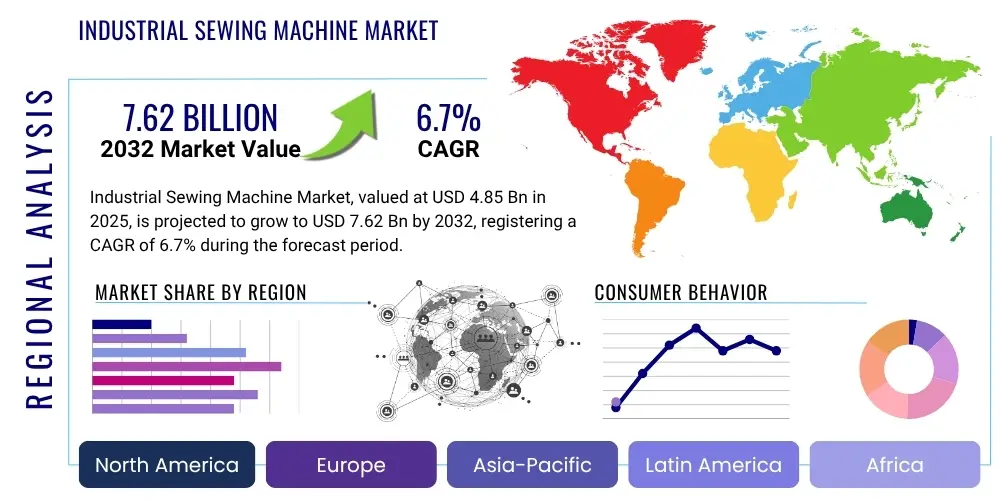

Industrial Sewing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430418 | Date : Nov, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Sewing Machine Market Size

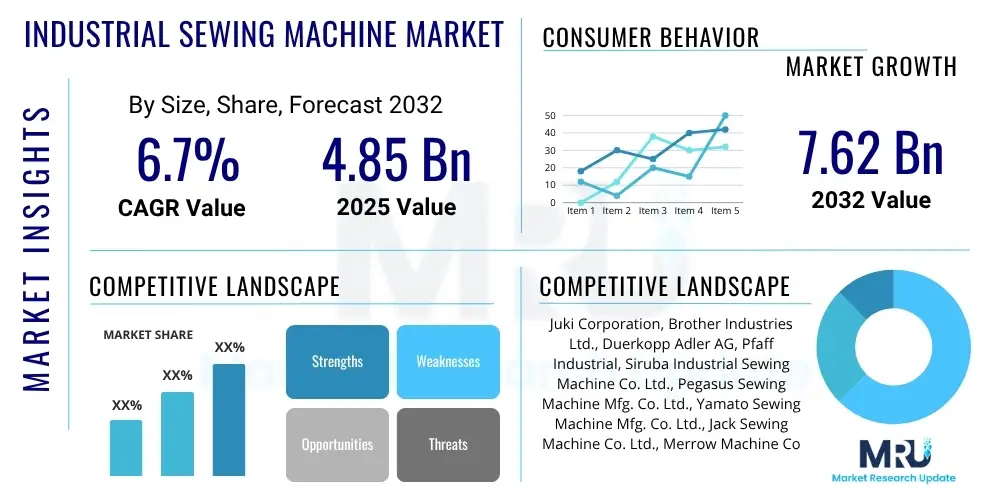

The Industrial Sewing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032. The market is estimated at $4.85 billion in 2025 and is projected to reach $7.62 billion by the end of the forecast period in 2032.

Industrial Sewing Machine Market introduction

The industrial sewing machine market encompasses a wide array of specialized equipment designed for large-scale production and heavy-duty sewing applications across various manufacturing sectors. Unlike domestic sewing machines, industrial variants are engineered for continuous operation, higher speeds, exceptional durability, and specialized functions tailored to specific materials and production processes. These machines are critical assets in industries where high volume, consistent quality, and efficient production are paramount. They are built to withstand rigorous use, often operating for multiple shifts per day, and are distinguished by their robust construction, powerful motors, and precision engineering, ensuring consistent stitch quality and seam integrity over long production runs. The product description of an industrial sewing machine typically highlights its specific stitch type capabilities, such as lockstitch, chainstitch, overlock, or coverstitch, along with its automation level, material handling capacity, and specialized attachments for intricate tasks.

Major applications for industrial sewing machines span a diverse range of industries, including apparel and garment manufacturing, automotive interiors, footwear production, home furnishings, and the rapidly growing sector of technical textiles. In apparel, they enable the efficient assembly of garments from delicate silks to heavy denim. For the automotive industry, these machines handle robust materials for seat covers, airbags, and interior trim with precision and strength. Footwear manufacturers rely on them for stitching leather, synthetic uppers, and sole components. The benefits derived from utilizing industrial sewing machines are manifold, primarily revolving around enhanced productivity, superior quality control, and cost efficiency. Their high operating speeds significantly reduce manufacturing cycle times, while their specialized designs ensure uniform stitch formation and strong seams, critical for product durability and aesthetic appeal. Furthermore, the capacity to handle diverse materials, from lightweight fabrics to thick composites, makes them indispensable tools in modern manufacturing environments, reducing manual labor and associated costs.

The driving factors propelling the growth of the industrial sewing machine market are intrinsically linked to global manufacturing trends and technological advancements. The burgeoning demand for ready-to-wear apparel, particularly from fast fashion and e-commerce segments, continues to fuel investment in high-speed, automated sewing solutions. The automotive industry's continuous evolution in interior design and safety features necessitates sophisticated machines for complex stitching tasks on specialized materials. Moreover, the expanding application scope of technical textiles in medical, aerospace, and construction sectors creates new demand for advanced industrial sewing machines capable of processing high-performance fabrics and composite materials. Increasing labor costs in traditional manufacturing hubs are also compelling businesses to adopt more automated and efficient sewing technologies, reducing reliance on manual operations and driving further market expansion. The push for greater sustainability and efficiency in production processes is also fostering innovation, leading to the development of energy-efficient and waste-reducing machinery.

Industrial Sewing Machine Market Executive Summary

The Industrial Sewing Machine Market is currently experiencing dynamic shifts driven by a confluence of technological innovation, evolving global manufacturing landscapes, and changing consumer demands. Business trends indicate a strong move towards automation and digitization within manufacturing facilities, with companies investing in advanced industrial sewing machines that offer integrated control systems, data analytics capabilities, and enhanced precision. There is an observable emphasis on improving supply chain resilience and flexibility, which translates into a demand for versatile machines capable of handling small-batch, on-demand production alongside mass manufacturing. Sustainability is also emerging as a pivotal business trend, prompting manufacturers to seek energy-efficient machinery and explore sustainable material processing capabilities, influencing procurement decisions and product development strategies across the industry. Customization and personalization trends in end-user markets are compelling manufacturers to adopt more adaptable and programmable sewing solutions.

Regional trends reveal significant disparities in market growth and adoption rates. The Asia Pacific region, particularly countries like China, India, Vietnam, and Bangladesh, continues to dominate the market in terms of production volume and consumption, primarily due to its established apparel and textile manufacturing base, lower labor costs, and expanding domestic markets. However, North America and Europe are leading in the adoption of advanced, high-automation, and specialized industrial sewing machines, driven by higher labor costs, a focus on technological innovation, and a growing emphasis on high-value technical textiles and niche product segments like luxury goods and performance wear. Latin America and the Middle East and Africa regions are demonstrating steady growth, fueled by increasing industrialization, rising disposable incomes, and foreign investments in manufacturing capabilities, particularly within the apparel and footwear sectors. These regions represent emerging opportunities for market players focusing on accessible and efficient solutions.

Segment trends underscore the evolving needs of various industries. The automatic industrial sewing machine segment is projected to witness the highest growth, driven by the imperative to reduce labor dependency, enhance productivity, and achieve consistent quality in mass production environments. This includes sophisticated machines with features like automatic thread trimming, pattern recognition, and robotic material handling. The application segment for technical textiles is rapidly expanding, fueled by innovations in aerospace, medical, and protective gear industries, requiring specialized machines for non-traditional materials and complex seams. The apparel and garment segment remains the largest by volume, with a continuous demand for high-speed lockstitch, overlock, and coverstitch machines. Furthermore, the market for refurbished or energy-efficient machines is gaining traction, reflecting a balance between economic viability and environmental consciousness, particularly among small and medium-sized enterprises seeking to optimize operational costs and adhere to sustainable practices.

AI Impact Analysis on Industrial Sewing Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Industrial Sewing Machine Market often center on how AI can enhance automation, precision, and efficiency in complex manufacturing processes. Common questions explore AI's role in improving stitch quality, reducing material waste, enabling predictive maintenance, and facilitating autonomous operations within smart factories. Users are keen to understand how AI algorithms can interpret visual data for real-time adjustments, optimize sewing paths, and manage diverse fabric properties, thereby minimizing human error and maximizing output. There is significant interest in AI's potential to integrate industrial sewing machines into broader IoT ecosystems, allowing for seamless data exchange and intelligent decision-making across the production floor. Stakeholders also express concerns about the initial investment costs, the need for specialized training, and the cybersecurity implications associated with adopting AI-driven technologies in traditional manufacturing setups, alongside expectations for significantly improved operational metrics and expanded capabilities in customized production.

- AI-powered vision systems enable real-time fabric detection and alignment, significantly enhancing precision and reducing material waste during complex sewing operations.

- Predictive maintenance algorithms analyze machine performance data to forecast potential failures, minimizing downtime and optimizing maintenance schedules, thus extending machine lifespan.

- Machine learning optimizes sewing parameters (e.g., tension, speed, stitch length) based on fabric type and desired seam quality, ensuring consistent and superior product finishes.

- Robotic process automation, guided by AI, facilitates autonomous material handling, loading, and unloading, integrating sewing machines seamlessly into fully automated production lines.

- AI-driven pattern recognition allows industrial sewing machines to adapt to intricate designs and varied fabric textures automatically, supporting mass customization and complex garment construction.

- Integration with production planning systems via AI optimizes workflow, dynamically assigning tasks and managing inventory, leading to improved overall factory efficiency and responsiveness.

- Advanced quality control systems leverage AI to detect stitching defects in real-time, providing immediate feedback and preventing faulty products from moving further down the production line.

- AI contributes to energy efficiency by optimizing machine cycles and power consumption based on real-time operational demands, aligning with sustainability goals.

DRO & Impact Forces Of Industrial Sewing Machine Market

The Industrial Sewing Machine Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its growth trajectory and competitive landscape. Key drivers include the robust expansion of the global apparel and textile industries, particularly fueled by fast fashion trends and the increasing demand from emerging economies for ready-to-wear garments. The continuous push for automation in manufacturing processes, driven by rising labor costs and the need for enhanced productivity and consistent quality, further propels the adoption of advanced industrial sewing machines. Additionally, the rapid growth in the technical textiles sector, encompassing applications in automotive, medical, and protective gear, necessitates specialized and high-performance sewing equipment capable of handling complex materials and intricate designs. The expanding e-commerce landscape also indirectly boosts demand by accelerating garment production cycles and increasing the volume of manufactured goods, requiring more efficient and high-speed machinery.

However, several restraints pose challenges to market expansion. The high initial capital investment required for purchasing advanced industrial sewing machines and associated automation systems can be a significant barrier for small and medium-sized enterprises (SMEs), limiting their ability to upgrade equipment. The complexity of maintaining and operating these sophisticated machines often requires a highly skilled workforce, leading to challenges related to labor training and retention in many regions. Furthermore, economic fluctuations, trade policies, and geopolitical uncertainties can impact manufacturing output and investment decisions, creating instability in demand for new machinery. Intense competition within the market, particularly from manufacturers offering lower-cost alternatives, also exerts pressure on pricing and profit margins for premium machine providers. The rapid pace of technological change can lead to quick obsolescence of older models, necessitating continuous investment in research and development to remain competitive.

Despite these challenges, substantial opportunities exist for market players. The integration of cutting-edge technologies like Artificial Intelligence (AI), Internet of Things (IoT), and robotics presents avenues for developing smart, interconnected sewing solutions that offer unprecedented levels of automation, predictive maintenance, and data analytics. This allows for greater efficiency, precision, and adaptability in production. The growing emphasis on sustainable manufacturing practices creates opportunities for developing energy-efficient machines and promoting circular economy principles within the textile industry, attracting environmentally conscious buyers. The rising trend of customization and on-demand production, particularly in advanced economies, opens new market niches for flexible and programmable sewing machines capable of handling diverse designs and small batch sizes efficiently. Furthermore, strategic expansion into untapped emerging markets, where industrialization is accelerating and manufacturing capabilities are scaling up, offers significant growth potential for market penetration. The continuous development of new high-performance materials also creates a demand for innovative sewing solutions that can handle their unique properties.

Segmentation Analysis

The Industrial Sewing Machine Market is segmented based on various critical attributes, including machine type, operational mode, application, and end-user, providing a granular view of market dynamics and catering to diverse industrial requirements. This segmentation allows for a comprehensive understanding of different product categories and their specific demand drivers across various manufacturing sectors. Analyzing these segments helps stakeholders identify key growth areas, competitive landscapes, and opportunities for product innovation and market penetration. Each segment reflects distinct technological characteristics, performance capabilities, and target user groups, ranging from high-volume garment producers to specialized technical textile manufacturers. The operational segmentation highlights the shift towards greater automation, while application-based segmentation showcases the machine's versatility across multiple industries, ultimately informing strategic business decisions and product development priorities within the market.

- By Type

- Lockstitch Machines

- Chainstitch Machines

- Overlock Machines

- Coverstitch Machines

- Buttonhole Machines

- Bartacking Machines

- Embroidery Machines

- Special Purpose Machines (e.g., heavy-duty, robotic sewing units)

- By Operation

- Manual Industrial Sewing Machines

- Semi-Automatic Industrial Sewing Machines

- Automatic Industrial Sewing Machines

- By Application

- Apparel and Garment Manufacturing

- Automotive Interiors (e.g., seat covers, airbags, trim)

- Footwear Production (e.g., leather goods, athletic shoes)

- Home Furnishings (e.g., upholstery, curtains, bedding)

- Technical Textiles (e.g., geotextiles, medical textiles, protective wear)

- Leather Goods (e.g., bags, wallets)

- Luggage and Bags

- Medical Textiles (e.g., surgical gowns, implants)

- Aerospace Composites

- Bookbinding

- By End-User

- Large Scale Manufacturers (e.g., multinational corporations)

- Small and Medium Enterprises (SMEs)

- Custom Design Workshops

- Research & Development Centers

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Industrial Sewing Machine Market

The value chain for the Industrial Sewing Machine Market begins with robust upstream activities involving the sourcing and manufacturing of critical components and raw materials. This includes suppliers of high-grade metals for machine frames and precision parts, electronic components for control systems and motors, advanced lubricants, and specialized needles. Key upstream players also include software developers who provide the sophisticated programming for automated and computerized sewing machines, enabling features like pattern programming, diagnostic capabilities, and integration with manufacturing execution systems. The quality and innovation at this stage are paramount, as they directly impact the performance, durability, and technological capabilities of the final industrial sewing machine. Strong supplier relationships and effective quality control are crucial to ensuring a consistent supply of reliable and high-performance components, which forms the bedrock of machine quality and longevity in demanding industrial environments.

Further along the value chain, the manufacturing stage involves the assembly, testing, and quality assurance of the industrial sewing machines. Leading manufacturers often integrate advanced robotics and automation in their own production lines to achieve high precision and efficiency in machine assembly. This stage is characterized by significant investment in research and development to innovate new machine types, enhance existing models, and incorporate cutting-edge technologies like IoT and AI. Post-manufacturing, the downstream segment primarily focuses on distribution, sales, and after-sales support. Distribution channels are varied, encompassing direct sales, where manufacturers sell directly to large industrial clients, and indirect channels, involving a network of distributors, dealers, and agents who cater to a broader range of customers, including SMEs and specialized workshops. These distributors often provide localized sales support, technical advice, and installation services, playing a critical role in market reach and customer satisfaction.

The distribution network is a crucial element, enabling market penetration and ensuring machines reach diverse end-users across various geographies. Direct distribution channels are typically favored by large manufacturers to serve major clients requiring custom solutions or high-volume orders, allowing for direct communication and tailored support. Indirect channels, through specialized dealers and value-added resellers, are essential for reaching smaller clients, offering localized inventory, maintenance services, and training. After-sales support, including spare parts supply, technical assistance, and regular maintenance services, forms a vital part of the value chain, directly influencing customer loyalty and repeat business. Effective service networks ensure minimal downtime for industrial operations, which is a critical factor for manufacturers relying on continuous production. The interplay of these stages, from raw material sourcing to end-user support, creates the overall value proposition for the industrial sewing machine market, underscoring the importance of seamless coordination and efficiency at each level.

Industrial Sewing Machine Market Potential Customers

The potential customers for the Industrial Sewing Machine Market are a diverse group of entities spanning various manufacturing sectors, each with unique requirements for speed, precision, and specialization in their sewing operations. Primary end-users and buyers include large-scale apparel and garment manufacturers, who require high-speed, automated machines for mass production of clothing, knitwear, and accessories to meet global demand for fast fashion and ready-to-wear items. The automotive industry is another significant customer segment, particularly manufacturers of vehicle interiors, seat covers, airbags, and dashboard components, which demand robust machines capable of handling thick, multi-layered materials and intricate stitching for safety and aesthetic purposes. These companies prioritize reliability, precision, and the ability to work with specialized technical textiles, ensuring the highest standards of safety and durability in their products.

Beyond these major segments, the footwear industry represents a substantial customer base, with manufacturers needing specialized machines for stitching leather, synthetic uppers, and attaching soles for various shoe types, from athletic wear to formal footwear. Home furnishings producers, involved in creating upholstery for furniture, curtains, drapes, bedding, and other textile-based household items, also constitute a key customer group, often requiring machines capable of handling heavy fabrics and decorative stitching. The burgeoning technical textiles sector, encompassing producers of geotextiles, medical textiles (e.g., surgical gowns, masks, implantable devices), protective wear, and aerospace composites, represents a rapidly growing segment seeking highly specialized, often automated, industrial sewing machines designed for advanced materials and performance requirements. These customers prioritize machines that can ensure structural integrity and meet stringent regulatory standards.

Furthermore, small and medium-sized enterprises (SMEs) within the textile and apparel sectors, custom design workshops, and niche manufacturers focusing on bespoke products or specialized goods like luggage, bags, and leather accessories also form a crucial part of the customer landscape. These entities may seek more versatile or semi-automatic machines that offer a balance between investment cost and productivity. Research and development centers, often affiliated with academic institutions or large corporations, also act as potential buyers for advanced, experimental, or specialized machines to explore new materials, sewing techniques, and automation possibilities. The underlying commonality among all these potential customers is the need for durable, efficient, and precise sewing solutions that can enhance productivity, maintain consistent quality, and ultimately contribute to their competitive advantage in their respective markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $4.85 billion |

| Market Forecast in 2032 | $7.62 billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Juki Corporation, Brother Industries Ltd., Duerkopp Adler AG, Pfaff Industrial, Siruba Industrial Sewing Machine Co. Ltd., Pegasus Sewing Machine Mfg. Co. Ltd., Yamato Sewing Machine Mfg. Co. Ltd., Jack Sewing Machine Co. Ltd., Merrow Machine Company, Consew, Strobel Spezialmaschinen GmbH, Seiko Sewing Machine Co. Ltd., Toyota Industrial Sewing Machine, Highlead Global, Kansai Special Sewing Machine Co. Ltd., Zoje Sewing Machine Co. Ltd., Union Special Corporation, Mitsubishi Electric Corporation, Singer Corporation (Industrial Division), Typical Sewing Machine Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Sewing Machine Market Key Technology Landscape

The Industrial Sewing Machine Market is undergoing a profound technological transformation, driven by the integration of advanced digital and smart manufacturing solutions. Key technologies revolutionizing this sector include the Internet of Things (IoT), which enables seamless connectivity between sewing machines and central production systems, allowing for real-time monitoring of operational status, output, and predictive maintenance alerts. This interconnectedness facilitates data-driven decision-making, optimizing workflow and reducing downtime. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly being embedded for tasks such as automated pattern recognition, intelligent fabric handling, and real-time quality control, where cameras and sensors feed data to AI algorithms that can detect stitching defects or adjust sewing parameters instantaneously, ensuring unparalleled precision and consistency across production batches. These AI-driven capabilities reduce the need for manual oversight and increase throughput significantly.

Robotic automation is another pivotal technology, with industrial sewing machines being integrated into larger robotic cells that handle material loading, positioning, and unloading. Collaborative robots (cobots) are also emerging, working alongside human operators to assist with repetitive or complex tasks, thereby enhancing safety and efficiency without fully replacing human intervention. The development of modular designs and customizable machine platforms allows manufacturers to quickly adapt their equipment to various production requirements, from delicate fabrics to heavy-duty materials, offering flexibility in a rapidly changing market. Advanced motor control systems, including servo motors, provide precise speed and stitch control, contributing to higher energy efficiency and reducing noise levels in factory environments. These systems allow for highly nuanced adjustments, which is crucial for intricate designs and specialized materials, and can contribute to significant energy savings over prolonged operations, aligning with broader sustainability goals.

Furthermore, the adoption of digital twin technology is gaining traction, creating virtual replicas of physical sewing machines and entire production lines. This allows for simulation, testing, and optimization of processes in a virtual environment before physical implementation, minimizing errors and accelerating product development. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) integration is becoming standard, streamlining the transition from design to production by directly programming sewing patterns and parameters into the machines. Augmented Reality (AR) is also being explored for maintenance and training purposes, providing technicians with interactive visual guides for troubleshooting and repairs, enhancing efficiency and reducing the learning curve for new operators. These technological advancements collectively contribute to a paradigm shift towards highly automated, intelligent, and flexible sewing operations, capable of meeting the demands of modern industrial manufacturing with superior efficiency, quality, and adaptability, while also addressing environmental concerns through optimized energy consumption and reduced material waste.

Regional Highlights

- North America: This region is characterized by a strong demand for high-automation and specialized industrial sewing machines, particularly within its robust automotive, aerospace, and technical textiles sectors. High labor costs drive the adoption of advanced robotics and AI-integrated solutions to enhance productivity and maintain competitiveness. There is a growing emphasis on re-shoring manufacturing and increasing investment in smart factory initiatives, fostering innovation in sewing technology.

- Europe: European countries, especially Germany and Italy, are leaders in manufacturing high-precision and technologically advanced industrial sewing machines, focusing on quality, sustainability, and energy efficiency. The region exhibits a significant market for specialized machines catering to luxury apparel, automotive interiors, and medical textiles, driven by stringent quality standards and a strong R&D base. There is a continuous push towards Industry 4.0 integration and circular economy principles within the textile industry.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for industrial sewing machines, primarily due to the expansive apparel and textile manufacturing bases in China, India, Vietnam, and Bangladesh. The region benefits from a large labor force, burgeoning domestic consumption, and increasing foreign direct investment in manufacturing. While demand for cost-effective basic machines remains strong, there is also a rapid uptake of semi-automatic and automatic machines to improve efficiency and meet global export quality standards.

- Latin America: The market in Latin America is witnessing steady growth, propelled by the development of local apparel and footwear industries and increasing investments in manufacturing infrastructure, particularly in countries like Brazil and Mexico. Demand is driven by both domestic consumption and export opportunities, leading to the adoption of modern industrial sewing machines to enhance production capabilities and product quality. Economic stability and trade agreements play a crucial role in shaping market dynamics.

- Middle East and Africa (MEA): This region is experiencing emerging growth in the industrial sewing machine market, primarily linked to the expansion of textile and apparel manufacturing sectors in countries like Turkey, Egypt, and South Africa. Investments in industrialization and diversification away from oil-dependent economies are fueling demand for efficient manufacturing equipment. The market is driven by both domestic demand for consumer goods and the ambition to establish competitive export capabilities, often with a focus on cost-effective yet reliable machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Sewing Machine Market.- Juki Corporation

- Brother Industries Ltd.

- Duerkopp Adler AG

- Pfaff Industrial

- Siruba Industrial Sewing Machine Co. Ltd.

- Pegasus Sewing Machine Mfg. Co. Ltd.

- Yamato Sewing Machine Mfg. Co. Ltd.

- Jack Sewing Machine Co. Ltd.

- Merrow Machine Company

- Consew

- Strobel Spezialmaschinen GmbH

- Seiko Sewing Machine Co. Ltd.

- Toyota Industrial Sewing Machine

- Highlead Global

- Kansai Special Sewing Machine Co. Ltd.

- Zoje Sewing Machine Co. Ltd.

- Union Special Corporation

- Mitsubishi Electric Corporation

- Singer Corporation (Industrial Division)

- Typical Sewing Machine Co. Ltd.

Frequently Asked Questions

What is the projected growth rate of the Industrial Sewing Machine Market?

The Industrial Sewing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2025 and 2032, driven by increasing automation and manufacturing demand.

Which factors are primarily driving the growth of this market?

Key drivers include the rapid expansion of global apparel and textile industries, growing demand for automation to reduce labor costs, the proliferation of technical textiles, and the impact of e-commerce on manufacturing volumes.

What role does AI play in modern industrial sewing machines?

AI enhances precision through vision systems, optimizes operations via predictive maintenance, improves quality control with real-time defect detection, and enables greater automation for complex and repetitive tasks.

Which geographical region dominates the Industrial Sewing Machine Market?

The Asia Pacific (APAC) region currently dominates the market, largely due to its extensive apparel and textile manufacturing capabilities and expanding domestic markets in countries like China and India.

What are the main challenges faced by the industrial sewing machine market?

Major restraints include high initial investment costs for advanced machinery, the need for skilled labor for operation and maintenance, and economic fluctuations affecting manufacturing sector investments globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager