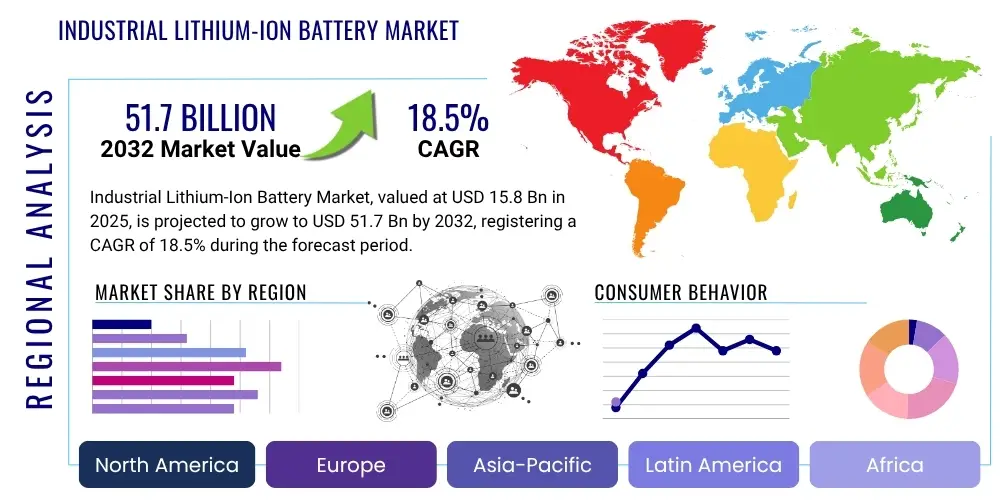

Industrial Lithium-Ion Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430436 | Date : Nov, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Lithium-Ion Battery Market Size

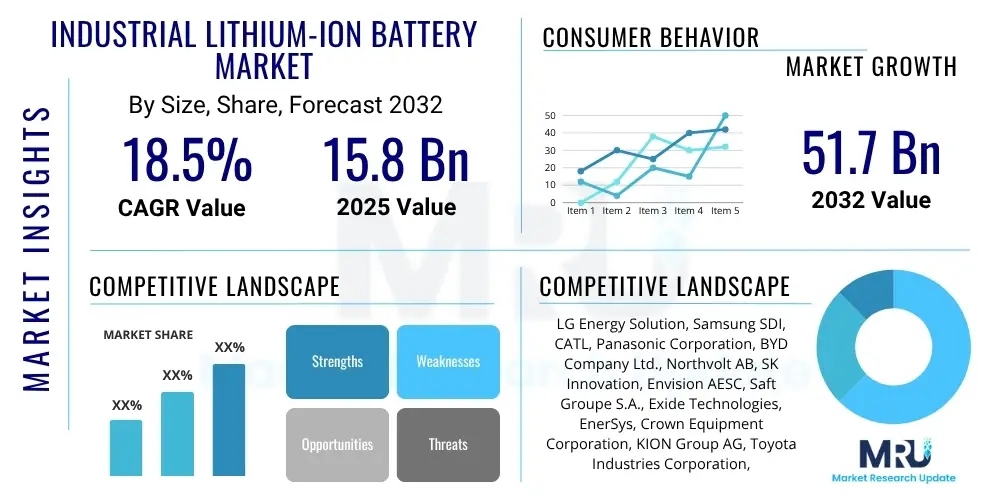

The Industrial Lithium-Ion Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2025 and 2032. The market is estimated at USD 15.8 Billion in 2025 and is projected to reach USD 51.7 Billion by the end of the forecast period in 2032.

Industrial Lithium-Ion Battery Market introduction

The Industrial Lithium-Ion Battery Market encompasses rechargeable battery systems specifically engineered to power heavy-duty equipment and large-scale applications across various industrial sectors, distinguishing them from their consumer electronics counterparts by their robust design, higher power output, and extended cycle life requirements. These advanced battery solutions are critical enablers for the global shift towards electrification and automation in manufacturing, logistics, mining, construction, and energy management. Products typically include various chemistries such as Lithium Iron Phosphate (LFP) for its superior safety, long cycle life, and cost-effectiveness, and Lithium Nickel Manganese Cobalt Oxide (NMC) offering higher energy density for more demanding applications, alongside other specialized variants like Lithium Cobalt Oxide (LCO) and Lithium Titanate Oxide (LTO), each selected based on specific performance needs. Major applications span from electrifying material handling equipment like forklifts and automated guided vehicles (AGVs) in warehouses and distribution centers, to providing resilient power for grid energy storage systems, large-scale mining trucks, marine vessels, and telecommunications infrastructure. The inherent benefits of these batteries are manifold; they include significantly higher energy efficiency, faster charging times compared to traditional lead-acid batteries, a negligible memory effect, and a substantially longer operational lifespan, which collectively contribute to reduced operational costs, lower maintenance requirements, and improved productivity. Furthermore, their zero-emission operation at the point of use aligns with environmental sustainability goals and increasingly stringent regulatory mandates. The market's growth is predominantly driven by the global imperative for decarbonization across industries, a strong regulatory push for cleaner energy adoption, the relentless pace of automation in logistics and manufacturing, and the consistent decline in battery manufacturing costs. This is augmented by continuous technological advancements enhancing battery performance, safety, and reliability, making industrial lithium-ion batteries an indispensable component of modern industrial infrastructure.

Industrial Lithium-Ion Battery Market Executive Summary

The Industrial Lithium-Ion Battery Market is currently undergoing a period of dynamic expansion, characterized by a complex interplay of evolving business trends, distinct regional growth patterns, and rapid segmentation shifts. From a business trends perspective, the market is defined by aggressive investments in new Gigafactories globally, indicating a significant commitment to scaling up production capacity to meet escalating demand, particularly from the automotive and industrial sectors that share similar battery technologies. There is a growing strategic emphasis on diversifying the supply chain and localizing battery production to mitigate geopolitical risks and ensure raw material security, fostering partnerships and joint ventures across the value chain from material extraction to end-use integration. Furthermore, technological innovation in battery management systems (BMS) and thermal management solutions is a key area of focus, enhancing battery safety, longevity, and overall performance, alongside the emergence of "battery-as-a-service" models that reduce upfront capital expenditure for industrial users. Regionally, Asia Pacific continues to dominate the market, largely attributed to established manufacturing hubs, robust industrialization, and strong governmental support for electrification initiatives, with China and South Korea leading in production and adoption. Europe and North America are experiencing accelerated growth, propelled by stringent environmental regulations, substantial government subsidies for electric vehicle adoption and renewable energy storage, and increasing automation in their respective industrial landscapes. Emerging markets in Latin America, the Middle East, and Africa are also showing promising growth, driven by infrastructure development and a push towards sustainable energy solutions. In terms of segment trends, the material handling segment, primarily encompassing electric forklifts and AGVs, remains the largest and most mature application, transitioning rapidly from traditional lead-acid batteries due to superior operational economics. However, the energy storage systems (ESS) segment for grid stabilization, peak shaving, and renewable energy integration is emerging as the fastest-growing application, driven by the global energy transition. Other segments such as mining, construction, and marine are witnessing accelerated adoption as industries seek to electrify heavy-duty machinery, reducing operational costs and environmental footprints, thereby contributing to the comprehensive growth trajectory of the industrial lithium-ion battery sector.

AI Impact Analysis on Industrial Lithium-Ion Battery Market

User inquiries frequently center on how artificial intelligence can optimize the performance, extend the lifespan, and bolster the safety of industrial lithium-ion batteries, as well as its role in streamlining manufacturing processes and enabling more effective integration into smart energy grids. There is a significant interest in AI's capacity to facilitate predictive maintenance, refine energy management strategies, and ultimately contribute to reductions in operational expenditure and environmental impact across the vast array of industrial applications. Stakeholders express high expectations for AI to revolutionize diagnostics, operational efficiency, and overall system resilience within this critical domain. Artificial intelligence is positioned to profoundly transform the industrial lithium-ion battery market by enhancing nearly every stage of the battery lifecycle, from initial design and advanced manufacturing to optimized operation and efficient recycling. AI algorithms are proving invaluable in refining battery management systems (BMS), enabling more precise real-time state-of-charge (SoC) and state-of-health (SoH) estimations, which critically extends battery lifespan and significantly improves operational reliability across demanding industrial environments. Predictive maintenance, powered by machine learning and deep learning models, can foresee potential battery failures before they manifest, thereby dramatically reducing unscheduled downtime and the associated maintenance costs for industrial operators. Furthermore, AI contributes substantially to more efficient and higher-quality battery manufacturing processes, allowing for enhanced defect detection, reduced waste, and accelerated production cycles, which are essential for meeting the escalating global demand for these indispensable power sources. Its application extends into the realm of large-scale industrial energy storage systems, where AI optimizes energy dispatch, load balancing, and grid integration, ensuring maximum efficiency, stability, and responsiveness for renewable energy utilization and grid services.

- Enhanced Battery Management Systems (BMS) through real-time data analytics and machine learning for precise state estimation.

- Predictive maintenance capabilities, minimizing unscheduled downtime and reducing operational and maintenance costs significantly.

- Optimized charging and discharging cycles, intelligently managed by AI to maximize battery lifespan and performance.

- Improved manufacturing efficiency, quality control, and defect detection using AI-driven vision systems and process optimization algorithms.

- Smarter energy grid integration and load balancing for large-scale industrial energy storage applications, ensuring stability and efficiency.

- Advanced thermal management and comprehensive safety monitoring through AI-powered anomaly detection for critical industrial deployments.

- Acceleration of new battery chemistry development and design through AI-powered simulation and material discovery platforms.

- Optimization of battery fleet management in logistics and material handling for improved asset utilization and energy consumption.

- Facilitation of battery recycling processes by AI-driven sorting and material identification, promoting circular economy principles.

DRO & Impact Forces Of Industrial Lithium-Ion Battery Market

The industrial lithium-ion battery market is propelled by a dynamic interplay of powerful drivers, significant restraints, compelling opportunities, and various impact forces that collectively shape its trajectory and competitive landscape. The foremost drivers include the escalating global imperative for decarbonization and stringent environmental regulations that are pushing industrial sectors towards cleaner, more sustainable energy solutions, alongside the accelerating adoption of automation in logistics and manufacturing, where electric forklifts, AGVs, and other robotic systems require highly efficient and reliable power sources. Furthermore, the continuous advancements in lithium-ion battery technology, leading to improved energy density, longer cycle life, enhanced safety features, and a steady decline in manufacturing costs, significantly boost their attractiveness for heavy-duty industrial applications and large-scale renewable energy integration. However, the market faces notable restraints such as the relatively high initial capital investment required for battery acquisition and the establishment of adequate charging infrastructure, which can pose a financial barrier for smaller or less capitalized enterprises. Persistent concerns regarding battery safety, particularly the risk of thermal runaway in certain applications, necessitate the implementation of robust safety protocols, advanced battery management systems (BMS), and sophisticated thermal management solutions. Moreover, the volatility in raw material prices, potential geopolitical risks associated with critical mineral sourcing (e.g., lithium, cobalt, nickel), and the complexities of establishing resilient supply chains present ongoing challenges. Despite these hurdles, substantial opportunities are emerging in the market, including the expansion into nascent industrial applications such as the electrification of heavy mining equipment, port machinery, construction vehicles, and urban electric transport systems, which traditionally relied on fossil fuels. The ongoing research and development into next-generation battery chemistries, such as solid-state batteries promising enhanced safety and energy density, along with the growth of second-life battery applications and advanced recycling technologies, are creating new avenues for sustainable market expansion. The market is also significantly influenced by several impact forces; the intense competitive rivalry among established battery manufacturers and emerging innovators drives continuous product improvement and cost reduction. The bargaining power of key raw material suppliers, often concentrated in a few regions, impacts production costs and supply stability. Conversely, the bargaining power of large industrial buyers, seeking customized and cost-effective solutions, exerts pressure on pricing and service offerings. The threat of substitutes, while diminishing due to the superior performance of lithium-ion, still exists from advanced lead-acid alternatives or hydrogen fuel cells in niche applications. The relatively high barriers to entry for new players, primarily due to capital intensity, technological complexity, and intellectual property, helps maintain market stability for incumbent companies, although disruptive innovations from new entrants could always shift market dynamics significantly.

Segmentation Analysis

The industrial lithium-ion battery market is intricately segmented to reflect the diverse operational requirements and technological preferences across a multitude of industrial applications, providing a granular understanding of market dynamics and growth opportunities. This comprehensive segmentation is crucial for stakeholders to identify specific market niches, tailor product development, and formulate targeted go-to-market strategies effectively. The classification by battery type highlights the ongoing evolution in battery chemistry, where each variant offers a unique balance of energy density, power output, cycle life, safety profile, and cost structure, catering to specific performance demands. Power capacity segmentation, on the other hand, delineates the market based on the varying energy storage needs of industrial equipment, ranging from smaller, agile automated systems to expansive, high-capacity grid-scale storage solutions, each demanding specific ampere-hour ratings and power delivery capabilities. Moreover, the application-based segmentation offers critical insights into the primary end-user industries that are driving adoption, showcasing which sectors are rapidly electrifying their operations and identifying emerging opportunities in specialized industrial niches such as heavy machinery, marine propulsion, and railway systems. This detailed analytical framework enables market participants to strategically align their product portfolios and research and development initiatives with the precise demands of each segment, thereby fostering sustainable market penetration and robust growth across the entire industrial landscape.

- By Type:

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Titanate Oxide (LTO)

- Other Chemistries (e.g., Lithium Manganese Oxide (LMO), Solid-state batteries)

- By Power Capacity:

- Less than 50 Ah

- 50-100 Ah

- More than 100 Ah

- By Application:

- Forklifts

- Automated Guided Vehicles (AGV)

- Telecom

- Mining

- Construction

- Marine

- Grid Energy Storage

- Railway

- Port Equipment

- Agricultural Machinery

- Robotics

- Other Industrial Equipment (e.g., Cranes, Aerial Work Platforms)

Value Chain Analysis For Industrial Lithium-Ion Battery Market

The value chain for the Industrial Lithium-Ion Battery Market is an intricate and globally interconnected network, meticulously spanning from the earliest stages of raw material sourcing to the final deployment and post-consumer life cycle management. The upstream segment of this chain commences with the extraction and meticulous processing of critical raw materials, which primarily include lithium, cobalt, nickel, manganese, graphite, and various other essential chemical components. This phase is often characterized by significant geopolitical complexities, environmental sustainability considerations, and intense competition for limited resources, necessitating robust supply chain management and ethical sourcing practices. Following raw material refinement, specialized manufacturers produce the core battery components: cathodes, anodes, electrolytes, and separators, each requiring advanced material science, chemical engineering expertise, and stringent quality control. Moving further downstream, the midstream segment focuses on the intricate processes of cell manufacturing, where individual battery cells are precision-engineered, assembled, and rigorously tested for performance, safety, and longevity. These individual cells are then integrated into larger, robust battery modules, which are subsequently combined to form complete industrial-grade battery packs. These packs incorporate sophisticated Battery Management Systems (BMS) for monitoring and control, advanced thermal management units for optimal operating conditions, and durable casings designed to withstand the harsh and demanding environments typical of industrial operations. The downstream activities encompass the comprehensive distribution, integration, and final deployment of these industrial battery packs into a diverse array of end-use applications. This involves various distribution channels; direct sales to large original equipment manufacturers (OEMs) of industrial machinery (such as forklift manufacturers, AGV developers, or heavy equipment producers) constitute a significant portion. Alongside direct sales, the market heavily relies on a network of specialized third-party distributors and system integrators who customize battery solutions to meet the unique specifications of individual industrial clients, offering value-added services like installation, commissioning, and ongoing maintenance. Indirect channels also include partnerships with value-added resellers who provide comprehensive solutions encompassing the entire power system. The entire value chain is underpinned by advanced logistics, comprehensive technical support, and, increasingly, by circular economy initiatives focusing on battery recycling and second-life applications. These initiatives aim to recover valuable materials, minimize waste, and extend the economic life of batteries, thereby contributing significantly to both economic efficiency and environmental sustainability throughout the industrial battery ecosystem. This integrated approach ensures the efficient flow of materials, technologies, and finished products, supporting the continuous growth and evolution of the industrial lithium-ion battery market globally.

Industrial Lithium-Ion Battery Market Potential Customers

The potential customers for the Industrial Lithium-Ion Battery Market comprise a vast and diverse ecosystem of industries that are progressively recognizing the imperative for efficient, powerful, and exceptionally durable energy storage solutions to ensure operational continuity, enhance productivity, and strategically advance their electrification goals. These end-users are predominantly organizations deeply involved in material handling, intricate logistics operations, large-scale energy infrastructure, heavy industries, telecommunications, and specialized manufacturing sectors. Key among these are material handling companies, including those managing extensive fleets of electric forklifts, pallet jacks, stackers, and sophisticated automated guided vehicles (AGVs) within warehouses, bustling distribution centers, and high-volume manufacturing facilities. Their demand is primarily driven by the compelling desire to dramatically improve operational efficiency, substantially reduce fuel and maintenance costs, minimize greenhouse gas emissions, and leverage the rapid charging capabilities that minimize equipment downtime. Furthermore, developers and operators of grid-scale energy storage systems (ESS) represent a critically important customer segment, as industrial lithium-ion batteries provide the robust reliability, high energy density, and scalable capacity essential for integrating intermittent renewable energy sources, performing vital peak shaving, offering frequency regulation, and ensuring overall grid stability and resilience. The inherently demanding mining and construction sectors are also rapidly adopting these advanced battery technologies for electrifying heavy machinery such as excavators, loaders, haul trucks, and drilling rigs. This transition is motivated by the dual objectives of significantly reducing dependency on volatile fossil fuels and their associated costs, alongside lowering operational noise levels and complying with increasingly stringent environmental regulations, particularly in sensitive or enclosed work environments. Telecommunication operators constitute another vital customer group, deploying industrial lithium-ion batteries for crucial backup power in their critical infrastructure, ensuring uninterrupted network services during power outages or grid instabilities. Emerging markets for these batteries also include the marine and railway industries, where robust lithium-ion solutions are being increasingly employed for electric propulsion and auxiliary power in ferries, cargo ships, and locomotives. Additionally, port authorities, committed to decarbonizing their extensive operations, are making substantial investments in electric port equipment, including electric cranes, container handlers, and terminal tractors. In essence, any industrial entity seeking to enhance productivity, significantly reduce its environmental footprint, and achieve lower long-term operating expenses through the adoption of advanced, reliable, and sustainable electrification technologies stands as a direct or indirect potential customer for industrial lithium-ion battery solutions, demonstrating the broad and impactful reach of this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 15.8 Billion |

| Market Forecast in 2032 | USD 51.7 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Energy Solution, Samsung SDI, CATL, Panasonic Corporation, BYD Company Ltd., Northvolt AB, SK Innovation, Envision AESC, Saft Groupe S.A., Exide Technologies, EnerSys, Crown Equipment Corporation, KION Group AG, Toyota Industries Corporation, Mitsubishi Logisnext Co., Ltd., Briggs & Stratton, Svolt Energy Technology Co., Ltd., Farasis Energy, EVE Energy Co., Ltd., Microvast Holdings Inc., QuantumScape Corporation, Freudenberg Sealing Technologies GmbH & Co. KG, Leclanché SA, Kokam Co., Ltd., SimpliPhi Power Inc., Valence Technology Inc., GS Yuasa Corporation, Hitachi Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Lithium-Ion Battery Market Key Technology Landscape

The key technology landscape of the Industrial Lithium-Ion Battery Market is defined by a relentless pursuit of innovation aimed at simultaneously enhancing performance metrics, bolstering safety protocols, and optimizing cost-effectiveness for the inherently demanding and diverse applications prevalent across industrial sectors. Significant advancements are continuously being made in fundamental cell chemistries, extending beyond the conventional lithium-ion formulations to actively explore and develop novel materials such as silicon-anode batteries, which promise substantially increased energy density for extended operational ranges and reduced physical footprints. Concurrently, solid-state batteries are garnering immense attention due to their potential for superior safety characteristics, inherent stability, and even higher energy densities, positioning them as a transformative technology for future industrial deployments. Central to the robust and reliable operation of any industrial battery system are sophisticated Battery Management Systems (BMS), which are evolving to incorporate advanced algorithms for exceptionally precise real-time state-of-charge (SoC), state-of-health (SoH), and state-of-power (SoP) estimations. These advanced BMS also provide critical active cell balancing, comprehensive fault diagnostics, and predictive analytics, ensuring optimal performance and mitigating potential issues before they escalate. These modern BMS are increasingly integrated with Internet of Things (IoT) platforms and cloud-based analytics, enabling real-time remote monitoring, granular diagnostics, and data-driven operational strategies, thereby facilitating predictive maintenance and maximizing asset utilization for industrial operators. Furthermore, rapid charging and increasingly efficient wireless charging technologies are gaining significant traction, directly addressing the critical industrial need for minimized equipment downtime and enhanced operational flexibility. Advanced thermal management systems, employing innovative solutions such as liquid cooling, forced air cooling, or phase-change materials, are absolutely crucial for maintaining optimal operating temperatures and preventing overheating, which directly impacts battery longevity, safety, and consistent performance under heavy loads. Innovations in battery pack design are also a vital area of technological focus, emphasizing modularity for scalability, ruggedization to withstand harsh industrial environments, and ease of serviceability for simplified maintenance and replacement. Moreover, research and development into second-life applications, where industrial batteries are repurposed after their primary use, and advanced recycling techniques form an indispensable part of the technological evolution, promoting sustainable resource management, reducing environmental impact, and contributing to a circular economy model within the industrial battery ecosystem. These combined technological efforts are collectively pushing the boundaries of what industrial lithium-ion batteries can achieve, driving efficiency, safety, and sustainability.

Regional Highlights

- North America: This region is witnessing robust growth, primarily driven by strong governmental incentives aimed at promoting electrification across various industries and substantial investments in renewable energy infrastructure projects that necessitate reliable energy storage. The increasing trend of automation in logistics, material handling, and manufacturing sectors further fuels the demand for industrial lithium-ion batteries. North America benefits from established industrial bases and a significant focus on reducing carbon emissions to meet ambitious climate targets, leading to widespread adoption in electric forklifts, AGVs, and grid storage.

- Europe: The European market is characterized by exceptionally stringent environmental regulations and ambitious decarbonization targets set by the European Union, which are major catalysts for the widespread adoption of industrial lithium-ion batteries. Significant investments in domestic Gigafactories, extensive research and development into advanced battery technologies, and a thriving market for electric material handling equipment, construction machinery, and rail applications are key drivers, bolstered by strong governmental support and policies promoting sustainable industrial practices.

- Asia Pacific (APAC): As the dominant market globally, APAC's leadership is fueled by unparalleled manufacturing capabilities, rapid industrialization, and consistently high demand from emerging economies, particularly China, Japan, and South Korea, which are at the forefront of both battery production and consumption. The region sees accelerated growth in material handling, electric heavy machinery, and large-scale energy storage applications, driven by favorable government policies, massive industrial expansion, and technological leadership in battery production.

- Latin America: This region represents an emerging and rapidly growing market for industrial lithium-ion batteries, spurred by increasing investments in key sectors such as mining, agriculture, and substantial renewable energy projects. There is a growing emphasis on electrifying heavy machinery in mining operations to reduce fuel costs and emissions, alongside efforts to improve energy grid stability and access in countries rich in natural resources, indicating significant future potential for industrial battery deployment.

- Middle East and Africa (MEA): The MEA region is characterized by substantial governmental and private sector investments in economic diversification, the development of smart cities, and large-scale renewable energy initiatives, particularly solar and wind farms. This drives a significant demand for industrial lithium-ion batteries for energy storage, backup power in telecommunications infrastructure, and the gradual electrification of heavy equipment in oil and gas operations and port logistics, marking it as a region with considerable long-term growth prospects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Lithium-Ion Battery Market.- LG Energy Solution

- Samsung SDI

- CATL (Contemporary Amperex Technology Co. Limited)

- Panasonic Corporation

- BYD Company Ltd.

- Northvolt AB

- SK Innovation

- Envision AESC

- Saft Groupe S.A.

- Exide Technologies

- EnerSys

- Crown Equipment Corporation

- KION Group AG

- Toyota Industries Corporation

- Mitsubishi Logisnext Co., Ltd.

- Briggs & Stratton

- Svolt Energy Technology Co., Ltd.

- Farasis Energy

- EVE Energy Co., Ltd.

- Microvast Holdings Inc.

- QuantumScape Corporation

- Freudenberg Sealing Technologies GmbH & Co. KG

- Leclanché SA

- Kokam Co., Ltd.

- SimpliPhi Power Inc.

- Valence Technology Inc.

- GS Yuasa Corporation

- Hitachi Ltd.

- Electrovaya Inc.

- Lithium Werks (now part of Reliance New Energy Solar)

Frequently Asked Questions

What are the primary advantages of industrial lithium-ion batteries over traditional lead-acid batteries?

Industrial lithium-ion batteries offer significantly higher energy density, providing more power in a compact size, alongside a much longer cycle life that reduces replacement frequency. They boast faster and more efficient charging capabilities, exhibit consistent power output throughout their discharge cycle, and are virtually maintenance-free. Furthermore, they contribute to a cleaner and safer operational environment due to zero emissions and significantly lower total cost of ownership over their lifespan, making them a superior choice for modern industrial applications.

How do industrial lithium-ion batteries contribute to sustainable industrial operations?

They are pivotal in enabling the widespread electrification of industrial fleets and heavy equipment, directly leading to zero direct emissions at the point of use and a substantial reduction in reliance on fossil fuels. This transition also lowers noise pollution in workplaces. Their inherently longer operational lifespan and the increasing focus on advanced recyclability and second-life applications further minimize their environmental footprint, actively supporting global decarbonization efforts and promoting a circular economy model within industrial sectors.

What are the key safety considerations for industrial lithium-ion battery deployment?

While significantly advanced in safety, key considerations for industrial lithium-ion battery deployment include implementing sophisticated thermal management systems to prevent overheating and ensure optimal operating temperatures. Robust Battery Management Systems (BMS) are essential for continuous monitoring of cell voltage, current, and temperature, along with advanced fault detection. Adherence to strict international safety standards, proper charging protocols, and the use of durable, protective casings are crucial to guarantee secure and reliable operation in demanding industrial environments.

Which industrial applications are currently driving the demand for lithium-ion batteries?

The material handling sector, encompassing electric forklifts, pallet jacks, and Automated Guided Vehicles (AGVs) in logistics and manufacturing, remains a dominant driver. Additionally, grid-scale energy storage systems (ESS) for renewable energy integration and grid stabilization, heavy-duty mining equipment, construction machinery, reliable backup power for telecommunications infrastructure, and propulsion systems for marine vessels are rapidly expanding application areas significantly boosting market demand.

What future technological advancements are expected in industrial lithium-ion batteries?

Future technological advancements are anticipated to include the commercialization of solid-state batteries, promising significantly enhanced safety, higher energy density, and extended cycle life. Further developments in silicon-anode technology are expected to boost battery capacity. We also foresee the evolution of ultra-fast charging and efficient wireless charging solutions, coupled with increasingly integrated, AI-powered Battery Management Systems (BMS) for unparalleled performance optimization, predictive maintenance, and longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager