InGaAs Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428022 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

InGaAs Cameras Market Size

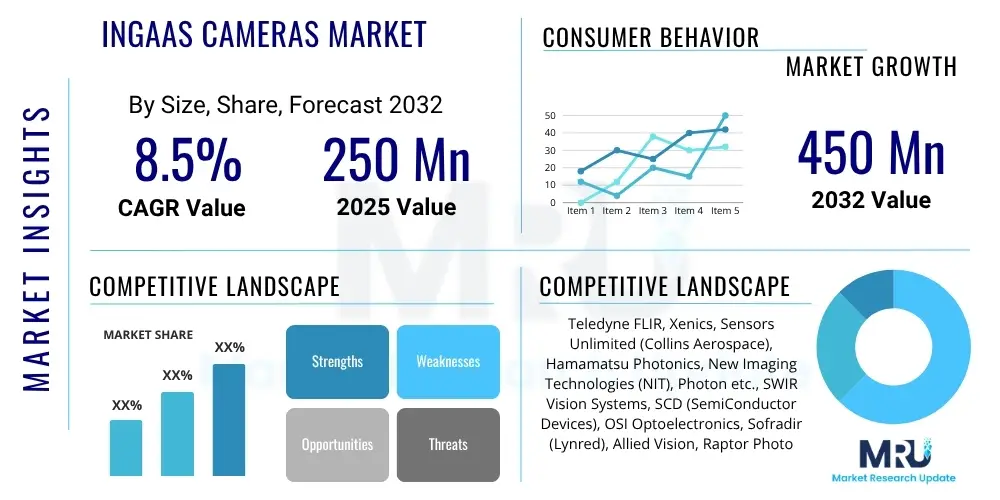

The InGaAs Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 250 million in 2025 and is projected to reach USD 450 million by the end of the forecast period in 2032.

InGaAs Cameras Market introduction

The InGaAs (Indium Gallium Arsenide) Cameras Market is characterized by sophisticated imaging solutions operating in the short-wave infrared (SWIR) spectrum, typically ranging from 0.9 μm to 1.7 μm. These cameras utilize InGaAs sensor technology, which is highly sensitive to SWIR light, enabling vision capabilities beyond the visible spectrum. This unique spectral range allows InGaAs cameras to penetrate certain materials opaque to visible light, such as silicon, plastics, and moisture, revealing hidden details and material properties that are otherwise undetectable. The ability to perform non-destructive testing and inspect objects under various environmental conditions makes InGaAs technology indispensable in a growing number of industrial and scientific applications.

Key applications of InGaAs cameras span diverse sectors, including industrial inspection for quality control, medical imaging for diagnostics, military and defense for surveillance and target acquisition, and scientific research for spectroscopy and chemical analysis. In industrial settings, they are crucial for detecting defects in semiconductors, solar cells, and food products, as well as for sorting materials based on their chemical composition. In medical fields, InGaAs cameras are employed for retinal imaging, blood vessel visualization, and tumor detection, offering enhanced contrast and depth penetration. Their utility in adverse atmospheric conditions, such as fog or haze, further expands their use in outdoor surveillance and autonomous navigation systems.

The primary benefits of InGaAs cameras include their high sensitivity in the SWIR range, superior image quality, and versatility in various challenging environments. They offer distinct advantages over visible light cameras by enabling precise material discrimination and inspection through packaging or coatings. Major driving factors for market growth include the escalating demand for advanced quality control and non-destructive testing across manufacturing industries, increased adoption in military and defense for enhanced situational awareness, and the continuous technological advancements leading to more compact, higher-resolution, and cost-effective InGaAs solutions. The expansion into emerging applications like autonomous vehicles, precision agriculture, and hyperspectral imaging also significantly contributes to the market's upward trajectory.

InGaAs Cameras Market Executive Summary

The InGaAs Cameras Market is undergoing significant transformation, driven by robust business trends that emphasize miniaturization, enhanced integration, and the pursuit of greater cost-effectiveness. Manufacturers are increasingly focusing on developing smaller, lighter, and more power-efficient camera modules that can be easily integrated into existing systems, such as drones, robotic arms, and portable inspection devices. There is a strong business impetus towards offering application-specific solutions, moving beyond general-purpose cameras to highly specialized systems tailored for particular industrial or scientific challenges. This trend also involves an increased adoption of AI and machine learning algorithms for real-time image processing and data analysis, which significantly enhances the capabilities and automation potential of InGaAs imaging systems.

Regionally, the market exhibits dynamic growth patterns, with Asia Pacific emerging as a dominant force due to its expansive manufacturing base and rapid industrialization, particularly in electronics, automotive, and food processing sectors. Countries like China, Japan, and South Korea are heavily investing in automation and advanced inspection technologies, fueling the demand for InGaAs cameras. North America and Europe continue to be strong markets, driven by significant investments in defense and security, advanced medical research, and high-tech industrial applications. These regions also lead in research and development, fostering innovation in InGaAs sensor technology and camera design. Emerging markets in Latin America and the Middle East & Africa are showing nascent growth, primarily in security, surveillance, and some industrial applications, as these regions modernize their infrastructure and industrial capabilities.

Segmentation trends within the InGaAs cameras market highlight robust growth across various product types, applications, and end-user industries. The demand for area scan InGaAs cameras remains strong for general imaging and inspection, while line scan cameras are gaining traction in high-speed web inspection and material sorting. Furthermore, the market for InGaAs modules is expanding rapidly, driven by original equipment manufacturers (OEMs) seeking to integrate SWIR capabilities into their proprietary systems. Application-wise, industrial automation and quality control represent the largest segment, but military & defense continues to be a crucial revenue stream. The medical and scientific research segments are experiencing accelerated growth due to advancements in diagnostic techniques and analytical instrumentation, underscoring the versatility and expanding utility of InGaAs technology across a broad spectrum of specialized fields.

AI Impact Analysis on InGaAs Cameras Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the InGaAs Cameras Market, shifting these devices from mere data capture tools to intelligent vision systems capable of autonomous decision-making and advanced analysis. Users are keenly interested in how AI can enhance the utility of InGaAs cameras, particularly concerning real-time anomaly detection, predictive maintenance, and the automation of complex inspection tasks. Common questions revolve around the ability of AI to process the rich spectral data generated by InGaAs sensors more efficiently, to filter out noise, and to identify subtle patterns indicative of defects, material properties, or health conditions that might be imperceptible to human operators or traditional algorithms. There is a strong expectation that AI will unlock new application frontiers, making InGaAs technology more accessible and impactful across various industries by reducing the need for extensive human intervention and specialized expertise.

A significant concern among users is also the practical implementation of AI in existing InGaAs systems, including issues of computational cost, data privacy, and the complexity of developing robust AI models. Users want to understand how AI-powered InGaAs solutions can lead to faster throughput, greater accuracy, and reduced operational costs in scenarios such as high-volume manufacturing inspection or continuous environmental monitoring. The desire for AI-driven insights that can improve process control, enhance product quality, and accelerate scientific discovery is pervasive. This includes the ability to perform complex spectral analysis in real-time for identifying material compositions, detecting contaminants, or assessing crop health with unprecedented precision, thus moving beyond basic imaging to sophisticated analytical capabilities. The expectation is that AI will democratize access to advanced SWIR imaging intelligence, making it applicable in sectors that previously found it too complex or labor-intensive.

Ultimately, the user community anticipates that AI will serve as a critical enabler for the next generation of InGaAs camera applications, facilitating a paradigm shift towards smart, self-optimizing imaging solutions. This includes automated calibration, adaptive imaging parameters, and the creation of highly specialized vision systems that can learn and improve over time. The key themes revolve around achieving higher levels of automation, extracting deeper and more actionable insights from SWIR data, and developing InGaAs cameras that are not only sensitive to the invisible but also intelligent enough to interpret what they see. These advancements are expected to broaden the market appeal of InGaAs technology significantly, driving its adoption in areas like autonomous vehicles for improved perception in adverse weather, smart agriculture for yield optimization, and advanced medical diagnostics for early disease detection, by providing capabilities far beyond traditional imaging.

- Enhanced image processing: AI algorithms improve image clarity, reduce noise, and correct distortions, optimizing the raw data from InGaAs sensors for better analysis and visualization.

- Automated defect detection: Machine learning models can be trained to automatically identify subtle defects, foreign objects, or inconsistencies in materials during high-speed industrial inspection, surpassing human capabilities in consistency and speed.

- Predictive analytics for maintenance: AI analyzes spectral signatures to predict material degradation or equipment failure, enabling proactive maintenance in industrial settings and preventing costly downtime.

- Autonomous navigation and perception: In autonomous vehicles and robotics, AI processes InGaAs data to improve perception in challenging conditions (fog, dust, darkness) by identifying objects and their properties more reliably than visible cameras.

- Advanced material characterization: AI-driven spectral analysis allows for precise identification and quantification of material components, critical for recycling, food sorting, and quality control in manufacturing.

- Reduced false positives/negatives: Intelligent algorithms minimize errors in detection and classification, leading to more reliable outcomes in critical applications like security surveillance and medical diagnostics.

- Real-time decision making: AI enables InGaAs systems to analyze data and make decisions instantly, facilitating automation of processes like sorting, grading, and quality control on production lines.

- Personalized medical diagnostics: AI assists in processing InGaAs medical images for early detection of diseases, improving the accuracy of diagnoses for conditions like diabetic retinopathy or certain cancers.

DRO & Impact Forces Of InGaAs Cameras Market

The InGaAs Cameras Market is significantly shaped by a confluence of Drivers, Restraints, and Opportunities, collectively forming the key impact forces. A primary driver is the accelerating trend towards automation and Industry 4.0 across global manufacturing sectors. The imperative for enhanced quality control, non-destructive testing, and process optimization fuels the demand for advanced imaging solutions capable of revealing hidden flaws and material compositions that visible light cameras cannot detect. Additionally, increasing defense and security expenditures globally, particularly for advanced surveillance, reconnaissance, and target acquisition systems, consistently boosts the adoption of InGaAs technology due to its superior performance in low-light and adverse weather conditions. The continuous innovation in sensor technology, leading to improved sensitivity, resolution, and frame rates, further expands the applicability and performance of InGaAs cameras across diverse high-tech industries.

Conversely, significant restraints hinder the market's full potential. The high manufacturing cost of InGaAs sensors and camera systems remains a critical barrier, making them a premium investment compared to conventional silicon-based cameras. This high cost limits their widespread adoption in price-sensitive applications and smaller enterprises. Furthermore, the limited availability of specialized InGaAs foundries and the complexity of the manufacturing process contribute to supply chain constraints and can lead to higher production costs. Export control regulations and restrictions, particularly for military-grade InGaAs technologies, also pose challenges for market players, limiting geographical market access and requiring intricate compliance procedures. The relatively smaller market size compared to visible light cameras means less investment in mass production efficiencies, which keeps unit costs elevated.

Despite these restraints, substantial opportunities are emerging that promise to propel the InGaAs cameras market forward. The development of new and miniaturized InGaAs sensor arrays, including wafer-level packaging and CMOS-compatible processes, is poised to reduce manufacturing costs and enable integration into more compact, portable devices. This facilitates penetration into high-volume consumer-adjacent markets, such as specialized smartphone attachments or smart home security systems. Moreover, the expanding application landscape in emerging sectors like autonomous vehicles for advanced driver-assistance systems (ADAS) and precision agriculture for crop health monitoring represents significant growth avenues. The growing interest in hyperspectral imaging, which leverages InGaAs for detailed spectral analysis, is also creating new markets in environmental monitoring, food safety, and pharmaceutical inspection, demonstrating the versatility and untapped potential of this technology to address complex challenges.

- Drivers:

- Growing demand for industrial automation and quality control in manufacturing processes.

- Increasing adoption of advanced surveillance, reconnaissance, and targeting systems in defense and security.

- Technological advancements leading to improved InGaAs sensor performance, resolution, and sensitivity.

- Expansion into new applications such as autonomous vehicles, precision agriculture, and medical diagnostics.

- Rising need for non-destructive testing (NDT) and material analysis across various industries.

- Restraints:

- High manufacturing cost of InGaAs sensors and camera systems, leading to premium pricing.

- Limited availability of specialized InGaAs foundries and complex fabrication processes.

- Strict export control regulations and restrictions on military-grade InGaAs technologies.

- Lower economies of scale compared to visible light cameras, impacting cost reduction efforts.

- Limited public awareness and understanding of SWIR technology benefits in some industrial sectors.

- Opportunities:

- Development of cost-effective and miniaturized InGaAs sensors and modules.

- Integration of InGaAs cameras into consumer-grade devices and portable solutions.

- Emergence of AI and machine learning for enhanced image processing and data analysis.

- Untapped potential in hyperspectral imaging for advanced material sorting and environmental monitoring.

- Expansion of applications in life sciences, food processing, and advanced scientific research.

- Impact Forces:

- Technological breakthroughs in sensor design and manufacturing processes.

- Global geopolitical stability influencing defense spending and export regulations.

- Economic conditions affecting industrial investment in advanced automation equipment.

- Regulatory frameworks concerning product safety and quality in industries like food and pharmaceuticals.

- Increasing demand for sustainable manufacturing and resource management requiring advanced inspection.

Segmentation Analysis

The InGaAs Cameras Market is comprehensively segmented to provide granular insights into its diverse operational landscape, allowing for a detailed understanding of market dynamics across various categories. This segmentation helps in identifying key growth drivers, competitive landscapes, and emerging opportunities within specific niches. The market is typically categorized by factors such as the type of camera, the specific application areas, and the end-user industries that utilize InGaAs technology. This structured approach is critical for market participants to tailor their strategies, product development, and marketing efforts to address the unique needs and demands of distinct market segments, fostering targeted innovation and market penetration. Analyzing these segments reveals varying growth rates, technological preferences, and adoption patterns, reflecting the multi-faceted nature of the SWIR imaging industry.

For instance, segmentation by camera type often differentiates between area scan cameras, line scan cameras, and InGaAs modules. Each type serves distinct functional requirements, with area scan cameras preferred for general imaging and surveillance, line scan cameras excelling in high-speed, continuous inspection of moving objects, and modules catering to OEMs for integration into custom systems. This distinction is crucial as it highlights the technological evolution and diversification of InGaAs products to meet specialized industrial demands. Similarly, segmenting by application elucidates the diverse roles InGaAs cameras play, from critical tasks in military and defense to precision inspection in industrial automation, and sensitive diagnostics in medical imaging. The performance requirements, regulatory standards, and budget allocations vary significantly across these application domains, influencing product design and market entry strategies.

Further segmentation by end-user industry provides a clear picture of which sectors are the primary adopters and beneficiaries of InGaAs technology. Industries such as manufacturing, food & beverage, life sciences, and security each present unique challenges and opportunities that InGaAs cameras are uniquely positioned to address. For example, manufacturing utilizes InGaAs for semiconductor inspection and quality control, while food & beverage leverages it for sorting and contaminant detection. Life sciences employs it for non-invasive medical imaging and research, and the security sector benefits from enhanced surveillance capabilities. This detailed segmentation is instrumental for market players to develop focused sales strategies, identify underserved markets, and anticipate future demand shifts, thereby optimizing their investment and product portfolio decisions to maximize market share and profitability within the rapidly evolving InGaAs camera ecosystem.

- By Type:

- Area Scan Cameras

- Line Scan Cameras

- InGaAs Modules/Sensors

- By Application:

- Industrial Automation & Quality Control

- Military & Defense

- Medical Imaging & Diagnostics

- Scientific Research & Spectroscopy

- Surveillance & Security

- Automotive (ADAS & Autonomous Driving)

- Agriculture & Food Processing

- Environmental Monitoring

- By End-User Industry:

- Manufacturing (Semiconductor, Electronics, Solar)

- Aerospace & Defense

- Life Sciences & Healthcare

- Food & Beverage

- Chemical & Pharmaceutical

- Recycling & Waste Management

- Geological & Mining

- Telecommunications

Value Chain Analysis For InGaAs Cameras Market

The value chain for the InGaAs Cameras Market is a sophisticated network involving several key stages, from raw material procurement to end-user delivery, each contributing significantly to the final product's value and market accessibility. The upstream segment of the value chain is critical, encompassing the research, development, and manufacturing of fundamental components. This primarily includes suppliers of Indium, Gallium, and Arsenic, which are essential raw materials for InGaAs wafer production. Beyond raw materials, specialized foundries are responsible for epitaxy and detector array fabrication, a highly technical process that determines the sensor's performance characteristics. This stage also includes the development and supply of advanced optical components such such as lenses, filters, and protective windows, which are vital for capturing and focusing SWIR light effectively. Furthermore, companies specializing in electronics design and packaging contribute integrated circuit boards and robust camera housing, forming the complete camera module.

Moving downstream, the value chain extends to the integration, distribution, and consumption of InGaAs cameras. Camera manufacturers integrate the specialized InGaAs sensors and optics with processing electronics, software, and enclosures to create a complete camera system. These manufacturers often specialize in different camera types, such as area scan, line scan, or specific application-oriented designs. Post-manufacturing, the distribution channel plays a pivotal role in bringing these advanced products to market. Direct sales are common for high-value, customized systems, particularly to large industrial clients, defense contractors, and research institutions, where direct technical support and consultation are essential. This direct approach allows for close collaboration between the manufacturer and the end-user, ensuring the system meets precise specifications and integration requirements.

Conversely, indirect distribution channels involve a network of distributors, value-added resellers (VARs), and system integrators. These intermediaries often have specialized expertise in specific application areas or geographic regions, providing localized sales, technical support, and customization services. VARs might combine InGaAs cameras with other hardware and software to create complete vision solutions, adding value for end-users who require comprehensive, turnkey systems. Online platforms and specialized e-commerce sites are also gaining traction for standard or lower-cost InGaAs modules and components, catering to a broader range of smaller businesses and researchers. The choice between direct and indirect channels is often dictated by the complexity of the product, the volume of sales, and the level of technical support required by the end-customer, all contributing to the overall efficiency and reach of the InGaAs camera market's value delivery system.

InGaAs Cameras Market Potential Customers

The InGaAs Cameras Market serves a diverse range of potential customers, characterized by their need for specialized imaging capabilities that transcend the limitations of visible light. These end-users are primarily industries and organizations that require non-destructive material analysis, enhanced vision in challenging environments, or highly sensitive spectral imaging for research and quality control. Manufacturing companies represent a significant customer segment, particularly those in the semiconductor, electronics, solar panel, and flat panel display industries, where InGaAs cameras are indispensable for detecting sub-surface defects, inspecting silicon wafers, and ensuring precise alignment during production. Food processing and agriculture sectors also emerge as crucial customers, utilizing InGaAs for sorting produce, detecting foreign objects, assessing ripeness, and analyzing crop health, where SWIR imaging provides critical insights into material composition and moisture content.

Another major segment of potential customers includes defense and aerospace contractors, as well as government agencies involved in security and surveillance. These entities procure InGaAs cameras for advanced night vision systems, target acquisition, missile guidance, and airborne reconnaissance, benefiting from the technology's ability to see through fog, haze, and smoke, and to operate effectively in low-light conditions. Medical and life science institutions, including hospitals, research laboratories, and pharmaceutical companies, are increasingly adopting InGaAs technology for applications such as retinal imaging, blood vessel visualization, tumor margin assessment, and drug discovery. Their demand stems from the desire for non-invasive diagnostic tools that offer deeper tissue penetration and better contrast compared to conventional imaging modalities, enabling more accurate diagnoses and improved patient outcomes.

Furthermore, scientific research institutions and universities constitute a consistent base of potential customers, leveraging InGaAs cameras for spectroscopy, chemical imaging, astronomy, and fundamental materials science research. These organizations require high-precision, sensitive imaging tools for analytical purposes and for pushing the boundaries of scientific understanding. The burgeoning autonomous vehicle industry is also becoming a significant potential customer, where InGaAs cameras are being explored for their ability to enhance perception and safety in adverse weather conditions, complementing existing sensor suites. Lastly, telecommunications companies use InGaAs cameras for inspecting fiber optics and laser alignment, highlighting the pervasive utility of SWIR imaging across a broad spectrum of high-tech and specialized industrial applications, each with unique requirements and growth potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 250 million |

| Market Forecast in 2032 | USD 450 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne FLIR, Xenics, Sensors Unlimited (Collins Aerospace), Hamamatsu Photonics, New Imaging Technologies (NIT), Photon etc., SWIR Vision Systems, SCD (SemiConductor Devices), OSI Optoelectronics, Sofradir (Lynred), Allied Vision, Raptor Photonics, SUI (Sensors Unlimited Inc.), Xenics NV, IRCameras LLC, Sierra-Olympic Technologies, FLIR Systems, Edmund Optics, Headwall Photonics, Specim Spectral Imaging |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

InGaAs Cameras Market Key Technology Landscape

The InGaAs Cameras Market is underpinned by a sophisticated and continuously evolving technology landscape, primarily centered around the Indium Gallium Arsenide (InGaAs) material science. At its core, the technology relies on the epitaxial growth of InGaAs layers on Indium Phosphide (InP) substrates, a complex process that dictates the sensor's spectral response, dark current, and overall quantum efficiency. Advanced wafer fabrication techniques, including molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD), are crucial for creating high-quality, uniform InGaAs focal plane arrays (FPAs). The development of higher pixel densities, smaller pixel pitches, and increased array sizes is a continuous technological pursuit aimed at achieving higher resolution and broader fields of view, essential for detailed imaging in diverse applications. Furthermore, the integration of thermoelectric cooling (TEC) or Stirling coolers into camera designs is vital for reducing sensor noise and improving sensitivity, particularly in demanding low-light conditions.

Beyond the core sensor technology, the InGaAs camera landscape benefits significantly from advancements in read-out integrated circuits (ROICs). These specialized chips are designed to interface directly with the InGaAs detector array, converting the photocurrent generated by incident SWIR light into digital signals. Innovations in ROIC design focus on reducing noise, increasing dynamic range, and enabling higher frame rates, which are critical for high-speed industrial inspection and real-time surveillance applications. Miniaturization efforts are also prominent, with the development of smaller, lower-power consumption ROICs and compact packaging techniques allowing for the creation of smaller, more portable camera modules. This drive towards miniaturization is essential for integrating InGaAs technology into space-constrained platforms such as drones, handheld devices, and specialized medical instruments, thereby expanding its potential market reach beyond traditional industrial and military uses.

The broader technology landscape also encompasses sophisticated optical systems and image processing algorithms. High-performance SWIR lenses, often made from materials like germanium or silicon, are specifically designed to transmit SWIR light efficiently while minimizing aberrations. The integration of advanced image processing capabilities, including real-time image enhancement, noise reduction filters, and contrast optimization, further refines the output from InGaAs cameras, making the data more actionable. Emerging technologies such as quantum dot-based SWIR sensors offer the potential for lower-cost, high-performance alternatives to traditional InGaAs, potentially disrupting the market by reducing manufacturing complexity. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) directly into camera hardware or accompanying software is revolutionizing how InGaAs data is interpreted, enabling automated defect detection, predictive analytics, and enhanced material identification capabilities, pushing the boundaries of what SWIR imaging can achieve.

Regional Highlights

- North America: This region is a leading market, propelled by substantial investments in defense and security, particularly from the United States, for advanced surveillance, reconnaissance, and target acquisition systems. The robust presence of research and development institutions, coupled with a strong aerospace industry and an increasing adoption of automation in manufacturing, further contributes to its market dominance.

- Europe: Europe represents a significant market, driven by its advanced industrial automation sector, strong focus on machine vision for quality control, and growing applications in medical imaging and scientific research. Countries like Germany, France, and the UK lead in technological innovation and have established industries that are early adopters of InGaAs camera systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to rapid industrialization, expanding manufacturing bases in countries like China, Japan, South Korea, and India, and increasing governmental investments in security and surveillance infrastructure. The rising demand for consumer electronics inspection and agricultural applications also fuels market expansion.

- Latin America: The market in Latin America is in an emerging phase, with gradual adoption driven by investments in industrial modernization, mining operations requiring advanced material analysis, and growing security concerns in urban areas. Brazil and Mexico are key markets within this region, showing increasing potential for InGaAs technology integration.

- Middle East & Africa (MEA): This region exhibits growth mainly due to significant defense spending, particularly from Gulf Cooperation Council (GCC) countries, for border security, critical infrastructure protection, and military modernization. The oil and gas sector also presents opportunities for InGaAs cameras in specialized inspection and monitoring applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the InGaAs Cameras Market.- Teledyne FLIR

- Xenics

- Sensors Unlimited (Collins Aerospace)

- Hamamatsu Photonics

- New Imaging Technologies (NIT)

- Photon etc.

- SWIR Vision Systems

- SCD (SemiConductor Devices)

- OSI Optoelectronics

- Sofradir (Lynred)

- Allied Vision

- Raptor Photonics

- SUI (Sensors Unlimited Inc.)

- Xenics NV

- IRCameras LLC

- Sierra-Olympic Technologies

- FLIR Systems

- Edmund Optics

- Headwall Photonics

- Specim Spectral Imaging

Frequently Asked Questions

Analyze common user questions about the InGaAs Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are InGaAs cameras primarily used for?

InGaAs cameras are primarily used for short-wave infrared (SWIR) imaging, enabling vision in applications where visible light is insufficient. This includes industrial inspection for quality control, non-destructive testing, military and defense surveillance, medical imaging for diagnostics, and scientific research for material analysis, by seeing through materials like silicon, plastics, and moisture.

Why are InGaAs cameras considered expensive?

InGaAs cameras are typically expensive due to the complex and specialized manufacturing processes required for Indium Gallium Arsenide sensors. The rarity of the raw materials, the intricate epitaxial growth techniques, and the limited economies of scale compared to silicon-based sensors contribute to higher production costs, positioning them as premium imaging solutions.

How does SWIR imaging differ from visible light or thermal imaging?

SWIR imaging (0.9-1.7 μm) differs from visible light by capturing light beyond what the human eye can see, allowing penetration through certain materials and revealing specific chemical compositions. Unlike thermal imaging (mid-wave/long-wave infrared) which detects heat emitted by objects, SWIR relies on reflected light, making it more akin to visible light but with unique material interaction properties.

What are the latest technological advancements in InGaAs camera technology?

Recent advancements in InGaAs camera technology include the development of smaller pixel pitches for higher resolution, increased array sizes, improved quantum efficiency, and reduced dark current for better low-light performance. There is also a significant trend towards miniaturization, cost reduction through wafer-level packaging, and the integration of AI and machine learning for enhanced image processing and autonomous analytics.

Which industries benefit most from the use of InGaAs cameras?

Industries that benefit most from InGaAs cameras include manufacturing (for semiconductor, electronics, and solar cell inspection), defense and security (for surveillance and target acquisition), medical and life sciences (for non-invasive diagnostics), and agriculture (for crop health monitoring and sorting). Their ability to reveal hidden details and material properties provides critical insights across these diverse sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager