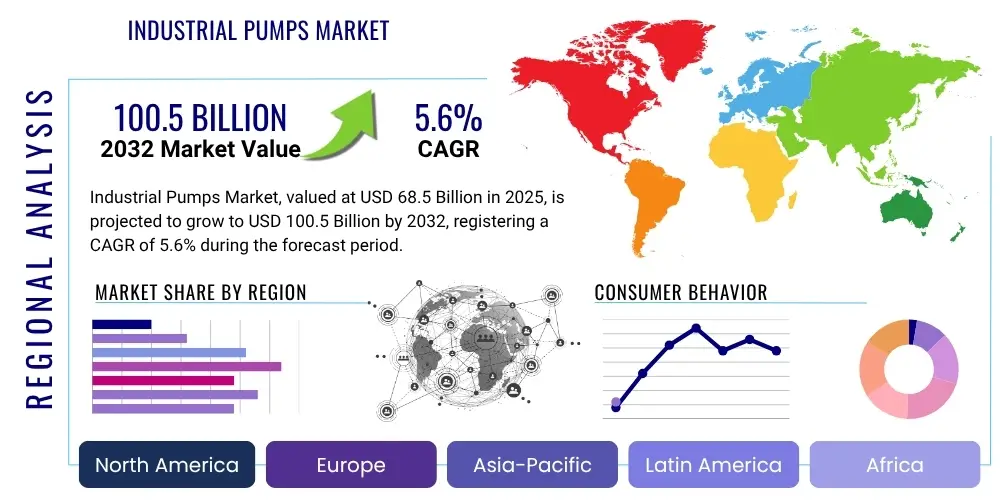

Industrial Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429308 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Industrial Pumps Market Size

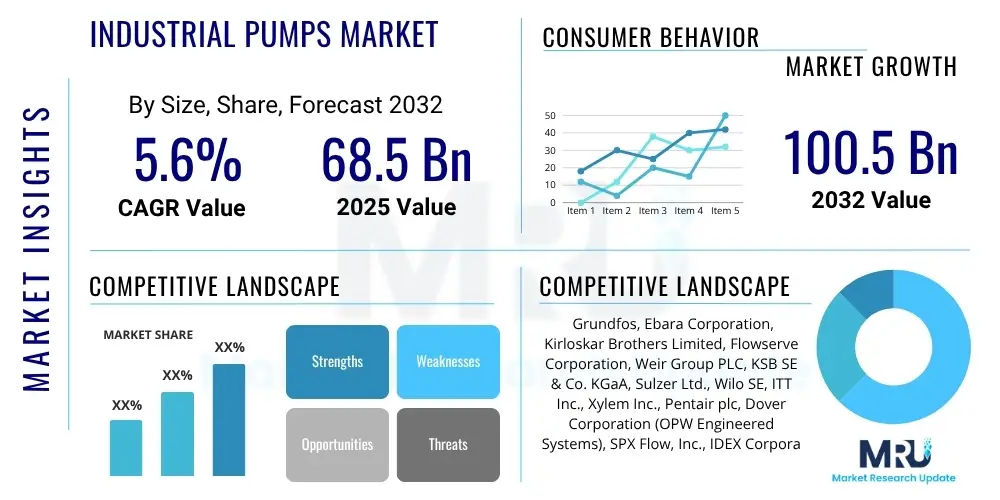

The Industrial Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2025 and 2032. The market is estimated at USD 68.5 Billion in 2025 and is projected to reach USD 100.5 Billion by the end of the forecast period in 2032. This substantial growth is primarily driven by increasing industrialization, expanding infrastructure projects, and the rising demand for efficient fluid management across diverse end-user sectors globally.

The market's expansion is further bolstered by technological advancements, including the integration of smart features and enhanced energy efficiency in pump designs. These innovations address critical industry needs for operational optimization and reduced environmental footprint, thereby sustaining a robust growth trajectory throughout the forecast period. Emerging economies, in particular, are expected to contribute significantly to this growth due to their rapid industrial development and urbanization trends.

Industrial Pumps Market introduction

The Industrial Pumps Market encompasses a wide array of devices designed to move fluids—liquids, gases, or slurries—across various industrial applications by converting mechanical energy into hydraulic energy. These essential machines are integral to manufacturing processes, infrastructure, and utility services, facilitating critical operations ranging from water treatment and oil extraction to chemical processing and power generation. The product description highlights their robust construction, often incorporating specialized materials to withstand corrosive or abrasive media, and their capability to handle diverse flow rates and pressures.

Major applications of industrial pumps span across sectors such as oil and gas, chemicals, water and wastewater treatment, power generation, pharmaceuticals, and food and beverages. In the oil and gas industry, they are crucial for extraction, refining, and transportation, while in water treatment, they enable purification, distribution, and wastewater management. The benefits of modern industrial pumps include enhanced operational efficiency, reduced energy consumption through advanced motor and impeller designs, and improved reliability and longevity due to superior engineering and materials.

Driving factors for the industrial pumps market include rapid global industrialization, particularly in developing economies, increased investment in infrastructure development, and stringent environmental regulations necessitating efficient water and wastewater management solutions. Furthermore, the growing demand for energy-efficient pumping systems and the advent of smart pump technologies incorporating IoT and AI for predictive maintenance and optimized performance are significant market stimulants, pushing innovation and adoption across industries worldwide.

Industrial Pumps Market Executive Summary

The Industrial Pumps Market is experiencing dynamic shifts, characterized by strong business trends focusing on sustainability, digital transformation, and customized solutions. Businesses are increasingly investing in energy-efficient pumps to comply with environmental regulations and reduce operational costs, alongside adopting smart pumping systems that leverage IoT for real-time monitoring and predictive maintenance. This strategic emphasis on advanced technology and sustainability is reshaping competitive landscapes, driving innovation in product design, and fostering new service models focused on lifecycle management and operational reliability.

Regional trends indicate robust growth in Asia Pacific, propelled by rapid industrialization, urbanization, and significant infrastructure investments, particularly in countries like China, India, and Southeast Asian nations. North America and Europe demonstrate a mature market, with growth primarily driven by replacement demand, stringent environmental policies, and the adoption of advanced, high-efficiency pumping solutions. Latin America, the Middle East, and Africa are also showing promising growth, fueled by expansion in oil and gas, mining, and water infrastructure projects, necessitating diverse pump types for various demanding applications.

Segmentation trends highlight a growing preference for positive displacement pumps in specialized applications requiring high pressure or precise dosing, while centrifugal pumps continue to dominate the market due to their versatility and cost-effectiveness in high-volume applications. The end-user industry segment shows significant demand from water and wastewater treatment, followed closely by oil and gas and chemicals. There is also an observable trend towards pumps made from advanced materials, such as stainless steel and specialized alloys, to enhance durability and corrosion resistance in harsh operating environments, reflecting a broader industry move towards specialized and resilient equipment.

AI Impact Analysis on Industrial Pumps Market

Common user questions regarding AI's impact on the Industrial Pumps Market frequently revolve around how artificial intelligence can enhance operational efficiency, extend equipment lifespan, and reduce maintenance costs. Users are particularly interested in the practical applications of AI for predictive maintenance, real-time monitoring, and optimizing pump performance in complex industrial environments. There's also significant curiosity about the integration of AI with IoT sensors to create "smart pumps" that can self-diagnose and adapt to changing conditions, as well as the potential for AI-driven analytics to improve energy consumption and identify operational anomalies.

Concerns often raised include the initial investment costs associated with AI implementation, data security and privacy challenges, the need for skilled personnel to manage and interpret AI systems, and the complexity of integrating new AI technologies with existing legacy infrastructure. Users seek clarity on the return on investment (ROI) for AI adoption and how these technologies can be scaled across different plant sizes and operational complexities. The expectation is that AI will revolutionize pump management, moving from reactive maintenance to proactive, data-driven strategies that minimize downtime and maximize productivity.

Overall, the key themes indicate a strong desire for AI to deliver tangible improvements in pump reliability, energy efficiency, and overall operational intelligence. The market anticipates AI will enable a paradigm shift towards autonomous and highly optimized pumping systems, leading to substantial cost savings and environmental benefits. The focus is on leveraging AI to unlock new levels of performance and sustainability, transforming traditional pump operations into intelligent, self-regulating fluid management systems capable of addressing the intricate demands of modern industry.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast potential failures, enabling proactive maintenance and reducing unscheduled downtime.

- Optimized Energy Consumption: AI models dynamically adjust pump operations based on demand, fluid properties, and energy costs, leading to significant energy savings.

- Real-time Performance Monitoring: AI-driven systems provide continuous insights into pump health, efficiency, and operational parameters, facilitating immediate issue detection.

- Automated Anomaly Detection: Machine learning identifies unusual operational patterns, flagging potential problems before they escalate into critical failures.

- Improved Operational Efficiency: AI optimizes pumping schedules, flow rates, and pressure levels, ensuring maximum throughput with minimal resource expenditure.

- Smart Pump Integration: AI enables pumps to communicate with other plant systems, forming intelligent, interconnected operational networks.

- Reduced Lifecycle Costs: By optimizing maintenance and extending asset life, AI contributes to a lower total cost of ownership for industrial pumps.

DRO & Impact Forces Of Industrial Pumps Market

The Industrial Pumps Market is significantly influenced by a confluence of drivers, restraints, and opportunities that collectively shape its growth trajectory and competitive landscape. Key drivers include accelerating global industrialization, especially in developing nations, where the expansion of manufacturing capabilities and infrastructure projects directly translates into increased demand for fluid management solutions. The growing emphasis on water and wastewater treatment dueid to escalating environmental concerns and stricter regulatory frameworks also acts as a powerful driver, necessitating efficient and reliable pumping systems for municipal and industrial applications. Furthermore, the oil and gas sector's ongoing exploration and production activities, alongside expansion in the chemical and power generation industries, continuously fuel the need for high-performance industrial pumps.

However, the market faces several significant restraints that could impede its growth. High capital expenditure associated with advanced industrial pumps, especially for specialized high-pressure or corrosive-resistant models, poses a barrier to entry or upgrade for some end-users. The significant energy consumption of conventional pumps and the associated operational costs also act as a restraint, prompting a shift towards more energy-efficient, albeit sometimes costlier, alternatives. Additionally, the fluctuating prices of raw materials, such as steel and specialized alloys, can impact manufacturing costs and, consequently, the final product pricing, affecting market demand and profitability.

Opportunities for growth are abundant, particularly with the advent of smart pump technologies incorporating IoT, AI, and advanced analytics for predictive maintenance, remote monitoring, and optimized energy usage. The rising adoption of sustainable and energy-efficient pumping solutions offers a substantial opportunity for manufacturers to innovate and gain a competitive edge. Moreover, the increasing demand for customized pump solutions tailored to specific industrial requirements, coupled with the potential for aftermarket services and digital twin technologies, presents fertile ground for market expansion. The ongoing upgrade and replacement cycles in mature markets also provide consistent demand for advanced, more efficient pump models, further bolstering market opportunities.

Segmentation Analysis

The Industrial Pumps Market is comprehensively segmented across various dimensions to provide a detailed understanding of its dynamics and growth prospects. These segmentations allow for a granular analysis of market demand, technological preferences, and end-user adoption patterns. Key categories include pump type, end-user industry, application, drive type, material of construction, and operational characteristics, each revealing unique market trends and opportunities for stakeholders. Understanding these segments is crucial for strategic planning, product development, and market entry decisions, enabling manufacturers to tailor their offerings to specific market needs and optimize their competitive positioning.

The segmentation by pump type differentiates between centrifugal and positive displacement pumps, highlighting their respective strengths and typical applications. End-user industry segmentation identifies the major sectors driving demand, such as oil and gas, chemicals, water treatment, and power generation, each with distinct requirements for pump performance and reliability. Application-based segmentation further refines this understanding by focusing on specific tasks like fluid transfer, wastewater management, or chemical dosing. Meanwhile, drive type and material segmentations shed light on technological preferences and the need for pumps capable of operating under diverse environmental conditions, from high temperatures and pressures to corrosive media. The evolution of smart and automated operational systems further diversifies the market, underscoring the shift towards more intelligent and integrated fluid management solutions.

- By Type:

- Centrifugal Pumps

- Positive Displacement Pumps

- Reciprocating Pumps

- Rotary Pumps

- By End-User Industry:

- Oil and Gas

- Chemicals

- Water and Wastewater Treatment

- Power Generation

- Pharmaceuticals

- Food and Beverages

- Pulp & Paper

- Metals & Mining

- Construction

- By Application:

- Water & Wastewater Management

- Oil & Gas Exploration & Production

- Chemical Processing

- Power Generation

- Manufacturing Operations

- Irrigation Systems

- By Drive Type:

- Electric

- Air-Operated

- Hydraulic

- Steam

- By Material:

- Cast Iron

- Stainless Steel

- Alloys

- Plastics

- By Operation:

- Manual

- Semi-Automatic

- Automatic

Value Chain Analysis For Industrial Pumps Market

The value chain for the Industrial Pumps Market begins with upstream analysis, which involves the sourcing of raw materials such as cast iron, stainless steel, various alloys (e.g., bronze, nickel alloys), and specialized plastics. This stage also includes the manufacturing of critical components like motors, impellers, seals, bearings, and casings by specialized suppliers. The quality and cost of these raw materials and components directly impact the final product's performance, durability, and pricing. Strong relationships with reliable and technologically advanced upstream suppliers are crucial for maintaining competitive advantages and ensuring consistent product quality in the market.

Moving downstream, the value chain encompasses the design, manufacturing, assembly, and testing of industrial pumps by pump manufacturers. This stage involves significant R&D investments to innovate pump designs, improve energy efficiency, integrate smart technologies, and develop solutions for specific industrial challenges. After manufacturing, pumps are distributed through a complex network, including direct sales channels to large industrial clients, and indirect channels such as distributors, agents, and system integrators. These distribution channels play a vital role in reaching diverse customer bases, providing local support, and facilitating installation and commissioning services. The efficiency and reach of this distribution network significantly influence market penetration and customer satisfaction.

The final stages of the value chain involve installation, commissioning, and extensive aftermarket services, which include maintenance, repair, spare parts supply, and upgrades. The provision of robust direct and indirect after-sales support is critical for customer retention and enhancing the overall value proposition of industrial pump manufacturers. A strong service network ensures optimal pump performance throughout its lifecycle, minimizes downtime, and supports the transition towards predictive maintenance models. The entire value chain is characterized by a high degree of technical expertise, quality control, and a strong emphasis on meeting stringent industry standards and customer specifications, from raw material sourcing to end-of-life servicing.

Industrial Pumps Market Potential Customers

The Industrial Pumps Market serves a broad spectrum of end-users and buyers, spanning across nearly all heavy and process industries that require fluid movement and management. Key potential customers include operators within the water and wastewater treatment sector, encompassing municipal water authorities and industrial plants that require pumps for purification, distribution, and effluent handling. The oil and gas industry is another major buyer, utilizing pumps for drilling, extraction, refining, pipeline transportation, and offshore operations. These applications often demand highly specialized pumps capable of handling abrasive, corrosive, or high-pressure fluids, from crude oil to refined petroleum products.

The chemical processing industry represents a significant customer base, relying on industrial pumps for transferring a wide array of chemicals, including acids, alkalis, and solvents, often under hazardous or extreme conditions. Similarly, the power generation sector, covering thermal, nuclear, and renewable energy plants, uses pumps for cooling systems, boiler feed, and ash slurry removal. Manufacturing industries, including pharmaceuticals, food and beverages, pulp and paper, and metals and mining, also form a critical segment of potential customers, requiring pumps for various production processes, material handling, and utility services, from precise dosing to high-volume transfer.

Beyond these large industrial sectors, emerging markets and infrastructure development projects globally are creating new customer segments. These include construction projects for building and road development, agricultural irrigation systems, and various environmental management initiatives. The diversity of applications and the critical nature of fluid handling in these industries ensure a consistently high demand for a variety of industrial pump types, from standard centrifugal pumps to advanced positive displacement and specialty pumps tailored to specific operational needs and regulatory compliance. The ongoing need for replacement, upgrades, and expansion in these sectors solidifies their role as enduring potential customers for industrial pump manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 68.5 Billion |

| Market Forecast in 2032 | USD 100.5 Billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Ebara Corporation, Kirloskar Brothers Limited, Flowserve Corporation, Weir Group PLC, KSB SE & Co. KGaA, Sulzer Ltd., Wilo SE, ITT Inc., Xylem Inc., Pentair plc, Dover Corporation (OPW Engineered Systems), SPX Flow, Inc., IDEX Corporation, Gardner Denver (Ingersoll Rand), Seepex GmbH, Netzsch Group, Viking Pump, Inc., Watson-Marlow Fluid Technology Solutions (Spirax Sarco Engineering plc), Danfoss A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Pumps Market Key Technology Landscape

The Industrial Pumps Market is characterized by a rapidly evolving technology landscape, driven by the imperative for enhanced efficiency, reliability, and reduced operational costs. A significant technological trend is the widespread adoption of smart pumping solutions, which integrate Internet of Things (IoT) sensors and connectivity to enable real-time monitoring, remote diagnostics, and data-driven performance analytics. These smart systems allow for predictive maintenance, anticipating potential failures before they occur, thereby minimizing downtime and extending the operational lifespan of the pumps. The integration of artificial intelligence (AI) and machine learning (ML) algorithms further enhances these capabilities, enabling pumps to optimize their own performance based on fluctuating operational demands and environmental conditions, leading to substantial energy savings and improved throughput.

Advanced materials technology also plays a crucial role in the industrial pumps market. Manufacturers are increasingly utilizing specialized alloys, ceramics, composites, and high-performance plastics to construct pumps that can withstand highly corrosive, abrasive, high-temperature, or high-pressure environments. These materials significantly enhance the durability, longevity, and operational scope of pumps, making them suitable for demanding applications in industries such as chemicals, oil and gas, and mining. Furthermore, innovations in hydraulic design are continuously improving pump efficiency, reducing energy consumption, and optimizing fluid dynamics to deliver higher performance with lower power input.

The pursuit of energy efficiency remains a paramount technological driver, with innovations focusing on more efficient motor designs, variable speed drives (VSDs), and optimized impeller and casing geometries. VSDs, in particular, allow pumps to adjust their speed according to demand, significantly reducing energy waste during periods of low load. Other key technological advancements include the development of mag-drive and canned motor pumps for leak-free operations in handling hazardous fluids, and advancements in seal technology to reduce emissions and improve reliability. The convergence of these technological innovations is transforming industrial pumps from simple fluid movers into sophisticated, intelligent, and environmentally responsible assets within complex industrial ecosystems.

Regional Highlights

- Asia Pacific: This region stands as the largest and fastest-growing market, driven by rapid industrialization, urbanization, and significant investments in infrastructure, manufacturing, and water & wastewater treatment in countries like China, India, and Southeast Asian nations.

- North America: A mature market characterized by a strong focus on advanced, energy-efficient pumping solutions and replacement demand. Growth is propelled by the oil and gas sector, water infrastructure upgrades, and adoption of smart pump technologies.

- Europe: This region exhibits stable growth, primarily due to stringent environmental regulations, a robust chemicals industry, and continuous investment in sustainable water management. Emphasis is on high-efficiency pumps and digitalization.

- Latin America: Expected to show moderate growth, largely influenced by investments in the mining sector, expanding oil and gas exploration, and improvements in public utility infrastructure across countries like Brazil and Mexico.

- Middle East and Africa (MEA): This region is experiencing considerable growth, fueled by substantial investments in the oil and gas sector, ambitious infrastructure projects, and increasing demand for water desalination and treatment facilities in the Gulf countries and parts of Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Pumps Market.- Grundfos

- Ebara Corporation

- Kirloskar Brothers Limited

- Flowserve Corporation

- Weir Group PLC

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Wilo SE

- ITT Inc.

- Xylem Inc.

- Pentair plc

- Dover Corporation (OPW Engineered Systems)

- SPX Flow, Inc.

- IDEX Corporation

- Gardner Denver (Ingersoll Rand)

- Seepex GmbH

- Netzsch Group

- Viking Pump, Inc.

- Watson-Marlow Fluid Technology Solutions (Spirax Sarco Engineering plc)

- Danfoss A/S

Frequently Asked Questions

Analyze common user questions about the Industrial Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of industrial pumps?

The two primary types are centrifugal pumps, which use rotational energy to move fluids, and positive displacement pumps, which trap and then force a fixed volume of fluid. Each type is suited for different applications based on flow rate, pressure, and fluid characteristics.

Which industries are the largest consumers of industrial pumps?

The largest consumers include water and wastewater treatment, oil and gas, chemicals, power generation, and manufacturing industries like pharmaceuticals and food and beverages. These sectors rely heavily on pumps for various fluid handling processes.

How is technology impacting the industrial pumps market?

Technology is driving significant advancements, including the integration of IoT for real-time monitoring, AI for predictive maintenance and operational optimization, and the development of energy-efficient designs and advanced materials for enhanced durability and performance.

What are the key factors driving growth in the industrial pumps market?

Key growth drivers include global industrialization, increasing investments in infrastructure development, stringent environmental regulations necessitating efficient water management, and expanding demand from the oil and gas and chemical industries.

What are the main challenges faced by the industrial pumps market?

Major challenges include the high initial capital expenditure for advanced systems, the significant energy consumption of conventional pumps, and volatility in raw material prices. The need for skilled maintenance personnel for complex systems also poses a challenge.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial Pumps Market Size Report By Type (Centrifugal Pump, Axial Flow Pump, Radial Flow Pump, Mixed Flow Pump, Positive Displacement Pump, Reciprocating, Rotary, Others), By Application (Oil & Gas, Chemicals, Construction, Power Generation, Water & Wastewater, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Industrial Pumps Market Statistics 2025 Analysis By Application (Oil & Gas, Chemicals, Construction, Power Generation, Water & Wastewater, Others), By Type (Centrifugal, Reciprocating, Rotary, Diaphragm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager