Industrial Transmission Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428277 | Date : Oct, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Industrial Transmission Substation Market Size

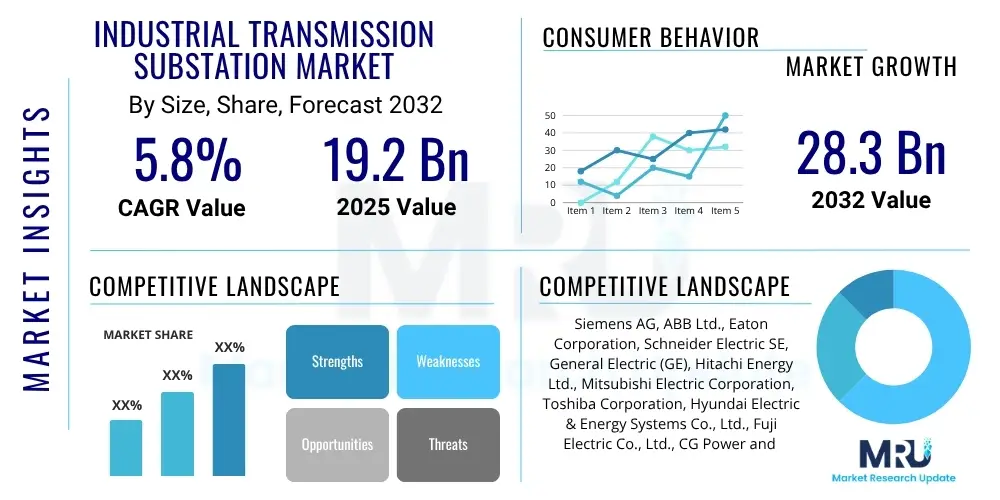

The Industrial Transmission Substation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2025 and 2032. The market is estimated at USD 19.2 Billion in 2025 and is projected to reach USD 28.3 Billion by the end of the forecast period in 2032.

Industrial Transmission Substation Market introduction

The Industrial Transmission Substation Market encompasses the comprehensive infrastructure and services related to the design, engineering, procurement, construction, and ongoing maintenance of electrical substations specifically tailored to serve industrial complexes. These substations function as critical nodes within the broader electrical grid, facilitating the efficient and reliable transmission of high-voltage electricity from utility grids or independent power producers to industrial end-users. Their primary role involves stepping down transmission-level voltages to appropriate distribution or utilization levels, ensuring a stable and consistent power supply essential for continuous operations in energy-intensive sectors such as manufacturing, oil & gas, mining, and large data centers. The bespoke nature of these installations often requires intricate planning to integrate seamlessly with existing industrial power systems and operational demands.

Product offerings within this specialized market segment are diverse, ranging from advanced power transformers engineered for high efficiency and minimal losses, to sophisticated switchgear systems, including Air Insulated Switchgear (AIS) and Gas Insulated Switchgear (GIS), which provide robust circuit protection and isolation capabilities. Essential components further include state-of-the-art control and protection systems, such as Intelligent Electronic Devices (IEDs) and Supervisory Control and Data Acquisition (SCADA) platforms, enabling precise monitoring, automated operation, and rapid fault isolation. Auxiliary equipment like busbars, insulators, surge arresters, and reactive power compensation devices are also integral, designed to enhance grid stability, power quality, and operational safety within demanding industrial environments. The continuous evolution of these products emphasizes greater digitalization, modularity, and environmental sustainability.

Major applications for industrial transmission substations span across a wide array of heavy industries where uninterrupted and high-quality power is non-negotiable. This includes large-scale manufacturing facilities (e.g., automotive, steel, chemicals), complex petrochemical plants, extensive mining operations, and critical data centers that demand extreme power reliability. The benefits derived from investing in advanced industrial transmission substations are significant, including enhanced operational reliability, reduced transmission losses, improved power quality, and increased safety for personnel and equipment. Key driving factors propelling market growth include rapid global industrialization, especially in emerging economies, the escalating demand for electricity across all sectors, the imperative to modernize and replace aging grid infrastructure, and the growing integration of renewable energy sources, all of which necessitate robust and intelligent power transmission solutions to support dynamic industrial landscapes.

Industrial Transmission Substation Market Executive Summary

The Industrial Transmission Substation Market is presently characterized by substantial growth and transformative business trends, largely driven by the global push for industrial expansion and energy efficiency. Digitalization is a paramount trend, with market participants increasingly focusing on offering integrated smart substation solutions that incorporate advanced analytics, Internet of Things (IoT) connectivity, and automation features. These innovations aim to optimize operational performance, facilitate predictive maintenance, and enhance grid resilience. Furthermore, there is a distinct shift towards modular and compact substation designs, addressing space constraints in urban industrial areas and enabling faster deployment. Sustainability considerations are also influencing business strategies, promoting the development and adoption of eco-friendly insulation materials and SF6-free switchgear to reduce environmental impact and comply with stringent regulatory frameworks.

Regionally, the market exhibits varied growth trajectories and investment priorities. Asia Pacific continues its trajectory as the leading and most rapidly expanding market segment, propelled by aggressive industrialization, large-scale infrastructure projects, and significant governmental investments in smart grid initiatives across countries such as China, India, and various Southeast Asian nations. North America and Europe, while representing more mature markets, are experiencing substantial capital infusions directed towards grid modernization, the replacement of aging infrastructure, and the seamless integration of distributed energy resources, thereby sustaining a robust demand for highly advanced and resilient substation technologies. Emerging economies in Latin America, the Middle East, and Africa are also poised for significant growth, driven by burgeoning industrial sectors, urbanization trends, and ambitious national development plans requiring considerable upgrades to their power transmission capabilities.

Segment trends within the market underscore the escalating demand for digital and automated substation components, which promise enhanced reliability, operational cost reductions, and improved safety protocols compared to conventional systems. The extra-high voltage (EHV) and ultra-high voltage (UHV) segments are witnessing particular growth, primarily due to the necessity for bulk power transmission over extensive distances and the interconnection of large-scale renewable energy projects. In terms of component types, intelligent power transformers equipped with advanced sensors and efficient gas-insulated switchgear (GIS) are experiencing heightened adoption rates. The manufacturing, oil & gas, and data center sectors remain the cornerstone application areas, consistently requiring cutting-edge, high-capacity, and exceptionally reliable power infrastructure. This comprehensive market evolution points towards a sustained and accelerating demand for innovative and robust industrial transmission substation solutions that can adapt to future energy landscapes.

AI Impact Analysis on Industrial Transmission Substation Market

User inquiries frequently highlight a keen interest in how Artificial Intelligence (AI) is poised to fundamentally reshape the operational dynamics and efficiency benchmarks within industrial transmission substations. Common questions typically explore AI's capabilities in bolstering grid stability, accurately predicting equipment malfunctions, optimizing maintenance schedules, and enhancing overall energy management. There is considerable curiosity surrounding the practical integration of AI solutions with existing legacy infrastructure, the potential for achieving autonomous substation operation, and critically, the cybersecurity implications that accompany increased digitalization. Users actively seek concrete case studies and examples demonstrating how AI applications yield tangible benefits, such as significant reductions in unplanned downtime, improved safety protocols, and a marked decrease in operational expenditures, while simultaneously expressing concerns regarding data privacy, system vulnerabilities, and the inevitable skills gap that arises from managing advanced AI-driven systems within highly critical infrastructure domains.

The prevailing sentiment among stakeholders is a strong desire to transition from conventional, reactive substation management strategies to proactive, intelligent systems powered by AI. This paradigm shift includes a focus on how sophisticated AI algorithms can meticulously process vast streams of real-time sensor data—from critical components such as transformers, circuit breakers, and protective relays—to identify subtle anomalies that often precede catastrophic equipment failures. Such predictive capabilities enable the implementation of highly effective predictive maintenance programs, thereby averting costly outages and extending asset lifespans. Another significant area of user concern and opportunity lies in AI's role in optimizing complex power flow dynamics and voltage regulation, an increasingly vital function given the inherent intermittency and variability introduced by the widespread integration of renewable energy sources. Furthermore, users frequently evaluate the return on investment (ROI) for AI integration projects, weighing the long-term benefits in terms of enhanced efficiency, reliability, and resilience against the considerable initial implementation costs and technical complexities involved in deploying such advanced technologies within mission-critical industrial environments.

- AI-driven predictive maintenance: Significantly reduces unplanned outages by accurately forecasting equipment failures.

- Optimized asset management: Extends the operational lifespan of critical components and improves resource allocation.

- Enhanced grid stability and resilience: AI analyzes real-time data for dynamic adjustments to power flow, preventing disruptions.

- Improved fault detection and isolation: Enables faster identification and containment of electrical faults, minimizing outage durations.

- Automated operational control: Facilitates remote and autonomous management of substation functions, enhancing operational flexibility.

- Cybersecurity posture strengthening: AI algorithms can detect and respond to unusual network activities and potential cyber threats.

- Energy management optimization: Improves the integration of distributed renewable sources and enables sophisticated demand-side management.

- Advanced data analytics for performance insights: Transforms raw operational data into actionable intelligence for strategic decision-making.

DRO & Impact Forces Of Industrial Transmission Substation Market

The Industrial Transmission Substation Market is significantly influenced by a robust array of drivers, predominantly the escalating global demand for electricity, which is intrinsically tied to rapid industrialization, burgeoning urbanization, and population growth, particularly prevalent in developing economies. The critical imperative to modernize and upgrade aging grid infrastructure across established markets in North America and Europe also acts as a powerful driver, as existing substations often lack the requisite capacity, technological sophistication, and resilience to meet contemporary and future energy demands. Furthermore, the accelerating worldwide integration of intermittent renewable energy sources, such as large-scale solar and wind farms, into national grids necessitates substantial investments in advanced transmission infrastructure to efficiently manage and reliably connect these power sources to industrial consumption centers, thereby catalyzing substantial market growth. Supportive regulatory frameworks that prioritize grid reliability, energy efficiency, and environmental sustainability further incentivize substantial capital investments in cutting-edge substation technologies and smart grid solutions.

Despite these compelling growth drivers, the market navigates several notable restraints. A primary impediment is the exceptionally high capital investment required for the initial construction, engineering, and commissioning of new high-voltage transmission substations, coupled with the inherently long project lifecycles, which can deter potential investors and create significant barriers to market entry for new players. The complexity of regulatory environments and stringent permitting processes, often involving multiple governmental agencies, local communities, and comprehensive environmental assessments, introduce considerable delays and escalate overall project costs. Moreover, challenges related to land acquisition, public opposition due to visual impact, and environmental concerns can further impede substation development. The increasing digitalization of substations also introduces inherent cybersecurity risks, as any successful breach could lead to catastrophic operational disruptions in industrial processes and compromise national security, necessitating continuous and substantial investments in robust protective measures against sophisticated cyber threats.

The Industrial Transmission Substation Market is also replete with substantial and diverse opportunities that are reshaping its future trajectory. The burgeoning trend towards distributed generation (DG) models and the widespread integration of large-scale energy storage solutions are creating a distinct demand for novel types of substations capable of efficiently managing bidirectional power flow, voltage fluctuations, and the complexities associated with grid-edge resources. The ongoing, pervasive digitalization of the energy sector, encompassing the implementation of advanced smart grid technologies, offers fertile ground for incorporating sophisticated analytics, real-time automation, and remote control capabilities into both new and existing substation designs and operational protocols. Additionally, the vast installed base of aging transmission infrastructure globally presents a considerable and lucrative opportunity for extensive retrofitting, comprehensive upgrades, and modernization projects. The increasing global focus on enhancing grid resilience against unpredictable extreme weather events, natural disasters, and sophisticated cyber threats further drives demand for more robust, intelligent, and self-healing substation solutions, ensuring an uninterrupted and high-quality power supply to critical industrial loads and vital national infrastructure.

Segmentation Analysis

The Industrial Transmission Substation Market is rigorously segmented across various dimensions to provide a nuanced and granular understanding of its complex structure, diverse components, varied applications, and the technological advancements shaping its evolution. This comprehensive segmentation is instrumental for market participants, investors, and policymakers to accurately identify specific growth sectors, evaluate competitive landscapes, and formulate targeted strategic initiatives. By dissecting the market into distinct categories, stakeholders can gain clearer insights into where demand is strongest, where innovation is most critical, and how different market forces interact. The primary segmentation criteria include component type, voltage level, application industry, and end-user, each offering unique perspectives on market dynamics and strategic opportunities.

- By Component:

- Transformers (Power Transformers, Distribution Transformers, Instrument Transformers, Smart Transformers)

- Switchgear (Circuit Breakers, Disconnect Switches, Reclosers, Load Break Switches, Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), Hybrid Switchgear)

- Busbars (Copper, Aluminum, Flexible, Rigid)

- Control & Protection Systems (Relay Panels, SCADA Systems, Substation Automation Systems, Remote Terminal Units (RTUs), Communication Equipment)

- Capacitors and Reactors (Shunt Capacitors, Series Capacitors, Shunt Reactors, Series Reactors)

- Insulators (Porcelain, Glass, Composite)

- Surge Arresters

- Metering Equipment (Revenue Meters, Smart Meters)

- Circuit Breaker Auxiliary Equipment

- By Voltage Level:

- Low Voltage (up to 33 kV)

- Medium Voltage (33 kV to 132 kV)

- High Voltage (132 kV to 400 kV)

- Extra-High Voltage (EHV) & Ultra-High Voltage (UHV) (above 400 kV to 1200 kV)

- By Application:

- Manufacturing Industries (Automotive, Food & Beverage, Chemicals, Metals & Mining, Pharmaceuticals, Textiles)

- Oil & Gas Sector (Upstream (Exploration & Production), Midstream (Pipelines & Storage), Downstream (Refining & Petrochemicals))

- Mining Operations (Surface Mining, Underground Mining)

- Data Centers & IT Infrastructure

- Transportation Infrastructure (Railways, Ports, Airports, Electric Vehicle Charging Infrastructure)

- Pulp & Paper Industry

- Cement Industry

- Water & Wastewater Treatment Facilities

- By End-User:

- Large-Scale Industrial Enterprises

- Small and Medium-Sized Industrial Enterprises (SMEs)

- Commercial Establishments with High Power Demands (e.g., large retail, hospitals)

- Electric Utilities (specifically for industrial customer connections and grid interfaces)

Value Chain Analysis For Industrial Transmission Substation Market

The value chain for the Industrial Transmission Substation Market is a multi-faceted and highly interconnected ecosystem, commencing with comprehensive upstream activities centered on the sourcing and processing of essential raw materials and the manufacturing of specialized components. This foundational stage involves key industries such as metallurgy for high-grade steel, copper, and aluminum conductors, the chemical sector for various insulating materials like porcelain, polymers, and transformer oils, and specialized producers of semi-finished goods crucial for substation equipment. Ensuring the consistent quality, reliable supply, and cost-effectiveness of these foundational inputs is paramount, as they directly influence the performance, durability, and ultimate cost efficiency of the final substation infrastructure. Disruptions in the supply chain or volatility in raw material prices can significantly impact manufacturing schedules, project profitability, and overall market stability, emphasizing the importance of robust supplier relationships and diversified sourcing strategies. Innovation in material science, particularly advancements leading to more sustainable, higher-performance, and environmentally friendly insulating and conductive materials, typically originates and proliferates within this upstream segment, driving future technological advancements downstream.

Progressing downstream, the value chain encompasses the sophisticated manufacturing of complex substation components, the intricate process of system integration, the precision of installation and commissioning, and finally, the vital realm of ongoing maintenance and support services. Major global manufacturers specialize in producing critical apparatus such as advanced power transformers, cutting-edge switchgear, sophisticated control and protection systems, and other auxiliary equipment, often investing substantially in research and development to meet evolving performance standards, grid codes, and technological imperatives. Engineering, Procurement, and Construction (EPC) firms play a pivotal role as system integrators, taking disparate components and custom-engineering them into functional, optimized, and project-specific industrial substations, managing the entire project lifecycle from initial design to final commissioning. Distribution channels are varied, often involving direct sales models from large manufacturers to utility operators or substantial industrial clients, alongside indirect channels utilizing a network of authorized distributors, local integrators, and specialized EPC contractors, particularly for large-scale and complex installations. Post-commissioning, the value chain extends into long-term operational support, encompassing routine maintenance, emergency repairs, planned upgrades, and the provision of digital services, all of which are essential for ensuring the continuous, efficient, and reliable functioning of the industrial substation throughout its extensive operational lifespan.

Industrial Transmission Substation Market Potential Customers

Potential customers for the Industrial Transmission Substation Market are predominantly composed of a broad spectrum of heavy industries and expansive commercial establishments that exhibit an indispensable requirement for significant, reliable, and uninterrupted electrical power to sustain their complex operations. These end-users are characterized by their extensive deployment of machinery, energy-intensive production processes, and an acute sensitivity to power quality and continuity, as any disruption can lead to substantial production losses, equipment damage, and considerable financial repercussions. Core customer segments include large-scale manufacturing enterprises across diverse sectors such as automotive production, steel and aluminum foundries, chemical processing, pulp and paper mills, and textile manufacturing, where the seamless operation of production lines is directly contingent upon a robust and stable power supply. The global oil & gas industry, encompassing upstream exploration and extraction, midstream transportation and storage, and downstream refining and petrochemical operations, represents another cornerstone customer base, driven by the immense power demands for its pumps, compressors, and sophisticated processing units.

Furthermore, the rapidly expanding and critically important data center industry emerges as a burgeoning segment of high-value potential customers. Data centers necessitate exceptionally resilient, high-capacity, and ultra-reliable power infrastructure to guarantee the 24/7 continuous operation of their vital servers, networking equipment, and intricate cooling systems, rendering industrial transmission substations an indispensable component of their energy supply chain. Mining operations, with their heavy-duty excavation, processing, and transportation equipment, also constitute a significant end-user category due to their substantial and often remote power requirements. Beyond these traditional industrial behemoths, large commercial establishments, including major international airports, extensive railway networks, metropolitan mass transit systems, and bustling port facilities, which house considerable electrified infrastructure, similarly rely on dedicated industrial transmission substations to manage their colossal and varied power demands. The defining characteristic uniting all these potential customers is their unwavering demand for bespoke, high-performance, and supremely resilient power solutions that are capable of enduring rigorous operational conditions, integrating seamlessly with their intricate industrial processes, and ensuring consistent power delivery to their mission-critical operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 19.2 Billion |

| Market Forecast in 2032 | USD 28.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Eaton Corporation, Schneider Electric SE, General Electric (GE), Hitachi Energy Ltd., Mitsubishi Electric Corporation, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd., Fuji Electric Co., Ltd., CG Power and Industrial Solutions Limited, Lucy Electric, WEG S.A., Arteche, Alstom SA, Powell Industries, Inc., Delta Star, Inc., Legrand S.A., Larsen & Toubro Limited, Kirloskar Electric Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Transmission Substation Market Key Technology Landscape

The Industrial Transmission Substation Market is profoundly shaped by a dynamic and rapidly evolving technology landscape, primarily driven by the overarching industry demands for enhanced operational efficiency, superior reliability, and increased intelligence in power transmission and distribution. A seminal technological shift is the accelerating widespread adoption of digital substations, which fundamentally transform traditional control and communication architectures by replacing conventional copper wiring with advanced fiber optic communication. This profound digitalization enables real-time data exchange, comprehensive remote monitoring capabilities, and highly sophisticated remote control functionalities. Such advancements facilitate the seamless integration of Intelligent Electronic Devices (IEDs) and advanced Supervisory Control and Data Acquisition (SCADA) systems, which are indispensable for enabling automated fault detection, implementing self-healing grid functionalities, and optimizing intricate power flow patterns. These integrated digital systems dramatically enhance operational flexibility, significantly reduce the crucial time required for fault location and subsequent restoration, and contribute substantively to the overall stability and resilience of the electrical grid, which is particularly vital for sensitive industrial loads that cannot tolerate even momentary power interruptions.

Further pivotal innovations within this technology landscape include the continuous development of advanced power transformers, which now feature cutting-edge amorphous core technology designed for significantly reduced energy losses, alongside the emergence of "smart transformers" equipped with integrated sensors, advanced diagnostics, and communication modules. These intelligent transformers provide continuous health monitoring, enabling highly accurate predictive maintenance and extending asset lifespans. Gas Insulated Switchgear (GIS) technology continues to gain substantial traction across the market due to its inherently compact design, superior safety standards, and significantly reduced environmental footprint compared to traditional air-insulated systems, making it an ideal solution for urban industrial areas facing severe space constraints. High-voltage direct current (HVDC) transmission technology is also becoming increasingly prevalent, especially for efficient long-distance bulk power transmission and for the robust interconnection of asynchronous electrical grids, which profoundly influences the design and specific requirements for associated industrial converter substations. The strategic integration of comprehensive cybersecurity measures, including sophisticated intrusion detection systems, robust data encryption protocols, and secure communication gateways, represents another critical technological focus, essential for safeguarding these increasingly networked and critical assets from potential cyber threats and ensuring the unwavering integrity and reliability of the industrial power supply.

Regional Highlights

- North America: This region represents a mature yet highly dynamic market segment, characterized by substantial ongoing investments in grid modernization initiatives and the imperative replacement of aging, legacy infrastructure. There is a discernible and growing adoption of advanced smart grid technologies, coupled with increasing integration of diverse renewable energy sources, which together drive a strong demand for sophisticated, resilient, and highly intelligent substations. This demand is particularly pronounced in sectors such as large-scale data centers and rapidly expanding manufacturing facilities. Robust regulatory support emphasizing energy efficiency, grid reliability, and cybersecurity further stimulates market expansion and technological innovation across the United States and Canada.

- Europe: Positioned at the forefront of global decarbonization efforts, Europe is allocating significant investments towards the expansion of renewable energy sources and the development of highly robust and interconnected transmission networks necessary to support these ambitious green energy targets. The region is governed by stringent environmental regulations that actively promote the widespread adoption of eco-friendly substation components, such as advanced SF6-free switchgear and bio-degradable transformer oils. Extensive cross-border grid interconnection projects across various European countries also contribute substantially to the sustained demand for high-capacity, efficient, and technologically advanced industrial transmission substations, fostering regional energy security and market integration.

- Asia Pacific (APAC): Emerging as the fastest-growing and most dominant market, APAC's expansion is unequivocally driven by unprecedented rates of industrialization, rapid urbanization, and massive government-led infrastructure development initiatives, particularly concentrated in economic powerhouses like China, India, and the diverse nations of Southeast Asia. The escalating demand for electricity from a burgeoning manufacturing sector, extensive mining operations, and burgeoning processing industries, coupled with strategic governmental support for smart grid implementation and comprehensive rural electrification programs, firmly positions APAC as the undisputed epicenter of growth within the global Industrial Transmission Substation Market, attracting significant foreign and domestic investment.

- Latin America: This region constitutes a promising emerging market segment with substantial untapped potential, fueled by consistent industrial growth across key sectors such as mining, oil & gas, and diversified manufacturing. Significant investments in grid expansion projects and comprehensive modernization efforts are actively underway to adequately meet the surging energy demand and improve electricity access and reliability across the continent. While market growth can be influenced by varying levels of political and economic stability in individual countries, there is a clear and sustained focus on enhancing power supply reliability and capacity to support the rapidly expanding industrial complexes and burgeoning urban centers throughout Latin America.

- Middle East and Africa (MEA): This region is experiencing considerable and accelerating market growth, propelled by ambitious industrial diversification strategies, a multitude of large-scale infrastructure mega-projects, and steadily increasing energy demand, especially evident within the oil-rich Gulf Cooperation Council (GCC) countries. Substantial investments in the development of new industrial cities, extensive expansions of the oil & gas sector, and pioneering renewable energy projects are collectively creating a wealth of lucrative opportunities for the widespread deployment of advanced industrial transmission substations. These developments are critical for building resilient and modern power grids capable of supporting rapid economic transformation and sustainable growth across the MEA region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Transmission Substation Market.- Siemens AG

- ABB Ltd.

- Eaton Corporation

- Schneider Electric SE

- General Electric (GE)

- Hitachi Energy Ltd.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Fuji Electric Co., Ltd.

- CG Power and Industrial Solutions Limited

- Lucy Electric

- WEG S.A.

- Arteche

- Alstom SA

- Powell Industries, Inc.

- Delta Star, Inc.

- Legrand S.A.

- Larsen & Toubro Limited

- Kirloskar Electric Company Limited

Frequently Asked Questions

What is an industrial transmission substation and its primary function?

An industrial transmission substation is a crucial electrical facility that steps down high-voltage electricity from main transmission lines to a lower, usable voltage suitable for large industrial consumers like factories, data centers, and mining operations, ensuring a consistent and reliable power supply for their operations.

How is AI transforming the Industrial Transmission Substation Market?

AI is revolutionizing this market by enabling predictive maintenance, optimizing power flow and voltage regulation, enhancing fault detection and isolation, and providing advanced analytics for better asset management and grid resilience, ultimately reducing downtime and operational costs.

What are the key factors driving growth in this market?

Key growth drivers include escalating global electricity demand, rapid industrialization in emerging economies, the necessity for modernizing aging grid infrastructure, and the increasing integration of renewable energy sources, all requiring robust transmission capabilities.

Which geographical region holds the largest market share or is growing fastest?

The Asia Pacific region, driven by extensive industrial expansion, urbanization, and significant government investments in power infrastructure, currently represents the largest and fastest-growing segment of the Industrial Transmission Substation Market.

What are the main components typically found in an industrial transmission substation?

The main components include power transformers, various types of switchgear (e.g., circuit breakers, disconnect switches, GIS/AIS), busbars, sophisticated control and protection systems (like SCADA and relays), insulators, capacitors, and surge arresters, all integrated for efficient power management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager