Instrument Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 430037 | Date : Nov, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Instrument Transformer Market Size

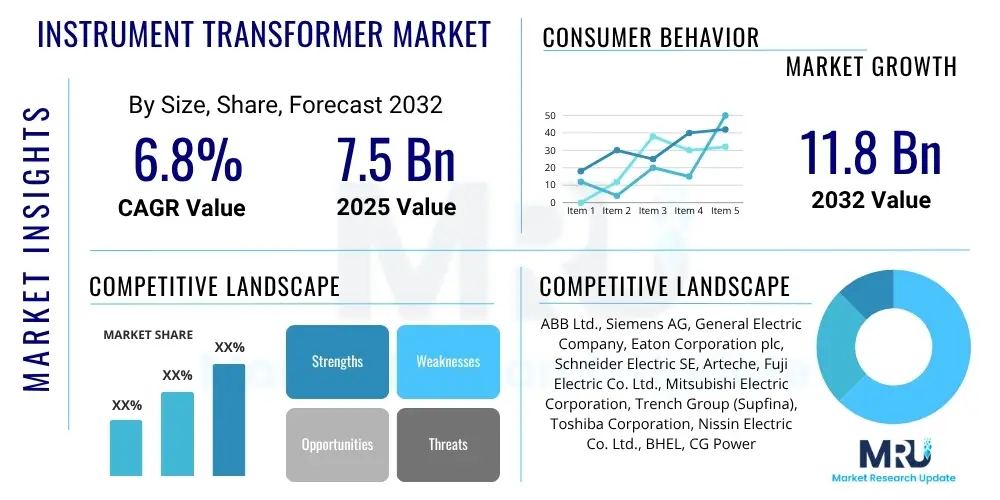

The Instrument Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 7.5 billion in 2025 and is projected to reach USD 11.8 billion by the end of the forecast period in 2032.

Instrument Transformer Market introduction

The Instrument Transformer Market encompasses devices essential for the safe and accurate measurement and protection of electrical power systems. Instrument transformers, comprising current transformers (CTs) and voltage transformers (VTs) or potential transformers (PTs), are crucial for stepping down high voltages and currents to measurable and safer levels for monitoring, control, and relay protection. These products ensure the integrity and stability of power grids by providing accurate data for billing, operational analysis, and fault detection, thereby safeguarding expensive equipment and personnel from hazardous electrical conditions.

Major applications for instrument transformers span across power generation, transmission, and distribution utilities, as well as various industrial sectors, including manufacturing, oil and gas, and mining. They are indispensable in substations, power plants, industrial facilities, and increasingly in renewable energy installations to manage and protect complex electrical infrastructure. The primary benefits of these devices include enhanced operational safety, improved measurement accuracy for revenue metering, and reliable protection of electrical apparatus, contributing significantly to overall system efficiency and longevity.

The market's growth is predominantly driven by global initiatives for grid modernization, the rapid integration of renewable energy sources into existing grids, expanding industrialization in developing economies, and the growing demand for smart grid solutions. Furthermore, the need for replacing aging infrastructure in developed regions and the expansion of electricity access in underserved areas worldwide continue to fuel the adoption of instrument transformers, making them a cornerstone of modern electrical networks.

Instrument Transformer Market Executive Summary

The Instrument Transformer Market is witnessing robust expansion, propelled by significant business trends such as the increasing global investment in smart grid technologies and renewable energy infrastructure. There is a discernible shift towards digital and intelligent instrument transformers, which offer enhanced communication capabilities and precision for advanced grid management. Utilities are increasingly demanding solutions that support predictive maintenance and real-time data analytics, driving innovation in product design and functionality.

Regional trends indicate that Asia Pacific remains the dominant and fastest-growing market, primarily due to rapid urbanization, industrialization, and extensive grid expansion projects in countries like China and India. North America and Europe are focusing on upgrading aging electrical infrastructure and integrating a higher proportion of renewable energy into their grids, thereby sustaining demand for advanced and reliable instrument transformers. Emerging economies in Latin America, the Middle East, and Africa are also contributing to market growth through significant investments in electrification and industrial development.

In terms of segments, current transformers continue to hold a larger market share, driven by their pervasive use across all voltage levels for both metering and protection. However, the voltage transformer segment is experiencing significant growth, particularly with the proliferation of higher voltage transmission lines. Dry type and gas insulated instrument transformers are gaining traction over traditional oil-immersed types due to their environmental benefits, enhanced safety features, and reduced maintenance requirements, indicating a clear trend towards more sustainable and efficient solutions.

AI Impact Analysis on Instrument Transformer Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the Instrument Transformer Market, particularly regarding enhanced operational efficiency, predictive maintenance, and improved grid reliability. Common concerns revolve around the integration challenges, data security, and the return on investment for AI-driven solutions. The key themes emerging from user questions highlight expectations for AI to enable more proactive grid management, optimize asset utilization, and automate fault detection and diagnostics within complex power systems, ultimately leading to a more resilient and intelligent electricity infrastructure.

- AI enables predictive maintenance by analyzing sensor data from instrument transformers, anticipating failures before they occur.

- Optimized grid operations through AI-driven load forecasting and real-time anomaly detection using transformer data.

- Enhanced cybersecurity for smart transformers by identifying unusual patterns indicative of cyber threats.

- Automated fault localization and diagnosis, significantly reducing outage times and operational costs.

- Improved design and manufacturing processes through AI-driven simulations and quality control, leading to more efficient and reliable transformers.

- Integration of AI with digital instrument transformers (DITs) to provide granular, high-fidelity data for advanced analytics and control systems.

- Facilitates the development of self-healing grids by allowing instrument transformers to communicate and adapt to changing conditions intelligently.

DRO & Impact Forces Of Instrument Transformer Market

The Instrument Transformer Market is significantly influenced by a confluence of drivers, restraints, and opportunities that shape its growth trajectory and competitive landscape. Key drivers include the global expansion of electricity networks, the escalating demand for reliable power, and substantial investments in smart grid infrastructure aimed at improving efficiency and resilience. The continuous integration of renewable energy sources, which necessitates specialized metering and protection equipment, also acts as a powerful catalyst for market growth. Moreover, the replacement of aging power infrastructure in developed economies to prevent failures and enhance safety contributes substantially to demand.

However, the market faces several restraints, notably the high initial capital expenditure required for advanced instrument transformers and their complex installation processes. Fluctuations in raw material prices, particularly for copper, steel, and insulating materials, can impact manufacturing costs and product pricing, creating uncertainty for market players. Furthermore, the global economic slowdowns and geopolitical tensions can disrupt supply chains and reduce investment in power infrastructure projects, thereby hindering market expansion. The long operational lifespan of existing transformers also means replacement cycles can be lengthy, moderating immediate demand for new units.

Opportunities for growth are abundant, particularly with the increasing adoption of digital instrument transformers (DITs) and low-power instrument transformers (LPITs) that offer enhanced accuracy, communication capabilities, and reduced footprints. The emergence of electric vehicle (EV) charging infrastructure and the development of microgrids present new application avenues for instrument transformers. Additionally, continued technological advancements in insulation materials and sensor technologies are fostering innovation. Expanding markets in developing countries, driven by urbanization and industrialization, offer significant untapped potential for market penetration and growth, especially in the smart city initiatives.

Segmentation Analysis

The Instrument Transformer Market is broadly segmented based on various critical attributes, including the type of transformer, the dielectric medium used, the voltage level it operates at, its specific application, and the end-use industry. This granular segmentation provides a comprehensive understanding of market dynamics, enabling stakeholders to identify high-growth areas and tailor their strategies accordingly. Each segment represents distinct technological requirements, regulatory compliance, and market demand patterns, reflecting the diverse operational environments and challenges within the global power sector.

Understanding these segments is crucial for manufacturers to optimize their product portfolios, for utility companies to make informed procurement decisions, and for investors to assess market potential. The ongoing evolution of power grids, driven by renewable energy integration and digitalization, continues to influence the growth and prominence of these segments. The shift towards more sustainable and efficient solutions is particularly noticeable across dielectric medium and technology type segments.

- By Type

- Current Transformer (CT)

- Potential/Voltage Transformer (PT/VT)

- Combined CT/PT

- By Dielectric Medium

- Oil Immersed Instrument Transformer

- Dry Type Instrument Transformer

- Gas Insulated Instrument Transformer (SF6, SF6-Free)

- Resin Cast Instrument Transformer

- By Voltage Level

- Distribution Voltage (Up to 36 kV)

- Sub-Transmission Voltage (36 kV to 170 kV)

- Transmission Voltage (170 kV to 800 kV)

- Ultra-High Voltage (Above 800 kV)

- By Application

- Power Utilities (Generation, Transmission, Distribution)

- Industrial (Manufacturing, Mining, Oil & Gas, Data Centers)

- Railways & Metros

- Renewable Energy (Solar, Wind)

- By End-Use

- Power Generation

- Power Transmission

- Power Distribution

- Industrial Automation

Value Chain Analysis For Instrument Transformer Market

The value chain for the Instrument Transformer Market begins with a robust upstream segment focused on the sourcing and processing of essential raw materials. Key raw materials include high-grade steel for cores, copper or aluminum for windings, various insulating materials such as paper, oil, resin, or SF6 gas, and porcelain or composite materials for bushings. Suppliers in this segment play a critical role in ensuring the quality and cost-effectiveness of these foundational components, which directly impact the performance and durability of the final instrument transformers. Strategic partnerships and long-term contracts with reliable raw material providers are crucial for manufacturers to mitigate supply chain risks and maintain competitive pricing.

Further along the value chain, the manufacturing segment involves complex processes from core winding and insulation to assembly, testing, and quality control. After manufacturing, instrument transformers move through various distribution channels to reach their end-users. Distribution can be direct, where manufacturers sell directly to large power utilities, national transmission companies, or major EPC (Engineering, Procurement, and Construction) contractors. This direct approach often involves customized solutions, technical support, and direct project engagement, fostering strong client relationships. Conversely, indirect distribution channels involve working with a network of distributors, agents, and system integrators who cater to smaller utilities, industrial clients, and specific project requirements, providing broader market reach and localized service.

The downstream analysis reveals the critical roles of system integrators and EPC contractors who incorporate instrument transformers into larger electrical infrastructure projects, such as new substations, power plants, or industrial facilities. These entities often act as intermediaries, specifying and procuring transformers based on project needs. The ultimate end-users are primarily power generation companies, transmission system operators, distribution utilities, and various industrial sectors that rely on these transformers for safe and accurate operation of their electrical systems. After-sales service, including installation support, maintenance, and diagnostics, forms an important part of the downstream value chain, ensuring the long-term performance and reliability of these crucial components.

Instrument Transformer Market Potential Customers

The Instrument Transformer Market serves a diverse range of potential customers whose operational requirements and strategic objectives significantly influence demand. These end-users are primarily entities responsible for generating, transmitting, distributing, or consuming large amounts of electrical power, where accurate measurement and robust protection of electrical circuits are paramount. Their purchasing decisions are often driven by factors such as grid expansion, infrastructure upgrades, regulatory compliance, and the need for enhanced operational safety and efficiency.

Power utilities form the largest segment of potential customers, encompassing state-owned and private entities involved in power generation (e.g., thermal, hydro, nuclear, renewable), transmission system operators (TSOs) managing high-voltage grids, and distribution system operators (DSOs) responsible for delivering power to end-consumers. These utilities continuously invest in new substations, grid modernization projects, and replacements for aging equipment, creating sustained demand for instrument transformers. Furthermore, industrial sectors, including heavy manufacturing, oil and gas, mining, cement, and petrochemicals, are significant buyers, utilizing instrument transformers for internal power distribution, motor protection, and energy management within their facilities.

Beyond traditional utilities and heavy industries, emerging customer segments include developers of renewable energy projects (solar farms, wind parks) that require specialized instrument transformers for grid integration and power quality monitoring. Railway and metro operators also represent a niche but growing customer base, as electrified transportation systems depend on accurate current and voltage measurements for traction power supply. Data centers, with their immense and critical power demands, are also becoming key buyers, prioritizing highly reliable and accurate instrument transformers to ensure uninterrupted operations and protect sensitive equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 7.5 Billion |

| Market Forecast in 2032 | USD 11.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric Company, Eaton Corporation plc, Schneider Electric SE, Arteche, Fuji Electric Co. Ltd., Mitsubishi Electric Corporation, Trench Group (Supfina), Toshiba Corporation, Nissin Electric Co. Ltd., BHEL, CG Power and Industrial Solutions Limited, Shandong Taikai Power Electronic Co. Ltd., Accuenergy Ltd., Xian XD Transformer Co. Ltd., Dalian Instrument Transformer Co. Ltd., Elpro International Ltd., Instrument Transformer Equipment Corporation, Beijing Power Equipment Group Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Instrument Transformer Market Key Technology Landscape

The Instrument Transformer Market is undergoing a significant technological transformation, driven by the imperative for increased accuracy, enhanced safety, and seamless integration with modern smart grids. A key advancement is the proliferation of digital instrument transformers (DITs), which utilize electronic circuits and fiber optic cables instead of traditional magnetic cores and copper windings. DITs, including Low Power Instrument Transformers (LPITs) and Non-Conventional Instrument Transformers (NCITs), offer superior accuracy, wider dynamic ranges, and reduced size and weight. They are also immune to electromagnetic interference and provide digital outputs that can be directly interfaced with digital protection and control systems, aligning perfectly with the IEC 61850 standard for substation automation.

Another prominent technological trend is the development of environmentally friendly insulation materials as alternatives to sulfur hexafluoride (SF6) gas, which is a potent greenhouse gas. Solutions such as dry air or other gas mixtures, as well as solid and resin-cast insulation, are gaining traction, especially in medium voltage applications. These innovations address growing environmental concerns and regulatory pressures while maintaining high dielectric strength and operational reliability. Furthermore, integrated sensor technologies within instrument transformers are becoming more sophisticated, allowing for continuous monitoring of various parameters like temperature, partial discharges, and vibrations, enabling predictive maintenance and optimizing asset management strategies.

The integration of IoT (Internet of Things) capabilities into instrument transformers is also revolutionizing their functionality. IoT-enabled transformers can communicate real-time data to a central control system, facilitating advanced analytics, fault diagnosis, and remote monitoring. This capability is vital for the development of self-healing grids and for optimizing the overall performance and reliability of the power system. Additionally, advancements in composite insulation materials offer improved mechanical strength, reduced weight, and enhanced resistance to environmental degradation, contributing to the longevity and performance of instrument transformers in harsh conditions.

Regional Highlights

- North America: This region is characterized by substantial investments in grid modernization and the replacement of aging infrastructure. The focus is on enhancing grid reliability, integrating renewable energy sources, and implementing smart grid technologies. Stringent regulatory frameworks and a strong emphasis on cybersecurity also drive the adoption of advanced instrument transformers.

- Europe: Driven by ambitious renewable energy targets and the need to upgrade an extensive legacy grid, Europe is a key market for instrument transformers. Countries are investing in smart grid projects and digital substations, leading to increased demand for digital instrument transformers and eco-friendly insulation solutions. The emphasis on energy efficiency and carbon neutrality further shapes market trends.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, propelled by rapid industrialization, urbanization, and massive investments in power generation, transmission, and distribution infrastructure, particularly in China and India. Expanding electricity access to remote areas and the development of smart cities are also significant drivers.

- Latin America: This region is experiencing growth due to increasing electrification projects, infrastructure development, and significant investments in renewable energy, especially hydro and solar power. Grid expansion and modernization efforts across countries like Brazil and Mexico are creating sustained demand.

- Middle East and Africa (MEA): The MEA region is witnessing substantial investments in oil and gas infrastructure, smart city projects (e.g., in UAE and Saudi Arabia), and electrification initiatives to improve power access. Rapid industrial development and growing energy demands are key factors driving the instrument transformer market here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Instrument Transformer Market.- ABB Ltd.

- Siemens AG

- General Electric Company

- Eaton Corporation plc

- Schneider Electric SE

- Arteche

- Fuji Electric Co. Ltd.

- Mitsubishi Electric Corporation

- Trench Group (Supfina)

- Toshiba Corporation

- Nissin Electric Co. Ltd.

- BHEL

- CG Power and Industrial Solutions Limited

- Shandong Taikai Power Electronic Co. Ltd.

- Accuenergy Ltd.

- Xian XD Transformer Co. Ltd.

- Dalian Instrument Transformer Co. Ltd.

- Elpro International Ltd.

- Instrument Transformer Equipment Corporation

- Beijing Power Equipment Group Co. Ltd.

Frequently Asked Questions

What is an instrument transformer and why is it important?

An instrument transformer is an electrical device used to step down high voltages or currents to lower, measurable, and safer levels for metering, protection, and control of power systems. It is crucial for ensuring accurate measurement, system reliability, and safety of personnel and equipment in power generation, transmission, and distribution.

What are the primary types of instrument transformers?

The primary types are Current Transformers (CTs), which measure current, and Potential Transformers (PTs) or Voltage Transformers (VTs), which measure voltage. Combined CT/PT units are also available, offering both functionalities in a single device.

How do smart grids influence the Instrument Transformer Market?

Smart grids significantly influence the market by driving demand for digital and intelligent instrument transformers (DITs/LPITs). These devices offer real-time data, enhanced communication, and integration with advanced grid management systems, facilitating predictive maintenance, optimized operations, and improved grid resilience.

Which regions are leading the growth in the Instrument Transformer Market?

The Asia Pacific region, particularly countries like China and India, is leading market growth due to rapid industrialization, urbanization, and extensive power infrastructure development. North America and Europe also show strong demand fueled by grid modernization and renewable energy integration initiatives.

What are the key technological advancements in instrument transformers?

Key advancements include digital instrument transformers (DITs/LPITs) for higher accuracy and digital outputs, environmentally friendly insulation materials replacing SF6 gas, integrated sensor technologies for predictive maintenance, and IoT integration for real-time monitoring and smart grid compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Optical Instrument Transformer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Instrument Transformer Market Size Report By Type (Current Transformer, Voltage Transformer, Others), By Application (Electrical Power and Distribution, Metallurgy & Petrochemical, Construction, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- HV Instrument Transformer Market Statistics 2025 Analysis By Application (Electrical Power and Distribution, Metallurgy & Petrochemical, Construction), By Type (Current Transformer, Voltage Transformer), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Instrument Transformer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Current Transformer (CT), Potential Transformer (PT/VT), Combined Instrument Transformer), By Application (Voltage measurement, Power Transform, Switch Gears), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager