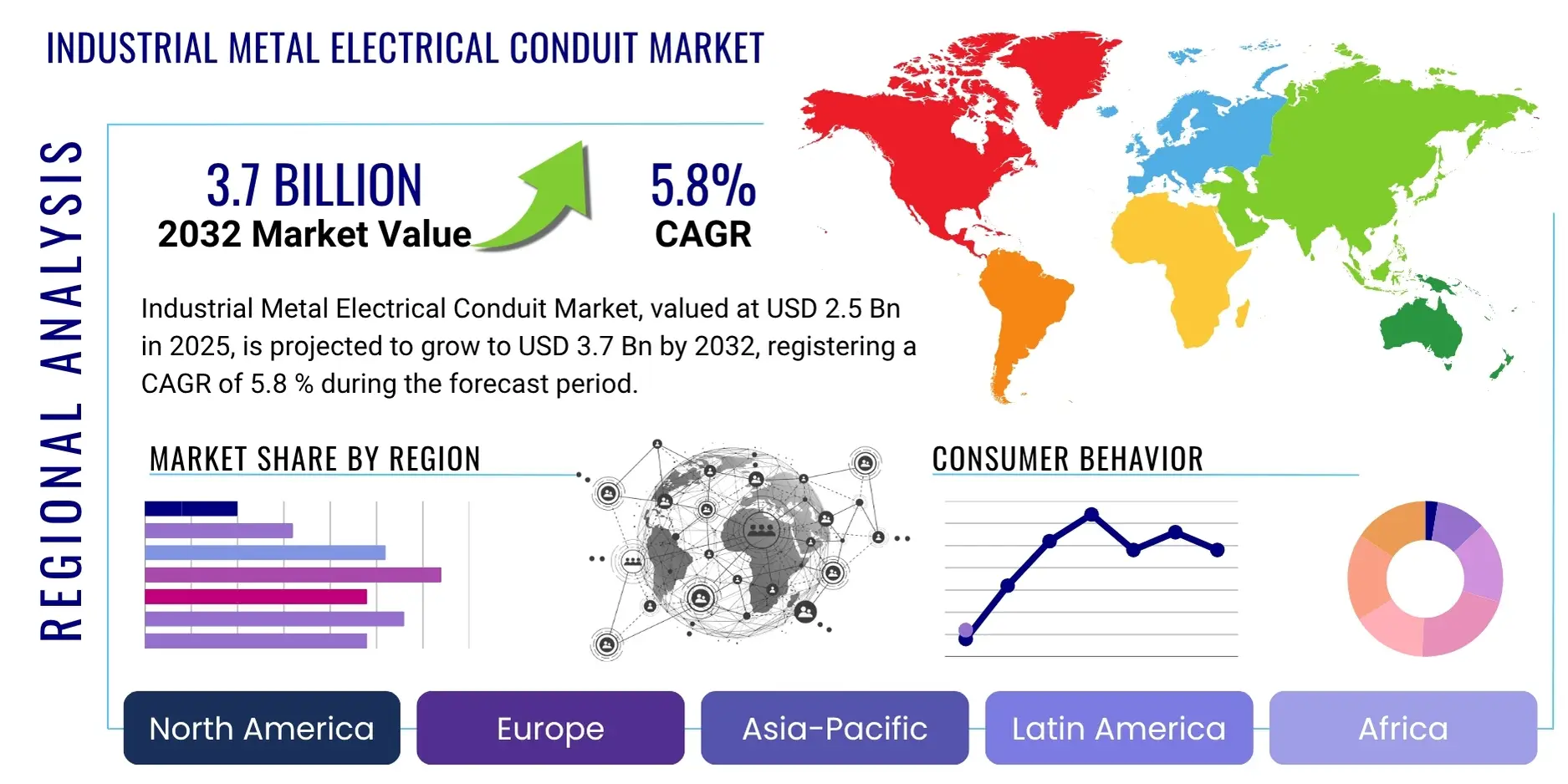

Industrial Metal Electrical Conduit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428209 | Date : Oct, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Industrial Metal Electrical Conduit Market Size

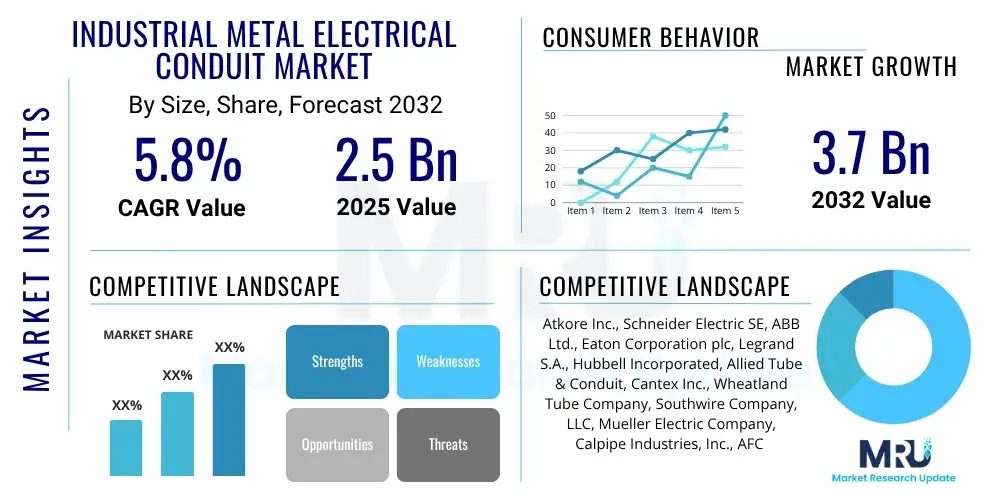

The Industrial Metal Electrical Conduit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 2.5 Billion in 2025 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2032.

Industrial Metal Electrical Conduit Market introduction

The industrial metal electrical conduit market encompasses the manufacturing, distribution, and installation of metallic tubes used to protect and route electrical wiring in industrial environments. These conduits are vital for ensuring the safety, reliability, and longevity of electrical systems within manufacturing facilities, power generation plants, chemical processing units, and heavy infrastructure projects. Their primary function is to shield conductors from mechanical damage, moisture, and chemical exposure, while also providing a grounded enclosure to prevent electrical shock and fire hazards. The market is characterized by a diverse range of products, including Rigid Metal Conduit (RMC), Intermediate Metal Conduit (IMC), Electrical Metallic Tubing (EMT), and various flexible metal conduits, each designed for specific applications and environmental conditions.

Products within this market are typically made from galvanized steel, aluminum, or stainless steel, offering varying degrees of corrosion resistance, strength, and flexibility. For instance, RMC and IMC are heavy-duty options suitable for harsh outdoor and industrial settings, providing robust physical protection. EMT, being lighter, is often preferred for indoor applications where less severe mechanical protection is required. Flexible metal conduits, such as Liquidtight Flexible Metal Conduit (LFMC) or Flexible Metal Conduit (FMC), are crucial in areas requiring frequent movement, vibration, or where rigid installations are impractical, like connecting motors or machinery.

Major applications for industrial metal electrical conduits span across diverse sectors, including oil and gas, mining, pulp and paper, food and beverage, automotive manufacturing, and data centers. The benefits derived from their use are extensive, primarily revolving around enhanced operational safety, prevention of costly electrical failures, and compliance with stringent electrical codes and regulations. These products ensure the integrity of critical electrical infrastructure, supporting the continuous operation of industrial processes and minimizing downtime. Key driving factors propelling market growth include rapid global industrialization, substantial investments in infrastructure development, increasing demand for robust safety standards in workplaces, and the modernization of existing industrial facilities.

The imperative for durable and secure electrical installations within factories, refineries, and other large-scale industrial complexes underscores the market's significance. Conduits not only protect wires but also help in organizing complex wiring networks, making maintenance and upgrades more manageable. As industries continue to automate and integrate more advanced machinery, the need for resilient and compliant electrical pathways becomes even more critical, ensuring uninterrupted power supply and data transmission within complex operational environments. The market's evolution is also influenced by advancements in material science and manufacturing techniques, leading to more efficient and specialized conduit solutions.

- Market Intro: Metallic tubing systems protecting and routing electrical wiring in industrial settings.

- Product Description: Rigid Metal Conduit (RMC), Intermediate Metal Conduit (IMC), Electrical Metallic Tubing (EMT), Flexible Metal Conduit (FMC), Liquidtight Flexible Metal Conduit (LFMC), typically made from galvanized steel, aluminum, or stainless steel.

- Major Applications: Manufacturing, oil & gas, mining, power generation, chemical processing, automotive, data centers, heavy infrastructure.

- Benefits: Enhanced safety, mechanical protection, corrosion resistance, EMI shielding, long-term durability, compliance with electrical codes, organized wiring.

- Driving Factors: Global industrial expansion, infrastructure spending, stringent electrical safety regulations, modernization of industrial facilities, growth in automation.

Industrial Metal Electrical Conduit Market Executive Summary

The industrial metal electrical conduit market is currently experiencing robust growth, driven by an accelerating pace of global industrialization and significant government and private sector investments in infrastructure development. Business trends indicate a strong emphasis on smart factory initiatives and automation across manufacturing sectors, which inherently increases the demand for sophisticated and reliable electrical protection systems. The market is witnessing a shift towards higher-performance conduits designed for demanding environments, offering superior corrosion resistance and fire protection. Supply chain resilience and efficient distribution networks are emerging as critical competitive differentiators for market players, especially in light of recent global disruptions affecting raw material availability and logistics.

Regional trends highlight Asia Pacific as a primary growth engine, fueled by rapid urbanization, extensive infrastructure projects, and the expansion of manufacturing capabilities in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, demonstrate steady demand driven by the modernization of existing industrial facilities, stringent regulatory compliance, and a focus on renewable energy infrastructure. Emerging economies in Latin America, the Middle East, and Africa are also showing promising growth, attributed to industrial diversification and increasing foreign direct investments in their manufacturing and energy sectors. The varying regulatory landscapes and climate conditions across these regions significantly influence product preferences and market dynamics.

Segmentation trends indicate a robust demand for galvanized steel conduits due to their cost-effectiveness and durability, though aluminum and stainless steel options are gaining traction for specialized applications requiring lighter weight or superior corrosion resistance. By application, the manufacturing and power generation sectors remain dominant, while the data center and telecommunications industries present significant growth opportunities due to their expanding infrastructure needs. The push for sustainability is also subtly influencing the market, with an increasing interest in recyclable materials and energy-efficient installation methods. Furthermore, the market is characterized by intense competition, with leading players focusing on product innovation, strategic partnerships, and expanding their geographical footprint to capture new opportunities.

Overall, the market is set for sustained expansion, propelled by fundamental industrial growth and a non-negotiable requirement for electrical safety and reliability. Manufacturers are focusing on differentiating their offerings through advanced coatings, ease of installation, and adherence to evolving international standards. The long-term outlook remains positive, underpinned by a global commitment to industrial expansion and infrastructure upgrades, making the industrial metal electrical conduit market a resilient and essential component of modern industrial ecosystems.

- Business Trends: Increased adoption of smart factory concepts and automation, focus on robust and high-performance conduit solutions, emphasis on supply chain optimization and resilience, competitive landscape driven by product innovation and strategic alliances.

- Regional Trends: Asia Pacific leading growth due to industrialization, North America and Europe driven by modernization and regulations, emerging markets expanding with industrial diversification and infrastructure investments.

- Segments Trends: Continued dominance of galvanized steel, growing demand for specialized aluminum and stainless steel variants, strong growth from manufacturing, power generation, and emerging data center sectors, increasing attention to sustainable materials.

AI Impact Analysis on Industrial Metal Electrical Conduit Market

User inquiries regarding AI's impact on the industrial metal electrical conduit market frequently center on how artificial intelligence can optimize manufacturing processes, enhance predictive maintenance of conduit systems, and streamline supply chain logistics. There is considerable interest in AI's potential to improve quality control, reduce waste, and increase efficiency in conduit production. Furthermore, users are exploring how AI might contribute to smart building integration, enabling conduits to become components of intelligent infrastructure, potentially through embedded sensors or advanced monitoring capabilities. Concerns often include the initial investment costs, the need for specialized skills to implement AI solutions, and the ethical implications of automation. Expectations are high for AI to deliver greater operational efficiencies, enhanced safety protocols, and a more adaptive supply chain within the industry.

The integration of AI in the manufacturing of industrial metal electrical conduits primarily focuses on process optimization and quality assurance. AI-powered analytics can monitor production lines in real-time, identifying anomalies and predicting equipment failures before they occur, thereby reducing downtime and maintenance costs. Machine learning algorithms can analyze vast datasets from manufacturing operations, leading to improved material utilization, reduced scrap rates, and more consistent product quality. This level of precision and predictive capability directly impacts the cost-effectiveness and reliability of the conduits produced, making the manufacturing process more agile and responsive to market demands. Moreover, AI can optimize energy consumption during production, contributing to more sustainable manufacturing practices.

Beyond manufacturing, AI is poised to transform the supply chain and logistics aspects of the industrial metal electrical conduit market. AI-driven demand forecasting can provide more accurate predictions for conduit types and quantities, enabling manufacturers to optimize inventory levels and reduce storage costs. Predictive analytics can also enhance logistics by optimizing delivery routes and schedules, minimizing transportation costs and carbon footprint. In terms of installation and maintenance, AI could facilitate the development of intelligent conduit systems capable of self-monitoring for damage, corrosion, or overheating through integrated sensors. This would enable predictive maintenance, ensuring that repairs are conducted proactively, extending the lifespan of installations, and significantly enhancing operational safety by preventing critical failures.

The future implications extend to the conceptualization of "smart conduits" within smart industrial environments. While current conduits are passive protectors, AI could enable them to play a more active role in data collection and environmental monitoring. For example, conduits embedded with micro-sensors and connected to an AI platform could report on temperature, humidity, and even structural integrity along their path, providing invaluable data for facility management and predictive analytics. This shift would transform conduits from mere protective enclosures into integral components of a facility's IoT network, contributing to a more responsive, efficient, and safer industrial ecosystem. However, realizing this vision requires significant research, development, and standardization within the industry to ensure interoperability and cybersecurity.

- Manufacturing Optimization: AI-driven process control, real-time quality inspection, predictive maintenance for production machinery, waste reduction, and energy efficiency.

- Supply Chain Management: Enhanced demand forecasting, optimized inventory management, intelligent logistics and route planning, improved raw material procurement efficiency.

- Predictive Maintenance: AI-powered monitoring of installed conduits for degradation, corrosion, or operational stress through integrated sensors, enabling proactive repairs and extended lifespan.

- Product Design & Customization: AI algorithms can analyze performance data to inform the development of more durable, application-specific, and customizable conduit solutions.

- Safety Enhancement: AI can analyze data from environmental sensors to detect potential hazards within conduit systems, such as overheating or arcing, triggering early warnings.

- Smart Infrastructure Integration: Potential for conduits to become active components of IoT networks in smart factories, transmitting environmental or structural data.

DRO & Impact Forces Of Industrial Metal Electrical Conduit Market

The industrial metal electrical conduit market is significantly shaped by a confluence of drivers, restraints, and opportunities, all influenced by various internal and external impact forces. The primary drivers include robust global industrial growth, driven by manufacturing expansion in developing economies and modernization in developed ones. Escalating infrastructure spending, particularly in sectors like renewable energy, data centers, and transportation, fuels consistent demand. Furthermore, stringent safety regulations and electrical codes mandated by authorities worldwide necessitate the use of highly protective and compliant conduit systems, underpinning market stability and growth. These regulations ensure that industries invest in quality protective solutions, making metal conduits a non-negotiable component of modern electrical installations.

However, the market also faces considerable restraints. Volatility in raw material prices, particularly for steel and aluminum, directly impacts manufacturing costs and profit margins. Economic slowdowns or geopolitical instabilities can lead to deferred industrial projects, subsequently dampening demand for conduits. Moreover, the increasing adoption of alternative wiring protection solutions, such as PVC conduits or armored cables in less demanding environments, poses a competitive challenge to metal conduits. These alternatives, while offering different performance characteristics, sometimes present a more cost-effective option for certain applications, potentially impacting market share. The need for specialized installation skills for metal conduits, compared to some alternatives, can also be a minor restraint in regions with labor shortages.

Opportunities within the market are abundant and varied. The global shift towards smart factories and industrial automation creates a demand for advanced conduit systems capable of protecting complex control wiring and data cables. The expansion of renewable energy infrastructure, including solar farms and wind power plants, requires durable and weather-resistant conduits for outdoor installations. Retrofitting and upgrading aging industrial facilities worldwide also present a significant opportunity, as older electrical systems are replaced with modern, compliant, and safer conduit solutions. Furthermore, advancements in materials science and coating technologies offer avenues for developing new products with enhanced corrosion resistance, fire protection, and ease of installation, thereby differentiating offerings and opening new market niches. The increasing focus on cybersecurity also indirectly supports metal conduits by providing a physical layer of protection for critical network cables.

Impact forces on the market include technological advancements that lead to innovative product features, such as specialized coatings for extreme environments or modular conduit systems for easier installation. Regulatory changes, particularly updates to electrical codes and safety standards, directly influence product specifications and market demand. Economic factors, including GDP growth, industrial output, and interest rates, significantly affect investment levels in industrial projects. Environmental concerns are driving demand for more sustainable manufacturing processes and recyclable materials. Finally, geopolitical events and trade policies can disrupt supply chains and alter market competitiveness, influencing both raw material availability and pricing. These forces collectively shape the competitive landscape and strategic decisions of market players.

- Drivers:

- Global industrial expansion and manufacturing growth, particularly in emerging economies.

- Increasing investments in infrastructure development across various sectors (e.g., smart cities, transportation, utilities).

- Stringent electrical safety regulations and building codes mandating robust wiring protection in industrial settings.

- Growing demand for reliable and durable electrical infrastructure to support automation and advanced machinery.

- Modernization and upgrading of aging industrial facilities requiring new, compliant conduit systems.

- Restraints:

- Volatility and fluctuations in raw material prices (steel, aluminum), impacting production costs.

- Economic downturns or geopolitical instabilities leading to delays or cancellations of industrial projects.

- Competition from alternative wiring protection solutions, such as PVC conduits or armored cables, in certain applications.

- Challenges related to skilled labor availability for complex conduit installations.

- Environmental regulations on heavy metal production and disposal affecting manufacturing processes.

- Opportunity:

- Expansion of renewable energy infrastructure (solar, wind) requiring robust outdoor conduit systems.

- Proliferation of data centers and telecommunications networks demanding secure and extensive electrical pathways.

- Growing adoption of smart manufacturing and Industry 4.0 technologies increasing the need for sophisticated conduit solutions.

- Development of advanced materials and coatings offering superior corrosion resistance and fire protection.

- Untapped potential in developing markets with burgeoning industrial and urban development projects.

- Impact Forces:

- Technological advancements in manufacturing processes and product design.

- Evolving regulatory landscape and international safety standards.

- Global economic cycles and industrial output trends.

- Environmental sustainability initiatives and material sourcing ethics.

- Supply chain disruptions and geopolitical trade policies.

Segmentation Analysis

The industrial metal electrical conduit market is highly diverse and can be effectively segmented based on several key parameters, including product type, material, application, and end-use industry. This segmentation provides a granular view of market dynamics, revealing specific growth areas and competitive landscapes within each category. The product type segment differentiates between rigid, intermediate, and flexible conduits, each serving distinct functional requirements. Material segmentation highlights the preferences for steel, aluminum, or stainless steel based on cost, environmental conditions, and specific performance needs like corrosion resistance or electromagnetic interference (EMI) shielding. Analyzing these segments helps stakeholders understand market niches and tailor their product development and marketing strategies accordingly.

Segmentation by product type is crucial, as each type of metal conduit offers unique advantages. Rigid Metal Conduit (RMC) is known for its heavy-duty protection and is preferred in hazardous locations and outdoor installations. Intermediate Metal Conduit (IMC) provides similar protection but with a lighter weight, making it a cost-effective alternative for many industrial applications. Electrical Metallic Tubing (EMT) is widely used indoors where less severe physical protection is needed due to its ease of bending and installation. Flexible Metal Conduits (FMC and LFMC) are indispensable for connecting moving machinery, in areas with vibration, or where installations require intricate bends and adaptability, offering crucial versatility in complex industrial layouts. Each type addresses specific challenges encountered in various industrial settings, driving distinct demand patterns across the market.

Material-based segmentation often distinguishes between galvanized steel, aluminum, and stainless steel conduits. Galvanized steel remains the most common choice due to its excellent balance of strength, cost-effectiveness, and corrosion resistance, making it suitable for a broad array of industrial environments. Aluminum conduits are valued for their lightweight properties, ease of handling, and superior resistance to certain corrosive agents, often used in outdoor or marine environments where weight is a factor. Stainless steel conduits are chosen for highly corrosive or hygienic environments, such as chemical processing, food and beverage, and pharmaceutical industries, where absolute resistance to rust and chemical attack is paramount. The selection of material is often a critical decision based on the anticipated operational conditions and budget constraints of a project.

Application and end-use industry segmentation further refines market understanding. Key applications include general wiring protection, motor feeder protection, data cable routing, and hazardous location wiring. End-use industries encompass a vast spectrum, including manufacturing (automotive, electronics, heavy machinery), power generation and utilities, oil and gas, mining, chemical processing, food and beverage, infrastructure (bridges, tunnels, public works), and commercial construction involving large industrial complexes. The specific demands of each end-use industry, from severe environmental conditions in mining to hygiene requirements in food processing, dictate the type, material, and protective features required from the conduits. This granular view allows manufacturers to target specific industry needs with specialized products and services, fostering innovation and market penetration.

- By Product Type:

- Rigid Metal Conduit (RMC)

- Intermediate Metal Conduit (IMC)

- Electrical Metallic Tubing (EMT)

- Flexible Metal Conduit (FMC)

- Liquidtight Flexible Metal Conduit (LFMC)

- Flexible Metallic Tubing (FMT)

- By Material:

- Galvanized Steel

- Aluminum

- Stainless Steel

- Other Alloys

- By Application:

- Wiring Protection & Routing

- Motor & Machine Feeder Protection

- Data & Communication Cable Protection

- Hazardous Location Wiring

- Control & Instrumentation Wiring

- By End-Use Industry:

- Manufacturing (Automotive, Electronics, Heavy Machinery)

- Power Generation & Utilities

- Oil & Gas

- Mining

- Chemical & Petrochemical

- Food & Beverage

- Pulp & Paper

- Data Centers & Telecommunications

- Infrastructure & Public Works

- Pharmaceutical

Value Chain Analysis For Industrial Metal Electrical Conduit Market

The value chain for the industrial metal electrical conduit market involves a series of interconnected stages, beginning with the sourcing of raw materials and extending to the final installation and maintenance at the end-user facility. Upstream activities primarily involve raw material suppliers, predominantly producers of steel (carbon steel, stainless steel) and aluminum. These suppliers play a critical role, as the quality, cost, and availability of metals directly impact conduit manufacturers. Midstream, the manufacturing process transforms these raw metals into various types of conduits through processes such as rolling, welding, galvanizing, threading, and coating. This stage requires significant capital investment in machinery, adherence to strict quality control, and compliance with industry standards. Downstream activities focus on bringing the finished products to market, encompassing distribution channels and reaching end-users for installation and long-term use.

The upstream segment of the value chain is characterized by its dependence on global commodity markets. Steel mills and aluminum smelters provide the fundamental inputs, and their operational efficiencies, production capacities, and pricing strategies profoundly influence the cost structure of conduit manufacturers. Relationships with these suppliers are critical for ensuring a stable and cost-effective supply, especially given the global nature of metal markets and their susceptibility to price volatility. Innovation at this stage, such as the development of advanced alloys or more sustainable metal production methods, can offer competitive advantages down the chain. Furthermore, the environmental impact and sourcing ethics of raw material suppliers are increasingly scrutinized, influencing manufacturers' choices and supply chain transparency efforts.

The downstream segment primarily involves the crucial steps of distribution and sales. Conduits reach end-users through a combination of direct and indirect distribution channels. Direct sales often involve large-scale industrial projects where manufacturers directly supply to major contractors or facility developers, providing customized solutions and bulk orders. Indirect channels, which form the backbone of broader market reach, utilize a network of wholesalers, distributors, and electrical supply houses. These intermediaries are vital for inventory management, logistical support, and providing local access to a wide range of conduit products for smaller contractors and maintenance operations. The effectiveness of these distribution networks is paramount for market penetration and customer service, as they ensure timely delivery and availability of diverse product types.

Furthermore, beyond distribution, the value chain extends to the installation contractors and finally the end-users. Installation contractors are responsible for the proper selection, bending, cutting, and fitting of conduits according to electrical codes and project specifications. Their expertise directly impacts the safety and performance of the electrical system. End-users, who are the ultimate beneficiaries, then maintain these systems over their operational lifespan. This entire chain is supported by various ancillary services such as logistics, quality certification, and technical support. The efficiency and collaboration across each stage of this value chain are critical for optimizing costs, ensuring product quality, and meeting the evolving demands of the industrial electrical market, highlighting the interdependent nature of all participants.

- Upstream Analysis: Involves suppliers of raw materials such as steel (galvanized, stainless) and aluminum. Key factors include commodity pricing, material quality, and stable supply chains from mills and smelters.

- Manufacturing: Transformation of raw materials into finished conduit products through processes like rolling, welding, threading, coating, and galvanizing. Focus on production efficiency, quality control, and compliance with industry standards.

- Downstream Analysis: Involves distribution to end-users.

- Distribution Channel:

- Direct: Sales directly to large industrial projects, major contractors, or specialized end-users requiring bulk or customized orders.

- Indirect: Utilizes a network of wholesalers, electrical distributors, and supply houses to reach a broader market, including smaller contractors and maintenance teams.

- End-Users/Installers: Electrical contractors, industrial maintenance teams, and facility managers responsible for installing and maintaining conduit systems.

- Distribution Channel:

- Ancillary Services: Logistics, warehousing, technical support, product certification, and after-sales service, all contributing to the overall value proposition.

Industrial Metal Electrical Conduit Market Potential Customers

The potential customers for industrial metal electrical conduits span a wide array of sectors that depend heavily on robust, safe, and reliable electrical infrastructure to power their operations. These end-users are primarily organizations and entities involved in large-scale industrial activities, infrastructure development, and critical facility management. Their demand for metal conduits is driven by the necessity to protect electrical wiring from mechanical damage, environmental factors, and electromagnetic interference, ensuring operational continuity and adherence to stringent safety regulations. The diverse requirements across these sectors mean that conduit manufacturers must offer a comprehensive range of products tailored to specific environmental conditions and performance criteria.

Key among these potential customers are companies within the manufacturing sector. This includes automotive plants, electronics assembly facilities, heavy machinery production sites, and processing plants across various industries. These facilities often feature complex machinery, automated production lines, and robotic systems, all requiring extensive electrical wiring that needs superior protection. The need for durable conduits in these environments is non-negotiable, given the potential for impact, abrasion, and exposure to oils, coolants, and other industrial chemicals. Similarly, the growing trend of smart factories and Industry 4.0 further intensifies the demand for conduits that can reliably protect both power and data cables in highly integrated operational settings.

Another significant segment of potential customers includes the energy and utilities sector. Power generation facilities, including conventional thermal power plants, nuclear power stations, and rapidly expanding renewable energy installations (solar farms, wind turbines), require conduits capable of withstanding extreme outdoor conditions, high temperatures, and corrosive environments. Transmission and distribution utilities also rely on metal conduits for substations and underground wiring protection. The oil and gas industry, encompassing upstream, midstream, and downstream operations, represents a critical customer base due demanding explosion-proof and highly corrosion-resistant conduit solutions for refineries, offshore platforms, and pipeline infrastructure. Mining operations, with their harsh and often hazardous environments, also constitute a vital market for heavy-duty, impact-resistant metal conduits.

Beyond these heavy industries, other significant end-users include data centers and telecommunications companies that require extensive and secure pathways for their critical power and network cabling. Infrastructure projects, such as bridges, tunnels, seaports, airports, and major transportation hubs, consistently demand durable and long-lasting electrical containment systems. The food and beverage industry, pharmaceutical manufacturing, and chemical processing plants also represent important customer segments, often requiring specialized stainless steel conduits for hygienic environments and resistance to aggressive cleaning agents or ch

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2032 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atkore Inc., Schneider Electric SE, ABB Ltd., Eaton Corporation plc, Legrand S.A., Hubbell Incorporated, Allied Tube & Conduit, Cantex Inc., Wheatland Tube Company, Southwire Company, LLC, Mueller Electric Company, Calpipe Industries, Inc., AFC Cable Systems, Electri-Flex Company, Precision Tube Company, United Tube Company, Bridgeport Fittings, Inc., O-Z/Gedney, Anamet Electrical, Inc., Phoenix Flexible Tubes Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Metal Electrical Conduit Market Key Technology Landscape

The industrial metal electrical conduit market, while rooted in traditional manufacturing, is continually evolving through the adoption of various key technologies aimed at enhancing product performance, improving manufacturing efficiency, and facilitating easier installation. Central to this landscape are advancements in material science, particularly concerning steel and aluminum alloys, which lead to conduits with superior strength-to-weight ratios, enhanced corrosion resistance, and improved ductility. Innovative coating technologies, such as specialized galvanization processes, PVC coatings, or epoxy-based internal and external finishes, are critical for extending the lifespan of conduits in highly corrosive or abrasive industrial environments. These technological improvements directly address the demanding operational conditions prevalent in end-use industries, making the conduits more resilient and cost-effective over their lifecycle.

Manufacturing technologies are also playing a significant role in shaping the market. Precision manufacturing techniques, including advanced rolling, welding, and threading processes, ensure tight tolerances and consistent product quality, which are crucial for reliable installations and system integrity. Automation and robotics in production lines reduce manufacturing costs, increase output, and improve workplace safety. For instance, automated galvanizing lines ensure uniform coating thickness, enhancing the product's protective qualities. Furthermore, the development of specialized bending and cutting equipment for installation purposes, often incorporating hydraulic or CNC capabilities, significantly improves efficiency and accuracy on job sites, reducing labor time and waste. These advancements in tooling also contribute to the overall appeal and ease of working with metal conduits.

Beyond the core product, the technology landscape extends to features that integrate conduits into more advanced industrial systems. The development of intelligent or "smart" conduits, though still nascent, represents a significant future trend. This involves embedding sensors within conduit systems to monitor environmental conditions (temperature, humidity), detect mechanical stress, or even identify potential electrical faults. Such integration could leverage IoT (Internet of Things) platforms to provide real-time data for predictive maintenance and operational analytics, transforming conduits from passive protectors into active components of a smart industrial infrastructure. While widespread adoption is years away, pilot projects and research initiatives indicate this potential for technological leap within the market.

Finally, the growing emphasis on sustainability and circular economy principles is driving technological innovations in material recycling and waste reduction during the manufacturing process. Technologies that enable more efficient use of raw materials, minimize energy consumption in production, and facilitate the recycling of end-of-life conduits are gaining traction. This includes advancements in metallurgy for creating more recyclable alloys and optimizing production lines to reduce scrap. Furthermore, digital technologies for design and simulation, such as CAD/CAM software, allow for more precise product development and custom solutions, reducing prototyping costs and accelerating time-to-market for specialized conduit products. These combined technological efforts aim to create conduits that are not only high-performing and safe but also environmentally responsible and future-proof.

- Advanced Material Science: Development of high-strength, lightweight, and corrosion-resistant alloys for steel and aluminum conduits.

- Specialized Coatings & Surface Treatments: Enhanced galvanization techniques, PVC coatings, epoxy finishes, and internal coatings for superior protection against corrosion, chemicals, and abrasion.

- Precision Manufacturing & Automation: Use of robotics, CNC machinery, and automated production lines for consistent quality, tight tolerances, and increased efficiency in rolling, welding, threading, and finishing processes.

- Smart Conduit Integration (Emerging): Embedding sensors for real-time monitoring of temperature, humidity, vibration, or electrical faults within conduit systems, enabling predictive maintenance and IoT connectivity.

- Installation Technologies: Innovations in bending, cutting, and joining tools and techniques that simplify and accelerate conduit installation while ensuring adherence to safety standards.

- Sustainable Production Methods: Technologies focused on reducing energy consumption, minimizing waste, and enabling higher recyclability of materials in the manufacturing process.

- Digital Design & Simulation: CAD/CAM and finite element analysis (FEA) software for optimized product design, custom solutions, and performance validation before physical prototyping.

Regional Highlights

- North America: A mature market characterized by stringent electrical codes (NEC, CEC) and a significant focus on modernizing aging industrial infrastructure. Demand is driven by investments in manufacturing, data centers, and renewable energy projects. Steady growth expected with a strong emphasis on high-quality, compliant products.

- Europe: Driven by strict environmental regulations, robust industrial automation initiatives, and substantial investments in smart cities and green energy infrastructure. Germany, the UK, and France are key contributors. There is a growing preference for conduits that are durable, sustainable, and meet high safety standards.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid industrialization, massive infrastructure development, and increasing foreign direct investment in manufacturing sectors, particularly in China, India, and Southeast Asian countries. Urbanization and expanding power grids also contribute significantly to demand.

- Latin America: An emerging market with increasing industrialization, particularly in countries like Brazil, Mexico, and Argentina. Growth is fueled by investments in energy, mining, and automotive sectors, leading to a rising demand for reliable electrical conduit systems. Economic stability and foreign investment are key growth enablers.

- Middle East and Africa (MEA): Experiencing substantial growth due to diversification efforts away from oil economies, leading to investments in manufacturing, infrastructure, and tourism. Large-scale construction projects and the development of new industrial zones drive the demand for metal conduits, often requiring products designed for harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Metal Electrical Conduit Market.- Atkore Inc.

- Schneider Electric SE

- ABB Ltd.

- Eaton Corporation plc

- Legrand S.A.

- Hubbell Incorporated

- Allied Tube & Conduit

- Cantex Inc.

- Wheatland Tube Company

- Southwire Company, LLC

- Mueller Electric Company

- Calpipe Industries, Inc.

- AFC Cable Systems

- Electri-Flex Company

- Precision Tube Company

- United Tube Company

- Bridgeport Fittings, Inc.

- O-Z/Gedney

- Anamet Electrical, Inc.

- Phoenix Flexible Tubes Ltd.

Frequently Asked Questions

What is an industrial metal electrical conduit and why is it important?

An industrial metal electrical conduit is a durable metallic tubing system used to protect and route electrical wiring in industrial environments. It is crucial for safeguarding conductors from physical damage, moisture, chemicals, and electromagnetic interference, thereby preventing electrical shock, fire hazards, and ensuring the reliability and longevity of complex industrial electrical systems. Its importance lies in maintaining operational safety and compliance with electrical codes.

What are the primary types of metal electrical conduits used in industrial settings?

The primary types include Rigid Metal Conduit (RMC), Intermediate Metal Conduit (IMC), and Electrical Metallic Tubing (EMT), along with Flexible Metal Conduit (FMC) and Liquidtight Flexible Metal Conduit (LFMC). RMC and IMC offer heavy-duty protection for harsh environments, while EMT is suitable for lighter-duty indoor applications. Flexible conduits are used where movement, vibration, or complex routing is required.

Which factors are driving the growth of the industrial metal electrical conduit market?

Key growth drivers include rapid global industrialization, substantial infrastructure development investments (e.g., smart cities, renewable energy), increasingly stringent electrical safety regulations, and the modernization of existing industrial facilities. The rising demand for automation and reliable electrical infrastructure in manufacturing and processing plants also significantly contributes to market expansion.

How does AI impact the manufacturing and use of industrial metal electrical conduits?

AI is beginning to impact the market by optimizing manufacturing processes through real-time monitoring and predictive maintenance, enhancing supply chain efficiency with advanced forecasting, and improving quality control. In the future, AI could enable "smart conduits" with embedded sensors for real-time monitoring of system integrity and environmental conditions, leading to more proactive maintenance and enhanced safety in industrial settings.

What are the major challenges faced by the industrial metal electrical conduit market?

The market faces challenges such as volatility in raw material prices (steel, aluminum), which directly impacts production costs and profitability. Economic slowdowns can also lead to delays in industrial projects, affecting demand. Additionally, competition from alternative wiring protection solutions, like PVC conduits, in less demanding applications presents a constraint to market growth for metal conduits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager