Industrial Wireless Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428026 | Date : Oct, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Wireless Sensor Market Size

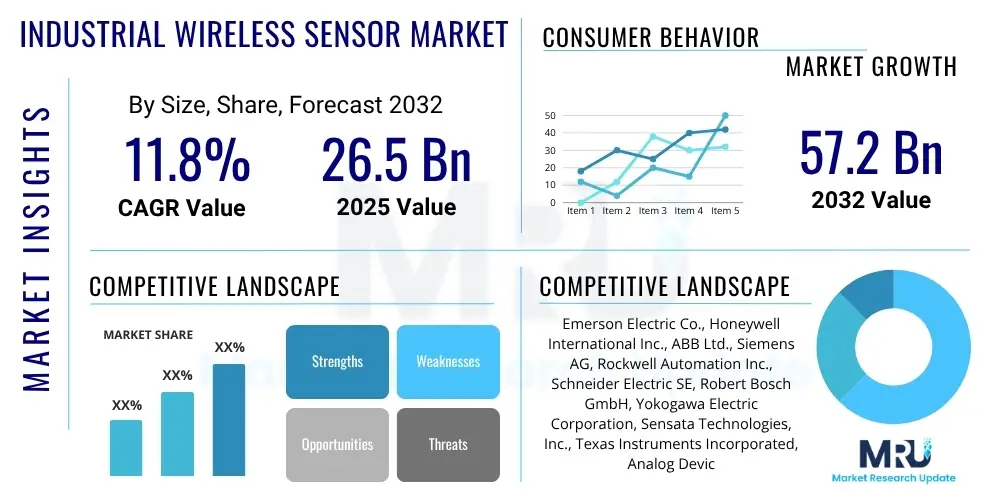

The Industrial Wireless Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2025 and 2032. The market is estimated at USD 26.5 billion in 2025 and is projected to reach USD 57.2 billion by the end of the forecast period in 2032.

Industrial Wireless Sensor Market introduction

The Industrial Wireless Sensor Market represents a pivotal segment within the broader industrial automation and Internet of Things (IoT) landscape, providing critical data acquisition capabilities without the constraints of traditional wired infrastructure. These advanced sensors are designed to operate in challenging industrial environments, transmitting real-time data on various parameters such as temperature, pressure, flow, vibration, and humidity. Their integration into manufacturing processes, oil and gas operations, utilities, and logistics networks is fundamentally transforming operational efficiency, safety protocols, and maintenance strategies. The primary value proposition of industrial wireless sensors lies in their ability to enable flexible deployment, reduce installation costs, and facilitate data collection from previously inaccessible or economically unfeasible locations, thereby accelerating the digital transformation journey across diverse industrial sectors.

Key products within this market include a wide array of sensor types, each tailored for specific industrial measurements, coupled with robust communication modules that leverage protocols like WirelessHART, ISA100.11a, Zigbee, Wi-Fi, and more recently, 5G and LPWAN technologies. These systems are integral to modern smart factories and Industry 4.0 initiatives, empowering businesses to move from reactive maintenance to proactive and predictive strategies. The benefits derived from their adoption are extensive, encompassing enhanced operational visibility, optimized resource utilization, significant reductions in downtime, and improved worker safety through continuous monitoring of critical assets and processes. The inherent flexibility and scalability of wireless solutions also support agile manufacturing and rapid reconfigurations of production lines, directly contributing to competitive advantages for adopting enterprises.

The driving forces behind the vigorous expansion of the Industrial Wireless Sensor Market are multifaceted. Foremost among these is the accelerating global trend towards industrial automation and digitalization, where real-time data is paramount for informed decision-making and operational excellence. The escalating demand for predictive maintenance solutions, aimed at minimizing unexpected equipment failures and extending asset lifespans, further fuels market growth. Additionally, the continuous advancements in sensor technology, including improvements in battery life, miniaturization, accuracy, and communication reliability, coupled with declining unit costs, are making wireless sensor deployment increasingly attractive and economically viable for a broader range of industrial applications. The push for enhanced worker safety and environmental compliance also necessitates robust monitoring systems, positioning industrial wireless sensors as indispensable tools in achieving these critical objectives.

Industrial Wireless Sensor Market Executive Summary

The Industrial Wireless Sensor Market is experiencing robust growth, propelled by overarching business trends centered on digital transformation, operational efficiency, and sustainability. Industries globally are increasingly recognizing the imperative to leverage real-time data for competitive advantage, leading to widespread adoption of IoT and Industry 4.0 paradigms. This shift necessitates flexible, scalable, and cost-effective data acquisition systems, which industrial wireless sensors are uniquely positioned to provide. Key business trends include the move towards remote monitoring capabilities, particularly in hazardous or geographically dispersed environments, and the integration of sensor data with advanced analytics platforms, including artificial intelligence and machine learning, to derive actionable insights. Furthermore, the emphasis on energy efficiency and reduction of carbon footprints drives demand for sensors that can optimize energy consumption and monitor environmental parameters, aligning with corporate sustainability objectives and regulatory pressures. The market is also witnessing a surge in solution-centric offerings, where vendors provide integrated hardware, software, and service packages to simplify deployment and maximize value for end-users.

From a regional perspective, the market exhibits dynamic growth patterns influenced by varying levels of industrial maturity and investment in digital infrastructure. Asia Pacific (APAC) is projected to be the fastest-growing region, driven by rapid industrialization, the proliferation of smart factories, and substantial government investments in manufacturing and infrastructure development, particularly in countries like China, India, and Japan. North America and Europe, while more mature, continue to hold significant market shares due to high adoption rates of advanced manufacturing techniques, robust R&D activities, and a strong emphasis on automation and digital transformation across diverse industries such as automotive, aerospace, and pharmaceuticals. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, with increasing investments in oil and gas, mining, and utility sectors, alongside a growing awareness of the benefits of modern industrial automation technologies. Each region's unique industrial landscape and regulatory environment contribute to differentiated demand for specific sensor types and communication protocols.

Segmentation trends within the Industrial Wireless Sensor Market highlight several key areas of development and growth. By type, vibration and temperature sensors continue to dominate, owing to their critical role in predictive maintenance for rotating machinery and process control in various industrial settings. However, pressure, flow, and level sensors are also experiencing significant uptake as industries seek comprehensive environmental and process monitoring. In terms of technology, WirelessHART and ISA100.11a remain prevalent in process industries due to their reliability and security, while Zigbee and Wi-Fi cater to broader industrial applications. The advent of 5G and LPWAN technologies like LoRaWAN and NB-IoT is opening new possibilities for long-range, low-power deployments. The end-use industry segmentation indicates robust demand from manufacturing, particularly discrete and process manufacturing, followed closely by oil & gas, chemicals, power & utilities, and the automotive sector. The growing sophistication of industrial applications demands integrated solutions that combine sensor hardware with advanced software platforms for data visualization, analytics, and control, leading to increased demand for comprehensive sensor-as-a-service models and integrated IoT solutions.

AI Impact Analysis on Industrial Wireless Sensor Market

The integration of Artificial Intelligence (AI) profoundly impacts the Industrial Wireless Sensor Market, addressing common user questions about enhancing sensor utility and data value. Users frequently inquire how AI can transform raw sensor data into actionable insights, what specific benefits it offers in terms of operational efficiency and predictive capabilities, and what challenges arise from its implementation. The core theme emerging from these questions is the desire to move beyond mere data collection to intelligent, autonomous decision-making. AI's role is primarily seen in its ability to process vast volumes of real-time data generated by wireless sensors, detect subtle anomalies that human operators might miss, and predict potential equipment failures before they occur. This paradigm shift from reactive to proactive maintenance, optimizing complex industrial processes, and enabling adaptive control systems, represents the most significant value proposition of AI within this domain. It addresses the critical need for improved reliability, reduced downtime, and enhanced resource utilization across industrial operations, moving closer to the vision of truly autonomous and self-optimizing smart factories.

The synergy between AI and industrial wireless sensors also extends to improving the sensors themselves. AI algorithms can be employed to optimize sensor networks, enhancing data transmission efficiency, prolonging battery life through intelligent power management, and even improving the accuracy of measurements by filtering noise and compensating for environmental interference. Furthermore, AI-driven insights enable more precise calibration and maintenance of the sensors, ensuring their continued reliability. This holistic impact means that AI not only elevates the data processing capabilities downstream but also refines the performance and longevity of the sensor infrastructure upstream. Consequently, the perceived value and ROI for deploying industrial wireless sensors are significantly magnified when coupled with advanced AI analytics, making the combined solution a cornerstone for future industrial automation strategies. This addresses user concerns regarding the complexity of data interpretation and the need for simplified, actionable intelligence from their sensor investments.

The impact of AI is also felt in the strategic long-term planning for industrial environments, particularly concerning the development of fully autonomous systems and advanced robotics. By providing contextual understanding and predictive capabilities, AI empowers industrial wireless sensors to play a more central role in adaptive manufacturing, intelligent inventory management, and dynamic process optimization. The ability of AI to learn from historical data and adapt to changing conditions transforms static sensor networks into dynamic, intelligent systems capable of continuous improvement. This evolution is critical for industries striving for maximum agility, resilience, and efficiency in an increasingly complex global landscape. For users, this translates into a higher degree of operational autonomy and a reduced reliance on manual oversight, freeing human resources for more strategic tasks and fostering a safer working environment by minimizing human exposure to hazardous areas.

- Enables predictive maintenance through anomaly detection and failure forecasting.

- Optimizes industrial processes by analyzing real-time sensor data for efficiency gains.

- Facilitates autonomous decision-making and adaptive control in smart factories.

- Enhances data quality and accuracy through intelligent filtering and calibration.

- Improves network optimization and power management for extended sensor lifespan.

- Supports advanced robotics and collaborative autonomous systems by providing contextual intelligence.

- Generates actionable insights from vast sensor datasets, reducing human analytical burden.

DRO & Impact Forces Of Industrial Wireless Sensor Market

The Industrial Wireless Sensor Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and adoption patterns. A primary driver is the accelerating global adoption of Industry 4.0 and the Internet of Things (IoT), which mandates ubiquitous connectivity and real-time data acquisition for intelligent automation and operational visibility. The burgeoning demand for predictive maintenance solutions, aimed at minimizing downtime, extending asset lifespans, and optimizing maintenance schedules, further fuels market expansion. Additionally, the inherent advantages of wireless systems—such as lower installation costs, reduced cabling, faster deployment, and enhanced flexibility in challenging environments—represent significant incentives for industrial enterprises to transition from traditional wired setups. The increasing emphasis on workplace safety, environmental monitoring, and regulatory compliance also serves as a strong catalyst, requiring continuous and reliable data streams that wireless sensors can effectively provide. These drivers collectively create a compelling business case for investing in wireless sensor technologies across diverse industrial landscapes.

Despite these powerful drivers, several significant restraints challenge the market's full potential. Cybersecurity concerns stand paramount, as wireless networks are inherently perceived to be more vulnerable to cyber threats, data breaches, and unauthorized access, posing risks to critical industrial infrastructure. Interoperability issues among different wireless protocols, sensor types, and existing legacy systems often complicate deployment and integration, leading to higher initial investment costs and implementation complexities. The need for reliable power management and extended battery life for sensors, especially in remote or difficult-to-access locations, also presents a technical hurdle. Furthermore, concerns regarding data reliability, latency, and potential interference in highly congested industrial radio environments can deter adoption, as consistent and accurate data transmission is crucial for mission-critical applications. Addressing these restraints requires continuous innovation in security protocols, standardization efforts, and advancements in energy harvesting and low-power communication technologies.

Concurrently, the market is rife with substantial opportunities that promise to propel future growth. The proliferation of 5G technology offers unprecedented bandwidth, ultra-low latency, and enhanced reliability, positioning it as a transformative communication backbone for industrial wireless sensors, enabling more sophisticated applications like real-time control and edge analytics. The convergence of industrial wireless sensors with Artificial Intelligence (AI) and Machine Learning (ML) analytics is unlocking new capabilities for advanced anomaly detection, process optimization, and autonomous decision-making, significantly enhancing the value derived from sensor data. Furthermore, the expansion into new application areas, such as smart agriculture, smart cities, and healthcare, alongside the ongoing digital transformation initiatives in developing economies, presents untapped market potential. Impact forces such as global economic shifts, evolving geopolitical landscapes, and a heightened focus on sustainability and energy efficiency will continue to influence investment decisions and drive the demand for resilient, data-driven industrial solutions. Technological advancements, particularly in sensor miniaturization, material science, and communication protocols, will also remain a persistent impact force, continuously opening new avenues for innovation and market growth.

Segmentation Analysis

The Industrial Wireless Sensor Market is extensively segmented to reflect the diverse applications, technological advancements, and end-user requirements prevalent across various industries. This comprehensive segmentation allows for a granular understanding of market dynamics, growth drivers within specific niches, and the evolving competitive landscape. Analyzing the market through these segments reveals distinct trends in adoption, technological preferences, and regional demand patterns, offering valuable insights for stakeholders, product developers, and strategic planners. The market can be broadly categorized by sensor type, communication technology, end-use industry, and component, each offering a unique perspective on the market's structure and future potential.

For instance, the segmentation by sensor type highlights the most prevalent measurements required in industrial settings, ranging from critical process variables to asset health monitoring. Similarly, technology segmentation showcases the competitive landscape of various wireless communication standards, each optimized for different ranges, power consumptions, and data rates, catering to specific operational needs. The end-use industry breakdown provides insights into which sectors are most heavily investing in wireless sensor solutions and for what primary objectives, from manufacturing efficiency to remote asset management in hazardous environments. Finally, the component segmentation distinguishes between the hardware, software, and services elements that comprise a complete industrial wireless sensor solution, reflecting the shift towards integrated platforms and subscription-based models.

- By Sensor Type:

- Temperature Sensors

- Pressure Sensors

- Flow Sensors

- Level Sensors

- Humidity Sensors

- Vibration Sensors

- Proximity Sensors

- Acoustic Sensors

- Chemical and Gas Sensors

- Position Sensors

- Current and Voltage Sensors

- By Communication Technology:

- WirelessHART

- ISA100.11a

- Zigbee

- Wi-Fi

- Bluetooth Low Energy (BLE)

- LoRaWAN

- NB-IoT

- 5G

- Proprietary Technologies

- By End-Use Industry:

- Manufacturing (Discrete and Process)

- Oil & Gas

- Chemicals

- Power & Utilities

- Mining

- Food & Beverage

- Automotive

- Pharmaceutical

- Aerospace & Defense

- Logistics & Transportation

- Building Automation

- Water & Wastewater Management

- By Component:

- Hardware

- Sensors

- Transceivers

- Gateways

- Routers

- Batteries/Power Management

- Software

- Data Acquisition Software

- Analytics & Visualization Software

- Network Management Software

- Cloud Platforms

- Services

- Consulting

- Implementation & Integration

- Maintenance & Support

- Hardware

Value Chain Analysis For Industrial Wireless Sensor Market

The value chain for the Industrial Wireless Sensor Market is a complex ecosystem encompassing multiple stages, from foundational component manufacturing to the final integration and service delivery to end-users. At the upstream segment, the chain begins with raw material suppliers providing essential components such as semiconductors, microcontrollers, communication modules, and specialized materials for sensor fabrication. These are then processed by sensor component manufacturers and original equipment manufacturers (OEMs) who design and produce the core wireless sensor devices, including the sensing elements, integrated circuits, and wireless transceivers. This stage is characterized by significant R&D investment, focusing on miniaturization, power efficiency, accuracy, and robustness to withstand harsh industrial environments. Innovation in these upstream activities directly influences the performance, cost-effectiveness, and reliability of the final wireless sensor products, forming the bedrock of the entire market. Strategic partnerships and intellectual property are critical competitive differentiators at this initial phase of the value chain.

Moving downstream, the value chain involves the crucial steps of system integration, distribution, and ultimately, deployment to the end-users. Once sensors are manufactured, they are typically acquired by system integrators who specialize in designing, installing, and configuring complete industrial wireless sensor networks (IWSNs) tailored to specific industrial applications. These integrators play a vital role in ensuring interoperability between diverse sensor types, communication protocols, and existing industrial control systems. The distribution channel is multifaceted, including direct sales from manufacturers to large industrial clients, third-party distributors who reach a broader customer base, and increasingly, online marketplaces for standard sensor components. Indirect channels often involve value-added resellers (VARs) who bundle sensors with their own software and services, providing comprehensive solutions. The effectiveness of these distribution channels significantly impacts market penetration and accessibility for various industrial clients, from small and medium-sized enterprises to large multinational corporations.

The final stage of the value chain centers on the end-users and the provision of ongoing services. After deployment, industrial wireless sensors generate vast amounts of data that require sophisticated software platforms for data acquisition, processing, analytics, and visualization. Service providers offer solutions ranging from cloud-based IoT platforms to on-premise data management systems, enabling end-users to derive actionable insights from their sensor data. Post-sales services, including maintenance, calibration, troubleshooting, and continuous technical support, are integral to ensuring the longevity and optimal performance of the deployed IWSNs. This downstream segment also highlights the direct relationship between solution providers and end-users, often fostering long-term partnerships built on trust and continuous value delivery. As the market matures, the emphasis is shifting towards integrated solutions that combine hardware, software, and services, offering a complete, end-to-end package that simplifies adoption and maximizes the return on investment for industrial clients. This trend underscores the importance of a holistic approach throughout the entire value chain, from component design to ongoing operational support.

Industrial Wireless Sensor Market Potential Customers

Potential customers for the Industrial Wireless Sensor Market span a broad spectrum of industries, all seeking to enhance operational efficiency, improve safety, reduce costs, and accelerate their digital transformation journeys. At the forefront are discrete and process manufacturing sectors, including automotive, aerospace, electronics, and chemicals, where wireless sensors are critical for monitoring production lines, equipment health, and environmental conditions to ensure quality control and minimize downtime. These industries leverage wireless sensors for applications such as predictive maintenance of rotating machinery, real-time tracking of assets, and optimizing energy consumption in their facilities. The ability to deploy sensors without extensive cabling makes them particularly attractive for retrofitting existing plants or configuring flexible production cells, aligning perfectly with the principles of lean manufacturing and agile automation.

Beyond traditional manufacturing, the oil and gas industry represents a significant segment of potential buyers. Here, wireless sensors are deployed in remote, hazardous, and often inaccessible locations—such as offshore platforms, pipelines, and refineries—to monitor pressure, temperature, flow, and structural integrity. These applications are crucial for ensuring worker safety, preventing environmental incidents, and optimizing extraction and processing operations. Similarly, the power and utilities sector, encompassing electricity generation, transmission, and distribution, utilizes wireless sensors for monitoring grid infrastructure, asset health in power plants, and ensuring the reliability of energy supply. The mining industry also relies heavily on wireless sensors for monitoring ventilation, gas detection, equipment health, and environmental parameters in harsh underground or open-pit environments, where wired solutions are impractical or cost-prohibitive.

Furthermore, the food and beverage industry employs wireless sensors for critical temperature and humidity monitoring in storage and production facilities to ensure product quality and compliance with stringent hygiene standards. The pharmaceutical sector uses them for environmental monitoring in cleanrooms and laboratories, as well as for tracking temperature-sensitive products. Even logistics and transportation companies are increasingly adopting wireless sensors for real-time monitoring of cargo conditions and fleet management. In essence, any industrial enterprise striving for enhanced automation, data-driven decision-making, and improved operational resilience, particularly those operating in challenging or extensive environments, stands as a potential customer for industrial wireless sensor solutions. The breadth of applications continues to expand as technology evolves and the benefits of wireless connectivity become more widely recognized across diverse industrial landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 26.5 billion |

| Market Forecast in 2032 | USD 57.2 billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Honeywell International Inc., ABB Ltd., Siemens AG, Rockwell Automation Inc., Schneider Electric SE, Robert Bosch GmbH, Yokogawa Electric Corporation, Sensata Technologies, Inc., Texas Instruments Incorporated, Analog Devices, Inc., Endress+Hauser Group Services AG, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Eaton Corporation plc, Dwyer Instruments, Inc., OMEGA Engineering Inc., Pepperl+Fuchs SE, Banner Engineering Corp., Monnit Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Wireless Sensor Market Key Technology Landscape

The Industrial Wireless Sensor Market is underpinned by a rapidly evolving technological landscape, characterized by continuous innovation aimed at enhancing performance, reliability, and security in challenging industrial environments. At its core, the technology involves advanced sensing elements capable of accurately measuring various physical and chemical parameters, coupled with robust, low-power wireless communication modules. Key communication protocols such as WirelessHART and ISA100.11a remain dominant in process automation due to their inherent reliability, security features, and self-organizing mesh networking capabilities, ensuring high data integrity in critical applications. For broader industrial IoT deployments, technologies like Zigbee and Wi-Fi offer cost-effectiveness and higher bandwidth, while Bluetooth Low Energy (BLE) caters to short-range, low-power applications, particularly for mobile asset tracking and localized monitoring. These established technologies form the backbone of many existing industrial wireless sensor networks, providing foundational connectivity and data transmission capabilities.

The emergence of next-generation wireless communication technologies is significantly expanding the capabilities and reach of industrial wireless sensors. The rollout of 5G networks is particularly transformative, offering ultra-reliable low-latency communication (URLLC), massive machine-type communication (mMTC), and enhanced mobile broadband (eMBB). These attributes make 5G an ideal backbone for mission-critical industrial applications requiring real-time control, edge analytics, and widespread sensor deployments across vast industrial campuses. Concurrently, Low-Power Wide-Area Network (LPWAN) technologies like LoRaWAN and NB-IoT are gaining traction for long-range, low-power applications, enabling cost-effective monitoring of geographically dispersed assets with extended battery life. These technologies bridge the gap for applications where traditional short-range wireless solutions are insufficient and cellular connectivity is overkill, opening up new opportunities in sectors like smart agriculture, logistics, and remote infrastructure monitoring. The ability to connect thousands of devices over large areas with minimal power consumption is a game-changer for scalability.

Beyond connectivity, the technological landscape is further defined by advancements in associated fields such as edge computing, cloud platforms, and Artificial Intelligence/Machine Learning (AI/ML). Edge computing allows for data processing and analysis to occur closer to the data source (i.e., at the sensor or gateway level), reducing latency, conserving bandwidth, and enabling faster decision-making, which is crucial for real-time industrial control. Cloud platforms provide scalable storage, powerful analytics tools, and centralized management for vast quantities of sensor data, facilitating enterprise-wide visibility and collaboration. The integration of AI/ML algorithms enables advanced analytics capabilities, including predictive maintenance, anomaly detection, process optimization, and even autonomous control systems. Furthermore, innovations in energy harvesting technologies, which allow sensors to draw power from ambient sources like vibration, light, or thermal gradients, are pushing the boundaries of maintenance-free operation and expanding deployment possibilities in previously inaccessible locations. The convergence of these sophisticated technologies is creating a highly intelligent and resilient ecosystem for industrial wireless sensors, driving unprecedented levels of automation, efficiency, and safety in modern industrial operations.

Regional Highlights

- North America: This region stands as a significant market for industrial wireless sensors, driven by early adoption of advanced manufacturing technologies, substantial investments in R&D, and a strong emphasis on automation across industries like automotive, aerospace, and oil & gas. The presence of key market players, robust digital infrastructure, and a focus on improving operational efficiency and cybersecurity further fuel market growth. Initiatives such as smart factories and the industrial internet of things (IIoT) are well-established, promoting continuous innovation and deployment of sophisticated wireless sensor solutions.

- Europe: The European market demonstrates steady growth, characterized by stringent industrial regulations, a strong focus on sustainability, and high adoption rates of Industry 4.0 initiatives, particularly in Germany's 'Industrie 4.0' program. Countries like Germany, the UK, and France are leading the charge in implementing advanced automation and predictive maintenance solutions in their manufacturing, chemical, and utility sectors. The region's emphasis on energy efficiency and environmental monitoring also drives the demand for precise wireless sensor applications.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing region in the industrial wireless sensor market, propelled by rapid industrialization, expanding manufacturing bases, and substantial investments in smart cities and factory automation across countries such as China, India, Japan, and South Korea. Government support for digital transformation, coupled with a large and growing industrial sector, creates immense opportunities for widespread adoption. The region is also witnessing significant technological advancements and the proliferation of affordable wireless solutions.

- Latin America: This emerging market is experiencing increasing awareness and adoption of industrial wireless sensors, particularly in sectors such as oil & gas, mining, and pulp & paper. Countries like Brazil, Mexico, and Argentina are investing in modernizing their industrial infrastructure to enhance productivity and safety. While initial adoption may be slower compared to developed regions, the long-term growth potential is significant as industrial digitalization efforts mature and expand across various economic sectors.

- Middle East and Africa (MEA): The MEA region presents considerable opportunities, driven primarily by extensive investments in the oil & gas industry, infrastructure development, and diversification efforts away from traditional hydrocarbon economies. Countries in the GCC region are rapidly adopting advanced technologies to optimize operations and ensure safety in their energy and petrochemical sectors. African countries are also showing growing interest in leveraging wireless sensor technology for various industrial applications as their manufacturing capabilities evolve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Wireless Sensor Market.- Emerson Electric Co.

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Sensata Technologies, Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Endress+Hauser Group Services AG

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Eaton Corporation plc

- Dwyer Instruments, Inc.

- OMEGA Engineering Inc.

- Pepperl+Fuchs SE

- Banner Engineering Corp.

- Monnit Corporation

Frequently Asked Questions

Analyze common user questions about the Industrial Wireless Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are industrial wireless sensors and why are they important?

Industrial wireless sensors are devices designed to monitor and transmit data on various parameters (e.g., temperature, pressure, vibration) in industrial environments without physical cables. They are crucial for Industry 4.0, enabling real-time data collection, enhancing operational efficiency, improving safety, and facilitating predictive maintenance by eliminating wiring complexities and expanding monitoring capabilities to remote or hazardous areas.

How do industrial wireless sensors contribute to predictive maintenance?

Industrial wireless sensors continuously collect data from machinery and processes, which can then be analyzed using advanced analytics, including AI/ML algorithms. This enables the early detection of anomalies or deviations from normal operating conditions, allowing maintenance teams to anticipate and address potential equipment failures before they occur, thereby minimizing downtime, reducing repair costs, and extending asset lifespan.

What are the primary challenges in adopting industrial wireless sensor technology?

Key challenges include ensuring robust cybersecurity to protect sensitive industrial data from threats, achieving seamless interoperability between various sensor types and existing legacy systems, managing power consumption for extended battery life, and addressing potential issues related to data reliability, latency, and signal interference in complex industrial environments. Initial investment costs and the complexity of integration can also be barriers.

Which industries benefit most from industrial wireless sensors?

Industries that benefit most include manufacturing (discrete and process), oil & gas, chemicals, power & utilities, and mining. These sectors require continuous monitoring of critical assets, hazardous processes, or geographically dispersed infrastructure, where wireless solutions offer unparalleled flexibility, cost-effectiveness, and enhanced safety compared to traditional wired systems. Benefits also extend to food & beverage, pharmaceuticals, and logistics.

What future technological advancements are expected in the industrial wireless sensor market?

Future advancements include deeper integration with 5G for ultra-reliable low-latency communication, enhanced edge computing capabilities for localized data processing, more sophisticated AI/ML for advanced analytics and autonomous decision-making, wider adoption of energy harvesting technologies for self-sustaining sensors, and improved interoperability standards. These innovations aim to further increase sensor intelligence, connectivity, and deployment flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager