIP), high adoption of advanced security solutions, and significant investments in critical infrastructure modernization across the United States and Canada.

- Europe: Strong market presence driven by comprehensive cybersecurity directives (e.g., NIS 2 Directive, GDPR) emphasizing critical infrastructure protection, coupled with a highly industrialized economy and increasing government focus on OT security.

- Asia Pacific (APAC): Fastest growing region, fueled by rapid industrialization, extensive critical infrastructure development, increasing awareness of cyber threats in manufacturing and energy sectors, and growing government initiatives in countries like China, India, Japan, and South Korea.

- Latin America: Emerging market with growing investments in infrastructure and digitalization across countries like Brazil and Mexico, leading to increased demand for ICS security solutions, though often challenged by budget constraints and varied regulatory landscapes.

- Middle East and Africa (MEA): Significant market growth due to vast oil & gas infrastructure, ongoing smart city projects, and diversification efforts across GCC countries. Increased awareness of cyber risks and strategic investments in national cybersecurity capabilities are driving adoption in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Control Systems Security Market.- Schneider Electric

- Siemens

- Honeywell

- Rockwell Automation

- ABB

- Palo Alto Networks

- Fortinet

- Cisco

- Check Point Software

- Claroty

- Dragos

- Tenable

- Forescout Technologies

- Nozomi Networks

- CyberArk

- CrowdStrike

- Mandiant (Google Cloud)

- Kaspersky Lab

- Sophos

- IBM

Frequently Asked Questions

What is Industrial Control Systems (ICS) Security?

ICS Security involves protecting operational technology (OT) systems like SCADA, DCS, and PLCs from cyber threats to ensure their availability, integrity, and confidentiality, which are crucial for industrial operations and safety.

Why is ICS Security becoming more critical?

It is becoming more critical due to the increasing digitalization and connectivity of industrial systems, the growing sophistication of cyberattacks targeting critical infrastructure, and stricter regulatory requirements.

What are the main challenges in implementing ICS Security?

Key challenges include the presence of legacy systems, real-time operational requirements, a shortage of skilled personnel, high implementation costs, and the need to avoid any disruption to critical industrial processes.

How does AI impact the ICS Security market?

AI enhances ICS security through advanced anomaly detection, predictive threat intelligence, automated incident response, and optimized vulnerability management, while also posing challenges related to new attack vectors.

Which industries are the primary adopters of ICS Security solutions?

Primary adopters include critical infrastructure sectors such as Power and Utilities, Manufacturing, Oil & Gas, Transportation Systems, and Chemicals & Pharmaceuticals, due to their operational criticality and vulnerability to cyber risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager