Industrial Emission Control System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427980 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Emission Control System Market Size

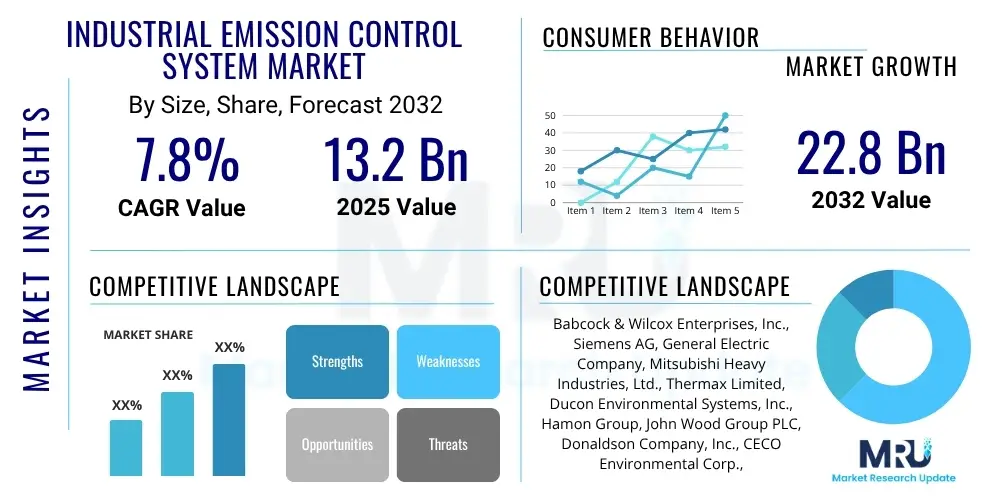

The Industrial Emission Control System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2025 and 2032. The market is estimated at USD 13.2 billion in 2025 and is projected to reach USD 22.8 billion by the end of the forecast period in 2032.

Industrial Emission Control System Market introduction

The Industrial Emission Control System (IECS) market encompasses a broad range of technologies and solutions designed to mitigate the release of harmful pollutants into the atmosphere from industrial processes. These systems are crucial for ensuring environmental compliance, protecting public health, and fostering sustainable industrial growth across various sectors. The inherent complexity of industrial operations, which often involve the combustion of fossil fuels, chemical reactions, and material processing, inevitably generates a diverse array of gaseous and particulate contaminants. IECS technologies provide the essential means to capture, treat, and neutralize these emissions before they can escape into the ambient air, thereby preventing air pollution and its associated detrimental impacts.

Products within this market range from advanced filtration units like fabric filters and electrostatic precipitators, which target particulate matter, to sophisticated gas treatment systems such as scrubbers for sulfur oxides (SOx) and nitrogen oxides (NOx), and catalytic converters for volatile organic compounds (VOCs). The widespread application of IECS spans numerous heavy industries, including power generation, oil and gas, chemical manufacturing, cement production, metals and mining, and waste incineration. Each application requires tailored solutions, often integrating multiple technologies to address specific pollutant profiles and operational conditions. The continuous innovation in materials science, process engineering, and digital controls is propelling the development of more efficient, cost-effective, and environmentally robust emission control solutions.

The primary benefits derived from the adoption of industrial emission control systems are multifaceted and far-reaching. Foremost among these is the ability to comply with increasingly stringent local, national, and international environmental regulations, thereby avoiding significant fines, operational disruptions, and reputational damage. Beyond compliance, these systems play a pivotal role in safeguarding public health by reducing respiratory illnesses and other health complications linked to air pollution. Environmentally, IECS contribute directly to combating climate change by curbing greenhouse gas precursors and preserving ecosystems. Furthermore, advanced systems can enhance operational efficiency by recovering valuable by-products or improving process control, while also bolstering corporate social responsibility profiles. Key driving factors include the global imperative for climate action, rapid industrialization in developing economies, growing public awareness and demand for cleaner air, and continuous technological advancements making these systems more accessible and effective.

Industrial Emission Control System Market Executive Summary

The Industrial Emission Control System market is poised for robust expansion, driven by an intensifying global focus on environmental sustainability and the universal tightening of regulatory frameworks governing industrial emissions. Key business trends indicate a significant shift towards integrated solutions that offer not only compliance but also enhanced operational efficiency, energy recovery, and predictive maintenance capabilities, often leveraging digital transformation technologies such as IoT and AI. Industries are increasingly seeking modular, scalable, and adaptable systems that can be retrofitted into existing infrastructures or seamlessly integrated into new facilities, reflecting a broader strategic pivot towards long-term environmental stewardship and operational resilience. There is also a notable trend in mergers and acquisitions, as larger players consolidate expertise and expand their technology portfolios to offer comprehensive, end-to-end solutions, catering to the diverse and complex needs of various industrial sectors. This consolidation aims to achieve greater economies of scale and enhance competitive advantages in a highly specialized market.

Regional dynamics play a critical role in shaping market growth, with Asia Pacific emerging as a dominant force due to rapid industrialization, burgeoning manufacturing sectors, and increasing regulatory enforcement in countries like China and India. This region is experiencing a surge in demand for new installations and upgrades to meet evolving environmental standards. Conversely, mature markets in North America and Europe, characterized by already stringent regulations and established industrial bases, are witnessing demand primarily driven by system upgrades, technological advancements, and the push towards circular economy principles, including carbon capture and utilization technologies. These developed regions are often at the forefront of adopting innovative and high-efficiency systems, setting benchmarks for global environmental performance. Latin America and the Middle East & Africa regions are also exhibiting promising growth potential, fueled by ongoing infrastructure development projects, expansion of their industrial capacities, and a gradual but steady increase in environmental consciousness and regulatory implementation, presenting new opportunities for market participants.

From a segmentation perspective, the market is observing significant growth across various technology types and end-use industries. Technologies like Selective Catalytic Reduction (SCR) and Flue Gas Desulfurization (FGD) continue to dominate in the power generation sector due to their efficacy in controlling NOx and SOx emissions, respectively. The demand for advanced particulate matter control systems, such as next-generation electrostatic precipitators and fabric filters, is also robust, particularly in industries like cement and metals and mining. Furthermore, the increasing complexity of industrial processes is driving a growing need for multi-pollutant control systems capable of addressing a wider spectrum of air contaminants simultaneously. The chemical and manufacturing sectors are increasingly investing in sophisticated Volatile Organic Compound (VOC) abatement technologies, including thermal oxidizers and adsorption systems, as regulatory scrutiny on these pollutants intensifies. This diversified growth across segments underscores the market's adaptability and responsiveness to specific industrial requirements and evolving environmental mandates.

AI Impact Analysis on Industrial Emission Control System Market

User questions regarding the impact of AI on Industrial Emission Control Systems frequently center on how these advanced technologies can enhance efficiency, reduce operational costs, and improve regulatory compliance in real-time. There is significant interest in AI's role in predictive maintenance, optimizing system performance, and providing actionable insights from the vast amounts of data generated by emission monitoring equipment. Users are keen to understand how AI can move beyond traditional reactive maintenance to proactive management, minimizing downtime and maximizing the lifespan of expensive control equipment. Concerns also arise regarding the integration complexity of AI systems with legacy industrial infrastructure, the data security implications, and the specialized skill sets required to deploy and manage AI-driven emission control solutions. The overarching expectation is that AI will revolutionize the operational paradigm of emission control, making systems smarter, more responsive, and more sustainable.

The integration of Artificial intelligence (AI) within the Industrial Emission Control System market is transforming operational methodologies by introducing unprecedented levels of precision, predictive capabilities, and autonomous decision-making. AI algorithms can process vast datasets from sensors, continuous emission monitoring systems (CEMS), and historical operational logs to identify patterns, predict potential equipment failures before they occur, and optimize system parameters in real-time for maximum efficiency. This proactive approach not only significantly reduces maintenance costs and unplanned downtime but also ensures continuous compliance with emission limits, a critical factor for industrial operators. For instance, AI can dynamically adjust the parameters of scrubbers or SCR units based on fluctuating industrial loads and raw material compositions, ensuring optimal pollutant removal rates while minimizing reagent consumption and energy usage. The ability to learn and adapt from operational data empowers systems to fine-tune their performance autonomously, leading to more consistent and superior environmental outcomes.

Furthermore, AI-driven platforms are enhancing the analytical capabilities for environmental reporting and compliance verification. By correlating emission data with operational parameters, weather conditions, and regulatory thresholds, AI can generate highly accurate and granular compliance reports, flagging anomalies or potential violations in advance. This capability significantly streamlines the auditing process and strengthens an organization's environmental governance. The development of digital twins, powered by AI, allows for virtual testing and simulation of various operational scenarios, enabling engineers to predict the impact of changes on emission levels and optimize control strategies in a risk-free environment. While the initial investment in AI integration can be substantial, the long-term benefits in terms of operational savings, enhanced environmental performance, and reduced regulatory risks are positioning AI as an indispensable tool for the future of industrial emission control.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures, reducing unplanned downtime and maintenance costs for emission control units.

- Operational Optimization: AI adjusts system parameters in real-time (e.g., reagent dosage, fan speeds) to maximize pollutant removal efficiency and minimize energy consumption.

- Real-time Monitoring & Compliance: AI platforms process continuous emission data to ensure constant adherence to regulatory limits and generate automated compliance reports.

- Enhanced Anomaly Detection: AI identifies unusual emission patterns or system malfunctions more quickly and accurately than traditional methods, allowing for prompt corrective action.

- Process Control & Automation: AI integrates with plant control systems to automate adjustments based on process changes, optimizing emission control responses.

- Data-driven Decision Making: Provides actionable insights from vast operational and environmental datasets, aiding strategic planning for emission reduction.

- Digital Twin Simulation: AI-powered digital twins allow for virtual testing of emission control strategies and prediction of system behavior under various scenarios.

DRO & Impact Forces Of Industrial Emission Control System Market

The Industrial Emission Control System market is fundamentally propelled by a confluence of stringent environmental regulations, rapid global industrialization, and a heightened public and corporate awareness regarding the adverse effects of air pollution. Governments worldwide are continually enacting and enforcing stricter emission standards for various industrial sectors, compelling industries to invest in advanced control technologies to avoid penalties and maintain their operating licenses. This regulatory imperative acts as the primary market driver, creating a non-negotiable demand for effective emission reduction solutions. Simultaneously, the accelerating pace of industrial expansion, particularly in emerging economies, necessitates the deployment of new emission control systems in greenfield projects and significant upgrades in existing facilities to manage the increasing pollutant load associated with growth. The escalating global concern over climate change, respiratory diseases, and environmental degradation further reinforces the demand for robust and innovative emission control solutions.

Despite the strong drivers, the market faces significant restraints, primarily stemming from the substantial capital investment required for the acquisition and installation of sophisticated emission control systems. These systems often represent a considerable portion of a project's overall budget, especially for small and medium-sized enterprises (SMEs) that may struggle with financing such large expenditures. Furthermore, the ongoing operational and maintenance costs, including energy consumption, reagent procurement, and specialized labor, can be substantial, adding to the total cost of ownership. The complexity of integrating advanced control systems into existing legacy infrastructure poses another challenge, requiring significant engineering effort and potentially leading to production downtime. In some regions, a lack of comprehensive regulatory enforcement or insufficient awareness among industrial stakeholders about the long-term benefits of emission control can also impede market penetration, resulting in delayed adoption of necessary technologies.

Opportunities within the IECS market are abundant and diverse, driven by technological advancements and unmet needs in specific sectors. The continuous innovation in materials science and digital technologies is paving the way for the development of more efficient, compact, and cost-effective emission control systems, including modular solutions that are easier to deploy and maintain. The burgeoning field of carbon capture, utilization, and storage (CCUS) presents a transformative opportunity, as industries seek to directly mitigate CO2 emissions, expanding the scope of emission control beyond traditional pollutants. Furthermore, the retrofitting of older industrial plants with modern, high-efficiency emission control systems represents a substantial market segment, particularly in developed economies where industrial infrastructure is mature. Emerging economies offer vast greenfield opportunities, as new industrial facilities are designed with state-of-the-art emission control from inception. The growing focus on circular economy principles and resource recovery is also creating demand for systems that can extract valuable by-products from industrial waste streams, turning pollution into profit. The inherent impact forces also shape the market; the bargaining power of buyers is high due to the significant investment required, leading to a demand for cost-effective and reliable solutions. Supplier power is moderate, driven by specialized technology and expertise. The threat of new entrants is low due to high capital requirements and regulatory complexities, while the threat of substitutes is also low as direct substitutes for mandated emission control are rare. Competitive rivalry is high among established players vying for large projects.

Segmentation Analysis

The Industrial Emission Control System market is intricately segmented across various dimensions, reflecting the diverse nature of industrial processes, the wide array of pollutants requiring abatement, and the different technological approaches available. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product offerings, and develop effective market penetration strategies. The primary segmentation typically revolves around the type of emission control technology employed, the specific pollutants targeted, and the end-use industries that deploy these systems. Each segment presents unique technical challenges, regulatory requirements, and economic considerations, driving the need for specialized solutions that can effectively address sector-specific environmental impact while optimizing operational efficiency and cost. The rapid evolution of industrial practices and the increasing stringency of environmental mandates continually reshape these segments, fostering innovation and creating new sub-segments focused on advanced pollution control and resource recovery.

- By Technology Type:

- Electrostatic Precipitators (ESPs)

- Fabric Filters/Baghouses

- Wet Scrubbers

- Dry/Semi-Dry Scrubbers

- Selective Catalytic Reduction (SCR)

- Selective Non-Catalytic Reduction (SNCR)

- Flue Gas Desulfurization (FGD)

- Wet FGD

- Dry FGD

- Semi-Dry FGD

- Thermal Oxidizers (TO)

- Regenerative Thermal Oxidizers (RTO)

- Catalytic Oxidizers (CO)

- Adsorption Systems (e.g., Activated Carbon)

- Biofilters & Bioreactors

- Mercury Control Systems

- Multi-pollutant Control Systems

- By Pollutant Type:

- Particulate Matter (PM2.5, PM10)

- Sulfur Oxides (SOx)

- Nitrogen Oxides (NOx)

- Volatile Organic Compounds (VOCs)

- Hazardous Air Pollutants (HAPs)

- Heavy Metals (e.g., Mercury, Lead)

- Carbon Monoxide (CO)

- Dioxins and Furans

- By End-Use Industry:

- Power Generation (Coal-fired, Gas-fired, Biomass)

- Cement Industry

- Metals & Mining (Steel, Non-ferrous Metals)

- Chemical Processing

- Oil & Gas Refineries

- Manufacturing (Automotive, Pharmaceutical, Food & Beverage)

- Waste Incineration

- Glass Industry

- Pulp & Paper

- Marine & Shipping

Value Chain Analysis For Industrial Emission Control System Market

The value chain for the Industrial Emission Control System market is a complex network involving multiple stakeholders, from raw material suppliers to end-users and after-market service providers. At the upstream end, the chain begins with the procurement of specialized raw materials such as high-grade metals (e.g., stainless steel, alloys), ceramic materials, specialized fabrics for filters, catalysts (e.g., vanadium, titanium), and various chemical reagents (e.g., lime, ammonia, activated carbon) essential for the manufacturing of emission control components. Suppliers in this segment are crucial for ensuring the quality, availability, and cost-effectiveness of these foundational inputs. Original Equipment Manufacturers (OEMs) then design, engineer, and manufacture the core emission control equipment, often integrating components from various specialized suppliers. This phase involves extensive research and development to innovate new technologies and improve existing ones, focusing on efficiency, durability, and compliance with evolving standards. The expertise in engineering and systems integration at this stage is a key determinant of competitive advantage.

Midstream activities involve the fabrication, assembly, and testing of complete emission control systems, often customized to specific industrial applications. This segment requires significant capital investment in manufacturing facilities, skilled labor, and advanced production techniques. Downstream activities encompass the installation, commissioning, and ongoing maintenance of these systems at client sites. Installation typically requires specialized engineering firms and contractors with expertise in industrial infrastructure and safety protocols. Post-installation, long-term support is critical, including the supply of spare parts, regular maintenance checks, performance monitoring, and troubleshooting, often managed through long-term service agreements. This after-market service segment is a significant revenue stream and a key factor in ensuring the sustained efficiency and compliance of the installed systems. Waste management for spent catalysts or collected pollutants also forms a critical part of the downstream value chain, often requiring specialized waste treatment and disposal services to prevent secondary environmental impacts.

Distribution channels in the IECS market are primarily structured around direct sales, owing to the high value, complexity, and customization required for most industrial projects. OEMs often have dedicated sales teams and engineers who engage directly with end-users, consultants, and engineering, procurement, and construction (EPC) firms. This direct approach facilitates detailed technical discussions, project-specific customizations, and integrated solution offerings. Indirect channels, though less prevalent for large-scale systems, include specialized distributors or agents who represent multiple manufacturers and cater to smaller projects or provide localized support and spare parts. Strategic partnerships with EPC contractors are also vital, as these contractors often manage large industrial projects and integrate emission control systems as part of broader plant construction or modernization efforts. The role of indirect channels might expand as standardized and modular solutions become more common, offering a wider reach, particularly in emerging markets where local presence and support networks are crucial for market penetration and customer trust. Both direct and indirect channels rely heavily on technical expertise and a deep understanding of customer needs and regulatory landscapes to successfully navigate the market.

Industrial Emission Control System Market Potential Customers

The primary potential customers for Industrial Emission Control Systems are industries characterized by processes that generate significant air pollutants, requiring robust abatement technologies to comply with environmental regulations and uphold corporate social responsibility. At the forefront are power generation companies, particularly those operating coal-fired and gas-fired power plants, which are major emitters of SOx, NOx, and particulate matter. As global energy demand continues to grow and the transition to cleaner energy sources progresses, these plants, both new and existing, represent a colossal market for advanced emission control technologies, including Flue Gas Desulfurization (FGD) and Selective Catalytic Reduction (SCR) systems. The continuous pressure to reduce the carbon footprint and mitigate local air quality impacts positions power generators as consistently high-value buyers in the IECS market, seeking solutions that offer both high efficiency and operational reliability for continuous, large-scale operations. The long operational lifespan of these plants means a sustained need for maintenance, upgrades, and sometimes complete system overhauls, thereby ensuring a recurring demand for parts, services, and new installations.

Beyond power generation, the cement industry stands out as a significant end-user, due to its energy-intensive processes that release substantial quantities of particulate matter, NOx, SOx, and greenhouse gases. Cement manufacturers are under increasing scrutiny to modernize their plants with efficient fabric filters, electrostatic precipitators, and NOx reduction technologies to meet evolving emissions limits, especially in rapidly urbanizing regions. Similarly, the metals and mining sector, encompassing steel production, non-ferrous metal smelting, and mineral processing, presents a large customer base. These industries are characterized by high-temperature operations and the handling of various ores, leading to significant emissions of particulate matter, SOx, and heavy metals. Consequently, they require robust and durable emission control systems capable of handling corrosive and high-dust environments, with a strong emphasis on particulate removal and gas cleaning to safeguard both worker health and the surrounding environment. The specific requirements vary greatly by the type of metal and the processing method, necessitating highly customized solutions.

Other crucial segments of potential customers include the chemical processing industry, where diverse chemical reactions generate a wide spectrum of volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and acid gases. Companies in this sector require sophisticated thermal oxidizers, catalytic oxidizers, and adsorption systems to neutralize these complex pollutants. The oil and gas industry, from upstream exploration to downstream refining, also represents a substantial market, with a need for emission control solutions to manage SOx, NOx, VOCs, and particulate emissions from flares, furnaces, and processing units. Manufacturing sectors, including automotive, pharmaceutical, and food & beverage, also contribute to the demand for specialized emission control systems, particularly for VOC abatement and odor control, driven by both regulatory compliance and the need to maintain pristine production environments. Lastly, waste incineration plants are critical customers, requiring advanced multi-pollutant control systems to manage highly toxic emissions such as dioxins, furans, heavy metals, and acid gases, ensuring safe waste disposal and energy recovery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 13.2 Billion |

| Market Forecast in 2032 | USD 22.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Babcock & Wilcox Enterprises, Inc., Siemens AG, General Electric Company, Mitsubishi Heavy Industries, Ltd., Thermax Limited, Ducon Environmental Systems, Inc., Hamon Group, John Wood Group PLC, Donaldson Company, Inc., CECO Environmental Corp., Fuji Electric Co., Ltd., Wärtsilä Corporation, Alfa Laval AB, Munters Group AB, Nederman Holding AB, Pall Corporation, AAF International (Daikin Industries, Ltd.), GEA Group Aktiengesellschaft, Parker Hannifin Corporation, Sumitomo Heavy Industries, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Emission Control System Market Key Technology Landscape

The technological landscape of the Industrial Emission Control System market is characterized by a diverse array of advanced solutions, each designed to tackle specific types of pollutants and cater to varying industrial applications. At the core are technologies for particulate matter control, such as Electrostatic Precipitators (ESPs) and Fabric Filters (also known as baghouses). ESPs work by electrostatically charging particulate matter and collecting it on charged plates, offering high efficiency for fine particles, particularly in power plants and cement factories. Fabric filters, on the other hand, utilize porous fabric bags to physically filter out particulate matter, excelling in applications where very high collection efficiencies are required, often coupled with the ability to handle fluctuating gas volumes. Ongoing innovations in these areas focus on improving energy efficiency, reducing footprint, and enhancing the durability of materials in harsh industrial environments. The development of advanced filter media with improved capture efficiency and longer lifespan is a continuous area of research, ensuring these established technologies remain relevant and highly effective.

For gaseous pollutant abatement, a range of chemical and catalytic processes are employed. Flue Gas Desulfurization (FGD) systems are crucial for removing sulfur oxides (SOx), predominantly from coal-fired power plants and smelters. These can be wet, dry, or semi-dry, with wet scrubbers typically offering the highest removal efficiency and often producing a usable byproduct like gypsum. Selective Catalytic Reduction (SCR) and Selective Non-Catalytic Reduction (SNCR) are the leading technologies for nitrogen oxide (NOx) control. SCR injects ammonia or urea into the flue gas in the presence of a catalyst to convert NOx into harmless nitrogen and water, achieving very high removal rates. SNCR performs a similar reaction at higher temperatures without a catalyst, offering a simpler but less efficient solution. Additionally, thermal oxidizers (TOs), including Regenerative Thermal Oxidizers (RTOs) and Catalytic Oxidizers, are widely used for destroying volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) by oxidizing them at high temperatures. RTOs are particularly notable for their high thermal efficiency, significantly reducing operational costs by recovering heat.

Beyond these foundational technologies, the market is also seeing increasing adoption of specialized systems for emerging pollutants and integrated solutions. Mercury control systems, often utilizing activated carbon injection, are gaining traction due to tightening regulations on heavy metal emissions. Bioreactors and biofilters are employed for odor control and removal of certain VOCs, leveraging biological processes for environmentally friendly treatment. Multi-pollutant control systems, which integrate several technologies to simultaneously address a range of contaminants (e.g., SOx, NOx, PM, mercury) in a single unit, are becoming more prevalent, offering comprehensive and space-saving solutions. The integration of digital technologies, such as advanced sensors, IoT connectivity, and artificial intelligence, is further enhancing the performance of these systems by enabling real-time monitoring, predictive maintenance, and optimized operational control. This digital transformation is key to improving the efficiency, reliability, and cost-effectiveness of emission control across all technological categories, paving the way for smarter, more adaptive pollution abatement strategies in industrial settings.

Regional Highlights

Regional dynamics are a significant determinant of growth and technological adoption within the Industrial Emission Control System market, reflecting varying levels of industrialization, regulatory stringency, and economic development across the globe. Each major geographic region presents a unique set of drivers, challenges, and opportunities that shape market trends and investment priorities. Understanding these regional specificities is crucial for market players to tailor their strategies, focusing on local regulatory frameworks, prevalent industrial sectors, and the specific emission challenges faced by industries in those areas. The global push for sustainability, coupled with localized environmental imperatives, ensures a dynamic and evolving landscape for emission control technologies. Different regions are at various stages of environmental policy maturity, influencing the demand for basic versus advanced control solutions.

- North America: Characterized by mature industrial sectors and some of the world's most stringent environmental regulations (e.g., EPA standards in the U.S. and Environment and Climate Change Canada regulations). Demand is driven by retrofitting older facilities, technological upgrades for enhanced efficiency, and continuous innovation in multi-pollutant control and carbon capture technologies. The region is a significant adopter of advanced SCR, FGD, and particulate control systems, with increasing emphasis on mercury and other hazardous air pollutant (HAP) reduction. Investment in AI and IoT for predictive maintenance and operational optimization is also prominent.

- Europe: Driven by ambitious environmental targets such as the European Green Deal, which mandates significant reductions in industrial emissions and moves towards a circular economy. The market here focuses on highly efficient, low-emission technologies, often integrating renewable energy sources. Stricter limits on NOx, SOx, and particulate matter push demand for sophisticated SCR, FGD, and fabric filter systems, alongside growing interest in carbon capture and utilization technologies. Innovation and R&D are strong, with a focus on sustainable solutions and compliance with directives like the Industrial Emissions Directive (IED).

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by rapid industrialization, burgeoning manufacturing sectors, and increasing energy demand, particularly in China, India, and Southeast Asian countries. While regulatory enforcement has historically varied, it is becoming increasingly stringent, driving massive investments in new emission control installations and upgrades in existing plants. Demand is high across all technology types, with a strong focus on cost-effective and scalable solutions for power generation, cement, metals & mining, and chemical industries. Air pollution control is a major public health concern, fueling government-led initiatives for cleaner air.

- Latin America: An emerging market with significant growth potential, driven by expanding industrial bases in countries like Brazil, Mexico, and Argentina, particularly in oil & gas, mining, and power generation. The region is characterized by evolving environmental regulations and a growing awareness of air quality issues. Demand is increasing for basic to moderately advanced emission control systems, with a focus on achieving initial compliance and gradually upgrading to more sophisticated technologies as regulatory frameworks mature and economic conditions improve.

- Middle East and Africa (MEA): This region is experiencing considerable infrastructure development and industrial expansion, especially in the oil & gas, petrochemical, and power generation sectors. While environmental regulations are still developing in many parts, the increasing foreign investment and a global push for sustainable practices are stimulating demand for emission control systems. Key drivers include new project development and the need to meet international environmental standards for export-oriented industries, with particular attention to SOx and NOx control from combustion processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Emission Control System Market.- Babcock & Wilcox Enterprises, Inc.

- Siemens AG

- General Electric Company

- Mitsubishi Heavy Industries, Ltd.

- Thermax Limited

- Ducon Environmental Systems, Inc.

- Hamon Group

- John Wood Group PLC

- Donaldson Company, Inc.

- CECO Environmental Corp.

- Fuji Electric Co., Ltd.

- Wärtsilä Corporation

- Alfa Laval AB

- Munters Group AB

- Nederman Holding AB

- Pall Corporation

- AAF International (Daikin Industries, Ltd.)

- GEA Group Aktiengesellschaft

- Parker Hannifin Corporation

- Sumitomo Heavy Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Emission Control System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of pollutants addressed by Industrial Emission Control Systems?

Industrial Emission Control Systems (IECS) are designed to abate a wide range of pollutants, including particulate matter (PM2.5, PM10), sulfur oxides (SOx), nitrogen oxides (NOx), volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and heavy metals like mercury. The specific type of system deployed depends on the nature and concentration of the pollutants generated by the industrial process.

Which industries are the largest consumers of Industrial Emission Control Systems?

The largest consumers of IECS are typically heavy industries with significant emission footprints, such as power generation (especially coal-fired plants), cement manufacturing, metals and mining (e.g., steel, non-ferrous metals), chemical processing, oil & gas refining, and waste incineration. These sectors require robust solutions to comply with stringent environmental regulations and mitigate their environmental impact.

How do environmental regulations impact the Industrial Emission Control System market?

Environmental regulations are the primary driver of the IECS market. Stricter local, national, and international emission standards compel industries to invest in new or upgraded control technologies to avoid penalties, maintain operational licenses, and uphold corporate social responsibility. These regulations dictate the type and efficiency of systems required, fostering innovation and market growth.

What role does Artificial Intelligence (AI) play in modern emission control systems?

AI is increasingly integrated into modern IECS for predictive maintenance, operational optimization, and real-time monitoring. AI algorithms analyze vast datasets to forecast equipment failures, dynamically adjust system parameters for maximum efficiency and minimum energy consumption, and ensure continuous compliance, transforming reactive approaches into proactive strategies for pollution control.

What are the main challenges facing the adoption of Industrial Emission Control Systems?

Key challenges include the high capital investment required for procurement and installation, significant ongoing operational and maintenance costs, and the complexity of integrating advanced systems with existing legacy infrastructure. Additionally, a lack of consistent regulatory enforcement or awareness in some regions can impede widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager