Industrial PC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428108 | Date : Oct, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Industrial PC Market Size

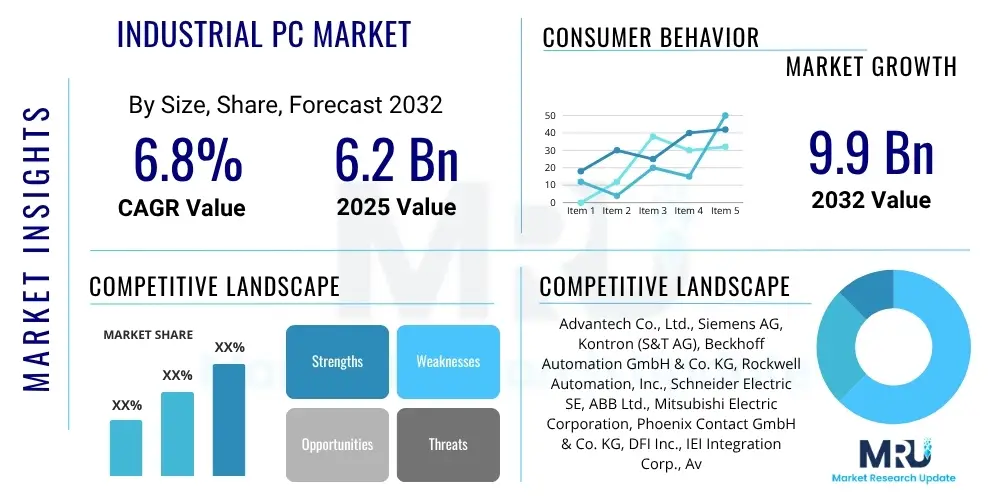

The Industrial PC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 6.2 Billion in 2025 and is projected to reach USD 9.9 Billion by the end of the forecast period in 2032. This robust growth is primarily driven by the accelerating pace of digital transformation across various industrial sectors and the increasing demand for advanced automation solutions capable of processing data at the edge.

Industrial PC Market introduction

The Industrial PC (IPC) market encompasses a specialized category of computing platforms designed for reliable operation in harsh industrial environments. Unlike standard commercial PCs, IPCs are engineered to withstand extreme temperatures, vibrations, shocks, dust, and electromagnetic interference, making them indispensable for critical applications within manufacturing, automation, and other demanding sectors. These robust systems often feature fanless designs, wide operating voltage ranges, and enhanced ingress protection ratings, ensuring continuous performance and data integrity in environments where conventional computers would fail.

Industrial PCs serve as the backbone for a multitude of applications, including process control, machine vision, data acquisition, human-machine interfaces (HMIs), and real-time analytics at the edge. Their product descriptions typically highlight their ruggedized chassis, extended product lifecycles, and diverse connectivity options, which are crucial for integrating with legacy systems and modern IoT devices. Major applications span smart factories, energy management systems, medical diagnostics equipment, intelligent transportation, and defense infrastructure, where precision, reliability, and continuous operation are paramount.

The core benefits of Industrial PCs include significantly enhanced operational stability, reduced downtime, and the ability to perform complex computational tasks directly at the source of data generation. Key driving factors propelling market expansion involve the global push towards Industry 4.0 initiatives, the burgeoning adoption of the Internet of Things (IoT) in industrial settings, the increasing need for real-time data processing, and the integration of artificial intelligence and machine learning algorithms for predictive maintenance and quality control. These factors collectively underscore the critical role IPCs play in enabling the next generation of industrial automation and smart manufacturing.

Industrial PC Market Executive Summary

The Industrial PC market is undergoing significant transformation, characterized by dynamic business trends centered on the escalating demand for high-performance edge computing solutions. Companies are increasingly investing in digital twins, predictive analytics, and AI-driven automation, all of which rely heavily on robust IPC infrastructure. The market is witnessing a shift towards more modular and compact designs, facilitating easier integration and maintenance within complex industrial setups. Furthermore, the focus on cybersecurity in industrial control systems is driving the development of IPCs with enhanced security features, addressing growing concerns about data integrity and operational resilience in interconnected environments.

Regional trends indicate Asia-Pacific as the dominant and fastest-growing market, propelled by rapid industrialization, large-scale manufacturing bases, and substantial government investments in smart factory initiatives, particularly in countries like China, Japan, and South Korea. North America and Europe also exhibit strong growth, driven by advanced manufacturing sectors, a mature automation industry, and a sustained emphasis on technological innovation and digital transformation. Emerging economies in Latin America and the Middle East & Africa are gradually increasing their adoption of IPCs as they modernize their industrial infrastructures, albeit from a lower base, presenting significant future growth opportunities.

Segment trends reveal a robust demand for panel PCs and embedded PCs, largely due to their compact form factors and integrated display capabilities, making them ideal for HMI and space-constrained applications. The market is also seeing heightened interest in IPCs equipped with advanced processors, including those optimized for AI workloads (e.g., GPUs and NPUs), as industries seek to deploy artificial intelligence at the edge. This trend is influencing component choices, leading to a greater emphasis on high-performance memory, storage, and specialized I/O modules that can handle sophisticated data processing requirements. Overall, the market is moving towards more intelligent, connected, and application-specific IPC solutions.

AI Impact Analysis on Industrial PC Market

Common user questions regarding AI's impact on the Industrial PC market frequently revolve around how IPCs can support AI workloads at the edge, the necessary hardware upgrades for AI integration, and the practical benefits AI brings to industrial applications. Users are concerned about the processing power required, the implications for data security, and the ease of deployment of AI algorithms on existing or new IPC platforms. They also seek understanding on specific use cases where AI-enabled IPCs deliver tangible improvements, such as enhanced operational efficiency, predictive maintenance, and quality control. These inquiries highlight a clear expectation for IPCs to evolve into intelligent edge devices capable of autonomously processing and acting upon complex data.

The integration of Artificial Intelligence (AI) is profoundly transforming the Industrial PC market, shifting the role of IPCs from mere data acquisition and control units to intelligent, autonomous edge computing platforms. AI enables IPCs to perform real-time data analysis, predictive modeling, and complex decision-making directly at the source, reducing latency and reliance on cloud infrastructure. This paradigm shift requires IPCs to incorporate more powerful processors, including GPUs and dedicated AI accelerators (NPUs), alongside ample memory and high-speed storage, to handle the computational demands of AI algorithms efficiently. Consequently, the demand for high-performance, AI-ready IPCs is rapidly accelerating across various industrial verticals, impacting product design, component selection, and software integration strategies.

This impact is manifesting in several key areas, allowing industrial enterprises to unlock new levels of efficiency, reliability, and innovation. The ability to execute AI models locally enhances operational resilience by ensuring continued functionality even without continuous network connectivity, a critical advantage in remote or volatile environments. Moreover, AI-driven insights from IPCs contribute significantly to optimized resource utilization, proactive problem identification, and a more adaptive and responsive manufacturing ecosystem. The proliferation of AI in industrial settings underscores the evolving need for IPCs that are not just rugged, but also inherently smart and capable of sophisticated computational tasks.

- Enables AI inferencing and machine learning model execution at the edge, minimizing latency.

- Drives demand for higher-performance processors, GPUs, and neural processing units (NPUs) in IPCs.

- Facilitates real-time data analysis, predictive maintenance, and quality control directly on the factory floor.

- Supports advanced machine vision and robotic automation applications with enhanced intelligence.

- Enhances autonomous decision-making capabilities within industrial control systems.

- Improves operational efficiency and reduces reliance on cloud-based AI processing.

- Increases the complexity and value proposition of industrial edge computing solutions.

DRO & Impact Forces Of Industrial PC Market

The Industrial PC market is shaped by a confluence of influential factors, categorized as Drivers, Restraints, Opportunities (DRO), and broader Impact Forces that dictate its trajectory. Foremost among the drivers is the relentless march of Industry 4.0 and smart manufacturing initiatives, which necessitate robust, reliable, and high-performance computing at the edge for real-time data processing and control. The pervasive adoption of the Industrial Internet of Things (IIoT) further fuels demand, as a growing array of sensors and devices generate vast datasets requiring local analysis. Additionally, the increasing need for automation across diverse sectors, coupled with global trends in digital transformation, positions IPCs as foundational technology for modern industrial infrastructure. These factors collectively create a strong pull for advanced and more capable Industrial PC solutions.

However, the market also faces notable restraints. The relatively high initial investment cost associated with ruggedized industrial-grade hardware, compared to commercial PCs, can be a deterrent for smaller enterprises or those with tighter capital expenditure budgets. Integrating IPCs into complex existing operational technology (OT) environments can present significant challenges, requiring specialized expertise and potentially leading to downtime during implementation. Furthermore, the rapid pace of technological advancements, while offering opportunities, also poses a restraint through accelerated obsolescence, as industries grapple with keeping their systems current. Cybersecurity concerns represent another critical restraint; as IPCs become more connected, they become potential targets for cyber threats, necessitating continuous investment in robust security measures.

Opportunities within the Industrial PC market are abundant and transformative. The burgeoning field of Edge AI represents a significant avenue for growth, leveraging IPCs to perform advanced analytics and machine learning inference directly at the data source. The widespread rollout of 5G technology promises enhanced connectivity and ultra-low latency, further enabling distributed computing architectures and real-time communication between IPCs and other industrial assets. Moreover, the development of vertical-specific IPC solutions tailored to the unique requirements of industries like healthcare, energy, and transportation offers specialized market niches. Impact forces, driven by Porter's Five Forces, include the moderate bargaining power of buyers due to specialized product needs, the increasing bargaining power of suppliers of high-end components, a low threat of new entrants due to high R&D costs and technical expertise required, and an intensifying competitive rivalry among established players vying for market share through innovation and differentiated offerings.

Segmentation Analysis

The Industrial PC market is extensively segmented to reflect the diverse applications, technological requirements, and end-user demands across various industries. This segmentation provides a granular view of market dynamics, allowing for a detailed understanding of growth drivers and challenges within specific product categories, components, applications, and regional landscapes. Analyzing these segments helps stakeholders identify key investment areas and emerging trends, crucial for strategic planning and product development in this highly specialized computing sector. Each segment represents distinct market characteristics and growth trajectories, influenced by technological innovation and industrial adoption patterns.

- By Type:

- Panel PC

- Box PC

- Embedded PC

- Rack-mount PC

- Thin Client Industrial PC

- By Component:

- Processor (Intel, AMD, ARM)

- Memory (DDR4, DDR5)

- Storage (SSD, HDD)

- Motherboard

- Chassis

- Power Supply

- I/O Modules

- By Application:

- Industrial Automation & Control

- Process Control

- Energy & Power

- Retail & Logistics

- Medical & Healthcare

- Transportation

- Military & Defense

- Building Automation

- Digital Signage

- By End-Use Industry:

- Manufacturing (Discrete, Process)

- Automotive

- Oil & Gas

- Chemical

- Food & Beverage

- Pharmaceutical

- Semiconductor

- Mining

- Marine

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Industrial PC Market

The value chain for the Industrial PC market is intricate, involving multiple stages from raw material sourcing to end-user deployment and after-sales support. At the upstream level, the value chain begins with a sophisticated network of component suppliers. These include manufacturers of high-performance processors (such as Intel, AMD, and ARM), memory modules (DDR4, DDR5), storage devices (SSDs, HDDs), specialized motherboards, displays, power supplies, and various I/O components. These suppliers are critical as their innovations directly influence the capabilities, reliability, and performance of the final IPC products. The quality and availability of these core components are paramount for IPC manufacturers to build robust and competitive solutions for demanding industrial environments.

Midstream in the value chain, Industrial PC manufacturers assemble these components, integrating them with specialized chassis, cooling systems (often fanless), and ruggedized enclosures designed to meet industrial standards (e.g., IP ratings, shock/vibration resistance). This stage involves significant research and development to optimize system architecture, thermal management, and power efficiency for extended operational lifecycles. Following manufacturing, the distribution channel plays a crucial role in bringing these specialized products to market. This includes both direct sales channels, where manufacturers engage directly with large enterprise customers or for highly customized projects, and indirect channels through a network of distributors, value-added resellers (VARs), and system integrators. These partners often provide localized support, integration services, and industry-specific expertise, extending the reach of IPC manufacturers to a broader customer base.

Downstream activities primarily involve the system integrators and the ultimate end-users. System integrators are vital as they configure, install, and customize IPC solutions within complex industrial environments, often merging them with other operational technology (OT) and information technology (IT) systems. They ensure seamless interoperability and address specific application requirements, providing complete turnkey solutions. End-users, ranging from manufacturing plants and energy utilities to healthcare facilities and transportation networks, deploy these IPCs to manage critical operations. The value chain concludes with after-sales services, including technical support, maintenance, repairs, and software updates, which are essential for ensuring the long-term reliability and performance of Industrial PCs in their demanding applications. The effectiveness of this entire chain dictates market efficiency and customer satisfaction.

Industrial PC Market Potential Customers

The Industrial PC market serves a diverse array of potential customers, spanning nearly every sector that requires robust, reliable computing solutions for critical operations. These end-users, or buyers of the product, are primarily organizations engaged in activities that necessitate automated control, real-time data processing, and environmental resilience beyond the capabilities of commercial-grade computing. Manufacturing plants, particularly those adopting Industry 4.0 paradigms, represent a significant customer base, leveraging IPCs for machine control, quality inspection, and production line automation. In this context, IPCs are essential for enabling smart factories, optimizing processes, and enhancing overall operational efficiency through edge computing capabilities.

Beyond traditional manufacturing, other key customer segments include the energy and power sector, where IPCs monitor and control grid infrastructure, renewable energy systems, and oil & gas operations in harsh outdoor or hazardous environments. The transportation sector, encompassing intelligent traffic systems, railway control, and marine applications, relies on IPCs for their reliability and ability to operate under dynamic conditions. Similarly, the medical and healthcare industry utilizes IPCs in diagnostic equipment, operating room systems, and patient monitoring devices, where high uptime, precision, and adherence to strict regulatory standards are paramount. Retail and logistics companies are also increasingly adopting IPCs for point-of-sale systems, inventory management, and automated warehousing, driven by the need for robust solutions in challenging commercial settings.

Furthermore, industries such as mining, military & defense, and building automation also constitute significant potential customers. In mining, IPCs manage heavy machinery and optimize extraction processes in extreme conditions. For military and defense applications, rugged IPCs are crucial for command and control systems, surveillance, and communication in demanding operational theaters. Building automation systems leverage IPCs for intelligent building management, climate control, and security systems. The common thread among these varied end-users is the fundamental requirement for computing solutions that can deliver uncompromised performance, durability, and long-term support in environments where standard computing equipment would predictably fail, making the specialized characteristics of Industrial PCs indispensable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 6.2 Billion |

| Market Forecast in 2032 | USD 9.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co., Ltd., Siemens AG, Kontron (S&T AG), Beckhoff Automation GmbH & Co. KG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Mitsubishi Electric Corporation, Phoenix Contact GmbH & Co. KG, DFI Inc., IEI Integration Corp., Avalue Technology Inc., NEXCOM International Co., Ltd., Lanner Electronics Inc., Fujitsu Ltd., DELL Technologies Inc., HP Inc., OnLogic (Logic Supply Inc.), Acnodes Corp., Pepperl+Fuchs AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial PC Market Key Technology Landscape

The technological landscape of the Industrial PC market is characterized by a continuous evolution driven by the demands of industrial automation, edge computing, and the integration of advanced digital technologies. A pivotal aspect is the increasing emphasis on high-performance processors, including multi-core CPUs from Intel and AMD, alongside a growing adoption of ARM-based architectures for lower-power, embedded applications. Furthermore, the incorporation of Graphics Processing Units (GPUs) and Neural Processing Units (NPUs) is becoming standard, particularly for IPCs designed to handle AI and machine learning workloads at the edge, enabling real-time inference and advanced analytics directly on the factory floor or in remote locations. This shift supports complex tasks such as machine vision, predictive maintenance, and autonomous control systems, requiring significant computational power.

Another critical area in the technology landscape is connectivity. The market is witnessing a surge in IPCs equipped with advanced IoT connectivity options, including 5G, Wi-Fi 6, and various industrial Ethernet protocols like PROFINET and EtherCAT. This ensures seamless communication between IPCs, sensors, actuators, and cloud platforms, facilitating efficient data flow and control within interconnected industrial ecosystems. Robust operating systems, such as Windows IoT Enterprise, various Linux distributions, and real-time operating systems (RTOS), are optimized for industrial applications, providing stability, security, and deterministic performance. Cybersecurity features are also integrated at the hardware and software levels, safeguarding against vulnerabilities in an increasingly networked industrial environment.

Beyond processing power and connectivity, the design and form factor technologies are equally crucial. Fanless designs are widely adopted to enhance reliability by eliminating moving parts and preventing dust ingress, making them ideal for harsh environments. Modular designs offer flexibility for upgrades and customization, allowing IPCs to adapt to evolving industrial requirements. Wide temperature range components and advanced thermal management systems ensure stable operation under extreme conditions. The trend towards miniaturization, leading to compact embedded and box PCs, is driven by space constraints in modern industrial setups. These technological advancements collectively contribute to IPCs becoming more intelligent, resilient, and versatile, capable of addressing the complex computational and environmental challenges of contemporary industrial operations.

Regional Highlights

- North America: This region demonstrates high adoption rates, particularly within the automotive, aerospace, and process industries, driven by a strong focus on advanced manufacturing, automation, and technological innovation. The U.S. and Canada are significant contributors due to substantial investments in smart factory initiatives and robust R&D activities.

- Europe: Characterized by mature industrial sectors and proactive Industry 4.0 initiatives, Europe exhibits consistent growth. Germany, with its strong manufacturing base and pioneering efforts in industrial automation, leads the market, followed by the UK, France, and Italy. Emphasis on energy efficiency, sustainable manufacturing, and strict regulatory standards also drives IPC adoption.

- Asia Pacific (APAC): Positioned as the largest and fastest-growing market globally, APAC's expansion is fueled by rapid industrialization, the presence of major manufacturing hubs (especially China, Japan, South Korea, and India), and significant government support for smart factory development. The region benefits from a large consumer base and increasing foreign direct investments in industrial infrastructure.

- Latin America: This region represents an emerging market with gradual growth driven by increasing industrialization, infrastructure development, and growing adoption of automation in sectors like mining, oil & gas, and agriculture. Countries such as Brazil and Mexico are leading the adoption, albeit from a lower market share compared to developed regions.

- Middle East & Africa (MEA): While currently a smaller market, MEA is experiencing growth due to ongoing industrial diversification, investment in oil & gas, infrastructure projects, and the development of smart cities. Countries like UAE and Saudi Arabia are investing in digitalization, creating new opportunities for IPC deployment in various industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial PC Market.- Advantech Co., Ltd.

- Siemens AG

- Kontron (S&T AG)

- Beckhoff Automation GmbH & Co. KG

- Rockwell Automation, Inc.

- Schneider Electric SE

- ABB Ltd.

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH & Co. KG

- DFI Inc.

- IEI Integration Corp.

- Avalue Technology Inc.

- NEXCOM International Co., Ltd.

- Lanner Electronics Inc.

- Fujitsu Ltd.

- DELL Technologies Inc.

- HP Inc.

- OnLogic (Logic Supply Inc.)

- Acnodes Corp.

- Pepperl+Fuchs AG

Frequently Asked Questions

Analyze common user questions about the Industrial PC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Industrial PC?

An Industrial PC (IPC) is a ruggedized computing system designed to operate reliably in harsh industrial environments, enduring extreme temperatures, vibrations, dust, and electrical interference. It provides essential computing power for automation, control, and data processing in factories and other industrial settings.

How do Industrial PCs differ from standard commercial PCs?

IPCs are engineered for durability and longevity, featuring robust components, fanless designs, wide operating temperature ranges, and specialized I/O for industrial protocols. Commercial PCs, in contrast, are designed for office environments and lack the resilience required for industrial applications.

What are the primary applications of Industrial PCs?

Industrial PCs are widely used in industrial automation, process control, machine vision, human-machine interfaces (HMIs), data acquisition, energy management, transportation systems, and medical equipment, facilitating real-time control and data analytics at the edge.

What key factors are driving the growth of the Industrial PC market?

Key growth drivers include the rapid adoption of Industry 4.0 and IoT, increasing demand for automation, advancements in edge computing and AI integration, and the need for reliable data processing solutions in challenging industrial environments.

How is AI impacting the Industrial PC market?

AI is transforming the IPC market by driving demand for higher-performance processors (including GPUs and NPUs) to enable real-time AI inference at the edge. This facilitates advanced applications like predictive maintenance, quality inspection, and autonomous decision-making, enhancing industrial efficiency and intelligence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager