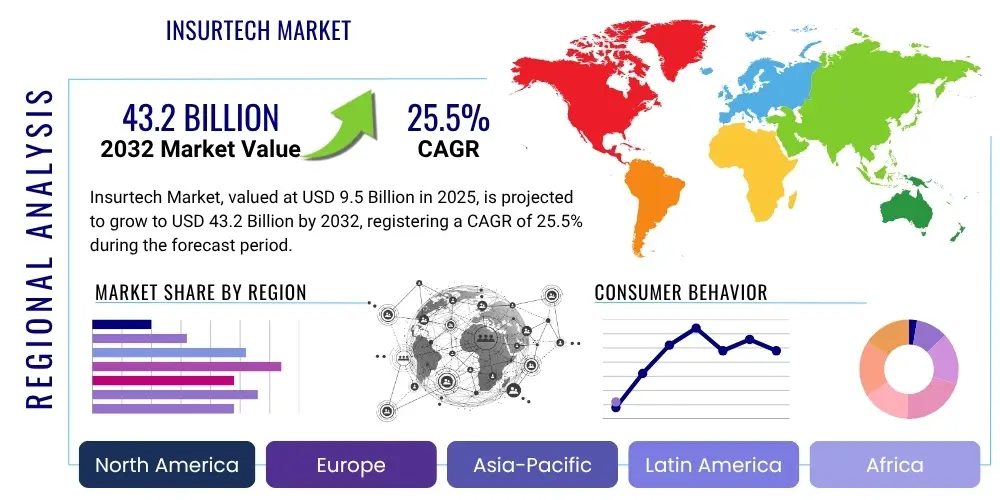

Insurtech Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428484 | Date : Oct, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Insurtech Market Size

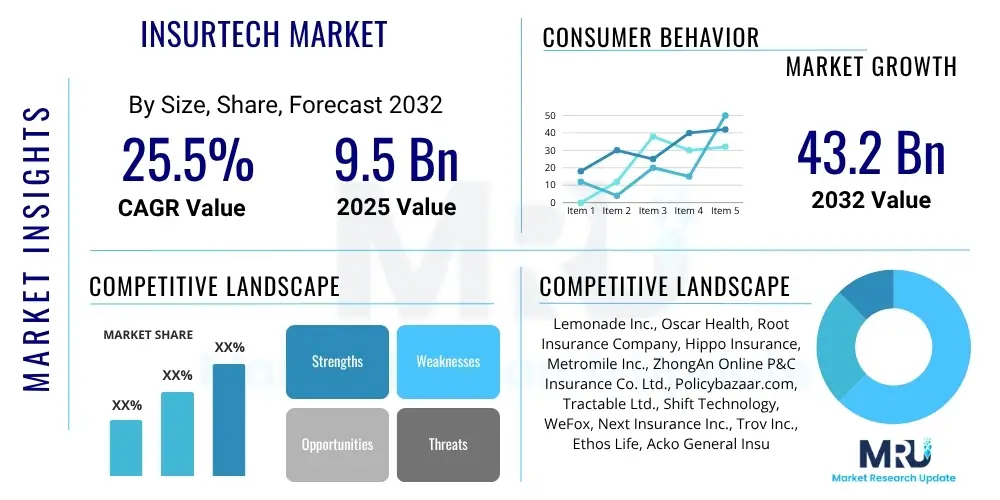

The Insurtech Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2025 and 2032. The market is estimated at USD 9.5 Billion in 2025 and is projected to reach USD 43.2 Billion by the end of the forecast period in 2032.

Insurtech Market introduction

The Insurtech market represents a revolutionary paradigm shift within the traditional insurance industry, integrating advanced technologies to enhance efficiency, personalize offerings, and improve customer experiences. This dynamic sector leverages innovations such as artificial intelligence, machine learning, blockchain, and the Internet of Things (IoT) to streamline operations, optimize risk assessment, and create novel insurance products. Its primary objective is to disrupt conventional insurance models by providing more accessible, transparent, and user-centric solutions, addressing long-standing pain points in policy purchasing, claims processing, and customer engagement.

Insurtech products typically encompass digital platforms for policy management, automated underwriting systems, AI-powered claims processing, peer-to-peer insurance models, and usage-based insurance (UBI) powered by telematics. Major applications span across life insurance, health insurance, property and casualty (P&C) insurance, and specialty lines, with a strong focus on enhancing fraud detection, improving customer onboarding, and enabling hyper-personalization of policies. The benefits are multifold, including reduced operational costs for insurers, faster claims settlements for customers, increased transparency, and the creation of more tailored and affordable insurance options. The market is primarily driven by the escalating demand for digital services, the widespread adoption of smartphones, the availability of vast datasets, and a growing consumer preference for convenience and personalized interactions.

Insurtech Market Executive Summary

The Insurtech market is experiencing robust expansion, characterized by significant business trends that include a heightened focus on digital transformation, strategic partnerships between Insurtech startups and established insurers, and a surge in venture capital funding. Companies are increasingly investing in data analytics and AI to gain competitive advantages, leading to more sophisticated risk modeling and personalized product offerings. Furthermore, there is a clear trend towards ecosystem integration, where Insurtech platforms connect various service providers, offering holistic solutions that extend beyond traditional insurance coverage, fostering a more collaborative and interconnected industry landscape.

Regionally, North America and Europe continue to be dominant markets, driven by technological maturity and significant investment in innovation, though Asia Pacific is emerging as a critical growth engine due to its large, underserved populations and rapid digital adoption rates, particularly in countries like China and India. Latin America and the Middle East and Africa also present considerable opportunities as digital infrastructure improves and financial inclusion initiatives gain traction. Segment-wise, the market is seeing substantial growth in solutions for property and casualty insurance, health insurance, and life insurance, with technology segments like AI/ML, blockchain, and cloud computing experiencing accelerated adoption. The increasing sophistication of data analytics and predictive modeling is transforming underwriting processes and enabling more dynamic pricing strategies across all these segments, while embedded insurance solutions are gaining prominence, integrating insurance directly into the purchase of other products or services.

AI Impact Analysis on Insurtech Market

User inquiries about AI's impact on the Insurtech market frequently center on its transformative potential to redefine traditional insurance operations, addressing concerns regarding job displacement, data privacy, and ethical AI deployment. Common questions explore how AI enhances claims processing efficiency, improves fraud detection, enables hyper-personalized policy creation, and revolutionizes risk assessment through advanced predictive analytics. Users are keen to understand the balance between AI-driven innovation and the need for human oversight, alongside the regulatory implications of deploying complex AI models in a highly regulated industry. There is also significant interest in AI's role in creating more accessible and affordable insurance products for diverse customer segments, and how it contributes to a seamless, proactive customer experience, moving insurance from a reactive service to a predictive one.

- Enhanced claims processing automation, reducing settlement times and operational costs.

- Superior fraud detection capabilities through advanced pattern recognition and anomaly detection.

- Personalized policy generation and dynamic pricing based on individual risk profiles and behavioral data.

- Improved customer engagement through AI-powered chatbots, virtual assistants, and proactive outreach.

- Revolutionized underwriting processes with faster, more accurate risk assessment using vast datasets.

- Development of innovative, usage-based insurance (UBI) models leveraging IoT and real-time data.

- Operational efficiency gains across the entire insurance value chain, from sales to service.

- Challenges in data privacy, ethical considerations, and regulatory compliance for AI model deployment.

- Potential for job displacement in traditional, repetitive insurance roles requiring re-skilling.

- Demand for skilled AI professionals within the insurance sector to drive innovation.

DRO & Impact Forces Of Insurtech Market

The Insurtech market is propelled by a robust set of driving forces, primarily the accelerating digital transformation across all industries and the increasing customer expectation for personalized, on-demand services. The pervasive adoption of smartphones and mobile internet facilitates direct consumer engagement with insurance products, while the vast quantities of data generated by IoT devices and digital interactions provide fertile ground for advanced analytics, enabling more precise risk assessment and tailored offerings. Moreover, the inherent inefficiencies and legacy systems within traditional insurance companies create a significant impetus for disruption, pushing innovation and the adoption of agile, technology-driven solutions to improve operational effectiveness and reduce costs across the value chain, making insurance more accessible and transparent.

Despite these powerful drivers, several restraints challenge the market's growth. Regulatory complexities and the need for compliance across diverse jurisdictions pose substantial barriers to entry and scalability for Insurtech startups, requiring significant legal and operational overhead. Data security and privacy concerns are paramount, as Insurtech models heavily rely on sensitive customer information, making robust cybersecurity infrastructure and compliance with regulations like GDPR critical. Furthermore, the inherent conservatism of the insurance industry, coupled with the high capital requirements for launching and scaling insurance operations, often leads to resistance to change and difficulty in securing initial funding or establishing trust with a broad customer base, necessitating innovative approaches to market entry and collaboration.

However, significant opportunities exist for growth and innovation. The Insurtech market can tap into vast underserved populations, particularly in emerging economies, by offering micro-insurance and simplified products via mobile channels, fostering greater financial inclusion. The rise of parametric insurance, which pays out based on specific triggers rather than traditional claims assessments, presents a novel avenue for rapid and transparent payouts in areas prone to natural disasters or specific events. Moreover, strategic partnerships and collaborations between Insurtech firms and established insurers offer a mutually beneficial pathway, allowing startups to leverage market reach and regulatory expertise while incumbents gain access to cutting-edge technology and agile innovation, accelerating market penetration and product diversification. These impact forces collectively shape a dynamic and evolving landscape for Insurtech.

Segmentation Analysis

The Insurtech market is comprehensively segmented to provide a detailed understanding of its diverse components and growth trajectories. These segments help in identifying specific areas of innovation, investment opportunities, and evolving customer needs. The market is typically segmented by technology, deployment model, type of insurance, application, and end-user, reflecting the broad spectrum of solutions and services offered by Insurtech companies. This multi-faceted segmentation allows for precise analysis of market dynamics, competitive landscapes, and strategic positioning for various stakeholders within the ecosystem.

- By Technology:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Cloud Computing

- Internet of Things (IoT)

- Big Data Analytics

- Robotic Process Automation (RPA)

- API and Open Insurtech

- Telematics

- By Deployment Model:

- On-premise

- Cloud-based

- By Type of Insurance:

- Property and Casualty (P&C) Insurance

- Auto Insurance

- Home Insurance

- Travel Insurance

- Commercial Insurance

- Life and Health Insurance

- Life Insurance

- Health Insurance

- Critical Illness Insurance

- Specialty Insurance

- Cyber Insurance

- Pet Insurance

- Parametric Insurance

- By Application:

- P&C Claims Management

- Life and Health Claims Management

- Policy Administration and Underwriting

- Fraud Detection and Prevention

- Customer Relationship Management (CRM)

- Sales and Marketing

- Risk Management and Compliance

- By End-User:

- Insurance Companies

- Brokers and Agents

- Third-Party Administrators (TPAs)

- Individuals

- Businesses

Value Chain Analysis For Insurtech Market

The Insurtech market's value chain is characterized by a dynamic interplay between various stakeholders, from technology providers to end-users, fundamentally reshaping traditional insurance processes. Upstream activities involve technology development, data acquisition, and analytics providers who supply the foundational tools, platforms, and insights necessary for Insurtech solutions. This segment includes companies specializing in AI/ML algorithms, blockchain infrastructure, cloud services, and IoT device integration, which serve as the backbone for innovative insurance products and operational efficiencies. These providers are crucial for empowering Insurtech firms with the capabilities to create smarter, more responsive, and data-driven insurance offerings, driving the initial innovation and enabling new product development.

Midstream, Insurtech companies leverage these technologies to develop proprietary platforms for underwriting, policy administration, claims processing, and customer engagement. This involves product design, risk modeling, and the creation of user interfaces that streamline the customer journey. Downstream, the distribution channels are rapidly evolving, moving beyond traditional agents and brokers to include direct-to-consumer digital platforms, embedded insurance within other services (e.g., auto sales, travel bookings), and partnerships with aggregators. The direct channel offers greater control over the customer experience and potentially lower acquisition costs, while indirect channels, through APIs and white-label solutions, enable broader market reach and integration into diverse ecosystems, allowing Insurtech solutions to be seamlessly offered at the point of sale for complementary products and services.

Insurtech Market Potential Customers

Potential customers for the Insurtech market are remarkably diverse, spanning individual consumers, small and medium-sized enterprises (SMEs), and large corporations, all seeking more efficient, personalized, and transparent insurance solutions. Tech-savvy millennials and Gen Z individuals represent a significant demographic, as they prioritize digital-first experiences, convenience, and value transparency in their financial services. These consumers are often underserved by traditional insurers who struggle to adapt to their digital expectations and desire for flexible, on-demand policies, creating a prime opportunity for Insurtech firms to capture market share through innovative mobile applications and intuitive online platforms that simplify the insurance buying process and claims submissions.

Moreover, SMEs represent a large and often overlooked customer segment that can greatly benefit from Insurtech. These businesses typically require flexible, scalable, and affordable insurance options tailored to their unique risks, which traditional, rigid policies often fail to provide. Insurtech solutions can offer customized business interruption insurance, cyber insurance, and liability coverage through streamlined digital interfaces, significantly reducing administrative burden and offering competitive pricing. Furthermore, traditional insurance carriers themselves are increasingly becoming customers of Insurtech providers, seeking to integrate advanced technologies like AI-powered underwriting and claims automation into their existing operations, illustrating a growing trend of collaboration and the adoption of external innovation to enhance their own product offerings and operational efficiencies, thereby expanding the customer base beyond direct policyholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2032 | USD 43.2 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lemonade Inc., Oscar Health, Root Insurance Company, Hippo Insurance, Metromile Inc., ZhongAn Online P&C Insurance Co. Ltd., Policybazaar.com, Tractable Ltd., Shift Technology, WeFox, Next Insurance Inc., Trov Inc., Ethos Life, Acko General Insurance, Wakam, BIMA, Clearcover, Slice Labs, Insureon, Bold Penguin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insurtech Market Key Technology Landscape

The Insurtech market's rapid evolution is fundamentally driven by a sophisticated and converging array of cutting-edge technologies that are reshaping how insurance products are designed, distributed, and managed. Artificial Intelligence (AI) and Machine Learning (ML) are paramount, enabling advanced data analytics for precise risk assessment, automated underwriting, and highly efficient fraud detection. These capabilities allow insurers to move beyond traditional actuarial tables, leveraging vast datasets from various sources to create dynamic, personalized pricing models and claims predictions, significantly improving accuracy and reducing operational costs. Furthermore, AI-powered chatbots and virtual assistants enhance customer service, providing instant support and streamlining communication, thereby improving overall customer satisfaction and retention.

Blockchain technology is gaining traction for its ability to foster transparency, security, and efficiency in insurance operations. It facilitates secure data sharing, simplifies claims processing through smart contracts, and enhances fraud prevention by creating immutable records of transactions and policy details. The Internet of Things (IoT) plays a crucial role, particularly in property and casualty as well as health insurance, by providing real-time data from connected devices such as smart homes, wearables, and telematics in vehicles. This data enables usage-based insurance (UBI), proactive risk mitigation, and personalized health programs, offering policyholders incentives for healthier behaviors or safer driving. Alongside these, cloud computing provides the scalable and flexible infrastructure required to store and process immense volumes of data, supporting the agility and rapid deployment of Insurtech solutions. Big Data analytics, Robotic Process Automation (RPA) for automating repetitive tasks, and open Application Programming Interfaces (APIs) for seamless ecosystem integration further solidify the technological foundation of the transformative Insurtech landscape, enabling interoperability and fostering a more connected and efficient insurance ecosystem.

Regional Highlights

- North America: A mature and highly innovative market, characterized by significant venture capital investments, a high concentration of Insurtech startups, and a strong regulatory framework. The region is a leader in adopting AI, machine learning, and big data analytics for personalized insurance products and efficient claims processing.

- Europe: Driven by evolving regulatory landscapes like GDPR and PSD2, which encourage data sharing and open banking, fostering a collaborative environment between traditional insurers and Insurtechs. The UK, Germany, and France are key hubs for innovation, focusing on customer-centric solutions and operational efficiency.

- Asia Pacific (APAC): The fastest-growing region, fueled by a large, underserved population, increasing digital literacy, and widespread mobile adoption. Countries like China and India are experiencing a boom in mobile-first insurance solutions, micro-insurance, and partnerships leveraging e-commerce platforms and super apps.

- Latin America: An emerging market with immense potential, driven by efforts to increase financial inclusion and the rising adoption of digital technologies. Insurtech solutions here often focus on simplifying complex insurance processes and providing access to previously uninsurable populations through mobile channels.

- Middle East and Africa (MEA): Witnessing growth due to government-led digitalization initiatives and a young, tech-savvy population. The region is exploring Insurtech to address specific challenges like underinsurance, improve claims handling, and enhance customer experience through innovative digital platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insurtech Market.- Lemonade Inc.

- Oscar Health

- Root Insurance Company

- Hippo Insurance

- Metromile Inc.

- ZhongAn Online P&C Insurance Co. Ltd.

- Policybazaar.com

- Tractable Ltd.

- Shift Technology

- WeFox

- Next Insurance Inc.

- Trov Inc.

- Ethos Life

- Acko General Insurance

- Wakam

- BIMA

- Clearcover

- Slice Labs

- Insureon

- Bold Penguin

Frequently Asked Questions

What is Insurtech?

Insurtech refers to the technological innovations designed to improve the efficiency and delivery of insurance services. It encompasses the application of advanced technologies like AI, blockchain, IoT, and data analytics to streamline operations, enhance customer experience, and create personalized insurance products across various lines of business.

How does AI impact the Insurtech market?

AI significantly impacts Insurtech by automating claims processing, improving fraud detection through predictive analytics, enabling personalized policy pricing and underwriting, and enhancing customer service via chatbots. It optimizes operational efficiency and allows for dynamic risk assessment, transforming traditional insurance models.

What are the key drivers of Insurtech market growth?

Key drivers include the global trend of digital transformation, increasing customer demand for convenient and personalized digital experiences, the proliferation of data from IoT devices, and the need for traditional insurers to innovate and reduce operational costs by adopting new technologies.

What are the primary challenges faced by the Insurtech market?

Major challenges involve navigating complex regulatory environments, ensuring robust data security and privacy compliance, overcoming the inherent conservatism of the traditional insurance industry, and attracting significant initial capital investment required for scaling operations and gaining customer trust.

Which regions are leading the Insurtech market?

North America and Europe currently lead the Insurtech market due to high technological adoption and investment. However, the Asia Pacific region is demonstrating rapid growth, driven by a large digital-savvy population and increasing demand for accessible insurance solutions in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Artificial Intelligence Ai Insurtech Market Size Report By Type (Hardware, Software, Service), By Application (Claims Management, Risk Management and Compliance, Chatbots, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- InsurTech (Insurance Technology) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others), By Application (Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager